Drone insurance is a distinctive and specialized type of insurance coverage designed to protect individuals and businesses that own and operate drones (unmanned aerial vehicles). It provides financial protection against potential liabilities, damages, and losses that may arise from drone operations. As the use of drones expands across multiple industries — including emerging applications like

drone taxi services drone insurance has become increasingly important for mitigating risks and ensuring regulatory compliance.

As drone use across industries like agriculture, logistics, and surveillance continues to rise rapidly, businesses have recognized their need for tailored insurance products to mitigate risks related to drone operations such as accidents or equipment malfunction. In parallel, insurers are also expanding offerings in segments like Term Insurance,

Cyber Insurance, and Pet Insurance, reflecting the broader industry trend of customizing products to diverse emerging needs, including emerging forms of unmanned aircraft insurance.

Recent developments in drone insurance emphasize offering more tailored coverage options. Insurers now specialize in offering policies for specific industries to protect businesses against risks related to drone operations like property damage, liability issues and cybersecurity threats posed by flying drones driving up demand for solutions tailored specifically towards meeting users' evolving needs, especially comprehensive drone liability coverage.

As the drone industry becomes more regulated, demand for comprehensive insurance has surged. New regulations in many countries mandate businesses operating drones to obtain coverage - further fuelling market expansion. Furthermore, increasing incidents related to drone accidents have necessitated businesses investing in insurance solutions in order to safeguard their investments and prevent possible claims and damages.

Opportunities in the market exist when insurers expand their offerings to cover emerging use cases such as drone deliveries and advanced industrial applications. With growing concerns around privacy and security, insurers should utilize this opportunity to create innovative products that address risks such as these to grow market presence and widen customer bases. Additionally, the rise of

Digital Insurance Platforms offers insurers the ability to integrate drone insurance seamlessly alongside products like Cyber Insurance, Term Insurance, and Travel Insurance, enhancing convenience for both commercial and individual policyholders.

As per electroiq & statista The global annuity insurance market experienced dramatic expansion between 2009 and 2023, with revenue growing from $776.7 billion to over $1.041.1 billion. Meanwhile, global gross premiums increased from $2.51 trillion in 2000 to $6.06 trillion by 2022 due to an increased need for insurance products worldwide.

Casualty insurance industry workforce also experienced rapid expansion from 2005-2023; employees increased from 652.1k in 2005 to 680.5k by 2023. Property insurance held the highest market share at 55.6% while life and health accounted for 44.4%, highlighting its wide coverage.

Allianz stands out among global insurers with its staggering market capitalization of $102.69 billion, followed by AIA, China Life and Ping An Insurance with respective market caps of $93.09 billion, $92.33 billion and $90.91 billion respectively. All these firms continue to dominate the industry while innovating new techniques while remaining highly successful and competitive. Many of these leading insurers are investing heavily in Digital Insurance Platforms to integrate products ranging from Drone Insurance to

Term Insurance, ensuring seamless customer experiences and cross-selling opportunities.

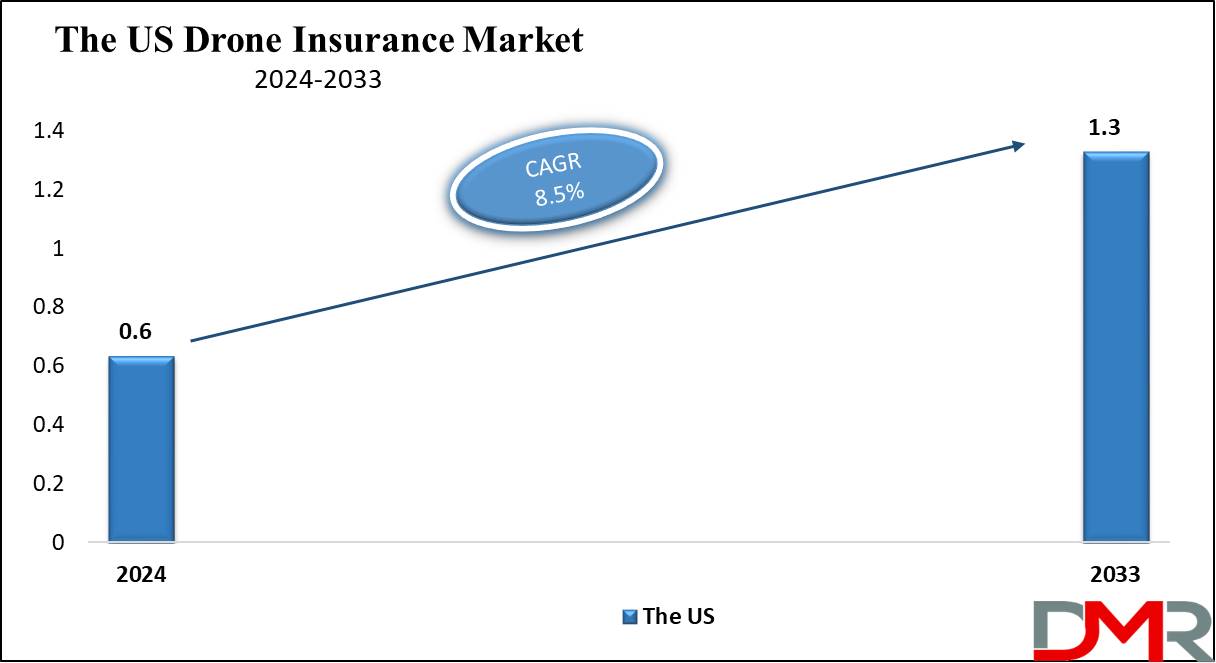

The US Drone Insurance Market

The US

Drone Insurance Market is projected to

reach USD 0.6 billion in 2024 at a compound annual

growth rate of 8.5% over its forecast period.

The U.S. drone insurance market provides many growth opportunities due to expanding commercial drone applications in industries like agriculture, construction, and logistics. More regulatory requirements for liability coverage, coupled with the growth in the adoption of drones for delivery services and infrastructure inspections, are driving demand for customized insurance solutions, creating room for innovative, usage-based policies and comprehensive risk coverage.

Further, the market is driven by the rising adoption of drones in sectors like agriculture, construction, and logistics, along with regulatory mandates for liability coverage. However, high insurance premiums & limited awareness about the importance of drone insurance among smaller operators act as restraints, slowing wider market penetration despite the growing demand for drone services.

Key Takeaways

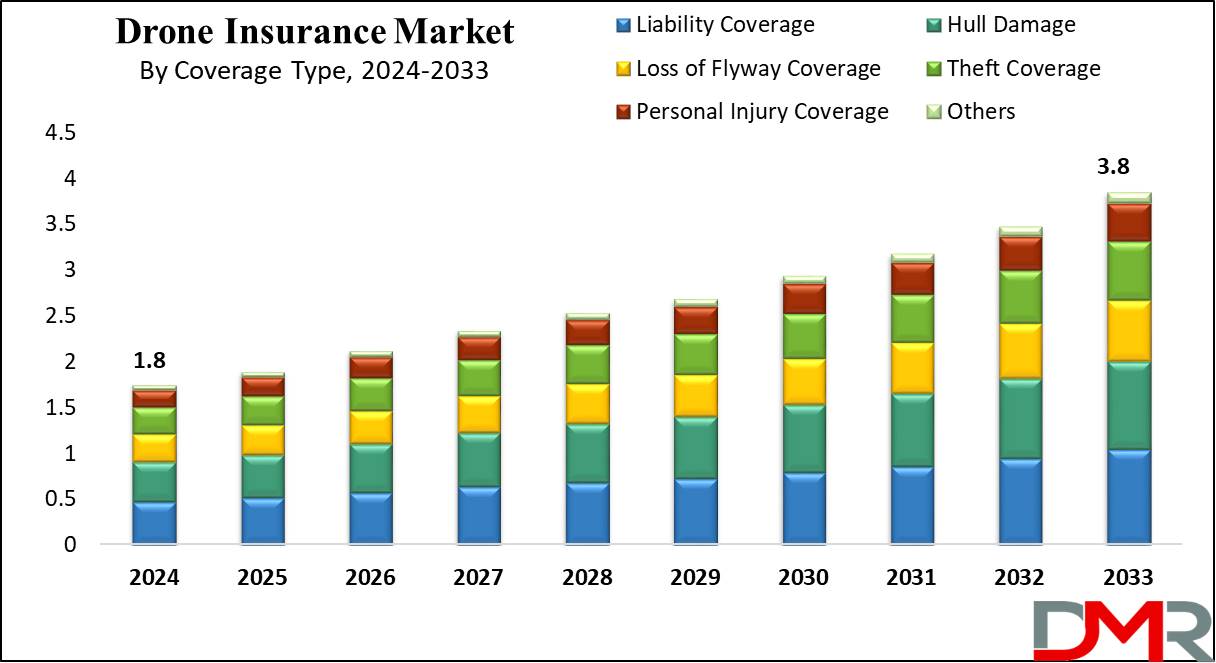

- Market Growth: The Drone Insurance Market size is expected to grow by 1.9 billion, at a CAGR of 9.1% during the forecasted period of 2025 to 2033.

- By Coverage Type: The liability coverage type is expected to lead in 2024 with a majority & is anticipated to dominate throughout the forecasted period.

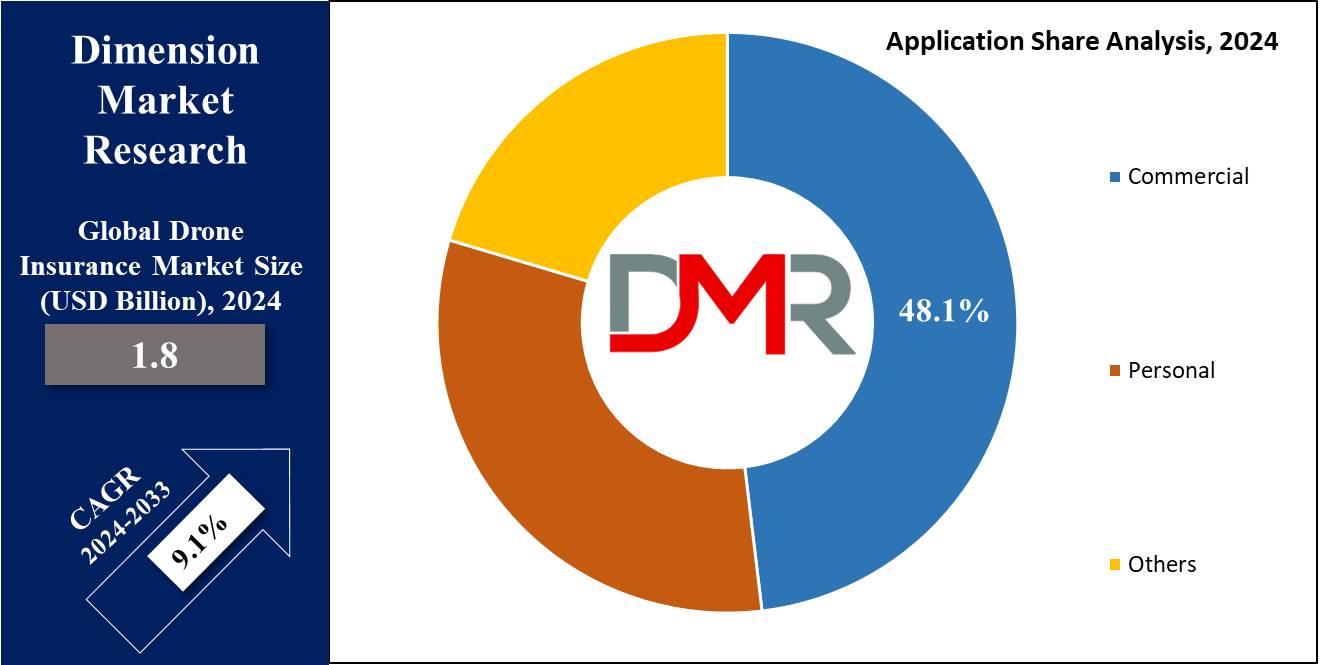

- By Application: The commercial segment is expected to get the largest revenue share in 2024 in the Drone Insurance Market.

- Regional Insight: North America is expected to hold a 39.8% share of revenue in the Global Drone Insurance Market in 2024.

- Use Cases: Some of the use cases of Drone Insurance include theft or loss, accidental damage, and more.

Use Cases

- Accidental Damage: Covers damage to the drone due to crashes, collisions, or malfunctions during flight.

- Liability Coverage: Protects against third-party claims for property damage or bodily injury caused by the drone.

- Theft or Loss: Insures against theft, vandalism, or loss of the drone during transport or operation.

- Payload and Equipment: Covers specialized cameras or sensors attached to the drone, safeguarding expensive equipment.

Market Dynamic

Driving Factors

Rising Drone Adoption

The growth in the use of drones across industries like agriculture, construction, and e-commerce has driven the demand for drone insurance. As more businesses integrate drones for tasks like surveying, delivery, and monitoring, the need for comprehensive insurance to cover liabilities and risks grows. The expansion into specialized products mirrors developments in other insurance lines like

Healthcare Insurance, Travel Insurance, and Cyber Insurance, where tailored coverage meets industry-specific demands.

Regulatory Framework

Governments are introducing stricter regulations for commercial drone operations, like mandatory insurance coverage. As regulatory requirements transform, businesses are more inclined to invest in drone insurance to comply with legal standards and protect their assets from unforeseen incidents.

Restraints

High Premium Costs

Drone insurance premiums can be expensive, mainly for businesses using high-end equipment or operating in riskier environments. This can discourage smaller companies or hobbyist operators from purchasing insurance, limiting the overall market growth.

Lack of Awareness

Many drone operators, especially hobbyists and small businesses, are unaware of the necessity or availability of drone insurance, with the lack of awareness, along with the perception that drones are low-risk, can restrain market demand.

Opportunities

Emerging Markets and Sectors

The expansion of drone use in new sectors such as healthcare, mining, and disaster management presents a significant opportunity for drone insurance providers. As these industries adopt drones for critical operations, the need for customized insurance policies will increase.

Technological Advancements

Innovations in drone technology, such as better sensors, AI, and autonomous systems, open up opportunities for insurers to offer more customized, data-driven policies. These developments allow real-time risk assessment, potentially lowering premiums and attracting more customers.

Trends

Usage-Based Insurance (UBI)

Insurers are increasingly adopting usage-based models where premiums are calculated based on drone flight hours, usage patterns, and risk factors. This flexible approach makes insurance more affordable for operators who fly less frequently or in lower-risk environments.

Integration of AI and Data Analytics

AI and real-time data analytics are becoming a trend in the drone insurance market. Insurers use drone flight data to assess risks more accurately, optimize claims processing, and provide customized policies based on actual usage and performance metrics.

Research Scope and Analysis

By Coverage Type

The liability coverage segment is set to lead the drone insurance market in 2024, by having a significant share of the market, due to its vital need for protection against third-party injury or property damage during drone operations. Whether for commercial or recreational use, liability insurance is important as drones become more common in sectors like delivery, aerial photography, and inspection services.

The growth in drone utilization increases the risk of accidents, making liability coverage highly important. In addition, many countries have regulatory need that mandate liability insurance before operators can obtain licenses, ensuring financial protection in case of accidents. Moreover, drone operators are now becoming more aware of the legal and financial risks associated with drone flights, driving the demand for liability coverage.

As drone technology transforms and operations become more complex, the chances of accidents also rise, which is likely to boost the growth of the liability coverage segment in the future. Complete liability insurance not only reduces financial risk but also enhances safety standards and the credibility of drone operations, encouraging broader use of drones across various industries.

By Application

Based on application, the commercial segment is expected to lead the drone insurance market in 2024, largely due to the increase in the use of drones across many industries like agriculture, real estate, construction, and film production. Drones in these sectors perform tasks like aerial photography, surveying, crop monitoring, and delivery services, all of which come with specific risks that demand customized insurance coverage.

The major share of the commercial segment also highlights the strict regulatory needs that govern commercial drone operations. Further, various countries need commercial drone operators to have full insurance that covers not only liability but also potential hull damage and theft, which ensures that businesses are protected from operational risks, helping various drone adoption in different industries.

In addition, as companies recognize the cost savings and efficiency that drones provide, demand for drones and related insurance products continues to grow. With the development in drone technology making them an even more attractive option in various fields, the commercial segment is likely to remain dominant as businesses highly incorporate drones into their operations and look insurance solutions that fit their specific needs.

The Drone Insurance Market Report is segmented on the basis of the following

By Coverage Type

- Liability Coverage

- Hull Damage

- Loss or Flyway Coverage

- Theft Coverage

- Personal Injury Coverage

- Others

By Application

- Commercial

- Personal

- Others

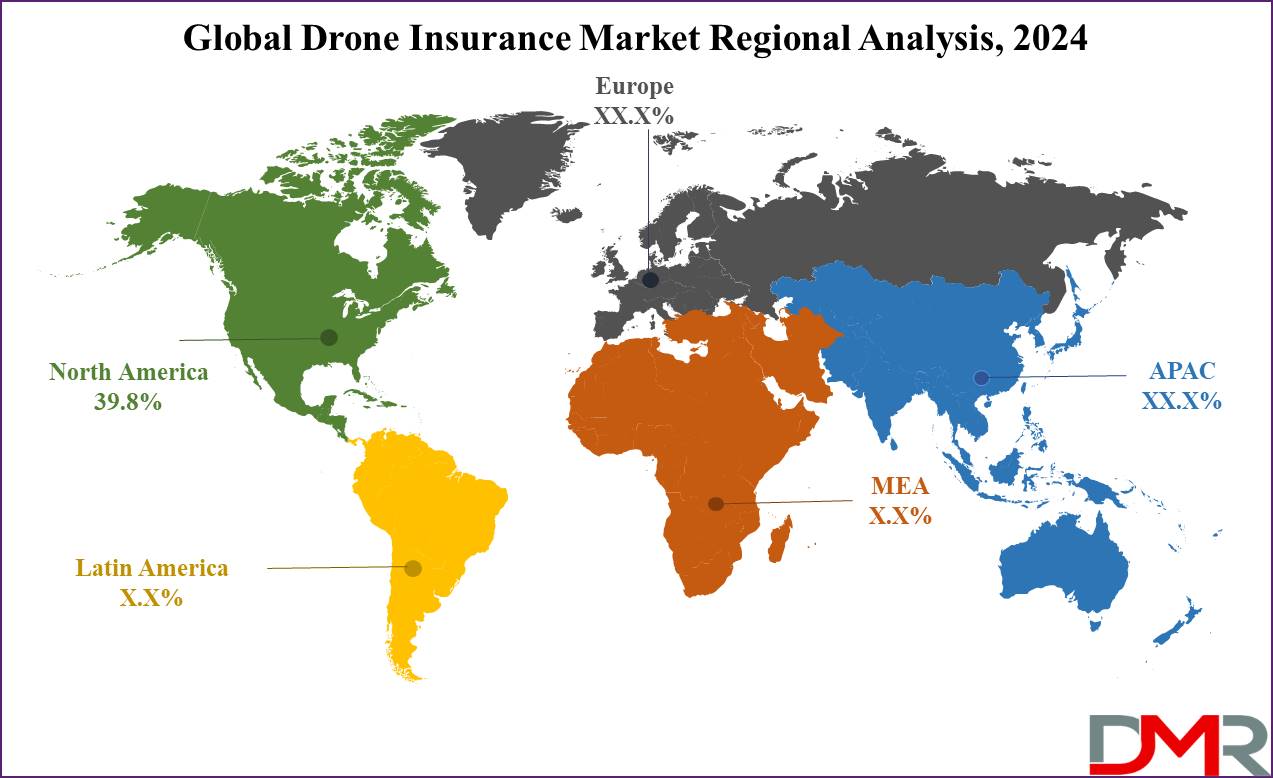

Regional Analysis

The Drone insurance market in North America is growing rapidly, as it is expected to

have 39.8% of the total market share in 2024 due to the increase in demand for drone services across industries like aerial photography, surveying, and delivery. As more commercial applications emerge, the number of drone operators is also growing, promoting the need for insurance.

In addition, new regulations focused on ensuring public & environmental safety are helping to create a more reliable and secure drone industry. These rules, along with the rise in demand for insurance coverage like protection against physical damage, third-party liability, and bodily injury, are driving the market’s expansion in North America.

Further, the Asian market is also experiencing major growth due to an increase in drone manufacturers and the need for services like aerial photography, surveying, and deliveries. However, challenges like limited awareness about the importance of drone insurance, a lack of standardization in policies, and the high cost of premiums are holding the market back. However, the drone insurance market in Asia is expected to grow substantially as the demand for insurance coverage to protect against risks continues to rise, driven by the growing use of drones across various sectors.

By Region

North America

Europe

- Germany

- The U.K.

- France

- Italy

- Russia

- Spain

- Benelux

- Nordic

- Rest of Europe

Asia-Pacific

- China

- Japan

- South Korea

- India

- ANZ

- ASEAN

- Rest of Asia-Pacific

Latin America

- Brazil

- Mexico

- Argentina

- Colombia

- Rest of Latin America

Middle East & Africa

- Saudi Arabia

- UAE

- South Africa

- Israel

- Egypt

- Rest of MEA

Competitive Landscape

The drone insurance market is becoming highly competitive as many insurers enter the space, providing specialized policies customized to both recreational and commercial drone operators. Competition is driven by the higher demand for coverage that addresses many risks, like liability, damage, theft, and third-party claims.

Insurers are also aiming to offer flexible pricing and usage-based models to attract customers. With developments in drone technology and regulatory requirements evolving, companies are continuously innovating their offerings to meet the growing needs of diverse industries using drones.

Some of the prominent players in the Global Drone Insurance are

- Moonrock Insurance

- Avion Insurance

- SkyWatch

- AIG US

- Coverdrone

- Aligned

- USAIG

- BWI

- REIN

- Global Aerospace Inc

- Other Key Players

Recent Developments

- In March 2024, Terra Drone Corporation and Advanced Air Mobility (AAM) unveiled an investment in Aloft Technologies (Aloft), a company focusing on developing UTM, which makes Terra Drone the largest shareholder in Aloft, with Aloft becoming an affiliate company of Terra Drone, as the partnership also marks Terra Drone’s official entry into the US, which is considered the world’s largest market for drones and AAMs.

- In February 2024, AutoPylot launched embedded drone insurance into its all-in-one flight planning solution, underwritten by Allianz Commercial, and in collaboration with Stere, AutoPylot emerges as one of the first FAA-approved B4UFLY and LAANC service providers to integrate complete insurance directly into its platform, which shows a major moment in the evolution of the drone ecosystem, simply integrating the opportunity to place insurance coverage into the regulatory compliance and flight planning process.

- In October 2023, SkyWatch, announced that the company has acquired Droneinsurance.com’s assets, which bring together two innovative platforms, to provide its clients with a better experience with more options. It also marks a major milestone in the drone insurance sector and underlines SkyWatch’s commitment to providing unmatched coverage and service to drone operators across North America.

- In October 2023, Moonrock Drone Insurance announced that it has been accepted as a member of the Managing General Agents Association (MGAA), which will help the company in attaining many opportunities to play an active part in the insurance discourse and contribute to all the important discussions in the MGA space.

- In October 2023, Moonrock Insurance introduced an exclusive partnership with Swiss Drone manufacturer Flyability, which will allow all commercial pilots flying Elios drones designed for the inspection and exploration of the most inaccessible places to obtain a personalized insurance product for their drone through Moonrock Insurance.