The market has seen significant growth over the past few years and is predicted to grow significantly during the forecasted period as well.

Debt collectors are organizations commissioned to recover outstanding debts on behalf of others. Typically, the initial company that offered the debt would transfer or sell the account to a collection agency when multiple payments are missed & their attempts to secure payment prove unsuccessful. Engaging debt collectors is generally a more financially practical approach for companies, by saving time for them by the ongoing use of their own resources to chase payments on overdue accounts.

According to the Collection Bureau of America, the Debt Collection Agencies market is shaped by significant trends and challenges. Approximately 28% of Americans have at least one debt in collections, with medical debts accounting for 52% of all collection activities. This aligns with the statistic that 41% of working Americans are paying off some form of medical debt.

U.S. nonfinancial businesses hold an outstanding $17.7 trillion in debt, reflecting the vast scope of recoverable accounts. However, the industry faces efficiency concerns, as the average debt recovery rate stands at 20%, a decline from 30% recorded a few decades ago.

The accounts receivable management industry is experiencing significant growth, driven by rising consumer debt and the increasing need for efficient recovery solutions. Key conferences like the Debt Collection & Recovery Summit and Receivables Management Association International (RMAI) Annual Conference bring industry leaders together to discuss trends, compliance, and technology.

Surveys reveal a growing demand for AI-driven debt recovery tools, ensuring efficiency and adherence to regulations. Recent news highlights advancements in

digital payment platforms and stricter data security norms. The market's expansion is supported by the adoption of omnichannel communication and personalized approaches to enhance debtor engagement and recovery rates.

Market Dynamic

Economic downturns or recessions can lead to large amounts of consumer debt & more missed payments, thus growing the demand for debt collection services. When credit is easily accessible, people are more likely to take on debt, creating a significant group of potential customers for debt collection agencies. Changes in rules & regulations that affect this industry can impact both the supply & demand for these services. Advancements in technology have made debt collection methods more effective, driving up the need for these services.

Factors such as aging populations & changing household sizes can also impact debt levels. As businesses grow internationally, the need for debt collection services that can look into global legal & cultural differences becomes even more important. Changes in laws related to debt collection, including rules on collection practices & consumer safety, can also have a big impact on this industry. However, debt collection operates within strict legal boundaries, making companies follow state & federal regulations to stay away from any penalties & reputational damage.

Strong competition in the debt recovery services market poses challenges for smaller players to compete against established ones. Consumer protection laws reduce collection methods, while economic conditions influence collection effectiveness. Moreover, technological development restrains debtor evasion but also complicates direct communication, intensified by growing consumer debt & shifting payment preferences, making debt collection a complicated challenge.

Research Scope and Analysis

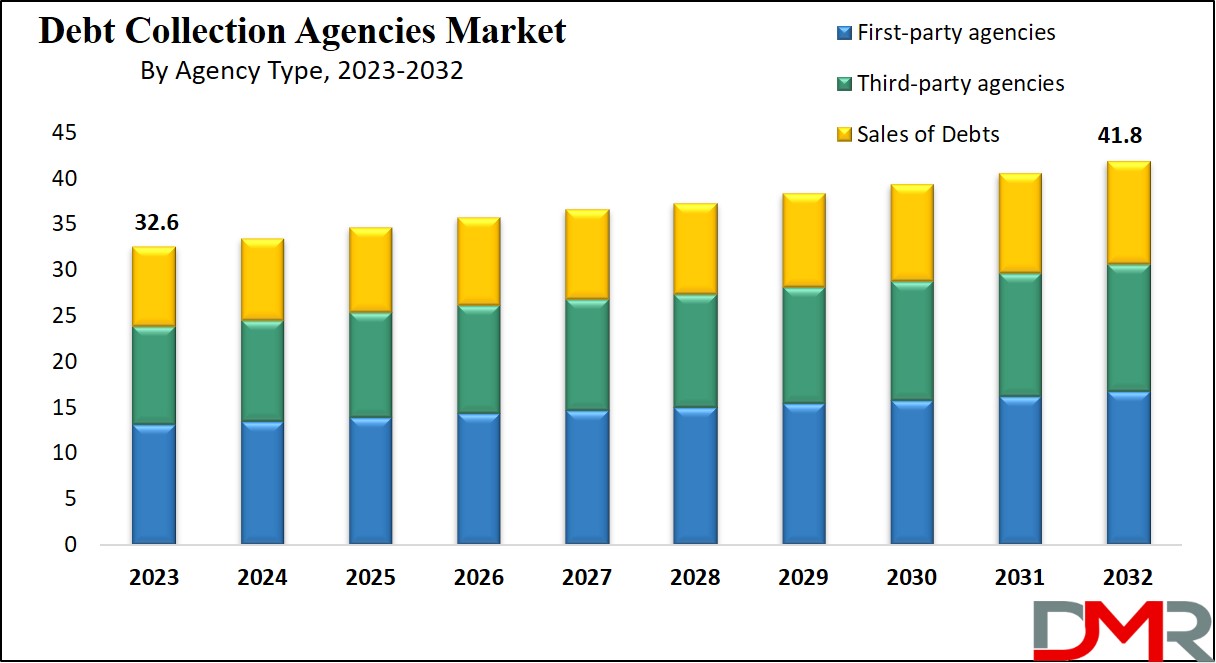

By Agency Type

First-party agencies, mostly termed "in-house" collections, work as major components of the original creditor's organization, controlling debt recovery directly for the lender. Further, third-party agencies, independent of the initial creditor, are allotted to recover debts on their behalf. Compensation methods can include a percentage of the recovered amount or a fixed flat fee.

Moreover, the debt buyer agencies obtain debts from creditors at a lower fraction of the initial owed sum & make efforts to collect the entire amount from the debtor. Debt buyers or entities associated with the sale of obligations may function as third-party agencies or maintain their own collection departments.

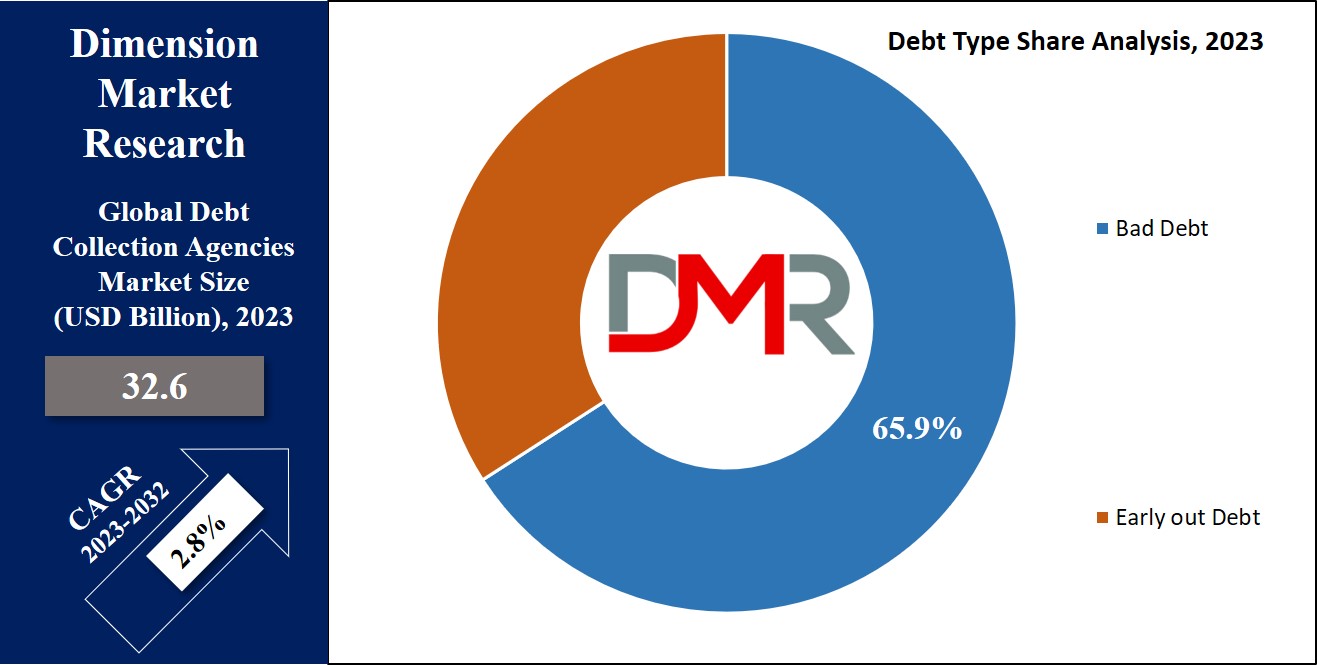

By Debt Type

In 2023, the leading factor driving market growth is the bad debt of borrowers. In such a case, if a credit or loan payment remains disputed for a period of over 90 days, the lender assigns it as a non-performing loan, thus categorizing it as bad debt. Moreover, such cases are given to debt collection agents/agencies for resolution. When faced with delayed payments, lenders often initiate contact with borrowers via collection teams in an effort to recover the owed funds.

Outsourced debt collection agencies carry out a fee structure based on a percentage of the successfully recovered sum, which is mostly viewed as a relatively costly approach to fund retrieval. The referral of a case to a specialist in debt collection only takes place when the lender is fairly certain that the debtor will not complete the payment obligation. On rare occasions, debt recovery agents are involved by the lender when the payment is due within a 90-day timeframe.

By Application

By application type, financial service applications remain a dominant force in the global market in 2023 and are anticipated to maintain their leadership, driven by growing customer payment demands. This growth is majorly due to the growing need for efficient payment processes. Responding to growth in fraud & cyberattacks, banks, & creditors are supporting global debt collection and settlement (GDDCS) solutions to recover loans from defaulters.

Further, the importance of debt collection services is growing due to the rising number of medical negligence cases, especially in nations like India, China, the U.K., Germany, & others. Private hospitals & insurance firms are struggling with significant losses stemming from defaults within schemes like KA/ASO. This intersects with industries like

Medical Aesthetics and broader healthcare financing, where delayed payments and defaults continue to challenge providers.

Individuals incompetent to meet their debt obligations often find themselves within the realm of collections agencies, risking their education & overall financial well-being. Debt collection services are mostly associated with student loans.

Additionally, governments are leveraging these services for many reasons, including tax recovery, management of court-related expenditures, & addressing overdue loans or fines. This growing interconnection between debt recovery and

Healthcare Quality Management further emphasizes the need for compliance-driven, efficient collection practices.

The Global Debt Collection Agencies Market Report is segmented on the basis of the following:

By Agency Type

- First-party agencies

- Third-party agencies

- Sales of Debts

By Debt Type

By Application

- Financial

- Healthcare

- Student Loans

- Government Debts

- Others

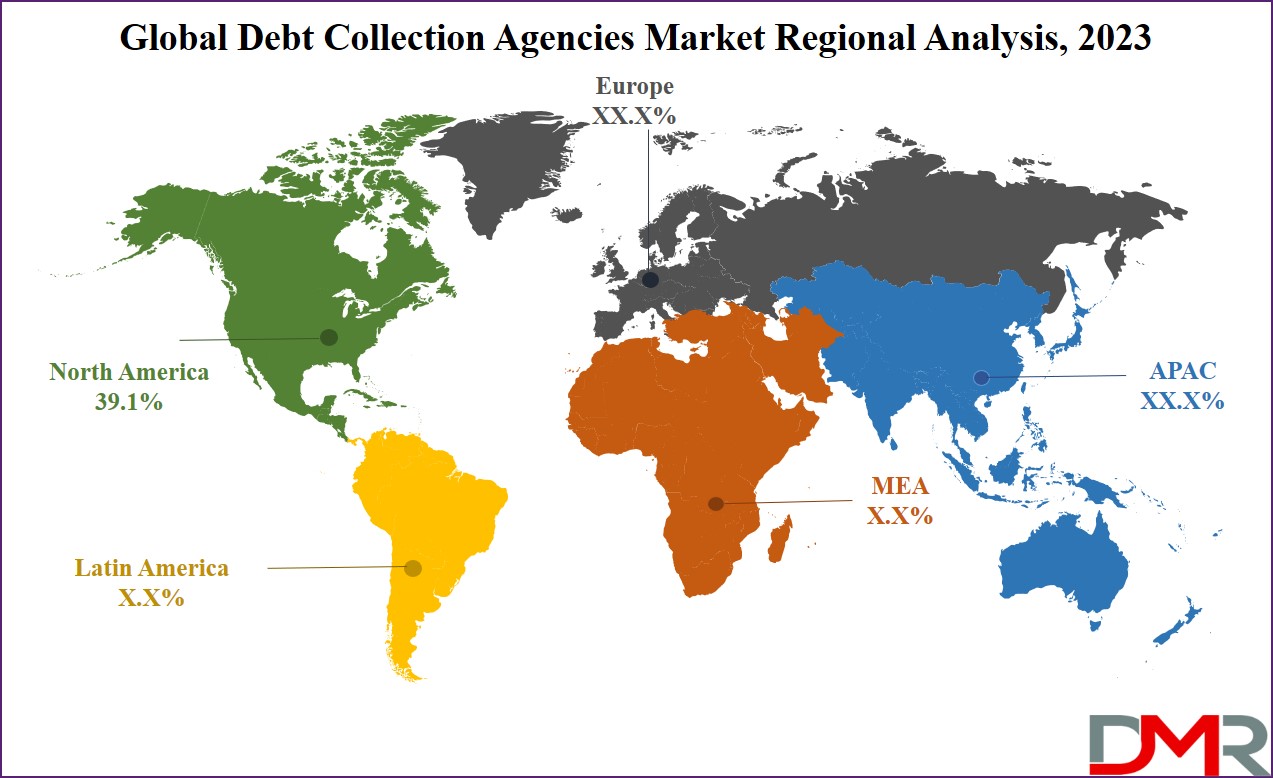

Regional Analysis

In 2023, the North American region secures a considerable market share, accounting for

about 39.1% of the total revenue for the global debt collection agencies market. North America & Europe stand as the major hubs for debt collection agencies, with the US and the UK leading the way in their respective regions. These areas possess mature legal & regulatory structures that oversee debt collection procedures, promoting an environment favorable to the industry's growth.

Also, the Asia-Pacific region is gaining significant importance, with China & India emerging as dominant markets in this region. The expansion of middle-class populations in these nations has catalyzed an increase in consumer lending activities, thereby generating a need for debt collection services to align with this growth.

By Region

North America

Europe

- Germany

- The U.K.

- France

- Italy

- Russia

- Spain

- Benelux

- Nordic

- Rest of Europe

Asia-Pacific

- China

- Japan

- South Korea

- India

- ANZ

- ASEAN

- Rest of Asia-Pacific

Latin America

- Brazil

- Mexico

- Argentina

- Colombia

- Rest of Latin America

Middle East & Africa

- Saudi Arabia

- UAE

- South Africa

- Israel

- Egypt

- Rest of MEA

Competitive Landscape

The debt collection agencies market experiences fragmentation, with many global & regional players. Competition in the market is strong, particularly from major market players possessing strong brand recognition & extensive distribution networks. To maintain their edge, companies are introducing expansion strategies like partnerships & new product launches.

The global debt collection landscape lacks organization due to the presence of a large number of small & medium businesses. Local players often hold larger market shares compared to those in different locations. Market participants are looking to differentiate themselves by offering technology-driven services.

For instance, in October 2022, Ohio-based Wakefield & Associates, a member company of ACA International, successfully completed the acquisition of Choice Recovery. This strategic step positions them for expansion within the Great Lakes region of the USA.

Some of the prominent players in the Global Debt Collection Agencies Market are:

- Capital Collection LLC

- IC Systems

- Encore Capital

- Aspen National Financial Inc

- Rocket Receivables

- Prestige Services Inc

- Atradius Collection

- Cedar Financials

- Rozlin Financial Group

- PRA Group

- Other Key Players

Recent Developments

- June 2025 Debt Collection Enters a New Era Powered by Vodex’s Voice AI Agents Vodex, a voice-AI startup gaining traction in U.S. collections, has launched a platform designed for compliance-heavy outreach. Its voice agents handle Tier-1 outbound calls, verify identity, present repayment options, and log interactions—while staying aligned with FDCPA, TCPA, HIPAA, SOC 2, and ISO 27001 requirements.

- October 2024 Neowise & Sarvam Launch AI-Driven Debt Collection SaaS Tools in India India’s Neowise (part of Decentro Group) unveiled two pioneering AI-powered products in partnership with Sarvam AI: NeoBot (a voice-based debt-collection chatbot) and NeoSight (an AI call analytics tool). These are designed to boost efficiency by ~15% and reduce collected-debt operational costs by roughly 33%.

- August 2025 Credgenics Takes Majority Stake in Debt Collection Firm Arrise Credgenics—a SaaS debt-resolution platform—acquired a majority stake in debt-collection firm Arrise to bolster its field-collections capabilities.

- May 2025 TrueAccord Acquires Sentry Credit, Expands Capabilities Digital-first debt collection agency TrueAccord acquired Sentry Credit, adding its first-party and litigation services, enhancing its client portfolio and reinforcing its empathetic, ML-driven platform

Report Details

| Report Characteristics |

| Market Size (2023) |

USD 32.6 Bn |

| Forecast Value (2032) |

USD 41.8 Bn |

| CAGR (2023-2032) |

2.8% |

| Historical Data |

2017 - 2022 |

| Forecast Data |

2023 - 2032 |

| Base Year |

2022 |

| Estimate Year |

2023 |

| Report Coverage |

Market Revenue Estimation, Market Dynamics, Competitive Landscape, Growth Factors and etc. |

| Segments Covered |

By Agency Type (First-party Agencies, Third-party

Agencies and Sales of Debts), By Debt Type (Bad Debt

and Early out Debt), By Application (Financial,

Healthcare, Student Loans, Government Debts and

Others) |

| Regional Coverage |

North America – The US and Canada; Europe – Germany, The UK, France, Russia, Spain, Italy, Benelux, Nordic, & Rest of Europe; Asia- Pacific– China, Japan, South Korea, India, ANZ, ASEAN, Rest of APAC; Latin America – Brazil, Mexico, Argentina, Colombia, Rest of Latin America; Middle East & Africa – Saudi Arabia, UAE, South Africa, Turkey, Egypt, Israel, & Rest of MEA

|

| Prominent Players |

Capital Collection LLC, IC Systems, Encore Capital,

Aspen National Financial Inc, Rocket Receivable,

Prestige Services Inc, Atradius Collection, Cedar

Financials, Rozlin Financial Group, PRA Group, and

Other Key Players |

| Purchase Options |

We have three licenses to opt for: Single User License (Limited to 1 user), Multi-User License (Up to 5 Users), and Corporate Use License (Unlimited User) along with free report customization equivalent to 0 analyst working days, 3 analysts working days and 5 analysts working days respectively. |