Market Overview

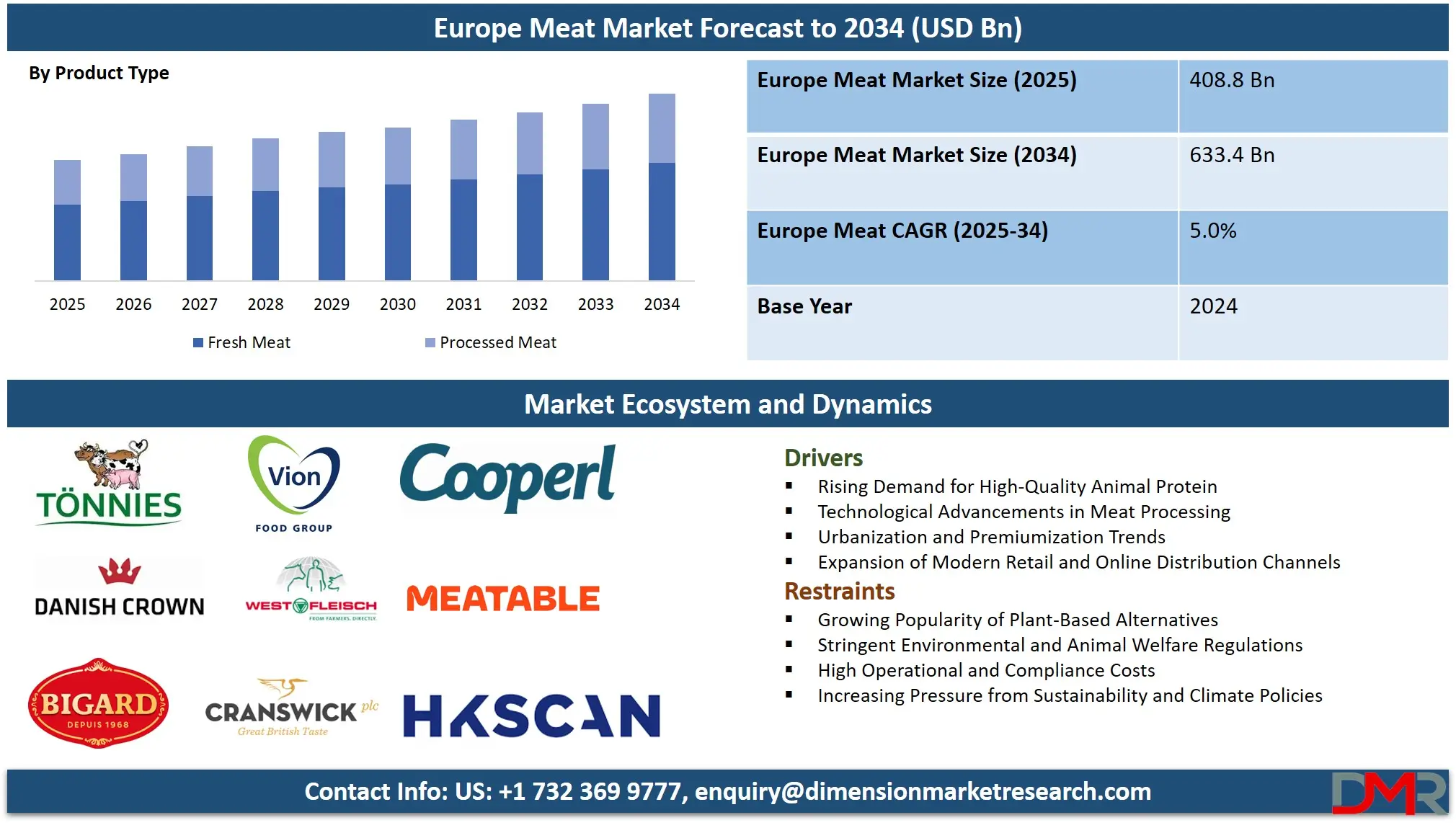

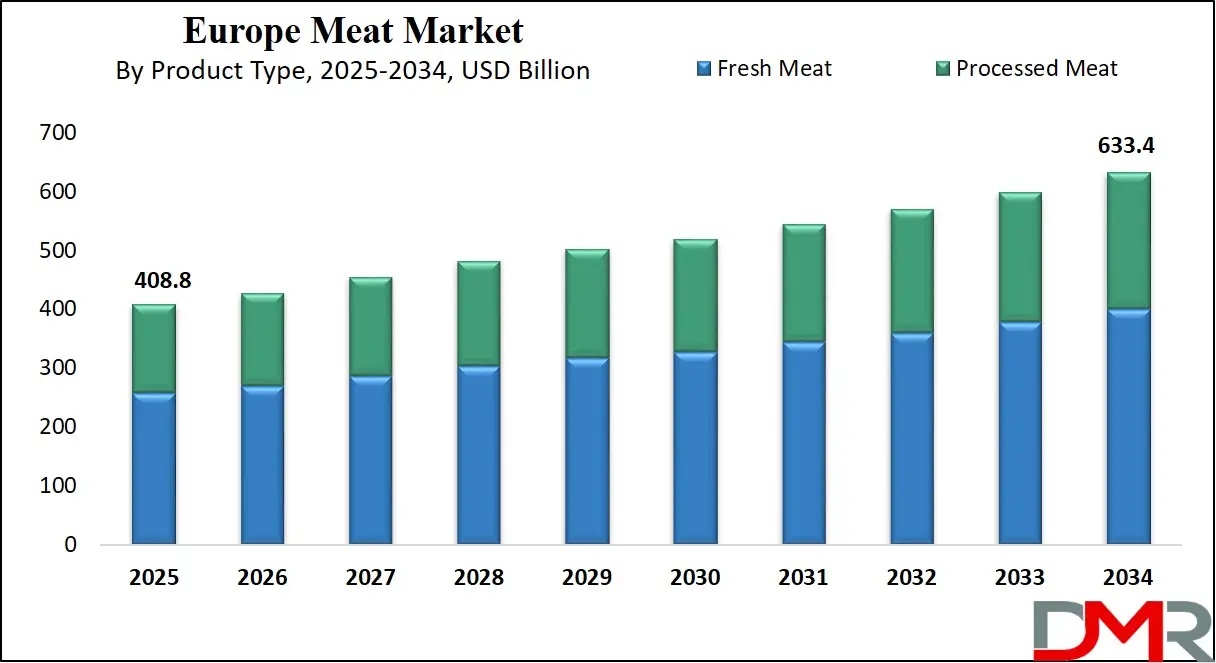

The Europe Meat Market is predicted to be valued at USD 408.8 billion in 2025 and is expected to grow to USD 633.4 billion by 2034, registering a compound annual growth rate (CAGR) of 5.0% from 2025 to 2034.

The Europe Meat Market encompasses the production, processing, distribution, and retailing of various meat products, including red meat, poultry, and processed meats such as sausages and deli cuts. This market plays a vital role in the region’s food industry, with diverse offerings tailored to traditional culinary preferences and modern dietary trends. The European meat industry has become increasingly responsive to evolving consumer preferences, regulatory standards, and related industries such as the Food Safety Testing, which ensures meat quality, compliance, and consumer trust.

Growing consumer demand for protein-rich diets, convenience foods, and high-quality meat products is driving market growth. Increased urbanization and changing lifestyles have led to higher consumption of ready-to-cook and processed meat options. Moreover, the expansion of the foodservice industry and rising disposable incomes contribute to increased meat consumption across Europe, further shaping meat consumption trends in Europe. The use of complementary innovations like

food coating technologies is also improving product appearance, shelf life, and safety standards in processed and packaged meats.

However, the market faces challenges from increasing health consciousness among consumers, ethical concerns regarding animal welfare, and environmental issues linked to meat production. The rising popularity of plant-based and cultured meat alternatives is also influencing consumer choices, reshaping the competitive dynamics. Some consumers are turning to

health coaching programs to better align their dietary habits with fitness, wellness, and ethical eating goals, influencing demand patterns for certain meat categories.

Opportunities are emerging through innovations such as clean-label processed meats, organic and grass-fed meat, and advanced packaging technologies that enhance shelf life and traceability. Sustainability trends are encouraging meat producers to adopt regenerative agriculture practices and reduce carbon footprints, aligning with evolving consumer values.

Technological advancements in cold chain logistics, meat processing automation, and blockchain for traceability are enhancing operational efficiency and transparency. In the regulatory landscape, stringent EU food safety and labeling regulations govern meat production, ensuring high standards for hygiene, traceability, and animal welfare.

Major players such as Danish Crown, Vion Food Group, and JBS Europe are focusing on mergers, brand diversification, and eco-friendly practices to maintain market leadership. Consumer preferences continue to evolve towards ethically sourced, minimally processed, and locally produced meat products. These shifts are crucial for the competitiveness of the meat export market in Europe, which seeks to retain global leadership.

Europe Meat Market: Key Takeaways

- Market Overview: The Europe meat market is projected to reach a value of USD 408.8 billion in 2025 and is anticipated to expand to USD 633.4 billion by 2034, growing at a compound annual growth rate (CAGR) of 5.0% during the forecast period from 2025 to 2034.

- By Product Type: Fresh meat is expected to lead the market in Europe, comprising around 62.0% of the total market share in 2025.

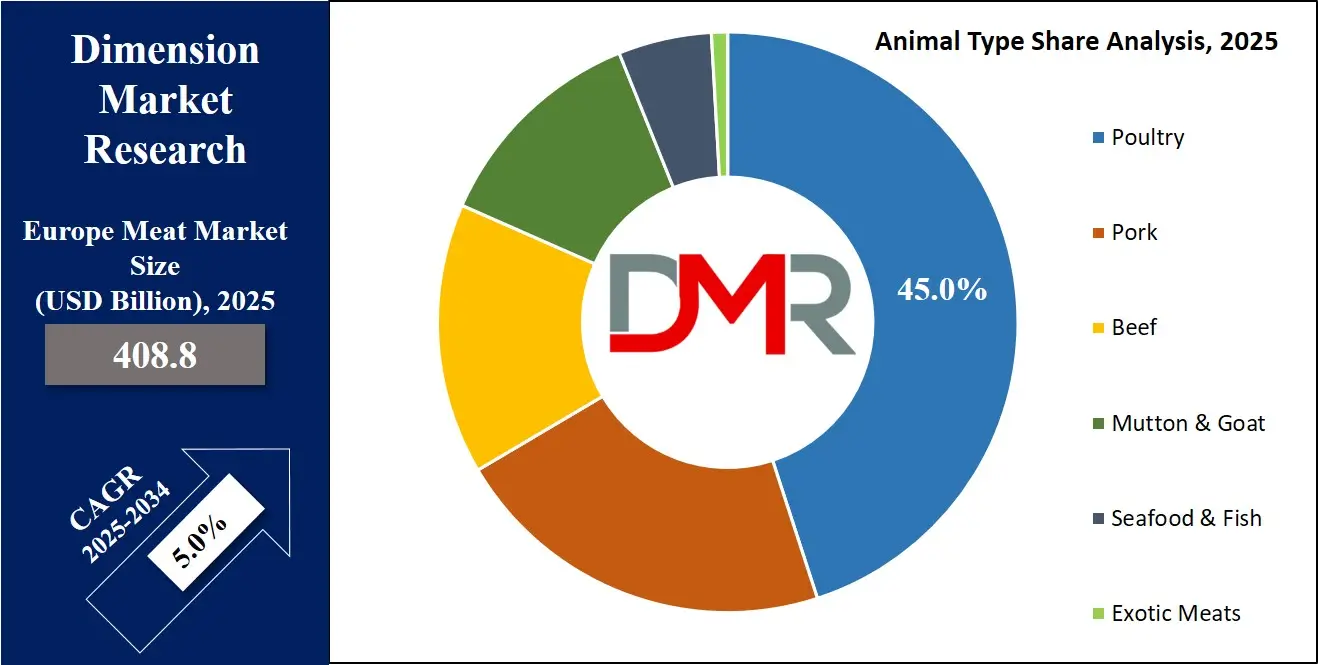

- By Animal Type: The poultry segment is set to be the most prominent in the market, holding approximately 45.0% of the market share in 2025.

- By Nature: Conventional meat is forecasted to maintain dominance, making up roughly 78.0% of the total market share in 2025.

- By Packaging: Vacuum packs are projected to be the most widely used packaging format, accounting for about 40.0% of the packaging share in 2025.

- By Distribution Channel: Supermarkets and hypermarkets are expected to be the leading distribution channel, capturing nearly 55.0% of the total market share.

- By End User: The household/consumer segment is predicted to be the primary end user, representing around 70.0% of the total market in 2025.

Europe Meat Market: Use Cases

- Traditional Cuisine: Meat is central to European traditional dishes like German bratwurst, Spanish jamón, and French coq au vin, reflecting regional heritage and cultural identity across generations.

- Convenience Foods: Pre-packaged meats such as sausages, deli slices, and ready-to-eat meals are widely consumed for their convenience in busy urban lifestyles, especially in the UK, Germany, and France.

- Hospitality & Foodservice: Restaurants, hotels, and catering services heavily feature meat-based dishes, from steak entrees to cured meat platters, meeting tourist expectations and supporting local culinary tourism.

- Nutritional Consumption: Meat is valued for its high protein and iron content, forming a key dietary component for athletes, fitness enthusiasts, and health-conscious consumers across Europe.

Europe Meat Market: Stats & Facts

- Eurostat: In 2022, the European Union produced approximately 42.1 million tonnes of meat, with pork accounting for the largest share at around 20.8 million tonnes.

- FAO (Food and Agriculture Organization): Per capita meat consumption in the EU has declined slightly, from about 69.8 kg in 2018 to 67.6 kg in 2022, reflecting growing interest in plant-based diets and health concerns.

- European Commission: The EU's beef and veal production in 2023 was estimated at around 6.5 million tonnes, a gradual decrease due to lower cattle inventories and environmental regulations.

- EEA (European Environment Agency): Livestock farming is a major contributor to greenhouse gas emissions in Europe, with cattle alone accounting for about 55% of the sector's methane emissions in 2021.

- OECD-FAO Agricultural Outlook: Meat consumption in Western Europe is projected to decline slightly through 2030, driven by demographic shifts, aging populations, and dietary changes.

- Eurobarometer (European Commission): A 2022 survey found that 29% of EU citizens had reduced their meat consumption over the previous year, mainly due to environmental and health concerns.

- European Livestock Voice: Despite declining consumption in some segments, the EU remains one of the world's largest meat exporters, particularly for pork, with key markets in China, Japan, and the Philippines.

- DG AGRI (European Commission Directorate-General for Agriculture and Rural Development): Organic meat production in Europe saw a steady rise, with organic beef and poultry farming increasing by over 10% annually between 2019 and 2022.

- European Court of Auditors: In a 2021 report, it was noted that the EU provided over €28 billion in subsidies related to livestock farming between 2014 and 2020 under the Common Agricultural Policy (CAP).

- WWF Europe: In 2023, the organization highlighted that meat consumption in Europe contributes to deforestation abroad, especially due to soybean imports for animal feed, primarily from Brazil.

Europe Meat Market: Market Dynamic

Driving Factors in the Europe Meat Market

Rising Demand for High-Quality Animal Protein

In Europe, the growing focus on health and nutrition is significantly increasing the demand for high-quality animal protein. Consumers are becoming more conscious of their dietary intake, opting for lean meat and fresh poultry to support protein-rich diets. The popularity of lifestyle trends like keto and paleo has encouraged increased red meat consumption, especially among fitness-oriented individuals.

Additionally, rising disposable incomes and rapid urbanization have driven consumers toward premium meat products, particularly in countries like Germany and France. Modern retail infrastructure, including supermarkets and online meat delivery platforms, has also enhanced accessibility and availability, further fueling growth in the regional meat industry.

Technological Advancements in Meat Processing

Europe's meat market is benefiting from rapid innovation in processing and packaging technologies. The adoption of automation in slaughterhouses and AI-powered meat grading systems has improved efficiency, hygiene, and consistency in product quality. Advanced refrigeration and vacuum-sealing methods are extending shelf life while ensuring food safety.

These technological improvements support the rising demand for processed meat products such as sausages, deli meats, and ready-to-cook items. Countries like Denmark and the Netherlands are at the forefront of these innovations, investing heavily in sustainable and efficient meat processing systems that comply with stringent European Union food safety regulations.

Restraints in the Europe Meat Market

Growing Popularity of Plant-Based Alternatives

The rising popularity of plant-based diets poses a considerable challenge to the traditional meat market in Europe. More consumers are adopting vegetarian or flexitarian lifestyles due to health, environmental, and ethical concerns. As a result, plant-based meat alternatives made from soy, peas, or fungi are increasingly appearing in mainstream grocery aisles and fast-food menus. Governments and NGOs are also actively promoting meat-free meals to reduce environmental impact. This dietary shift, coupled with innovations in plant protein that mimic the taste and texture of meat, is influencing a decline in conventional meat consumption, particularly among younger, sustainability-minded Europeans.

Stringent Environmental and Animal Welfare Regulations

Europe has some of the world’s strictest environmental and animal welfare regulations, which create cost and compliance challenges for meat producers. Policies targeting greenhouse gas emissions and land use under the EU Green Deal are putting pressure on livestock farmers to adopt more sustainable practices.

Regulations concerning animal treatment, antibiotic use, and traceability further increase operational burdens. Although these measures aim to ensure ethical production and food safety, they can lead to higher production costs and, consequently, higher retail prices. This dynamic may impact competitiveness and limit the ability of smaller producers to scale operations in an already mature market.

Opportunities in the Europe Meat Market

Expanding Export Potential to Non-EU Markets

European meat producers are increasingly capitalizing on the growing demand in global markets, particularly in Asia and the Middle East. Countries such as Spain and Poland are significantly expanding pork and poultry exports to destinations like China, where quality European meat is perceived as safe and premium.

The demand for certified halal meat is also surging in Muslim-majority countries, opening additional export avenues. Strict EU standards for food safety and traceability enhance the reputation of European meat abroad, making it a preferred choice for international buyers. This growing export potential offers significant revenue opportunities for meat processors and suppliers in the region.

Innovation in Functional and Value-Added Meat Products

The Europe meat industry is witnessing increased consumer interest in functional and value-added products. These include low-sodium sausages, high-protein snacks, and meats fortified with omega-3 or probiotics. With rising health awareness, particularly around heart health and obesity, consumers are seeking nutrient-dense options that align with wellness goals.

This shift is encouraging producers to innovate and diversify their offerings beyond traditional cuts. Ready-to-eat and ready-to-cook formats also cater to urban, time-pressed consumers. By focusing on product differentiation and nutritional benefits, European meat companies can tap into emerging segments and expand their market share.

Trends in the Europe Meat Market

Rise of Ethical and Sustainable Meat Production

Sustainability is emerging as a core trend in Europe’s meat market, driven by environmentally aware consumers. There is growing demand for ethically sourced products such as grass-fed beef, free-range poultry, and organic meat. Labels promoting lower carbon footprints and animal welfare are influencing purchase decisions, particularly among millennials and Gen Z.

European producers are adopting regenerative agriculture, water-efficient farming, and recyclable packaging to meet this evolving demand. This trend aligns with broader EU initiatives on sustainability, helping companies strengthen brand loyalty while meeting regulatory expectations for greener supply chains.

Digitalization and E-Commerce in Meat Retail

Digital transformation is reshaping how European consumers purchase meat, with e-commerce platforms offering greater convenience and transparency. Online butchers, subscription services, and direct-to-consumer models have gained popularity, especially in urban areas. Consumers are now using mobile apps and websites to order premium cuts, trace meat origins, and customize delivery options. QR codes and blockchain-based tracking systems are helping improve trust by verifying sourcing, safety, and freshness. This trend not only supports market expansion but also allows producers to collect valuable consumer data, enabling personalized marketing and demand forecasting.

Europe Meat Market: Research Scope and Analysis

By Product Type Analysis

Fresh Meat segment is predicted to dominate the Europe meat market, accounting for approximately

62.0% of the total market share in 2025. The increasing consumer preference for natural and minimally processed foods, along with growing demand from households and foodservice sectors, drives this dominance. Fresh cuts of beef, pork, and poultry remain popular due to their perceived nutritional value and quality.

Additionally, the expansion of cold chain infrastructure across European countries supports the availability and freshness of meat products. As awareness around food safety and traceability improves, consumers tend to favor fresh meat over processed alternatives. This trend is bolstered by the rising inclination towards clean-label products and the influence of health-conscious eating habits across urban and rural populations.

The Processed Meat segment is expected to register the highest CAGR during the forecast period, driven by growing consumer demand for convenient and ready-to-eat food options. Increasing urbanization and busier lifestyles fuel the need for processed meat products such as sausages, ham, and bacon. Technological advancements in meat preservation and packaging enhance shelf life and product appeal, further accelerating market growth.

Moreover, expanding modern retail formats and online sales channels provide greater accessibility to processed meat varieties. The rise in product innovation and diversified flavor profiles attracts younger consumers, while the foodservice industry’s increasing use of processed meat items also contributes to this segment’s rapid expansion in Europe’s competitive meat market.

By Animal Type Analysis

Poultry segment is predicted to dominate the Europe meat market, capturing approximately 45.0% of the overall market share in 2025. This leadership is driven by increasing consumer preference for leaner protein sources due to health concerns and changing dietary patterns. Poultry meat, including chicken and turkey, is favored for its affordability, versatility, and lower fat content compared to red meats.

Additionally, the expansion of poultry farming and advanced processing technologies across European countries contributes to a consistent supply and quality. Growing awareness about animal welfare and sustainable farming practices also encourages consumers to choose poultry. The ready availability of poultry products through supermarkets and online platforms further strengthens its market dominance in the region.

The Exotic Meats segment is projected to experience the highest CAGR through 2025, fueled by evolving consumer tastes and demand for unique, premium protein sources. Increasing interest in specialty meats such as venison, bison, and wild game is gaining traction among food enthusiasts and niche markets. The rise of gourmet dining and innovative culinary experiences encourages experimentation with exotic varieties.

Furthermore, growing awareness around sustainability and ethical sourcing boosts demand for alternative meat options. Market players are responding with product diversification and targeted marketing strategies. Expanding distribution through specialty stores and e-commerce channels also supports the rapid growth of exotic meats within Europe’s competitive protein market landscape.

By Nature Analysis

Conventional meat segment is predicted to dominate the Europe meat market, accounting for approximately

78.0% of the total market share in 2025. This dominance is largely due to the established supply chains, large-scale production, and cost-effectiveness of conventional meat products. The conventional segment benefits from widespread availability across retail outlets, including supermarkets, butcher shops, and foodservice channels.

Consumer demand for affordable protein sources continues to drive the preference for conventionally produced meat. Additionally, advancements in livestock farming and processing technology support high-volume production, meeting the needs of the growing population. Despite increasing interest in organic options, conventional meat remains the preferred choice for many households due to its accessibility and price competitiveness.

The Organic meat segment is expected to register the highest CAGR by the end of 2025, propelled by rising consumer awareness about health, food safety, and environmental sustainability. Demand for organic meat is driven by concerns over antibiotics, hormones, and chemical residues commonly associated with conventional farming.

European consumers are increasingly seeking products labeled as natural, ethically sourced, and free from synthetic additives. Growth in organic certifications, along with expanding distribution through specialty retailers and online platforms, is enhancing market penetration. The trend toward clean-label and eco-friendly products further boosts organic meat consumption. Additionally, government initiatives and policies promoting sustainable agriculture contribute to the accelerated expansion of this segment across Europe.

By Packaging Analysis

Vacuum Packs segment is predicted to dominate the Europe meat market, accounting for approximately 40.0% of the overall packaging share in 2025. Vacuum packaging is widely favored for its ability to extend shelf life by reducing oxygen exposure, thus preserving meat freshness and quality. This packaging method supports better product safety and hygiene, which aligns with increasing consumer demand for clean-label and preservative-free meat products.

Additionally, vacuum packs are highly compatible with modern cold chain logistics, enabling efficient distribution across retail and foodservice sectors. The convenience and visibility of vacuum packs also appeal to both retailers and consumers, making it the preferred choice for fresh and processed meat items across European markets.

The Modified Atmosphere Packaging (MAP) segment is expected to register the highest CAGR by 2025 due to its advanced preservation technology that maintains meat color, texture, and flavor. MAP extends the shelf life of meat products by replacing oxygen with inert gases, which slows microbial growth and oxidation. The growing demand for minimally processed, ready-to-cook meat products supports the adoption of MAP.

Furthermore, consumer preference for convenience foods and increasing penetration of modern retail formats encourage market growth. Innovations in packaging materials and sustainability efforts, such as recyclable MAP solutions, further boost adoption in Europe’s competitive meat industry. Expansion in online grocery shopping also enhances MAP’s market penetration by ensuring product freshness during delivery.

By Distribution Channel Analysis

Supermarkets & Hypermarkets segment is predicted to dominate the Europe meat market, accounting for approximately 55.0% of the overall distribution channel share in 2025. This dominance is driven by the convenience and wide product variety offered by these retail formats, which attract a broad consumer base. Supermarkets and hypermarkets benefit from well-established supply chains, efficient cold storage, and competitive pricing strategies.

The expansion of private-label meat products and promotions also encourages customer loyalty. Additionally, these outlets provide easy access to both fresh and processed meat products, meeting the diverse needs of households. The growth of organized retail and increasing urbanization across Europe further solidifies supermarkets and hypermarkets as the primary distribution channels for meat products.

The Online Retail segment is expected to witness the highest CAGR by 2025, fueled by rising internet penetration and changing consumer shopping habits. Increasing demand for contactless purchases and home delivery options accelerates the growth of e-commerce platforms offering fresh and processed meat. Advances in cold chain logistics and packaging technology ensure product freshness during shipping, enhancing customer trust.

The convenience of browsing product information, comparing prices, and accessing a wide range of meat varieties online appeals particularly to younger, tech-savvy consumers. Additionally, COVID-19 pandemic-driven shifts in retail behavior have permanently boosted online grocery sales, making online retail a rapidly expanding channel within Europe’s meat market ecosystem.

By End User

Household/Consumers segment is predicted to dominate the Europe meat market, accounting for approximately

70.0% of the total market share in 2025. The dominance is fueled by rising consumer demand for protein-rich diets and increased awareness of nutritional benefits associated with various meat products. Growing urbanization, changing lifestyles, and higher disposable incomes contribute to increased meat consumption in households.

Additionally, the expansion of modern retail formats and online grocery platforms improves accessibility to fresh and processed meat products. Consumers are also showing greater interest in traceability, food safety, and product quality, which influences purchasing decisions. The rise in home cooking trends and the preference for convenience and ready-to-cook meat products further reinforce the household segment’s substantial share in the market.

The Commercial/Institute segment is expected to register the highest CAGR by the end of 2025, driven by growth in the foodservice industry, including restaurants, hotels, and catering services. Increasing dining out trends and demand for diverse meat-based menu options support market expansion. The hospitality sector’s focus on quality ingredients and premium meat products attracts consumer spending.

Additionally, institutional demand from schools, hospitals, and corporate cafeterias is growing due to a rising focus on balanced nutrition and meal planning. Technological advancements in cold chain management and bulk supply logistics facilitate efficient procurement for commercial users. Expansion of tourism and business travel in Europe also stimulates meat consumption within the commercial segment, contributing to its rapid growth trajectory.

The Europe Meat Market Report is segmented on the basis of the following:

By Product Type

- Fresh Meat

- Processed Meat

By Animal Type

- Poultry

- Pork

- Beef

- Mutton & Goat

- Seafood & Fish

- Exotic Meats

By Nature

By Packaging

- Vacuum Packs

- Cans & Tins

- Trays with Plastic Film

- Plastic Bags & Pouches

- Modified Atmosphere Packaging

- Paper & Cardboard Boxes

- Bulk Packaging

By Distribution Channel

- Supermarkets & Hypermarkets

- Butcher Shops

- Convenience Stores

- Online Retail

- Foodservice

- Others

By End User

- Commercial/Institute

- Household/Consumers

Competitive Landscape

The competitive landscape of the Europe meat market is characterized by the presence of several well-established multinational corporations and regional players striving to capture market share through product innovation, sustainable practices, and strategic partnerships. Leading companies such as JBS S.A., Danish Crown, Vion Food Group, and Tyson Foods dominate the market with extensive supply chains, strong brand portfolios, and advanced processing facilities. These players focus on expanding their product offerings across fresh, processed, and organic meat segments to cater to evolving consumer preferences.

Sustainability and traceability have become critical factors influencing competition, with many companies investing in eco-friendly farming methods, animal welfare certifications, and blockchain technology to ensure transparency throughout the supply chain. Additionally, innovation in packaging solutions like vacuum sealing and modified atmosphere packaging enhances product shelf life and appeal, providing competitive advantages.

The rise of private-label meat products by major retailers also intensifies competition, as these offerings often provide cost-effective alternatives to branded meat products. Moreover, growing demand for specialty and exotic meats is prompting players to diversify portfolios and enter niche markets. Strategic collaborations, mergers, and acquisitions remain key tactics for market expansion and technology acquisition, shaping a dynamic competitive environment in Europe’s meat industry.

Some of the prominent players in the Europe Meat Market are:

- Tönnies Holding

- Vion Food Group

- Danish Crown AmbA

- Cooperl Arc Atlantique

- Groupe Bigard

- Hilton Food Group

- Cranswick plc

- HKScan

- Westfleisch SCE

- heristo holding gmbh

- Meatable

- Moving Mountains

- The Meatless Farm

- THIS

- Heura Foods

- NovaMeat

- Mosa Meat

- Redefine Meat

- Planted

- Innocent Meat

- Other Key Players

Recent Developments

- In July 2024, Meatly announced it had obtained regulatory approval to sell cultivated meat for pet food in the UK, becoming the first company worldwide to receive authorization for cultivated pet food. This milestone represents a significant advancement for the cultivated meat sector, as it also makes Meatly the first cultivated meat company authorized to sell its products in any European country.

- Then, in November 2024, Dutch startup Meatable, which specializes in cultivated meat technology, secured a strategic investment from Betagro Ventures, the venture capital division of Thailand’s Betagro food group. While the funding amount was not disclosed, this deal marks Betagro’s initial entry into the cultivated meat industry and underscores their interest in Meatable’s cell-based technology designed to replicate traditional pork and beef.

Report Details

| Report Characteristics |

| Market Size (2025) |

USD 408.8 Bn |

| Forecast Value (2034) |

USD 633.4 Bn |

| CAGR (2025–2034) |

3.9% |

| Historical Data |

2019 – 2024 |

| Base Year |

2024 |

| Estimate Year |

2025 |

| Report Coverage |

Market Revenue Estimation, Market Dynamics, Competitive Landscape, Growth Factors, etc. |

| Segments Covered |

By Product Type (Fresh Meat, Processed Meat), By Animal Type (Poultry, Pork, Beef, Mutton & Goat, Seafood & Fish, Exotic Meats), By Nature (Organic, Conventional), By Packaging (Vacuum Packs, Cans & Tins, Trays with Plastic Film, Plastic Bags & Pouches, Modified Atmosphere Packaging, Paper & Cardboard Boxes, Bulk Packaging), By Distribution Channel (Supermarkets & Hypermarkets, Butcher Shops, Convenience Stores, Online Retail, Foodservice, Others), By End User (Commercial/Institute, Household/Consumers) |

| Regional Coverage |

Europe – Germany, UK, France, Russia, Spain, Italy, Benelux, Nordic, Rest of Europe |

| Prominent Players |

Tönnies Holding, Vion Food Group, Danish Crown AmbA, Cooperl Arc Atlantique, Groupe Bigard, Hilton Food Group, Cranswick plc, HKScan, Westfleisch SCE, heristo holding gmbh, Meatable, Moving Mountains, The Meatless Farm, THIS, Heura Foods, NovaMeat, Mosa Meat, Redefine Meat, Planted, Innocent Meat, and Other Key Players |

| Purchase Options |

We have three licenses to opt for: Single User License (Limited to 1 user), Multi-User License (Up to 5 Users), and Corporate Use License (Unlimited User) along with free report customization equivalent to 0 analyst working days, 3 analysts working days, and 5 analysts working days respectively. |

Frequently Asked Questions

The Europe Meat Market size is estimated to have a value of USD 408.8 billion in 2025 and is expected to reach USD 633.4 billion by the end of 2034.

Some of the major key players in the Europe Meat Market are Tönnies Holding, Danish Crown AmbA, Vion Food Group and many others.

The market is growing at a CAGR of 5.0 % over the forecasted period.

Contents

1.1.Objectives of the Study

1.3.Market Definition and Scope

2.Europe Meat Market Overview

2.1.Europe Meat Market Overview by Type

2.2.Europe Meat Market Overview by Application

3.Europe Meat Market Dynamics, Opportunity, Regulations, and Trends Analysis

3.1.1.Europe Meat Market Drivers

3.1.2.Europe Meat Market Opportunities

3.1.3.Europe Meat Market Restraints

3.1.4.Europe Meat Market Challenges

3.2.Emerging Trend/Technology

3.4.PORTER'S Five Forces Analysis

3.6.Opportunity Map Analysis

3.11.Supply/Value Chain Analysis

3.12.Covid-19 & Recession Impact Analysis

3.13.Product/Brand Comparison

4.Europe Meat Market Value ((US$ Mn)), Share (%), and Growth Rate (%) Comparison by Product Type, 2019-2034

4.1.Europe Meat Market Analysis by Product Type: Introduction

4.2.Market Size and Forecast by Region

5.Europe Meat Market Value ((US$ Mn)), Share (%), and Growth Rate (%) Comparison by Animal Type, 2019-2034

5.1.Europe Meat Market Analysis by Animal Type: Introduction

5.2.Market Size and Forecast by Region

6.Europe Meat Market Value ((US$ Mn)), Share (%), and Growth Rate (%) Comparison by Nature, 2019-2034

6.1.Europe Meat Market Analysis by Nature: Introduction

6.2.Market Size and Forecast by Region

7.Europe Meat Market Value ((US$ Mn)), Share (%), and Growth Rate (%) Comparison by Packaging, 2019-2034

7.1.Europe Meat Market Analysis by Packaging: Introduction

7.2.Market Size and Forecast by Region

7.5.Trays with Plastic Film

7.6.Plastic Bags & Pouches

7.7.Modified Atmosphere Packaging

7.8.Paper & Cardboard Boxes

8.Europe Meat Market Value ((US$ Mn)), Share (%), and Growth Rate (%) Comparison by Distribution Channel, 2019-2034

8.1.Europe Meat Market Analysis by Distribution Channel: Introduction

8.2.Market Size and Forecast by Region

8.3.Supermarkets & Hypermarkets

9.Europe Meat Market Value ((US$ Mn)), Share (%), and Growth Rate (%) Comparison by End User, 2019-2034

9.1.Europe Meat Market Analysis by End User: Introduction

9.2.Market Size and Forecast by Region

10.Europe Meat Market Value ((US$ Mn)), Share (%), and Growth Rate (%) Comparison by Region, 2019-2034

10.1.1.Europe Europe Meat Market: Regional Analysis, 2019-2034

11.Europe Meat Market Company Evaluation Matrix, Competitive Landscape, Market Share Analysis, and Company Profiles

11.1.Market Share Analysis

11.3.2.Financial Highlights

11.3.5.Key Strategies and Developments

11.4.2.Financial Highlights

11.4.5.Key Strategies and Developments

11.5.2.Financial Highlights

11.5.5.Key Strategies and Developments

11.6.2.Financial Highlights

11.6.5.Key Strategies and Developments

11.7.Cooperl Arc Atlantique

11.7.2.Financial Highlights

11.7.5.Key Strategies and Developments

11.8.2.Financial Highlights

11.8.5.Key Strategies and Developments

11.9.2.Financial Highlights

11.9.5.Key Strategies and Developments

11.10.2.Financial Highlights

11.10.3.Product Portfolio

11.10.5.Key Strategies and Developments

11.11.2.Financial Highlights

11.11.3.Product Portfolio

11.11.5.Key Strategies and Developments

11.12.2.Financial Highlights

11.12.3.Product Portfolio

11.12.5.Key Strategies and Developments

11.13.heristo holding gmbh

11.13.2.Financial Highlights

11.13.3.Product Portfolio

11.13.5.Key Strategies and Developments

11.14.2.Financial Highlights

11.14.3.Product Portfolio

11.14.5.Key Strategies and Developments

12.Assumptions and Acronyms