Market Overview

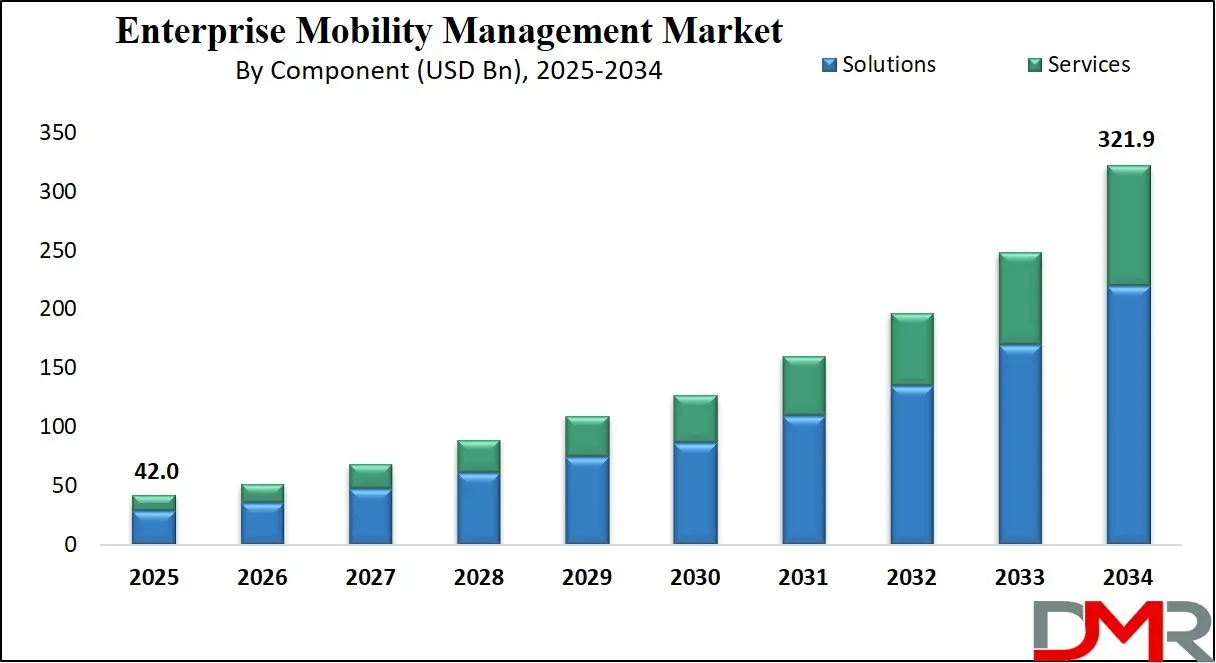

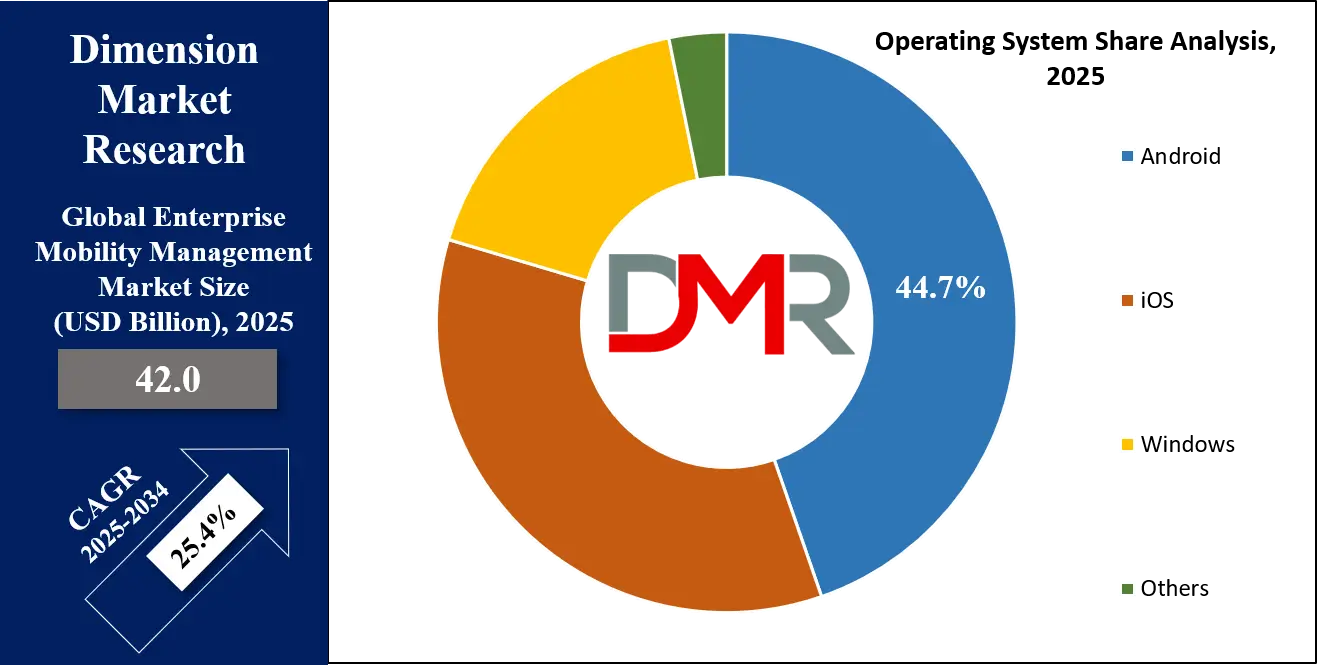

The Global Enterprise Mobility Management Market size is projected to reach USD 42.0 billion in 2025 and grow at compound annual growth rate of 25.4% from there until 2034 to reach a value of USD 321.9 billion.

Enterprise Mobility Management (EMM) is a group of tools and technologies used by companies to manage the mobile devices, applications, and data their employees use for work. With the growing use of smartphones, tablets, and laptops, companies need systems to make sure these devices are secure, updated, and compliant with internal policies. EMM solutions help businesses monitor, control, and support devices whether they are company-owned or employee-owned, allowing employees to work from anywhere while protecting sensitive company information.

The need for EMM has grown due to the rise of remote work, flexible job roles, and the use of personal devices for professional tasks. As more employees work outside traditional office settings, organizations face new challenges in securing data and ensuring smooth access to company resources. EMM tools help manage these challenges by offering features like device tracking, remote locking, and data encryption. They also support functions such as secure file sharing, email management, and app controls. These capabilities make it easier for businesses to provide flexible work environments without compromising on security.

Recent trends in the EMM space include integration with cloud platforms, support for Internet of Things (IoT) devices, and the use of Artificial Intelligence (AI) to automate tasks. Companies are also focusing more on Unified Endpoint Management (UEM), which combines EMM with management of desktops and other endpoints. Another trend is the increasing use of analytics in EMM tools, allowing IT teams to understand usage patterns, detect threats early, and optimize resource use. As digital workforces grow, companies want systems that are not just secure, but also smart and easy to manage.

Over the past few years, several key events have shaped the EMM market. Major tech firms have expanded their mobility solutions, while newer players have introduced AI-powered features to help automate routine tasks. Partnerships between cybersecurity companies and mobility vendors have strengthened the security layer of EMM platforms. Some vendors have added remote support tools, recognizing the need to troubleshoot devices quickly as hybrid and remote work models become permanent for many firms.

The COVID-19 pandemic accelerated the need for EMM solutions, as millions of employees shifted to working from home. This sudden change made mobile management a top priority for businesses worldwide. Even post-pandemic, many organizations continue to support hybrid work, and EMM remains essential for ensuring employees have safe, reliable access to work systems from anywhere. EMM also plays a role in helping businesses comply with data protection rules, especially when handling client data across multiple locations.

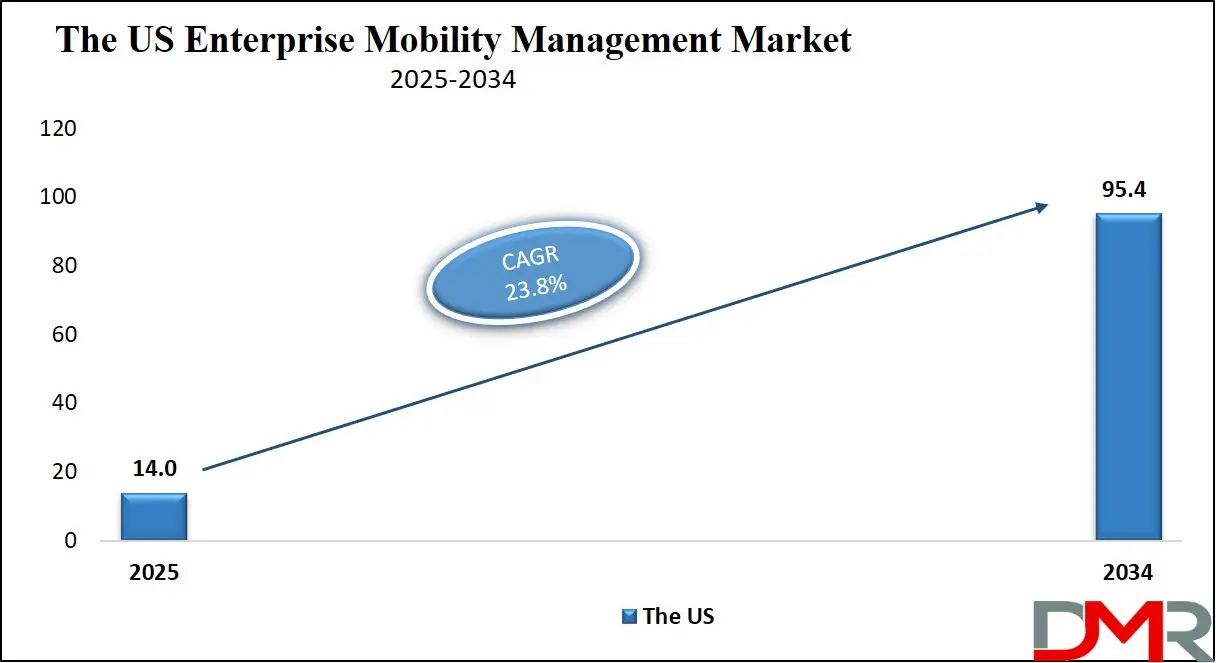

The US Enterprise Mobility Management Market

The US Enterprise Mobility Management Market size is projected to reach USD 14.0 billion in 2025 at a compound annual growth rate of 23.8% over its forecast period.

The US plays a leading role in the Enterprise Mobility Management (EMM) market due to its advanced technology infrastructure and high adoption of mobile and cloud-based solutions. Many of the world’s top EMM providers are headquartered in the US, driving innovation through continuous upgrades and feature development.

The country’s strong focus on cybersecurity, remote work, and digital transformation fuels demand for secure mobility solutions across industries. US businesses, both large and small, are early adopters of BYOD policies and remote workforce tools, making the market highly dynamic. Government regulations and corporate compliance standards in the US also push organizations to adopt robust EMM systems. As a result, the US continues to set trends and shape the global direction of EMM solutions.

Europe Enterprise Mobility Management Market

Europe Enterprise Mobility Management Market size is projected to reach USD 10.1 billion in 2025 at a compound annual growth rate of 24.9% over its forecast period.

Europe holds a significant position in the Enterprise Mobility Management (EMM) market, driven by strong data protection regulations such as GDPR and a growing focus on cybersecurity. Organizations across Europe are investing in secure mobility solutions to support remote work, improve compliance, and manage diverse device ecosystems.

The region is known for its strict privacy standards, which encourage the adoption of EMM tools with advanced encryption and data control features. European enterprises, especially in sectors like finance, healthcare, and government, are increasingly adopting BYOD and hybrid work models, further fueling demand for EMM. In addition, cross-border business operations and a multilingual workforce make centralized mobility management essential. Europe’s regulatory environment and digital strategies continue to shape the development of EMM platforms.

Japan Enterprise Mobility Management Market

Japan Enterprise Mobility Management Market size is projected to reach USD 2.1 billion in 2025 at a compound annual growth rate of 28.9% over its forecast period.

Japan plays a growing and strategic role in the Enterprise Mobility Management (EMM) market as it embraces digital transformation and mobile-first work environments. Japanese companies are increasingly adopting EMM solutions to manage mobile devices, ensure data security, and support remote and hybrid workforces. With a strong focus on quality, compliance, and operational efficiency, businesses in Japan look for reliable and scalable EMM platforms.

The country’s advanced technology infrastructure and commitment to automation further drive interest in intelligent mobility tools. As cybersecurity awareness rises, EMM is becoming essential in industries like manufacturing, healthcare, and finance. Additionally, government efforts to modernize work practices and promote flexible work arrangements are accelerating the demand for secure mobile management solutions across Japan.

Enterprise Mobility Management Market: Key Takeaways

- Market Growth: The Enterprise Mobility Management Market size is expected to grow by USD 270.3 billion, at a CAGR of 25.4%, during the forecasted period of 2026 to 2034.

- By Component: The solutions is anticipated to get the majority share of the Enterprise Mobility Management Market in 2025.

- By Operating System: The android segment is expected to get the largest revenue share in 2025 in the Enterprise Mobility Management Market.

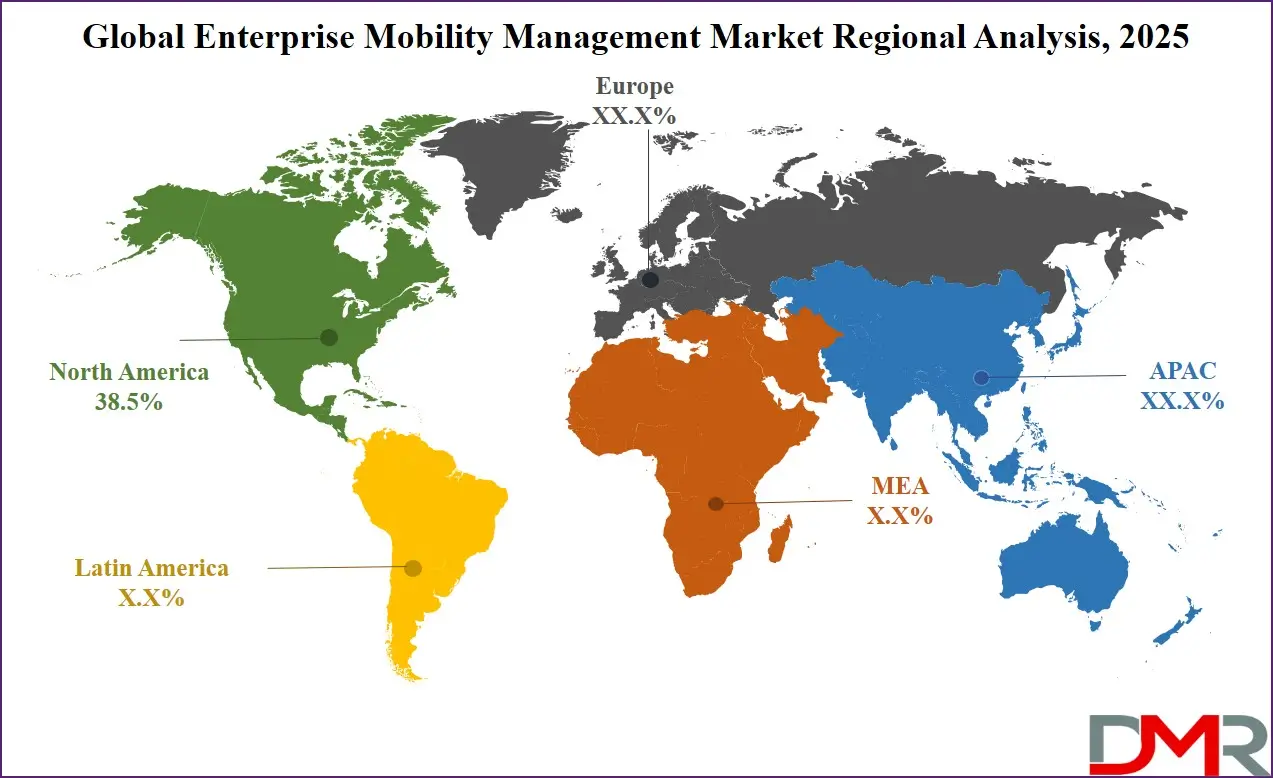

- Regional Insight: North America is expected to hold a 38.5% share of revenue in the Global Enterprise Mobility Management Market in 2025.

- Use Cases: Some of the use cases of Enterprise Mobility Management include Remote work management, BYOD Support, and more.

Enterprise Mobility Management Market: Use Cases

- Remote Work Management: EMM enables employees to securely access company resources from anywhere using their mobile devices. IT teams can control access, monitor usage, and enforce security policies remotely. This helps ensure productivity and data safety in a hybrid or remote work environment.

- Bring Your Own Device (BYOD) Support: With BYOD policies, employees use personal devices for work. EMM helps separate personal and professional data on these devices. It ensures that company information remains secure without interfering with personal apps or usage.

- Device and App Management: EMM tools allow businesses to remotely manage, update, and monitor devices and applications. This includes pushing updates, blocking harmful apps, or wiping data from lost or stolen devices. It reduces risks and ensures consistent performance.

- Compliance and Data Protection: Companies handling sensitive data must meet strict security rules. EMM ensures devices follow company policies, encrypts data, and keeps audit logs. It helps organizations stay compliant with legal and industry regulations.

Stats & Facts

- According to OECD (2023):

- Around 90% of countries had either implemented or were in the process of developing a national digital strategy by 2023, reflecting a growing global commitment to digital transformation across public services and governance structures. These strategies play a crucial role in shaping the future of digital economies.

- Digital government, connectivity, and digital skills were ranked as the top priorities for national digital policy agendas in 2023, with many countries aligning their broader development plans around these pillars to keep up with global technology shifts.

- Nearly half of the 38 countries surveyed had established dedicated digital ministries to lead digital strategy creation and implementation, a significant increase from just under 25% of countries in 2016, signaling a growing political focus on digitalization.

- Among 1,200 policy initiatives tracked across OECD countries, nearly one-third aimed to enhance digital technology use, stimulate innovation, and contribute to inclusive social development. AI and 5G technologies were most frequently mentioned across national initiatives.

- The share of women working as ICT specialists in OECD countries remains worryingly low, ranging from only 11% to 24%. This gender imbalance highlights the ongoing challenges related to digital inclusion and equal participation in the tech workforce.

- Fibre-optic networks have become the leading broadband access method across OECD nations, indicating a shift toward high-speed internet infrastructure to meet the growing demand for data-heavy applications like streaming, video conferencing, and cloud computing.

- Mobile data consumption per user nearly tripled between 2018 and 2023 in OECD countries, illustrating the surge in smartphone use, mobile applications, and on-the-go digital services that demand fast, affordable, and reliable mobile connectivity.

- Reliable and affordable connectivity is increasingly essential, especially in rural and underserved regions. Ensuring accessibility, service quality, and affordability is seen as a key priority to bridge the urban-rural digital divide.

- Advancements in AI and robotics are reshaping the skills landscape in OECD nations, creating urgent demand for education systems and workforce development programs to prepare individuals for a technology-driven economy.

- Investment in digital education, training, and lifelong learning initiatives is now seen as critical, as AI adoption grows and traditional roles evolve. Countries are being encouraged to future-proof their labor markets through sustained human capital development.

- Nearly 50% of individuals across OECD countries report avoiding certain websites, mobile applications, or social media platforms due to privacy or data security concerns, showing how digital trust is becoming a key issue in user behavior and digital platform engagement.

Market Dynamic

Driving Factors in the Enterprise Mobility Management Market

Rise of Remote and Hybrid Workforces

The global shift toward remote and hybrid work has become a major driver for the Enterprise Mobility Management market. As organizations allow employees to work from home or split time between office and remote locations, they need secure ways to manage access to corporate resources. EMM tools provide essential features such as remote device control, secure file sharing, and mobile application management, making them critical for managing distributed teams.

These solutions also help maintain productivity by offering seamless access to work tools while keeping sensitive data protected. The demand for secure mobility tools surged during the pandemic and continues to grow as flexible work models become permanent across various industries. Companies now prioritize mobility strategies as part of their long-term IT planning.

Growing Adoption of BYOD Policies

Many companies are adopting Bring Your Own Device (BYOD) policies to reduce hardware costs and improve employee satisfaction. However, managing and securing a wide range of personal devices presents major challenges. EMM solutions address these issues by separating corporate data from personal information, allowing businesses to retain control over sensitive assets without invading employee privacy.

They also enable secure application management, remote data wiping, and threat detection on non-company-owned devices. As the number of personal smartphones and tablets used for work increases, businesses rely on EMM to ensure consistent security and compliance. The flexibility offered by BYOD, combined with strong EMM support, is helping companies boost agility and reduce infrastructure spending.

Restraints in the Enterprise Mobility Management Market

High Implementation and Maintenance Complexity

One major weakness of the Enterprise Mobility Management market is the complexity involved in implementing and maintaining these solutions. Setting up an EMM system often requires integration with existing IT infrastructure, configuring security protocols, and managing a wide variety of devices and operating systems. For companies without dedicated IT teams, this can be overwhelming and time-consuming.

Regular updates, policy changes, and ongoing support are needed to keep systems secure and functional. This complexity can lead to increased costs and slower adoption, especially for small and medium-sized businesses. The technical demands may also lead to inconsistent enforcement of policies, putting sensitive data at risk and reducing the overall effectiveness of EMM solutions.

User Experience and Privacy Concerns

Another key challenge in the EMM market is balancing device security with user experience and privacy. Employees often resist using EMM tools on personal devices due to concerns about data privacy and surveillance. Strict security policies, background tracking, and limited control over personal apps can negatively impact user satisfaction.

In some cases, the presence of EMM software can slow down devices or interfere with normal usage, leading to frustration and lower productivity. If not implemented transparently, EMM tools can damage employee trust and create a negative perception of IT governance. These concerns may limit the success of BYOD programs and reduce the adoption of mobility solutions across organizations.

Opportunities in the Enterprise Mobility Management Market

Integration with AI and Automation

A major opportunity in the Enterprise Mobility Management market lies in the integration of Artificial Intelligence (AI) and automation. AI can enhance EMM by enabling predictive analytics, automated threat detection, and intelligent policy enforcement. Automated workflows can reduce manual tasks such as device onboarding, compliance checks, and software updates, saving time and improving consistency.

These features also help IT teams respond faster to incidents, reducing downtime and risks. As businesses seek smarter and more efficient tools, EMM solutions that leverage AI can offer competitive advantages. This shift can also lead to the development of adaptive security systems that adjust policies based on real-time behavior, further strengthening enterprise mobility strategies.

Expansion into Small and Mid-sized Businesses (SMBs)

The growing digital transformation among small and mid-sized businesses presents a strong opportunity for EMM providers. Previously, many SMBs avoided EMM due to cost and complexity, but with cloud-based and subscription models now available, entry barriers have lowered. Lightweight, scalable EMM solutions tailored for SMBs can meet their needs without heavy infrastructure investment.

These businesses are also adopting remote work and BYOD policies, creating demand for affordable and easy-to-use mobility management tools. Vendors that design simplified platforms with guided setup and minimal maintenance can tap into this largely underpenetrated market. As cybersecurity threats rise, even smaller companies are beginning to see EMM as essential for protecting sensitive data and maintaining operational continuity.

Trends in the Enterprise Mobility Management Market

AI-Driven Automation and Zero-Trust Security

Enterprise Mobility Management is seeing a strong shift toward AI-powered automation to improve efficiency and reduce manual IT workload. AI helps identify risky behavior, automate policy enforcement, and improve incident response times. At the same time, businesses are adopting zero-trust security models, which assume no device or user is automatically trusted. This means every access request is verified before being granted, even within the company network.

These two approaches work together to strengthen security, especially in remote and hybrid work environments. AI also supports smarter decision-making by analyzing usage patterns and system behavior. Together, these trends are making EMM solutions more proactive, intelligent, and secure.

5G, Edge, and IoT Device Expansion

The rollout of 5G is enabling faster and more stable mobile connections, leading to the rise of new connected devices in the workplace. EMM systems are now expected to manage not just smartphones and tablets, but also wearables, smart sensors, and edge devices. This growth is especially important in sectors like healthcare, logistics, and manufacturing. With edge computing, data is processed closer to the device, improving performance and reducing delays. EMM tools are being updated to support this wider range of devices and real-time data needs. Augmented reality and virtual collaboration tools are also becoming part of the EMM ecosystem. These developments are expanding the role of EMM far beyond traditional device control.

Impact of Artificial Intelligence in Enterprise Mobility Management Market

- Automated Threat Detection and Response: AI enables EMM platforms to detect unusual behavior or potential security threats in real time. It can automatically respond to incidents by isolating compromised devices or triggering alerts, reducing the risk of data breaches.

- Smarter Policy Enforcement: AI helps create adaptive policies that adjust based on user behavior, device usage, location, and risk levels. This ensures better security while minimizing disruptions to employee productivity.

- Predictive Maintenance and Issue Prevention: By analyzing device performance and usage patterns, AI can predict technical issues before they occur. This allows IT teams to take proactive steps and reduce downtime.

- Enhanced User Experience: AI-driven features like virtual assistants and intelligent suggestions help employees troubleshoot issues, access apps, and configure settings more easily, reducing the burden on IT support.

- Efficient Device and App Management: AI streamlines large-scale device provisioning, app deployment, and updates by automating routine tasks, helping organizations save time and manage resources more efficiently.

Research Scope and Analysis

By Component Analysis

Solution segment is set to be the leading component in the Enterprise Mobility Management market in 2025, with an estimated share of 68.3%. Businesses are increasingly adopting EMM solutions to manage mobile applications, devices, and content across their workforce. These solutions offer centralized control, security policy enforcement, and app management, which are critical in today’s mobile-first work environments. With more organizations supporting bring-your-own-device (BYOD) models and remote work, demand for scalable, secure, and easy-to-deploy mobility solutions continues to grow.

EMM solutions help streamline device provisioning, automate compliance, and protect sensitive data from unauthorized access. Integration with cloud platforms and advanced analytics has further boosted their adoption. The solution segment plays a major role in enabling enterprises to implement effective mobility strategies while reducing manual IT efforts and improving productivity. Its flexibility and comprehensive functionality make it the preferred choice for businesses investing in enterprise mobility initiatives.

Services segment, having significant growth over the forecast period, plays a key supporting role in driving the Enterprise Mobility Management market. These services include consulting, implementation, support, and training that help organizations effectively deploy and manage their mobility solutions. As businesses adopt more complex mobile infrastructures, they rely on expert services to ensure smooth integration, configuration, and long-term system optimization.

Managed services, in particular, are gaining popularity for offering continuous monitoring, updates, and issue resolution without burdening internal IT teams. The need for customized service packages tailored to specific industries and enterprise sizes is also growing. With evolving compliance standards and rising cybersecurity risks, service providers are essential in helping organizations keep their EMM systems secure and updated. The services segment complements the solution offering by ensuring proper planning, execution, and support throughout the mobility lifecycle.

By Operating System Analysis

Android is expected to be the leading operating system in the Enterprise Mobility Management market in 2025, with an estimated share of 44.7%. Its dominance is supported by its widespread use, affordability, and flexibility across a wide range of devices. Enterprises prefer Android for its open-source nature, which allows greater customization and control over apps, device settings, and security features.

The availability of Android devices at various price points makes them suitable for businesses of all sizes, especially in emerging markets. With rising demand for mobile device management, application security, and remote access, Android’s role in enterprise mobility continues to grow. Its support for work profiles, encryption, and policy controls make it well-suited for managing corporate data. As companies expand their mobile infrastructure, Android remains a key choice for implementing cost-effective and scalable enterprise mobility strategies across industries.

iOS segment, having significant growth over the forecast period, plays a vital role in shaping the Enterprise Mobility Management market. Known for its strong security architecture and smooth user experience, iOS is widely used in enterprise settings, especially in developed markets.

Businesses that prioritize privacy, encryption, and regular updates often choose iOS devices to manage sensitive information and critical business operations. With increasing use of iPhones and iPads in the workplace, companies are investing more in iOS-compatible mobility tools that support device configuration, app management, and secure data access. Its integration with cloud services and compatibility with productivity apps also enhances remote working capabilities. As mobile strategies become more advanced, iOS continues to gain traction among organizations looking for secure and reliable mobile environments.

By Deployment Mode Analysis

Cloud deployment mode is projected to lead the Enterprise Mobility Management market in 2025 with an estimated share of 68.3%. Businesses are rapidly shifting to cloud-based EMM solutions due to their flexibility, scalability, and lower upfront costs. Cloud platforms allow organizations to manage mobile devices, applications, and data from anywhere, making them ideal for remote and hybrid work environments. These solutions are quick to deploy, require minimal on-site infrastructure, and support automatic updates and backups. With rising demand for secure remote access and centralized mobility control, cloud deployment continues to gain traction across industries.

It also enables faster response to security threats and easier integration with other enterprise tools. As companies focus on cost-effective digital transformation and global workforce connectivity, cloud-based EMM solutions remain the preferred choice for managing mobile operations with greater speed, security, and efficiency.

On-premises deployment mode, having significant growth over the forecast period, remains an important part of the Enterprise Mobility Management market. Organizations with strict data privacy requirements, especially in sectors like healthcare, finance, and government, often prefer on-premises solutions to maintain full control over their infrastructure.

This deployment type allows internal IT teams to manage data access, security updates, and system configurations within their physical networks. While more resource-intensive than cloud solutions, on-premises models offer high levels of customization and compliance with local regulations. Businesses concerned with data residency laws or operating in regions with limited cloud access rely on this mode for greater oversight. Despite growing cloud adoption, the demand for secure, in-house mobility management continues to support the relevance of on-premises EMM solutions in specific enterprise environments.

By Industry Vertical Analysis

IT & Telecom industry is projected to lead the Enterprise Mobility Management market in 2025 with an estimated share of 20.4%. This sector relies heavily on mobile devices, remote access, and real-time communication, making mobility management a top priority. Companies in IT and telecom use EMM solutions to manage a large number of endpoints, ensure data security, and maintain smooth operations across globally distributed teams. The fast-paced nature of the industry demands scalable, cloud-based, and policy-driven tools that can adapt to rapid changes.

With employees often working from various locations and using different devices, EMM plays a key role in securing corporate data, managing mobile applications, and supporting seamless collaboration. This vertical continues to adopt advanced mobility strategies to reduce risks, improve productivity, and support growing customer expectations, solidifying its leadership in the EMM market during the ongoing digital expansion in 2025.

Transportation & Logistics sector, having significant growth over the forecast period, plays a vital role in expanding the Enterprise Mobility Management market. Businesses in this field depend on mobile technologies for route planning, real-time tracking, fleet coordination, and supply chain visibility. EMM tools help logistics teams manage mobile devices used by field workers and drivers, protect sensitive data, and ensure smooth communication across networks.

These solutions improve delivery accuracy, enhance worker productivity, and minimize security risks when devices are lost or accessed remotely. As the industry continues to digitize and adopt smart mobility technologies, the demand for secure, scalable, and reliable mobility solutions keeps rising. The need to stay connected and responsive across moving assets makes EMM a key part of operational success in transportation and logistics.

The Enterprise Mobility Management Market Report is segmented on the basis of the following:

By Component

- Solutions

- Mobile Device Management (MDM)

- Mobile Application Management (MAM)

- Mobile Content Management (MCM)

- Identity and Access Management (IAM)

- Telecom Expense Management (TEM)

- Services

- Professional Services

- Managed Services

By Operating System

- Android

- iOS

- Windows

- Others

By Deployment Mode

By Industry Vertical

- BFSI

- Healthcare

- Retail

- IT & Telecom

- Government & Public Sector

- Manufacturing

- Transportation & Logistics

- Education

- Energy & Utilities

- Others

Regional Analysis

Leading Region in the Enterprise Mobility Management Market

North America, leading in 2025 with a share of 38.5%, continues to play the most dominant role in the growth of the Enterprise Mobility Management market. The region’s strong presence is driven by widespread adoption of mobile technologies, advanced IT infrastructure, and the rising need for secure remote access solutions. In the US and Canada, businesses across all sizes are increasingly embracing remote and hybrid work models, creating a higher demand for secure and flexible mobility management tools.

Enterprise Mobility Management solutions are widely used to support bring-your-own-device (BYOD) policies, enforce compliance, and protect sensitive corporate data. The presence of major technology providers, early adoption of cloud and AI, and growing concerns over cybersecurity further support market growth. In addition, regulatory standards and data protection laws in the region are pushing organizations to adopt structured mobile management frameworks. North America remains a key driver of innovation and investment in this space, shaping global trends and setting performance benchmarks in 2025.

Fastest Growing Region in the Enterprise Mobility Management Market

Asia Pacific is showing significant growth over the forecast period in the Enterprise Mobility Management market, driven by rapid digital transformation, increasing mobile workforce, and the expanding use of smartphones and tablets for business tasks. Countries like China, India, Japan, and South Korea are witnessing rising demand for secure mobile device management, data protection, and application control across various industries. With more businesses adopting bring-your-own-device (BYOD) policies and cloud-based solutions, the need for efficient enterprise mobility strategies is growing fast.

It is also expected that government support for digitalization and rising awareness around cybersecurity will further boost the adoption of mobility solutions, making Asia Pacific a major growth engine in this market.

By Region

North America

Europe

- Germany

- The U.K.

- France

- Italy

- Russia

- Spain

- Benelux

- Nordic

- Rest of Europe

Asia-Pacific

- China

- Japan

- South Korea

- India

- ANZ

- ASEAN

- Rest of Asia-Pacific

Latin America

- Brazil

- Mexico

- Argentina

- Colombia

- Rest of Latin America

Middle East & Africa

- Saudi Arabia

- UAE

- South Africa

- Israel

- Egypt

- Rest of MEA

Competitive Landscape

The Enterprise Mobility Management (EMM) market is highly competitive, with many global and regional players offering a variety of solutions. Companies in this space are constantly improving their tools to offer better security, user experience, and support for multiple devices and operating systems. The market is shaped by innovation, with a focus on adding automation, analytics, and cloud integration.

Larger vendors often provide all-in-one platforms, while smaller firms may focus on specialized features or industry-specific needs. As remote and hybrid work models grow, more businesses are adopting EMM solutions, driving competition further. Pricing, ease of use, and scalability are key factors in buying decisions, and providers often compete by offering flexible plans, strong customer support, and continuous updates.

Some of the prominent players in the global Enterprise Mobility Management are:

- Microsoft

- IBM

- VMware (Broadcom)

- Citrix Systems

- Cisco Systems

- BlackBerry

- SAP

- Oracle

- Google

- Apple

- Samsung SDS

- MobileIron (acquired by Ivanti)

- Ivanti

- Sophos

- ManageEngine (Zoho Corp)

- SOTI

- Matrix42

- Jamf

- Snow Software

- Scalefusion

- Other Key Players

Recent Developments

- In April 2025, Bosch introduced its cloud-based Supply Chain Studio at the inaugural Mobility Platform and Solutions (MPS) Summit 2025, aiming to improve supply chain visibility and efficiency. Unveiled before logistics providers, warehouse managers, and mobility leaders, the platform brings together key stakeholders across the supply chain. Developed in line with India’s Gati Shakti initiative, it addresses critical gaps in multimodal transport, warehousing, and last-mile operations. The Studio integrates with ERPs like Tally and third-party marketplaces to streamline fragmented, manual-heavy supply chains with real-time, adaptable solutions.

- In March 2025, Motorola Mobility partnered with e& UAE, the telecom division of global tech group e&, to deliver enterprise-grade mobility solutions for businesses across the UAE. This collaboration offers advanced digital technology, mobile device management, and data security to support organizations of all sizes. From SMBs to large enterprises, the partnership provides a flexible range of devices and services to boost productivity and ensure secure operations. As the UAE advances its digital transformation journey, the alliance aims to enhance business agility, connectivity, and long-term operational efficiency.

- In January 2025, Toyota Kirloskar Motor launched its wholly owned subsidiary, Toyota Mobility Solutions and Services India Pvt. Ltd. (TMSS), with its head office in Bidadi near Bangalore, Karnataka. This move underscores Toyota’s commitment to becoming a true mobility company and delivering increasingly better cars. TMSS marks a key step in transforming India’s pre-owned car market while reinforcing the brand’s core philosophy of Quality, Durability, and Reliability. It ensures that customers receive the same trusted Toyota experience across both new car sales and the used vehicle segment.

- In December 2024, Pioneer Corporation has formed a strategic partnership with HERE Technologies, a leading location data and technology platform, to co-develop connected devices and services for two-wheelers, fleet management, and micro-mobility globally. This collaboration blends Pioneer’s four-wheeler infotainment expertise with HERE’s advanced mapping content to expand into the two-wheeler segment. By integrating HERE SDK with Pioneer’s hardware, the partnership will offer smart solutions like real-time traffic navigation and dynamic routing. The joint effort aims to meet rising demand for connectivity, safety, and convenience in motorcycles and emerging mobility options.

Report Details

| Report Characteristics |

| Market Size (2025) |

USD 42.0 Bn |

| Forecast Value (2034) |

USD 321.9 Bn |

| CAGR (2025–2034) |

25.4% |

| The US Market Size (2025) |

USD 14.0 Bn |

| Historical Data |

2019 – 2024 |

| Forecast Data |

2026 – 2034 |

| Base Year |

2024 |

| Estimate Year |

2025 |

| Report Coverage |

Market Revenue Estimation, Market Dynamics, Competitive Landscape, Growth Factors, etc. |

| Segments Covered |

By Component (Solutions and Services), By Operating System (Android, iOS, Windows, and Others), By Deployment Mode (On-Premises and Cloud-Based), By Industry Vertical (BFSI, Healthcare, Retail, IT & Telecom, Government & Public Sector, Manufacturing, Transportation & Logistics, Education, Energy & Utilities, and Others) |

| Regional Coverage |

North America – US, Canada; Europe – Germany, UK, France, Russia, Spain, Italy, Benelux, Nordic, Rest of Europe; Asia-Pacific – China, Japan, South Korea, India, ANZ, ASEAN, Rest of APAC; Latin America – Brazil, Mexico, Argentina, Colombia, Rest of Latin America; Middle East & Africa – Saudi Arabia, UAE, South Africa, Turkey, Egypt, Israel, Rest of MEA |

| Prominent Players |

Microsoft, IBM, VMware (Broadcom), Citrix Systems, Cisco Systems, BlackBerry, SAP, Oracle, Google, Apple, Samsung, MobileIron, Ivanti, Sophos, ManageEngine (Zoho Corp), SOTI, Matrix42, Jamf, Snow Software, Scalefusion, and Other Key Players |

| Purchase Options |

We have three licenses to opt for: Single User License (Limited to 1 user), Multi-User License (Up to 5 Users), and Corporate Use License (Unlimited User) along with free report customization equivalent to 0 analyst working days, 3 analysts working days, and 5 analysts working days respectively. |

Frequently Asked Questions

The Global Enterprise Mobility Management Market size is expected to reach a value of USD 42.0 billion in 2025 and is expected to reach USD 321.9 billion by the end of 2034.

North America is expected to have the largest market share in the Global Enterprise Mobility Management Market, with a share of about 38.5% in 2025.

The Enterprise Mobility Management Market in the US is expected to reach USD 14.0 billion in 2025.

Who are the key Enterprise Mobility Management Market?

The market is growing at a CAGR of 25.4 percent over the forecasted period.