Market Overview

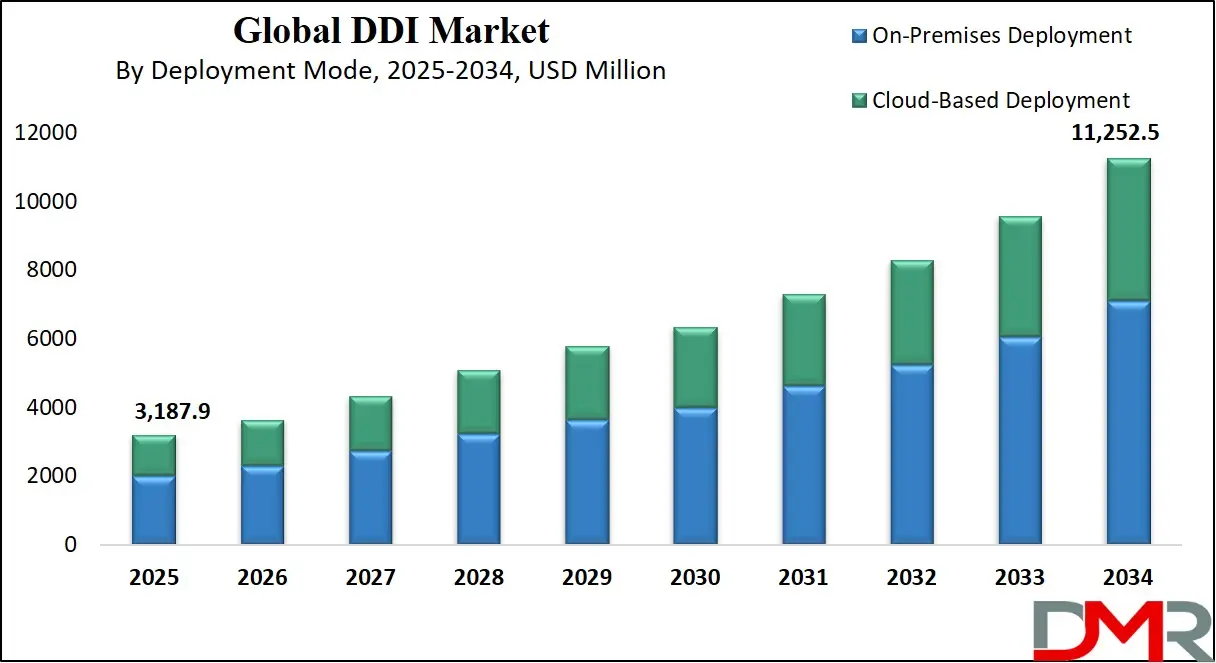

The Global DDI (DNS, DHCP, and IP Address Management) Market is predicted to be valued at USD 3,187.9 million in 2025 and is expected to grow to USD 11,252.5 million by 2034, registering a compound annual growth rate (CAGR) of 15.0% from 2025 to 2034.

DDI, or DNS, DHCP, and IP Address Management, is an integrated solution that combines three critical network services into a unified platform. DNS (Domain Name System) translates domain names into IP addresses, DHCP (Dynamic Host Configuration Protocol) assigns dynamic IP addresses to devices, and IP Address Management (IPAM) provides tools to manage and track IP address usage across networks.

ℹ

To learn more about this report –

Download Your Free Sample Report Here

Together, DDI enables centralized control, automation, and enhanced visibility into network infrastructure. It streamlines administrative tasks, improves security, reduces downtime, and supports scalability in modern enterprise and cloud environments, making it essential for managing complex and dynamic IT networks efficiently.

The global DDI (DNS, DHCP, and IP Address Management) market encompasses integrated solutions that automate and manage core network services, enhancing visibility, control, and security over IP address spaces. These platforms ensure seamless communication between devices, enabling reliable internet connectivity and efficient network performance. The growing complexity of IT infrastructures, increased IP-enabled device usage, and the rise in data traffic have expanded the demand for DDI solutions across enterprises and service providers globally.

Cloud migration, digital transformation, and hybrid networking models are fueling demand for scalable and automated DDI solutions. Organizations are increasingly adopting DDI platforms to enhance network agility, optimize IP address management, and reduce operational overhead. The proliferation of Internet of Things (IoT) devices, along with the growth of 5G networks, is also reinforcing the need for centralized DDI systems to manage large-scale, distributed environments efficiently and securely.

Artificial intelligence integration, machine learning-driven analytics, and software-defined networking (SDN) compatibility are transforming DDI offerings. Vendors are investing in real-time DNS threat detection, zero-touch provisioning, and multi-cloud DDI support to meet evolving enterprise needs. The shift toward SaaS-based DDI platforms is also gaining momentum as businesses look for flexible and cost-effective network management tools with enhanced security, automation, and analytics capabilities.

Major players in the DDI market include Infoblox, BlueCat, Cisco Systems, EfficientIP, and Nokia. These companies are focusing on innovation, strategic partnerships, and geographic expansion to strengthen their market position. Many are emphasizing AI-powered DDI, unified management interfaces, and integrated security features to address the growing demand for secure, scalable, and intelligent network services.

ℹ

To learn more about this report –

Download Your Free Sample Report Here

The US DDI Market

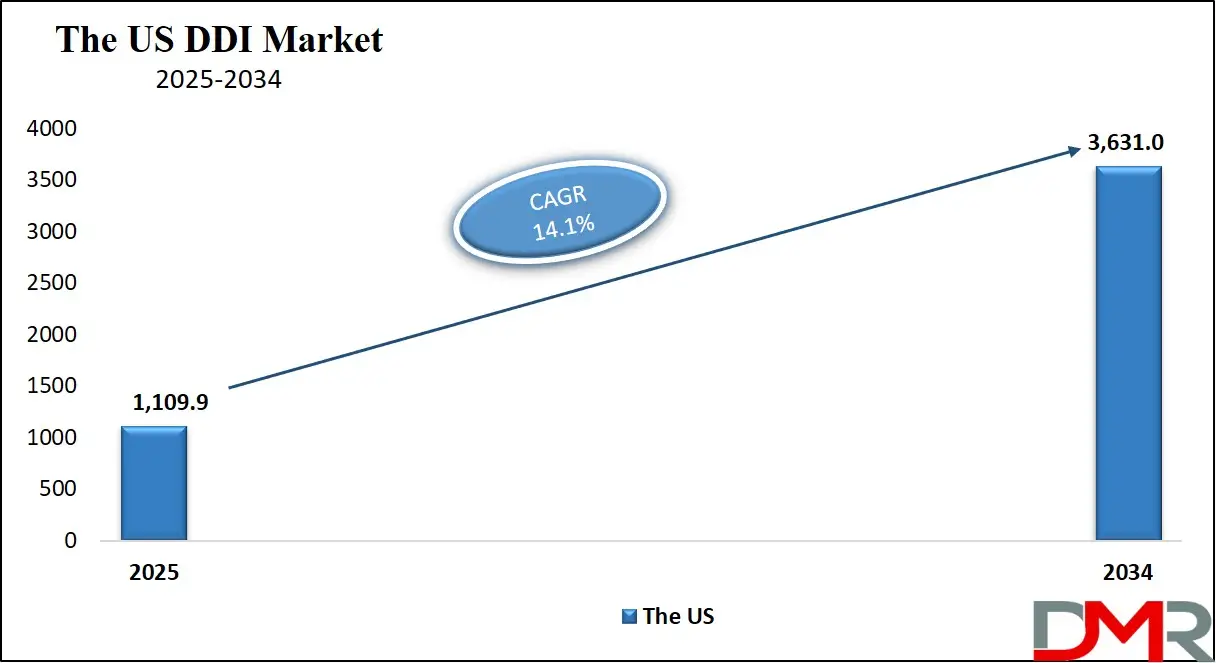

The US DDI market is projected to be valued at USD 1,109.9 million in 2025. It is expected to witness subsequent growth in the upcoming period as it holds USD 3,631.0 million in 2034 at a CAGR of 14.1%.

The US DDI market is driven by the rapid adoption of advanced network infrastructure and the rising demand for automated IP address management across enterprises. With increasing reliance on cloud computing and IoT devices, organizations seek dynamic DNS and IP address management solutions for greater scalability and operational efficiency. Regulatory compliance, particularly in sectors like healthcare and finance, fuels the need for robust DDI solutions.

Additionally, heightened cybersecurity concerns and the growing frequency of cyber threats are prompting businesses to strengthen their network foundation through integrated DDI platforms, making it a critical component of modern network administration and governance in the country.

One major trend in the US DDI market is the integration of DDI solutions with hybrid cloud environments to ensure seamless network control and visibility. Enterprises are also increasingly adopting AI-powered DDI platforms to enhance predictive analytics and automate responses to IP conflicts or DNS failures. There's a growing preference for managed DDI services among small to mid-sized organizations, driven by the complexity of network infrastructure.

Additionally, the shift toward IPv6 adoption is influencing the development of next-gen DDI platforms. The market is also witnessing consolidation, with key vendors acquiring niche DDI providers to broaden their service offerings and geographical reach.

ℹ

To learn more about this report –

Download Your Free Sample Report Here

The Japan DDI Market

The Japan DDI market is projected to be valued at USD 318.9 million in 2025. It is expected to witness subsequent growth in the upcoming period as it holds USD 1,291.2 million in 2034 at a CAGR of 15.7%.

Japan’s DDI market is primarily driven by the country's advanced telecommunications ecosystem and increasing digitalization across sectors. The rapid deployment of 5G and smart infrastructure projects has heightened the need for robust DNS, DHCP, and IPAM solutions. Enterprises are modernizing their IT infrastructure to support large-scale IoT deployments, requiring highly automated and scalable DDI solutions.

Additionally, Japan's focus on technological innovation and its high internet penetration contribute to strong demand for network management tools. Government initiatives promoting digital transformation in public services and corporate governance further incentivize the adoption of DDI systems for streamlined and secure IP address management.

Japan is experiencing a shift toward fully automated and cloud-integrated DDI platforms, particularly in tech-savvy industries like automotive, electronics, and smart manufacturing. The country’s strong emphasis on data security is prompting the inclusion of advanced DNS security protocols in DDI offerings. With increasing hybrid work models, enterprises are seeking remote-access optimized DDI systems.

There’s also growing investment in DDI-as-a-service models, especially among mid-sized enterprises. The transition to IPv6, driven by mobile and IoT expansion, is another major trend. Furthermore, collaborations between Japanese telecom firms and global DDI solution providers are fostering innovation in scalable, AI-driven network management platforms.

The Europe DDI Market

The Europe DDI market is projected to be valued at USD 860.7 million in 2025. It is expected to witness subsequent growth in the upcoming period as it holds USD 2,961.3 million in 2034 at a CAGR of 14.8%.

In Europe, the DDI market is fueled by stringent data protection laws like GDPR, pushing enterprises to invest in secure and compliant IP address management solutions. The rise of smart city initiatives and expanding digital transformation across public sectors are driving demand for reliable and scalable DDI infrastructure. The proliferation of IoT and connected devices across industries such as manufacturing, automotive, and healthcare necessitates efficient IP address allocation and DNS resolution.

Moreover, the increasing complexity of enterprise networks and the need for centralized network management are prompting European organizations to deploy integrated DDI platforms to streamline operations and minimize outages.

Europe trends indicate a significant shift toward automation and orchestration within network management. Businesses are increasingly adopting DDI tools with centralized dashboards and AI-driven functionalities for real-time monitoring and incident response. Multi-cloud deployments are influencing demand for cross-platform DDI compatibility, allowing seamless integration with cloud-native environments. There's a rising focus on cybersecurity, with organizations prioritizing DNS-layer security as a critical component of their overall defense strategy.

Additionally, sustainability concerns are pushing IT departments to optimize network infrastructure efficiency, further promoting the use of intelligent DDI solutions. Partnerships between European telecom providers and DDI vendors are also shaping the competitive landscape.

DDI Market: Key Takeaways

- Market Overview: The global DDI (DNS, DHCP, and IP Address Management) market is expected to be valued at USD 3,187.9 million by 2025 and is projected to grow significantly to USD 11,252.5 million by 2034, registering a robust CAGR of 15.0% during the forecast period from 2025 to 2034.

- The US DDI Market: The DDI market in the United States is forecasted to reach USD 1,109.9 million by 2025 and is anticipated to expand further, hitting USD 3,631.0 million by 2034, at a CAGR of 14.1%, driven by increasing demand for efficient IP management in complex network environments.

- The Japan DDI Market: Japan’s DDI market is expected to be valued at USD 318.9 million in 2025, growing to USD 1,291.2 million by 2034, registering a CAGR of 15.7%. This growth is supported by Japan’s advanced telecom infrastructure and rising adoption of network automation technologies.

- The Europe DDI Market: Europe is anticipated to hold a DDI market size of USD 860.7 million in 2025, with the market reaching USD 2,961.3 million by 2034, reflecting a CAGR of 14.8%, owing to stringent data compliance regulations and strong investments in digital infrastructure.

- Component Insights: The Solutions segment is expected to dominate the global DDI market in 2025, accounting for approximately 68.4% of the total revenue share. This dominance is driven by the need for integrated and automated IP address management solutions across large enterprise networks.

- Deployment Mode Insights: The On-Premises deployment model is projected to lead the market in 2025, with a market share of about 57.9%, due to heightened concerns over data privacy and security in critical sectors such as BFSI and government.

- Organization Size Insights: Large Enterprises are anticipated to contribute the largest portion to the DDI market, capturing around 64.2% of the market share by the end of 2025, attributed to their extensive and distributed network infrastructures requiring centralized control and automation.

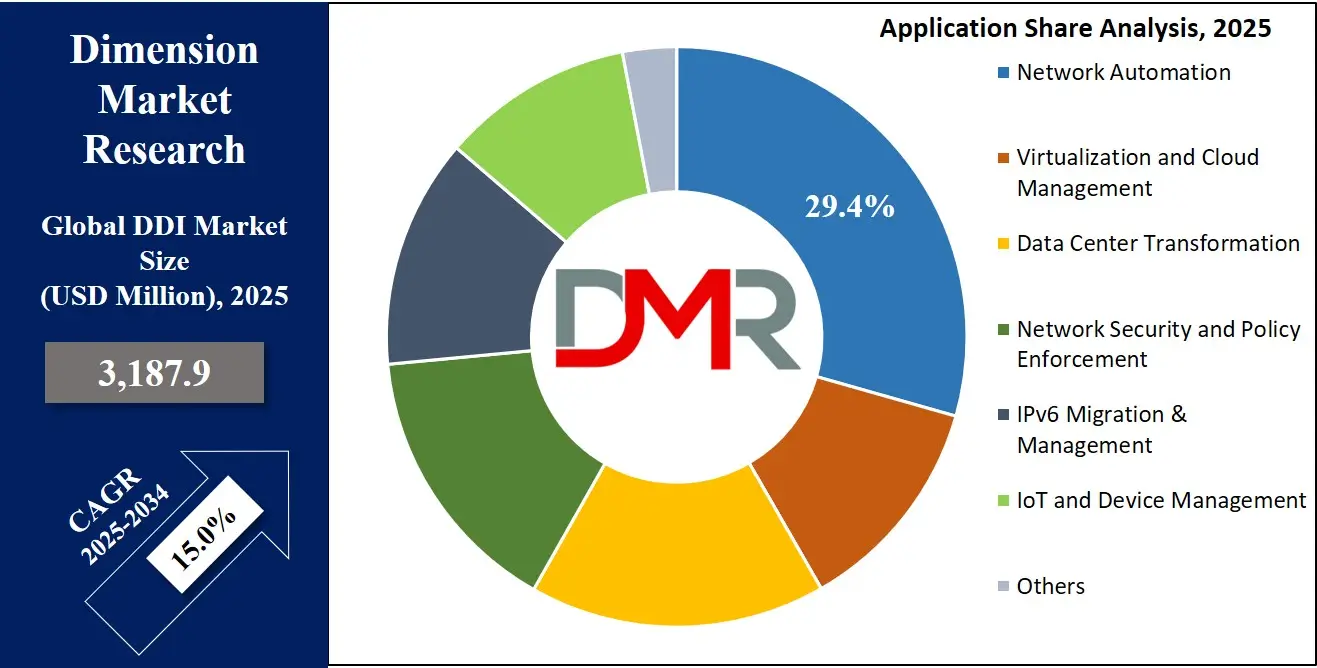

- Application Insights: In terms of application, Network Automation is projected to be the leading segment, commanding approximately 33.7% of total market revenue in 2025. The rising demand for reducing manual network configurations and operational costs is a major growth factor.

- Vertical Insights: The Telecom and IT sector is set to dominate the global DDI market by vertical, accounting for nearly 29.4% of the market share in 2025, supported by rapid digital transformation and the surge in connected devices.

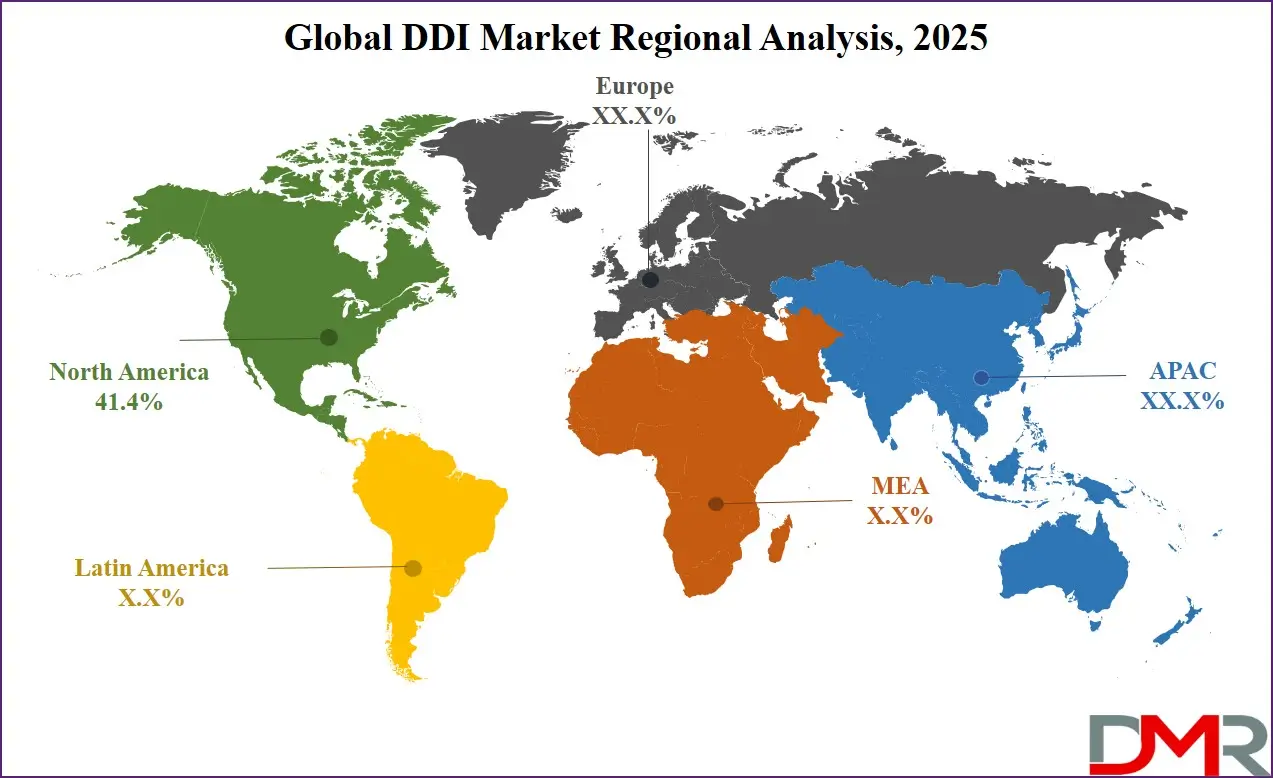

- Regional Insights: North America is projected to maintain the largest regional share in the global DDI market, holding approximately 41.4% of the total market value in 2025.

DDI Market: Use Cases

- Automated IP Address Management in Large Enterprises: DDI solutions help enterprises automate IP address allocation across thousands of devices. By integrating DNS, DHCP, and IPAM, they reduce manual configuration errors, streamline network provisioning, and enhance visibility across hybrid environments, especially critical during mass onboarding or network scaling across multiple branch offices.

- Cloud Infrastructure and Hybrid Network Management: In cloud and hybrid environments, DDI enables seamless IP address assignment and dynamic DNS updates for virtual machines and containers. It ensures consistent connectivity, auto-provisions network resources, and aligns with DevOps automation, supporting scalability and service continuity across AWS, Azure, and on-premises infrastructure.

- Enhanced Network Security and Threat Detection: DDI systems play a crucial role in detecting malicious domains, unauthorized devices, or anomalous DHCP requests. By centralizing network data and DNS query logs, they aid in identifying threats early, enforcing DNS firewall policies, and integrating with SIEM platforms for real-time incident response.

- Smart Device and IoT Network Management: With the rise of IoT, DDI platforms ensure efficient management of a vast number of dynamically changing IP addresses and hostnames. They provide visibility, automated provisioning, and secure DNS/DHCP services for IoT ecosystems, ensuring seamless communication and reducing the risk of network fragmentation or downtime.

DDI Market: Stats & Facts

- Cisco states that DNS is responsible for over 90% of malware-related command-and-control (C2) communications, making DDI a critical security enforcement point in network infrastructure.

- Infoblox highlights that automated DDI solutions can reduce IP address management time by up to 80%, significantly improving IT operational efficiency.

- Gartner reports that misconfigured DNS and DHCP services are a top cause of network outages, underlining the importance of centralized DDI management.

- Microsoft indicates that integrating DDI in cloud and hybrid environments supports scalable network provisioning, especially as enterprises adopt IPv6 and SD-WAN.

- RIPE NCC (Réseaux IP Européens Network Coordination Centre) emphasizes that IPv6 adoption is steadily increasing worldwide, pushing organizations to upgrade their DDI systems to handle dual-stack networks effectively.

- US-CERT (United States Computer Emergency Readiness Team) warns that open and improperly secured DNS servers can be exploited in DDoS attacks, reinforcing the need for secure DDI implementations.

- ISC (Internet Systems Consortium), developer of BIND DNS software, confirms that regular DDI software patching is essential due to the discovery of multiple DNS-related vulnerabilities each year.

- ICANN (Internet Corporation for Assigned Names and Numbers) underscores that robust DNS infrastructure, a part of DDI, is foundational to internet stability and resilience.

DDI Market: Market Dynamic

Driving Factors in the DDI Market

Surge in Demand for Network Automation and IP Management

The rapid expansion of enterprise networks and connected devices is fueling the demand for automated DDI solutions. Organizations increasingly rely on network automation to streamline IP address management, reduce manual errors, and avoid IP conflicts. With the proliferation of IoT and BYOD policies, traditional IPAM systems are no longer sufficient. DDI solutions help enterprises maintain operational efficiency and ensure seamless device connectivity.

These tools also support dynamic DNS and DHCP services, essential for efficient network performance. The growing reliance on enterprise network infrastructure and the need for real-time IP address management is driving the adoption of network-centric DDI systems, particularly in sectors like telecom, BFSI, and healthcare.

Rising Cybersecurity Threats and Regulatory Compliance

As cyberattacks become more advanced, the need for robust DDI solutions intensifies. DDI platforms offer essential visibility and control over network components, enabling faster threat detection and mitigation. They provide secure DNS and DHCP services, reducing the risk of DNS spoofing and DDoS attacks. Regulatory frameworks like GDPR and HIPAA mandate secure handling of user and device data, pushing enterprises to deploy DDI systems that offer strong policy enforcement and compliance support.

The integration of DDI with cybersecurity tools, DNS security extensions (DNSSEC), and threat intelligence platforms makes it a strategic investment for data-sensitive industries like finance and defense.

Restraints in the DDI Market

High Initial Investment and Deployment Complexity

While DDI solutions offer long-term benefits, their initial deployment can be complex and capital-intensive. Integrating DDI into existing IT infrastructure often requires specialized expertise, hardware upgrades, and network redesigns. For small to mid-sized enterprises, these costs can be a significant barrier. The complexity increases further in hybrid environments where legacy systems coexist with modern cloud platforms.

Delays in implementation and training contribute to resistance in adoption. Many organizations are hesitant to replace their existing IP address tracking tools with full-scale DDI platforms, especially if their network environments are not experiencing rapid scalability or transformation.

Limited Awareness

Many small and medium enterprises (SMEs), particularly in emerging economies, lack awareness about the strategic importance of DDI systems. These businesses often manage networks manually or with basic IPAM tools, underestimating the risks of IP conflicts and service downtime. Additionally, the misconception that DDI is only relevant for large-scale enterprises hinders market penetration.

Limited IT budgets and technical expertise further constrain adoption. Without proactive education about the benefits of integrated DNS, DHCP, and IPAM solutions, SMEs continue to operate with suboptimal network visibility and control, limiting the global expansion potential of the DDI solutions market.

Opportunities in the DDI Market

Growing Adoption of Cloud-Based and SaaS DDI Solutions

The shift toward cloud-native infrastructure opens new opportunities for DDI vendors. Cloud-based DDI solutions eliminate the need for on-premise hardware, offering scalability, ease of deployment, and cost-effectiveness. These platforms support dynamic IP provisioning and centralized network management, critical for businesses with multi-site or remote operations. SaaS-based DDI offerings also provide automatic updates and security patches, reducing administrative burden.

As hybrid and multi-cloud environments become mainstream, the demand for cloud-managed DNS and DHCP services is projected to rise. This creates growth potential for vendors that offer flexible DDI-as-a-service platforms tailored to the evolving needs of digital enterprises.

Expansion in 5G and Edge Computing Infrastructure

The deployment of 5G networks and the rise of edge computing is generating vast numbers of new IP-enabled devices. This surge is increasing the complexity of IP address allocation and management, making automated DDI solutions indispensable. Telecom operators and cloud service providers require real-time DNS and DHCP provisioning to ensure low-latency connectivity across distributed environments.

Moreover, the combination of IPv6 transition and edge network scaling presents a significant opportunity for DDI vendors. Companies that can deliver low-latency, scalable, and resilient DDI services to support high-density, latency-sensitive applications will gain a competitive edge in this evolving landscape.

Trends in the DDI Market

Integration of AI and ML in DDI Solutions

Artificial Intelligence (AI) and Machine Learning (ML) are transforming how DDI systems operate by enabling predictive analytics, anomaly detection, and intelligent automation. AI-driven DDI platforms can proactively identify configuration errors, detect suspicious DNS activity, and recommend optimization strategies. These capabilities reduce human error and enhance network security and uptime.

Vendors are increasingly embedding AI-powered analytics to provide network insights, such as traffic patterns and IP utilization trends. As networks grow more complex, the integration of intelligent automation into DDI tools becomes a key differentiator in delivering efficient, secure, and self-healing network infrastructure.

Increased Emphasis on IPv6 Readiness and Transition

As IPv4 address exhaustion becomes critical, the transition to IPv6 is gaining momentum across industries. DDI systems that offer seamless IPv6 support are becoming vital for future-ready network infrastructure. Enterprises are looking for tools that can simplify the dual-stack (IPv4 and IPv6) environment and ensure smooth migration.

Vendors are enhancing their platforms to provide advanced IPv6 address management, DNS64/NAT64 translation, and dual-stack support. Governments and large service providers are especially focusing on IPv6-compliant DDI solutions to maintain uninterrupted service delivery and scalability. The emphasis on IPv6 readiness reflects a long-term shift in IP resource planning and global internet expansion.

DDI Market: Research Scope and Analysis

By Component Analysis

The Solutions segment is predicted to dominate the global DDI market, accounting for approximately 68.4% of the total revenue share in 2025. The increasing demand for centralized control over DNS and DHCP functions, along with enhanced visibility into IP address utilization, drives this dominance. Enterprises are rapidly adopting DNS Solutions and IPAM platforms to ensure seamless network performance, reduce downtime, and optimize resource allocation.

The growth in network complexity and demand for secure connectivity is also accelerating the deployment of advanced DHCP Solutions. With the rise of hybrid and multi-cloud strategies, businesses are prioritizing scalable and reliable solutions to streamline network management across diverse environments and maintain efficient operational continuity.

The Services segment is projected to register the highest CAGR in the global DDI market by the end of 2025. As organizations increasingly migrate toward digital infrastructure, demand for managed services and professional consultation is rising. These services help businesses implement, customize, and optimize their DNS and DHCP configurations while addressing compliance and network security requirements.

Integration and deployment support have become critical as networks expand across cloud platforms and edge devices. Training and consulting services are also gaining traction due to the shortage of in-house networking expertise. The evolving nature of enterprise IT, particularly with the adoption of IoT and remote work models, further propels the demand for comprehensive service-based DDI solutions.

By Deployment Mode Analysis

On-Premises Deployment segment is expected to dominate the global DDI market, securing around 57.9% of the total market share in 2025. Enterprises with strict regulatory requirements and security policies continue to prefer in-house control over DNS and DHCP infrastructure. This mode enables full customization, low-latency network access, and robust protection of IP address data, especially within industries such as defense, healthcare, and finance.

The need to maintain legacy systems and the sensitivity of internal data encourage organizations to retain local DDI configurations. Despite the shift to cloud-based environments, many large corporations prioritize direct control and compliance adherence, keeping on-premises solutions the most widely adopted DDI deployment model globally.

The Cloud-Based Deployment segment is projected to experience the highest CAGR in the global DDI market by the end of 2025. As digital transformation accelerates, businesses are embracing flexible, scalable DDI infrastructure hosted via cloud platforms. Public, private, and hybrid cloud models allow rapid deployment, simplified network administration, and cost efficiency, particularly appealing to small and medium-sized enterprises.

Cloud-native DDI services are optimized for dynamic IP address management in decentralized and multi-tenant environments. This model also enables seamless integration with SD-WAN, virtualized data centers, and containerized applications. As organizations adopt distributed workforces and Internet of Things ecosystems, cloud-based deployment offers the agility and automation essential for managing modern, cloud-first network architectures.

By Organization Analysis

Large Enterprises are projected to dominate the global DDI market, capturing approximately 64.2% of the total market share by the end of 2025. These organizations typically manage extensive and complex network infrastructures, requiring advanced DNS, DHCP, and IP address management solutions to ensure uninterrupted operations. Large enterprises prioritize network availability, high security, and policy-based automation, which drives significant investment in enterprise-grade DDI platforms. With expanding global footprints, these businesses demand centralized control and visibility across multiple data centers and cloud environments.

The need for compliance with industry-specific regulations and support for high-density virtual environments further fuels adoption. Additionally, large organizations increasingly adopt DDI systems to support hybrid cloud strategies and reduce configuration errors in large-scale IT networks.

The Small & Medium-Sized Enterprises (SMEs) segment is forecasted to grow at the highest CAGR in the global DDI market by the end of 2025. SMEs are recognizing the value of automating IP address management and securing network services to support expanding digital operations. Cost-effective, cloud-based DDI solutions are particularly attractive to this segment, enabling streamlined deployment and scalability without the need for heavy infrastructure investment.

As SMEs increasingly adopt virtualized networks and SaaS platforms, they seek simplified tools to manage DNS and DHCP functions efficiently. The rising threat landscape and the need for dependable connectivity in remote work environments are also pushing smaller businesses toward adopting managed DDI services, boosting growth in this segment.

By Application Analysis

Network Automation is expected to dominate the global DDI market, accounting for around 33.7% of the total revenue share in 2025. With the increasing complexity of enterprise networks, organizations are adopting DDI platforms that enable automated provisioning and management of DNS, DHCP, and IP address resources. Automation reduces manual configuration errors, improves operational efficiency, and accelerates network provisioning, especially vital for large-scale and hybrid IT environments.

Enterprises leverage network automation to support digital transformation, improve uptime, and ensure faster deployment of services. The growing reliance on software-defined networking and cloud-native infrastructure further accelerates demand for automated DDI systems, making it the most widely implemented application across diverse verticals globally.

The IoT and Device Management segment is projected to register the highest CAGR in the global DDI market by the end of 2025. The explosive growth in connected devices across smart cities, manufacturing, and healthcare ecosystems has significantly increased the need for scalable DDI systems. Managing dynamic IP address allocation and securing connectivity for thousands of devices requires robust DHCP and DNS coordination.

As organizations adopt edge computing and real-time analytics, efficient DDI integration ensures seamless device onboarding, monitoring, and communication. This segment is also driven by the need for centralized visibility and control over distributed IoT networks. Enterprises are prioritizing DDI-based solutions to maintain operational continuity and enhance performance across diverse and dynamic device environments.

ℹ

To learn more about this report –

Download Your Free Sample Report Here

By Vertical Analysis

Telecom and IT segment is projected to dominate the global DDI market, holding approximately 29.4% of the total market share in 2025. The telecommunications industry relies heavily on high-performance DNS and DHCP services to maintain uninterrupted connectivity and manage large-scale IP address environments. With growing 5G deployments, cloud-native network functions, and edge computing, the need for agile and scalable DDI systems is critical.

IT service providers use DDI solutions to deliver efficient, secure network services to customers while optimizing infrastructure utilization. The demand for reliable, automated provisioning in virtualized environments, along with the need to manage dynamic subscriber networks, positions this vertical as the top contributor to global DDI revenue by 2025.

The Healthcare and Life Sciences segment is expected to record the highest CAGR in the DDI market by the end of 2025. The rising adoption of telemedicine, electronic health records, and connected medical devices is increasing the complexity of healthcare IT networks. To ensure secure, real-time data flow and device interoperability, organizations are turning to robust DDI platforms.

Hospitals and research institutions require automated IP address management and secure DNS configurations to maintain uptime and protect patient data. As healthcare networks scale to include cloud services and remote monitoring tools, DDI solutions provide the necessary backbone for centralized visibility and policy enforcement. The growing emphasis on cybersecurity and regulatory compliance further accelerates adoption in this sector.

The DDI Market Report is segmented on the basis of the following:

By Component

- Solutions

- DNS Solutions

- DHCP Solutions

- IP Address Management (IPAM) Solutions

- Services

- Professional Services

- Managed Services

- Integration & Deployment

- Consulting & Training

By Deployment Mode

- On-Premises Deployment

- Cloud-Based Deployment

- Public Cloud

- Private Cloud

- Hybrid Cloud

By Organization

- Small & Medium-Sized Enterprises (SMEs)

- Large Enterprises

By Application

- Network Automation

- Virtualization and Cloud Management

- Data Center Transformation

- Network Security and Policy Enforcement

- IPv6 Migration & Management

- IoT and Device Management

- Others

By Vertical

- Telecom and IT

- Banking, Financial Services, and Insurance (BFSI)

- Government and Defense

- Healthcare and Life Sciences

- Education

- Retail and E-Commerce

- Manufacturing

- Energy and Utilities

- Others

Regional Analysis

Region with the largest Share

North America is projected to hold the largest share of 41.4% in the global DDI market by 2025. This dominance is driven by the widespread adoption of advanced networking solutions, the strong presence of major DDI vendors, and a highly digitized economy. The region's demand for secure and scalable network infrastructure across industries such as BFSI, telecom, government, and healthcare significantly contributes to this growth.

Additionally, the increasing adoption of cloud computing, IoT, and 5G technologies further fuels the DDI market. With robust IT infrastructure and heightened cybersecurity concerns, enterprises in the U.S. and Canada are accelerating investments in automated IP address management and DNS security solutions, reinforcing North America’s leadership in the DDI market.

ℹ

To learn more about this report –

Download Your Free Sample Report Here

Region with Highest CAGR

Asia Pacific is expected to witness the highest CAGR in the global DDI market from 2025 to 2034. The rapid pace of digital transformation across countries like China, India, Japan, and Southeast Asia is fueling demand for efficient network management solutions. Increasing internet penetration, growing cloud adoption, and the expansion of data centers are creating a robust environment for DDI deployment.

Enterprises and governments in the region are investing heavily in smart city projects, 5G rollouts, and cybersecurity infrastructure, further accelerating the market. Additionally, the rise of SMEs and startups embracing digital platforms is expanding the customer base. The region’s focus on automation and network scalability positions Asia Pacific as a high-growth frontier in the DDI market landscape.

By Region

North America

Europe

- Germany

- The U.K.

- France

- Italy

- Russia

- Spain

- Benelux

- Nordic

- Rest of Europe

Asia-Pacific

- China

- Japan

- South Korea

- India

- ANZ

- ASEAN

- Rest of Asia-Pacific

Latin America

- Brazil

- Mexico

- Argentina

- Colombia

- Rest of Latin America

Middle East & Africa

- Saudi Arabia

- UAE

- South Africa

- Israel

- Egypt

- Rest of MEA

Competitive Landscape

The global DDI (DNS, DHCP, and IP Address Management) market features a competitive landscape dominated by key players offering comprehensive network automation and management solutions. Major vendors such as Infoblox Inc., Cisco Systems, BlueCat Networks, EfficientIP, and BT Diamond IP are leading the market with robust DDI platforms that support enterprise-scale DNS and DHCP services. These companies focus on enhancing network visibility, security, and performance through integrated DDI solutions, which are increasingly vital in hybrid and multi-cloud environments.

Strategic initiatives such as mergers, acquisitions, and partnerships are common as companies aim to expand their global footprint and technological capabilities. For instance, vendors are incorporating AI-driven threat detection and automated IP address tracking to improve network resilience and reduce downtime. The shift toward IPv6 adoption, growing demand for unified network management tools, and the expansion of 5G infrastructure are fueling competition.

Startups and regional players are also gaining traction by offering cost-effective and scalable DDI solutions tailored for SMEs and emerging markets. As the market evolves, innovation in DNS security, cloud-based DDI solutions, and policy-driven IPAM tools are expected to shape competitive dynamics. Overall, technological advancement, strategic collaborations, and cybersecurity integration remain key competitive differentiators.

Some of the prominent players in the Global DDI Market are:

- Infoblox Inc.

- Cisco Systems Inc.

- BlueCat Networks Inc.

- EfficientIP

- Nokia Corporation

- FusionLayer

- BT Diamond IP

- Microsoft Corporation

- SolarWinds Corporation

- Men & Mice

- TCPWave Inc.

- PC Network Inc.

- ApplianSys Limited

- NS1

- NCC Group

- Empowered Networks

- Apteriks

- INVETICO

- Datacomm

- Other Key Players

Recent Developments

- In October 2024, AnyMind Group partnered with Digital Distribusi Indonesia (DDI) to enhance live commerce for WRP, Rohto Indonesia, and Kobayashi Indonesia. They also launched AnyLive, a GenAI platform blending AI and human presenters for continuous, interactive shopping experiences.

- In September 2024, Infoblox launched the Universal DDI Product Suite to simplify hybrid and multi-cloud network management. Featuring Universal Asset Insights, Universal DDI Management, and NIOS-X as a Service, the suite boosted automation, security, and operational efficiency while reducing disruptions.

- In September 2024, Cloudflare introduced a DNS Partnership Program for ISPs and hardware vendors, offering its 1.1.1.1 DNS service at no cost. The program aimed to enhance DNS resolution speed and safety through strategic industry collaborations.

- In August 2024, Hadrian released SanicDNS, an open-source DNS scanning tool optimized for rapid network enumeration. Using advanced networking and parallel processing, it delivered speeds 100 times faster than traditional tools and enabled real-time vulnerability detection for cybersecurity professionals.

- In September 2023, BlueCat Networks partnered with Grupo Dice to tackle network complexity for organizations in Latin America and Mexico. The collaboration targeted enhanced DDI solutions through cooperation with IT systems integrators and local technology experts.

- In June 2023, Cygna Labs launched a VitalQIP product update after acquiring the business. The integration with Cygna Radar improved DNS threat detection and provided greater visibility, reporting, and forensic capabilities across enterprise DDI environments.

- In May 2023, BlueCat Networks acquired Men&Mice to expand its DDI management capabilities. The move aimed to address the complex needs of hybrid, multi-cloud, and on-premises environments across mid-market and enterprise segments.

Report Details

| Report Characteristics |

| Market Size (2025) |

USD 3,187.9 Mn |

| Forecast Value (2034) |

USD 11,252.5 Mn |

| CAGR (2025–2034) |

15.0% |

| Historical Data |

2019 – 2024 |

| The US Market Size (2025) |

USD 1,109.9 Mn |

| Forecast Data |

2025 – 2033 |

| Base Year |

2024 |

| Estimate Year |

2025 |

| Report Coverage |

Market Revenue Estimation, Market Dynamics, Competitive Landscape, Growth Factors, etc. |

| Segments Covered |

By Component (Solutions, Services), By Deployment Mode (Cloud-Based Deployment, On-Premises Deployment), By Organization (Small & Medium-Sized Enterprises (SMEs), Large Enterprises), By Application (Network Automation, Virtualization and Cloud Management, Data Center Transformation, Network Security and Policy Enforcement, IPv6 Migration & Management, IoT and Device Management, Others), By Vertical (Telecom and IT, Banking, Financial Services, and Insurance (BFSI), Government and Defense, Healthcare and Life Sciences, Education, Retail and E-Commerce, Manufacturing, Energy and Utilities, Others) |

| Regional Coverage |

North America – US, Canada; Europe – Germany, UK, France, Russia, Spain, Italy, Benelux, Nordic, Rest of Europe; Asia-Pacific – China, Japan, South Korea, India, ANZ, ASEAN, Rest of APAC; Latin America – Brazil, Mexico, Argentina, Colombia, Rest of Latin America; Middle East & Africa – Saudi Arabia, UAE, South Africa, Turkey, Egypt, Israel, Rest of MEA |

| Prominent Players |

Infoblox Inc., Cisco Systems Inc., BlueCat Networks Inc., EfficientIP, Nokia Corporation, FusionLayer, BT Diamond IP, Microsoft Corporation, SolarWinds Corporation, Men & Mice, TCPWave Inc., PC Network Inc., ApplianSys Limited, NS1, NCC Group, |

| Purchase Options |

We have three licenses to opt for: Single User License (Limited to 1 user), Multi-User License (Up to 5 Users), and Corporate Use License (Unlimited User) along with free report customization equivalent to 0 analyst working days, 3 analysts working days, and 5 analysts working days respectively. |

Frequently Asked Questions

How big is the Global DDI Market?

▾ The Global DDI Market size is estimated to have a value of USD 3,187.9 million in 2025 and is expected to reach USD 11,252.5 million by the end of 2034.

Which region accounted for the largest Global DDI Market?

▾ North America is expected to be the largest market share for the Global DDI Market with a share of about 41.4% in 2025.

Who are the key players in the Global DDI Market?

▾ Some of the major key players in the Global DDI Market are Infoblox Inc., Cisco Systems Inc., BlueCat Networks Inc, and many others.

What is the growth rate in the Global DDI Market?

▾ The market is growing at a CAGR of 15.0% over the forecasted period.

How big is the US DDI Market?

▾ The US DDI Market size is estimated to have a value of USD 1,109.9 million in 2025 and is expected to reach USD 3,631.0 million by the end of 2034.