Market Overview

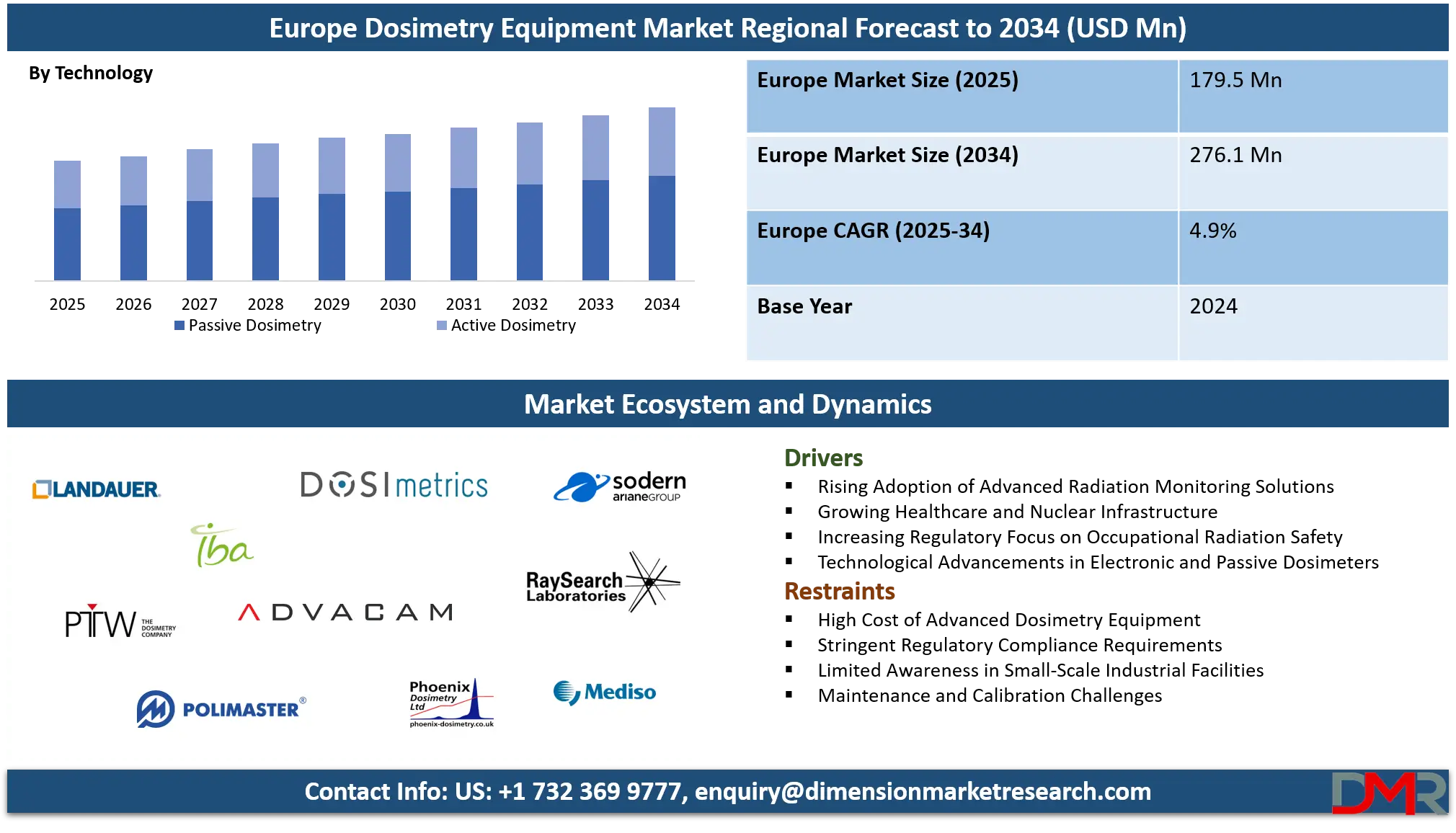

The Europe dosimetry equipment market is projected to grow from USD 179.5 million in 2025 to USD 276.1 million by 2034, registering a CAGR of 4.9%. Rising demand for radiation monitoring solutions, increasing adoption of electronic personal dosimeters, and stringent safety regulations across healthcare and industrial sectors are driving market expansion. Growing investments in radiology, nuclear energy, and occupational safety initiatives further support steady revenue growth in the region.

Dosimetry equipment refers to specialized instruments and devices designed to measure, monitor, and assess the exposure of individuals or objects to ionizing radiation. These tools play a crucial role in fields such as medical radiology, nuclear energy, industrial applications, and research laboratories by ensuring the safety of personnel and compliance with regulatory standards. Dosimeters can be wearable, handheld, or integrated into systems, and they typically quantify radiation dose through electronic, photographic, or chemical means.

The accuracy, sensitivity, and reliability of these devices are critical, as they provide data that inform protective measures, optimize radiation use, and prevent overexposure, which can lead to severe health risks. Advanced dosimetry equipment often incorporates digital readouts, real-time monitoring capabilities, wireless connectivity, and sophisticated algorithms for precise dose calculation, making them indispensable for occupational safety and scientific experimentation.

The European dosimetry equipment market is witnessing steady growth due to increasing awareness regarding radiation safety and stringent government regulations across healthcare, nuclear, and industrial sectors. Rising investments in diagnostic imaging technologies and radiotherapy equipment have fueled demand for accurate radiation monitoring tools in hospitals and research centers.

Moreover, the adoption of electronic personal dosimeters and automated monitoring systems has transformed traditional radiation assessment methods, allowing for real-time exposure tracking and data analysis. The market is also benefiting from collaborations between regulatory bodies and private manufacturers to develop advanced, compliant devices tailored for diverse applications.

In addition, the European market is influenced by technological innovation and the expansion of industrial sectors such as nuclear power generation, aerospace, and pharmaceutical research that require consistent radiation monitoring. The presence of key players focusing on product development, maintenance services, and software integration further strengthens the market ecosystem.

Rising concerns about occupational safety, integrated with growing demand for portable and user-friendly dosimetry equipment, are encouraging both hospitals and industrial facilities to invest in modern solutions. Government initiatives promoting workplace safety and continuous R&D in radiation measurement technologies are expected to sustain market momentum over the coming years.

Europe Dosimetry Equipment Market: Key Takeaways

- Market Value: The Europe Dosimetry Equipment market size is expected to reach a value of USD 276.1 million by 2034 from a base value of USD 179.5 million in 2025 at a CAGR of 4.9%.

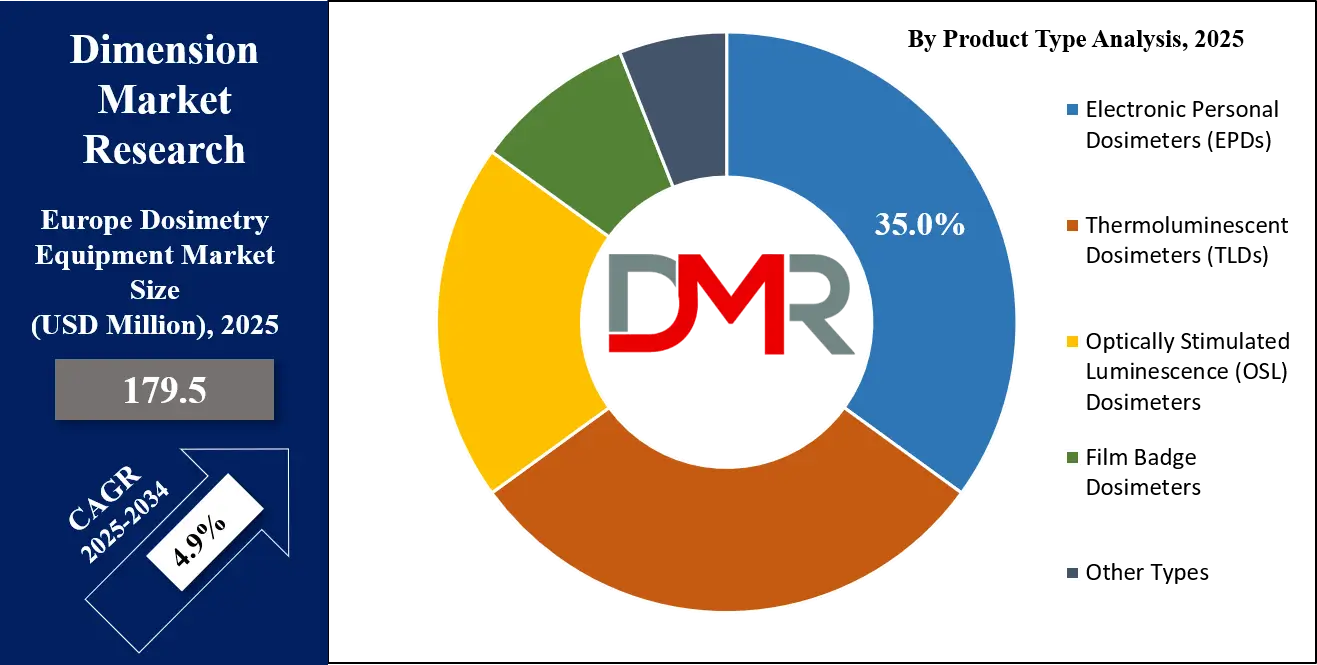

- By Product Type Segment Analysis: Electronic Personal Dosimeters (EPDs) are expected to maintain their dominance in the product type segment, capturing 35.0% of the total market share in 2025.

- By Technology Segment Analysis: Passive Dosimetry will dominate the technology segment, capturing 75.0% of the market share in 2025.

- By Application Segment Analysis: Medical applications are anticipated to dominate the application segment, capturing 53.0% of the total market share in 2025.

- By End-User Segment Analysis: Healthcare Facilities will dominate the end-user segment, capturing 39.0% of the market share in 2025.

- Key Players: Some key players in the Europe Dosimetry Equipment market are Landauer Europe, IBA Dosimetry (Ion Beam Applications), PTW Freiburg GmbH (Physikalisch-Technische Werkstätten), Polimaster Europe, Dosimetrics, Advacam, Phoenix Dosimetry Ltd, Sodern, RaySearch Laboratories, Mediso Ltd, STUK (Säteilyturvakeskus), NPL (National Physical Laboratory), and Others.

Europe Dosimetry Equipment Market: Use Cases

- Medical Radiation Monitoring: Dosimetry equipment in Europe is extensively used in hospitals and diagnostic centers to monitor radiation exposure for patients and healthcare professionals. Devices such as electronic personal dosimeters and area monitors track real-time radiation levels during X-rays, CT scans, and radiotherapy sessions. Accurate dose measurement ensures compliance with safety regulations and helps optimize treatment plans while minimizing unnecessary exposure. Growing investments in advanced imaging technologies and radiotherapy infrastructure are driving the adoption of reliable dosimetry solutions across European healthcare facilities.

- Nuclear Power Plant Safety: In the European nuclear energy sector, dosimetry equipment is critical for ensuring occupational safety and regulatory compliance. Radiation monitoring systems, including fixed and portable detectors, continuously measure exposure levels for plant workers and surrounding environments. These devices help prevent overexposure, maintain operational safety, and provide essential data for emergency response planning. With increasing focus on sustainable energy and modernization of nuclear facilities, the deployment of advanced radiation detection and monitoring technologies is steadily increasing.

- Industrial and Research Applications: European industries such as aerospace, pharmaceuticals, and manufacturing use dosimetry equipment to monitor radiation in processes involving radioactive materials or high-energy devices. Researchers in laboratories rely on precise dose measurements for experiments in physics, chemistry, and material sciences. The use of wearable dosimeters, area monitors, and automated data logging systems ensures safety, regulatory compliance, and accurate documentation, which is critical for operational efficiency and scientific reliability.

- Occupational Safety and Regulatory Compliance: Workplace safety across European sectors relies heavily on dosimetry solutions to protect employees from harmful radiation exposure. Regulatory authorities mandate routine monitoring, and companies implement dosimetry programs to adhere to these guidelines. Personal dosimeters, environmental monitors, and software-enabled dose tracking systems provide actionable insights to mitigate risks. Increasing awareness of radiation hazards, integrated with government safety initiatives, is driving widespread adoption of dosimetry technologies in both public and private sectors.

Impact of Artificial Intelligence on the Europe Dosimetry Equipment market

- Enhanced Precision in Radiation Therapy: AI algorithms are revolutionizing radiation therapy by automating complex tasks such as tumor segmentation and organ delineation. This automation reduces human error and accelerates treatment planning, leading to more accurate and personalized radiation delivery. AI's ability to analyze large datasets enables the development of tailored treatment plans that optimize therapeutic outcomes while minimizing exposure to healthy tissues.

- Real-Time Monitoring and Predictive Analytics: AI-powered dosimetry systems facilitate real-time monitoring of radiation exposure in healthcare settings. These systems utilize predictive analytics to anticipate potential overexposure scenarios, allowing for timely interventions. By integrating AI with cloud-based platforms, healthcare providers can access and analyze radiation data remotely, enhancing decision-making processes and ensuring continuous safety compliance.

- Integration into Personalized Medicine: The integration of AI into dosimetry equipment supports the advancement of personalized medicine. AI assists in tailoring radiopharmaceutical therapies by accurately calculating individual radiation doses, thereby improving treatment efficacy and patient safety. This approach aligns with the growing trend towards personalized healthcare, where treatments are customized based on individual patient profiles.

- Regulatory Compliance and Workflow Optimization: AI enhances compliance with stringent European Union medical device regulations by ensuring that dosimetry equipment meets safety and performance standards. Additionally, AI streamlines workflow processes in medical facilities by automating routine tasks, reducing the workload on healthcare professionals, and allowing them to focus on patient care.

Europe Dosimetry Equipment Market: Stats & Facts

European Commission – EURATOM Supply Agency Annual Report 2024

- In 2023, 13 EU countries with nuclear electricity production generated 619,601 gigawatt hours (GWh) of electricity, marking a 1.7% increase compared to 2022.

- At the end of 2024, the Euratom Supply Agency employed 17 staff members, with 13 different EU nationalities represented.

- In 2024, the Agency's assets totaled EUR 1,210,786.64, up from EUR 1,058,925.85 in 2023.

- The Agency's liabilities in 2024 amounted to EUR 156,750.66, representing 12.95% of the total assets.

- Equity financing in 2024 was EUR 1,054,035.98, accounting for 87.05% of the Agency's assets.

- The 2024 provisional accounts, budget outturn, and report on budget implementation were submitted to the European Court of Auditors and the Commission’s Accounting Officer.

European Commission – EUR-Lex Document CELEX 52025DC0061

- In 2024, the European Commission launched nine projects related to radiation applications and protection, with EUR 50 million in grants allocated.

- The EURATOM research and training programme is scheduled to run from 2021 to 2025, focusing on nuclear safety, radiation protection, and fusion energy.

- The interim evaluation of the 2021-2025 EURATOM programme was published in February 2025.

- The evaluation report provides insights into the effectiveness and impact of the EURATOM programme in advancing nuclear research and training.

Europe Dosimetry Equipment Market: Market Dynamics

Europe Dosimetry Equipment Market: Driving Factors

Rising Adoption of Advanced Radiation Monitoring Solutions

The European dosimetry equipment market is being driven by the increasing adoption of sophisticated radiation monitoring solutions in healthcare, nuclear, and industrial sectors. Hospitals and diagnostic centers are investing in electronic personal dosimeters and automated radiation detection systems to ensure patient and staff safety. The integration of real-time data tracking and cloud-based reporting enhances operational efficiency while maintaining compliance with strict European safety regulations, thereby fueling market growth.

Growing Healthcare and Nuclear Infrastructure

Expansion in medical imaging, radiotherapy, and nuclear energy facilities across Europe is significantly boosting demand for dosimetry equipment. As more hospitals and research centers incorporate high-energy imaging and radiopharmaceutical treatments, the need for accurate dose measurement and exposure management becomes critical. This infrastructural growth, integrated with increasing awareness about occupational radiation safety, drives the adoption of reliable dosimetry solutions.

Europe Dosimetry Equipment Market: Restraints

High Cost of Advanced Dosimetry Equipment

Despite technological advancements, the high procurement and maintenance costs of electronic dosimeters, automated monitoring systems, and integrated software platforms can limit adoption, especially in smaller clinics and industrial facilities. Budget constraints and the need for regular calibration and servicing of these devices pose challenges, restraining market expansion in certain regions.

Stringent Regulatory Compliance Requirements

While regulatory frameworks ensure safety, they can also act as a barrier for new entrants and small-scale manufacturers. Compliance with European Union medical device directives, radiation safety standards, and occupational exposure limits requires substantial investment in certification, testing, and documentation, which may slow down product deployment.

Europe Dosimetry Equipment Market: Opportunities

Integration of Artificial Intelligence and IoT

The convergence of AI and Internet of Things (IoT) technologies with dosimetry equipment presents significant growth opportunities. AI-driven predictive analytics and IoT-enabled real-time monitoring can enhance exposure tracking, optimize treatment planning in radiotherapy, and improve industrial safety protocols. Such innovations open avenues for developing smarter, connected dosimetry solutions that offer superior accuracy and user convenience.

Expansion into Emerging Industrial Sectors

Beyond healthcare and nuclear energy, emerging industries such as aerospace, pharmaceuticals, and research laboratories are increasingly adopting radiation-based technologies. These sectors require precise dose measurement and compliance with safety regulations, creating opportunities for dosimetry equipment manufacturers to expand their market reach with tailored solutions.

Europe Dosimetry Equipment Market: Trends

Shift towards Portable and Wearable Dosimeters

The market is witnessing a trend toward compact, portable, and wearable dosimetry devices that allow continuous monitoring of radiation exposure for workers in hospitals, nuclear plants, and industrial settings. These devices enhance mobility, ease of use, and real-time reporting, reflecting a broader move toward user-centric and smart radiation monitoring solutions.

Focus on Digitalization and Cloud-Based Platforms

Digital transformation in the European dosimetry equipment market is driving the adoption of cloud-enabled monitoring systems and software-integrated solutions. These platforms allow centralized data management, remote access, predictive analysis, and seamless regulatory reporting, increasing operational efficiency and supporting evidence-based decision-making in radiation safety management.

Europe Dosimetry Equipment Market: Research Scope and Analysis

By Product Type Analysis

Electronic Personal Dosimeters (EPDs) are anticipated to retain their leading position within the product type segment of the European dosimetry equipment market, projected to capture approximately 35.0% of the total market share in 2025. EPDs are widely favored due to their ability to provide real-time monitoring of radiation exposure, digital readouts, and integration with software platforms for data management and analysis.

These devices are particularly valuable in healthcare, nuclear power, and industrial settings where continuous and accurate dose tracking is critical for occupational safety. The convenience of portability, user-friendly interfaces, and immediate alerts for high radiation levels make EPDs highly effective for protecting personnel from overexposure and ensuring compliance with stringent European safety regulations.

Thermoluminescent Dosimeters (TLDs) also play a significant role in this market segment by offering precise and reliable measurement of cumulative radiation doses over time. Unlike EPDs, TLDs do not provide real-time data but are highly effective for long-term monitoring in environments where periodic assessment is sufficient.

They work by absorbing radiation energy and releasing it as light when heated, with the emitted light intensity correlating to the dose received. TLDs are commonly used in hospitals, research laboratories, and nuclear facilities due to their high accuracy, stability, and ability to measure a wide range of radiation types. Together, EPDs and TLDs form a complementary range of solutions, addressing both immediate monitoring needs and long-term exposure tracking in the European dosimetry equipment market.

By Technology Analysis

Passive dosimetry is expected to dominate the technology segment of the European dosimetry equipment market, capturing approximately 75.0% of the market share in 2025. Passive dosimeters, such as thermoluminescent dosimeters (TLDs) and film badges, are designed to record cumulative radiation exposure over a defined period without requiring continuous power or active monitoring.

Their widespread adoption is driven by their simplicity, cost-effectiveness, and reliability for long-term radiation monitoring in healthcare facilities, nuclear power plants, and industrial environments. These devices are particularly valued for regulatory compliance and periodic safety assessments, as they provide accurate dose measurements over time and can be analyzed to ensure adherence to occupational exposure limits.

Active dosimetry, on the other hand, refers to devices that provide real-time monitoring of radiation exposure, including electronic personal dosimeters (EPDs) and electronic area monitors. These devices continuously detect and display radiation levels, offering immediate alerts if exposure exceeds predefined thresholds.

Active dosimetry is increasingly adopted in environments where instant feedback is critical for safety, such as radiology departments, nuclear reactors, and high-energy research laboratories. While active dosimeters typically represent a smaller share of the market compared to passive systems, their ability to enhance workplace safety, support timely interventions, and integrate with digital reporting systems makes them an essential complement to passive technologies in the European dosimetry equipment market.

By Application Analysis

Medical applications are expected to dominate the application segment of the European dosimetry equipment market, accounting for approximately 53.0% of the total market share in 2025. The widespread use of radiation-based diagnostic and therapeutic procedures, including X-rays, CT scans, and radiotherapy, drives the demand for reliable dosimetry solutions in hospitals, clinics, and research centers.

Dosimeters, both electronic and passive, are employed to monitor radiation exposure for patients and healthcare professionals, ensuring safety and compliance with strict European medical regulations. The increasing adoption of advanced imaging technologies and radiopharmaceutical treatments further reinforces the need for accurate dose measurement, contributing to the dominance of the medical sector within the market.

Industrial applications also play a significant role in this market segment, encompassing sectors such as nuclear power generation, aerospace, manufacturing, and research laboratories. In these settings, dosimetry equipment is used to monitor radiation exposure for workers handling radioactive materials or operating high-energy equipment.

Industrial facilities rely on both passive and active dosimeters to maintain occupational safety, meet regulatory standards, and prevent overexposure. The demand for robust, durable, and accurate radiation monitoring solutions in industrial environments provides significant growth opportunities for manufacturers, complementing the medical segment while addressing the safety and compliance requirements of various European industries.

By End-User Analysis

Healthcare facilities are expected to dominate the end-user segment of the European dosimetry equipment market, capturing approximately 39.0% of the market share in 2025. Hospitals, diagnostic centers, and radiotherapy clinics are the primary users of dosimetry equipment due to the high prevalence of radiation-based procedures such as X-rays, CT scans, and nuclear medicine treatments.

Electronic personal dosimeters and passive devices are widely deployed to monitor the exposure of medical staff and patients, ensuring adherence to strict European radiation safety standards. The increasing focus on patient safety, regulatory compliance, and adoption of advanced imaging technologies further strengthens the reliance on healthcare facilities as the leading end-users of dosimetry solutions.

Industrial sectors, including non-destructive testing (NDT) and manufacturing, also constitute a significant portion of the end-user segment. In these applications, dosimetry equipment is essential for monitoring radiation exposure during processes such as radiographic testing, sterilization, and material inspection.

Both active and passive dosimeters are employed to ensure worker safety and compliance with occupational exposure limits. The need for precise, reliable, and durable radiation monitoring solutions in industrial environments supports the steady growth of this end-user segment, complementing the healthcare sector in the European dosimetry equipment market.

The Europe Dosimetry Equipment Market Report is segmented on the basis of the following:

By Product Type

- Electronic Personal Dosimeters (EPDs)

- Thermoluminescent Dosimeters (TLDs)

- Optically Stimulated Luminescence (OSL) Dosimeters

- Film Badge Dosimeters

- Other Types

By Technology

- Passive Dosimetry

- Active Dosimetry

By Application

- Medical

- Industrial

- Nuclear Power

- Environment Monitoring

- Others

By End-User

- Healthcare Facilities

- Industrial (NDT & Manufacturing)

- Nuclear Facilities

- Research Institutes

- Others

By Region

Europe

- Germany

- The U.K.

- France

- Italy

- Russia

- Spain

- Benelux

- Nordic

- Rest of Europe

Europe Dosimetry Equipment Market: Competitive Landscape

The Europe dosimetry equipment market is characterized by intense competition, driven by continuous technological innovation, product diversification, and strategic partnerships. Key players focus on developing advanced electronic and passive dosimeters with real-time monitoring, cloud-based data integration, and AI-enabled analytics to enhance accuracy and user convenience.

Companies are also investing in research and development to improve sensitivity, portability, and compliance with stringent European radiation safety regulations. The competitive landscape is shaped by a combination of product quality, service support, and the ability to offer customized solutions for healthcare, nuclear, and industrial applications, driving overall market growth and adoption across the region.

Some of the prominent players in the Europe Dosimetry Equipment market are:

- Landauer Europe

- IBA Dosimetry (Ion Beam Applications Dosimetry)

- PTW Freiburg GmbH (Physikalisch-Technische Werkstätten Freiburg GmbH)

- Polimaster Europe

- Dosimetrics

- Advacam

- Phoenix Dosimetry Ltd

- Sodern

- RaySearch Laboratories

- Mediso Ltd

- STUK (Säteilyturvakeskus – Radiation and Nuclear Safety Authority)

- NPL (National Physical Laboratory)

- IRS (Institut de Radioprotection et de Sûreté Nucléaire)

- DTU Health Tech

- RadPro International

- Sun Nuclear Corporation

- Kromek Group

- Jenoptik AG

- Thermo Fisher Scientific

- Mirion Technologies

- Other Key Players

Europe Dosimetry Equipment Market: Recent Developments

- October 2025: Thermo Fisher Scientific introduced the Thermo Scientific NetDose Pro digital dosimeter, a wearable device designed for real-time radiation monitoring. This device aims to enhance occupational safety by providing continuous exposure data and integrating seamlessly with digital platforms for comprehensive radiation management.

- October 2025: The VERIFIED project, focusing on in vivo patient-specific real-time dosimetry for adaptive radiotherapy, was selected for funding during the first PIANOFORTE Open Call. This EU-funded initiative aims to advance personalized radiation therapy through innovative dosimetry solutions.

- September 2025: Mirion Technologies announced its acquisition of Paragon Energy Solutions, a leading provider of highly engineered solutions for large-scale nuclear power plants and small modular reactors in the United States. This strategic move aims to expand Mirion's capabilities in the nuclear sector and enhance its service offerings.

- April 2025: Mirion Dosimetry Services launched the InstadoseVUE wireless radiation dosimeter. This next-generation X-ray badge features advanced technologies to increase occupational radiation safety, convenience, and compliance, catering to the evolving needs of medical and industrial sectors.

Report Details

| Report Characteristics |

| Market Size (2025) |

USD 179.5 Mn |

| Forecast Value (2034) |

USD 276.1 Mn |

| CAGR (2025–2034) |

4.9% |

| Historical Data |

2019 – 2024 |

| Forecast Data |

2026 – 2034 |

| Base Year |

2024 |

| Estimate Year |

2025 |

| Report Coverage |

Market Revenue Estimation, Market Dynamics, Competitive Landscape, Growth Factors, etc. |

| Segments Covered |

By Product Type (Electronic Personal Dosimeters (EPDs), Thermoluminescent Dosimeters (TLDs), Optically Stimulated Luminescence (OSL) Dosimeters, Film Badge Dosimeters, Other Types), By Technology (Passive Dosimetry, Active Dosimetry), By Application (Medical, Industrial, Nuclear Power, Environment Monitoring, Others), and By End-User (Healthcare Facilities, Industrial (NDT & Manufacturing), Nuclear Facilities, Research Institutes, Others).

|

| Regional Coverage |

Europe |

| Prominent Players |

Landauer Europe, IBA Dosimetry (Ion Beam Applications), PTW Freiburg GmbH (Physikalisch-Technische Werkstätten), Polimaster Europe, Dosimetrics, Advacam, Phoenix Dosimetry Ltd, Sodern, RaySearch Laboratories, Mediso Ltd, STUK (Säteilyturvakeskus), NPL (National Physical Laboratory), and Others. |

| Purchase Options |

We have three licenses to opt for: Single User License (Limited to 1 user), Multi-User License (Up to 5 Users), and Corporate Use License (Unlimited User) along with free report customization equivalent to 0 analyst working days, 3 analysts working days, and 5 analysts working days respectively. |

Frequently Asked Questions

The Europe Dosimetry Equipment market is projected to be valued at USD 179.5 million in 2025. It is expected to witness subsequent growth in the upcoming period as it holds USD 276.1 million in 2034 at a CAGR of 4.9%.

Some of the major key players in the Europe Dosimetry Equipment market are Landauer Europe, IBA Dosimetry (Ion Beam Applications), PTW Freiburg GmbH (Physikalisch-Technische Werkstätten), Polimaster Europe, Dosimetrics, Advacam, Phoenix Dosimetry Ltd, Sodern, RaySearch Laboratories, Mediso Ltd, STUK (Säteilyturvakeskus), NPL (National Physical Laboratory), and Others.