Market Overview

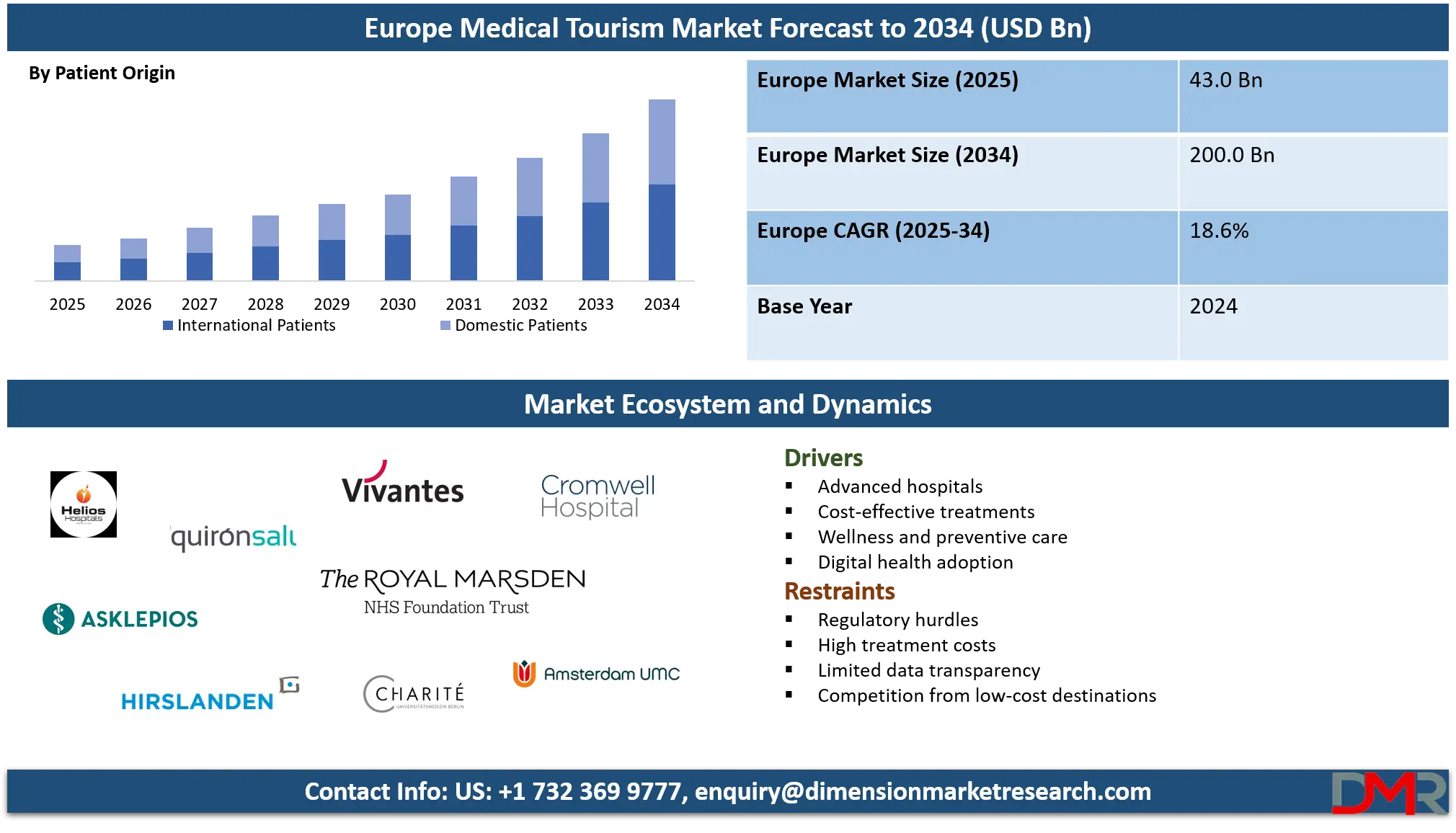

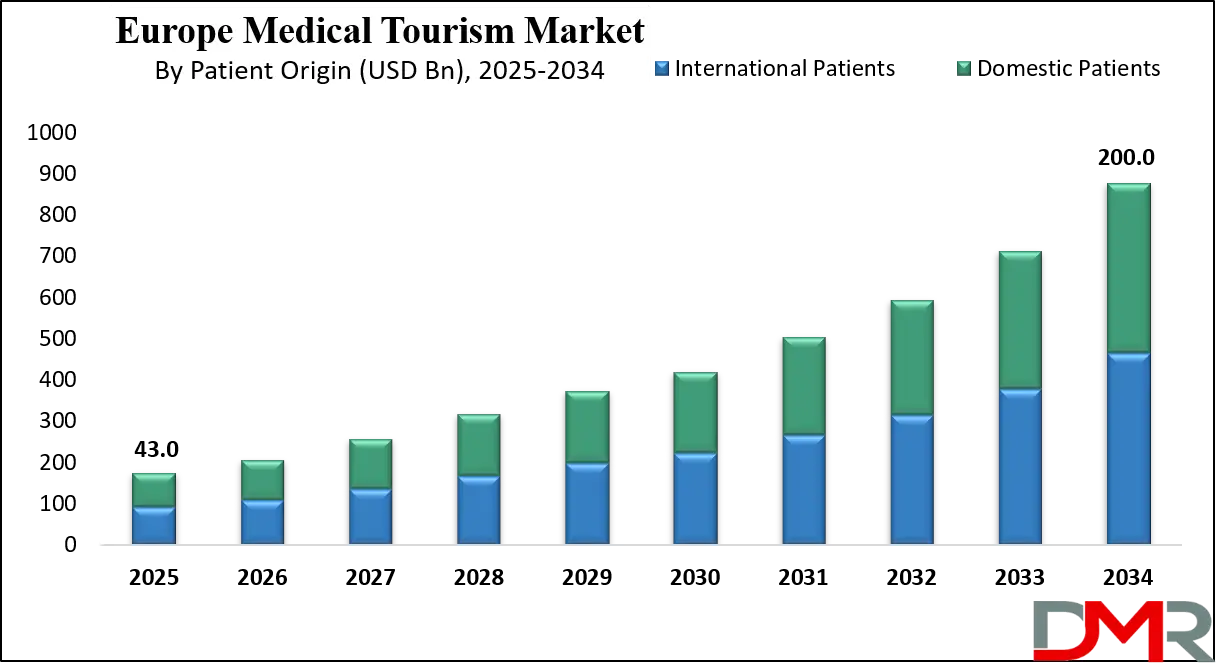

The Europe medical tourism market is forecast to expand from USD 43.0 billion in 2025 to USD 200.0 billion by 2034, registering a strong CAGR of 18.6%, driven by rising cross border healthcare demand, advanced treatment facilities, and increasing inflow of international patients.

Medical tourism refers to the practice of individuals traveling across international borders to access medical treatments, surgical procedures, or wellness services that may be more affordable, more advanced, or more readily available than in their home country. It encompasses a wide range of healthcare services including elective surgeries, specialized treatments, diagnostic procedures, fertility care, cosmetic procedures, and rehabilitation services.

ℹ

To learn more about this report –

Download Your Free Sample Report Here

Patients are often motivated by factors such as shorter waiting times, access to globally accredited hospitals, experienced medical professionals, and cost-effective treatment packages combined with travel and recovery amenities. The growing integration of healthcare with hospitality infrastructure, digital appointment systems, and international insurance coverage has further strengthened the global medical travel ecosystem.

The Europe medical tourism market represents one of the most mature and technologically advanced healthcare travel destinations globally, driven by the presence of world class hospitals, internationally trained physicians, and strong regulatory frameworks that ensure patient safety and clinical excellence. Countries such as Germany, Spain, France, Switzerland, Italy, and Turkey attract a large volume of international patients seeking advanced cardiac care, oncology services, orthopedic surgeries, dental procedures, and cosmetic treatments. The region benefits from strong medical infrastructure, widespread adoption of innovative medical technologies, and globally recognized healthcare accreditations, making it a preferred destination for complex and high precision treatments.

In addition to advanced clinical capabilities, the Europe medical tourism market is also supported by well developed transportation networks, medical visa facilitation, multilingual healthcare staff, and integrated post treatment recovery services. The rising demand for wellness tourism, fertility treatments, and minimally invasive procedures is further reshaping patient inflow patterns across European destinations.

ℹ

To learn more about this report –

Download Your Free Sample Report Here

Digital health platforms, teleconsultation services, and cross border healthcare collaborations are enhancing accessibility and transparency for international patients. As healthcare quality continues to rise alongside personalized treatment offerings, Europe remains a strategically important hub within the global medical tourism landscape.

Europe Medical Tourism Market: Key Takeaways

- Market Value: The Europe medical tourism market size is expected to reach a value of USD 200.0 billion by 2034 from a base value of USD 43.0 billion in 2025 at a CAGR of 18.6%.

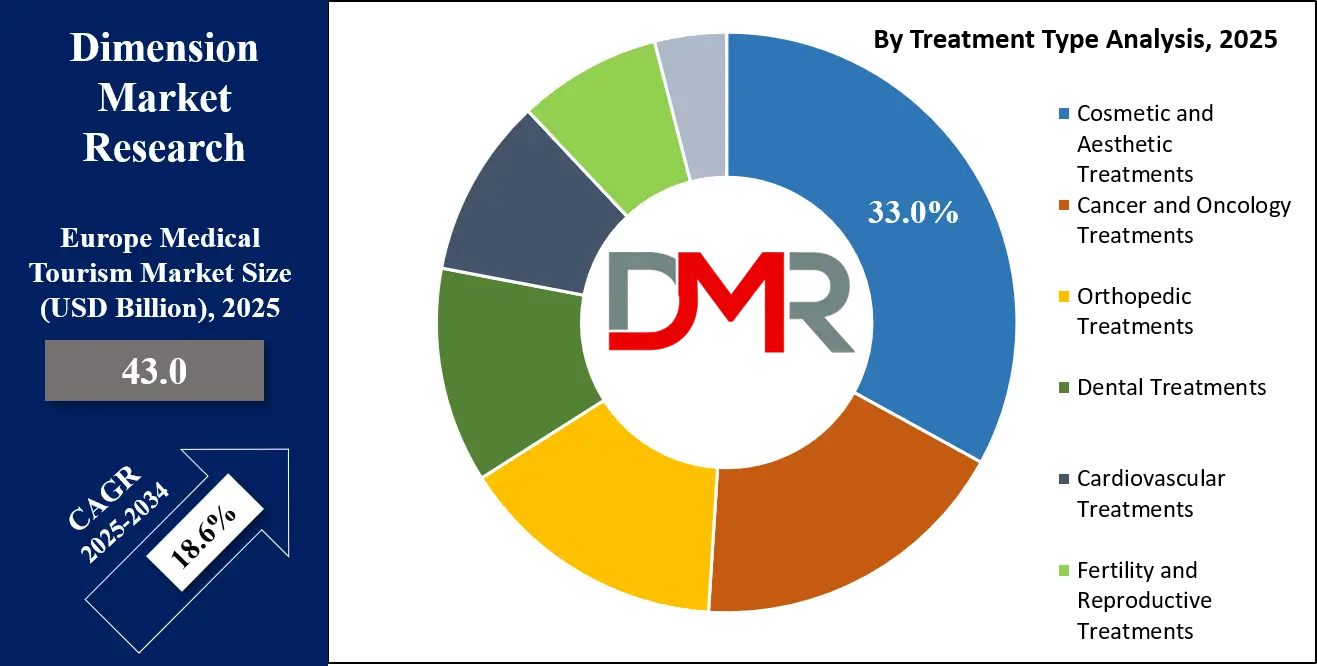

- By Treatment Type Segment Analysis: Cosmetic and Aesthetic Treatments are anticipated to dominate the treatment type segment, capturing 33.0% of the total market share in 2025.

- By Service Nature Segment Analysis: Medical and Surgical Treatment is expected to maintain its dominance in the service nature segment, capturing 51.0% of the total market share in 2025.

- By Patient Origin Segment Analysis: International Patients will account for the maximum share in the patient origin segment, capturing 53.0% of the total market value.

- By Service Provider Segment Analysis: Private Hospitals and Clinics will dominate the service provider segment, capturing 63.0% of the market share in 2025.

- Key Players: Some key players in the Europe medical tourism market are Helios Hospitals, Quirónsalud, Asklepios Kliniken, Hirslanden Private Hospital Group, Vivantes Hospital Group, The Royal Marsden Hospital, Cromwell Hospital, Charité – Universitätsmedizin Berlin, Institut de la Hernie Paris, Amsterdam University Medical Center, Leiden University Medical Center, Erasmus MC, Humanitas Research Hospital, and Others.

Europe Medical Tourism Market: Use Cases

- Advanced Cardiac and Oncology Treatments: Europe is a preferred destination for international patients seeking high precision cardiac surgeries and advanced cancer care due to its cutting edge medical technology, specialized hospitals, and globally accredited treatment centers. Countries such as Germany, Switzerland, and France attract patients for complex procedures like heart valve replacement, robotic surgery, radiation therapy, and targeted oncology treatments, supported by strong clinical outcomes and patient safety standards.

- Cosmetic and Aesthetic Medical Tourism: The region experiences strong inflow for cosmetic surgery and aesthetic treatments driven by high quality outcomes, skilled surgeons, and modern medical infrastructure. Spain, Turkey, and Italy are leading hubs for procedures such as rhinoplasty, body contouring, hair transplantation, and facial reconstruction, supported by affordable treatment packages and post treatment wellness recovery services.

- Orthopedic and Sports Medicine Procedures: Europe plays a major role in orthopedic medical tourism through advanced joint replacement surgeries, sports injury treatments, and rehabilitation care. Patients from across the globe travel for knee and hip replacement, spinal surgery, and minimally invasive orthopedic procedures due to access to innovative surgical techniques, robotic assisted systems, and specialized physiotherapy centers.

- Fertility Treatments and Reproductive Healthcare: The Europe medical tourism market is witnessing rising demand for fertility treatments such as IVF, egg freezing, and reproductive endocrinology services. Favorable success rates, progressive medical regulations, advanced fertility clinics, and experienced specialists make Europe a global hub for cross border reproductive healthcare and assisted reproductive technologies.

Impact of Artificial Intelligence on the Europe medical tourism market

Artificial intelligence is transforming the Europe medical tourism market by enhancing diagnostic accuracy, personalizing treatment planning, and improving operational efficiency across international healthcare services. AI enabled imaging, predictive analytics, and robotic assisted procedures are supporting faster and more precise clinical decision making, which strengthens Europe’s position as a preferred destination for advanced medical care.

In addition, AI driven patient engagement platforms, virtual consultations, and automated travel coordination systems are simplifying cross border healthcare access for international patients. These technologies are improving treatment outcomes, reducing waiting times, and boosting patient confidence, thereby accelerating inbound medical travel across leading European healthcare destinations.

Europe Medical Tourism Market: Stats & Facts

European Commission / Cross-Border Healthcare Directive data

- Between 2021 and 2023, there were 11,981 requests for cross-border healthcare requiring prior authorisation under Directive 2011/24/EU. Of those, 83.7% were authorised.

- In the same period, there were 1,386,735 requests for cross-border healthcare not subject to prior authorisation; 76.8% of them were granted.

- Total expenditure on cross-border healthcare by EU/EEA national contact points between 2021–2023 was €465,172,680. Of that, €18,380,839 was for care requiring prior authorisation, and €446,791,841 for care not requiring prior authorisation.

- In 2023, 12 out of 27 reporting EU Member States had a system for prior notification; 17 out of 27 had a system for prior authorisation under the Directive. Among requests made in that year under the Directive, 80.9% were authorised.

Broader Health System Capacity & Workforce — OECD / WHO-region data

- As of 2023, across OECD countries (many of which are European), on average there were 9.3 practising physicians per 1,000 population and 9.2 practising nurses per 1,000 population.

- Also in 2023, the average number of hospital beds per 1,000 population across OECD countries was 4.2.

- Between 2014 to 2023, the number of foreign-trained doctors working in the WHO European Region grew by 58%, while foreign-trained nurses increased by 67%. Annual inflows into the health labour market of doctors nearly tripled, and nurses increased fivefold.

- In 2024, 3.6% of people aged 16 or older in the EU who needed medical care reported that they were unable to access it due to financial reasons, waiting lists, or distance.

- In 2023, total EU health expenditure corresponded to about 10.0% of EU GDP.

Europe Medical Tourism Market: Market Dynamics

Europe Medical Tourism Market: Driving Factors

Advanced Healthcare Infrastructure and Clinical Excellence

Europe’s strong network of technologically advanced hospitals, internationally accredited healthcare facilities, and highly skilled medical professionals continues to drive cross border patient inflow. The availability of advanced diagnostic systems, robotic assisted surgeries, and precision medicine enhances Europe’s reputation as a trusted destination for complex treatments such as oncology, cardiology, and orthopedics.

Rising Demand for Cost Efficient High Quality Treatment

International patients increasingly choose European destinations due to the balance between treatment affordability and superior healthcare outcomes. Competitive medical travel packages, transparent pricing, and access to specialized procedures attract patients seeking value driven medical care without compromising clinical quality.

Europe Medical Tourism Market: Restraints

Regulatory Complexity and Medical Visa Challenges

Strict healthcare regulations, varying medical laws across countries, and evolving patient data protection policies often slow down international treatment access. Medical visa approval delays and administrative barriers can limit patient mobility and affect the ease of cross border healthcare travel.

High Treatment Costs in Western Europe

Although Europe offers world class healthcare services, treatment costs in countries such as Switzerland, Germany, and France remain comparatively high. This pricing gap creates competitive pressure from emerging medical tourism destinations in Eastern Europe and Asia that offer similar procedures at lower costs.

Europe Medical Tourism Market: Opportunities

Growth in Wellness Tourism and Preventive Healthcare

The increasing global focus on preventive care, anti-aging treatments, and holistic wellness programs is opening new revenue streams across European destinations. Demand for rehabilitation centers, thermal therapy, regenerative medicine, and long term recovery programs is expanding medical travel beyond traditional surgical treatments.

Expansion of Digital Health and Virtual Care Services

The integration of telemedicine platforms, digital patient engagement tools, and AI driven consultation services is creating strong opportunities for Europe to attract pre and post treatment international patients. These technologies streamline treatment planning, improve patient trust, and enhance continuity of care across borders.

Europe Medical Tourism Market: Trends

Rising Popularity of Minimally Invasive and Robotic Procedures

There is a growing shift toward minimally invasive surgeries and robot assisted medical procedures across Europe. These advanced treatment methods reduce recovery time, minimize surgical risks, and strengthen patient confidence in choosing European healthcare providers for high precision interventions.

Country Specialization and Niche Treatment Hubs

European countries are increasingly positioning themselves as niche medical tourism hubs for specialized treatments such as fertility care in Spain, cosmetic surgery in Turkey, orthopedic care in Germany, and oncology services in Switzerland. This specialization is reshaping patient flow and enhancing destination branding across the regional healthcare tourism ecosystem.

Europe Medical Tourism Market: Research Scope and Analysis

By Treatment Type Analysis

Cosmetic and aesthetic treatments are anticipated to dominate the Europe medical tourism treatment type segment by capturing 33.0% of the total market share in 2025, driven by the region’s strong reputation for high quality cosmetic procedures, advanced surgical techniques, and experienced plastic surgeons. Countries such as Turkey, Spain, Italy, and Germany attract a large volume of international patients for procedures including rhinoplasty, body contouring, hair transplantation, breast augmentation, and facial rejuvenation.

The dominance of this segment is further supported by comparatively affordable treatment packages, short recovery time for minimally invasive procedures, high success rates, and the availability of integrated post treatment wellness and rehabilitation services. The rising influence of social media, growing beauty consciousness, and increasing acceptance of aesthetic enhancement across age groups continue to accelerate demand for cosmetic medical travel across Europe.

Cancer and oncology treatments represent a highly critical and fast growing segment within the Europe medical tourism market, supported by the presence of globally recognized cancer hospitals, advanced radiation therapy systems, precision oncology, and cutting edge immunotherapy solutions. International patients are drawn to Europe for complex cancer treatments such as proton therapy, targeted drug therapies, robotic tumor surgeries, and personalized cancer care programs.

Countries like Germany, Switzerland, France, and the UK serve as major destinations due to their strong clinical research ecosystem, multidisciplinary oncology teams, and high survival outcomes. The growing burden of cancer worldwide, combined with long waiting times in developing nations and limited access to advanced oncology infrastructure, continues to drive steady inbound patient flow into this segment.

ℹ

To learn more about this report –

Download Your Free Sample Report Here

By Service Nature Analysis

Medical and surgical treatment is expected to maintain its dominance in the Europe medical tourism service nature segment, capturing 51.0% of the total market share in 2025, owing to the region’s advanced hospital infrastructure, highly skilled surgeons, and access to cutting edge medical technologies. International patients frequently travel to Europe for complex procedures such as cardiac surgeries, orthopedic replacements, neurosurgeries, and cancer interventions, benefiting from high success rates, multidisciplinary care, and comprehensive post operative support.

The presence of internationally accredited hospitals, adherence to stringent clinical protocols, and the availability of specialized treatment packages that include accommodation and travel assistance further reinforce Europe’s position as a preferred destination for medical and surgical treatments, attracting a steady inflow of cross border patients.

Wellness and preventive treatments are also gaining traction in the Europe medical tourism market, driven by increasing global awareness of preventive healthcare, holistic wellness, and long term health management. Patients are increasingly seeking services such as health check ups, nutritional counseling, spa therapies, anti aging programs, and lifestyle disease management offered by specialized wellness centers and integrated medical facilities.

Countries like Switzerland, Germany, and Austria are emerging as key destinations due to their focus on personalized wellness programs, rehabilitation services, and preventive health screenings that complement medical treatments. The rising demand for stress management, preventive diagnostics, and non invasive therapies is creating new opportunities for Europe to expand its medical tourism offerings beyond traditional surgical interventions.

By Patient Origin Analysis

International patients are expected to account for the maximum share in the Europe medical tourism patient origin segment, capturing 53.0% of the total market value. This is driven by Europe’s reputation for advanced healthcare infrastructure, globally accredited hospitals, and specialized treatment offerings in areas such as oncology, cardiology, orthopedics, and cosmetic surgery.

Patients from countries with limited access to high quality medical facilities or long waiting periods, including the Middle East, Africa, and parts of Asia, frequently travel to European destinations seeking superior clinical outcomes, skilled medical professionals, and advanced diagnostic technologies. In addition, comprehensive medical travel packages, assistance with visa and accommodation, and post treatment care enhance Europe’s attractiveness for cross border healthcare.

Domestic patients also form a significant portion of the patient base in Europe’s medical tourism market, primarily driven by the convenience of accessing high quality healthcare within their own country. These patients often prefer advanced medical centers for elective surgeries, specialized procedures, and preventive health check ups that may not be available in smaller regional hospitals. Strong awareness of healthcare quality, widespread insurance coverage, and proximity to trusted healthcare providers encourage domestic patients to utilize local medical facilities, complementing the inflow of international patients and contributing to the overall growth of the medical tourism market in Europe.

By Service Provider Analysis

Private hospitals and clinics are expected to dominate the Europe medical tourism service provider segment, capturing 63.0% of the market share in 2025, owing to their ability to offer personalized care, shorter waiting times, and specialized treatment packages for international and domestic patients. These facilities often invest in state of the art medical technologies, internationally accredited quality standards, and highly skilled specialists across various medical disciplines such as cosmetic surgery, orthopedics, cardiology, and oncology.

Additionally, private providers focus on creating seamless patient experiences by integrating accommodation, travel assistance, concierge services, and post treatment care, making them highly attractive for patients seeking convenience, efficiency, and high quality outcomes.

Public healthcare institutions also play an important role in the Europe medical tourism market, particularly for patients seeking affordable access to advanced medical treatments and surgical procedures. These institutions benefit from government funding, comprehensive healthcare programs, and established infrastructure for complex procedures like cardiac surgery, cancer care, and neurology treatments.

While public hospitals may have longer waiting periods compared to private facilities, their focus on high quality clinical outcomes, research driven treatments, and accessibility for domestic and international patients ensures they remain a significant component of the region’s healthcare ecosystem, complementing the services offered by private providers.

Europe Medical Tourism Market Report is segmented on the basis of the following:

By Treatment Type

- Cosmetic and Aesthetic Treatments

- Cancer and Oncology Treatments

- Orthopedic Treatments

- Dental Treatments

- Cardiovascular Treatments

- Fertility and Reproductive Treatments

- Other Treatments

By Service Nature

- Medical and Surgical Treatment

- Wellness and Preventive Treatments

- Alternative Treatments and Therapies

By Patient Origin

- International Patients

- Domestic Patients

By Service Provider

- Private Hospitals and Clinics

- Public Healthcare Institutions

Europe Medical Tourism Market: Regional Analysis

The Europe medical tourism market is primarily concentrated in countries with advanced healthcare infrastructure, internationally accredited hospitals, and a high concentration of specialized medical professionals. Germany, France, Switzerland, Spain, Italy, and Turkey are the leading destinations, attracting patients seeking complex treatments such as oncology, cardiology, orthopedic procedures, cosmetic surgery, and fertility care.

The market is supported by well-developed transportation networks, medical visa facilitation, multilingual healthcare staff, and integration of wellness and post-treatment recovery services. Additionally, rising awareness of preventive healthcare, digital health platforms, and telemedicine services is enhancing accessibility for international patients, further strengthening Europe’s position as a key hub for cross-border medical care.

ℹ

To learn more about this report –

Download Your Free Sample Report Here

By Region

Europe

- Germany

- The U.K.

- France

- Italy

- Russia

- Spain

- Benelux

- Nordic

- Rest of Europe

Europe Medical Tourism Market: Competitive Landscape

The Europe medical tourism market is highly competitive, driven by continuous innovation, adoption of advanced medical technologies, and a focus on patient centric care. Key players are investing in expanding specialized treatment offerings, enhancing hospital infrastructure, and integrating digital health solutions such as telemedicine and AI driven diagnostic tools to attract international patients.

Competition is also influenced by the development of tailored medical travel packages, strategic partnerships with travel and hospitality services, and the implementation of globally recognized quality standards. The emphasis on high precision procedures, shorter recovery times, and superior patient experiences is intensifying rivalry among healthcare providers, while emerging destinations within the region are increasingly leveraging niche medical specialties to differentiate themselves in the cross border healthcare market.

Some of the prominent players in the Europe medical tourism market are:

- Helios Hospitals

- Quirónsalud

- Asklepios Kliniken

- Hirslanden Private Hospital Group

- Vivantes Hospital Group

- The Royal Marsden Hospital

- Cromwell Hospital

- Charité – Universitätsmedizin Berlin

- Institut de la Hernie Paris

- Amsterdam University Medical Center

- Leiden University Medical Center

- Erasmus MC

- Humanitas Research Hospital

- Anadolu Medical Center

- Medistanbul Hospital

- Kolan International Hospital

- Centre Hospitalier Universitaire Vaudois (CHUV)

- University Hospital Zurich

- KCM Clinic

- Grande Ospedale Metropolitano

- Other Key Players

Europe Medical Tourism Market: Recent Developments

- December 2025: A prominent medical‑tourism facilitator expanded its network across Europe, increasing accessibility to affordable cosmetic and aesthetic procedures for international patients.

- September 2025: The European healthtech sector attracted strong investment, healthtech companies in Europe raised roughly €4 billion in the first half of 2025, reflecting rising investor confidence in digital health, medical devices, and cross‑border care platforms that support medical tourism.

- July 2025: A major private hospital operator announced construction of an 81,000‑square‑foot cancer treatment centre in London to offer advanced oncology and haematology services, including immunotherapy, radiotherapy, and surgical oncology, to both UK and international patients.

- May 2025: A leading Europe‑based medical‑tourism platform launched a new online booking portal enabling patients worldwide to book treatments across 250+ accredited clinics with transparent pricing, visa support, and multilingual facilitation.

Report Details

| Report Characteristics |

| Market Size (2025) |

USD 43.0 Bn |

| Forecast Value (2034) |

USD 200 Bn |

| CAGR (2025–2034) |

18.6% |

| Historical Data |

2019 – 2024 |

| Forecast Data |

2026 – 2034 |

| Base Year |

2024 |

| Estimate Year |

2025 |

| Report Coverage |

Market Revenue Estimation, Market Dynamics, Competitive Landscape, Growth Factors, etc. |

| Segments Covered |

By Treatment Type (Cosmetic and Aesthetic Treatments, Cancer and Oncology Treatments, Orthopedic Treatments, Dental Treatments, Cardiovascular Treatments, Fertility and Reproductive Treatments, Other Treatments), By Service Nature (Medical and Surgical Treatment, Wellness and Preventive Treatments, Alternative Treatments and Therapies), By Patient Origin (International Patients, Domestic Patients), and By Service Provider (Private Hospitals and Clinics, Public Healthcare Institutions)

|

| Regional Coverage |

Europe – Germany, The UK, France, Russia, Spain, Italy, Benelux, Nordic, & Rest of Europe |

| Prominent Players |

Helios Hospitals, Quirónsalud, Asklepios Kliniken, Hirslanden Private Hospital Group, Vivantes Hospital Group, The Royal Marsden Hospital, Cromwell Hospital, Charité – Universitätsmedizin Berlin, Institut de la Hernie Paris, Amsterdam University Medical Center, Leiden University Medical Center, Erasmus MC, Humanitas Research Hospital, and Others. |

| Purchase Options |

We have three licenses to opt for: Single User License (Limited to 1 user), Multi-User License (Up to 5 Users), and Corporate Use License (Unlimited User) along with free report customization equivalent to 0 analyst working days, 3 analysts working days, and 5 analysts working days respectively. |

Frequently Asked Questions

How big is the Europe medical tourism market?

▾ Europe medical tourism market size is estimated to have a value of USD 43.0 billion in 2025 and is expected to reach USD 200 billion by the end of 2034, with a CAGR of 18.6%.

Who are the key players in the Europe medical tourism market?

▾ Some of the major key players in the Europe medical tourism market are Helios Hospitals, Quirónsalud, Asklepios Kliniken, Hirslanden Private Hospital Group, Vivantes Hospital Group, The Royal Marsden Hospital, Cromwell Hospital, Charité – Universitätsmedizin Berlin, Institut de la Hernie Paris, Amsterdam University Medical Center, Leiden University Medical Center, Erasmus MC, Humanitas Research Hospital, and Others.