Market Overview

The Global Endpoint Detection and Response (EDR) Market is predicted to be valued at

USD 6.5 billion in 2025 and is expected to grow to

USD 50.5 billion by 2034, registering a compound annual growth rate

(CAGR) of 25.7% from 2025 to 2034.

Endpoint Detection and Response (EDR)is a cybersecurity solution that continuously monitors and analyzes endpoint activities to detect, investigate, and respond to security threats. It collects data from devices like computers, servers, and mobile devices, using advanced analytics, machine learning, and behavioral analysis to identify suspicious activities. EDR provides real-time threat detection, forensic analysis, and automated or manual response actions to mitigate risks. It helps organizations combat malware, ransomware, and advanced persistent threats (APTs) by offering visibility into endpoint security incidents. EDR is essential for modern cybersecurity strategies, complementing traditional antivirus and firewalls to enhance overall threat defense.

-market-analysis.webp)

ℹ

To learn more about this report –

Download Your Free Sample Report Here

Endpoint Detection and Response (EDR)solutions have experienced explosive growth due to rising cyberthreats, evolving attack techniques, and remote work becoming more widely adopted by organizations. Businesses prioritize Endpoint Detection and Response (EDR) solutions as an essential way of strengthening their cybersecurity posture and mitigating risks from malware such as ransomware or APTs, with digital transformation, cloud computing and IoT devices increasing attack surfaces for businesses of all industries; making endpoint security paramount concern across every vertical industry.

Regulation compliance requirements such as GDPR, HIPAA and CCPA dictate organizations to implement robust security measures. Businesses have increasingly moved away from traditional antivirus solutions in favor of advanced EDR tools which offer real-time threat detection, automatic response and forensic capabilities - in response to more complex cyberattacks as well as behavioral analytics, machine learning-based anomaly detection and threat mitigation capabilities that offer real-time threat prevention capabilities.

EDR market opportunities are abundant, especially within industries like BFSI, healthcare, government and IT where data security is of primary concern. Small and medium-sized enterprises (SMEs) are taking an interest in EDR solutions due to cloud-based cost-effective security offerings available through extended detection and response platforms (XDR) such as Security Information Event Management Systems (SIEM). Further opportunities arise with managed detection and response (MDR) services offering solutions tailored for organizations lacking cybersecurity experts on staff.

-market-growth-analysis.webp)

ℹ

To learn more about this report –

Download Your Free Sample Report Here

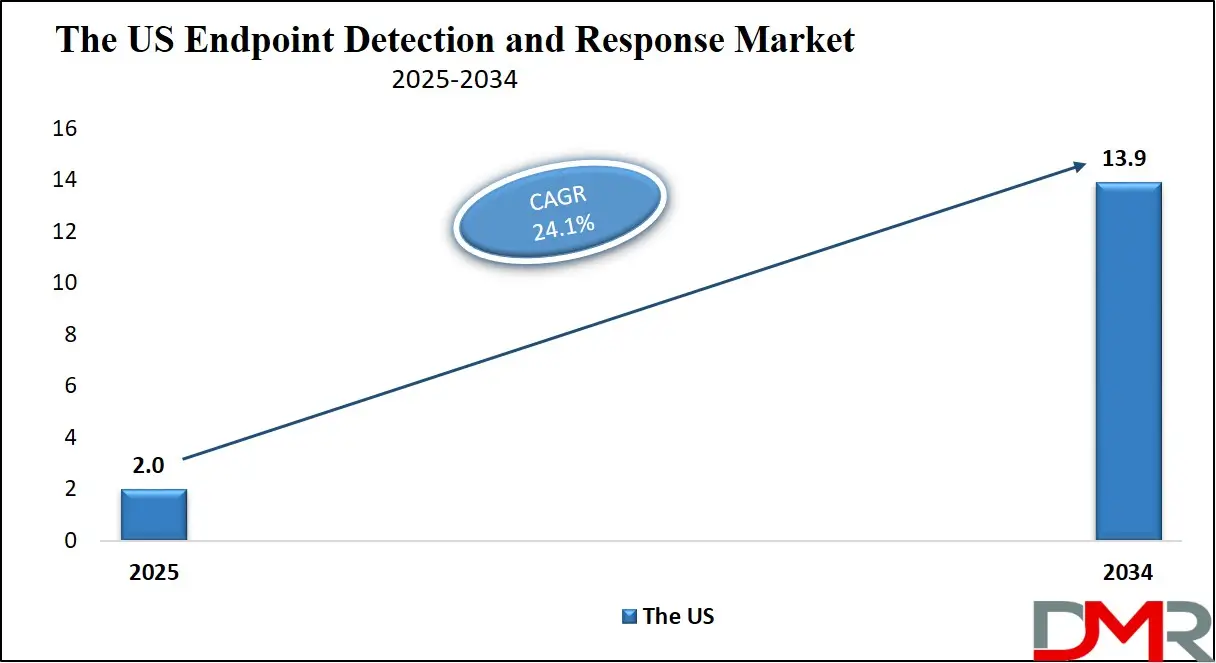

The US Endpoint Detection and Response (EDR) Market

The

US Endpoint Detection and Response (EDR) market is projected to be valued at

USD 2.0 billion in 2025. It is expected to witness subsequent growth in the upcoming period as it holds

USD 13.9 billion in 2034 at a

CAGR of 24.1%.

The U.S. Endpoint Detection and Response (EDR)market growth can be seen from rising cyberattack frequency, rising adoption of remote work arrangements, and regulatory compliance requirements. Ransomware, phishing attacks and advanced persistent threats (APTs) force organizations to invest in real-time threat detection solutions like ransomware detection with automated response capabilities that include real-time threat forensic capabilities to protect sensitive data; regulatory mandates like GDPR or CCPA require organizations implement robust cybersecurity measures further driving demand while remote working arrangements expand attack surfaces necessitating endpoint security solutions as organizations move into remote working arrangements requiring enhanced endpoint security protection measures.

One key trend in the US EDR market is AI-powered threat detection, which enhances real-time analysis and response automation. Cloud-based EDR solutions have emerged as businesses adopt hybrid work models and decentralized IT infrastructures; extended detection and Response (XDR) solutions which integrate multiple security layers beyond endpoints have also gained ground as comprehensive approaches to cybersecurity; furthermore zero trust models such as zero-trust security are influencing EDR strategies by continuously verifying users and devices before responding. Managed Detection Response Services (MDR) are becoming popular by giving organizations outsource EDR capabilities for improved security operations capabilities for security operations purposes.

ℹ

To learn more about this report –

Download Your Free Sample Report Here

Endpoint Detection and Response (EDR) Market: Key Takeaways

- Market Overview: The global Endpoint Detection and Response (EDR)market is projected to grow significantly, reaching USD 50.5 billion by 2034 from USD 6.5 billion in 2025, registering a CAGR of 25.7% during the forecast period.

- US Endpoint Detection and Response (EDR) Market: In the United States, the EDR market is expected to be valued at USD 2.0 billion in 2025 and is anticipated to expand to USD 13.9 billion by 2034, growing at a CAGR of 24.1%.

- Solution Analysis: The software segment is expected to dominate the market, accounting for 68.4% of total revenue by 2025. This growth is driven by its advanced security features, including behavioral analytics, threat intelligence, and cloud-based detection.

- Endpoint Device Analysis: Network devices and servers are projected to hold the largest market share, contributing 35.4% of total revenue by 2025. Their critical role in IT infrastructure makes them prime targets for cyber threats.

- Deployment Analysis: Cloud-based EDR solutions are anticipated to lead the market with a 63.4% revenue share in 2025, owing to their scalability, cost-effectiveness, and ease of deployment.

- Enterprise Analysis: Large enterprises are expected to dominate the EDR market, holding 55.2% of total revenue in 2025. Their extensive IT infrastructure, high volume of sensitive data, and stringent regulatory requirements drive this dominance.

- Industry Vertical Analysis: The Banking, Financial Services, and Insurance (BFSI) sector is projected to hold the largest share, accounting for 24.1% of total revenue in 2025. This is due to the high volume of sensitive financial and personal data it processes, making it a major target for cyber threats.

- Regional Insights: North America is expected to dominate the global EDR market, holding the largest share of 36.5% by 2025. The Asia-Pacific region is projected to experience the highest growth rate, driven by rapid digital transformation and increasing cybersecurity regulations.

Endpoint Detection and Response (EDR) Market: Use Cases

- Threat Detection and Investigation: EDR continuously monitors endpoint activities for signs of cyber threats like malware, ransomware, and advanced persistent threats (APTs). It helps security teams analyze suspicious behavior, detect anomalies, and investigate security incidents in real time.

- Incident Response and Mitigation: Once a threat is detected, EDR provides tools to contain and remediate the issue. It can isolate compromised endpoints, terminate malicious processes, and guide security teams on further response actions.

- Behavioral Analysis and Anomaly Detection: EDR uses artificial intelligence and machine learning to detect abnormal behaviors that deviate from normal endpoint activity. It identifies insider threats, compromised credentials, and other sophisticated attacks that traditional antivirus solutions may miss.

- Forensics and Threat Hunting: EDR collects and stores endpoint data for forensic analysis. Security teams can use this data to conduct proactive threat hunting, uncover hidden threats, and strengthen their overall security posture.

Endpoint Detection and Response (EDR) Market: Stats & Facts

- Prevalence of Endpoint Attacks: According to the Ponemon Institute, 68.0% of organizations have experienced at least one endpoint attack that compromised data or IT infrastructure. Additionally, 81.0% of businesses have faced malware-related attacks, while 28.0% encountered breaches due to compromised or stolen devices. These figures emphasize the increasing risk of endpoint security vulnerabilities in organizations worldwide.

- Rise in Ransomware Attacks: Ransomware attacks have risen dramatically in recent years. In 2021, 53.0% of organizations suffered at least one ransomware attack, with 23.0% facing multiple attacks (Ponemon Institute). SonicWall reported a 148.0% year-over-year increase in ransomware incidents, while Check Point found that corporate networks experienced a 50.0% rise in weekly ransomware attacks compared to 2020.

- Methods of Endpoint Attacks: Malware is a primary method of endpoint attacks, with 40.0% of breaches involving password dumpers that steal stored credentials (Verizon). Malware is commonly delivered via email and web-based methods, often embedded in Windows applications and Office documents. Webroot research indicates that 83.0% of malware threats reside in %temp%, %appdata%, %cache%, and %desktop%, making them difficult to detect.

- Mobile and SIM Swapping Attacks: Cybercriminals frequently exploit mobile devices through methods like “juice jacking,” where malware is installed via public USB charging ports. Webroot found that 79.0% of business travelers have unknowingly exposed their devices to this risk. SIM swapping is another growing threat, with Ponemon Institute reporting that such attacks have doubled annually since 2016 due to the increased use of personal cell phones for work.

- Ransomware Entry Points: Ransomware typically infiltrates organizations via phishing emails and malicious downloads. According to Sophos, 29.0% of ransomware attacks originate from phishing links, 21.0% from remote server breaches, and 16.0% from email attachments. SonicWall also reports that Ryuk ransomware, often distributed via TrickBot or Emotet phishing campaigns, is responsible for one-third of all ransomware incidents.

- Vulnerabilities and Patching Delays: Zero-day vulnerabilities account for 80.0% of successful breaches (Ponemon Institute). However, organizations take an average of 97.0 days to test and deploy patches. Further data from Ponemon shows that 48.5% of enterprise Android devices do not have managed updates, increasing their exposure to cyber threats. Slow patching processes leave businesses at a higher risk of exploitation.

- BYOD Risks and Remote Workforce Security: Remote work has increased cybersecurity risks, especially for personal devices. Ponemon Institute found that 33.0% of US employees use personal computers and smartphones for work, while only 17.0% rely on corporate-issued devices. Due to these challenges, 67.0% of IT professionals believe BYOD policies weakened security during the COVID-19 pandemic, and 71.0% are concerned about remote workers increasing breach risks.

- Industries and Organizations Targeted: Organizations of all sizes face ransomware threats. Ponemon Institute reports that 47.0% of SMBs (100–1,000 employees) and 54.0% of larger enterprises (1,001–5,000 employees) have been targeted by ransomware. The most affected industry is media, leisure, and entertainment (60.0%), followed by IT and telecoms (56.0%), energy and utilities (55.0%), and professional services (50.0%).

- Financial Costs of Endpoint Breaches: Cyberattacks impose significant financial burdens. IBM reports that the average cost of a data breach is USD 4.3 million, with ransomware-related breaches costing USD 4.6 million. Coveware found that while the average ransom payout remained steady in 2021, the median payout doubled. Additionally, the percentage of companies paying ransoms increased from 47.8% in Q3 to 59.6% in Q4 2021.

- Impact of Ransomware on Businesses: Ransomware attacks cause severe operational disruptions. According to Sophos, affected organizations experienced an average downtime of 21.0 days in Q4 2020. Data recovery remains difficult, with only 56.0% of companies restoring data from backups, while 26.0% recovered data after paying a ransom. Furthermore, Sophos found that paying a ransom doubles the overall cost of dealing with an attack, averaging USD 761,106 globally and USD 505,827 for SMBs.

Endpoint Detection and Response (EDR) Market: Market Dynamics

Driving Factors in the Endpoint Detection and Response (EDR) Market

Rising Concerns over Data Security in Remote WorkThe increasing adoption of remote work has heightened the risk of cyber threats, making data security a top priority for organizations. Remote work exposes corporate networks to threats such as data breaches, malware, and unauthorized access due to device theft or hacking. EDR solutions address these concerns by providing real-time behavioral analysis, threat detection, and incident response. They also offer historical visibility into system activities, ensuring comprehensive security. As businesses continue embracing remote work, the demand for EDR solutions is expected to grow, driving market expansion to safeguard sensitive corporate data against evolving cyber threats.

Regulatory Compliance and Data Protection Standards

Many industries operate under stringent regulatory frameworks that mandate strict data security measures. Regulations such as GDPR, HIPAA, and CCPA require organizations to implement robust cybersecurity protocols to protect sensitive information. EDR solutions help businesses comply with these regulations by providing monitoring, detection, and response capabilities to mitigate cyber risks. Additionally, EDR solutions enable IT administrators to enforce security policies, ensuring corporate data is handled securely across all endpoints. As regulatory compliance becomes a critical factor for businesses, the necessity for EDR solutions continues to rise, further fueling market demand and adoption across various industries.

Restraints in the Endpoint Detection and Response (EDR) Market

High Implementation Costs and Complexity

The adoption of EDR solutions often requires significant financial investment, making it challenging for budget-conscious organizations. Deployment costs, licensing fees, and ongoing maintenance expenses can be barriers, particularly for SMEs. Additionally, integrating EDR solutions with existing IT infrastructure requires skilled cybersecurity professionals, which many businesses lack. The complexity of managing and fine-tuning EDR systems to reduce false positives and optimize threat response further adds to the challenge. Without cost-effective and user-friendly solutions, adoption rates may be hindered, limiting market growth among smaller enterprises and organizations with limited cybersecurity expertise.

False Positives and Alert Fatigue

Security teams often struggle with the overwhelming number of alerts generated by EDR solutions, many of which turn out to be false positives. This can lead to alert fatigue, where critical threats may be ignored due to an overload of notifications. The inefficiency of sifting through large volumes of alerts reduces response times and increases the risk of undetected cyber threats. Organizations need more refined threat intelligence, automated threat prioritization, and AI-driven filtering to enhance accuracy. Failure to address these issues could slow adoption rates, as businesses seek more efficient and less resource-intensive security solutions.

Opportunities in the Endpoint Detection and Response (EDR) Market

Integration of AI and Machine Learning for Advanced Threat Detection

The growing adoption of artificial intelligence (AI) and machine learning (ML) in cybersecurity presents a significant opportunity for EDR solutions. AI-powered EDR systems can analyze vast amounts of endpoint data in real time, detect anomalous behavior, and predict potential cyber threats before they occur. Automated threat detection and response reduce the need for manual intervention, enhancing the efficiency of security teams. As cyberattacks become more sophisticated, organizations are investing in AI-driven EDR solutions to improve their security posture, creating lucrative growth opportunities for EDR vendors and driving innovation in endpoint protection.

Expansion into Small and Medium-Sized Enterprises (SMEs)

While large enterprises have widely adopted EDR solutions, there is an emerging opportunity in the SME sector. Small and medium-sized businesses are increasingly targeted by cybercriminals due to their limited cybersecurity resources. As awareness of cybersecurity threats rises, SMEs are seeking cost-effective and scalable EDR solutions to protect their networks and data. Vendors offering cloud-based, subscription-based, or managed EDR services tailored to SMEs can tap into this growing market segment. The expansion of EDR adoption among smaller businesses presents a strong growth opportunity for vendors, encouraging further development of affordable and flexible cybersecurity solutions.

Trends in the Endpoint Detection and Response (EDR) Market

Growing Adoption of Bring Your Own Device (BYOD) Policies

The rise of BYOD policies has significantly influenced the demand for EDR solutions. As employees increasingly use personal devices for work, organizations face challenges in securing these endpoints. EDR solutions help manage and protect personal devices by enforcing security policies, such as encryption, access control, and remote data wiping. The ability to monitor and mitigate threats on employee-owned devices ensures that corporate networks remain secure despite the decentralized nature of modern workplaces. As BYOD adoption grows, organizations are investing in EDR solutions to maintain cybersecurity while allowing flexibility in device usage.

Centralized Endpoint Management and Threat Intelligence

Organizations are increasingly adopting EDR solutions that offer centralized management of endpoints, applications, and security policies. These solutions provide IT administrators with a unified dashboard to monitor and respond to threats across all devices in real time. Additionally, EDR solutions integrate advanced threat intelligence to detect and prevent sophisticated cyberattacks. AI-driven analytics and machine learning enhance threat detection capabilities, enabling proactive security measures. As businesses seek more efficient cybersecurity solutions, the trend of centralized endpoint management and AI-powered threat intelligence continues to shape the evolution of EDR technologies in the market.

Endpoint Detection and Response (EDR) Market: Research Scope and Analysis

By Solution Analysis

The endpoint detection and response (EDR) market will demonstrate a revenue structure of 68.4% for the software segment by 2025 because of its advanced security features using behavioral analytics together with threat intelligence and cloud-based detection measures. The implementation of EDR software helps IT administrators enact security protocols that maintain compliance with HIPAA and PCI DSS, and GDPR regulatory requirements. Organizations obtain active security monitoring capabilities that facilitate productivity growth, together with smooth user experiences.

Market expansion results from the rising industries' implementation of EDR software because organizations seek powerful cybersecurity solutions for their operations. Its successful capability to stop and locate threats as well as implement rapid cyber defense strategies will power its position as market leader.

The services segment demonstrates the highest growth rate because organizations demand professional and managed services that assist with cybersecurity enhancement and compliance maintenance, along with threat mitigation. Organizations now depend on Endpoint Detection and Response (EDR) services as a solution to control endpoint safety, resolve system weaknesses, and stop unauthorized access to their data. Expert risk assessment services from professionals combine with continuous monitoring services that deliver threat response through managed solutions. The transition to remote work, together with rising cyber threat difficulty, creates business needs for outsourced security solutions, which propels the adoption of EDR services and drives their swift market progress.

By End Point Device Analysis

Network devices and servers are projected to dominate the endpoint detection and response market at 35.4% revenue share by 2025, due to their criticality to an organization's IT infrastructure, making them prime targets of cyber threats. Routers, switches, and firewalls play an essential role in data transmission and storage, increasing their vulnerability to viruses such as ransomware. Due to an increase in real-time threat detection and response requirements for critical assets within enterprises, enterprises have turned increasingly toward Endpoint Detection and Response (EDR)solutions in order to secure these assets in real time. Cyber attacks against enterprise networks combined with strict data protection regulations have created even further demand for EDR solutions; network devices and servers being the dominant market segment.

Cybercriminals often target point of sale (POS) devices as they process sensitive financial transactions. As more data breaches, payment fraud, and malware attacks against these devices occur, robust security solutions such as EDR solutions have become essential in providing real-time threat detection, response, compliance monitoring with PCI DSS regulations, and real-time threat response capabilities to enhance device protection. As digital transformation in retail and hospitality sectors accelerates along with greater adoption of cloud POS systems driving market growth further, businesses prioritizing customer data security may increase demand for EDR solutions, providing real-time threat detection response capabilities.

By Deployment Analysis

Cloud-based Endpoint Detection and Response (EDR)solutions are projected to lead the market with a revenue share of 63.4% in 2025, due to their scalability, cost-effectiveness, and ease of deployment. Unlike on-premise systems, cloud-based EDR eliminates the need for extensive hardware, reducing upfront investment and maintenance costs. These solutions offer real-time threat detection and automatic updates, ensuring strong security without requiring dedicated IT teams. Their accessibility from any location enhances operational efficiency, making them ideal for modern, distributed workforces.

Additionally, cloud providers implement advanced security measures, making cloud-based EDR a reliable choice for businesses aiming to enhance cybersecurity while optimizing resources.

On-premise EDR solutions are expected to witness the highest CAGR due to their ability to offer greater control, security, and compliance. Organizations handling sensitive data, such as government agencies and financial institutions, prefer on-premise solutions to maintain complete ownership over their cybersecurity infrastructure.

These systems allow tailored configurations that meet specific regulatory and security requirements. While implementation and maintenance costs are higher, businesses are increasingly investing in robust cybersecurity to counter sophisticated threats. The growing concern over data privacy, coupled with strict compliance mandates, is driving demand for on-premise EDR solutions, resulting in their rapid market expansion.

By Enterprise Analysis

Large enterprises are projected to dominate the EDR market with revenue share of 55.2% in 2025, due to their extensive IT infrastructure, high volume of sensitive data, and stringent regulatory requirements. These organizations prioritize advanced cybersecurity measures to prevent cyber threats, ensuring compliance with industry standards.

EDR solutions provide large businesses with real-time threat detection, end-to-end visibility, and automated response capabilities, enhancing security and operational efficiency. Additionally, these enterprises have the financial resources to invest in sophisticated security systems, reducing downtime and mitigating risks. The ability to integrate EDR solutions seamlessly across multiple endpoints makes them a preferred choice for large-scale organizations.

Small and medium-sized enterprises (SMEs) are expected to witness the highest CAGR in the EDR market due to their growing need for cost-effective cybersecurity solutions. Limited IT budgets and resources make it challenging for SMEs to maintain in-house security teams. EDR solutions provide an efficient way to detect threats early, ensuring device security and compliance without significant investment. As cyber threats become more sophisticated, SMEs increasingly adopt EDR solutions to enhance protection, streamline IT operations, and extend device longevity. The rising awareness of cybersecurity risks and the affordability of cloud-based EDR solutions further drive growth in this segment.

By Vertical Analysis

The BFSI segment is projected to dominate the Endpoint Detection and Response (EDR) Market with a revenue share of 24.1% in 2025, due to the high volume of sensitive financial and personal data it handles, making it a prime target for cyber threats. Financial institutions require robust security solutions to detect and mitigate sophisticated cyberattacks. EDR solutions provide an additional security layer beyond traditional antivirus software by offering real-time threat detection, endpoint activity monitoring, and rapid incident response. The increasing adoption of digital banking, cloud services, and mobile transactions further amplifies security concerns, driving the demand for advanced EDR solutions to safeguard critical financial operations and customer data.

The retail & e-commerce segment is expected to grow at the highest CAGR due to the rising digital transformation, increasing online transactions, and expanding e-commerce platforms. Cyber threats such as ransomware, malware, and phishing attacks pose significant risks to customer data and payment information. EDR solutions enhance real-time endpoint monitoring, helping retailers identify and mitigate security threats promptly. Additionally, retailers benefit from improved threat intelligence, reduced data breach risks, and enhanced response time. As the industry shifts toward omnichannel strategies and cloud-based operations, the demand for robust cybersecurity solutions, including EDR, continues to surge.

-marketvertical-share-analysis.webp)

ℹ

To learn more about this report –

Download Your Free Sample Report Here

The Endpoint Detection and Response (EDR) Market Report is segmented on the basis of the following

By Solution

- Software

- Service

- Professional Services

- Managed Services

By End Point Device

- Network Devices & Servers

- Mobile Devices

- Point Of Sale (POS) Devices

- Others

By Deployment

By Enterprise

- Small & Medium-sized Enterprises

- Large Enterprises

By Vertical

- Banking, Financial Services, and Insurance (BFSI)

- Healthcare & Life Sciences

- Government & Defense

- Retail & E-commerce

- IT & Telecom

- Energy & Utilities

- Others

Regional Analysis

Region with the largest Share

North America is expected to dominate the Endpoint Detection and Response (EDR)market, holding the largest share of

36.5% by the end of 2025, due to the widespread adoption of desktops, servers, and mobile devices. The growing Bring Your Own Device (BYOD) trend and increasing cybersecurity concerns have driven the demand for robust EDR solutions. The U.S., in particular, leads the region due to the presence of major EDR vendors like Palo Alto Networks, SentinelOne, and Broadcom, Inc. These companies provide advanced security solutions to protect networks and systems from cyber threats, making North America a key player in the global EDR market.

Region with Highest CAGR

The Asia Pacific region is projected to grow at the highest CAGR, driven by rapid digital transformation and increasing cybersecurity regulations. The rise in BYOD adoption, coupled with government initiatives to enhance cybersecurity compliance, has fueled demand for EDR solutions. Additionally, the growing preference for cloud-based EDR solutions is boosting market expansion, as organizations seek cost-effective and scalable security measures. Sectors such as government, BFSI, and retail are expected to be major contributors to this growth, as businesses prioritize endpoint security to mitigate cyber threats and ensure data protection.

-market-regional-analysis.webp)

ℹ

To learn more about this report –

Download Your Free Sample Report Here

By Region

North America

Europe

- Germany

- The U.K.

- France

- Italy

- Russia

- Spain

- Benelux

- Nordic

- Rest of Europe

Asia-Pacific

- China

- Japan

- South Korea

- India

- ANZ

- ASEAN

- Rest of Asia-Pacific

Latin America

- Brazil

- Mexico

- Argentina

- Colombia

- Rest of Latin America

Middle East & Africa

- Saudi Arabia

- UAE

- South Africa

- Israel

- Egypt

- Rest of MEA

Competitive Landscape

The Endpoint Detection and Response (EDR)market is witnessing significant growth due to the increasing need for advanced cybersecurity solutions to combat evolving cyber threats. The rise in remote work, cloud adoption, and sophisticated cyberattacks has fueled demand for EDR solutions. Key industry players, including Cisco Systems Inc., General Electric, Schneider Electric, and ITRON Inc., are heavily investing in research and development to enhance their product offerings and maintain a competitive edge. These companies are leveraging advanced technologies such as artificial intelligence (AI) and machine learning to improve threat detection, real-time response, and overall cybersecurity resilience.

Cisco Systems Inc. is a leading player in the market, offering a comprehensive suite of security solutions that integrate AI-driven threat detection with real-time response mechanisms. General Electric focuses on industrial cybersecurity, providing EDR solutions tailored to protect critical infrastructure and operational technology. Schneider Electric specializes in cybersecurity for industrial control systems, ensuring the safety of automated processes and industrial networks. Meanwhile, ITRON Inc. is strengthening its position in the market by integrating EDR solutions into smart grids and utility infrastructure to safeguard against cyberattacks.

The competitive landscape is marked by product innovation, strategic partnerships, and mergers & acquisitions. Companies are continuously launching new solutions with enhanced threat intelligence and response capabilities. Strategic alliances with cybersecurity firms enable businesses to expand their EDR offerings, while acquisitions of emerging cybersecurity startups help integrate cutting-edge technology. Additionally, to maintain cost efficiency and expand market presence, companies are increasingly focusing on local manufacturing and competitive pricing strategies.

Some of the prominent players in the Global Endpoint Detection and Response (EDR) Market are

- Bitdefender

- Broadcom, Inc.

- Cisco Systems

- CrowdStrike

- ESET

- FireEye

- Fortinet

- Kaspersky

- McAfee

- Microsoft Corporation

- Palo Alto Networks

- SentinelOne

- Sophos

- Trend Micro

- VMware Carbon Black

- Carbon Black Inc

- Cisco Systems Inc

- CrowdStrike, Inc.

- Intel Corporation

- McAfee

- Microsoft Corporation

- Palo Alto Networks Inc

- RSA Security

- Symantec Corporation

- SyncDog, Inc

- Other Key Players

Recent Developments

- In July 2024, Acronis, a global leader in cybersecurity and data protection, launched Acronis XDR, the latest addition to its security solutions portfolio. Designed for seamless deployment, management, and maintenance, Acronis XDR builds upon the existing endpoint detection and response (EDR) capabilities. It provides comprehensive, natively integrated cybersecurity with data protection, endpoint management, and automated recovery, specifically tailored for managed service providers (MSPs).

- In April 2024, Miggo, an application detection and response (ADR) platform, introduced a new ADR system to combat the growing threat of application attacks. This system establishes baseline behaviors for application components and continuously monitors for deviations, enabling the detection of anomalies that may indicate potential security breaches.

- In October 2023, IBM introduced a new AI-powered Managed Detection and Response (MDR) service, expanding its security portfolio after launching the QRadar Suite in April. IBM Threat Detection and Response (TDR) Services enhances alert quality and speeds up responses using AI, reducing low-value SIEM alerts by 45% and escalating 79% more high-value alerts requiring immediate action.

- In October 2023, Okta launched Identity Threat Protection with Okta AI, enhancing real-time detection and response for identity-based threats in its Workforce Identity Cloud. The solution continuously assesses user risk beyond initial authentication, responding to threats throughout sessions. It helps security teams navigate overwhelming security data, improving policy-making and response to critical cyber threats.

Report Details

| Report Characteristics |

| Market Size (2025) |

USD 6.5 Bn |

| Forecast Value (2034) |

USD 50.5 Bn |

| CAGR (2025-2034) |

25.7% |

| Historical Data |

2019 – 2024 |

| The US Market Size (2025) |

USD 2.0 Bn |

| Forecast Data |

2025 – 2033 |

| Base Year |

2024 |

| Estimate Year |

2025 |

| Report Coverage |

Market Revenue Estimation, Market Dynamics, Competitive Landscape, Growth Factors and etc. |

| Segments Covered |

By Solution (Software, and Service), By End Point Device (Network Devices & Servers, Mobile Devices, Point Of Sale (POS) Devices, and Others), By Deployment (Cloud, and On-premise), By Enterprise (Small & Medium-sized Enterprises, and Large Enterprises), By Vertical (Banking, Financial Services, and Insurance (BFSI), Healthcare & Life Sciences, Government & Defense, Retail & E-commerce, IT & Telecom, Energy & Utilities, and Others) |

| Regional Coverage |

North America – The US and Canada; Europe – Germany, The UK, France, Russia, Spain, Italy, Benelux, Nordic, & Rest of Europe; Asia- Pacific– China, Japan, South Korea, India, ANZ, ASEAN, Rest of APAC; Latin America – Brazil, Mexico, Argentina, Colombia, Rest of Latin America; Middle East & Africa – Saudi Arabia, UAE, South Africa, Turkey, Egypt, Israel, & Rest of MEA

|

| Prominent Players |

Bitdefender, Broadcom Inc., Cisco Systems, CrowdStrike, ESET, FireEye, Fortinet, Kaspersky, McAfee, Microsoft Corporation, Palo Alto Networks, SentinelOne, Sophos, Trend Micro, VMware Carbon Black, Carbon Black Inc., Cisco Systems Inc, CrowdStrike Inc., Intel Corporation, McAfee, Microsoft Corporation, Palo Alto Networks Inc., RSA Security, Symantec Corporation, SyncDog Inc., and Other Key Players. |

| Purchase Options |

We have three licenses to opt for: Single User License (Limited to 1 user), Multi-User License (Up to 5 Users) and Corporate Use License (Unlimited User) along with free report customization equivalent to 0 analyst working days, 3 analysts working days and 5 analysts working days respectively. |

Frequently Asked Questions

How big is the Global Endpoint Detection and Response (EDR) Market?

▾ The Global Endpoint Detection and Response (EDR) Market size is estimated to have a value of USD 6.5 billion in 2025 and is expected to reach USD 50.5 billion by the end of 2034.

Which region accounted for the largest Global Endpoint Detection and Response (EDR) Market?

▾ North America is expected to be the largest market share for the Global Endpoint Detection and Response (EDR) Market with a share of about 36.5% in 2025.

Who are the key players in the Global Endpoint Detection and Response (EDR) Market?

▾ Some of the major key players in the Global Endpoint Detection and Response (EDR) Market are CrowdStrike, SentinelOne, Microsoft Corporation, and many others.

What is the growth rate in the Global Endpoint Detection and Response (EDR) Market?

▾ The market is growing at a CAGR of 25.7 percent over the forecasted period.

How big is the US Endpoint Detection and Response (EDR) Market?

▾ The US Endpoint Detection and Response (EDR) Market size is estimated to have a value of USD 2.0 billion in 2025 and is expected to reach USD 13.9 billion by the end of 2034.