Market Overview

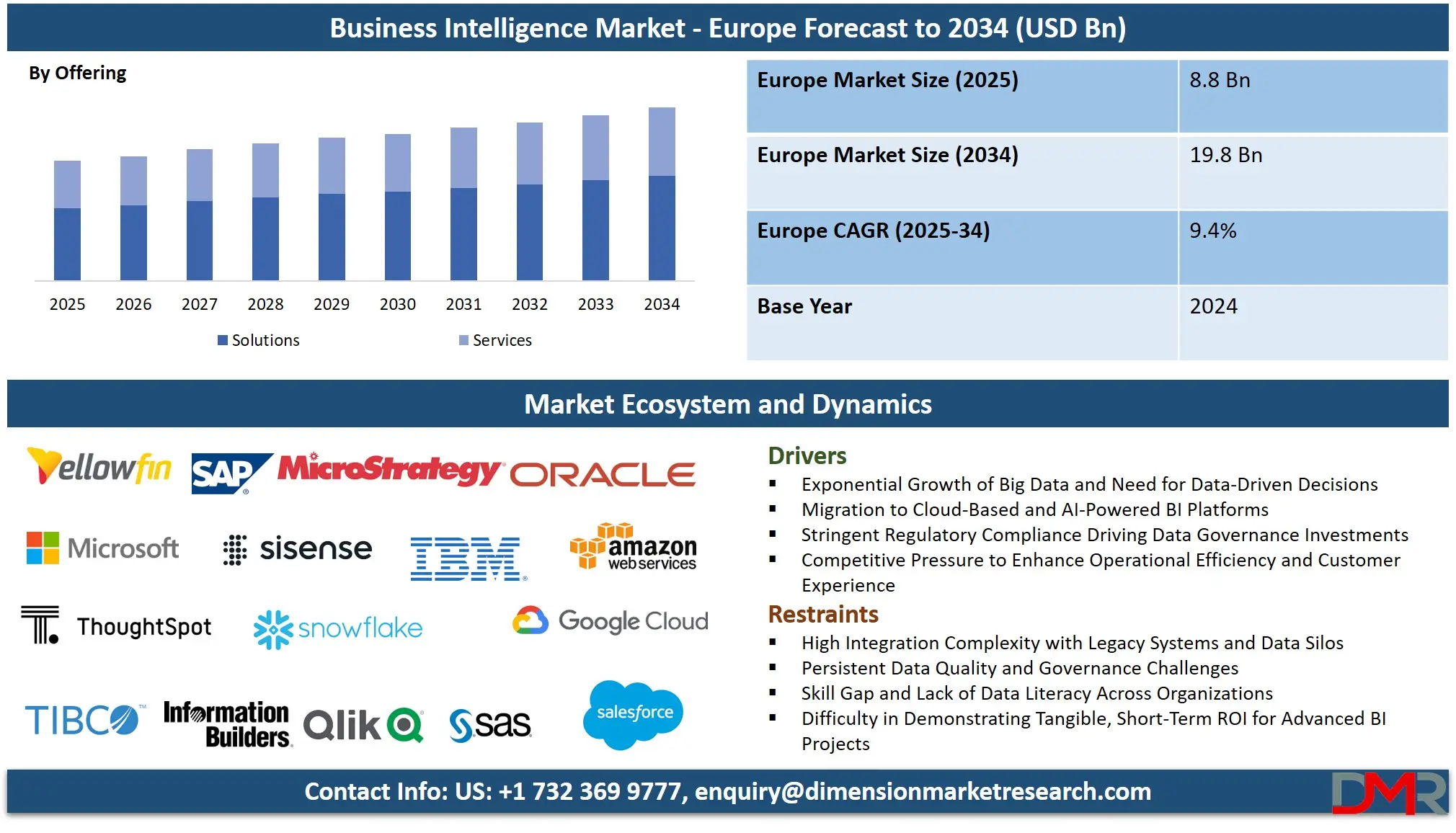

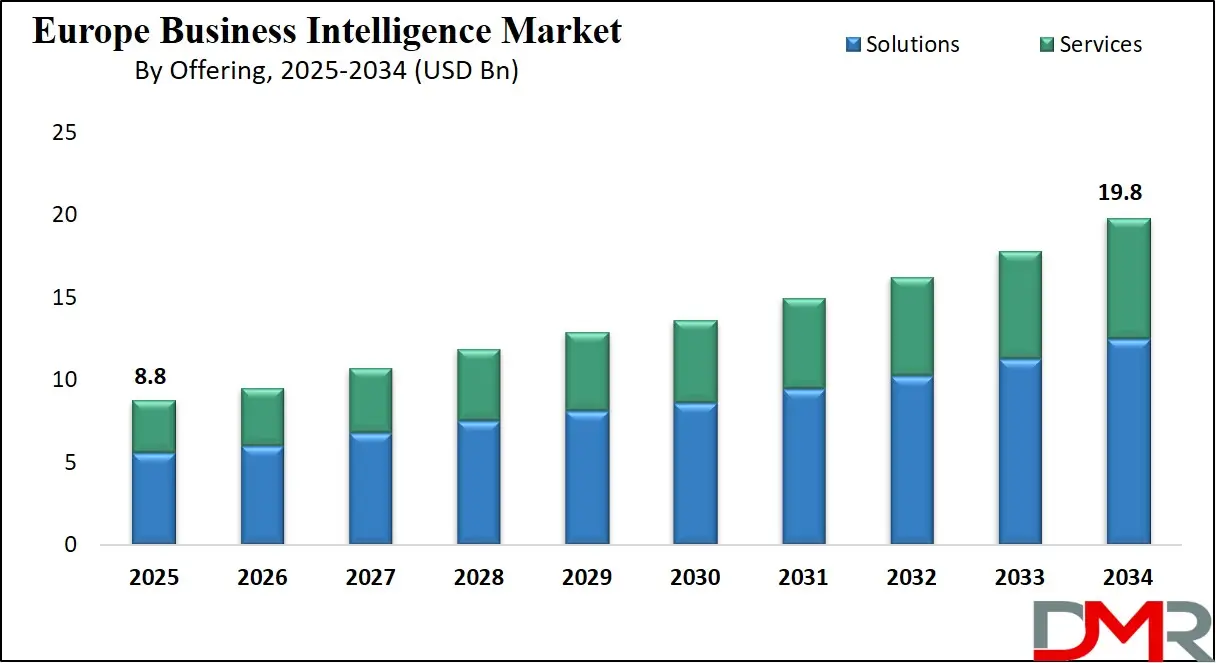

The Europe Business Intelligence (BI) Market is anticipated to reach USD 8.8 billion in 2025, propelled by the escalating volume of enterprise data, the critical need for data-driven decision-making, and the accelerated digital transformation across all industry sectors. The market is expected to expand at a robust compound annual growth rate (CAGR) of 9.4% from 2025 to 2034, reaching a projected value of USD 19.8 billion by 2034.

Growth is fueled by the widespread adoption of cloud-based BI platforms, the strategic integration of artificial intelligence (AI) and machine learning (ML) for predictive analytics, stringent data governance and compliance requirements (GDPR), and the increasing demand for real-time, actionable insights to enhance operational efficiency and competitive advantage. Furthermore, the expanding applications across Supply Chain, Customer Relationship Management (CRM), and Financial Performance Management, coupled with the necessity for user-friendly, self-service analytics, are expected to significantly accelerate market expansion.

ℹ

To learn more about this report –

Download Your Free Sample Report Here

The European BI landscape is evolving from static, IT-centric reporting to dynamic, democratized analytics ecosystems. A pivotal trend is the strategic convergence of advanced data visualization and self-service analytics, where BI platforms are transforming into comprehensive intelligence hubs. These hubs enable interactive dashboards, ad-hoc querying, and automated reporting, which are crucial for meeting agility targets and empowering business users under modern operational models.

This integration fosters a culture of data literacy and facilitates real-time strategic and operational decisions. Concurrently, BI solution providers are embedding sophisticated augmented analytics and natural language processing (NLP) tools, offering automated insight generation and personalized data storytelling as core features, making advanced analytics accessible to non-technical users. The fusion of AI with BI platforms is also gaining prominence, optimizing forecast accuracy and proactively identifying market trends and operational inefficiencies across Europe's diverse economic landscape.

ℹ

To learn more about this report –

Download Your Free Sample Report Here

The market's expansion is underpinned by significant opportunities in predictive and prescriptive analytics, particularly for optimizing complex processes and supporting integrated business ecosystems that demand seamless data flow and reliability. Large Enterprises and SMEs have emerged as primary adopters, leveraging BI technology for scalable data management, performance monitoring, and strategic planning, which are seeing rapid utilization growth.

Moreover, the continuous development of novel, industry-specific analytic applications, including embedded analytics and AI-driven business monitoring, is creating new avenues for intelligent operations that are highly responsive and insightful. These innovations are poised to address critical challenges in data silos and fragmented reporting, such as in cross-departmental performance analysis and real-time supply chain visibility, providing a competitive edge essential for sustainable growth across the EU.

Europe Business Intelligence Market: Key Takeaways

- Europe Market Size Insights: The Europe Business Intelligence Market is projected to be valued at USD 8.8 billion in 2025. It is expected to witness subsequent growth in the upcoming period, reaching a projected value of USD 19.8 billion in 2034.

- The Europe Market Growth Rate: The market is growing at a CAGR of 9.4 percent over the forecasted period from 2025 to 2034.

- Key Drivers: Growth is primarily fueled by the exponential growth of big data, the migration to cloud-based and AI-powered BI solutions, stringent regulatory compliance necessitating robust data management, and the competitive pressure to enhance operational efficiency and customer experience.

- Competitive Landscape: The market is highly competitive and features a mix of global software giants (Microsoft, IBM, Oracle), specialized analytics and data visualization vendors (Tableau, Qlik), hyperscale cloud platforms (AWS, Google Cloud), and regional system integrators and consultants.

- Segment Insights: Within offerings, Solutions, particularly Data Integration & ETL and Reporting & Visualization, are the largest component, while Financial Performance & Strategy Management remains a dominant application segment due to its universal criticality across all business sectors.

Europe Business Intelligence Market: Use Cases

- Real-Time Supply Chain Optimization for a Manufacturing Conglomerate: A European industrial manufacturer uses an integrated BI platform with dashboards & scorecards to monitor global supply chain operations. AI-driven predictive analytics forecast material shortages and logistical bottlenecks, triggering automated alerts and enabling pre-emptive rerouting, drastically reducing downtime and inventory costs.

- Unified Customer View for a Pan-European Retailer: A retail chain partners with a vendor to deploy a CRM Analytics solution combined with data integration tools. The platform unifies online and in-store customer data, offering personalized sales performance dashboards and customer segmentation analysis, improving marketing campaign ROI and customer lifetime value at a regional level.

- Financial Consolidation and Reporting for a Financial Services Group: A banking institution implements a hybrid BI platform offering cloud-based reporting for regulatory compliance and on-premises query & analysis for sensitive financial modeling. This ensures accurate, timely financial close processes, reduces manual reporting errors, and improves strategic planning for investors.

- Production Efficiency Monitoring with IoT Analytics: An automotive manufacturer utilizes an IoT-enabled BI platform with sensors on assembly lines. ML algorithms analyze production data in real-time to predict equipment failures and identify process inefficiencies, enabling pre-emptive maintenance and optimization by operations managers, preventing costly production halts.

- SME Growth Analytics Enablement via Cloud BI: A mid-sized technology firm deploys a comprehensive cloud-based BI service with pre-built templates for financial performance management. It enables the leadership team to perform self-service analysis on sales, expenses, and profitability without extensive IT support, driving data-informed strategic decisions and managing growth effectively.

Europe Business Intelligence Market: Stats & Facts

EUROSTAT (European Union Official Statistical Office)

- Eurostat reports that in 2024 more than 10 million people were employed as ICT specialists across the EU, representing 5% of all employed persons.

- Eurostat confirms that ICT-specialist employment in the EU increased by 62% between 2014 and 2024, far outpacing overall employment growth.

- Eurostat states that 67% of ICT specialists in the EU in 2024 had completed tertiary-level education.

- Eurostat notes that in 2024, 19.5% of ICT specialists in the EU were women.

- Eurostat shows that in 2023, the EU employed 9.8 million ICT specialists, equal to 4.8% of total employment.

- Eurostat reports that in 2022 more than 9 million people worked as ICT specialists in the EU, accounting for almost 5% of all workers.

- Eurostat confirms that in 2022, 21% of EU enterprises employed ICT specialists.

- Eurostat finds that in 2021 around 60% of enterprises in the EU that tried to recruit ICT staff faced difficulties filling these vacancies.

- Eurostat indicates that 13.5% of EU enterprises used AI technologies in 2024, marking a large year-on-year increase.

- Eurostat states that 8% of EU enterprises used AI technologies in 2023.

- Eurostat reports that EU enterprises have increasingly adopted ICT training for staff, especially larger employers.

- Eurostat shows that the overall share of ICT specialists in EU employment has risen by 1.6 percentage points since 2014.

- Eurostat data reveals that ICT-specialist employment grew nearly six times faster than total employment during the past decade.

CEDEFOP (European Centre for the Development of Vocational Training)

- Cedefop reports that in 2022 about 4.6 million workers in the EU were specifically classified as ICT professionals.

- Cedefop indicates that employment in ICT professional roles increased by 90% between 2012 and 2022.

- Cedefop confirms that about 300,000 ICT-professional jobs were created during the 2020 lockdown period despite broader economic contraction.

- Cedefop states that by the end of 2022, the number of ICT-professional jobs in the EU was 1 million higher than in 2019.

- Cedefop reports that in 2021 roughly 54% of ICT professionals worked within the ICT sector itself.

- Cedefop indicates that about 80% of ICT professionals in the EU possess qualifications at the first stage of tertiary education or above.

- Cedefop projects that employment for ICT professionals in the EU will rise by 30% between 2022 and 2035.

INE (Spain’s National Statistics Institute – EU Official Source for Spain)

- INE reports that in early 2024, 44.3% of enterprises in Spain with 10 or more employees used paid cloud-computing services.

- INE confirms that in early 2024, 21.1% of Spanish enterprises with 10 or more employees used AI-based technologies.

- INE states that in 2025, 69.7% of Spanish enterprises with internet access used social media for business purposes.

- INE notes that 84.5% of enterprises in Spain had a corporate website or webpage in 2025.

EU DIGITAL ECONOMY & SOCIETY DATA (DESI / EC Reports)

- Official EU digital-economy reporting shows that cloud-computing adoption has increased steadily across the EU, with large enterprises leading adoption.

- EU digital-economy indicators confirm that data-driven services and digital-transformation activities continue to account for a growing share of enterprise investment.

- EU performance reports note that member states with higher ICT-skills levels show significantly faster adoption of BI, analytics, and AI technologies.

- EU monitoring results show that digital-skills shortages remain one of the largest barriers to BI and analytics adoption across European enterprises.

- The EU digital-economy framework indicates that interoperability and data-governance requirements are driving higher demand for BI and enterprise-analytics tools.

- EU bodies report that the rapid rise in cloud adoption, AI use, and digital-public-services integration is accelerating analytics investments across most member states.

Europe Business Intelligence Market: Market Dynamic

Driving Factors in the Europe Business Intelligence Market

Convergence of Cloud, AI, and Self-Service Analytics into Unified Platforms

A major trend is the rapid market shift from standalone reporting tools to integrated, intelligent platforms that combine data integration, advanced analytics, and intuitive visualization. European businesses are demanding unified data environments to avoid insight fragmentation from multiple tools and to gain a holistic, real-time view of operations.

This convergence is critical for managing cross-functional performance, where data from sales, finance, and supply chain must be correlated. Regulatory pushes for transparency and data governance (e.g., GDPR) and competitive pressures further accelerate investment in platforms that can aggregate, cleanse, and analyze data from diverse sources, including ERP, CRM, and IoT systems, to drive coordinated action and measure business outcomes.

Proliferation of Augmented Analytics and Accessible Data Tools

Another powerful driver is the burgeoning ecosystem of AI-powered augmented analytics and low-code/no-code data preparation tools. Features like natural language querying and automated insight generation are being embedded into mainstream BI platforms. This formalizes advanced analytics as part of standard business processes for non-technical users. Simultaneously, easier-to-use data integration and visualization tools empower business units to create their own reports. BI platforms that seamlessly integrate these democratized data tools into the analytics workflow create significant value, enabling faster decision cycles and fostering a pervasive data culture.

Restraints in the Europe Business Intelligence Market

Unsustainable Data Silos and Legacy System Integration

One of the most powerful, underlying challenges is the operational reality: Europe's enterprises often operate with fragmented data architectures and legacy systems. IT departments are strained by the costs and complexity of integrating new BI solutions with outdated ERP, CRM, and other core systems.

This creates an urgent, non-negotiable imperative for effective data management and integration strategies. Business leaders are increasingly compelled to invest in modern BI and data integration solutions as strategic assets for breaking down data silos, ensuring data quality, and enabling a single source of truth, directly targeting the reduction of inefficiencies and poor decisions based on incomplete data.

Accelerating Need for Data Skills and Evolving Strategic Priorities

The accelerated evolution towards data-driven cultures and the complexity of modern BI tools is a major adoption catalyst and challenge. Initiatives like enterprise-wide digital transformation programs and the creation of new data literacy training are reducing usage barriers but also highlighting skill gaps.

These strategic moves are actively funding analytics projects, clarifying data ownership, and creating sustainable analytics practices. This environment de-risks investment for some but also stimulates demand for specialized skills and change management, fueling widespread adoption of BI platforms as core infrastructure for modern business operations, provided the talent is available.

Opportunities in the Europe Business Intelligence Market

Advanced AI/ML for Predictive and Prescriptive Business Insights

The application of advanced AI and machine learning beyond descriptive analytics represents a significant high-value opportunity. The next frontier involves prescriptive analytics that not only predict a market shift or operational failure but also recommend specific, optimized business actions with estimated impacts. Furthermore, AI for process optimization, predicting customer churn, optimizing logistics networks, or automating financial forecasting can deliver substantial competitive and efficiency gains. Vendors that can embed these sophisticated, explainable AI capabilities into their platforms will capture premium opportunities, especially with large enterprises focused on strategic agility.

Expansion into Embedded Analytics and Industry-Specific Applications

While financial and sales analytics are established markets, substantial growth opportunities lie in expanding robust BI capabilities into more operational and embedded use cases. This includes embedded analytics within SaaS applications, real-time IoT dashboards for operations, and especially industry-specific analytic applications (e.g., for retail merchandising or telecom network performance). Platforms that can handle real-time data streams, provide domain-specific templates, and integrate seamlessly into operational workflows will address critical gaps. The development of embedded analytics SDKs or vertical-specific solution bundles presents a major avenue for innovation and market capture.

Trends in the Europe Business Intelligence Market

High Integration Complexity and Persistent Data Quality Hurdles

A major restraint is the significant technical and operational complexity involved in integrating new BI solutions into Europe's heterogeneous and legacy-heavy IT landscapes. Ensuring seamless data integration with multiple, often siloed source systems, and maintaining high data quality and consistency requires substantial customization, ongoing data governance, and cross-departmental cooperation. These challenges are amplified by the lack of universal data models and varying data maturity across the EU. For organizations, this results in high upfront and ongoing costs, extended time-to-insight, and user frustration, which can stall or derail projects, particularly for SMEs with limited IT resources.

Fragmented Business Case and Challenges in Demonstrating Tangible ROI

Despite clear potential, justifying the investment for advanced BI services remains challenging across and within European organizations. While basic reporting is seen as essential, the ongoing costs of platform licensing, data integration projects, and user training are often scrutinized. This creates financial uncertainty. Linked to this is the challenge of demonstrating clear, short-term Return on Investment (ROI) in hard financial terms. While improved decision-making and efficiency are evident, translating them into immediate, attributable cost savings or revenue growth for a specific department can be difficult, making procurement decisions slower and more risk-averse.

Europe Business Intelligence Market: Research Scope and Analysis

By Offering Analysis

Solutions constitute the dominant and core value segment of the European BI market, projected to hold the largest revenue share. This category encompasses the essential software platforms and tools that form the technological foundation for data-driven decision-making. Dashboards & Scorecards are pivotal for providing executives and managers with real-time, visual performance monitoring against key performance indicators (KPIs), enabling swift strategic adjustments. Data Integration & ETL (Extract, Transform, Load) tools serve as the critical data backbone, tasked with ingesting, cleansing, and harmonizing data from a vast array of disparate sources—from legacy ERP systems to modern cloud applications and IoT sensors.

ℹ

To learn more about this report –

Download Your Free Sample Report Here

This process is fundamental to creating a reliable single source of truth. Reporting & Visualization Platforms democratize data access by enabling both IT and business users to create, distribute, and consume static and highly interactive reports, transforming complex datasets into intuitive charts and graphs.

Query & Analysis Tools empower business analysts and data-savvy users to perform ad-hoc data exploration, drilling down into specifics without predefined reports. The sustained demand for these solutions is driven by the universal business imperative to convert sprawling raw data into actionable, consumable insights that drive efficiency, innovation, and competitive advantage. As data volumes explode, the sophistication and necessity of these core software components only intensify.

By Deployment Analysis

Cloud-based deployment is unequivocally expected to dominate and fastest-growing model, projected to capture a decisive majority of the market share. Its ascendancy is fueled by technological and economic advantages perfectly aligned with modern business needs. The model offers elastic scalability, allowing businesses to easily adjust resources in line with data growth and user demand without major infrastructure projects. It transforms large upfront capital expenditure (CapEx) into predictable operating expenses (OpEx) via the subscription-based Software-as-a-Service (SaaS) model, a critical factor for budget management. Automatic updates ensure all users have access to the latest features and security patches without disruptive upgrade cycles.

Accessibility from anywhere supports remote and hybrid work models, fostering collaboration. Crucially, major cloud providers now offer sovereign EU-based data regions with advanced, pre-certified security frameworks (e.g., ISO 27001), directly addressing stringent GDPR compliance and data residency concerns. This effectively democratizes enterprise-grade analytics, enabling a small or medium-sized enterprise (SME) to leverage the same powerful BI and AI capabilities as a multinational corporation through a scalable, pay-as-you-go subscription, thereby leveling the competitive playing field.

By Organization Size Analysis

Large Enterprises are poised to remain the primary early adopters and major revenue contributors in the BI market. These organizations possess complex, global operations that generate massive, siloed data across numerous departments and legacy systems. Their use of BI is sophisticated and multifaceted, focusing on enterprise-wide data consolidation to achieve a single source of truth, advanced forecasting and predictive modeling for strategic planning, and complex financial and operational reporting to satisfy regulatory and stakeholder demands. They invest in comprehensive, often customized, BI platforms capable of handling high data volumes and integrating with a wide suite of enterprise applications (ERP, CRM, SCM).

Conversely, SMEs (Small and Medium-sized Enterprises) represent the segment with the highest growth rate. This is driven almost exclusively by the proliferation of affordable, cloud-based, and user-friendly BI solutions. These platforms offer pre-built connectors, intuitive drag-and-drop interfaces, and subscription pricing that eliminates large upfront costs. For SMEs, BI tools are a force multiplier, enabling them to optimize operations, gain deep customer insights, and manage financial performance with a level of analytical rigor previously available only to larger competitors, all without requiring a large, dedicated in-house IT team. This access is transformative for their competitiveness.

By Application Analysis

Financial Performance & Strategy Management remains the dominant and most universal application segment. It is the cornerstone of corporate intelligence, essential across all industries for core functions like budgeting, forecasting, profitability analysis, financial consolidation, and regulatory reporting. BI tools automate and enhance these processes, providing finance teams and executives with real-time visibility into revenue, costs, margins, and cash flow, enabling proactive financial control and strategic pivots. Supply Chain Analytic Applications are critical, especially in manufacturing and retail, for logistics optimization, inventory management, demand forecasting, and supplier performance analysis.

They provide end-to-end visibility, mitigating disruption risks. CRM Analytics Operations are revenue-centric, focusing on sales performance tracking, customer segmentation, lifetime value analysis, and marketing campaign ROI measurement to drive growth and retention. Production Planning Analytic Operations are key for manufacturers to optimize production schedules, improve quality control through statistical analysis, and implement predictive maintenance strategies, maximizing asset utilization and minimizing downtime.

The Others category encompasses a growing range of applications, including Human Resources analytics for talent management and Risk Management analytics for identifying operational or compliance threats, indicating the expanding permeation of BI across all business functions.

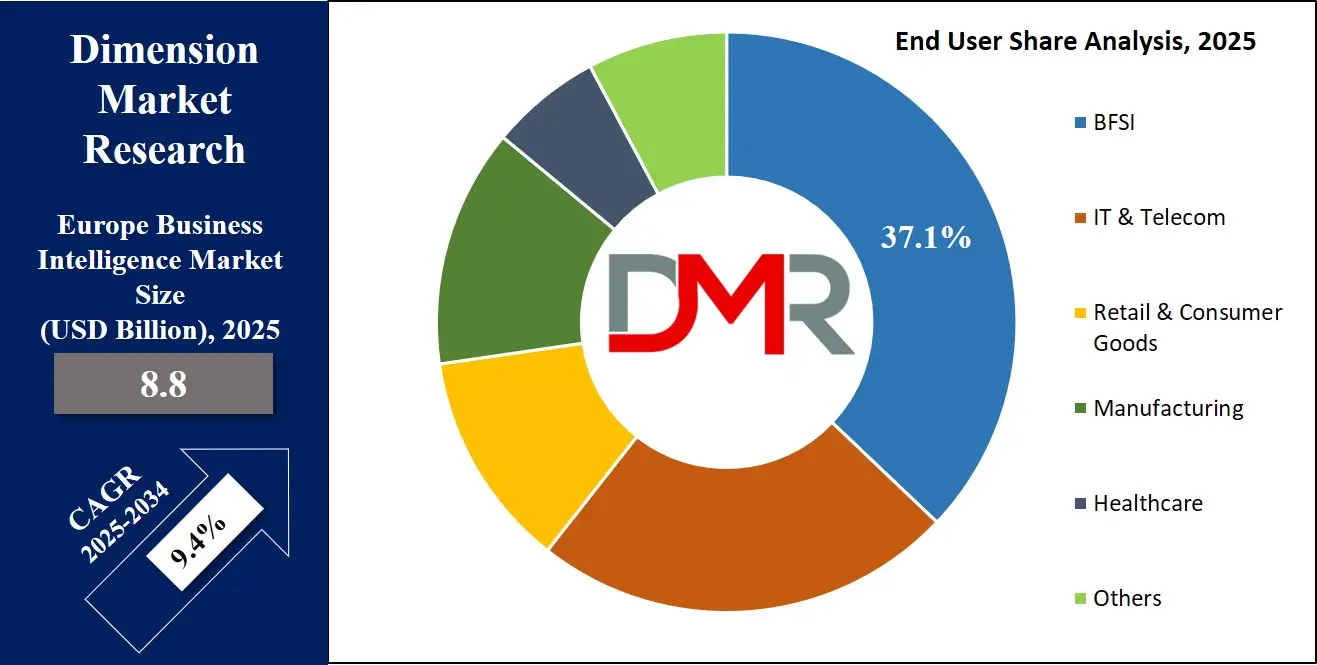

By End User Analysis

The BFSI (Banking, Financial Services, and Insurance) sector is a leading end-user, leveraging BI as a mission-critical tool for risk management and modeling, fraud detection, customer 360-degree profiling, regulatory compliance (e.g., Basel III, IFRS 9), and portfolio performance analysis.

The data-intensive and highly regulated nature of finance makes BI indispensable. IT & Telecom companies utilize BI for network performance monitoring, predicting and reducing customer churn, optimizing service quality, and analyzing product usage patterns. Retail & Consumer Goods relies heavily on BI for inventory analysis and optimization, sales trend forecasting at granular levels, understanding customer buying behavior through loyalty data, and personalizing marketing efforts.

Manufacturing employs BI for supply chain visibility, operational efficiency monitoring (OEE), predictive maintenance of machinery, and quality assurance analytics. Healthcare organizations use BI increasingly for operational efficiency (staffing, resource utilization), clinical outcome analysis, and financial performance management amidst rising cost pressures. The Others category includes vital sectors like Energy (for smart grid analytics), Transportation & Logistics (for route optimization), and the Public Sector (for performance tracking and citizen service analytics), demonstrating the pervasive utility of business intelligence across the modern economy.

The Europe Business Intelligence Market Report is segmented on the basis of the following:

By Offerings

- Solutions

- Dashboards & Scorecards

- Data Integration & ETL

- Reporting & Visualization

- Query & Analysis

- Services

- Consulting

- Deployment & Integration

- Support & Maintenance

By Deployment

By Organization Size

By Application

- Supply Chain Analytic Applications

- CRM Analytics Operations

- Financial Performance & Strategy Management

- Production Planning Analytic Operations

- Others

By End User

- BFSI

- IT & Telecom

- Retail & Consumer Goods

- Manufacturing

- Healthcare

- Others

Impact of Artificial Intelligence in the Europe Business Intelligence Market

- Automated Insight Generation & Anomaly Detection: AI/ML models automatically analyze datasets to surface significant trends, correlations, and outliers, saving analysts time and revealing hidden opportunities or risks.

- Natural Language Processing (NLP) for Query and Reporting: Allows users to ask business questions in plain language and receive answers via generated reports or visualizations, dramatically expanding access to analytics.

- Predictive Forecasting and Scenario Modeling: AI enhances traditional forecasting by incorporating a wider range of variables and automatically generating multiple scenarios for strategic planning.

- Intelligent Data Preparation and Cataloging: AI automates data cleansing, tagging, and cataloging tasks, improving data quality and reducing the time spent on data preparation.

- Personalized Dashboard and Alert Creation: AI can suggest relevant visualizations and key performance indicators (KPIs) for individual users based on their role and past interactions, and set intelligent thresholds for alerts.

By Region

Europe

- Germany

- The U.K.

- France

- Italy

- Russia

- Spain

- Benelux

- Nordic

- Rest of Europe

Europe Business Intelligence Market: Competitive Landscape

The competitive landscape of the Europe Business Intelligence market is dynamic and moderately fragmented, characterized by diverse players from software, cloud, and consulting sectors converging on data analytics. Established Software Giants like Microsoft (Power BI), IBM (Cognos), and Oracle leverage their extensive enterprise relationships, broad software portfolios, and cloud infrastructure to offer integrated solutions. Specialized Analytics Vendors (e.g., Tableau, Qlik, SAS) compete with best-in-class, user-centric data visualization and advanced analytics platforms known for superior design and analytical depth.

ℹ

To learn more about this report –

Download Your Free Sample Report Here

Hyperscale Cloud Providers (AWS, Google Cloud, Microsoft Azure) play a dual role as infrastructure partners and as platforms offering data warehousing and AI/ML services that form the foundation for many modern BI stacks. System Integrators and Consultancies (Accenture, Capgemini) are critical partners, providing implementation, customization, and strategic data advisory services. Competition is intensifying around who can best deliver ease-of-use, actionable intelligence, seamless integration, and proven business value for both technical and business users.

Some of the prominent players in the Europe Business Intelligence Market are

- Amazon Web Services (AWS)

- Google Cloud

- IBM

- Information Builders

- Microsoft

- MicroStrategy

- Oracle

- Qlik

- SAP

- SAS Institute

- Salesforce (Tableau)

- Sisense

- Snowflake

- TIBCO Software

- ThoughtSpot

- Yellowfin

- Other Key Players

Recent Developments in the Europe Business Intelligence Market

- November 2025: Leading European consultancy Capgemini and cloud analytics platform Snowflake announced a deepened strategic partnership to offer industry-specific BI accelerators for financial services and manufacturing, combining consulting expertise with cloud data platform technology for faster deployment.

- October 2025: At the Gartner Data & Analytics Summit in London, vendors Qlik and ThoughtSpot unveiled new augmented analytics features. These tools use generative AI to automatically write data narratives and suggest follow-up questions for deeper analysis, reducing the analytical skills gap for business users.

- September 2025: SAP announced the general availability of its next-generation SAP Analytics Cloud platform with enhanced Joule AI copilot capabilities for the European market, focusing on tighter integration with SAP S/4HANA and industry-specific content.

- September 2025: A consortium of major European banks initiated a joint working group to define common data models and BI reporting standards for ESG (Environmental, Social, and Governance) compliance, aiming to streamline regulatory reporting through shared analytics frameworks.

- August 2025: Global retailer H&M Group partnered with Microsoft to deploy a unified BI and AI platform across its supply chain and retail operations, aiming to enhance demand forecasting, personalize customer offers, and optimize inventory in real-time.

- December 2024: Salesforce completed the deep integration of Tableau into its Customer 360 platform, launching new packaged CRM Analytics solutions tailored for sales and marketing teams in Europe, simplifying the path to insights.

- May 2024: Google Cloud launched Looker Studio Pro as a dedicated enterprise service in Europe, featuring enhanced governance, collaboration tools, and support for multi-cloud data sources, targeting large organizations seeking a unified business reporting environment.

- May 2024: Microsoft expanded the data residency and compliance certifications for its Power BI service across several EU member states, directly addressing data sovereignty concerns of public sector and highly regulated industry clients.

Frequently Asked Questions

How big is the Europe Business Intelligence Market?

▾ The Europe Business Intelligence Market size is estimated to have a value of USD 8.8 billion in 2025 and is expected to reach USD 19.8 billion by the end of 2034.

What is the growth rate in the Europe Business Intelligence Market?

▾ The market is growing at a CAGR of 9.4 percent over the forecasted period from 2025 to 2034.

Which are the key players in the Europe Business Intelligence Market?

▾ Some of the major key players are Microsoft, IBM, Oracle, SAP, Amazon Web Services, Google LLC, and Tableau (Salesforce), and many others.