Market Overview

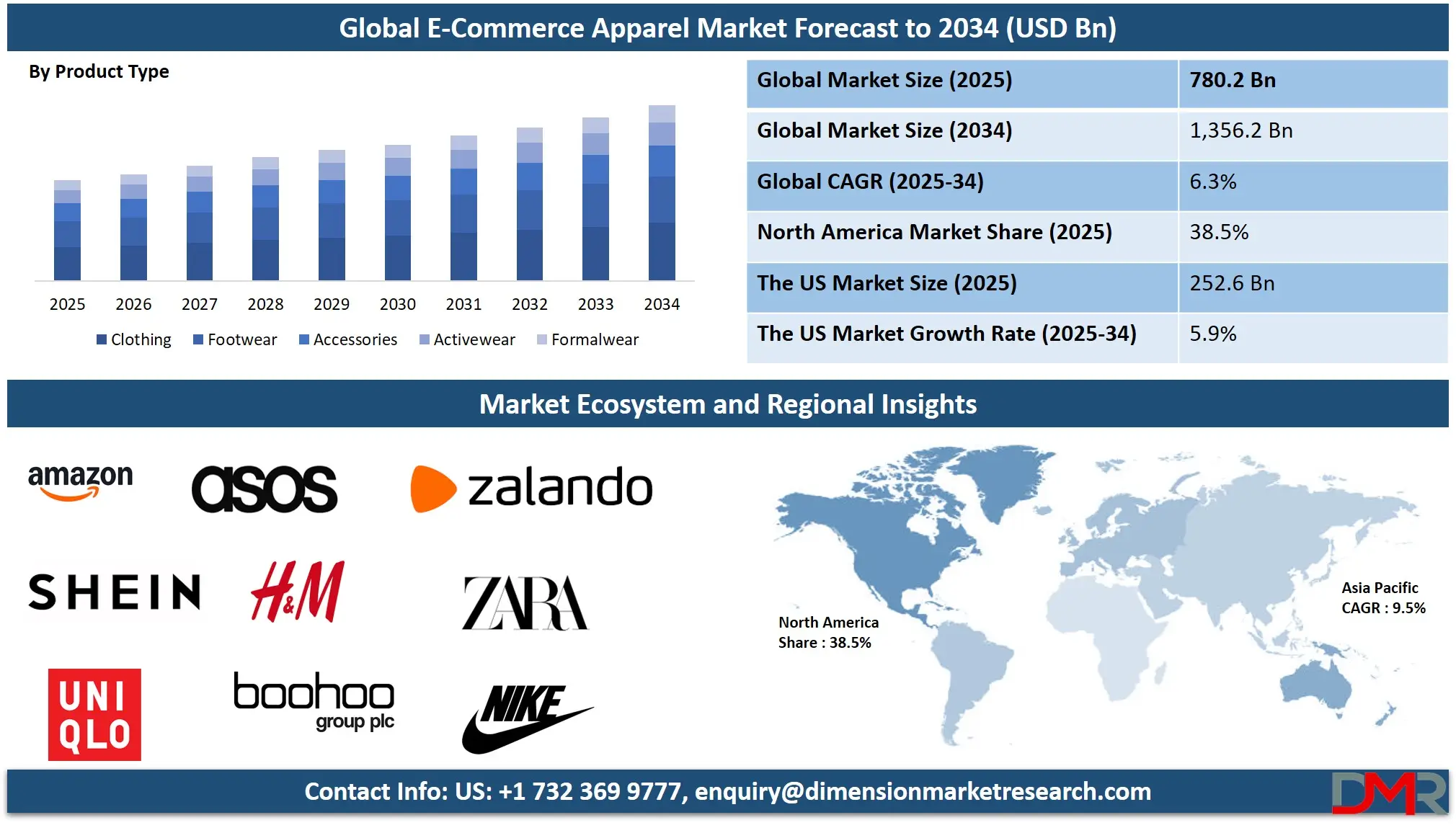

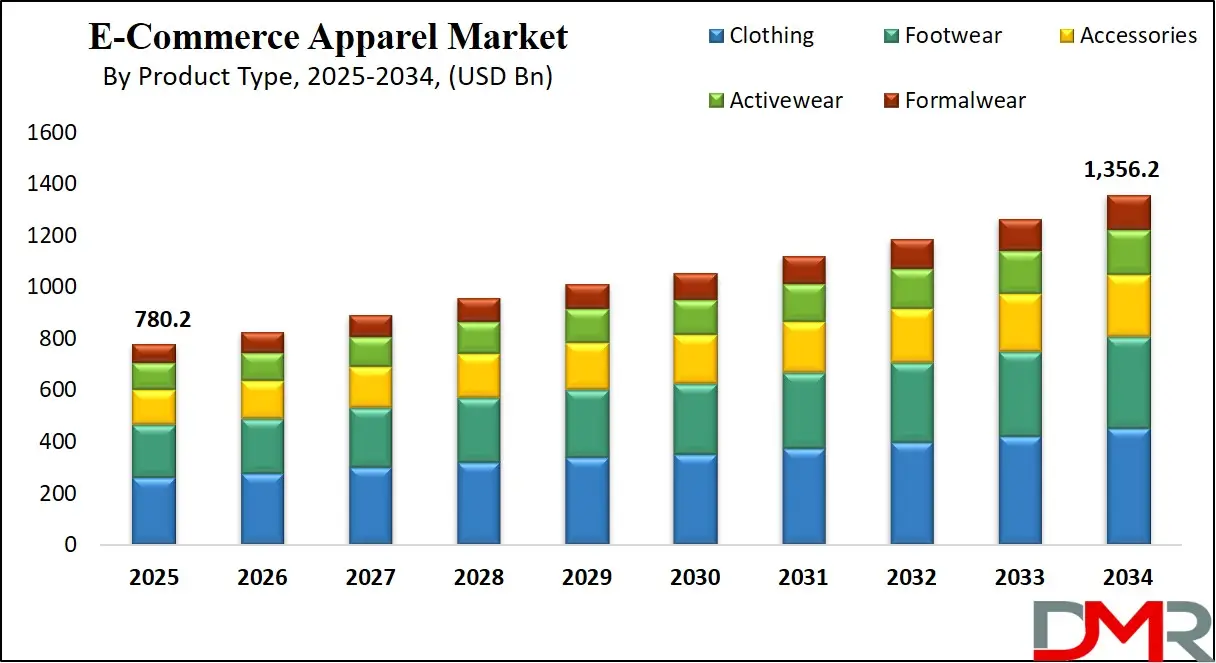

The Global E-Commerce Apparel Market is predicted to be valued at USD 780.2 billion in 2025 and is expected to grow to USD 1,356.2 billion by 2034, registering a compound annual growth rate (CAGR) of 6.3% from 2025 to 2034.

E-commerce apparel refers to the buying and selling of clothing and fashion accessories through online platforms. This includes a wide range of products such as men’s, women’s, and children’s clothing, footwear, and accessories like bags and jewelry. E-commerce apparel enables consumers to browse, select, and purchase fashion items from the comfort of their homes using websites or mobile apps.

ℹ

To learn more about this report –

Download Your Free Sample Report Here

It offers convenience, a wider selection of brands and styles, and access to seasonal deals and discounts. The sector is driven by technological advancements, digital marketing, social media influence, and the increasing popularity of mobile shopping and online payment systems.

The global e-commerce apparel market is experiencing substantial transformation, driven by changing consumer preferences, digital advancements, and increasing mobile internet penetration. The shift toward online clothing stores is fueled by the convenience of virtual shopping, ease of product comparison, and access to a diverse range of fashion apparel.

Online fashion retailers are leveraging data analytics, AI, and augmented reality to personalize the shopping experience and optimize customer engagement. Virtual fitting rooms, style recommendation engines, and seamless checkout options are enhancing user experience. Additionally, social commerce and influencer marketing continue to fuel the demand for trendy and seasonal clothing through digital platforms.

Consumer demand for sustainable fashion and inclusive sizing has influenced e-commerce fashion brands to adopt ethical practices and offer a broader product range. From luxury apparel to budget-friendly everyday wear, digital fashion marketplaces cater to varied demographics. The rise in mobile commerce, same-day delivery, and hassle-free returns has further strengthened market confidence.

The market is highly competitive, with global fashion brands, local boutiques, and emerging direct-to-consumer labels expanding their online presence. Omni channel retail strategies, user-generated content, and loyalty programs are increasingly being used to drive repeat purchases. As fashion e-retailers continue to innovate and invest in technology, the global online apparel market is poised for continued evolution and consumer-centric growth.

ℹ

To learn more about this report –

Download Your Free Sample Report Here

This digital retail landscape encompasses segments such as men's wear, women's wear, children's clothing, activewear, and festive apparel. The rise of fast fashion, eco-friendly clothing, and cross-border e-commerce is reshaping the future of the online fashion industry.

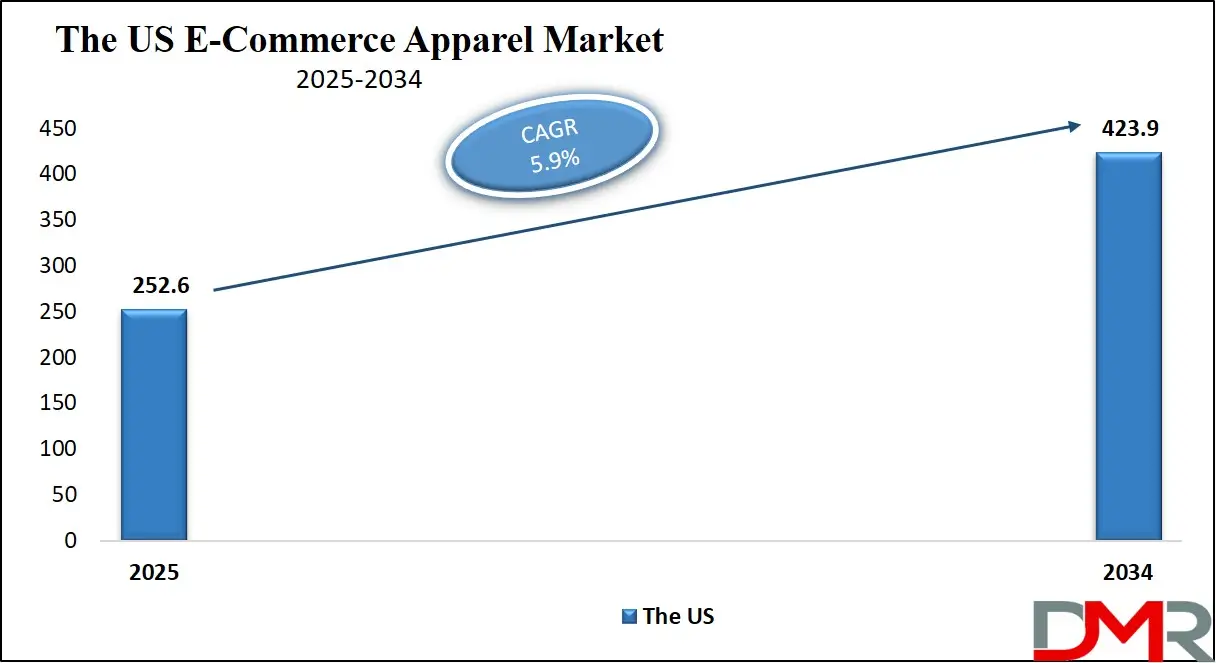

The US E-Commerce Apparel Market

The US E-Commerce Apparel Market is projected to be valued at USD 252.6 billion in 2025. It is expected to witness subsequent growth in the upcoming period as it holds USD 423.9 billion in 2034 at a CAGR of 5.9%.

The US e-commerce apparel market is driven by the increasing preference for digital shopping platforms, fueled by widespread internet penetration and mobile commerce. Consumers value the convenience, wider product range, and personalized recommendations offered by online retailers. The rise of influencer marketing, combined with robust return policies and virtual try-on technologies, has significantly enhanced user confidence in online fashion purchases.

Additionally, fast shipping options, targeted promotions, and loyalty programs incentivize repeat purchases. The demand for sustainable and inclusive clothing lines further encourages digital-native brands to innovate. These elements collectively boost online apparel sales and strengthen the region's digital fashion ecosystem.

In the US, e-commerce apparel is witnessing trends such as the growing popularity of direct-to-consumer (DTC) brands, which offer customized fashion experiences. Social commerce is gaining traction, with platforms like Instagram and TikTok driving impulsive and influencer-led purchases. There's a marked rise in demand for sustainable fashion, pushing brands toward eco-friendly fabrics and ethical production.

AI-driven personalization and virtual fitting rooms are improving customer satisfaction. Subscription-based models and rental fashion services are emerging as alternatives to traditional ownership. Additionally, gender-neutral fashion and plus-size categories are expanding, reflecting shifting consumer values and inclusivity within the digital apparel space.

ℹ

To learn more about this report –

Download Your Free Sample Report Here

The Japan E-Commerce Apparel Market

The Japan E-Commerce Apparel Market is projected to be valued at USD 54.6 billion in 2025. It is expected to witness subsequent growth in the upcoming period as it holds USD 84.7 billion in 2034 at a CAGR of 5.1%.

Japan’s e-commerce apparel market is primarily driven by its tech-savvy population and strong digital infrastructure. The cultural emphasis on fashion and grooming encourages high engagement with online clothing platforms. Convenience plays a crucial role, with busy urban lifestyles prompting consumers to favor mobile-friendly shopping experiences. The popularity of domestic fashion brands and a high level of trust in product quality support online retail growth.

Furthermore, integration of advanced technologies like virtual fitting tools and AI-driven style advisors enhances the shopping journey. Loyalty programs, limited-time offers, and precise delivery options contribute to increased consumer retention and digital apparel sales.

Emerging trends in Japan’s e-commerce apparel market include the surge in fashion-tech integration, such as augmented reality try-ons and AI style assistants. Consumers increasingly favor minimalist and functional fashion, reflecting evolving lifestyle preferences. Influencer marketing and celebrity collaborations on social platforms like LINE and Instagram are shaping buying behaviors.

There’s also growing demand for genderless fashion and size-inclusive collections, reflecting social progressiveness. Subscription boxes offering curated outfits are gaining popularity among younger consumers. Sustainable fashion is rising in prominence, encouraging brands to focus on eco-friendly materials and ethical production. Overall, personalization and innovation continue to define the market landscape.

The Europe E-Commerce Apparel Market

The Europe E-Commerce Apparel Market is projected to be valued at USD 136.5 billion in 2025. It is expected to witness subsequent growth in the upcoming period as it holds USD 242.7 billion in 2034 at a CAGR of 6.5%.

Europe's e-commerce apparel market is driven by rising digital literacy and growing demand for omni channel retail experiences. Consumers increasingly rely on mobile devices and social platforms to discover, compare, and purchase clothing. A surge in cross-border e-commerce, supported by efficient logistics and seamless payment systems, facilitates international brand access.

Eco-conscious consumers are pushing for transparent supply chains, driving digital brands to prioritize sustainable sourcing and ethical production. Fashion-conscious millennials and Gen Z buyers actively seek personalized clothing options online. Innovations in AR and AI enhance online shopping experiences, making virtual try-ons and personalized styling tools key drivers of growth.

Key trends in Europe's e-commerce apparel landscape include the rise of second-hand and vintage clothing platforms, appealing to environmentally aware consumers. Subscription-based services and rental fashion are becoming mainstream, especially in urban areas. Mobile-first shopping, integrated with influencer and social commerce, is reshaping how consumers interact with fashion brands.

Sustainability remains a central theme, with increasing adoption of recycled fabrics and low-impact packaging. Personalization through AI and data analytics is transforming product recommendations and enhancing user engagement. The demand for local and culturally relevant apparel is also rising, prompting brands to adopt region-specific marketing and product strategies.

E-Commerce Apparel Market: Key Takeaways

- Market Outlook: The Global E-Commerce Apparel Market is expected to be valued at USD 780.2 billion in 2025 and is projected to reach USD 1,356.2 billion by 2034, growing at a compound annual growth rate (CAGR) of 6.3% between 2025 and 2034.

- Product Type Analysis: Clothing is anticipated to be the leading segment by the end of 2025, contributing around 58.2% of the total market revenue.

- Pricing Model Analysis: Discounted apparel is projected to dominate the market landscape, accounting for 61.7% of global market share by 2025.

- Material Analysis: Cotton is expected to remain the most preferred material in the e-commerce apparel market, holding 42.8% of the market share by the end of 2025.

- Seasonality Analysis: All-season wear is forecasted to lead in terms of revenue generation, making up 37.9% of the global market by 2025.

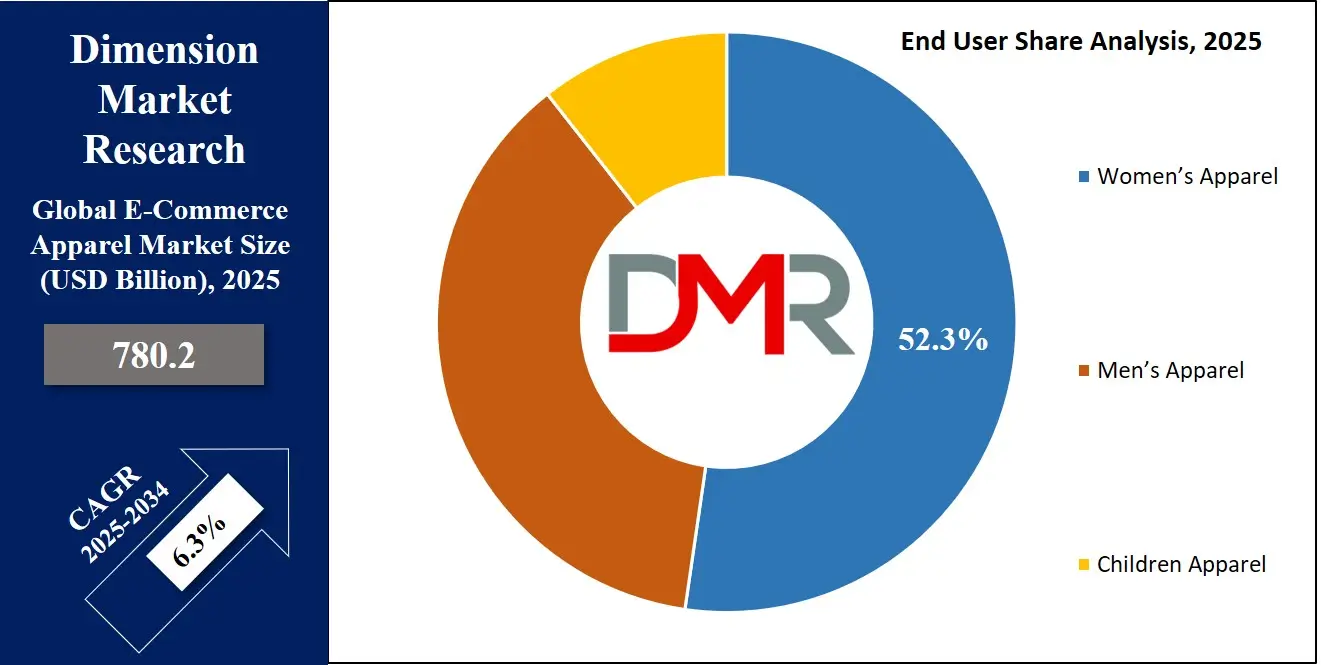

- End User Analysis: Women’s apparel is set to dominate the end-user segment, with an expected 52.3% share of overall revenue by the end of 2025.

- Regional Outlook: North America is projected to secure the largest regional share in the global market, representing 38.5% of total revenue by 2025.

E-Commerce Apparel Market: Use Cases

- Virtual Try-Ons & Fit Prediction: E-commerce apparel platforms use AI-powered virtual try-on tools and size recommendation engines to enhance customer experience. Shoppers can visualize garments on their digital avatars, reducing returns and improving satisfaction, especially when shopping for fitted clothing like jeans, jackets, or dresses.

- Seasonal & Trend-Based Collections: Online apparel retailers curate and promote seasonal and trending collections based on consumer behavior and fashion analytics. This helps brands align with ongoing trends—like summer wear or festival outfits—offering timely, relevant clothing options that appeal to specific demographics or climate conditions.

- Subscription-Based Clothing Boxes: E-commerce apparel brands offer curated clothing boxes on a subscription basis. Customers receive personalized outfits based on preferences and lifestyle, simplifying wardrobe selection. This model suits busy professionals and fashion-conscious consumers seeking convenience, variety, and surprise elements without manually browsing hundreds of items.

- Influencer & Social Commerce Integration: Many e-commerce apparel sites integrate with social media platforms and influencer marketing. Users can shop directly from live streams, posts, or influencer collections, blending entertainment with shopping. This drives impulse purchases and strengthens brand loyalty through familiar and relatable digital personalities.

- Sustainable Fashion Marketplaces: E-commerce apparel platforms increasingly cater to eco-conscious consumers by offering sustainable, recycled, or upcycled fashion products. Brands highlight ethical sourcing, carbon-neutral shipping, and recyclable packaging, attracting customers who prioritize sustainability in their wardrobe choices while shopping conveniently from home.

E-Commerce Apparel Market: Stats & Facts

- U.S. Census Bureau: In Q1 2024, U.S. e-commerce sales of clothing and accessories reached approximately USD 38.2 billion, accounting for nearly 23% of total clothing retail sales in the country.

- Forbes: Mobile commerce contributes to over 60% of e-commerce apparel traffic, driven by user-friendly apps and social media integrations.

- NielsenIQ: Nearly 52% of global apparel shoppers say they prefer buying clothes online due to convenience, easy price comparisons, and broader selection.

- Adobe Digital Insights: During Black Friday 2023, online apparel sales in the U.S. surged by 10.2% YoY, with sneakers and outerwear ranking among the most sold categories.

- eMarketer: In 2023, China's e-commerce fashion segment alone generated over USD 415 billion, making it the world's largest online apparel market.

- Shopify: Return rates for apparel bought online range between 20–30%, largely due to sizing issues, which is significantly higher than the 8–10% return rate for physical retail stores.

- UNCTAD (United Nations): Developing countries, especially in Southeast Asia, have seen a 40% increase in cross-border apparel e-commerce since 2021 due to digitalization and improved logistics.

- Amazon: Apparel is among the top three categories by sales volume on Amazon globally, with billions in yearly gross merchandise value (GMV).

E-Commerce Apparel Market: Market Dynamics

Driving Factors in the E-Commerce Apparel Market

Growth in Smartphone Penetration and Internet Access

The increasing penetration of smartphones and high-speed internet access globally is significantly fueling the e-commerce apparel market. Mobile commerce allows consumers to explore a wide range of fashion products, compare pricing models, and make instant purchases from anywhere. The ease of using mobile apps and mobile-optimized websites encourages more engagement with online clothing platforms.

Additionally, features like real-time order tracking, easy returns, and secure payment gateways further enhance customer satisfaction. As online shopping becomes more seamless and accessible, more consumers are shifting from physical stores to digital channels, especially for seasonal wear and premium apparel categories. These technological advancements are crucial in accelerating online clothing sales across demographics.

Rising Demand for Personalized and Trendy Fashion

Consumers today seek unique, on-trend, and customized clothing, driving demand within the e-commerce apparel market. Advanced data analytics and AI algorithms enable retailers to offer personalized recommendations based on purchase history, style preferences, and browsing behavior. This customization increases customer retention and enhances user satisfaction.

Influencer marketing and fast fashion cycles also play vital roles in shaping buying decisions, especially among Gen Z and millennial consumers. Whether it’s women's apparel, men’s fashion, or festive and occasion wear, consumers want variety and freshness. Online platforms meet this demand quickly through efficient supply chains, keeping inventory updated with the latest fashion trends and seasonal styles.

Restraints in the E-Commerce Apparel Market

High Product Return Rates and Reverse Logistics Costs

A major challenge for the e-commerce apparel market is the high volume of returns due to sizing issues, color discrepancies, or unmet expectations. The absence of a physical trial before purchase often leads customers to return products, which affects profitability. Managing reverse logistics for online clothing stores is both costly and complex, involving repackaging, restocking, and quality checks. These operational inefficiencies can erode margins, particularly in discounted apparel segments.

Frequent returns also strain inventory management systems and delay reselling cycles. For premium or branded clothing, returns may involve additional service support or warranty considerations, adding further pressure on retailers. Controlling return rates remains critical for sustaining long-term profitability.

Data Privacy and Cybersecurity Concerns

With the surge in digital transactions, concerns over data privacy and cybersecurity have become a growing restraint in the e-commerce apparel market. Customers are increasingly wary of sharing personal details like payment credentials, addresses, and shopping preferences online. Cyber-attacks, phishing, and identity theft incidents negatively impact consumer trust.

Apparel platforms need to invest heavily in secure payment systems and data encryption technologies to protect user information. Non-compliance with data protection regulations such as GDPR can lead to legal consequences and brand damage. These risks deter some consumers, especially in regions with low digital literacy, from engaging with online clothing portals despite attractive pricing and convenience.

Opportunities in the E-Commerce Apparel Market

Expansion in Emerging Markets

The rapid digital transformation in emerging economies presents a significant opportunity for growth in the e-commerce apparel market. Countries across Asia-Pacific, Latin America, and Africa are witnessing a surge in internet users, leading to increased demand for online shopping. Localized fashion preferences, combined with rising disposable incomes, create vast potential for retailers to tap into regional styles and consumer behaviors.

Brands investing in vernacular language support, regional warehousing, and targeted marketing can significantly increase their market share. From children’s apparel to everyday wear, providing affordable, accessible clothing through online platforms helps capture underserved segments and supports market penetration in these high-growth regions.

Integration of Augmented Reality and Virtual Try-Ons

Technological innovations like augmented reality (AR) and virtual try-on features offer exciting new opportunities in the e-commerce apparel market. These tools allow users to visualize how clothing fits and looks without visiting a physical store. This reduces uncertainty and significantly lowers return rates.

Retailers can enhance the customer experience by integrating AR into mobile apps or websites, making it easier for users to choose the right size, color, and style. This trend is especially beneficial in premium and occasion wear segments, where fit and appearance are critical. As technology adoption increases, AR solutions are expected to become a standard in fashion e-commerce.

Trends in the E-Commerce Apparel Market

Rise of Sustainable and Ethical Fashion

Sustainability is emerging as a dominant trend in the e-commerce apparel market. Environmentally conscious consumers are seeking ethical clothing options that use eco-friendly fabrics, support fair labor practices, and reduce carbon footprints. Online platforms are responding by promoting sustainable collections and clearly labeling green products.

From plant-based textiles to circular fashion and recycled packaging, brands are making conscious efforts to align with consumer values. Transparency in sourcing and production is increasingly influencing purchase decisions across all pricing models. Sustainable fashion is no longer a niche; it's a growing priority for both mass-market and premium segments in the online clothing landscape.

Surge in Influencer-Driven Shopping and Social Commerce

Social media platforms are reshaping the e-commerce apparel market through influencer-driven marketing and shoppable content. Platforms like Instagram, TikTok, and YouTube enable fashion influencers to showcase new trends and drive direct traffic to product pages. Consumers now discover fashion through reels, stories, and live streams, making purchase decisions based on real-time reviews and style inspiration.

Brands are leveraging this trend by collaborating with micro and macro influencers to reach targeted audiences. Social commerce bridges the gap between discovery and purchase, particularly for youth-focused and trendy categories like streetwear, women’s apparel, and festive wear. This trend is redefining digital fashion engagement.

E-Commerce Apparel Market: Research Scope and Analysis

By Product Type Analysis

Clothing is anticipated to dominate the global E-Commerce Apparel market by the end of 2025, accounting for 58.2% of the total market share. This dominance is fueled by the wide variety of apparel options available online, ranging from casual to festive styles. Digital fashion platforms prioritize clothing due to its high purchase frequency, seasonality, and trend-driven nature. With the increasing shift toward online wardrobe updates, consumers actively seek convenience, variety, and fast delivery.

The surge in digital catalogs, personalized styling tools, and AI-driven size recommendations has improved the online shopping experience for garments. In particular, user-friendly interfaces and fast-changing fashion trends make clothing the most transacted category in the global online fashion merchandise ecosystem.

Activewear is projected to register the highest CAGR in the global E-Commerce Apparel market by the end of 2025. The segment’s growth is propelled by the increasing popularity of fitness culture, wellness routines, and hybrid lifestyle fashion. Online platforms are witnessing rising demand for stylish yet performance-focused garments such as leggings, compression tops, and gym-friendly outerwear.

Consumers are gravitating toward breathable, quick-dry, and stretchable fabrics that offer both comfort and mobility. The integration of functional designs with fashion-forward aesthetics has made activewear a preferred choice for everyday wear. Digital influencers, virtual fitness classes, and athleisure campaigns are further accelerating interest in this category, enhancing its growth trajectory within the online sports-inspired clothing segment.

By Pricing Model Analysis

Discounted apparel is projected to dominate the Global E-Commerce Apparel Market by the end of 2025, capturing 61.7% of the total market share. The widespread appeal of affordability, coupled with the rising popularity of flash sales and off-season clearance events, has significantly boosted this segment. Consumers, particularly in price-sensitive emerging markets, are increasingly inclined toward purchasing value-driven fashion through digital platforms.

The proliferation of online shopping festivals, cashback offers, and bulk buying discounts continues to attract a large customer base. Moreover, the availability of branded clothing at lower prices through online outlets and third-party e-commerce websites enhances the competitive edge of this pricing model, fueling its leadership in the digital clothing retail ecosystem.

Premium apparel is forecasted to register the highest CAGR in the global E-Commerce Apparel market by the end of 2025. This growth is largely driven by the rising demand for high-end fashion among affluent consumers, particularly in urban areas and developed economies. The growing trend of aspirational shopping, along with increasing interest in luxury experiences through digital platforms, is pushing this segment forward.

Online fashion platforms offering exclusive collections, superior quality, and enhanced customization are attracting a loyal customer base. Additionally, the growth of digital fashion influencers and virtual try-on technologies is elevating the online luxury shopping experience, encouraging the expansion of the upscale clothing category in the virtual retail apparel landscape.

By Material Analysis

Cotton is projected to dominate the global E-Commerce Apparel market by the end of 2025, accounting for 42.8% of the total market share. Its widespread popularity stems from comfort, breathability, and versatility, making it a preferred fabric for everyday wear. Online shoppers increasingly favor cotton-based garments for casual, work-from-home, and leisure activities. The fabric’s hypoallergenic properties and adaptability across climates enhance its appeal in digital fashion retail.

E-commerce platforms are showcasing diverse cotton collections, including organic and sustainably produced options, aligning with eco-conscious buying behavior. As consumers prioritize comfort and quality, cotton continues to lead in product listings across virtual clothing marketplaces, supporting its dominant position in the expanding online fashion distribution ecosystem.

Denim is expected to grow at the highest CAGR in the global E-Commerce Apparel market by the end of 2025. The rising demand for stylish, durable, and all-season fashion staples is propelling denim's growth in online clothing platforms. Consumers are drawn to stretchable and eco-washed denim variants, appealing to both fashion and sustainability preferences.

Digital fashion brands are launching trend-driven jeans, jackets, and skirts with detailed size charts and visual fit guides, increasing purchase confidence. Social commerce and influencer styling tips are also boosting denim visibility and engagement. Moreover, the expansion of customization options like embroidered or distressed finishes via online configurators is further enhancing denim’s position in the fast-evolving internet fashion retail segment.

By Seasonality Analysis

All-season Wear is anticipated to dominate the Global E-Commerce Apparel Market by the end of 2025, accounting for 37.9% of the total revenue share. The demand for trans-seasonal clothing that can be worn year-round has surged, especially with the rise of minimalistic wardrobes and functional fashion. Consumers increasingly seek versatile pieces that are both stylish and adaptable across climates, boosting the online sale of durable, lightweight jackets, neutral-toned tees, and layering basics.

E-retailers are responding by offering curated year-round collections that align with global travel trends and changing work-life patterns. This category’s consistent sales cycle and practicality across diverse demographics are strengthening its position in the web-based clothing retail environment.

Festive & Occasion Wear is expected to grow at the highest CAGR in the global E-Commerce Apparel market by the end of 2025. The increasing penetration of online ethnic fashion portals, combined with rising disposable incomes and digital gifting culture, is fueling the demand for occasion-specific garments. Virtual try-on tools and AI-driven size guides are enhancing the online shopping experience for elaborate dresses, traditional attire, and ceremonial outfits.

Additionally, regional fashion festivals and culturally themed online collections are resonating with global diaspora communities. Limited-edition festive drops and influencer-driven festive campaigns are accelerating growth in this niche, positioning it as a high-potential segment in the digital fashion and celebration-focused wardrobe space.

By End User Analysis

Women’s Apparel is predicted to dominate the global E-Commerce Apparel market by the end of 2025, accounting for 52.3% of the overall revenue share. This dominance can be attributed to the wide variety of styles, rising fashion consciousness, and increased participation of women in the workforce, which fuels online clothing purchases. The surge in social media influence, digital fashion trends, and mobile shopping apps has further enhanced women’s online clothing consumption.

Brands are increasingly investing in personalized recommendations, inclusive sizing, and seamless digital experiences, boosting engagement in the online fashion retail space. The segment also benefits from high seasonal product turnover, exclusive online launches, and influencer-led promotions, solidifying its strong position within the digital garment retail industry.

Children Apparel is expected to grow at the highest CAGR in the global E-Commerce Apparel market by the end of 2025. This growth is driven by the increasing preference of parents for the convenience of online shopping, especially in urban areas. Rising birth rates in developing economies and growing demand for stylish, comfortable, and affordable children’s clothing online contribute to market expansion.

Additionally, the availability of themed collections, organic and sustainable kidswear, and subscription-based clothing boxes has added to segment momentum. E-retailers focusing on user-friendly interfaces, return flexibility, and fast delivery services are enhancing the appeal of digital kidswear shopping, fostering robust growth in this niche within the broader online clothing ecosystem.

ℹ

To learn more about this report –

Download Your Free Sample Report Here

The E-Commerce Apparel Market Report is segmented on the basis of the following:

By Product Type

- Clothing

- Footwear

- Accessories

- Activewear

- Formalwear

By Pricing Model

By Material

- Cotton

- Synthetic

- Wool

- Denim

By Seasonality

- Summer Wear

- Winter Wear

- All-season Wear

- Festive & Occasion Wear

By End User

- Women’s Apparel

- Men’s Apparel

- Children Apparel

Regional Analysis

Region with the largest Share

North America is projected to hold the largest share in the Global E-Commerce Apparel Market, with a revenue share of 38.5% by the end of 2025. The region's dominance is fueled by high internet penetration, widespread smartphone usage, and a well-established online retail infrastructure. Consumers in the U.S. and Canada exhibit strong brand loyalty and frequently engage in digital shopping for convenience and variety.

Major players like Amazon, Walmart, and fashion-centric platforms such as Shein and ASOS have further enhanced accessibility to online fashion. Innovations such as AI-based personalization, same-day delivery, and flexible return policies have improved the user experience. Additionally, the rise in sustainable fashion choices and influencer-led marketing campaigns continues to drive revenue in North America's digital clothing commerce.

ℹ

To learn more about this report –

Download Your Free Sample Report Here

Region with Highest CAGR

Asia-Pacific is anticipated to register the highest CAGR in the global E-Commerce Apparel market by the end of 2025. Rapid urbanization, a growing middle-class population, and increased smartphone adoption are major growth drivers. Countries such as China, India, and Southeast Asian nations are witnessing a significant surge in online apparel consumption due to expanding internet accessibility and mobile-first shopping behavior.

Local e-commerce giants like Alibaba, Flipkart, and Tokopedia are investing heavily in logistics and customer experience enhancements. The cultural diversity and high demand for both western and traditional garments further support market expansion. Moreover, live-stream shopping, app-based promotions, and digital payment solutions are reshaping online fashion retail in this fast-evolving regional market.

By Region

North America

Europe

- Germany

- The U.K.

- France

- Italy

- Russia

- Spain

- Benelux

- Nordic

- Rest of Europe

Asia-Pacific

- China

- Japan

- South Korea

- India

- ANZ

- ASEAN

- Rest of Asia-Pacific

Latin America

- Brazil

- Mexico

- Argentina

- Colombia

- Rest of Latin America

Middle East & Africa

- Saudi Arabia

- UAE

- South Africa

- Israel

- Egypt

- Rest of MEA

Impact of Artificial Intelligence in the E-Commerce Apparel Market

- Enhanced Personalization: Artificial Intelligence (AI) enables e-commerce apparel platforms to deliver highly personalized shopping experiences. By analyzing customer behavior, purchase history, and browsing patterns, AI-driven algorithms recommend products tailored to individual preferences. This increases customer satisfaction, engagement, and conversion rates while reducing the time spent searching for relevant apparel.

- Virtual Fitting and Size Prediction: AI-powered virtual try-on tools and fit prediction engines revolutionize the way customers shop online. These technologies use computer vision and machine learning to help users visualize garments on their bodies or avatars and suggest accurate sizing. This minimizes product returns, improves fit accuracy, and enhances buyer confidence in online purchases.

- Inventory and Demand Forecasting: AI improves inventory management by accurately forecasting demand based on sales trends, seasonality, and real-time data. This allows apparel retailers to maintain optimal stock levels, reduce overproduction or understocking, and streamline the supply chain. Efficient inventory control leads to cost savings and better customer service.

- Visual Search and Voice Commerce: AI enables advanced visual and voice search features that simplify product discovery. Shoppers can upload images or use voice commands to find similar styles instantly. This enhances user convenience and aligns with emerging digital shopping behaviors, especially among mobile-first and tech-savvy consumers in the fashion e-commerce segment.

Competitive Landscape

The competitive landscape of the global E-Commerce Apparel market is highly dynamic, with numerous players vying for consumer attention through innovation, pricing strategies, and personalized experiences. Leading companies such as Amazon, Alibaba, ASOS, Shein, Zalando, Flipkart, and Boohoo are continually enhancing their digital storefronts to capture a larger market share. These players are leveraging artificial intelligence for real-time recommendations, virtual fitting rooms, and customer behavior analytics to improve user engagement and conversion rates.

Global fashion retailers are also focusing on expanding their reach in emerging markets through regional partnerships and mobile-first platforms. Fast fashion, sustainable apparel, and direct-to-consumer models are gaining traction across demographics. Loyalty programs, influencer collaborations, and seasonal campaigns are becoming key marketing tools in the digital apparel retail landscape.

Technological advancements in logistics and last-mile delivery are helping e-retailers reduce cart abandonment rates and boost customer satisfaction. Moreover, the integration of augmented reality and interactive catalogs is transforming the way consumers browse and purchase fashion online. As competition intensifies, players are investing in omnichannel strategies to blend online and offline experiences, ensuring brand visibility across all touchpoints. The e-commerce apparel space continues to evolve rapidly, driven by changing consumer behavior and the digitization of the global fashion industry.

Some of the prominent players in the Global E-Commerce Apparel Market are:

- Amazon

- ASOS

- Zalando

- Shein

- H&M

- Zara (Inditex)

- Uniqlo (Fast Retailing)

- Boohoo Group

- Nike

- Adidas

- Macy’s

- Nordstrom

- Revolve

- Fashion Nova

- Forever 21

- Lulus

- PrettyLittleThing

- Gap Inc.

- Net-a-Porter

- SSENSE

- Other Key Players

Recent Developments

- In June 2025, emerging D2C brand Snitch launched a pilot for rapid fashion delivery in Bengaluru, joining peers like Newme, Slikk, Myntra, Ajio, and Nykaa in testing ultra-fast apparel logistics.

- In January 2025, Reid and Taylor Apparel integrated Unicommerce’s omnichannel retail, warehouse, and order management systems to optimize operations across its e-store, offline outlets, and warehouses using a unified control panel.

- In April 2025, Saks Fifth Avenue teamed up with Amazon Fashion to debut "Saks on Amazon" within Luxury Stores, offering customers access to a curated luxury collection directly through the Amazon ecosystem.

- In March 2024, H&M launched a resale platform in India, enabling customers to buy and sell pre-owned clothing via its mobile app as part of its broader circular fashion and sustainability push.

- In July 2024, Boohoo partnered with TikTok Shop to offer live-stream shopping experiences, blending influencer content with instant purchase features to enhance engagement among Gen Z consumers.

- In October 2024, Zara introduced its virtual fitting room using augmented reality in select global markets, aiming to reduce return rates and enhance online customer satisfaction through immersive size and style previews.

- In May 2024, Amazon India rolled out “Try Before You Buy” for Prime users, letting shoppers try clothes at home before paying, boosting convenience and reducing purchase hesitancy in fashion e-commerce.

- In December 2024, Flipkart expanded its fashion arm with the launch of “TrendStop,” a dedicated vertical spotlighting influencer-driven collections and emerging styles to attract young urban shoppers in Tier 1 cities.

Report Details

| Report Characteristics |

| Market Size (2025) |

USD 780.2 Bn |

| Forecast Value (2034) |

USD 1,356.2 Bn |

| CAGR (2025–2034) |

6.3% |

| Historical Data |

2019 – 2024 |

| The US Market Size (2025) |

USD 252.6 Bn |

| Forecast Data |

2025 – 2033 |

| Base Year |

2024 |

| Estimate Year |

2025 |

| Report Coverage |

Market Revenue Estimation, Market Dynamics, Competitive Landscape, Growth Factors, etc. |

| Segments Covered |

By Product Type (Clothing, Footwear, Accessories, Activewear, Formalwear), By Pricing Model (Luxury, Mid-range, Economy), By Material (Cotton, Synthetic, Wool, Denim), By Seasonality (Summer Wear, Winter Wear, All-season Wear, Festive & Occasion Wear), By End User (Women’s Apparel, Men’s Apparel, Children Apparel) |

| Regional Coverage |

North America – US, Canada; Europe – Germany, UK, France, Russia, Spain, Italy, Benelux, Nordic, Rest of Europe; Asia-Pacific – China, Japan, South Korea, India, ANZ, ASEAN, Rest of APAC; Latin America – Brazil, Mexico, Argentina, Colombia, Rest of Latin America; Middle East & Africa – Saudi Arabia, UAE, South Africa, Turkey, Egypt, Israel, Rest of MEA |

| Prominent Players |

Amazon, ASOS, Zalando, Shein, H&M, Zara, Uniqlo, Boohoo Group, Nike, Adidas, Macy’s, Nordstrom, Revolve, Fashion Nova, Forever 21, Lulus, PrettyLittleThing, Gap Inc., Net-a-Porter, SSENSE, and Other Key Players |

| Purchase Options |

We have three licenses to opt for: Single User License (Limited to 1 user), Multi-User License (Up to 5 Users), and Corporate Use License (Unlimited User) along with free report customization equivalent to 0 analyst working days, 3 analysts working days, and 5 analysts working days respectively. |

Frequently Asked Questions

How big is the Global E-Commerce Apparel Market?

▾ The Global E-Commerce Apparel Market size is estimated to have a value of USD 780.2 billion in 2025 and is expected to reach USD 1,356.2 billion by the end of 2034.

Which region accounted for the largest Global E-Commerce Apparel Market?

▾ North America is expected to be the largest market share for the Global E-Commerce Apparel Market with a share of about 38.5% in 2025.

Who are the key players in the Global E-Commerce Apparel Market?

▾ Some of the major key players in the Global E-Commerce Apparel Market are Amazon, Shein, Zara, and many others.

What is the growth rate in the Global E-Commerce Apparel Market?

▾ The market is growing at a CAGR of 6.3% over the forecasted period.

How big is the US E-Commerce Apparel Market?

▾ The US E-Commerce Apparel Market size is estimated to have a value of USD 252.6 billion in 2025 and is expected to reach USD 423.9 billion by the end of 2034.