Market Overview

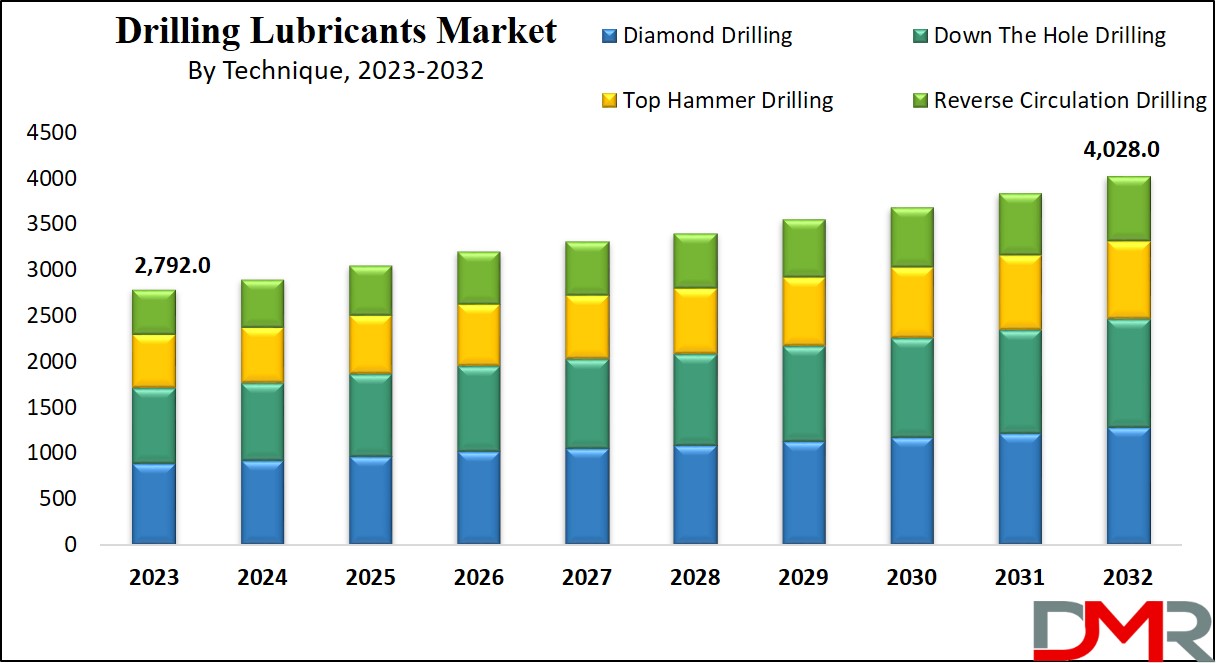

The Global Drilling Lubricants Market is expected to reach a valuation of USD 2,792 Million in 2023 and is set to grow with a 4.2% CAGR for the forecasted period (2023-2032).

Drilling lubricants are essential substances used in the drilling of boreholes across various sectors such as oil and gas, mining, and construction. These lubricants play a crucial role by reducing friction between the drill bit and geological formations, cooling the drill bit, and facilitating the removal of drill cuttings from boreholes.

Operating within the lubricant oil manufacturing industry, which employed around 17,163 people and generated revenues exceeding $25 billion in the U.S. as of February 2024, the drilling lubricants market significantly impacts economic activities and industrial operations.

Drilling lubricants are essential substances used in the drilling of boreholes across various sectors such as oil and gas, mining, and construction. These lubricants play a crucial role by reducing friction between the drill bit and geological formations, cooling the drill bit, and facilitating the removal of drill cuttings from boreholes.

Operating within the lubricant oil manufacturing industry, which employed around 17,163 people and generated revenues exceeding $25 billion in the U.S. as of February 2024, the drilling lubricants significantly impacts economic activities and industrial operations.

The year 2024 presents varied growth opportunities within the drilling lubricants market, appealing to both major industry players and new entrants. Established companies are likely to continue their innovation, particularly towards the development of environmentally sustainable lubricants, aligning with stricter environmental regulations. Similarly, the Drilling Fluids is poised for growth due to these advancements.

Conversely, smaller or newly established businesses can capitalize on niche markets by offering specialized products or focusing on regional demands. The market's potential is further underscored by the efficiency of recycling used motor oil, where only one gallon is required to produce the same 2.5 quarts of lubricating oil as 42 gallons of crude oil would, emphasizing a significant opportunity for sustainable and cost-effective practices.

The drilling lubricants is witnessing a shift towards environmental sustainability, driven by increasing regulatory demands for environmentally friendly products. There is also a growing demand for lubricants that can withstand extreme conditions, such as those encountered in deepwater or high-pressure high-temperature (HPHT) drilling operations.

A study from the Norwegian Continental Shelf, analyzing 576 wells, reported kick rates of 9% in standard drilling, 32% in deepwater, and 139% in HPHT wells, highlighting the need for highly effective lubricants in these challenging environments.

The substantial sales volume of automotive lubricants, which reached 7,527.27 KL in the first quarter of 2023, indicates robust demand and broader applications for lubricants, including those used in drilling operations. This growth is also reflected in the broader Oilfield Chemicals and Oil Spill Management, both of which are witnessing increasing demand for specialized products.

Moreover, trade insights reveal Russia, the United States, and Vietnam as the top three importers of India’s drilling fluids, together accounting for 89% of its exports. This data provides strategic market entry and expansion insights, essential for businesses aiming to penetrate these significant markets.

By integrating these insights, companies operating within the drilling lubricants sector can tailor their strategies to meet evolving market demands and regulatory standards, thereby positioning themselves advantageously in a competitive global landscape.

This comprehensive market understanding is also crucial for engaging effectively with clients, showcasing deep industry knowledge, and facilitating informed decision-making processes.

Key Takeaways

- The Global Drilling Lubricants Market is valued at USD 2,792 million in 2023 with a projected CAGR of 4.2% from 2023 to 2032.

- Diamond Drilling leads the market in the Technique segment with the highest revenue share in 2023.

- The oil and gas sector is a key driver of demand for drilling lubricants, ensuring efficient drilling processes.

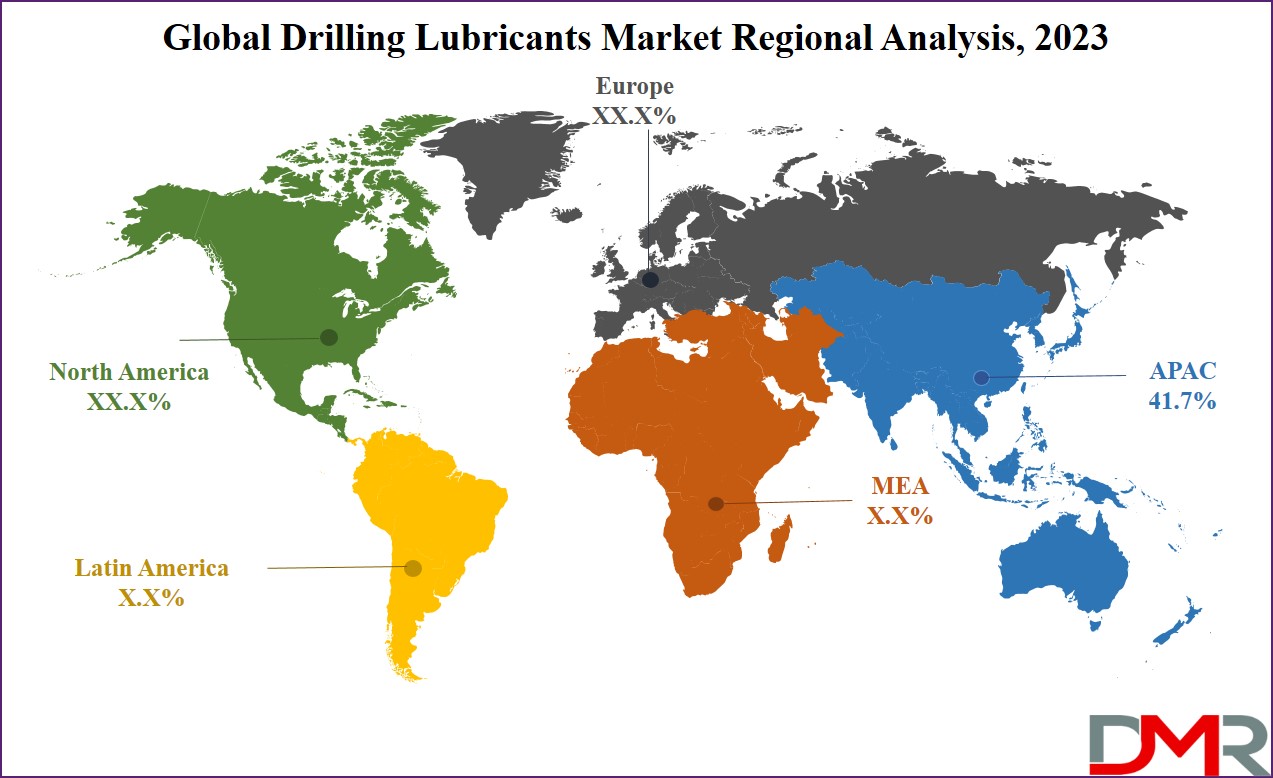

- The Asia Pacific region dominated the market in 2023, accounting for 41.7% of the global share.

- Growing demand for Generative AI in Oil and Gas and Artificial Intelligence in Oil and Gas Market is also expected to influence market dynamics in the near future.

Market Dynamic

The Drilling Lubricant Market dynamics are driven by expanding drilling activities across various sectors, including oil and gas, construction, mining, & others. The rising global demand for energy resources fuels the requirements for efficient drilling operations, hence elevating the desire for more developed & advanced lubricant solutions.

Growing environmental awareness leads to the creation of eco-friendly lubricants, while advancements & further improvements in technology result in specialized formulations made to withstand extreme operational conditions. Collaborative alliances & strategic mergers optimize the collective industry expertise & market outreach.

Nevertheless, the market encounters challenges such as fluctuating oil prices and the growing shift towards renewable energy sources, necessitating continuous innovation, robust product development, and strategic partnerships to adeptly navigate these complexities and secure a competitive foothold. This ever-changing context highlights the industry's ability to endure & adjust to shifts in market dynamics & new trends, also influencing the broader

Marine Lubricants and

Industrial Lubricants Market.

Research Scope and Analysis

By Technique

Under the Technique segment, Diamond Drilling dominates the market with a maximum revenue share in 2023 as compared to its counterparts. Diamond drilling holds a vital position in the drilling lubricant market, specifically valued for its precision in challenging spaces such as concrete & rock.

Extensively utilized in construction, mining, & geological exploration, diamond drilling depends on effective lubrication. These lubricants manage heat, reduce friction, & prevent bit wear.

Specialized formulations are essential due to high temperatures & pressures. As the diamond drilling sector grows, manufacturers are anticipated to create specific lubricants to enhance efficiency and optimize outcomes in several sectors.

By End Use

The oil and gas sub-segment under the segmentation of End Use, stands out as a cornerstone within the drilling lubricant market. Drilling lubricants play a vital role in this sector, leading to seamless & efficient drilling processes.

These lubricants are indispensable for protecting wellbore integrity, regulating thermal conditions, curbing friction, & minimizing damage to equipment. Their significance amplifies while addressing the intricacies of drilling across several geological formations, temperature ranges, and depths.

As the oil and gas sector continues to explore & exploit energy resources, the requirement for high-performance drilling lubricants remains steadfast. These lubricants are critical in optimizing drilling activities, leading to efficiency in operation, & ultimately fostering drilling endeavors in this sector.

Moreover, the Mining sector followed by Oil & Gas sector is anticipated to grow with a maximum CAGR for the forecast period. It encompasses the extraction of metals, minerals & several resources valuable to a diverse range of sectors worldwide.

These minerals extraction globally is fostering the growth of this sector in upcoming years. The increase in industrialization & burgeoning infrastructural developments is propelling the demand for such metals & vital resources, which is expected to drive the growth of this market.

The Drilling Lubricants Market Report is segmented on the basis of the following:

By Technique

- Diamond Drilling

- Top Hammer Drilling

- Down The Hole Drilling

- Reverse Circulation Drilling

By End-Use

- Oil & Gas

- Construction

- Mining

- Others

Regional Analysis

The

Asia Pacific region exhibits dominance in 2023, capturing a significant share of

41.7% globally. This growth trajectory can be accredited to the rapid expansion of pivotal end-use sectors, especially the flourishing oil and gas & construction sectors within the region.

Meanwhile, Europe commands a substantial revenue share followed by Asia-Pacific. Importantly, the European construction sector stands as a cornerstone, contributing approx. 9.2% of the overall GDP.

Adopting a forward-looking approach, this sector is actively utilizing digitalization & innovation, incorporating advanced technologies such as BIM (Building Information Modelling),

3D printing, & other digital technologies to enhance efficiency, cost management, & environmental sustainability. This shift is said to elevate the domain of construction, finally leading to a positive ripple effect on the growth of the market in the forthcoming years.

By Region

North America

Europe

- Germany

- The U.K.

- France

- Italy

- Russia

- Spain

- Benelux

- Nordic

- Rest of Europe

Asia-Pacific

- China

- Japan

- South Korea

- India

- ANZ

- ASEAN

- Rest of Asia-Pacific

Latin America

- Brazil

- Mexico

- Argentina

- Colombia

- Rest of Latin America

Middle East & Africa

- Saudi Arabia

- UAE

- South Africa

- Israel

- Egypt

- Rest of MEA

Competitive Landscape

The Global Drilling Lubricants Market presents a dynamic competitive landscape where established leaders and emerging players deploy diverse strategies to enhance market presence, foster innovation, and cater to evolving needs in drilling-dependent sectors.

Notably, a growing emphasis on environmental sustainability drives investment in eco-friendly drilling lubricants to meet the rising demand for environmentally conscious solutions, prompted by both consumer preferences and regulatory mandates.

Furthermore, market consolidation through mergers, acquisitions, and partnerships aids in expanding reach and optimizing operations. Advanced additive integration enables the delivery of high-performance lubricants with extended service life and improved environmental characteristics. Amidst this evolution, industry-specific research and development efforts contribute to strengthening companies' competitive positioning.

Some of the prominent players in the Global Drilling Lubricants Market are:

- Baroid Industrial Drilling Products

- Baker Hughes, Inc.

- Halliburton, Inc.

- Chevron Corporation

- SINO MUD

- Imdex Limited

- Schlumberger Limited

- Other Key Players

Recent Development

- In November 2024, Hephae Energy raised $4 million in funding to advance the development of its high-temperature drilling technology. The funds will be used to conduct extensive field trials and optimize the technology for commercial applications.

- In July 2024, TotalEnergies acquired Tecoil, a company specializing in the regeneration of used lubricants. This acquisition aims to strengthen TotalEnergies' capabilities in sustainable lubricant solutions and circular economy initiatives.

- In April 2024, GA Drilling announced the first close of a $15 million funding round to further develop its advanced drilling technologies. The funding will help expand operations and accelerate commercialization efforts for global markets.

- In December 2024, Alberta invested $50 million to establish Canada's first dedicated test site for advancing energy technologies. The initiative focuses on fostering innovation in clean energy and drilling technologies within the province.

- In August 2024, SKF made a strategic acquisition to enhance its lubrication management offerings. This move aims to integrate advanced solutions into SKF’s portfolio to improve efficiency and reliability in industrial applications.

Report Details

| Report Characteristics |

| Market Size (2023) |

USD 2,792.0 Mnn |

| Forecast Value (2032) |

USD 4,028.0 Mn |

| CAGR (2023-2032) |

4.2% |

| Historical Data |

2017 - 2022 |

| Forecast Data |

2023 - 2032 |

| Base Year |

2022 |

| Estimate Year |

2023 |

| Report Coverage |

Market Revenue Estimation, Market Dynamics, Competitive Landscape, Growth Factors and etc. |

| Segments Covered |

By Technique (Diamond Drilling, Top Hammer Drilling, Down The Hole Drilling, and Reverse Circulation Drilling), and By End-Use (Oil & Gas, Construction, Mining, and Others). |

| Regional Coverage |

North America – The US and Canada; Europe – Germany, The UK, France, Russia, Spain, Italy, Benelux, Nordic, & Rest of Europe; Asia- Pacific– China, Japan, South Korea, India, ANZ, ASEAN, Rest of APAC; Latin America – Brazil, Mexico, Argentina, Colombia, Rest of Latin America; Middle East & Africa – Saudi Arabia, UAE, South Africa, Turkey, Egypt, Israel, & Rest of MEA |

| Prominent Players |

Baroid Industrial Drilling Products, Baker Hughes, Inc., Halliburton, Inc., Chevron Corporation, SINO MUD, Imdex Limited, Schlumberger Limited, and Other Key Players. |

| Purchase Options |

We have three licenses to opt for: Single User License (Limited to 1 user), Multi-User License (Up to 5 Users), and Corporate Use License (Unlimited User) along with free report customization equivalent to 0 analyst working days, 3 analysts working days and 5 analysts working days respectively. |

Frequently Asked Questions

The Global Drilling Lubricants Market is expected to reach a valuation of USD 2,792 Million in 2023.

The Global Drilling Lubricants Market is expected to grow at a compound annual growth rate (CAGR) of

42% from 2023 to 2032.

The Asia Pacific region has dominated the Global Drilling Lubricants Market with a significant revenue

share exceeding 41.7%.

Some of the prominent players in the Global Drilling Lubricants Market include Baroid Industrial Drilling

Products, Baker Hughes, Inc., Halliburton, Inc., Chevron Corporation, SINO MUD, Imdex Limited, etc.