Market Overview

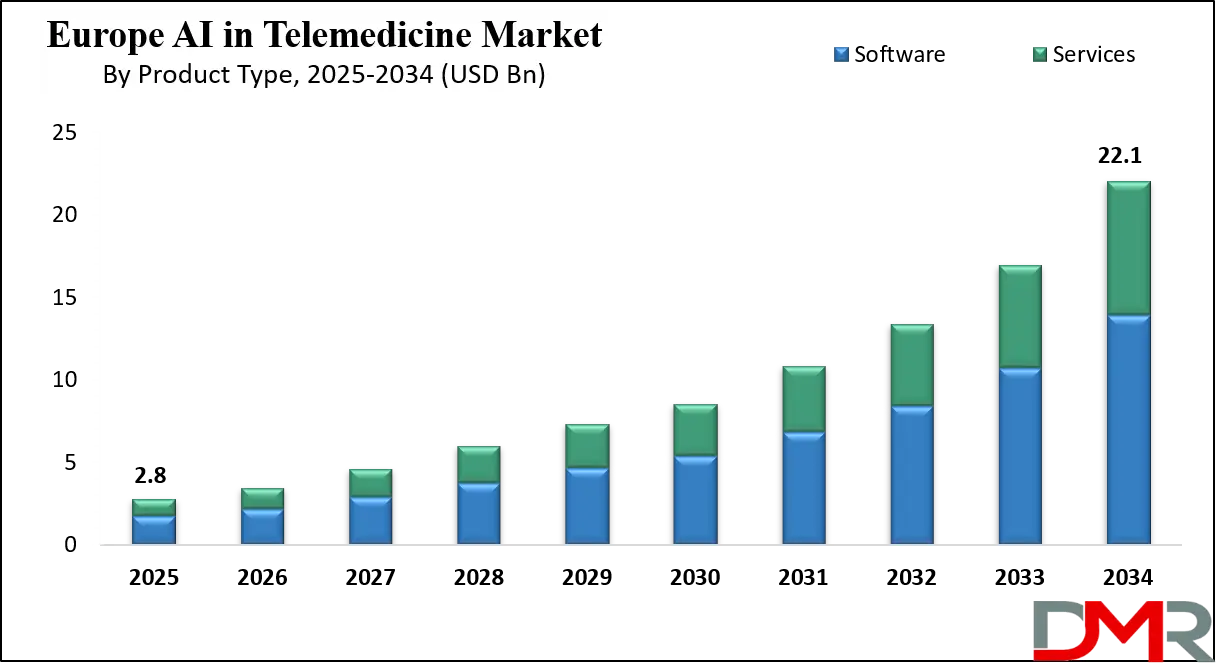

The Europe AI in Telemedicine Market is projected to achieve a valuation of USD 2.8 billion by 2025 and is anticipated to expand at a robust compound annual growth rate (CAGR) of 25.9% through 2034, potentially reaching USD 22.1 billion by the end of the forecast period. This growth is fueled by the increasing adoption of AI-powered virtual care platforms, remote patient monitoring solutions, and predictive analytics tools across hospitals, clinics, and home care settings.

Key drivers include the rising prevalence of chronic diseases, government initiatives supporting digital health transformation, integration of machine learning and deep learning algorithms in diagnostics, and enhanced interoperability across telemedicine ecosystems. Additionally, regulatory support, growing investment in healthcare IT infrastructure, and the focus on improving patient outcomes and operational efficiency are expected to further accelerate market expansion, positioning Europe as a leading region for AI-driven telehealth innovation.

Substantial opportunities for market penetration and growth are emerging from the pressing need to address Europe's demographic shifts and healthcare accessibility challenges. The continent's aging population creates a fertile ground for AI-driven virtual nursing assistants and conversational agents that can deliver scalable, round-the-clock support for chronic disease management and medication adherence, thereby alleviating pressure on overstretched clinical staff.

Furthermore, the ongoing harmonization of digital health regulations, exemplified by the European Health Data Space (EHDS) initiative, unlocks the potential for cross-border telemedicine. Here, natural language processing and machine learning algorithms are instrumental in overcoming linguistic and clinical protocol barriers, enabling seamless access to specialized medical expertise and second opinions across member states and democratizing the distribution of advanced medical knowledge.

Notwithstanding the optimistic outlook, the market's ascent is tempered by a complex regulatory ecosystem and persistent integration challenges. The European Union's stringent General Data Protection Regulation (GDPR) and the newly enacted AI Act establish a rigorous compliance landscape for algorithm development and data utilization, often imposing significant hurdles that can slow the pace of innovation and market entry for novel solutions.

A parallel and significant restraint involves the "black box" conundrum of many complex neural networks, where the inability to fully elucidate a diagnostic or therapeutic recommendation erodes clinician trust and introduces substantial medico-legal complexities. This lack of transparent algorithmic interpretability remains a critical barrier to widespread, deep-seated adoption within established clinical pathways.

Europe AI in Telemedicine Market: Key Takeaways

- Robust Market Growth: The Europe AI in Telemedicine Market is expected to grow from approximately USD 2.8 billion in 2025 to USD 22.1 billion by 2034, achieving a CAGR of 25.9%, driven by increasing adoption of AI for remote healthcare delivery, diagnostics, and virtual consultations across hospitals, clinics, and homecare services.

- Software as the Leading Segment: Software is poised to dominate due to its scalability, integration with hospital information systems, and ability to provide real-time analytics. Platforms for predictive modeling, clinical decision support, and EHR integration form the backbone of telemedicine innovation in Europe, enabling more efficient, data-driven patient care.

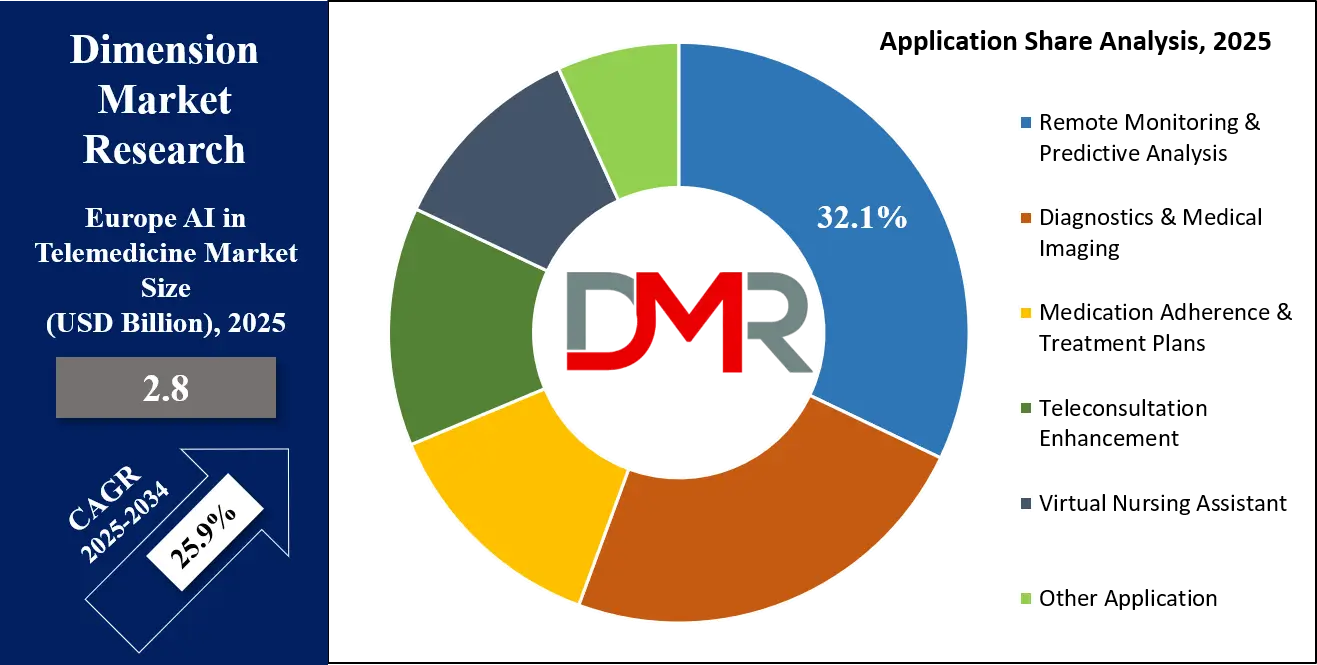

- Remote Monitoring & Predictive Analytics Drive Applications: Continuous patient monitoring and predictive analytics remain the most impactful applications. AI processes data from IoT devices and connected wearables to detect anomalies, forecast health risks, and support early interventions, improving patient outcomes and reducing hospital readmissions.

- Healthcare Facilities as Primary Users: Hospitals, clinics, and diagnostic centers are the main adopters due to their capacity to implement AI solutions at scale. Their focus on operational efficiency, enhanced patient engagement, and evidence-based care drives consistent adoption of AI-powered telemedicine technologies.

- Enhanced Workforce Efficiency: AI automates administrative tasks such as documentation, triage, and claims processing, reducing clinician workload and mitigating burnout. These solutions boost productivity, minimize errors, and elevate overall care quality in European healthcare settings.

- Supportive Policies and Regulations: EU initiatives promoting digital health, national telehealth reimbursement programs, and AI-friendly regulatory frameworks create a favorable environment. These measures reduce barriers to adoption and encourage continued investment in AI-enabled telemedicine solutions.

Europe AI in Telemedicine Market: Use Cases

- Chronic Disease Management: AI platforms analyze continuous glucose monitoring and lifestyle data from diabetic patients. The system provides personalized insulin dosage recommendations and dietary advice, alerting healthcare providers only when intervention is necessary. This proactive approach improves glycemic control and reduces emergency admissions, enabling more efficient management of population health.

- Teleradiology Triage: Deep learning algorithms automatically prioritize critical findings in X-rays and CT scans uploaded to telemedicine platforms. Studies indicating potential strokes, pulmonary embolisms, or fractures are flagged for immediate radiologist review, significantly cutting down diagnosis times and improving patient outcomes in time-sensitive emergencies, thus optimizing radiology workflow distribution.

- Mental Health Support: Conversational AI chatbots deliver initial cognitive behavioral therapy (CBT) techniques and mood tracking for individuals with anxiety or depression. These tools provide 24/7 accessible support, triage severity levels, and gather structured data for human therapists, enhancing the scalability of mental health services and ensuring help is available during intersession periods.

- Remote Patient Monitoring (RPM) for Elderly Care: AI algorithms process data from in-home sensors and wearables to monitor elderly patients' daily activities and vital signs. The system detects anomalies like falls, changes in sleep patterns, or missed meals, automatically alerting family members or community care teams to enable aging in place safely and reduce hospital readmissions.

- Virtual Dermatology Assistants: Patients upload images of skin conditions via a tele-dermatology app. An AI model conducts an initial analysis, assessing the lesion's borders, color, and asymmetry, providing a preliminary risk score for malignancy. This helps dermatologists prioritize high-risk cases for urgent in-person appointments, streamlining patient pathways and potentially enabling earlier skin cancer detection.

Europe AI in Telemedicine Market: Stats & Facts

World Health Organization (WHO) Europe

- A 2022 report highlighted that over 50% of its European member states have now established a national digital health strategy, many of which explicitly reference AI as a core component for future health system resilience.

- It estimates that leveraging digital health technologies, including AI, could address over 50% of the gap in achieving the United Nations Sustainable Development Goals for health in the European region.

European Commission

- The EU's Horizon Europe research and innovation programme has allocated over €2 billion for digital health and AI-related projects for the 2021-2027 period.

- The Commission's assessment states that the broad adoption of AI in healthcare could lead to a 10-20% efficiency gain in healthcare systems across the EU.

- The proposed European Health Data Space aims to enable secure access and sharing of health data across borders, which is a foundational element for training robust AI models.

National Health Service (NHS) England

- As of 2023, over 90 AI-powered medical imaging tools were in various stages of deployment and testing across NHS trusts.

- The NHS Long Term Plan commits to ensuring that, within the next five years, every patient will have the right to be offered a digital-first primary care consultation where appropriate.

German Federal Ministry of Health

- The Digital Healthcare Act (DVG) has created a fast-track process for "Digital Health Applications" (DiGA); as of late 2023, over 40 AI-supported apps have been approved for prescription and reimbursement by statutory health insurers.

Haute Autorité de Santé (HAS) France

- France's health technology assessment body has integrated specific pathways for the evaluation and reimbursement of AI-based software as a medical device (SaMD).

- A 2023 report from the French government indicated a 45% year-on-year increase in the number of telehealth consultations that utilized a decision-support software tool.

Organisation for Economic Co-operation and Development (OECD)

- OECD data shows that on average, European countries spent about 10.9% of their GDP on healthcare in 2022, with pressures mounting to improve cost-efficiency, a key driver for AI adoption.

- A survey of European healthcare providers found that 65% identified "improving operational efficiency" as a primary objective for their digital transformation projects involving AI.

European Society of Radiology (ESR)

- A survey of European radiologists found that 70% believe AI will significantly impact their workflow within the next 5 years, primarily by automating routine tasks and prioritizing critical cases.

- The ESR estimates that the volume of medical imaging data is growing by over 30% annually, creating a pressing need for AI-powered tools to manage the workload.

Statutory Health Insurances in Germany

- Data from a consortium of German health insurers showed that reimbursed prescriptions for Digital Health Applications (DiGAs), many incorporating AI, exceeded 150,000 in the first half of 2023, reflecting growing physician and patient acceptance.

Other Governmental and Organizational Bodies

- The Italian Ministry of Health has allocated €1 billion from the National Recovery and Resilience Plan (PNRR) specifically for transitioning to a more data-driven and digitally advanced healthcare system, including telemedicine and AI.

- The Spanish government's "Digital Spain 2026" strategy includes a specific budget of over €700 million for projects related to digital health and AI.

- The Dutch Ministry of Health, Welfare, and Sport reported that over 80% of Dutch hospitals now have at least one active AI project in a pilot or production phase.

- The Swedish eHealth Agency's data indicates that 95% of all primary care clinics in Sweden now use a national digital platform that is being upgraded to support integration with third-party AI applications.

- The Finnish Institute for Health and Welfare (THL) reported a 300% increase in the use of its national telemedicine service platform from 2019 to 2023, creating a vast new dataset for potential AI training and deployment.

- The Norwegian Directorate of eHealth stated that 75% of Norwegians now have access to their electronic health records online, a crucial data source for developing personalized AI-driven health solutions.

- The Danish Health Data Authority has successfully facilitated the secondary use of health data for over 200 research and innovation projects, many focused on AI algorithm development.

- The Health Service Executive (HSE) Ireland's digital strategy outlines a goal to have 90% of all patient interactions with the public health system available digitally by 2030, creating a framework for AI integration.

- The Swiss Federal Office of Public Health (FOPH) has launched a national "Digital Health" strategic initiative with a focus on interoperability standards that are essential for scalable AI solutions.

- The Polish National Health Fund (NFZ) reported processing over 5 million telemedicine consultations in 2022, a volume that necessitates automated AI-powered administrative processing.

- The Central Administration of the Czech Health Insurance Companies notes that the legal framework for the reimbursement of telemedicine services was fully implemented in 2023, opening financial pathways for AI-enhanced consultations.

- The Belgian National Institute for Health and Disability Insurance (INAMI-RIZIV) has approved reimbursement codes for specific AI-assisted remote monitoring programs for chronic conditions like congestive heart failure.

- The American Academy of Family Physicians (AAFP) reports that its members' use of AI for clinical documentation has increased by over 300% since 2021.

- The U.S. Department of Veterans Affairs (VA) provides over 2.5 million virtual care visits annually, many of which utilize its integrated AI tools for triage and chronic condition management.

Europe AI in Telemedicine Market: Market Dynamics

Driving Factors in the Europe AI in Telemedicine Market

Post-Pandemic Digital Health Acceleration and Supportive Policy Frameworks

The COVID-19 pandemic served as a massive catalyst, forcing a rapid and permanent adoption of telemedicine across Europe. This created a foundational infrastructure and widespread acceptance among both providers and patients for digital health solutions. Concurrently, European Union and national government policies are actively fueling growth.

Initiatives like the EU's European Health Data Space (EHDS), which aims to facilitate cross-border health data exchange, and national strategies like Germany's Digital Healthcare Act (DVG), which provides a reimbursement pathway for Digital Health Applications (DiGAs), are creating a structured and financially viable market for AI in telemedicine, de-risking investment, and encouraging innovation.

Escalating Healthcare Costs and Demographic Pressures

Europe's aging population is placing an unsustainable strain on its healthcare budgets and workforce. The rising prevalence of chronic diseases associated with an older demographic necessitates more efficient and scalable care delivery models. AI in telemedicine presents a compelling solution to this systemic pressure by automating routine tasks, enabling remote management of chronic conditions, and optimizing resource allocation. By facilitating early intervention and reducing unnecessary hospital visits and readmissions, AI-driven tools offer a tangible path to curbing escalating healthcare costs while simultaneously maintaining or improving the quality of care for a growing patient population.

Restraints in the Europe AI in Telemedicine Market

Stringent Data Privacy Regulations and Algorithmic Compliance Hurdles

The European market is governed by the world's most rigorous data protection laws, primarily the General Data Protection Regulation (GDPR), and is soon to be impacted by the AI Act. Compliance creates substantial hurdles. The GDPR's requirements for data minimization, purpose limitation, and the "right to explanation" for automated decisions directly conflict with the data-hungry and often complex nature of AI development. Furthermore, the AI Act's classification of most medical AI as high-risk necessitates passing stringent conformity assessments, requiring extensive clinical validation and post-market monitoring, which significantly increases development costs, time-to-market, and ongoing compliance burdens for companies.

Clinical Integration Challenges and the "Black Box" Problem

The successful integration of AI into established clinical workflows remains a major impediment. Many advanced AI models, particularly deep learning networks, operate as "black boxes," where the reasoning behind a specific output is not easily interpretable by a human clinician.

This lack of transparency and explainability erodes trust and poses significant medico-legal risks, as a physician remains ultimately responsible for a diagnosis or treatment decision, even if it was AI-informed. Overcoming this requires not only technological advances in Explainable AI (XAI) but also extensive clinician education, workflow redesign, and the development of clear legal frameworks governing liability for AI-assisted care.

Opportunities in the Europe AI in Telemedicine Market

Expansion into Mental Health and Primary Care Triage

A significant growth avenue lies in deploying AI to address the acute shortage of mental health professionals and the overwhelming demand for primary care services. AI-powered cognitive behavioral therapy (CBT) platforms and intelligent conversational agents can provide scalable, first-line support for individuals with mild-to-moderate anxiety and depression, offering 24/7 access and structured therapeutic exercises. In primary care, sophisticated AI triage systems can analyze patient-reported symptoms through structured dialogues, accurately directing them to the most appropriate level of care—be it self-management, a pharmacy, a general practitioner, or an emergency department—thereby streamlining access and improving system-wide efficiency.

Cross-Border Telemedicine and Specialized Expertise Networks

The ongoing harmonization of digital health regulations within the EU, particularly through the EHDS, unlocks the potential for a seamless cross-border telemedicine market. AI is the key enabler for this. Machine learning algorithms can assist with language translation of medical summaries, while clinical decision support systems can help reconcile different national treatment guidelines. This allows for the creation of European-wide specialist networks where, for instance, a rare disease expert in Sweden can reliably provide a second opinion via telemedicine to a patient in Greece, with AI tools ensuring data compatibility and clinical context, thereby democratizing access to highly specialized medical knowledge.

Trends in Europe AI in Telemedicine Market

Convergence of Predictive Analytics and Remote Patient Monitoring (RPM)

A dominant trend is the sophisticated fusion of AI-powered predictive analytics with data streams from Internet of Medical Things (IoMT) devices. Moving beyond simple data transmission, advanced machine learning models now analyze continuous real-time data from wearables and in-home sensors to forecast individual patient health trajectories.

These systems can predict potential adverse events, such as a heart failure exacerbation or a hypoglycemic episode, days in advance. This enables a paradigm shift from reactive care to proactive, preemptive intervention, where clinicians can contact at-risk patients for timely adjustments to treatment plans, thereby preventing hospitalizations and improving long-term outcomes for chronic disease populations.

Advancement of Natural Language Processing for Clinical Workflow Automation

The application of Natural Language Processing (NLP) is evolving from simple chatbot interactions to complex clinical documentation and administrative automation. Advanced NLP algorithms are now integrated directly into telemedicine platforms and Electronic Health Record (EHR) systems.

They can automatically transcribe and structure doctor-patient conversations from virtual consultations, generating clinical notes, summarizing key findings, and suggesting relevant diagnostic codes. This significantly reduces the administrative burden and documentation time for physicians, combating burnout and allowing them to focus more on patient care. Furthermore, NLP is being used to mine unstructured clinical data from historical records to identify patients suitable for clinical trials or specific remote monitoring programs.

Europe AI in Telemedicine Market: Research Scope and Analysis

By Product Type Analysis

In Europe, software is projected to dominate the product type segment in the AI in telemedicine market due to its pivotal role in enabling AI-driven healthcare solutions across hospitals and clinics. AI-powered telemedicine platforms, clinical decision support systems (CDSS), predictive analytics tools, and EHR-integrated patient management systems form the backbone of software offerings in European healthcare. These solutions enable real-time patient monitoring, remote consultations, diagnostics, and personalized treatment plans, which are increasingly essential amid Europe’s aging population and rising chronic disease burden.

The adoption of digital health technologies across countries such as Germany, the UK, France, and the Nordics has accelerated software utilization. Unlike services, which mainly cover AI implementation, integration, and maintenance delivered periodically, software provides continuous operational and analytical value. European healthcare facilities benefit from software solutions that scale across departments, handle large volumes of patient data, and deliver actionable insights.

Integration with existing hospital information systems, wearables, and IoT devices further enhances utility. Continuous updates, AI model improvements, and cloud-based deployment ensure adaptability to evolving clinical standards, reinforcing software as the dominant product type in Europe’s AI telemedicine market.

By Application Analysis

Remote Monitoring & Predictive Analysis is anticipated to lead the AI telemedicine application segment in Europe. Leveraging AI algorithms, this application continuously analyzes patient vitals collected via wearables, connected medical devices, and IoT platforms. By predicting potential health events, AI enables early interventions, lowering complications and hospital readmissions—critical in countries facing aging populations and high chronic disease prevalence.

Key drivers include chronic disease management, elderly care, and post-operative monitoring, where continuous oversight significantly improves outcomes. AI-powered predictive analytics identifies patterns and anomalies in patient data, enabling proactive care. While applications like virtual nursing assistants, diagnostics, medical imaging, and teleconsultation enhancements are important, remote monitoring provides uninterrupted, actionable insights directly impacting patient health.

Hospitals and healthcare providers benefit from improved operational efficiency and data-driven clinical decision-making. Patient engagement also increases via personalized alerts, reminders, and health insights. With Europe’s high IoT adoption and advanced AI models for predictive analytics, remote monitoring is set to remain the most widely adopted and impactful AI telemedicine application.

By End User Analysis

Healthcare facilities are expected to dominate the end-user segment of Europe’s AI in telemedicine market due to their ability to adopt technology at scale and deploy AI solutions across multiple operational areas. Hospitals, clinics, diagnostic centers, and specialty care centers utilize AI-enabled platforms for teleconsultations, remote monitoring, predictive analytics, diagnostics, and medical imaging. Large European healthcare facilities can justify AI investments due to gains in operational efficiency, reduced readmission rates, better patient outcomes, and optimized resource management.

Homecare adoption is growing but remains limited by device costs, technical literacy, and inconsistent internet connectivity in certain regions. Other end users, including corporate health programs, government healthcare initiatives, and telemedicine service providers, constitute niche markets with relatively limited adoption compared to institutional healthcare.

European healthcare facilities benefit from centralized deployment of AI software and integrated services, ensuring seamless interoperability across departments. The ability to process large volumes of patient data enhances clinical decision-making and operational planning. Consequently, healthcare facilities remain the primary driver of AI telemedicine growth in Europe, investing consistently to meet rising patient expectations, optimize workflows, and maintain a competitive edge.

Europe AI in Telemedicine Market Report is segmented on the basis of the following:

By Product Type

- Software

- AI-powered Telemedicine Platforms

- Clinical Decision Support Systems (CDSS)

- AI-based Patient Management & EHR Integration Tools

- Predictive Analytics Software

- Services

- AI Implementation & Integration Services

- Remote Patient Monitoring Services

- Consultation & Training Services

- Managed AI Telemedicine Services

By Application

- Remote Monitoring & Predictive Analysis

- AI-driven Wearables & IoT Monitoring

- Predictive Analytics for Chronic Disease Management

- Diagnostics & Medical Imaging

- AI Imaging Interpretation & Analysis

- AI-based Diagnostic Tools (Radiology, Pathology, etc.)

- Medication Adherence & Treatment Plans

- AI Reminders & Personalized Treatment Plans

- Digital Therapeutics Integration

- Teleconsultation Enhancement

- AI-assisted Video Consultations

- Natural Language Processing (NLP) for Medical Documentation

- Virtual Nursing Assistant

- AI Chatbots & Symptom Checkers

- Personalized Patient Interaction Systems

- Other Application

By End User

- Homecare / Patients at Home

- Chronic Disease Patients

- Elderly Care

- Post-Surgery Care

- Healthcare Facilities

- Hospitals & Clinics

- Diagnostic Centers

- Specialty Care Centers

- Other End Users

By Region

Europe

- Germany

- The U.K.

- France

- Italy

- Russia

- Spain

- Benelux

- Nordic

- Rest of Europe

Europe AI in Telemedicine Market: Competitive Landscape

The competitive landscape of the Europe AI in telemedicine market is a dynamic and fragmented arena, characterized by a vibrant mix of established technology giants, specialized pure-play AI startups, and traditional healthcare and telecommunication companies converging on the space. Large technology firms like Google Health, IBM Watson Health, and Microsoft leverage their immense cloud computing resources, AI research prowess, and strategic partnerships with major hospital networks and telehealth providers to offer comprehensive platform-based solutions.

Competing directly are agile European and U.S.-based startups, such as Babylon Health, Ada Health, and Kheiron Medical (specializing in radiology AI), which focus on developing best-in-class, niche applications for specific clinical use cases like symptom checking, dermatology, or medical imaging analysis. These smaller players often rely on venture capital funding and seek to be acquired or form alliances to achieve scale.

A notable trend is the increasing involvement of telecom operators and medical device manufacturers, who are integrating AI capabilities into their existing connectivity and hardware offerings to create end-to-end remote care solutions. The landscape is further shaped by intense merger and acquisition (M&A) activity, as larger entities acquire innovative startups to rapidly bolster their technological portfolios and gain market share. Success in this complex environment is contingent not merely on technological superiority but also on navigating the intricate EU regulatory maze, demonstrating clear clinical utility and cost-effectiveness to secure reimbursement, and fostering trust through seamless integration into the healthcare provider's workflow.

Some of the prominent players in the Europe AI in Telemedicine Market are:

- Teladoc Health

- Amwell (American Well)

- Babylon Health

- Ping An Good Doctor

- Doctor On Demand

- MDLive

- Infermedica

- Ada Health

- Buoy Health

- K Health

- Viz.ai

- Google Health

- Microsoft Healthcare AI

- Amazon Web Services Healthcare AI

- Nuance Communications (Microsoft)

- Lunit

- HealthTap

- SensAI (Philips Healthcare AI)

- Zoom Communications

- Other Key Players

Recent Developments in Europe AI in Telemedicine Market

- May 2024: The European Commission officially adopted the first-ever legal framework on AI (the AI Act), formally classifying most medical AI as high-risk, setting the stage for a new compliance era.

- April 2024: German telehealth platform TeleClinic partnered with Dutch AI diagnostics company Thirona to integrate its AI-powered lung CT analysis tools into its specialist tele-radiology services.

- March 2024: The UK's NHS AI Lab announced a new USD 15 million funding round specifically for real-world testing and validation of AI tools in telemedicine and virtual ward settings.

- February 2024: French AI startup Synapse Medicine, which focuses on medication error prevention, secured USD 25 million in a Series B funding round to expand its AI decision-support platform across European hospital telemedicine networks.

- January 2024: Doctolib, a major European health booking platform, acquired the German AI-powered doctor's assistant tool Tankerapp, signaling a deeper move into in-consultation AI support.

- November 2023: The European Society of Radiology (ESR) and the European Federation of Pharmaceutical Industries and Associations (EFPIA) co-hosted the "AI in Digital Health" conference in Berlin, focusing on cross-sector collaboration.

- October 2023: Philips and the Karolinska University Hospital in Sweden announced a strategic 5-year collaboration to co-develop and implement AI algorithms for remote patient monitoring and predictive care in oncology and cardiology.

- September 2023: The European Health Data Space (EHDS) regulation achieved a provisional political agreement between the European Parliament and Council, a critical step for pan-European health data access, crucial for AI training.

Report Details

| Report Characteristics |

| Market Size (2025) |

USD 2.8 Bn |

| Forecast Value (2034) |

USD 22.1 Bn |

| CAGR (2025–2034) |

25.9% |

| Historical Data |

2019 – 2024 |

| Forecast Data |

2026 – 2034 |

| Base Year |

2024 |

| Estimate Year |

2025 |

| Report Coverage |

Market Revenue Estimation, Market Dynamics, Competitive Landscape, Growth Factors, etc. |

| Segments Covered |

By Product Type (Software, Services), By Application (Remote Monitoring & Predictive Analysis, Diagnostics & Medical Imaging, Medication Adherence & Treatment Plans, Teleconsultation Enhancement, Virtual Nursing Assistant, and Other Applications), and By End User (Homecare / Patients at Home, Healthcare Facilities, and Other End Users) |

| Regional Coverage |

North America – US, Canada; Europe – Germany, UK, France, Russia, Spain, Italy, Benelux, Nordic, Rest of Europe; Asia-Pacific – China, Japan, South Korea, India, ANZ, ASEAN, Rest of APAC; Latin America – Brazil, Mexico, Argentina, Colombia, Rest of Latin America; Middle East & Africa – Saudi Arabia, UAE, South Africa, Turkey, Egypt, Israel, Rest of MEA |

| Prominent Players |

Teladoc Health, Amwell, Babylon Health, Ping An Good Doctor, Doctor On Demand, MDLive, Infermedica, Ada Health, Buoy Health, K Health, Viz.ai, Google Health, Microsoft Healthcare AI, AWS Healthcare AI, Nuance Communications, Lunit, HealthTap, SensAI (Philips), Zoom Communications., and Other Key Players |

| Purchase Options |

We have three licenses to opt for: Single User License (Limited to 1 user), Multi-User License (Up to 5 Users), and Corporate Use License (Unlimited User) along with free report customization equivalent to 0 analyst working days, 3 analysts working days, and 5 analysts working days respectively. |

Frequently Asked Questions

Europe AI in Telemedicine Market size is estimated to have a value of USD 2.8 billion in 2025 and is expected to reach USD 22.1 billion by the end of 2034.

The market is growing at a CAGR of 25.9 percent over the forecasted period of 2025.

Some of the major key players in the Europe AI in Telemedicine Market are Teladoc Health, Amwell, Babylon Health, Ping An Good Doctor, Doctor On Demand, MDLive, Infermedica, Ada Health, Buoy Health, K Health, and many others.