Digital signage is a subset of signage that includes technologies such as LED, LCD & projection to showcase digital content like images, videos, streaming media, & information. These digital displays, including billboards, are used in numerous settings like transportation systems, public spaces, museums, stadiums, hotels, restaurants, retail stores, & corporate buildings for purposes like marketing, navigation, exhibitions, & outdoor advertising.

The Digital Signage Market is witnessing significant growth driven by its effectiveness in visual communication and customer engagement. According to LLCBuddy, 70% of Americans report having seen a digital display, and 64% of digital signage users cite increased consumer involvement as a key advantage. Additionally, 75% of caregivers and patients affirm that digital signage improves healthcare communication. Furthermore, 84% of retailers observe enhanced brand recognition through digital signage, while educational institutions (73%) see it as vital for communication. As visual data makes up 90% of brain intake and 30% of cortical activity, the market’s impact is profound.

As per Fugo Digital Signage, the Digital Signage Market is undergoing rapid transformation, driven by immersive engagement and data-rich formats. 60% of enterprises without current deployments plan to implement signage within the next two years, reinforcing a robust pipeline. Retail leads with 25% of global installations, leveraging digital displays that secure 400% more views and drive 68% of consumers to consider purchases.

Dwell time is 2.6x longer on digital screens, with 76% of users entering stores due to compelling signage. Moreover, 84% of viewers feel wait times are 35% faster. Mobile resolutions are shifting—360x800 (mobile), 1920x1080 (laptops), 768x1024 (tablets) enhancing UX. 70% of Americans saw a digital display last month, 52% last week. In education, 77% of students report better focus via digital signage. As

digital twins merge real-time data with content delivery, the sector is poised for intelligent, personalized expansion.

Digital Signage Key Takeaways

- Market Size and Growth: The Global Digital Signage Market is valued at USD 28.3 billion in 2023 and is projected to reach USD 58.1 billion by 2032, growing at a CAGR of 8.3%, reflecting strong demand across multiple sectors.

- Leading Segments: Video walls and kiosks are currently dominant, with kiosks expected to become the largest revenue-generating segment. Transparent LED screens are the fastest-growing segment due to high resolution, energy efficiency, and operational cost benefits.

- Component Analysis: Hardware leads the market in 2023, driven by demand for advanced displays (1080p, 4K, 8K) and glasses-free 3D technology. Software and services hold smaller shares, with services limited by lower maintenance requirements.

- Application and Usage: Retail dominates the market, leveraging digital signage for marketing and consumer engagement. The transportation sector is the fastest-growing application, with increasing use in stations, vehicles, and public spaces.

- Regional Performance: North America leads the market with a 35% revenue share in 2023, supported by strong retail adoption and specialized product providers. Asia Pacific is the fastest-growing region, led by India and China, driven by rising awareness, disposable income, and adoption in retail, healthcare, and hospitality.

Digital Signage Use Case

- Retail Engagement: Digital signage in stores captures customer attention, drives 68% of purchase consideration, and increases dwell time by 2.6x, enhancing brand visibility and sales.

- Transportation & Mobility: Real-time displays in airports, metro stations, bus stops, and on vehicles provide location updates, context-aware advertising, and travel information, improving commuter experience.

- Healthcare Communication: Hospitals and clinics utilize digital screens for patient information, wayfinding, health guidelines, and digital queue management, improving communication efficiency and patient satisfaction.

- Education & Corporate Training: Schools, universities, and corporate campuses use digital signage for announcements, interactive learning, and employee engagement, resulting in better focus and knowledge retention.

- Hospitality & Events: Hotels, convention centers, and stadiums deploy video walls and kiosks for event information, navigation, promotions, and immersive guest experiences, enhancing visitor engagement.

Digital Signage Market Dynamic

The growth of public infrastructure, transportation networks, & the construction of new commercial buildings, mainly in developing economies, is building promising opportunities within the digital signage market. Digital signage is expanding finding applications in different modes of public transportation, acting as a means to engage on-the-move travelers by giving real-time location data & context-aware advertising. In addition, it's rapidly becoming a standard feature in educational institutions, as schools & corporate campuses embrace digital signage systems.

However, the decline in export shipments & sluggish domestic demand for digital signage & display products, when compared to the pre-COVID-19 era, has temporarily hindered the need for digital signage. Yet, sectors like hospitals & restaurants continue to use digital signage for different purposes, including digital payments, digital ordering, drive-through services, & displaying social guidelines on digital screens.

Digital Signage Market Research Scope and Analysis

By Type

The video walls are a driving factor in the growth of the market, & are anticipated to persist through the forecast period. The video walls & kiosks segment claims substantial shares in 2023, with video screens following closely. Video walls & screens have gained significant traction in locations like shopping malls & other public areas. However, in the coming times, the kiosks segment is anticipated to become the most revenue-generating category, ultimately becoming the largest type segment globally. Kiosks are commonly employed for providing information & advertising in educational institutions & retail settings.

Furthermore, the transparent LED screens segment is anticipated to emerge as the fastest-growing sector, and show significant growth in the forecast period. Transparent LED screens provide a transparency level of over 80% while maintaining high resolution. Moreover, they are energy-efficient, effectively lowering power consumption & optimizing users' operational costs. These compelling attributes are expected to drive the need for transparent LED screens over the next six years, strengthening the growth of this segment.

By Component

In 2023, the hardware components segment leads securing the largest market share, & it's expected to maintain this position in the forecast period. Hardware components include several elements like displays, parts crucial for developing digital panels, banners, & more. Hardware requirements are considerable compared to software, contributing to its significant share in the industry. The growing popularity of innovative display technologies like 1080p, 4K,

4K-Tv, and

8K displays is set to drive the need for hardware components in the years to come. Furthermore, advancements in 3D technology have led to the development of glasses-free

3D displays, which are used in various products.

Moreover, the services segment registers lower demand comparatively due to fewer maintenance & service requirements. The services offered within the industry include integration & installation, maintenance, and consulting. Further, the major services include setting up digital displays & ensuring internet connectivity. As a result, service offerings are more affordable in comparison to hardware & software needs, leading to a smaller market share for this segment.

By Location

The market is categorized into in-store and out store, in terms of location. In 2023, the in-store location segment leads by securing the largest share of the market. This category involves the installation of digital posters within enclosed spaces, including corporate offices, shopping malls, banks, retail stores, & healthcare centers. The significant dominance of this segment can be said due to the large demand from retail stores, which stand out as the most promising application sector for digital advertising displays. It's expected that this segment will maintain its position in the global market, sustaining a steady growth trend throughout the forecast period due to its consistent demand.

Further, the out-store location segment is anticipated to notice rapid growth in the coming years. This growth in demand at out-store locations can be said due to the growing transportation sector, mainly in developing nations. Additionally, the rise in the necessity to effectively promote products on a high scale & the emergence of popular trends such as introductory offers on products and services, election campaigns, as well an increase in the number of live concerts & shows, are likely to drive the adoption of digital posters in open spaces, further driving the growth of the out-store segment.

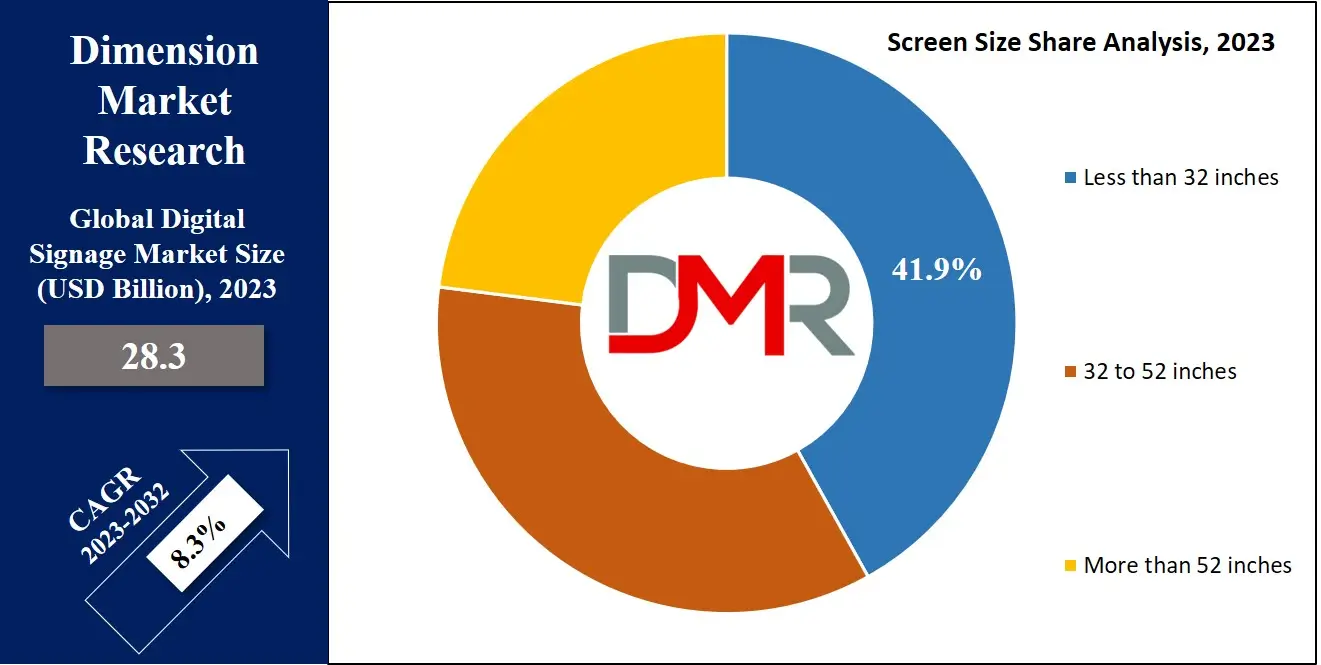

By Screen Size

The below 32-inch display segment captures the largest market share in 2023, primarily driven by its broad adoption in the retail industry. The constraints of retail store dimensions make smaller-sized digital displays more practical, resulting in their higher use & significant market share, which is anticipated to continue as the dominant force in the industry.

Also, the digital signage landscape is growing, with changing size requirements & increase in demands for more impactful content. The market for 32 to 52-inch digital displays is anticipated to notice fast growth in response to growing demand from corporate, healthcare & retail sectors. Moreover, the market for displays larger than 52 inches is also set to grow significantly, driven by the booming transportation sector & the advertising industry's continued growth.

By Application

The retail sector dominates the market, holding the largest share of the overall global digital signage market in 2023. Retail is a major industry that heavily depends on digital advertising to market & promote its products & services. Intense competition among retailers, driven by the vast array of offerings, has increased the significance of effective marketing strategies. In addition, the retail sector largely uses digital posters as a highly effective means of capturing the attention of target consumers.

Further, the transportation segment is anticipated to be the fastest-growing sector, noticing large expansion throughout the forecast period. The transportation sector includes digital promotions & posters at locations like railway stations, metro stations, airports, & bus stops. Moreover, digital displays are broadly deployed on vehicles like public buses, taxis, & other modes of transportation for advertising products & services. The fast urbanization & expanding transportation industry in emerging economies are expected to drive the advertising sector's growth, along with fueling the digital signage market.

The Global Digital Signage Market Report is segmented on the basis of the following:

By Type

- Video Walls

- Video Screen

- Kiosks

- Digital Poster

- Transparent LED Screen

- Others

By Component

- Hardware

- Software

- Service

By Location

By Screen Size

- Less than 32 Inches

- 32 to 52 Inches

- More than 52 Inches

By Application

- Retail

- Corporate

- Hospitality

- Education

- Government

- Transportation

- Others

Digital Signage Market Regional Analysis

North America leads the overall global market by accounting for about

35.0% of the revenue share in 2023, followed by Europe. This strong position is linked to the growth in the number of specialized product providers & a growing demand for signage in the retail sector. Further, the U.K., Germany, & the U.S. are expected to experience significant growth, driven primarily by growing research & development efforts to enhance product quality & government initiatives to implement digital signage in various offices, ensuring a continuous flow of information.

Moreover, during the forecast period, Asia Pacific is anticipated to be the fastest-growing region, driven by an increased awareness of the advantages of digital signage. Mainly, India & China are expected to experience large expansion, primarily due to the growth in usage of digital signage in hospitals, retail stores, corporate offices, & hotels. Further, the increase in disposable income has led to more visitors in malls & multiplex stores in emerging Asian countries, which enterprises are capitalizing on by using large displays to improve audience engagement. As the number of shopping malls & multiplexes continues to grow, the adoption of digital signage in the hospitality industry is anticipated to grow.

By Region

North America

Europe

- Germany

- The U.K.

- France

- Italy

- Russia

- Spain

- Benelux

- Nordic

- Rest of Europe

Asia-Pacific

- China

- Japan

- South Korea

- India

- ANZ

- ASEAN

- Rest of Asia-Pacific

Latin America

- Brazil

- Mexico

- Argentina

- Colombia

- Rest of Latin America

Middle East & Africa

- Saudi Arabia

- UAE

- South Africa

- Israel

- Egypt

- Rest of MEA

Digital Signage Market Competitive Landscape

The digital signage market is moderately fragmented, as it consists of big global companies, like NEC Display Solutions Ltd, Panasonic Cor, Samsung & Sony Corp, focusing on the hardware side of things. On the software side, there are various medium & smaller companies. Additionally, new players keep joining the market, bringing innovative product applications & serving as specialized niche players in this industry.

For instance, in March 2022, Planar introduced two new LED video wall display collections, the Planar Luminate Pro Series & Planar Venue Pro Series, customized to meet the needs of dynamic events &well-lit spaces. These new displays come with innovative components that make it simple & faster to set up & take down for temporary & mobile events. They also provide the convenience of full front development & servicing, making them apt for more permanent wall-mounted applications.

Some of the prominent players in the Global Digital Signage Market are

- Sony Corp

- NEC Display Solution

- Panasonic Corp

- Samsung

- LG Display

- Barco Nv

- Cisco System

- BrightSign LLC

- Hitachi Ltd

- Planar System Inc

- Other Key Players

Recent Developments

- In August 2025: Palmer Digital Group introduced its first battery-powered kiosk solutions, designed for retail and hospitality environments. These portable kiosks offer up to 24 hours of battery life per charge and feature wireless occupancy sensors to optimize customer engagement strategies.

- In August 2025: Bluefin International launched COLORFRAME, a customizable digital signage frame that allows customers to select from a wide range of RAL color finishes. This innovation enables users to tailor the frame color to match their branding or interior decor, enhancing the visual appeal of digital signage installations.

- In August 2025: Navori Labs acquired Signagelive, forming the world's largest independent, channel-only content management system (CMS) platform provider by installed base. The merger aims to enhance capabilities in scalable, API-first, headless CMS solutions enriched with AI analytics and advanced data integrations.

- In May 2025: ScreenCom Group was formed following the acquisition of Sony's digital signage software division. The merger positions the combined company as an end-to-end provider of integrated solutions for visual communication and workplace optimization.

Digital Signage Market Report Details

| Report Characteristics |

| Market Size (2023) |

USD 28.3 Bn |

| Forecast Value (2032) |

USD 58.1 Bn |

| CAGR (2023-2032) |

8.3% |

| Historical Data |

2017 – 2022 |

| Forecast Data |

2023 – 2032 |

| Base Year |

2023 |

| Estimate Year |

2024 |

| Report Coverage |

Market Revenue Estimation, Market Dynamics, Competitive Landscape, Growth Factors and etc. |

| Segments Covered |

By Type (Video Walls, Video Screen, Kiosks, Digital Poster, Transparent LED Screen, and Others), By Component (Hardware, Software, and Service), By Location (In-store, and Out-store), By Screen Size (Less than 32 inches, 32 to 52 inches, and More than 52 inches), By Application (Retail, Corporate, Hospitality, Education, Government, Transportation, and Others) |

| Regional Coverage |

North America – The US and Canada; Europe – Germany, The UK, France, Russia, Spain, Italy, Benelux, Nordic, & Rest of Europe; Asia- Pacific– China, Japan, South Korea, India, ANZ, ASEAN, Rest of APAC; Latin America – Brazil, Mexico, Argentina, Colombia, Rest of Latin America; Middle East & Africa – Saudi Arabia, UAE, South Africa, Turkey, Egypt, Israel, & Rest of MEA |

| Prominent Players |

Sony Corp, NEC Display Solution, Panasonic Corp, Samsung, LG Display, Barco NV, Cisco System, BrightSign LLC, Hitachi Ltd, Planar System Inc, and Other Key Players |

| Purchase Options |

We have three licenses to opt for: Single User License (Limited to 1 user), Multi-User License (Up to 5 Users), and Corporate Use License (Unlimited User) along with free report customization equivalent to 0 analyst working days, 3 analysts working days and 5 analysts working days respectively. |