Market Overview

The European maternity Wear Market is expected to reach a value of

USD 3,403.7 million by the end of 2024, and it is further anticipated to reach a market value of

USD 5,321.4 million by 2033 at a

CAGR of 5.1%.

Maternity apparel is a kind of clothing that is purposely made for pregnant women to accommodate the body shape changes that naturally take place while in maternity. The dawn of the trend of maternity wear could be traced back to the Middle Ages. It evolved there and then it was adapted and revolutionized in the contemporary period. This market is known for its variety of products from maternity tops, bottoms, dresses, outerwear, and lingerie in many different shapes and sizes catering to a pregnant woman.

These clothes do not only serve as a support and comfort to women but are also made of a certain fabric to tailor-fit their needs. Different brands currently offer custom maternity wear options as an alternative for the customer, which is a growing trend in the European maternity wear industry. Hence, this market serves all the needs and tastes of a pregnant woman by combining the style, comfort, and usefulness of these clothes.

Key Takeaways

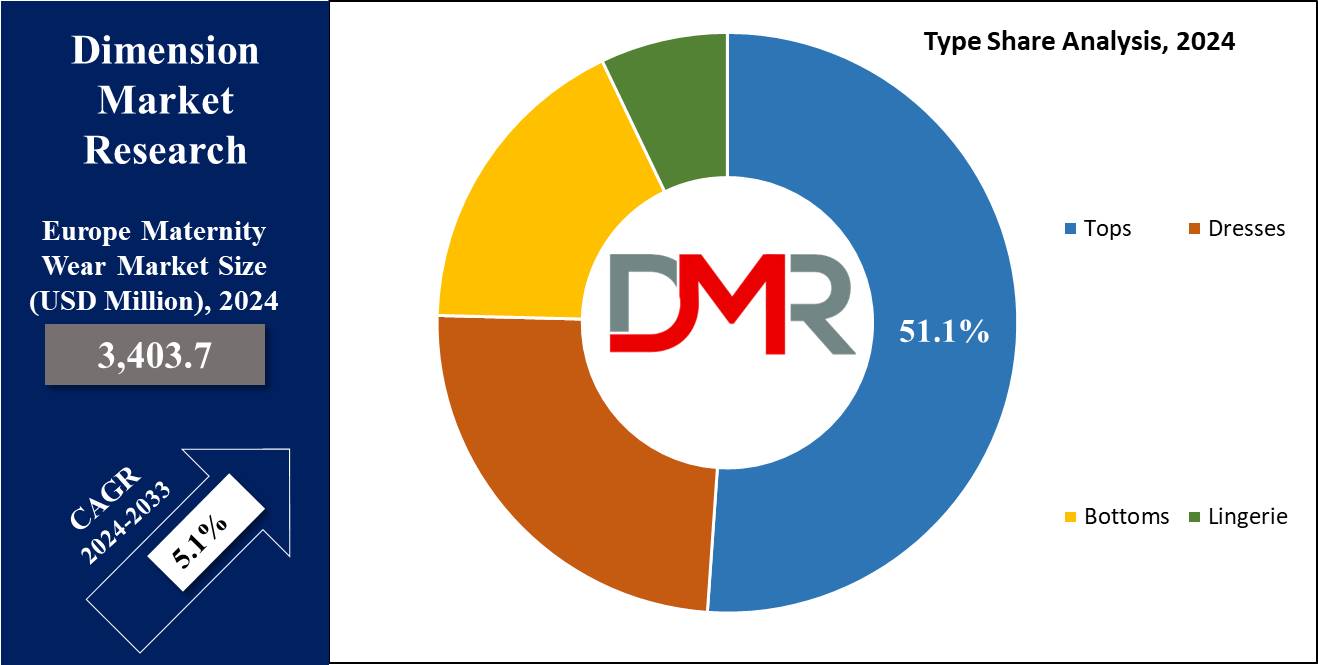

- Maternity Tops are projected to dominate the Europe maternity wear market in the context of clothing type with 51.1% of the market share by the end of 2024.

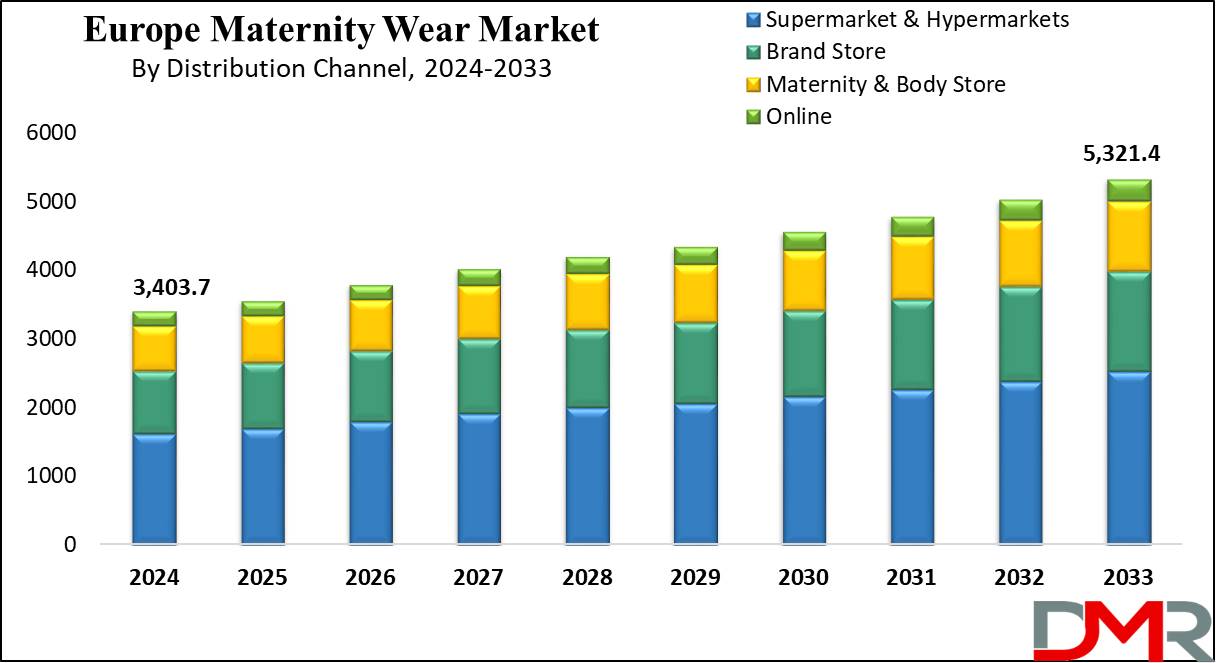

- Supermarkets and hypermarkets are anticipated to dominate this market in terms of distribution channels as they hold 47.4% of the market share in 2024

- The Europe Maternity Wear Market size is estimated to have a value of USD 3,403.7 million in 2024 and is expected to reach USD 5,321.4 million by the end of 2033.

- The market is growing at a CAGR of 5.1 percent over the forecasted period.

Use Cases

- Comfort with Style: The maternity clothes are designed to provide comfort to pregnant women with style daily. These include maternity jeans, leggings, tops, and casual dresses that provide ease of movement.

- Workwear: This market provides workwear that includes pants, blouses, dresses, and suits which ensure comfort and professionalism while working at the same time.

- Activewear with comfort: Women who plan to maintain their fitness and stay active at the same time during pregnancy prefer to wear maternity workout leggings, tops, sports bras, and supportive athletic wear designed to provide flexibility and support during exercise.

- To provide proper support: This market provides comfortable and supportive lingerie to pregnant women to alleviate their discomfort associated with changes in breast size and weight.

Market Dynamic

The rising maternal population in Europe, including birth rates and the mother's age, directly affects the demand for maternity wear. The highly fashion-aware population which keeps updated with the changing fashion styles and trends plays a major role in the growth of this market. Secondly, mothers are not able to move that freely during pregnancy which has been pushing the growth of online retail growth which provides maternity wearers with more options. Besides that, environmental sustainability and ethical concepts play a key role in creating the demand for eco-friendly products, where manufacturers should use sustainable materials and ethical ideas.

These influencing factors determine the dynamics of the maternity wear market in Europe, thus, the concerns about demographic trends, staying up-to-date with fashion, considering the economic conditions, using the technology progress, embracing online retail, and taking sustainability and ethics into account are of paramount importance in meeting the requirements of the target groups.

Research Scope and Analysis

By Type

Maternity Tops are projected to dominate the Europe maternity wear market in the context of clothing type with 51.1% of the market share by the end of 2024. The popularity of maternity tops in this market can be accredited to their availability in various styles which can be paired with various bottoms ranging from jeans, leggings, skirts, and trousers. These tops are in most cases designed with stretchable fabrics to help the mother throughout her pregnancy.

These tops are made of breathable fabric which helps the mother to move easily, especially in the later period of their pregnancy. In some instances, tops also work goods in terms of layering where various layers of clothes are worn based on the changing temperature according to personal comfort which adds depth to outfits. In other words, maternity tops provide comfort, style, and versatility which make them the ideal choice among pregnant women, pushing them to lead the maternity wear market compared to other clothing types.

By Distribution Channel

Supermarkets and hypermarkets are anticipated to dominate this market in terms of distribution channels as they hold 47.4% of the market share in 2024 they allow the consumer to buy their necessities and clothing in one place which minimizes the inconvenience of visiting different shops for different things. These marts also save time as it is hard for mothers to travel a lot as they have busy schedules and mobility constraints. Supermarkets offer a variety of clothes from different brands which saves the time of pregnant women by visiting different stores to see various styles of clothing.

This type of variety gives them the option to choose and compare different clothes in various sizes and patterns. Also, in hypermarts, the prices of these clothes are relatively lower than the market price due to high competition and bulk supply to B2B. The hypermarts also provide basic amenities like baby changing facilities, parenting resources, and children's play areas to the mothers which solidify their trust and popularity in this market.

The Maternity Wear Market Report is segmented based on the following

By Type

- Tops

- Dresses

- Bottoms

- Lingerie

By Distribution Channel

- Supermarket & Hypermarkets

- Brand Store

- Maternity & Body Store

- Online

European Country Analysis

In the European maternity wear markets countries like France, Spain, Italy, and the UK stand out as a major market for maternity wear as they have their own fashion culture and fashion-conscious population who put a special emphasis on what they are wearing. Germany is an economically strong country in this region, putting a special focus on stylists and trendy clothes which put it at the forefront of the maternity wear market.

While Scandinavian countries like Sweden and Denmark prefer clothes that are sustainable and eco-friendly that is pushing the growth of ethical maternity wear. The growth of this region in the maternity market is due to the rise in fashion-conscious population and disposable income. The changes in cultural attitudes toward pregnancy work as another factor that pushes the growth of this market in Europe.

By European Countries

- Germany

- The U.K.

- France

- Italy

- Russia

- Spain

- Benelux

- Nordic

- Rest of Europe

Competitive Landscape

The competitive landscape of the European maternity wear market is characterized by many dominant players competing for market share. This region fosters various maternity wear brands such as Gap Inc. Seraphine, Isabella Oliver, and JoJo Maman Bébé which offer a wide range of maternity clothing options from casual to formal wear.

This market also has a few fast fashion retailers like H&M and Zara who compete with each other in terms of affordable clothing option for women. Generally, the competitive environment within the maternity wear market of Europe is multi-faceted and evolving, where the competition is fueled by factors, such as brand reputation, product quality, price, fashion trends, distribution channels, and others.

Some of the prominent players in the Europe Maternity Wear Market are:

- Gap Inc.

- Seraphine

- Isabella Oliver.

- Destination Maternity

- H and M Hennes and Mauritz AB.

- Brunelli and co. S. R. L

- Mothercare

- Boob Design

- Gennies Maternity

- Pink Blush Maternity

- Organic & More

- Envie de Fraises

- Other Key Players

Recent Development

- In February 2024, Marks & Spencer invests £89m in retail pay and £5m annually for improved family leave policies, aiming to support employees and enhance work-life balance.

- In January 2024, Glamour UK presents 19 best maternity clothes brands for 2024, offering stylish options from ASOS, H&M, Seraphine, and more, focusing on comfort, longevity, and personal style.

- In November 2023, A famous maternity, baby, and infant clothing company Prental was acquired by Mutares, a private equity investor for their E-commerce activities in the Netherlands.

- In April 2022, Next and investment firms acquired JoJo Maman Bébé, a baby and maternity clothing retailer founded in 1993, aiming to expand its brand and reach new markets.

Report Details

| Report Characteristics |

| Market Size (2024) |

USD 3,403.7 Mn |

| Forecast Value (2033) |

USD 5,321.4 Mn |

| CAGR (2023-2032) |

5.1% |

| Historical Data |

2018 – 2023 |

| Forecast Data |

2024 – 2033 |

| Base Year |

2023 |

| Estimate Year |

2024 |

| Report Coverage |

Market Revenue Estimation, Market Dynamics, Competitive Landscape, Growth Factors and etc. |

| Segments Covered |

By Type (Tops, Dresses, Bottoms, and Lingerie), By

Distribution Channel (Supermarket & Hypermarkets,

Brand Store, Maternity & Body Store, and Online) |

| Regional Coverage |

North America – The US and Canada; Europe – Germany, The UK, France, Russia, Spain, Italy, Benelux, Nordic, & Rest of Europe; Asia- Pacific– China, Japan, South Korea, India, ANZ, ASEAN, Rest of APAC; Latin America – Brazil, Mexico, Argentina, Colombia, Rest of Latin America; Middle East & Africa – Saudi Arabia, UAE, South Africa, Turkey, Egypt, Israel, & Rest of MEA

|

| Prominent Players |

Gap Inc., Seraphine, Isabella Oliver., Destination

Maternity, H and M Hennes and Mauritz AB., Brunelli

and co. S. R. L, Mothercare, Boob Design, Gennies

Maternity, Pink Blush Maternity, Organic & More,

Envie de Fraises, and Other Key Players |

| Purchase Options |

We have three licenses to opt for: Single User License (Limited to 1 user), Multi-User License (Up to 5 Users), and Corporate Use License (Unlimited User) along with free report customization equivalent to 0 analyst working days, 3 analysts working days and 5 analysts working days respectively. |

Frequently Asked Questions

The Europe Maternity Wear Market size is estimated to have a value of USD 3,403.7 million in 2024 and is expected to reach USD 5,321.4 million by the end of 2033.

Some of the major key players in the Europe Maternity Wear Market are Gap Inc., Seraphine, Isabella Oliver., Destination Maternity, and many others.

The market is growing at a CAGR of 5.1 percent over the forecasted period.