Market Overview

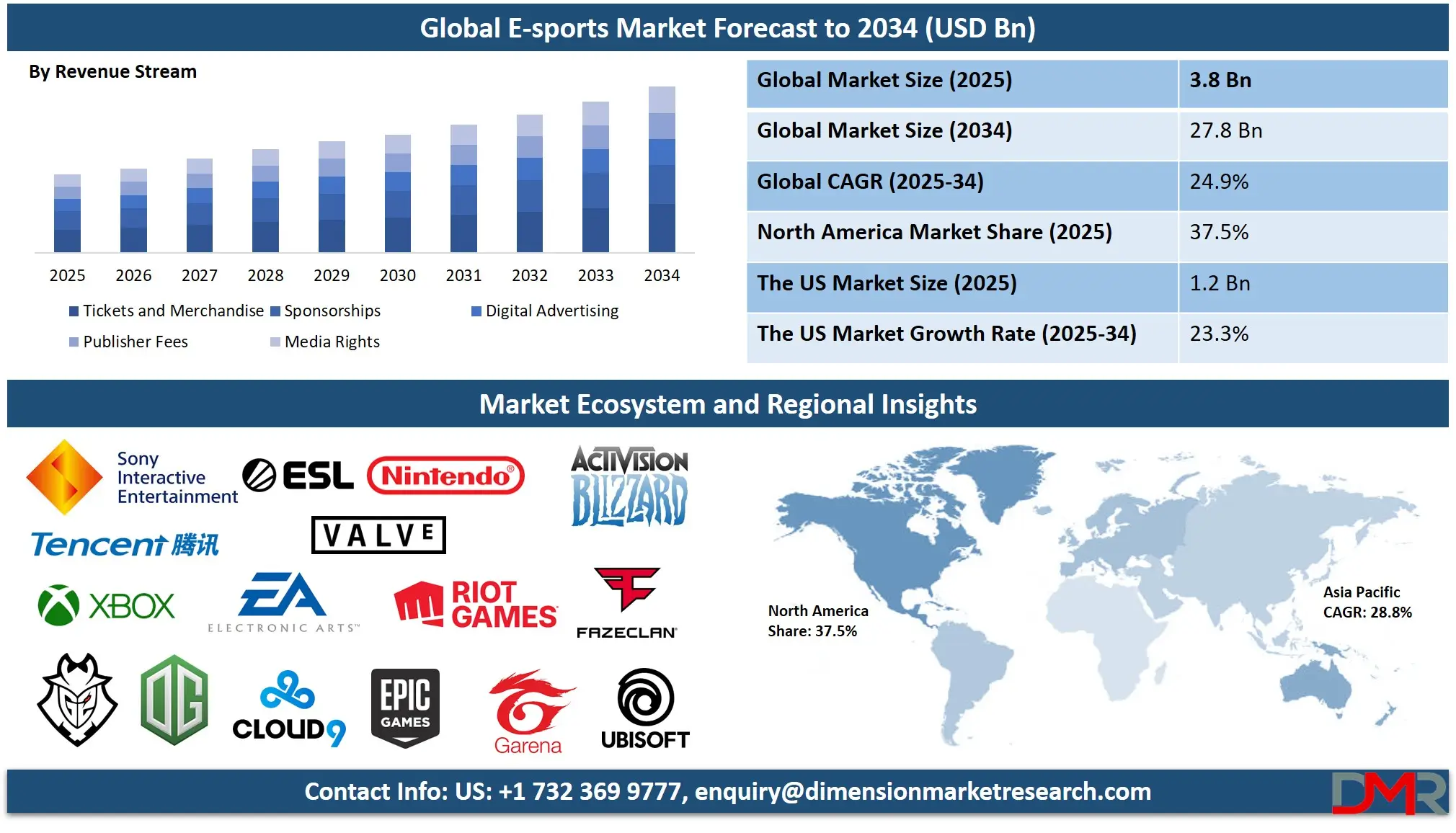

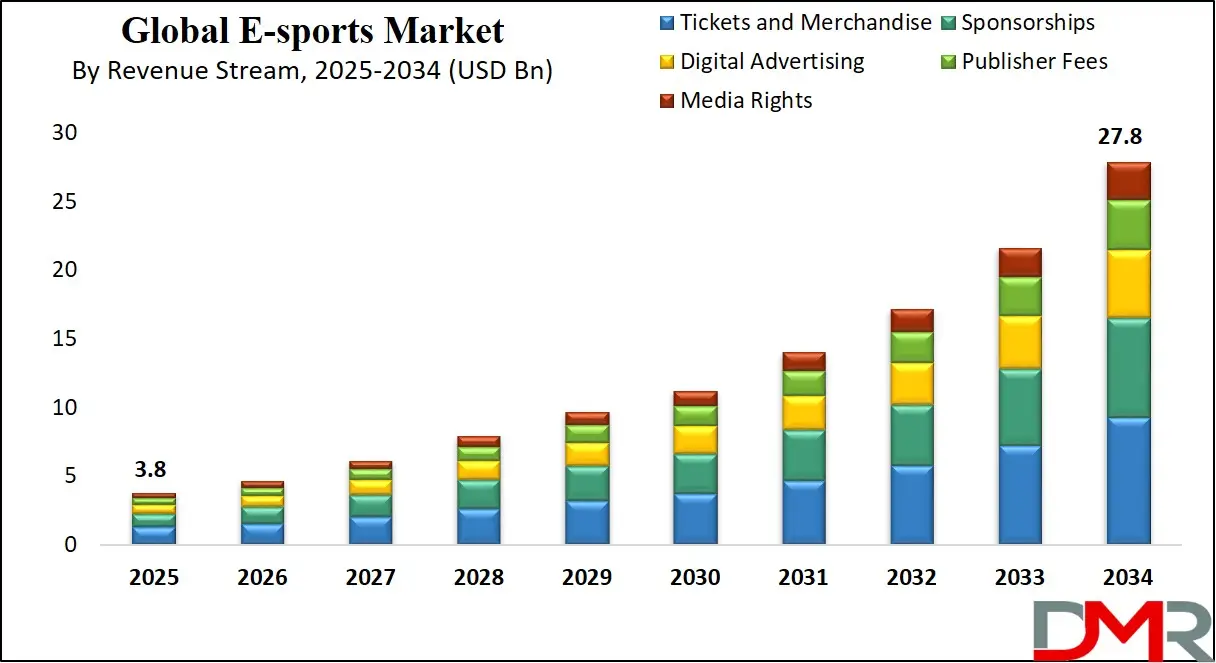

The Global Esports Market is projected to reach USD 3.8 billion in 2025 and grow at a compound annual growth rate of 24.9% from there until 2034 to reach a value of USD 27.8 billion.

The global esports market is undergoing exponential growth, fueled by the convergence of digital entertainment, competitive gaming, and online community culture. This acceleration is driven by expanding internet penetration, growing smartphone usage, and an increasing number of digital-native consumers who engage with competitive gaming as a form of mainstream entertainment. Esports is now recognized on par with traditional sports in many markets, both culturally and economically.

ℹ

To learn more about this report –

Download Your Free Sample Report Here

Several trends define the landscape. Streaming platforms like Twitch and YouTube Gaming are not only broadcasting hubs but also monetization channels through advertising, donations, and sponsorships. Simultaneously, publishers are investing heavily in franchise leagues, structured tournaments, and cross-platform integration. There is also a notable rise in collegiate and high school esports programs, providing formalized growth from the grassroots level. Blockchain integration and digital collectibles, including NFTs, are emerging as monetization enhancements, offering unique ways for fans to engage.

The market offers vast opportunities. Brands are increasingly leveraging esports for targeted marketing among Gen Z and millennials. Regional expansion, particularly in Latin America, the Middle East, and Southeast Asia, presents strong growth potential. Educational institutions are adopting esports in curriculum development, blending STEM learning with competitive strategy. However, challenges persist. Regulatory uncertainties, especially around gambling-linked features like loot boxes, remain contentious.

Mental health and player burnout also pose risks to long-term sustainability.

Nevertheless, the outlook is bright. As 5G networks proliferate and cross-device gaming becomes seamless, viewership and participation will deepen. Strategic partnerships between tech companies, broadcasters, and game publishers are amplifying global reach. With increased inclusion in multi-sport events and Olympic recognition on the horizon, esports is rapidly solidifying its place in the global entertainment economy.

ℹ

To learn more about this report –

Download Your Free Sample Report Here

The US Esports Market

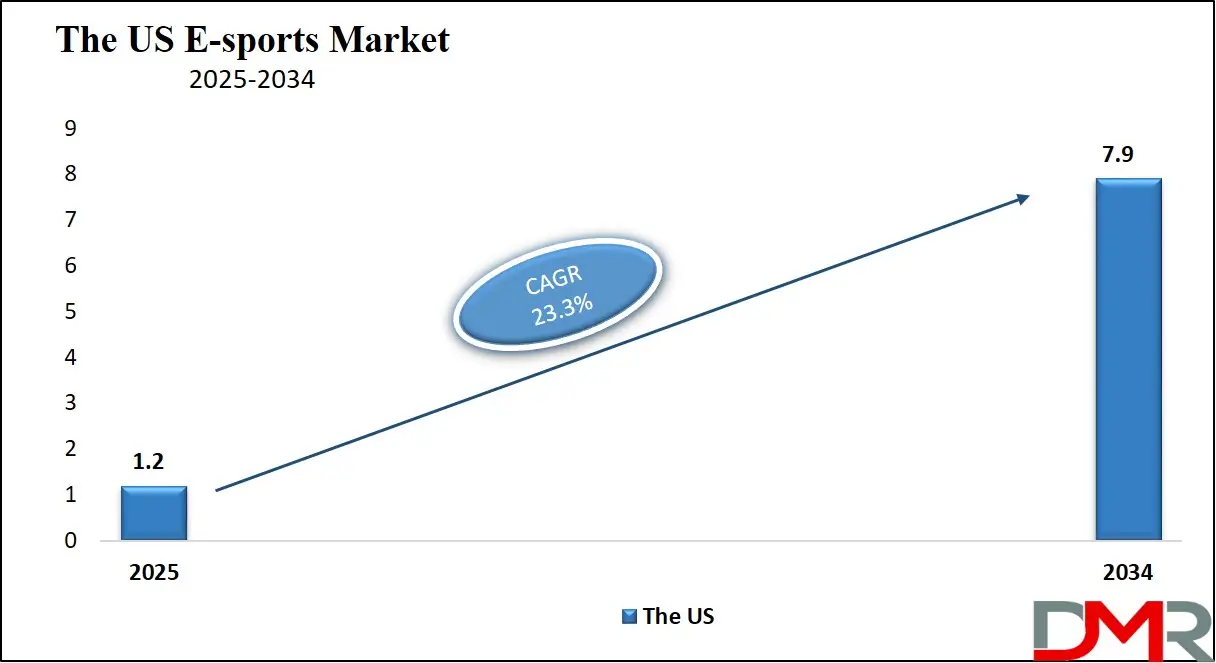

The US Esports Market is projected to reach

USD 1.2 billion in 2025 at a

compound annual growth rate of 23.3% over its forecast period.

The United States stands at the forefront of the global esports ecosystem, underpinned by a robust digital infrastructure, a mature gaming industry, and high consumer engagement. According to the Entertainment Software Association (ESA), over 65% of Americans play video games, with esports being a major driver of engagement, especially among those aged 18–34. U.S. high schools and colleges are rapidly expanding their esports programs, supported by organizations like the National Association of Collegiate Esports (NACE), which includes over 170 member schools and offers scholarships and structured leagues.

Government-backed initiatives like the U.S. Department of Education’s recognition of esports as a legitimate extracurricular activity are enhancing legitimacy and participation. The military has also launched esports teams, such as the U.S. Army Esports team, aimed at outreach and recruitment through popular platforms like Twitch. The United States benefits from a massive domestic market, where platforms like Twitch, YouTube Gaming, and Facebook Gaming are headquartered, allowing for seamless content creation, sponsorship deals, and media rights distribution.

Demographically, the U.S. esports audience is highly attractive: digital-first, multicultural, and financially influential. Census and Pew Research data show that young Americans are consuming more digital content than television, placing esports in prime territory for advertisers. The rise of local esports arenas, such as the HyperX Esports Arena in Las Vegas, highlights the growth of physical infrastructure supporting the industry. The U.S. esports sector continues to evolve through technological innovation, including VR/AR integration and 5G connectivity, driving long-term growth and global influence.

ℹ

To learn more about this report –

Download Your Free Sample Report Here

The Europe Esports Market

The European Esports Market is estimated to be valued at

USD 570.0 million in 2025 and is further anticipated to reach

USD 2.94 billion by 2034 at a

CAGR of 20.0%.

Europe’s esports market represents a mature and highly structured ecosystem, supported by a pan-European gaming culture and increasing institutional backing. According to the European Commission, esports is being explored for its educational potential and contribution to youth engagement, digital literacy, and STEM initiatives. Countries such as Germany, France, and Poland have become key esports hubs, hosting major tournaments and homegrown teams.

Government bodies like the French Ministry of the Economy have recognized esports as a formal sector, enacting laws that regulate professional player contracts and event taxation. Meanwhile, Nordic countries such as Sweden and Finland lead in esports infrastructure and broadband accessibility, enabling high-quality competitive environments. European esports benefits from widespread multilingual content consumption and cross-border league participation, increasing the region’s strategic value for publishers and advertisers.

Demographically, Eurostat data reveals that over 90% of young Europeans use the internet daily, and a substantial portion engage with gaming regularly. The rise of esports in education is further supported by initiatives like the UK’s Digital Schoolhouse and Germany’s Esports Bund, which promote gaming literacy and talent development. Despite challenges such as fragmented regulation and varying national policies, Europe offers strong growth prospects. The rollout of 5G networks and support for public-private partnerships in digital innovation are setting the stage for continued expansion, with Europe poised to be a leading force in global esports development.

The Japan Esports Market

The Japan Esports Market is projected to be valued at USD 228.0 million in 2025. It is further expected to witness subsequent growth in the upcoming period, holding USD 1.96 billion in 2034 at a CAGR of 27.0%.

Japan’s esports market is emerging as a regional powerhouse, supported by a rich gaming legacy and rapidly modernizing digital infrastructure. Though a late adopter of competitive gaming in its modern form, Japan has seen exponential growth in the last decade. This shift is fueled by the Japan Esports Union (JeSU), which has worked closely with the Ministry of Economy, Trade and Industry (METI) to standardize professional licensing and promote industry legitimacy.

Japan’s demographic advantage lies in its deep-rooted gaming culture and high-tech urban landscape. According to the Ministry of Internal Affairs and Communications, internet penetration exceeds 93%, and over 70% of the population engages with digital gaming. Esports is being increasingly included in educational and civic programs, with cities like Tokyo and Osaka launching dedicated esports high schools and training centers. Events like Tokyo Game Show now feature prominent esports tournaments, drawing global attention and participation.

Challenges include a relatively conservative regulatory environment and a generational gap in digital media adoption. However, reforms are underway to relax laws around monetary prize pools and gambling-related mechanics, which were previously constraints to growth. Japan is also exploring synergies between anime, gaming, and esports to create cross-industry content strategies. With strategic investments in cloud gaming, 5G rollouts, and international partnerships, Japan is not only catching up but also innovating uniquely within the global esports narrative.

Global Esports Market: Key Takeaways

- Global Market Size Insights: The Global Esports Market size is estimated to have a value of USD 3.8 billion in 2025 and is expected to reach USD 27.8 billion by the end of 2034.

- The US Market Size Insights: The US Esports Market is projected to be valued at USD 1.2 billion in 2025. It is expected to witness subsequent growth in the upcoming period as it holds USD 7.9 billion in 2034 at a CAGR of 23.3%.

- Regional Insights: North America is expected to have the largest market share in the Global Esports Market with a share of about 37.5% in 2025.

- Key Players: Some of the major key players in the Global Esports Market are Tencent, Activision Blizzard, Riot Games, Electronic Arts, Valve Corporation, Epic Games, Microsoft, Sony Interactive Entertainment, Nintendo, and many others.

- The Global Market Growth Rate: The market is growing at a CAGR of 24.9 percent over the forecasted period of 2025.

Global Esports Market: Use Cases

- Brand Engagement: Major brands use esports platforms to market products to Gen Z and millennial audiences. Through sponsorships, in-stream ads, and branded tournaments, companies integrate into gaming culture, fostering loyalty and measurable engagement.

- Educational Integration: Schools and universities are incorporating esports into curriculum and extracurricular programs. This promotes teamwork, critical thinking, and technical skills, while preparing students for careers in gaming, media, and STEM fields.

- Healthcare and Cognitive Research: Esports is being studied for cognitive development, reaction time, and attention span analysis. Health startups use competitive gaming for therapeutic interventions and to monitor behavioral patterns in children and young adults.

- Military and Tactical Training: Esports games that simulate real-time strategy and combat environments are being used by defense organizations for training exercises. They help personnel develop fast decision-making, coordination, and digital communication skills.

- Smart City Entertainment Hubs: Cities are building esports arenas and integrating gaming zones into smart infrastructure. These hubs host tournaments, generate tourism, and position cities as global innovation centers, attracting youth and tech investors.

Global Esports Market: Stats & Facts

International Olympic Committee (IOC) and Olympic Esports Series

- The inaugural Olympic Esports Week was held in Singapore in June 2023, attracting significant attention to virtual sports. It included live finals for 10 disciplines of the Olympic Esports Series.

- Over 20,000 people attended the event in person over four days at the Suntec Convention Centre, demonstrating strong public interest in esports as a legitimate competitive format.

- The Olympic Esports Series expanded to include Fortnite in 2023, where a specially designed shooting competition map was created in partnership with the International Shooting Sport Federation.

- The International Olympic Committee approved the establishment of the first Olympic Esports Games, scheduled for 2025 in Riyadh, Saudi Arabia, highlighting growing institutional support for the industry.

Global Esports Viewership

- The global esports audience was estimated at 662.6 million people in 2020, showing the rapid mainstream adoption of competitive gaming.

- This audience rose to approximately 921 million in 2022, including both casual and enthusiast viewers.

- The 2016 League of Legends World Championship final was watched by 43 million unique viewers, with 14.7 million peak concurrent viewers and a total of 370 million hours of content consumed.

- The same tournament generated 396 million cumulative daily unique impressions, showing sustained engagement across multiple days.

U.S. Securities and Exchange Commission (SEC)

- According to public filings and related reports, esports viewership in the United States surpassed 60 million, reflecting the increasing cultural relevance of gaming competitions.

- The audience skew in the U.S. is predominantly male (57%), with most viewers falling into the 18–34 age range. They are often digitally native, highly educated, and relatively affluent compared to the broader media audience.

PubMed Central – Academic Study on Student Esports Engagement

- Among male university student gamers, 58% report regularly watching or following esports content.

- For female students, 37.2% follow esports, indicating a growing but still disproportionate gender representation.

- Over half (54%) of all student gamers (across genders) engage with esports content on at least one platform.

- Twitch is the most popular platform among student gamers, with 89% using it for esports; 59% use YouTube, only 6% rely on television, and 10% attend in-person esports events.

- Participation in competitive esports events was reported by 25.4% of student gamers; of these, 91.6% were male and just 8.4% were female.

- A strong preference for digital formats was noted, with 78% preferring to compete online, while 29% have also participated in hybrid or offline tournaments.

Asian Games and Esports Integration

- Esports was included as an official medal event at the 2022 Asian Games in Hangzhou, China.

- More than 30 countries sent teams to compete across seven esports disciplines, showing strong regional institutional support.

Twitch – Esports Broadcast Partnerships

- Twitch has streamed the League of Legends World Championship annually since 2012, making it a central hub for esports content.

- Dota 2’s global tournament, "The International," has been broadcast on Twitch since 2013, reinforcing the platform's dominance in high-tier esports.

- Rocket League began hosting its major events on Twitch in 2016, with millions of unique viewers tuning in.

- In 2017, Twitch signed an exclusive broadcasting deal with Blizzard to air Overwatch League and Hearthstone esports.

- Twitch also launched a special All-Access Pass for the Overwatch League in 2018, integrating premium fan experiences like alternate camera angles and chat channels.

China – Gaming Regulations for Youth

- In 2021, China introduced strict regulations limiting individuals under the age of 18 to just three hours of online video gaming per week. These restrictions were enforced to reduce gaming addiction and promote academic focus.

Military and Government Use of Esports

- The U.S. Army operates its esports team, leveraging platforms like Twitch to engage with younger demographics and aid recruitment efforts.

- In South Korea, professional esports players who win gold medals in international competitions like the Asian Games may be granted exemptions from mandatory military service, acknowledging esports as a nationally recognized athletic pursuit.

Collegiate Esports and Education in the U.S.

- Over 65% of Americans play video games, according to the Entertainment Software Association. A growing subset engages in esports, often through college-level leagues.

- More than 170 colleges and universities in the U.S. are members of the National Association of Collegiate Esports (NACE), offering scholarships, training, and competitive infrastructure for esports athletes.

Global Esports Market: Market Dynamic

Driving Factors in the Global Esports Market

Rising Youth Demographic and High Digital Engagement

One of the strongest growth drivers for esports is its alignment with the global youth demographic, particularly Gen Z and Millennials, who are digital natives. According to the Entertainment Software Association, over 70% of Americans under the age of 35 play video games regularly. These young audiences are not only players but also consumers of gaming content across Twitch, YouTube, and social media. Esports provides a culturally relevant medium that blends competition, entertainment, and social interaction.

The format’s appeal is further heightened by its accessibility, most events are free to watch and widely shared online. Unlike traditional sports, esports is not geographically restricted, allowing fans from any country to follow global teams. Youth-centric content, influencer marketing, and integration with memes, music, and fashion make esports resonate as a lifestyle, not just a competition. The sustained interest among this tech-savvy, media-literate demographic ensures long-term viability and increasing monetization opportunities.

Expansion of High-Speed Internet and Mobile Gaming Infrastructure

Global improvements in digital infrastructure, particularly 5G rollout and broadband penetration, are transforming esports access and consumption. In regions like Southeast Asia, Latin America, and Africa, mobile-first gaming communities are rapidly emerging. High-speed mobile internet enables smooth streaming, low-latency gameplay, and participation in cloud-based gaming tournaments. This technological leap democratizes access to competitive gaming and expands the talent pool.

In developed markets, fiber networks support 4K streaming, multi-angle broadcasts, and real-time fan interactions. Moreover, affordable smartphones and low data costs have made mobile esports, such as PUBG Mobile or Free Fire, dominant in countries like India, Brazil, and Indonesia. As cloud gaming becomes more mainstream, even players without high-end consoles or PCs can engage in competitive gaming. Infrastructure upgrades are not just improving performance, they are expanding the geographic and demographic footprint of the entire esports economy.

Restraints in the Global Esports Market

Regulatory Challenges and Cultural Perception Barriers

Despite its popularity, esports faces legal and cultural challenges in many regions. Government regulations, particularly around age restrictions, violent content, and gambling-like features in games, can limit growth. For instance, China’s strict policies limit minors to three hours of online gaming per week, significantly affecting viewership and participation. Similar concerns about screen time and addiction prompt resistance from educational and parental groups in the West.

Moreover, esports is still not universally recognized as a legitimate sport, affecting funding, visa approvals for international players, and access to public infrastructure. Some countries lack an official esports governing body, creating legal gray zones for tournaments and sponsorship deals. Negative stereotypes around gaming culture, coupled with fragmented rules across jurisdictions, can deter advertisers, investors, and institutions from entering the space. Addressing these policy and perception issues is critical for sustainable global growth.

Monetization Imbalances and Revenue Dependence on Sponsorships

A structural limitation of the esports economy is its heavy reliance on sponsorships and advertising. While some high-tier tournaments offer lucrative prize pools, most organizations remain financially unviable without brand partnerships. Sponsorships account for more than 50% of esports revenue in many markets, making it vulnerable to economic downturns or changes in brand strategies. Unlike traditional sports, esports lacks substantial income from broadcasting rights, as most content is free-to-view on platforms like Twitch or YouTube.

Additionally, game publishers hold disproportionate control over tournaments and monetization rights, limiting revenue diversification for third-party event organizers and teams. The absence of standardized unionization or revenue-sharing models also adds to financial instability. These factors make it challenging to sustain smaller organizations, amateur leagues, and grassroots tournaments, ultimately constraining ecosystem diversity and growth.

Opportunities in the Global Esports Market

Integration with Traditional Sports and Entertainment Ecosystems

Esports offers an untapped convergence point between traditional sports, entertainment, and digital innovation. Increasingly, major sports franchises (like FC Barcelona, PSG, and NBA teams) are investing in esports divisions, bridging two fan ecosystems. Crossovers in content, such as esports versions of FIFA, NBA 2K, and Formula 1, offer new monetization streams via broadcasting, sponsorships, and branded experiences.

Additionally, major festivals and events now include esports tournaments as central attractions. Live music performances during esports finals and celebrity show matches enhance audience reach. There’s also growing interest from entertainment conglomerates, such as Disney and Netflix, in licensing or producing esports content. By integrating esports into mainstream media packages, the sector can attract broader audiences and premium advertisers. As intellectual property rights become more robust, content syndication, merchandising, and OTT distribution present billion-dollar opportunities.

Educational, Health, and Career Pathways via Esports

Beyond entertainment, esports has begun to create value in education, mental skill development, and career-building. Schools and universities globally are establishing esports programs, using them to teach teamwork, digital literacy, and strategic thinking. Organizations like the National Association of Collegiate Esports (NACE) in the U.S. now recognize esports as a pathway for scholarships and degree programs.

This presents opportunities to formalize training, coaching, broadcasting, and management roles. Esports also creates jobs in marketing, event production, game design, and data analytics. In parallel, gamified fitness platforms and eye-tracking tools used in esports training are finding healthcare applications, such as in cognitive therapy and rehabilitation. The narrative is shifting from “gaming addiction” to “skill-based competition,” opening doors to public-private funding, educational grants, and even Olympic recognition. These cross-sector collaborations can elevate esports as a structured and socially accepted profession.

Trends in the Global Esports Market

Professionalization and Institutionalization of Esports

Esports is undergoing rapid institutionalization, with universities, governments, and global sports bodies formalizing participation and pathways. Traditional sports organizations like the International Olympic Committee have embraced esports through initiatives such as the Olympic Esports Series and the upcoming Olympic Esports Games in 2025. This professional shift is evident in the standardization of team structures, athlete contracts, and dedicated venues like Esports Stadium Arlington.

Educational institutions now offer scholarships, curriculum integration, and training facilities for esports, indicating its transition from an informal hobby to a career path. Leagues like the Overwatch League and League of Legends Championship Series function similarly to traditional sports franchises, complete with drafts, salary caps, and merchandising strategies. This trend fosters long-term ecosystem sustainability and legitimizes esports as a viable professional industry.

Multi-Platform Content Consumption and Fan Interactivity

Esports thrives on its digital-native approach to media, where fans engage through platforms like Twitch, YouTube Gaming, and Discord. Livestreaming, on-demand replays, real-time chat, and interactive polls are not supplementary but integral to the viewing experience. Fans follow their favorite players on social media, contribute to crowdfunding for tournaments, and even buy team-branded skins or NFTs.

This multi-platform strategy drives 24/7 engagement and builds loyalty. Mobile streaming is also rising in popularity, especially in Asia, where mobile-first audiences dominate. The seamless integration of real-time statistics, multi-language broadcasts, and VR/AR overlays further enriches the user experience. As esports increasingly embraces emerging tech like AI-based player analytics or blockchain-based rewards, it reflects an evolving media ecosystem shaped by interactivity and inclusivity.

Global Esports Market: Research Scope and Analysis

By Revenue Stream Analysis

The Tickets and Merchandise segment is projected to dominate the revenue stream in the esports market due to its strong alignment with fan culture, community engagement, and brand loyalty. Live esports events, such as the League of Legends World Championship, The International (Dota 2), and Valorant Champions, regularly draw tens of thousands of attendees, filling stadiums globally. These in-person events create a festival-like atmosphere where fans actively purchase tickets, team apparel, posters, gaming accessories, and exclusive limited-edition merchandise. With events often integrated with cosplay contests, fan zones, and interactive brand activations, they serve as monetization goldmines.

Unlike digital sponsorships or advertising, merchandise sales directly engage the fan base. Wearing team jerseys, hoodies, or caps becomes a mode of identity and belonging within the esports community. Franchised leagues like the Overwatch League or Call of Duty League further amplify this model by mirroring traditional sports in their merchandising strategies, selling not just apparel but branded collectibles, hardware, and in-game items tied to real-world teams.

Moreover, global e-commerce platforms allow for year-round merchandise sales beyond event days, while digital merchandise, including exclusive skins and avatar gear, adds a new monetization layer. These digital goods often appeal more to Gen Z, a demographic comfortable with virtual ownership.

As the esports audience matures and team loyalty deepens, the combined power of physical and digital merchandise, coupled with the draw of sold-out events, makes this segment the most stable and high-margin revenue generator in the esports ecosystem.

By Streaming Type Analysis

Live streaming is anticipated to dominate the esports streaming landscape due to its real-time engagement, immersive interactivity, and community-centric dynamics. Esports is inherently a spectator sport, where audiences thrive on high-stakes, fast-paced matches viewed live. Platforms like Twitch, YouTube Gaming, and Facebook Gaming have revolutionized esports broadcasting by turning it into an interactive experience rather than passive consumption. Viewers engage with streamers and fellow fans through live chat, emotes, donations, and fan polls, forming parasocial relationships and fostering loyalty.

Unlike on-demand content, live streaming builds urgency and communal excitement. Fans worldwide tune in simultaneously, creating “digital stadium” moments during major tournaments like CS: GO Majors or Valorant Masters. This synchronized global engagement makes live content more attractive to advertisers and sponsors, who seek maximum visibility during peak viewership windows. Brands often integrate real-time ads, influencer shoutouts, and sponsored giveaways to capture the audience’s full attention.

Esports events often come with unpredictable outcomes and dramatic plays, best experienced in the moment. This “fear of missing out” (FOMO) propels live viewership, especially among competitive titles like League of Legends, Dota 2, or Call of Duty, where strategies unfold in real time. Streamers also run live commentary, Q&A sessions, and behind-the-scenes content that enhance the real-time appeal.

Moreover, advancements in low-latency streaming, mobile broadcasting, and 5G connectivity allow fans to watch live from anywhere, on any device. As esports further integrates with betting, fantasy leagues, and VR experiences all requiring real-time data live streaming will continue to dominate as the cornerstone of esports content consumption.

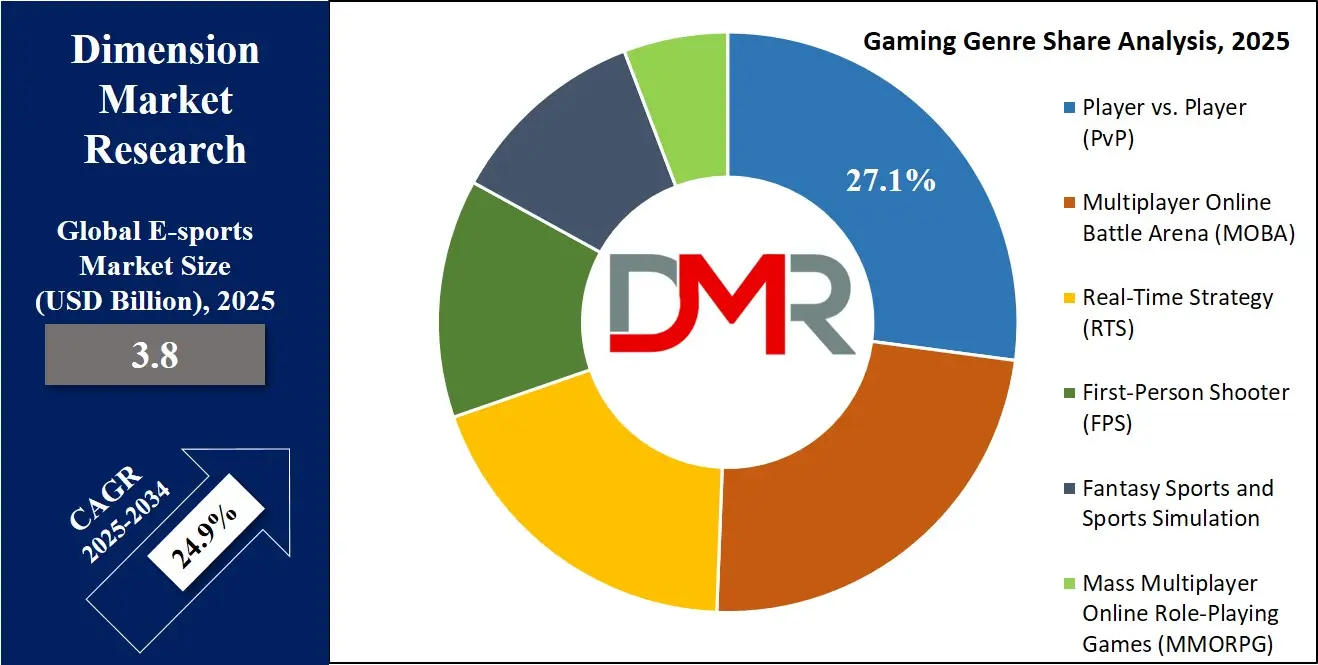

By Gaming Genre Analysis

Player vs. Player (PvP) gaming is projected to dominates the esports genre due to its competitive intensity, instant engagement, and broad adaptability across multiple platforms. PvP formats allow real-time contests between human players, making each match unpredictable, skill-based, and compelling to watch. The thrill of two or more individuals or teams clashing in fast-paced, tactical battles is the essence of esports entertainment. Games like Street Fighter, FIFA, Super Smash Bros., and Apex Legends are PvP-based and have achieved massive viewership and participation rates globally.

PvP formats offer high replay value and minimal predictability, which keeps audiences engaged. Whether it's a 1v1 showdown or a team battle, the real-time decisions, reactions, and clutch moments create narratives that fans love to follow. PvP titles often highlight individual player talent and rivalries, further drawing fan loyalty and emotional investment. Unlike story-driven or cooperative genres, PvP fosters ongoing leagues, ladders, and global tournaments with defined rankings, formats, and champions.

From a developer’s perspective, PvP games are easier to balance and scale for competitive formats. They’re also more suitable for streaming and broadcasting, as they deliver short bursts of action that suit the digital attention span. Furthermore, PvP titles adapt well to mobile and console platforms, allowing broader player bases and monetization options.

The universality of competition regardless of age, culture, or language gives PvP games a global appeal. As esports increasingly resemble traditional sports in organization and fandom, PvP remains the genre that most closely mimics the excitement, unpredictability, and raw skill on display in competitive athletics.

ℹ

To learn more about this report –

Download Your Free Sample Report Here

By Device Type Analysis

Smartphones have projected to emerged as the dominant device in esports due to their widespread accessibility, affordability, and compatibility with mobile-first gaming titles that drive massive engagement, especially in emerging markets. Unlike traditional consoles or gaming PCs which require substantial upfront costs smartphones are nearly ubiquitous across income brackets and regions. In countries like India, Brazil, Indonesia, and the Philippines, mobile esports titles such as PUBG Mobile, Free Fire, and Mobile Legends: Bang Bang have developed enormous user bases and competitive scenes.

The mobile format aligns perfectly with the esports demographic: young, always connected, and digitally fluent. Smartphones enable instant access to games, streams, chats, and live tournaments from virtually anywhere. This convenience supports both casual play and competitive progression. Games optimized for mobile often have shorter match durations and more streamlined interfaces, making them ideal for on-the-go consumption and short attention spans, especially among Gen Z users.

Mobile esports events attract millions of viewers and participants globally. Tournaments like the PUBG Mobile Global Championship and Free Fire World Series have reported peak concurrent viewership numbers in the millions. Additionally, 5G technology, cloud gaming platforms, and the increasing power of mobile processors are further eliminating performance barriers for high-quality gaming on smartphones.

With brands, game publishers, and telecom operators heavily investing in mobile-first esports ecosystems ranging from sponsorships to tournaments and game streaming apps, the smartphone’s role is central to esports growth. Its democratizing effect has widened the talent pool, diversified the audience, and unlocked monetization avenues in previously underserved regions, firmly establishing it as the primary esports device globally.

The Global Esports Market Report is segmented on the basis of the following

By Revenue Stream

- Tickets and Merchandise

- Sponsorships

- Digital Advertising

- Publisher Fees

- Media Rights

By Streaming Type

- Live Streaming

- On-Demand Streaming

By Gaming Genre

- Player vs. Player (PvP)

- Multiplayer Online Battle Arena (MOBA)

- Real-Time Strategy (RTS)

- First-Person Shooter (FPS)

- Fantasy Sports and Sports Simulation

- Mass Multiplayer Online Role-Playing Games (MMORPG)

By Device Type

- Smartphones

- Smart TVs

- Desktops/Laptops/Tablets

- Gaming Consoles

Global Esports Market: Regional Analysis

Region with the Largest Revenue Share

North America is projected to hold a dominant position in the global esports market as it

holds 37.5% of the total revenue by the end of 2025, due to its mature digital infrastructure, robust investment ecosystem, and highly engaged consumer base. The United States, in particular, has long embraced video gaming as mainstream entertainment, fostering early development of professional esports leagues such as the Overwatch League (OWL), Call of Duty League (CDL), and North American League of Legends Championship Series (LCS). The region boasts top-tier production quality, corporate sponsorships from global brands like Coca-Cola, Intel, and Nike, and institutional support, including scholarships and varsity programs in over 170 U.S. colleges, according to the National Association of Collegiate Esports (NACE).

Major streaming platforms like Twitch and YouTube Gaming, both headquartered in the U.S., further amplify visibility and monetization. In addition, North America is home to some of the largest esports organizations, such as FaZe Clan, Team Liquid, and 100 Thieves, that have grown into lifestyle brands. High disposable incomes, a strong media rights market, and favorable regulation around content creation and monetization make the region commercially attractive. These factors combined ensure that North America remains the most lucrative esports market by revenue despite intense competition from other regions.

Region with the Highest CAGR

The Asia Pacific region records the highest compound annual growth rate (CAGR) in the global esports market, driven by its massive mobile gaming population, rapid digital adoption, and government recognition of esports as a formal sport in several countries. Nations such as China, South Korea, India, Indonesia, and the Philippines are hotspots of mobile-first gaming culture. China has institutionalized esports education, while South Korea’s infrastructure and culture make it a global esports pioneer.

The region benefits from affordable smartphones, widespread 4G/5G coverage, and the popularity of games like Honor of Kings, PUBG Mobile, Arena of Valor, and Mobile Legends. Platforms such as Douyu, Huya, and Nimo TV offer localized streaming tailored to diverse linguistic audiences. Government-led initiatives, for example, China’s Ministry of Education integrating esports into vocational programs, are accelerating legitimacy and job creation. Moreover, the younger demographic in APAC is digitally native and heavily invested in competitive gaming. These dynamics contribute to explosive growth and make APAC the fastest-expanding esports market globally.

By Region

North America

Europe

- Germany

- The U.K.

- France

- Italy

- Russia

- Spain

- Benelux

- Nordic

- Rest of Europe

Asia-Pacific

- China

- Japan

- South Korea

- India

- ANZ

- ASEAN

- Rest of Asia-Pacific

Latin America

- Brazil

- Mexico

- Argentina

- Colombia

- Rest of Latin America

Middle East & Africa

- Saudi Arabia

- UAE

- South Africa

- Israel

- Egypt

- Rest of MEA

Global Esports Market: Competitive Landscape

The global esports industry is marked by a dynamic and fragmented competitive landscape featuring game publishers, tournament organizers, streaming platforms, teams, and technology providers. Game developers such as Riot Games (League of Legends), Activision Blizzard (Call of Duty, Overwatch), and Valve (Dota 2, CS: GO) wield significant control by owning both content and tournament IP. Their vertical integration enables them to control monetization, event branding, and fan engagement.

Esports teams like Team Liquid, T1, G2 Esports, and Fnatic operate as professional organizations with coaching staff, merchandising arms, and diversified content strategies. Many of these entities have received investments from celebrities, athletes, and private equity firms, further blurring the line between sports and entertainment. Tech giants, including Amazon (Twitch), Google (YouTube Gaming), and Tencent (major stakes in Riot, Supercell, and Epic Games), play key roles as streaming enablers and content distributors.

Additionally, infrastructure providers such as ESL FACEIT Group and DreamHack dominate large-scale event management, while startups and regional entities continue to innovate in grassroots tournaments. With rising interest from non-endemic brands and traditional sports franchises, the esports ecosystem is evolving into a commercially robust, multi-stakeholder arena where agility, innovation, and fan-centric strategies define success.

Some of the prominent players in the Global Esports Market are

- Tencent

- Activision Blizzard

- Riot Games

- Electronic Arts (EA)

- Valve Corporation

- Epic Games

- Microsoft (Xbox Gaming)

- Sony Interactive Entertainment

- Nintendo

- Ubisoft

- Take-Two Interactive

- NetEase

- Garena

- ESL FACEIT Group

- TSM (Team SoloMid)

- FaZe Clan

- Cloud9

- G2 Esports

- NRG Esports

- OG Esports

- Other Key Players

Recent Developments in the Global Esports Market

June 2025

- NIP Group Merger: NIP Group, which emerged from the merger of Ninjas in Pyjamas and China’s ESV5, remains the top publicly traded esports company globally. As of June 2025, it holds a market capitalization of approximately USD 125 million. This solidifies its leadership in terms of public market valuation among all esports organizations, highlighting investor confidence and the commercial maturity of the merged entity.

- Esports World Cup 2025 Announcement: The Saudi-backed Esports World Cup Foundation, in collaboration with ESL FACEIT Group, announced that the Esports World Cup 2025 will be held in Riyadh from July 8. The event boasts a prize pool of USD 70.45 million, the largest ever for a multi-title esports competition. This underscores the region’s strategic investment in positioning itself as a global esports hub.

May 2025

- Global Esports Industry Week: The Esports Integrity Commission (ESIC), tournament operator BLAST, and analytics firm Esports Radar announced the launch of Global Esports Industry Week 2025. Scheduled for June 18–22 in Austin, Texas, the event will be a major B2B convention focusing on regulation, partnerships, and infrastructure across the esports value chain.

- Savvy Games Group–HP Partnership: Savvy Games Group, backed by Saudi Arabia’s Public Investment Fund, signed a memorandum of understanding with Hewlett-Packard (HP) to launch the HP Gaming Garage in Saudi Arabia. This initiative will enhance esports education and talent development, in line with the kingdom’s Vision 2030 strategy.

- Mergers and Team Expansions:

- Version 1 merged with G2 Esports to consolidate their presence and brand value in North America.

- Giants Gaming partnered with Excel Esports to strengthen their operational capabilities and increase their European market share.

- Major Investments and Sponsorships:

- NIP Group secured an investment of USD 40 million from the Abu Dhabi Investment Office. This capital will support the relocation of its headquarters to Abu Dhabi and drive expansion across the MENA region.

- Virtus.pro, a prominent Russian esports team, entered a strategic partnership with Samsung to upgrade its training facilities.

- Cloud9 finalized a sponsorship agreement with KIA, expanding their partnership for competitive League of Legends tournaments.

April 2025

- FaZe Clan Media Acquisition: GameSquare Holdings, a digital media company, completed the acquisition of FaZe Clan’s media division. The deal enhances GameSquare’s events and experiences portfolio and includes a USD 2 million credit line to support strategic executions within the esports and lifestyle branding domains.

March 2025

- North American Esports Expo: A large-scale expo was held in Los Angeles to spotlight technological innovation in esports. The event featured product showcases from hardware manufacturers, software platforms for streaming and broadcast enhancement, and a special focus on collegiate and grassroots esports ecosystems. Over 10,000 attendees, including sponsors and team representatives, participated.

Report Details

| Report Characteristics |

| Market Size (2025) |

USD 3.8 Bn |

| Forecast Value (2034) |

USD 27.8 Bn |

| CAGR (2025–2034) |

24.9% |

| The US Market Size (2025) |

USD 1.2 Bn |

| Historical Data |

2019 – 2024 |

| Forecast Data |

2026 – 2034 |

| Base Year |

2024 |

| Estimate Year |

2025 |

| Report Coverage |

Market Revenue Estimation, Market Dynamics, Competitive Landscape, Growth Factors and etc. |

| Segments Covered |

By Revenue Stream (Tickets and Merchandise, Sponsorships, Digital Advertising, Publisher Fees, Media Rights), By Streaming Type (Live Streaming, On-Demand Streaming), By Gaming Genre (Player vs. Player (PvP), Multiplayer Online Battle Arena (MOBA), Real-Time Strategy (RTS), First-Person Shooter (FPS), Fantasy Sports and Sports Simulation, Mass Multiplayer Online Role-Playing Games (MMORPG)), By Device Type (Smartphones, Smart TVs, Desktops/Laptops/Tablets, Gaming Consoles) |

| Regional Coverage |

North America – The US and Canada; Europe – Germany, The UK, France, Russia, Spain, Italy, Benelux, Nordic, & Rest of Europe; Asia-Pacific – China, Japan, South Korea, India, ANZ, ASEAN, Rest of APAC; Latin America – Brazil, Mexico, Argentina, Colombia, Rest of Latin America; Middle East & Africa – Saudi Arabia, UAE, South Africa, Turkey, Egypt, Israel, & Rest of MEA |

| Prominent Players |

Tencent, Activision Blizzard, Riot Games, Electronic Arts, Valve Corporation, Epic Games, Microsoft, Sony Interactive Entertainment, Nintendo, Ubisoft, Take-Two Interactive, NetEase, Garena, ESL FACEIT Group, TSM, FaZe Clan, Cloud9, G2 Esports, NRG Esports, OG Esports, and Other Key Players |

| Purchase Options |

We have three licenses to opt for (Single User License (Limited to 1 user), Multi-User License (Up to 5 Users), and Corporate Use License (Unlimited User) along with free report customization equivalent to 0 analyst working days, 3 analyst working days, and 5 analyst working days respectively. |

Frequently Asked Questions

How big is the Global Esports Market?

▾ The Global Esports Market size is estimated to have a value of USD 3.8 billion in 2025 and is expected to reach USD 27.8 billion by the end of 2034.

What is the size of the US Esports Market?

▾ The US Esports Market is projected to be valued at USD 1.2 billion in 2025. It is expected to witness subsequent growth in the upcoming period as it holds USD 7.9 billion in 2034 at a CAGR of 23.3%.

Which region accounted for the largest Global Esports Market?

▾ North America is expected to have the largest market share in the Global Esports Market with a share of about 37.5% in 2025.

Who are the key players in the Global Esports Market?

▾ Some of the major key players in the Global Esports Market are Tencent, Activision Blizzard, Riot Games, Electronic Arts, Valve Corporation, Epic Games, Microsoft, Sony Interactive Entertainment, Nintendo, and many others.

What is the growth rate in the Global Esports Market in 2025?

▾ The market is growing at a CAGR of 24.9 percent over the forecasted period of 2025.