Market Overview

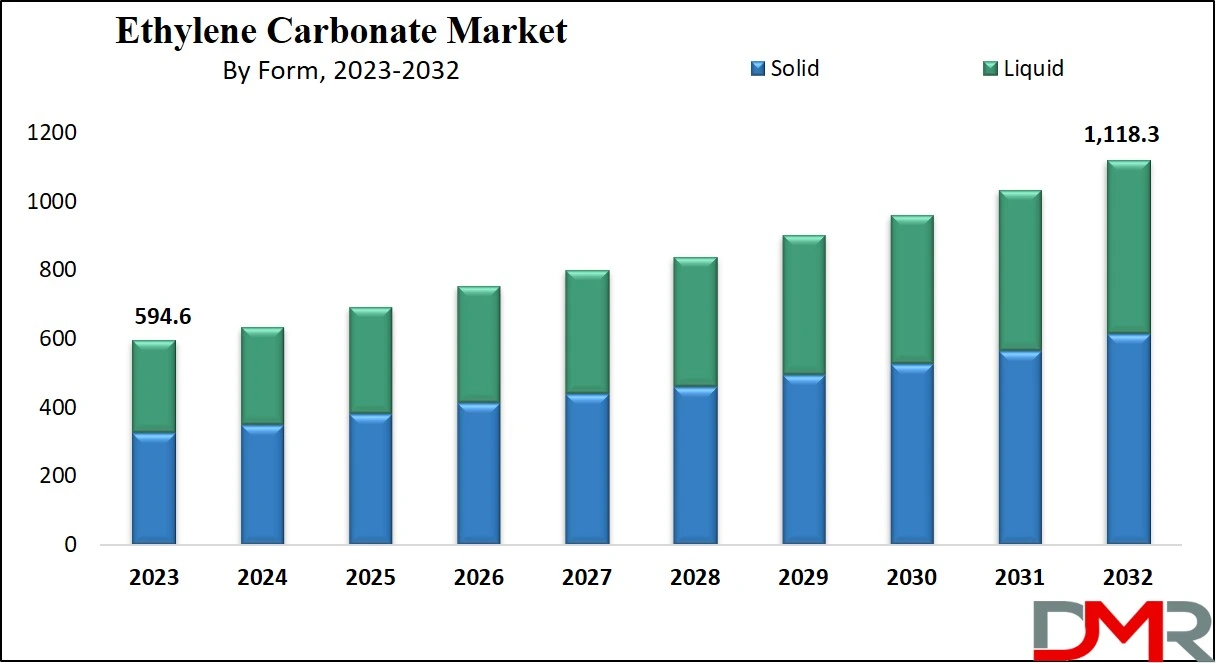

The Global Ethylene Carbonate Market is expected to reach a significant value of USD 594.6 million in 2023. Looking ahead, it is anticipated to grow with a CAGR of 7.3% for the forecast period (2023-2032). The rising demand for battery electrolyte solvents and carbonate-based chemicals is further driving market adoption across industries.

To produce ethylene carbonate, the main raw materials needed are ethylene oxide & carbon dioxide. Ethylene oxide is commonly derived from petroleum or natural gas through the conversion of ethylene. Carbon dioxide can be obtained from different avenues, such as streams of industrial waste, or by purifying it from the atmosphere.

ℹ

To learn more about this report –

Download Your Free Sample Report Here

The manufacturing process occurs within a carefully & properly controlled reactor system, which is designed or manufactured to manage reaction conditions, for safety, & enhance production efficiency.

The global Ethylene Carbonate Market is experiencing sustained expansion, due to its essential role in lithium-ion batteries used for electric vehicles (EVs) and renewable energy storage solutions.

Government initiatives aiming at decreasing greenhouse gas emissions have fuelled increased interest for these solutions – adding further significance to this growing industrial relevance of ethylene carbonate products used across plastics manufacturing, pharmaceutical production,

Precipitated Calcium Carbonate processes, and coating industries.

Market dynamics showcase opportunities through innovations in production processes and the increased adoption of sustainable polymers, while facing persistent challenges like price volatility of raw materials and manufacturing using hazardous substances. Huntsman Corporation and Lotte Chemical have recently expanded to demonstrate how their respective industries prioritize meeting consumer demand while meeting sustainability concerns simultaneously.

Economic pressures have influenced in 2024 as well, with rising freight costs and upstream supply constraints leading to price spikes. Furthermore, Asia-Pacific remains a critical area of expansion due to its robust industrial base, friendly policies, and increasing EV adoption - although fluctuations in consumer interest for electric vehicles--especially within the U.S.--underline market complexities.

The global ethylene carbonate industry is experiencing exponential growth, particularly for battery applications. Lithium-ion batteries that comprise over

25% ethylene carbonate by weight are vital for

electric vehicles (EVs). More than 5 million tons of ethylene carbonate is consumed each year across various sectors; approximately 40% is allocated specifically as battery electrolyte; in the U.S. alone over

20% supports industrial lubricants!

Asia-Pacific dominates production of ethylene carbonate, with China accounting for close to 45% of global output while South Korea and Japan produced

25% each. Freight costs increased significantly between

15-20% between 2024-2025; increasing costs contributed

$50-$75 per ton to logistics expenses associated with producing and transporting carbonate, with rising upstream ethylene costs pushing raw material prices up by

12-13% annually in Q2, further destabilizing overall market stability.

Key Takeaways

- The ethylene carbonate market is projected to reach USD 594.6 million in 2023, growing at a CAGR of 7.3% from 2023 to 2032.

- Solid ethylene carbonate is the leading form due to its stability and high temperature resistance.

- Lubricants are the primary application of ethylene carbonate, driven by demand in automotive, oil & gas, and industrial sectors.

- The automotive sector is the top end-user of ethylene carbonate, utilizing it extensively in component manufacturing and Polycarbonate Safety Glasses production.

- Asia Pacific is the dominant market, with a 37.6% revenue share in 2023, fueled by favorable government policies, strong industrial base, and low labor costs.

Ethylene Carbonate Market Use Cases

- Ethylene carbonate is used as a high-performance solvent in lithium-ion batteries, enhancing electrolyte solutions.

- It serves as an additive in lubricants to improve thermal stability and reduce wear in machinery and automotive components.

- Utilized in the synthesis of polycarbonate plastics, providing improved flexibility and durability for various products.

- Acts as an intermediate in the pharmaceutical industry to produce various medicinal compounds.

- Employed as a textile dye solvent, ensuring vibrant and long-lasting color adherence in fabrics.

Ethylene Carbonate Market Dynamic

Presently, the transportation sector heavily relies on oil as a fuel, resulting in rising concerns from environmentalists and economists alike. However, the growing awareness of sustainable energy sources has resulted in the widespread adoption of batteries in vehicles.

Notably, the IEA (International Energy Agency) reports that the number of EVs on the roads has crossed 10 million, with sales & distribution experiencing considerable growth. Given ethylene carbonate's crucial role as a polar solvent in the formulation of electrolytes for Lithium-Ion batteries, its demand is expected to grow in upcoming years.

Therefore, it can be said that ethylene carbonate plays a crucial role in forming electrolytes for lithium-ion batteries, which have a wide range of applications in portable electronics, renewable energy storage solutions, electric vehicles, & EVs (Electric Vehicles). Moreover, this versatile product finds utility beyond batteries, as it is used in the manufacturing of coatings, plastics, pharmaceuticals, adhesives, and even in industries such as

Refurbished Electronics for energy storage solutions.

Ethylene carbonate also serves as a plasticizer, enhancing the ionic conductivity of polymer electrolytes in various applications, including PVC cables, vinyl flooring, and automobile part manufacturing. To adhere to strict regulations concerning harmful phthalates' usage as plasticizers, the industry has sought environmentally friendly alternatives, leading to the development of plasticizers utilizing ethylene carbonate.

As the demand for PVC products is expected to grow substantially in the coming years, accounting for more than 90% of plasticizer usage, this creates a favorable opportunity for ethylene carbonate manufacturers to target and capture a significant market share.

Research Scope and Analysis

By Form

The solid form of ethylene carbonate dominates the market within the Form segment. This can be attributed to its prolonged life and ability to withstand higher temperatures without undergoing any chemical changes. Solid ethylene carbonate is utilized across various sectors, such as chemical, automotive, industrial, & medical sectors.

Additionally, it works as an important additive in the manufacturing of pharmaceuticals, soldering fluxes & cosmetics. Moreover, in the oil & gas sector, it works as a solution of solvent to decrease thickness during more-pressure or more-temperature drilling procedures, specifically, when other fluids are ineffective due to their low viscosity. This versatility and wide-ranging applicability make solid ethylene carbonate a valuable choice in numerous applications.

In its liquid state, ethylene carbonate is widely used in lubricants & polymers. It plays a significant role in producing high-density plastics known for their resistance to chemical deterioration or degradation. When combined with substances like ethene oxide, propylene oxide & diethyl carbonate, and liquid ethylene carbonate various specialized materials can be easily made to cater specific needs of customers.

Moreover, ethylene carbonate in the liquid form is of utmost importance in the manufacturing process of lithium-ion battery electrolytes. Its versatile properties make it an important constituent in various industrial applications, ensuring its relevance and demand in different sectors.

By Application

The lubricants sector dominates the market within the application segment. This can be due to the widespread use of lubricants in various industries, such as automotive, Oil & Gas, and industrial sectors, among others. Ethylene carbonate is a pivotal component within this sector, functioning as an enhancer within its compositions to improve their characteristics & effectiveness.

Furthermore, it enhances the slipperiness & film-forming qualities of the lubricants, resulting in less friction & deformation among mobile components. Through the establishment of a protective layer on metal surfaces, ethylene carbonate avoids metal surface-to-metal surface interaction, reducing the chances of surface harm & component breakdown. This makes ethylene carbonate a crucial constituent in lubricants, improving their efficacy & durability across a wide range of usage.

However, the lithium battery electrolyte segment stood second after the lubricant sector in application, holding a significant share. Ethylene carbonate is extensively been used in Li-ion batteries. It acts as an important component in formulating the solution of electrolyte, easing the movement of ions between the negative & positive electrodes of the battery.

By End Use

The automotive sector dominates the end-use segment, holding a substantial revenue share. This can be accredited to the increasing adoption of ethylene carbonate in automotive manufacturing, especially in the production of vital components like spark plugs, battery terminals & ignition cable sets. Ethylene carbonate’s impressive dielectric strength plays a pivotal role in bolstering safety measures and guarding against electrical hazards in automotive uses.

Following closely, the Oil & Gas industry stood as the second-largest end-use segment. The utilization of ethylene carbonate as a solvent in diverse extraction procedures has been on the rise due to its effective capability to dissolve specific substances, like aromatic hydrocarbons, facilitating their extraction from their materials.

Additionally, the product serves as a key component in drilling fluids, where it reduces viscosity and improves the lubricity of the mud, resulting in enhanced drilling efficiency and reduced friction between the drill bit and the wellbore.

Moreover, ethylene carbonate finds significant use as a solvent or co-solvent in pharmaceutical drug formulations. Its ability to dissolve and solubilize various active pharmaceutical ingredients (APIs) or other components contributes to the development of drug formulations with improved bioavailability and stability.

Acting as a stabilizer, plasticizer, or viscosity modifier, ethylene carbonate enhances the performance and functionality of the final drug product, making it a valuable component in the pharmaceutical industry.

The Global Ethylene Carbonate Market Report is segmented based on the following:

By Form

By Application

- Lithium Battery Electrolytes

- Lubricants

- Others

By End Use

- Industrial

- Automotive

- Medical

- Oil & Gas

- Others

Ethylene Carbonate Market Regional Analysis

Asia Pacific dominates the market, holding a considerable revenue

share of 37.6% in 2023. Several reasons like governmental regulations, a robust industrial foundation, and the availability of affordable labor encourage significant industry leaders to make investments in this area which further drives its growth.

Furthermore, China's flourishing automotive sector, particularly the growing desire for EVs (electric vehicles) has made a substantial impact on the region's utilization of ethylene carbonate. Moreover, the electronics industry in the nation is experiencing considerable expansion due to the increasing uptake of consumer electronics & technological advancements. The extensive application of ethylene carbonate in the manufacturing of electronic components like printed circuit boards & capacitors has led to an increase in its utilization in the area.

In North America, especially in the United States., the automotive sector has experienced notable growth in the manufacturing and consumption of EVs. The country's emphasis on minimizing the utilization of fossil fuels & shift towards clean energy sources has led to the growth of the energy storage industry. Because ethylene carbonate is utilized in the production of lithium-ion batteries for storing energy, its usage in the area has been experiencing substantial growth.

By Region

North America

Europe

- Germany

- The U.K.

- France

- Italy

- Russia

- Spain

- Benelux

- Nordic

- Rest of Europe

Asia-Pacific

- China

- Japan

- South Korea

- India

- ANZ

- ASEAN

- Rest of Asia-Pacific

Latin America

- Brazil

- Mexico

- Argentina

- Colombia

- Rest of Latin America

Middle East & Africa

- Saudi Arabia

- UAE

- South Africa

- Israel

- Egypt

- Rest of MEA

Competitive Landscape

Continuous research and development activities, product innovations, strategic collaborations, and expansion endeavors by major players are defining characteristics of the market. To retain their market positions and cater to the evolving demands of various industries, companies are actively engaging in these initiatives.

A notable example is Huntsman Corporation, which is currently increasing the production capacity of Ultrapure Ethylene as it plays a crucial role in ensuring the optimal performance and long-lasting durability of lithium-ion batteries used in electric vehicles (EVs) and electronic devices. This enhancement will aid in meeting the growing demands of the EV and electronics industries, emphasizing the importance of staying at the forefront of technological advancements in the market.

Some of the prominent players in the Global Ethylene Carbonate Market are

- Oriental Union Chemical Corporation

- Huntsman International LLC

- BASF

- Mitsubishi Chemical Corporation

- Huntsman International LLC

- Zibo Donghai Industries Co. Ltd.

- TAOGOSEI CO. LTD.

- New Japan Chemical Co. Ltd.

- Other Key Players

Recent Developments

- In March 2024, Dow announced plans to invest in a new world-scale carbonate solvents facility in the U.S., aiming to meet growing demand for high-quality solvents used in lithium-ion batteries and other applications.

- In June 2023, the Department of Energy (DOE) invested $2 million to enhance lithium-ion battery recycling and remanufacturing technologies, seeking to improve the sustainability and efficiency of battery usage across various sectors.

- In November 2024, Molyon secured $4.6 million in funding to develop next-generation lithium-sulfur batteries, focusing on applications for robots and drones that require advanced power solutions for longer endurance and efficiency.

Report Details

| Report Characteristics |

| Market Size (2023) |

USD 594.6 Mn |

| Forecast Value (2032) |

USD 1,118.3 Mn |

| CAGR (2023-2032) |

7.3% |

| Historical Data |

2017 - 2022 |

| Forecast Data |

2023 - 2032 |

| Base Year |

2022 |

| Estimate Year |

2023 |

| Report Coverage |

Market Revenue Estimation, Market Dynamics, Competitive Landscape, Growth Factors and etc. |

| Segments Covered |

By Form (Solid and Liquid), By Application (Surface Coatings, Lithium Battery Electrolytes, Lubricants, Plasticizers, and Others). |

| Regional Coverage |

North America – The US and Canada; Europe – Germany, The UK, France, Russia, Spain, Italy, Benelux, Nordic, & Rest of Europe; Asia- Pacific– China, Japan, South Korea, India, ANZ, ASEAN, Rest of APAC; Latin America – Brazil, Mexico, Argentina, Colombia, Rest of Latin America; Middle East & Africa – Saudi Arabia, UAE, South Africa, Turkey, Egypt, Israel, & Rest of MEA |

| Prominent Players |

Oriental Union Chemical Corporation, Huntsman International LLC, BASF, Mitsubishi Chemical Corporation, Huntsman International LLC, Zibo Donghai Industries Co. Ltd., TAOGOSEI CO. LTD., New Japan Chemical Co. Ltd., and Other Key Players. |

| Purchase Options |

We have three licenses to opt for: Single User License (Limited to 1 user), Multi-User License (Up to 5 Users), and Corporate Use License (Unlimited User) along with free report customization equivalent to 0 analyst working days, 3 analysts working days and 5 analysts working days respectively. |

Frequently Asked Questions

How big is the Global Ethylene Carbonate Market?

▾ The Global Ethylene Carbonate Market is expected to reach a significant value of USD 594.6 million in

2023.

What is the expected CAGR for the Global Ethylene Carbonate Market?

▾ The expected CAGR for the Global Ethylene carbonate Market is 7.3% between 2023 and 2032.

Which is the dominant segment (by form) for the Global Ethylene Carbonate Market?

▾ In 2023, the Solid form of ethylene carbonate dominates the Global Ethylene Carbonate Market.

Who are the prominent players in the Global Ethylene Carbonate Market?

▾ Some of the prominent players in the Global Ethylene Carbonate Market include Oriental Union

Chemical Corporation, Huntsman International LLC, BASF, Mitsubishi Chemical Corporation, etc.