Market Overview

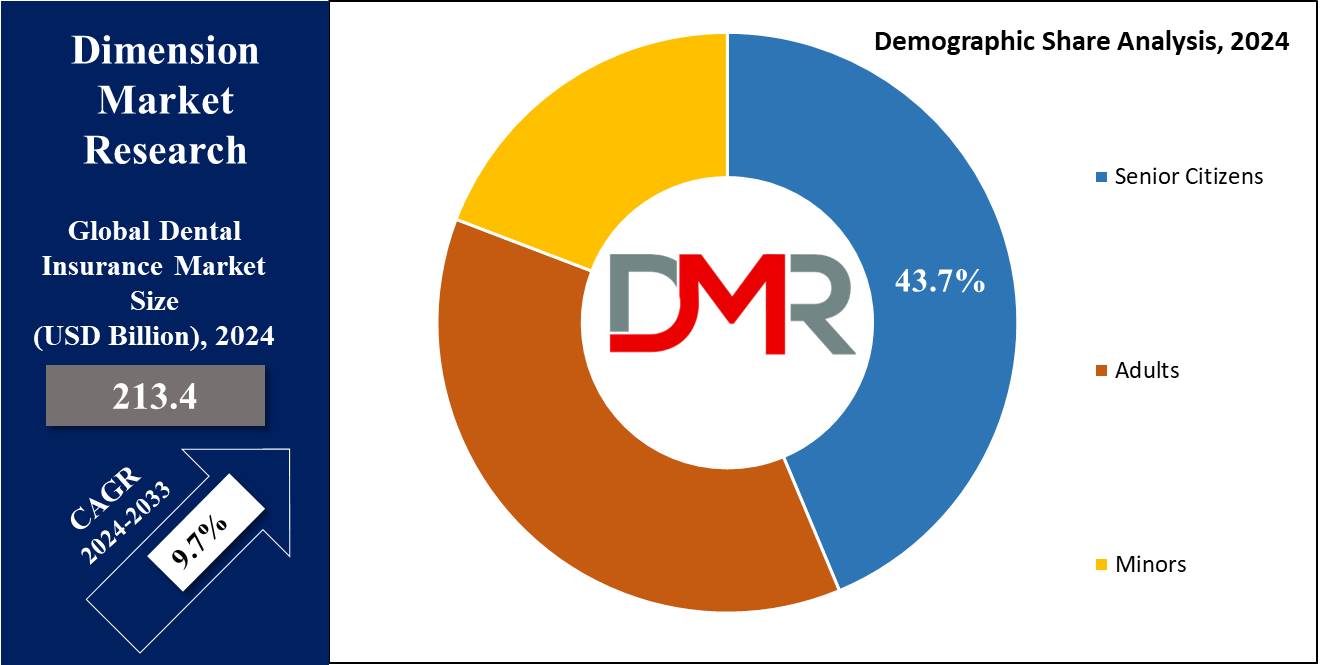

Global

Dental Insurance Market is forecasted to reach

USD 213.4 billion by the end of 2024 and grow to

USD 489.2 billion in 2033, with a

CAGR of 9.7%.

Dental insurance is a type of health insurance designed to cover the expenses associated with dental treatment. Dental care can be quite expensive due to the expertise and specialized equipment required, as well as the effects of inflation. The costs for dental services vary based on the type of treatment, the number of sessions needed for each procedure, and other factors. It's important to note that dental insurance typically covers treatments arising from accidents, injuries, or illnesses, as prescribed by a dental healthcare professional.

It covers the costs associated with dental treatments, including routine check-ups, cleanings, fillings, and various other procedures. The growth of the dental insurance market is fueled by greater government support aimed at safeguarding insurers against fluctuations in revenues, prices, and yields, as well as an increased awareness of oral hygiene.

The US Dental Insurance Market

The US Dental Insurance Market is projected to reach USD 79.3 billion by the end of 2024 and grow substantially to an expected USD 173.8 billion market by 2033 at an anticipated CAGR of 9.1 percent.

The US dental insurance market is primarily driven by the increasing awareness of oral health and the importance of preventive care. As consumers become more health-conscious, the demand for dental insurance rises, encouraging regular check-ups and treatments.

In the United States, numerous employers include dental insurance in their employee benefits packages, which helps ensure broad access to dental care. Furthermore, a variety of plans, such as Dental Preferred Provider Organizations (DPPOs) and Dental Health Maintenance Organizations (DHMOs), address different consumer needs, improving both affordability and accessibility. Increasingly, insurers are leveraging digital insurance platforms to manage these plans efficiently and enhance customer engagement, mirroring trends seen across other sectors like term insurance and

cyber insurance.

Key Takeaways

- Market Growth: The global Dental Insurance market is projected to grow by USD 257.3 billion, with a CAGR of 9.7%.

- Market Definition: Dental insurance is a type of health coverage that helps pay for dental care, including preventive, basic, and major services, reducing the costs for individuals and families.

- Coverage Analysis: Dental Preferred Organizations (DPPO) are expected to account for the largest revenue share based on coverage, by 2024.

- Type Analysis: Preventive is likely to lead the market with the highest revenue share based on type by 2024.

- Demographic Analysis: Senior citizens are predicted to dominate the market in terms of demographics with a significant revenue share in 2024.

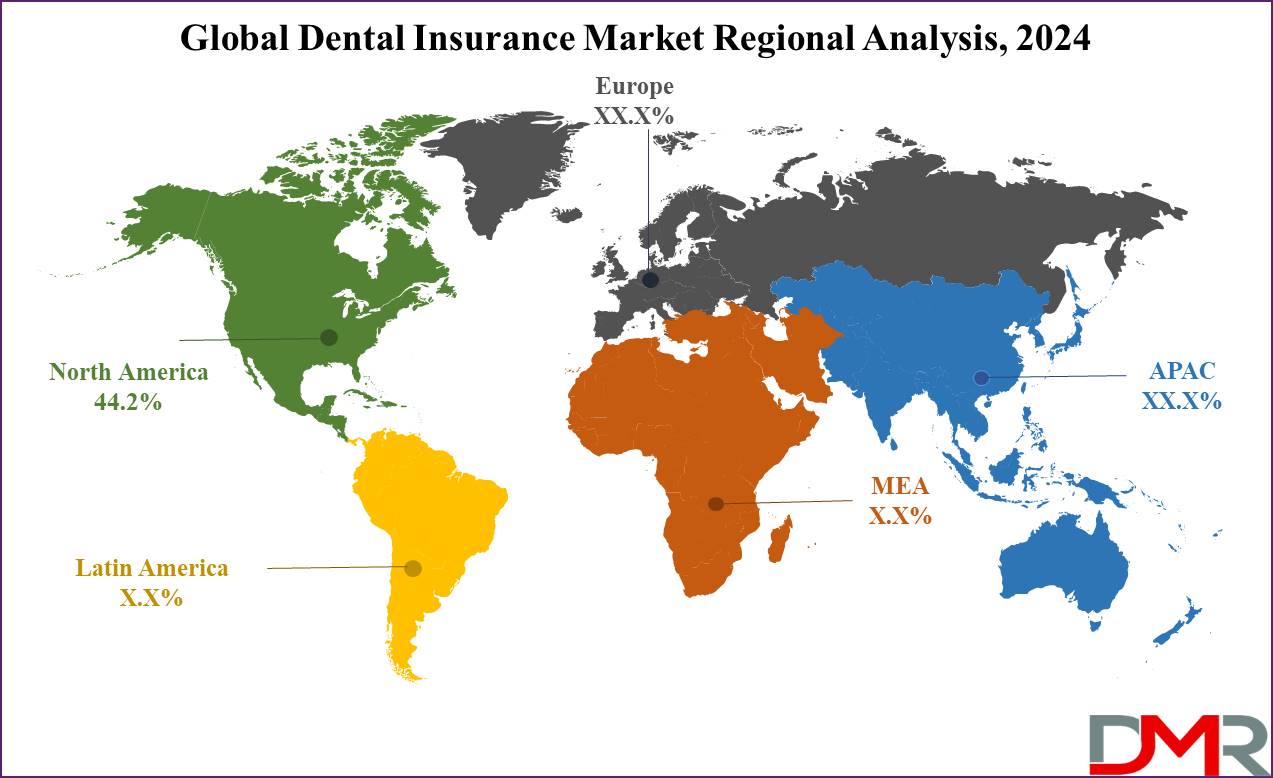

- Regional Analysis: North America is expected to lead the global Dental Insurance market with a market share of 44.2% by 2024.

Use Cases

- Preventive Care Coverage: Most dental insurance plans cover preventive services, such as routine check-ups, cleanings, and X-rays, often at little to no out-of-pocket cost. This encourages regular dental visits, helping detect issues early and reducing the need for more extensive treatments in the future. This preventive approach is increasingly integrated into digital insurance platforms, providing seamless user experiences for policyholders.

- Orthodontic Treatment: Many dental insurance policies provide coverage for orthodontic procedures, such as braces and aligners, especially for children. This support can make orthodontic care more accessible, helping patients achieve better alignment and oral health.

- Major Dental Procedures: Insurance plans often cover major dental procedures like root canals, dentures, dental implants, and oral surgery. While these procedures can be costly, having dental insurance can significantly reduce the financial impact, ensuring that patients receive the necessary treatment without delay.

- Emergency Dental Care: Dental insurance can cover emergency services, such as treatment for severe toothaches, injuries, or infections. This coverage provides peace of mind, allowing patients to seek urgent care without worrying about the costs, ultimately protecting their overall health.

- Preventive Care Coverage: Most dental insurance plans cover preventive services like check-ups, cleanings, & X-rays at less cost which encourages regular visits that allow early detection of issues that will reduce future extensive treatment needs.

- Orthodontic Treatment: Most dental insurance policies cover orthodontic procedures like braces and aligners for children enrolled in treatment plans, making orthodontic care more accessible, & helping achieve improved alignment and overall oral health for their members.

- Major Dental Procedures: Most insurance plans provide coverage for major dental procedures like root canals, dentures, & oral surgery which may be costly without financial coverage, and also help to ensure patients can get necessary treatments promptly.

- Emergency Dental Care: Dental insurance provides peace of mind by covering emergency treatments for severe toothaches, injuries, or infections that require prompt care without incurring costly fees - helping ensure overall patient wellness is preserved in this way.

Market Dynamic

Drivers

Increase in Awareness of Oral HygieneThe demand for dental hygiene services is increasing due to awareness & the importance of maintaining good oral health, which drives the growth of the dental insurance market. It covers many services, including minor oral infection treatments, nerve procedures, tooth extractions, & other minor surgeries. Also, increasing public awareness about the value of oral health further propels the expansion of the dental insurance market.

Rising Prevalence of Dental ConditionsThe increasing occurrence of dental issues like tooth decay, gum disease, & oral cancers is driven by factors like poor diet, inadequate oral hygiene, & genetic predispositions. These conditions often require frequent and costly dental interventions, which can be financially challenging without insurance, contributing to the growth of the market. The use of innovative

dental equipment for diagnosis and treatment is also expanding the range of covered services, further fueling market growth.

Restraints

Impact of Rising CompetitionRising competition within the dental insurance market is expected to slow growth, as dental coverage becomes more integrated with health insurance plans. This trend is further complicated by the competitive nature of the health insurance industry, which offers specialized dental coverage, limiting the momentum for bundling dental and health insurance plans. Furthermore, insurance providers are facing pressure to innovate across product lines, including offerings like cyber insurance and

term insurance, creating a highly competitive environment.

High Premium Costs

The increasing costs of dental insurance premiums can be a significant barrier for consumers, particularly for those on tight budgets. High premiums may lead individuals and families to forgo dental insurance altogether, which can limit market growth and reduce overall participation in dental care plans.

Opportunities

Technical Developments

It is also very much ready through technological innovation for creating substantial growth opportunities in dental insurance. Among them, the adoption of SaaS and cloud-based solutions over traditional legacy systems is the transformation that health and dental insurance providers might face in their operations. Away from on-premises expensive servers, heavy cost reductions are allowed, and it enhances easy access to critical information. These solutions also provide greater ease of use, knowledge to create an effective, rich, and fully satisfying experience for consumers and healthcare professionals alike.

Offerings with Machine Learning and AI

The dental insurance market presents enormous opportunities for existing products and service growth. Insurers can add more value to customers and expand their offerings by integrating advanced technologies like machine learning and AI-powered chatbots. These technologies make claims processing easier, with minimal manual intervention, while simultaneously reducing the likelihood of insurance fraud and errors related to overdiagnosis and diagnosis.

Trends

Increasing digital platform

Digitalization is transforming the dental insurance landscape. Customers now expect easy access to plan information, claims processing, and customer support through mobile apps and online platforms. Insurers are investing in digital tools to enhance the customer experience, simplify policy management, and improve transparency.

Rising Demand for Customized Insurance Plans

As consumers become more conscious of their specific dental health needs, there is an increasing demand for tailored insurance plans. Insurers are offering flexible options, allowing policyholders to choose coverage levels based on their unique requirements, whether they need preventive care, basic treatments, or major procedures.

Research Scope and Analysis

By Coverage

Dental Preferred Organizations (DPPO) are predicted to dominate the dental insurance market with the largest revenue share in 2024. This dominance is due to their flexibility and wide provider network as it allows policyholders to visit any dentist, although choosing an in-network provider results in lower out-of-pocket costs. This coverage often features a network of dentists who offer services to plan members at a reduced rate, which helps lower out-of-pocket costs compared to traditional co-pays or medical bills as many individuals opt for these plans to save on dental care expenses.

In addition, these insurance types often provide a billing schedule that details the costs of specific procedures, allowing consumers to better manage & plan for their dental expenses. This flexibility appeals to consumers seeking more control over their healthcare decisions while still benefiting from reduced costs when utilizing in-network services. Moreover, DPPO plans generally do not require referrals to specialists, enhancing convenience for policyholders. Their balance of affordability, accessibility, and provider choice has made DPPOs particularly attractive, contributing to their dominance in the market.

By Type

Preventive dental insurance plans are projected to dominate the dental insurance market with the highest revenue share by 2024, as their focus on routine care helps prevent more serious and expensive dental issues in the future. These services include annual checkups, cleanings, and X-rays which are covered 100% by most health plans and encourage policyholders to prioritize early intervention as part of a wellness regimen.

These services help detect potential dental issues early on to minimize more costly procedures later. Preventive dental insurance policies can be highly advantageous to insurers as well as consumers, making preventive types a popular choice that promotes long-term oral health while limiting out-of-pocket expenses. Preventive policies cover issues like cavities, gum disease, and enamel erosion while the demand is further fueled by forms of dentistry which encourage good hygiene practices to maintain strong, clean teeth for the future.

Meanwhile, basic dental insurance covers slightly more complex procedures like fillings, extractions, and treatment of gum disease. They are affordable and provide essential care beyond preventive treatments which typically involve some co-payments or cost-sharing. These insurances are often preferred by individuals who require more than routine care and wants to avoid the higher costs associated with major procedures.

By Demographic

Senior citizens are projected to take up the highest revenue share in 2024 with the dental insurance market due to their increasing need for dental care as they age. Health issues such as gum disease and tooth decay increase, and dentures or implants become necessary as people age, thus, contributing to this segment's expansion. Older individuals require frequent dental visits and complex treatments, making dental insurance essential to manage rising costs of care.

Since many seniors live on fixed incomes, having this coverage allows them to afford necessary procedures more affordable. Provide ongoing access to preventive healthcare that can reduce more serious health concerns. Due to rising awareness among seniors of the importance of dental insurance in protecting overall health and avoiding conditions like cardiovascular disease or diabetes, demand for it has seen significant gains.

Adults make up the second dominant market segment as they enter their prime working years and may already possess employer-sponsored dental plans. Adults need additional coverage to protect their oral health from costly procedures later. Basic services like fillings, root canals, and gum treatments that dental insurance covers also encourage consistent dental hygiene care for adult customers.

Global Dental Insurance Market Report is segmented on the basis of the following

By Coverage

- Dental Preferred Provider Organizations (DPPO)

- Dental Health Maintenance Organizations (DHMO)

- Dental Indemnity Plans

- Others

By Type

By Demographic

- Senior Citizens

- Adults

- Minors

Regional Analysis

North America is predicted to dominate the dental Insurance market with a revenue share of 44.2% in 2024, due to rising consumer awareness, large coverage options, & a strong regulatory framework. There are different dental plans & insurance in this part of the region due to the importance of oral health in overall health & well-being. There is an increasing focus on preventive care insurance policies in this region which further encourages regular dental visits, fostering a culture of proactive health management.

Furthermore, advancements in technology and digital healthcare solutions have made it easier for consumers to understand and navigate their insurance options, promoting greater participation in dental plans. Government regulations also encourage the market by establishing standards for coverage and consumer protection, thus enhancing trust in the system, which drives the growth of the market in this region.

Moreover, Canadians rely heavily on private insurance, employer-based insurance plans, government programs, and self-payment regarding dental care. After North America, Europe is the second most dominating region in the market, with a broader awareness of oral health and robust healthcare policies that include dental insurance as part of public health benefits.

Europe

- Germany

- The U.K.

- France

- Italy

- Russia

- Spain

- Benelux

- Nordic

- Rest of Europe

Asia-Pacific

- China

- Japan

- South Korea

- India

- ANZ

- ASEAN

- Rest of Asia-Pacific

Latin America

- Brazil

- Mexico

- Argentina

- Colombia

- Rest of Latin America

Middle East & Africa

- Saudi Arabia

- UAE

- South Africa

- Israel

- Egypt

- Rest of MEA

Competitive Landscape

Major players in the dental insurance market are pursuing a variety of strategic initiatives to strengthen their market presence. These strategies encompass collaborations with other firms, partnerships with essential stakeholders, and the introduction of new insurance plans tailored to diverse customer needs. In 2023, the global dental insurance market is significantly influenced by leading companies such as Cigna, AFLAC Inc., AXA, Allianz SE, Ameritas Life Insurance Corp, and other important entities. Each of these organizations plays a vital role in shaping market dynamics through their strategic efforts, product diversification, and integration of technology.

Some of the prominent players in the global dental Insurance market are

- Cigna

- AXA

- AFLAC Inc

- Allianz SE

- Aetna

- Ameritas Life Insurance Corp

- United HealthCare Services Inc.

- Metlife Services & Solutions

- Delta Dental Plans Association

- HDFC Ergo Health Insurance Ltd

- United Concordia

- Other Key Players

Recent Development

- In June 2024, Canadian families with children under 18 may qualify for the new Canada Dental Care Plan (CDCP). This initiative aims to alleviate the financial burden of out-of-pocket dental expenses for individuals without a private dental plan, particularly those below a certain income threshold, similar to benefits typically offered to full-time employees. The implementation of this strategy is being rolled out gradually.

- In May 2024, the Canadian government is celebrating significant progress in making oral healthcare more affordable and accessible. By this week, two million seniors in Canada will have received coverage under the Canadian Dental Care Plan (CDCP), with around 90,000 seniors already benefiting from services provided by approximately 10,000 participating providers.

- In May 2024, graduates from Loma Linda University School of Dentistry are celebrating innovation and community engagement. Chief Information Officer David Tsao shares insights on the importance of persistence and service, while students reflect on compassion and diversity within the field of dentistry.

- In May 2024, Plum founders Abhishek Poddar and Saurabh Arora are transforming health insurance by introducing comprehensive features, including dental plans and chronic disease management. Their goal is to expand their reach and integrate technology, currently serving over 4,000 companies.

Report Details

| Report Characteristics |

| Market Size (2024) |

USD 213.4 Bn |

| Forecast Value (2033) |

USD 489.2 Bn |

| CAGR (2024-2033) |

9.7% |

| Historical Data |

2018 – 2023 |

| The US Market Size (2024) |

USD 79.3 Bn |

| Forecast Data |

2025 – 2033 |

| Base Year |

2023 |

| Estimate Year |

2024 |

| Report Coverage |

Market Revenue Estimation, Market Dynamics, Competitive Landscape, Growth Factors and etc. |

| Segments Covered |

By Coverage (Dental Preferred Provider Organizations (DPPO), Dental Health Maintenance Organizations (DHMO), Dental Indemnity Plans, and Others), By Type (Preventive, Basic, and Major), By Demographic (Senior Citizens, Adults, and Minors) |

| Regional Coverage |

North America – The US and Canada; Europe – Germany, The UK, France, Russia, Spain, Italy, Benelux, Nordic, & Rest of Europe; Asia- Pacific– China, Japan, South Korea, India, ANZ, ASEAN, Rest of APAC; Latin America – Brazil, Mexico, Argentina, Colombia, Rest of Latin America; Middle East & Africa – Saudi Arabia, UAE, South Africa, Turkey, Egypt, Israel, & Rest of MEA

|

| Prominent Players |

Cigna, AXA, AFLAC Inc, Allianz SE, Aetna, Ameritas Life Insurance Corp, United HealthCare Services Inc., Metlife Services & Solutions, Delta Dental Plans Association, HDFC Ergo Health Insurance Ltd, United Concordia, and Other Key Players |

| Purchase Options |

We have three licenses to opt for: Single User License (Limited to 1 user), Multi-User License (Up to 5 Users) and Corporate Use License (Unlimited User) along with free report customization equivalent to 0 analyst working days, 3 analysts working days and 5 analysts working days respectively. |

Frequently Asked Questions

The Global Dental Insurance Market size is estimated to have a value of USD 213.4 billion in 2024 and is expected to reach USD 489.2 billion by the end of 2033.

North America is expected to be the largest market share for the Global DENTAL INSURANCE Market with a share of about 44.2% in 2024.

Some of the major key players in the Global Dental Insurance Market are Cigna, AFLAC Inc., AXA, and many others.

The market is growing at a CAGR of 9.7 percent over the forecasted period.

The Global US Dental Insurance Market size is estimated to have a value of USD 79.3 billion in 2024 and is expected to reach USD 173.8 billion by the end of 2033.