Drug discovery markets play an essential role in driving healthcare forward as they enable the identification and development of new pharmaceutical treatments. The broader pharmaceutical research market continues to evolve, targeting future growth with increased research and development efforts within the pharmaceutical sector particularly to meet growing demands for innovative treatments.

The industry aims for further expansion with increased considerations in research and development efforts across its entirety. Market experts anticipate continued market expansion over the coming years due to technological innovations such as

artificial intelligence (AI) and high-throughput screening (HTS).

Major manufacturers and their research affiliates are making considerable investments in drug discovery tools to accelerate drug discovery processes, shorten time-to-market, and increase efficiency when selecting drug candidates. North America represents an essential region in this market due to its advantages for pharmaceutical research and development infrastructure.

Pfizer Inc., Agilent Technologies, and many other leading pharmaceutical and biotech firms make significant contributions in terms of small molecule drugs, biologic therapies, and new therapeutics development. As healthcare needs and diseases change rapidly, drug discovery should experience rapid expansion on the market. This growth can be linked to global investments in innovation in research and development, further strengthening the drug development industry.

A survey conducted by the Life Science Strategy Group involving 120 clinical development decision-makers across the U.S., China, and Europe indicates that industry professionals are implementing strategic changes to sustain their market share amid an increasingly unpredictable market landscape. Over the past two decades, the pharmaceutical industry has undergone transformational shifts, including patent expirations, a growing emphasis on biologics, and the downsizing of in-house drug discovery operations by major pharmaceutical companies. These factors have collectively accelerated the adoption of outsourcing strategies, enabling firms to optimize efficiency and focus on core competencies.

A breakdown of the drug discovery process into distinct phases—hit confirmation, lead generation, lead optimization, and high-speed screening—has facilitated specialization, allowing industry players to enhance efficiency and innovation in their respective domains.

Furthermore, drug discovery outsourcing is expanding rapidly, driven by increasing global R&D pipelines and service expansions. Industry estimates suggest that 75.0% to 80.0% of research and development (R&D) expenditure in the

biopharmaceutical sector can be outsourced, creating significant growth opportunities for Contract Research Organizations (CROs). As pharmaceutical companies continue to streamline operations and optimize resources, the rising demand for outsourced R&D services is expected to be a key driver of market expansion in the coming years.

The US Drug Discovery Market

The US Drug Discovery Market is projected to be valued at USD 25.0 billion in 2024. It is expected to witness subsequent growth in the upcoming period as it holds USD 54.5 billion in 2033 at a CAGR of 9.0%.

The United States is considered an innovator and hub for drug discovery due to its robust pharmaceutical sector and significant investments in research and development. Key trends to note include an increasing reliance on artificial intelligence for drug discovery. AI will meet the demand for data processing at high volumes, improved target identification capabilities and more efficient processes when developing drugs.

AI and

machine learning technologies have significantly expedited the identification and recruitment of new candidates through high-throughput screening approaches and precision medicine approaches. As trends emerge, more pharmaceutical firms are teaming up with academic institutions or small biotech firms in an attempt to foster an innovation ecosystem. Another factor driving growth within the U.S. drug discovery market was personalized medicine, which involves customizing therapies according to individual patient profiles.

Additionally, regulatory advances included FDA support for novel clinical trial designs and expedited approval processes that helped expand market opportunities. Government funding and partnerships, or increasing use of biologic drugs alongside small molecule medicines are also contributing to an expansion in domestic pharmaceutical sales something which underpins the status of the United States as a trendsetter in pharmaceutical developments.

Key Takeaways

- Global Market Value: The global drug discovery market size is estimated to have a value of USD 60.9 billion in 2024 and is expected to reach USD 138.5 billion by the end of 2033.

- The US Market Value: The US Drug Discovery Market is projected to be valued at USD 54.5 billion in 2033 from a base value of USD 25.0 billion in 2024 at a CAGR of 9.0%.

- By Technology Segment: High Throughput Screening (HTS) has dominated this segment as it holds 24.1% of market share in 2024.

- By End User Segment Analysis: Pharmaceutical companies are projected to dominate the end-user segment in this market with 49.6% of the market share in 2024.

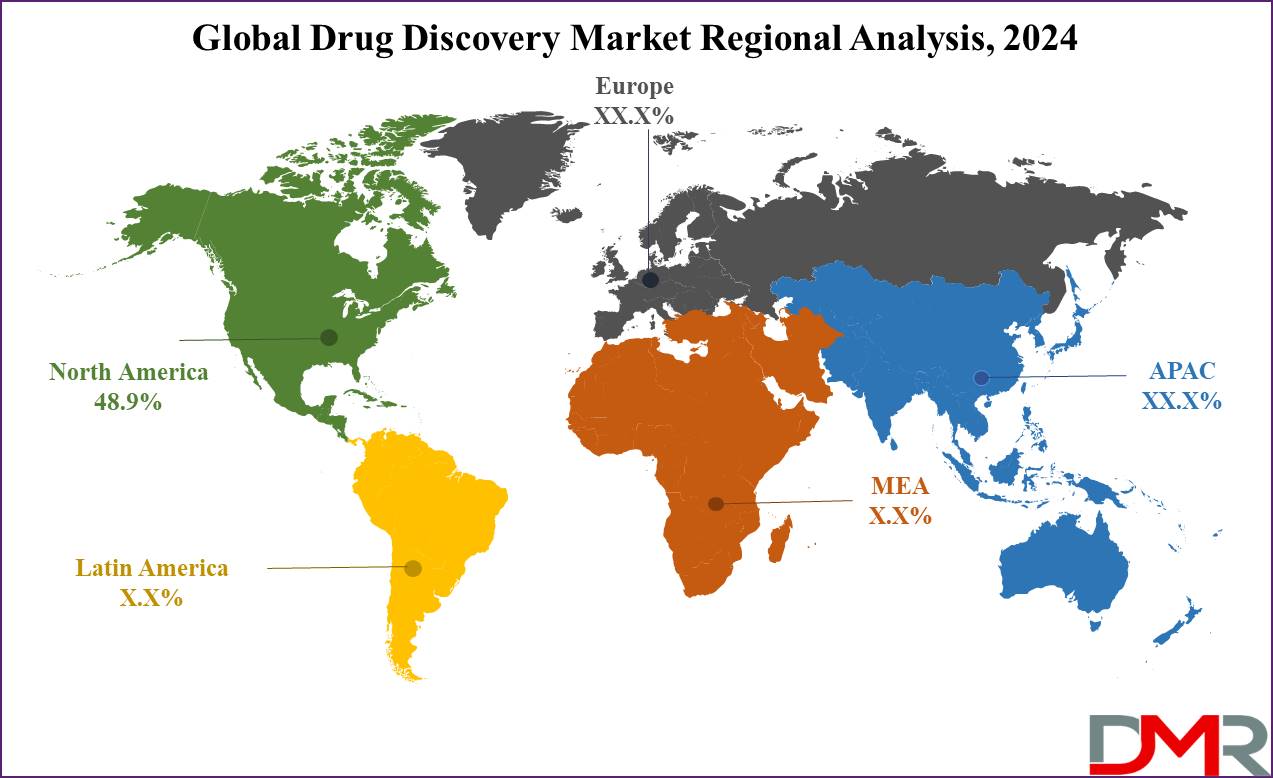

- Regional Analysis: North America is expected to have the largest market share in this market with a share of about 48.9% in 2024.

- Key Players: Some major key players in the Global Drug Discovery Market are Agilent Technologies Inc., Eli Lilly and Company, F. Hoffmann-La Roche Ltd, Bayer AG, Abbott Laboratories Inc., AstraZeneca PLC, and many others.

- Global Growth Rate: The market is growing at a CAGR of 9.6 percent over the forecasted period.

Use Cases

- Oncology Drug Discovery: This segment develops therapies for cancer using cutting-edge AI, immunotherapies, and molecular targeting technologies in designing new drugs against various tumor types.

- Cardiovascular Drug Discovery: With heart diseases on the rise, this use case entails discovering novel therapies to prevent and treat cardiovascular conditions; often including small molecules drugs, and biologics.

- Neurological Disorders Drug Discovery: To find treatments for Alzheimer's and Parkinson's diseases, this area employs high-throughput screening (HTS) technology as well as AI to expedite neuroprotective agents quickly.

- Anti-Infectives Drug Discovery: Pharmaceutical companies often employ AI and HTS techniques in search of drugs that target infectious diseases, including antibiotics or antiviral therapies that will effectively combat emerging pathogens.

- Penicillin Drug Derivatives: Despite being one of the earliest antibiotic classes, penicillin drugs remain central in anti-infectives drug discovery. Ongoing research focuses on modifying the core structure of Penicillin to combat antimicrobial resistance and improve efficacy against emerging pathogens.

Market Dynamic

Market Trends

AI and Machine Learning Integration

Artificial intelligence and machine learning have brought revolutionary changes in drug discovery. By speeding up processes and providing efficient analysis of large datasets, artificial intelligence identifies new candidates for testing as well as predicting efficacy predictions; designing optimal drugs; automating data analyses through AI platforms reduce human errors while speeding up discovery; this trend will only become more evident as pharmaceutical companies adopt AI tools into their research portfolios.

Collaborative Drug Discovery Models

Collaborative models for drug discovery where pharmaceutical companies increasingly collaborate with academic institutions, biotechnology firms, and CROs for faster and cost-effective drug development. Collaboration allows pharmaceutical companies to share resources, expertise, and technology for faster development with greater innovation potential in areas like genomics and precision medicine that accelerate innovation while creating much more targeted therapies, this model has seen particular popularity within oncology, neurology, and rare disease therapeutic areas.

Growth Drivers

Rising Demand for Novel Therapeutics

One key driver of growth in the global drug discovery market is the rising demand for more efficacious therapeutic solutions for chronic illnesses like cancer, cardiovascular issues, and neurological conditions such as dementia. As more elderly suffer from such ailments due to age-related causes, urgent development efforts for effective newer treatments must take place immediately - hence drawing significant investment by pharmaceutical companies into R&D on small molecule drugs and biologics as the two key segments that will continue to drive market expansion.

Technological Advancements in Drug Discovery

One key driver for growth can be seen in the rapid advances of technologies like HTS, AI, and genomics which is expected to drive market expansion in coming years. Such innovations make the identification and optimization of potentially new drug candidates much simpler and faster, decreasing the time to market for new drugs significantly faster, AI allows pharmaceutical companies to analyze complex biological data more easily than before thus making drug design and development much more cost-effective and driving growth across drug discovery market globally.

Growth Opportunities

Expansion in Emerging Markets

The pharmaceutical drug discovery market offers immense growth prospects in emerging regions like Asia-Pacific and Latin America. Drug companies have found these emerging markets attractive as the result of sustained investments being made by them in healthcare infrastructure and R&D projects, offering opportunities to them for expansion. Pharmaceutical firms increasingly view them as potential growth markets.

With rising healthcare expenditure in emerging nations like China and India coupled with their increasing demands for new therapeutic interventions, great opportunities exist for the drug discovery market in these regions. Furthermore, governments in these nations have taken initiatives towards investing more programs and funds in research & development, thus offering even further potential growth potential for market expansion.

Precision Medicine and Personalized Therapies

Drug discovery that addresses individual genetic profiles by offering tailored therapy options has exciting prospects for the growth of the drug discovery market. Pharmaceutical companies will increasingly turn their focus toward targeted and tailored treatments as precision medicines become more effective treatments; oncology and rare disease patient populations could especially benefit. Genomics, artificial intelligence (AI), and molecular biology advancements are at play here too as drug identification for specific patient populations with advanced therapeutic outcomes becomes a reality.

Restraints

High Cost of Drug Discovery

The process of drug discovery is pretty expensive, as the research expenses and clinical trials, along with its approval, take a heavy toll. For years to come, it usually takes billions of dollars to bring one new drug to market, while many other drugs fail in the development process. This high cost presents one of the major restraints on market growth, primarily for small-scale biotech firms, possibly without sufficient financial capabilities to invest in prolonged R&D activities. Moreover, pharmaceutical companies are under much stress caused by the high chance of failure, further adding to the economic burden.

Stringent Regulatory Requirements

The process of drug discovery and development faces a lot of strict regulatory requirements. The approval of new drugs is quite cumbersome, with the regulatory process differing from region to region. There may be delays in bringing new drugs to the market owing to this very factor. Thus, high bars for safety and efficacy are placed by regulatory agencies like the U.S. FDA and the European Medicines Agency, or EMA, which gradually makes it tough for pharmaceutical companies to accelerate the process towards commercialization of new drugs.

All these different regulatory obstacles could delay innovation, lengthen the time-to-market for new therapies, and therefore restrain growth in the drug discovery market.

Research Scope and Analysis

By Drug Type

Small molecule drugs are projected to dominate the drug type segment in the global drug discovery market in 2024. Small molecule drugs dominate this segment due to some unique advantages of small molecule drugs in molecular structure, synthesis easiness, and cell permeability.

Unlike large biologics, small molecules easily enter the cell and interact with intracellular targets, thus being in a position to modulate biological processes at the molecular level. These drugs also are likely to have oral bioavailability for better convenience in patient administration. All of these reasons, along with the fact that small molecules generally have much lower manufacturing costs and can even be produced on a larger scale, add to the cost efficiency of pharmaceutical companies.

Established techniques like high-throughput screening and medicinal chemistry support the process of drug discovery with small molecules. Both of these enable faster identification and optimization of drug candidates, amply supporting their success across different therapeutic areas like oncology, cardiovascular diseases, and metabolic disorders.

Due to continuous development and research studies and advancement in AI-driven drug discovery approaches small molecules have been continuously holding great promise for the development of new innovative therapies and hence can claim the top position in this market.

By Technology

High Throughput Screening (HTS) has become a dominant technology in the drug discovery market as it hold 24.1% of market share in 2024. HTS is a prevailing technology in drug discovery services due to its ever-growing power of identifying active compounds, antibodies, or genes modulating particular biological pathways.

HTS was providing an opportunity for every pharmaceutical company and researcher to test thousands of chemical, biological, or pharmacological matching compounds within relatively less time. This speeds up the drug discovery process, thereby reducing the time and cost involved in identifying drug candidates and enhancing the overall productivity of R&D activities. HTS also promotes efficiency in lead compound selection, which is one of the most critical activities in the early stages of drug development.

Another driving element for the dominance of HTS is compatibility with automation technologies that enable large-scale screening with the least human intervention. AI adoption further enhances the efficiency of HTS by optimizing data analysis and developing improved accuracy in spotting potential hits. Due to ongoing development within the global drug discovery market, integration processes involving HTS with AI and other advanced technologies keep updating the process of discovering new drugs, hence placing it in the leading technology position within the market.

By End User

Pharmaceutical companies are projected to dominate the end-user segment in the global drug discovery market with 49.6% of the market share in 2024. The major pharmaceutical companies are dominating the end-user segment in the global drug discovery market owing to huge investments in R&D, followed by translation of scientific findings into marketable therapies. Companies possess enough resources, including advanced technologies like HTS, AI, and precision medicine, capable of leading positions in drug discovery.

Pharmaceutical companies with ample funds and infrastructure may undertake large-scale drug discovery projects from preclinical research through clinical trials to commercialization, all the way from pre-clinical research through to commercialization. Strong relationships with regulatory bodies such as the FDA can assist pharmaceuticals with getting new drugs approved and launched on the market more smoothly.

Pharmaceuticals frequently collaborate with academic institutions, contract research organizations, and biotech startups to enhance their R&D capacities and capabilities. Pharmaceutical companies enjoy leading market positions by developing small molecule drugs and biologics targeting broad therapeutic areas like oncology, cardiovascular diseases, and neurology.

With drug discovery markets growing ever faster over time, pharmaceutical companies continue their lead position when it comes to investment capacity for advanced technologies and new drug candidates.

The Drug Discovery Market Report is segmented on the basis of the following

By Drug Type

- Small Molecule Drugs

- Large Molecule Drugs

- Monoclonal Antibodies (mAbs)

- Peptides

- Recombinant Proteins

- Cell and Gene Therapies

By Technology

- High Throughput Screening (HTS)

- Pharmacogenomics

- Combinatorial Chemistry

- Nanotechnology

- AI-based Drug Discovery

- CRISPR and Gene Editing Technologies

- Other Technologies

By End User

- Pharmaceutical Companies

- Contract Research Organizations (CROs)

- Academic and Research Institutes

- Government and Public Health Organizations

How Does Artificial Intelligence Contribute To Improve Drug Discovery Market ?

- Target Identification and Validation: AI algorithms analyze biological data to identify potential drug targets with higher precision, reducing the time required for early-stage research.

- Drug Screening and Lead Optimization: Machine learning models predict molecular interactions, helping to screen vast chemical libraries and optimize lead compounds efficiently.

- Predicting Drug-Drug Interactions and Toxicity: AI can simulate and analyze potential adverse reactions between drugs, improving patient safety and regulatory approvals.

- Accelerating Clinical Trials: AI-driven patient recruitment, real-time monitoring, and predictive analytics streamline trial processes, reducing costs and time.

- Personalized Medicine Development: AI enables the design of drugs tailored to genetic profiles, enhancing treatment effectiveness and minimizing side effects.

- Repurposing Existing Drugs: AI identifies new therapeutic uses for approved drugs, accelerating development and reducing R&D costs.

- Enhancing Drug Formulation and Manufacturing: AI optimizes formulation processes and ensures quality control in drug manufacturing through predictive analytics.

Regional Analysis

North America is projected to dominate the global drug discovery market as it will

hold 48.9% of market share in 2024. The dominating factor of the global drug discovery market is North America, owing to the strong pharmaceutical industry, highly developed infrastructural environment for R&D, and high investment in new technologies. Major companies in the pharmaceutical industry, such as Pfizer Inc. and Johnson & Johnson, are headquartered in the United States, thereby driving technological advancements in drug discovery.

This is further supported by added advantages in North America in terms of ecosystem, including institutes with academic standing, CROs, and biotech organizations. These encourage interactions and innovation. Furthermore, the regulatory framework, particularly the FDA, offers accelerated approval for new drugs, hence allowing their commercialization at a faster rate.

The adoption of advanced technologies, like AI, machine learning, and high-throughput screening, has improved the process of drug discovery in North America by reducing the time and cost used in the identification of a new lead molecule. Government funding for research programs and investment from venture capital in R&D activities also enhance market growth. Also, the focus of North America on precision medicines and biologics is considered the main development area in drug discovery, hence its dominance. The region continues to remain at the forefront of the industry as it keeps on changing.

By Region

North America

Europe

- Germany

- The U.K.

- France

- Italy

- Russia

- Spain

- Benelux

- Nordic

- Rest of Europe

Asia-Pacific

- China

- Japan

- South Korea

- India

- ANZ

- ASEAN

- Rest of Asia-Pacific

Latin America

- Brazil

- Mexico

- Argentina

- Colombia

- Rest of Latin America

Middle East & Africa

- Saudi Arabia

- UAE

- South Africa

- Israel

- Egypt

- Rest of MEA

Competitive Landscape

The drug discovery market is highly competitive worldwide, with several key participants including major pharmaceutical companies, biotechnology companies, and CROs. Large players are dominating the market, such as Pfizer Inc., Johnson & Johnson, and Roche, due to their large investment in research and development and rich pipelines for drugs. Such companies use state-of-the-art technologies, including artificial intelligence and high-throughput screening techniques to speed up drug discovery processes and, therefore, be competitive.

Today, these are not limited to just large pharmaceutical companies but also to small biotech firms and CROs that increasingly form an important part of the drug discovery operation. They provide special services at all levels, from molecular biology and genomics through to AI-driven drug discovery. Collaboration between big pharma and such smaller entities is increasing, further driving innovation and market expansion. Ongoing mergers and acquisitions add to the competitive environment where leading firms seek stronger portfolios by acquiring companies with promising drug candidates or state-of-the-art technologies.

Based on geographical distribution, the market has been dominated by North America, followed by Europe and the Asia Pacific. In such a scenario, with continuous technological advancements and R&D efforts, the future of drug discovery will still be expected to see a dynamic competitive scenario.

Some of the prominent players in the Global Drug Discovery Market are

Recent Developments

- October 2024: Pfizer Inc. announced its strategic partnership with an AI-driven biotech company to enhance the use of artificial intelligence (AI) in the drug discovery process, aiming to reduce development timelines.

- September 2024: Agilent Technologies Inc. launched a new high-throughput screening platform designed to accelerate early-stage drug discovery, optimizing compound identification.

- August 2024: Johnson & Johnson entered into a collaboration with a leading contract research organization (CRO) to expand its drug discovery capabilities, particularly in the field of oncology.

- July 2024: Roche completed the acquisition of a biotech firm specializing in small molecule drug development, strengthening its oncology drug pipeline.

- May 2024: The U.S. FDA approved an accelerated regulatory pathway for drug candidates identified using AI-based high-throughput screening, expediting the process of bringing new drugs to market.

- April 2024: Novartis announced its significant investment in expanding its R&D facility dedicated to advancing drug discovery in the cardiovascular and neurology sectors.