An energy drink is designed to boost the energy level of the body mentally and physically. These drinks include a mixture of components, including sugar or artificial sweeteners, vitamins, amino acids, caffeine, and sports supplements, which are consumed to reduce tiredness, improve focus, & promote strength.

They are commonly used by individuals looking to increase their energy levels, particularly during periods of studying, extended work hours, or physical activities. It is getting popular among many consumer groups, including professionals, students, and athletes who require a quick energy boost.

Also, there is a diverse range of energy drinks, each famous for its unique flavor and taste among all age demographics. Additionally, the growing popularity of ready-to-drink premixes further supports this demand, particularly in vending machine sales.

These beverages are gaining popularity among health-conscious consumers as they are free from sugar, glucose, and high fructose corn syrup. Manufacturers are actively promoting these beverages as functional drinks that increase energy and attentiveness. They are designed to be consumed for rehydration purposes and can be both carbonated or non-carbonated, making them suitable for various dietary preferences, such as non-alcoholic beverages.

Key Takeaways

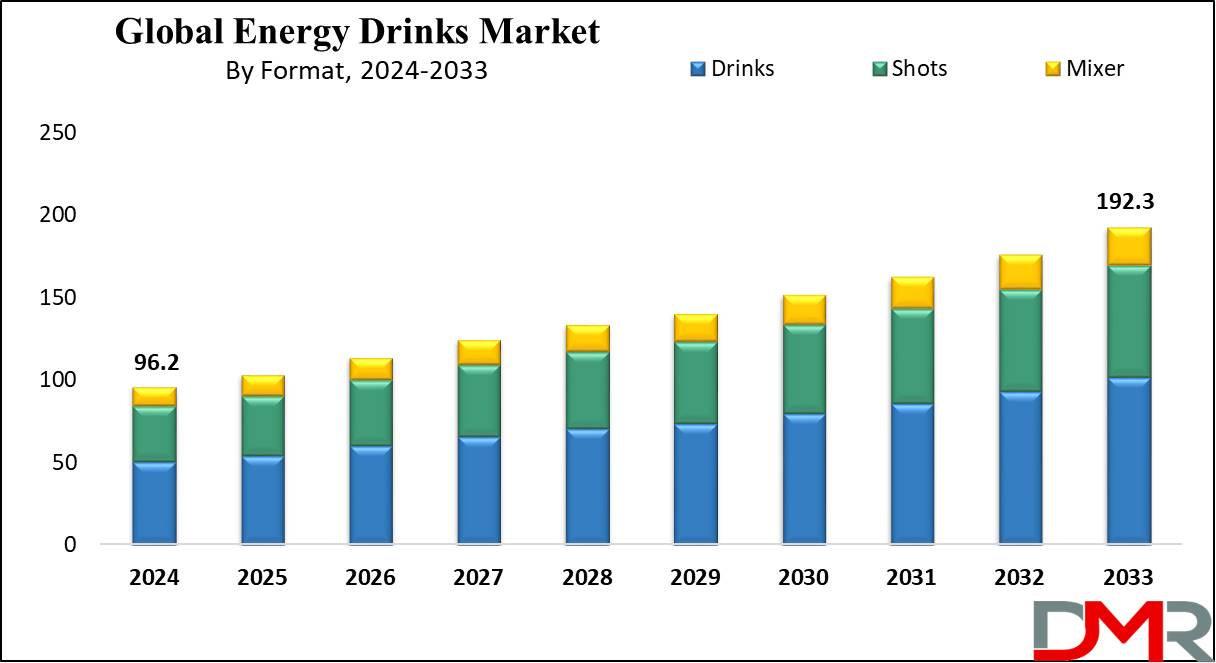

- Market size: The Global Energy Drinks Market is expected to grow by 89.2 billion, at a CAGR of 8.0% during the forecasted period of 2025 to 2033, according to Energy Drinks Market Research.

- Market Definition: Energy Drinks are beverages to provide high energy levels containing ingredients like caffeine, vitamins, amino acids, & natural extracts, aligning with the growing interest in sports medicine and protein supplements.

- Format Segment Analysis: In terms of format, drinks are expected to dominate the energy drink market with the largest revenue share of 52.7% in 2024.

- Nature Segment Review: Based on nature, the conventional segment is anticipated to lead the market with the largest revenue share in 2024.

- Packaging Segment Analysis: Cans segment is predicted to experience notable growth based on packaging throughout the forecasted period.

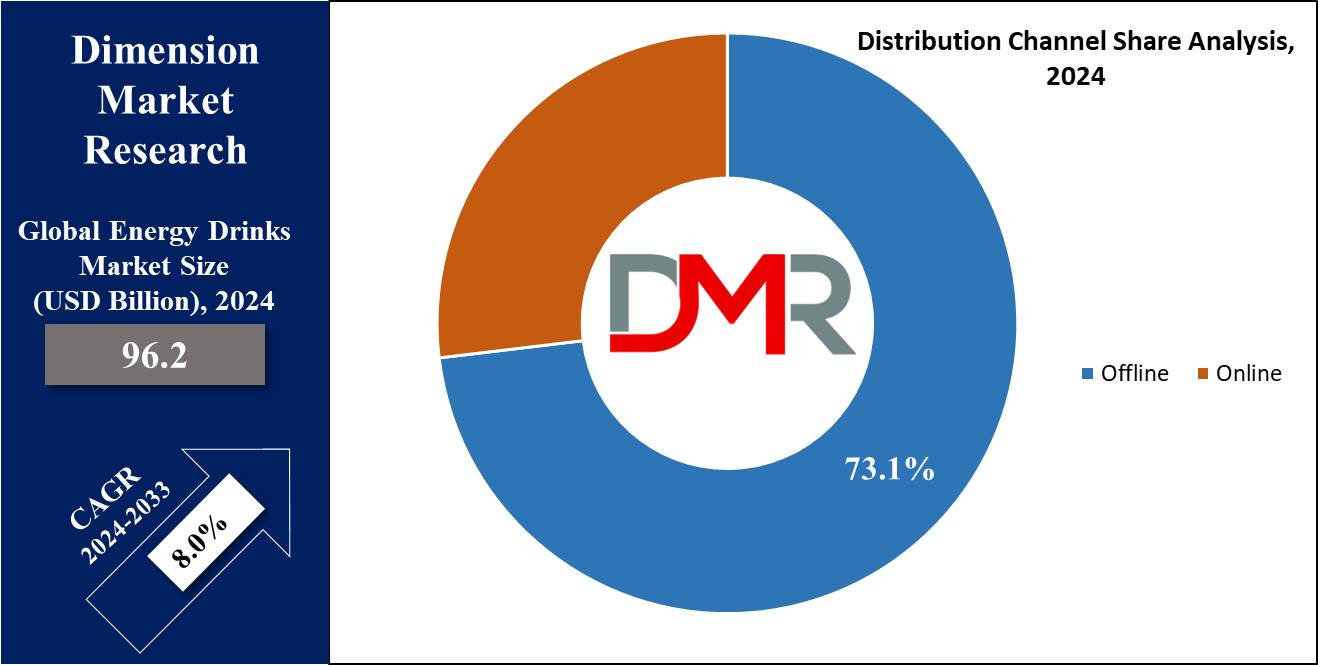

- Distribution Channel: Based on the distribution channel, offline segments are expected to dominate the energy drink market with the largest revenue share of 73.1% in 2024.

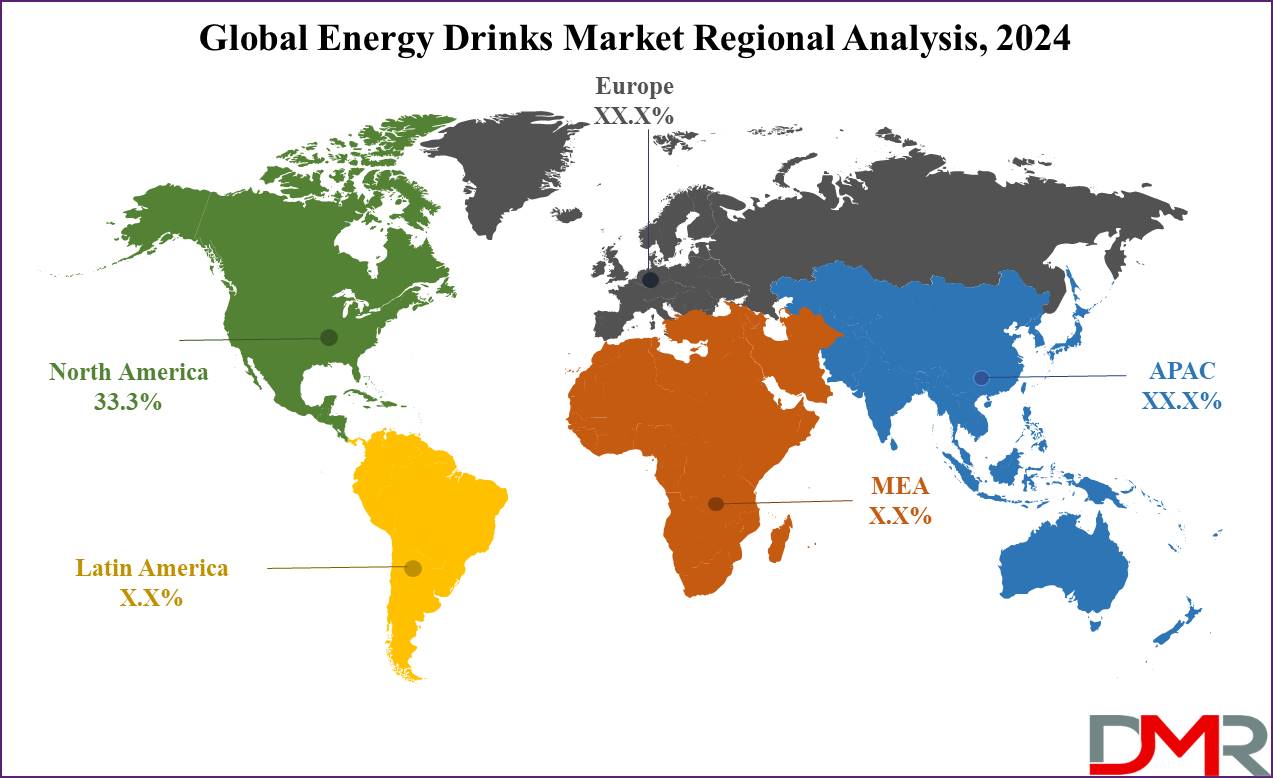

- Regional Analysis: North America is expected to dominate the market with a revenue share of 33.3 % in 2024.

Use Cases

- Studying and Work: Students and professionals often require energy drinks during their long working periods, as drinks like caffeine help them to improve concentration, mental alertness, and cognitive function, making it easier to stay focused and productive. This can be especially effective when paired with sports nutrition supplements to maintain performance.

- Night Shift Workers: These are preferred by night shift workers as they can improve concentration, mental alertness, and cognitive function. In this context, energy drinks also overlap with protein ingredients aimed at enhancing recovery.

- Weight Management: These drinks are marketed to be helpful in weight management and claim to increase metabolism and promote fat-burning. This aligns with the growing trend of dietary supplements aimed at improving metabolism.

- Outdoor Activities: Hiking, biking, or climbing are some of the outdoor activities that require energy drinks as they increase the energy level in the body, especially when combined with natural language processing techniques for creating tailored bubble tea or other health-oriented products.

- Increases Alertness: Consumers want to improve their mental alertness and concentration, like long-distance drivers or those tackling mentally challenging tasks, frequently use energy drinks. They are also marketed as functional beverages that enhance focus without alcohol.

Market Dynamic

The energy drink market is experiencing growth mainly due to the popularity of beverages excluding alcohol, and natural energy drinks which contain many nutritional benefits. Caffeinated energy drinks are a good pre-workout option due to the rising gym culture, which is driving the growth of this market.

Protein supplements and sports analytics have also contributed to an increase in product awareness and consumption, especially among athletes. Pre-workout drinks contain amino acids, caffeine, sugar, as well as vitamins that help to stay energized and focused during training sessions. Sports equipment like wearable fitness technology further enhances the utility of these drinks.

Taurine is used in these energy drinks, which are important for the proper functioning of cardiovascular activities and the development of skeletal muscle. These factors are significant for the growth of the energy drink market, particularly as consumers demand more sports nutrition-focused products.

Further, an increase in health consciousness along with the change in consumer lifestyle and rise in awareness toward health and wellness products are expected to fuel the market growth globally.

Moreover, the availability of ready-to-drink beverages through many distribution channels is also a key factor in driving the growth of this market. Energy drinks with high carbohydrate content improve the performance of the body by increasing the recovery process and boosting the energy level.

These drinks are increasingly used in the sports industry as they help athletes to improve their performance. However, the overconsumption of caffeine can cause hypertension, nausea, restlessness, & other associated health risks, which obstruct the growth of this market. The Nutraceuticals sector also faces regulatory challenges as more consumers demand transparency in ingredients.

Research Scope and Analysis

By Format

The drinks segment is expected to experience a revenue share of 52.7% based on the format in 2024, as they offer quick hydration and essential nutrients, promoting overall well-being, which is favored by consumers.

It has a wide consumer base due to its availability and versatility, which can be enjoyed at work, after a workout, or during a sports or leisure activity, driving the demand for these drinks among consumers.

The drinks segment includes a variety of flavors and formulations, fulfilling the needs of all customer bases, which can be easily mixed with vitamins, minerals, and other nutrients that contribute to the growth of this segment.

The shots segment is increasingly getting popular during the upcoming year due to its convenience, as they can be easily carried in pockets, purses, or gym bags. They are normally consumed in smaller quantities and can be easily absorbed by the body as they contain a simple texture, which provides quick energy to the consumers.

The mixer is anticipated to experience significant growth in this segment in the forecasted perio,d fueled by the increasing use of mixers as beverage enhancers. This segment is preferred by consumers to create high-quality cocktails and alcoholic mocktails, driving the growth of this segment.

In addition, major new brands are experimenting with new mixer flavors to attract a larger consumer base. Further, mixer of alcohol with caffeinated energy drinks or soft drinks can minimize the harmful effects of neat alcohol, which boosts the growth of this market.

By Nature

The conventional segment is expected to dominate the energy drink market with the largest revenue share in 2024 due to lesser awareness about organic products, which favors the growth of this segment. In addition, these are normally affordable as compared to organic drinks as they consist of less expensive ingredients and production processes.

Many consumers are familiar with conventional drinks, and being loyal to the known brand contributes to the growth of this segment. Major manufacturers and retailers in this market also prefer conventional energy drinks for a high profit margin per unit of shelf space, which boosts the growth of this segment in the energy drink market.

On the other hand, the organic segment is forecasted to grow at a high CAGR due to its richness in nutrients and antioxidants, which is appealing to health-conscious consumers.

Also, there is a growing trend to use healthier and safer alternatives, which drives the growth of the organic energy drink market. These drinks are aimed at specific consumer segments, such as athletes and fitness enthusiasts, to meet their needs & preferences.

By Packaging

The can segment is predicted to experience notable growth throughout the forecasted period as they are preferred by the young consumer due to their portability and durability compared to glass.

These are lightweight and easy to carry, making them suitable for sports, workouts, outdoor events, and travel. This metal also offers cooling properties that keep the drink colder for a long period, appealing to all consumers, driving the growth of this market.

Aluminum cans are getting popular among other cans as they are recyclable and align with sustainability trends, which contributes to the growth of this segment. The bottles segment is anticipated to grow with the second-largest revenue share during the forecasted period as ready-to-drinks are initially launched in this packaging which becomes very popular globally.

Also, the bottle packaging segment is growing continuously due to the shortage of aluminum in some areas. Bottles made from plastic cause land and water pollution, which has driven the demand for glass bottles as these bottles are convenient and more environmentally friendly. Moreover, the growing shift toward glass bottles is expected to drive the growth of energy drinks in this packaging format.

By Product Type

Caffeinated beverage is expected to influence the energy drink market throughout the forecasted period as they contain caffeine, which is famous for its ability to enhance alertness, focus, and energy levels suitable for students, professionals, & athletes.

The introduction of new flavors, formulations, and functional ingredients in these beverages drives the growth of this segment by fulfilling the preferences of the evolving consumer base. These drinks are convenient and fit perfectly well with the busy lifestyle at the office, and workout sessions to boost energy.

Decaffeinated energy drinks are getting popular as they attract health-conscious consumers searching for energy drinks that have functional benefits without using caffeine as an ingredient and often include non-caffeinated ingredients for energy and well-being.

These beverages are preferred by consumers, particularly for evening consumption, promoting relaxation and improved sleep quality, and also providing hydration and nutrients. These factors are significantly dominating the growth of this market.

By Flavor

Flavored energy drinks are expected to lead the energy drinks market with the largest revenue share in 2024 due to their diverse range of taste options and consumer preferences. Flavors like fruit, berry, citrus, tropical, and herbal variants are available to satisfy a variety of consumers and offer enjoyable sensory experiences.

Individuals who prefer a more relaxing and tastier beverage over unflavored ones often opt for flavored energy drinks. Also, flavored energy drinks allow companies to establish themselves apart from the competition in a crowded market, drawing in new clients and strengthening brand loyalty.

Further, these drinks can adjust to new flavor trends and their ability to target specific groups with marketing campaigns adds to their market success and steady expansion. Unflavored drinks are experiencing consistent growth in the energy drink market, fueled by several key factors like a rising population of health-conscious consumers who value simplicity and natural components in their drinks.

These drinks are favored by consumers who prefer pure and clean choices without additional flavors or synthetic additives. Moreover, the adoption of these drinks allows the consumer to use them in many way,s like missing them with other drinks or including them in dishes, increasing their demand and reaching a wider audience.

By Categories

Natural energy drinks are expected to lead the energy drink market with the largest revenue share in 2024 due to their rising consumer choice for healthier and cleaner drink options.

Consumers are searching for products made with natural ingredients like plant extracts, herbs, vitamins, & minerals, to provide energy without artificial additives or excessive sugars.

This segment focuses on organic and non-genetically modified organism ingredients, as well as certifications such as US Department of Agriculture Organic, which align with consumers who are environmentally aware. Major known brands in this segment are focused on transparency, sustainability, and ethical sourcing practices to appeal to consumers.

The sports drink is anticipated to show constant growth mainly due to increasing participation in sports and fitness activities globally. These are popular with athletes, gym-goers, and those who live active lifestyles as they are used to restore electrolytes, carbohydrates, and fluids lost during physical activity.

The non-alcoholic segment, including energy drinks without alcohol, shows constant growth due to increasing consumer preference for non-alcoholic substitutes. These are suitable for many occasions and are preferred by those consumers who are searching for energy-boosting beverages without the effects of alcohol.

By Distribution Channel

Offline segments are expected to dominate the energy drink market with the largest revenue share of 73.1% in 2024. This segment includes supermarkets/hypermarkets, convenience stores, specialized stores, and others. These channels are fueled by the growth of the energy drink market due to increasing consumer demand for energy beverages, with customers preferring to physically inspect the product quality, ingredients, and brand offerings

These are preferred by many manufacturers and companies as they have a wide base of consumers and extensive reach in the market. Walmart, Walgreens, CVS Pharmacy, Target Brands, Inc., Kroger, and Safeway are some of the known supermarkets that offer a range of brands for the energy drink market.

Online channels are anticipated to show significant growth due to the popularity of online retailers and e-commerce sites. Consumers are increasingly purchasing energy drinks through digital channels like online retail and e-commerce sites with the increasing popularity of online shopping and the convenience it offers. These platforms provide a vast array of options and allow the consumer to compare brands, flavors, prices, and reviews, which improves their purchasing experience.

The Global Energy Drinks Market Report is segmented based on the following

By Format

By Nature

By Packaging

By Product Type

- Caffeinated Beverage

- De-caffeinated Beverage

By Flavor

By Categories

- Natural Energy Drink

- Sports Drink

- Non-Alcoholic Beverage

- Functional beverages

- Non-carbonated packaged drinks

By Distribution Channel

Regional Analysis

North America is expected to show notable growth with a revenue

share of 33.3% in 2024 and is expected to continue its dominance in the forecasted period from 2024 to 2033. This dominance is attributed to the increasing consumption of energy drinks due to rising disposable incomes, the emergence of domestic brands, and intensified marketing efforts. This region is leading the market due to evolving demographics, changing consumer tastes, and drinking preferences.

Also, the presence of diversified platforms ranging from modern trade to online sales channels resulted in the expansion of the global energy drinks market in this region. The drinking habits of consumers are impacted by migration trends and globalization, which has given the market players the chance to expand their beverage portfolios to satisfy a variety of tastes.

Asia-Pacific is predicted to be the second fastest-growing region in 2024 due to increasing consumer openness to new flavors and high demand from immigrant interest in different beverages. The introduction of new products aimed at capturing consumers' attention and meeting their preferences effectively is also one of the factors expanding the growth of the market.

By Region

North America

Europe

- Germany

- The U.K.

- France

- Italy

- Russia

- Spain

- Benelux

- Nordic

- Rest of Europe

Asia-Pacific

- China

- Japan

- South Korea

- India

- ANZ

- ASEAN

- Rest of Asia-Pacific

Latin America

- Brazil

- Mexico

- Argentina

- Colombia

- Rest of Latin America

Middle East & Africa

- Saudi Arabia

- UAE

- South Africa

- Israel

- Egypt

- Rest of MEA

Competitive Landscape

Major market participants commonly employ strategies such as introducing new products and expanding through investments. Manufacturers and suppliers are focusing on logistical improvements and strengthening distribution channels as part of their business growth strategies.

This market is defined by the existence of a handful of established companies alongside numerous small and medium-sized players. These initiatives are improving the product adoption rates among global consumers.

Companies are continuously launching new innovative products with natural flavors and creative packaging designs to attract more customers. For instance, Red Bull has introduced its "Red Bull Editions" range, featuring different versions like sugar-free Red Bull Editions with zero sugar and calories, caffeine-free Red Bull Editions, organic Red Bull Editions, and others.

The energy drinks market is fragmented due to many participants, and it is anticipated that there will be moderate to intense competition among the companies. Some of the major key players in the Global market are Coca-Cola Company, PepsiCo. Inc., Red Bull & many others. Companies in this market allocate resources toward R&D to introduce high-quality frozen pizza products.

Some of the prominent players in the global energy drinks market are:

- Red Bull

- Taisho Pharmaceutical Co. Ltd.

- PepsiCo. Inc.

- Monster Energy

- Lucozade

- The Coca-Cola Company

- Amway

- AriZona Beverages USA

- Living Essentials LLC

- Xyience Energy

- Others

Recent Development

- In January 2024, Rockstar Energy Drink has introduced Rockstar Focus, a new product in their expanding energy lineup which is designed to provide consumers with both energy and mental clarity, aiding in enhancing focus.

- In March 2023, Red Bull has extended its 'Summer Edition' series by introducing a fresh Juneberry-flavored energy drink that offers a taste that evokes dark cherries, raisins, and blueberries.

- In February 2022, PepsiCo. Inc. unveiled a hemp-based energy drink in the United States, featuring ingredients like hemp oil, vitamin B, spearmint, lemon balm, and caffeine.

- In January 2022, Anheuser-Busch Companies LLC announced plans to introduce energy drinks in India, targeting the energy drinks market fueled by millennials and affluent consumers in major urban areas.

- In January 2022, Starbucks teamed up with PepsiCo. Inc. to launch energy drinks, initially available in grocery stores, national retailers, and convenience stores across the U.S.