Market Overview

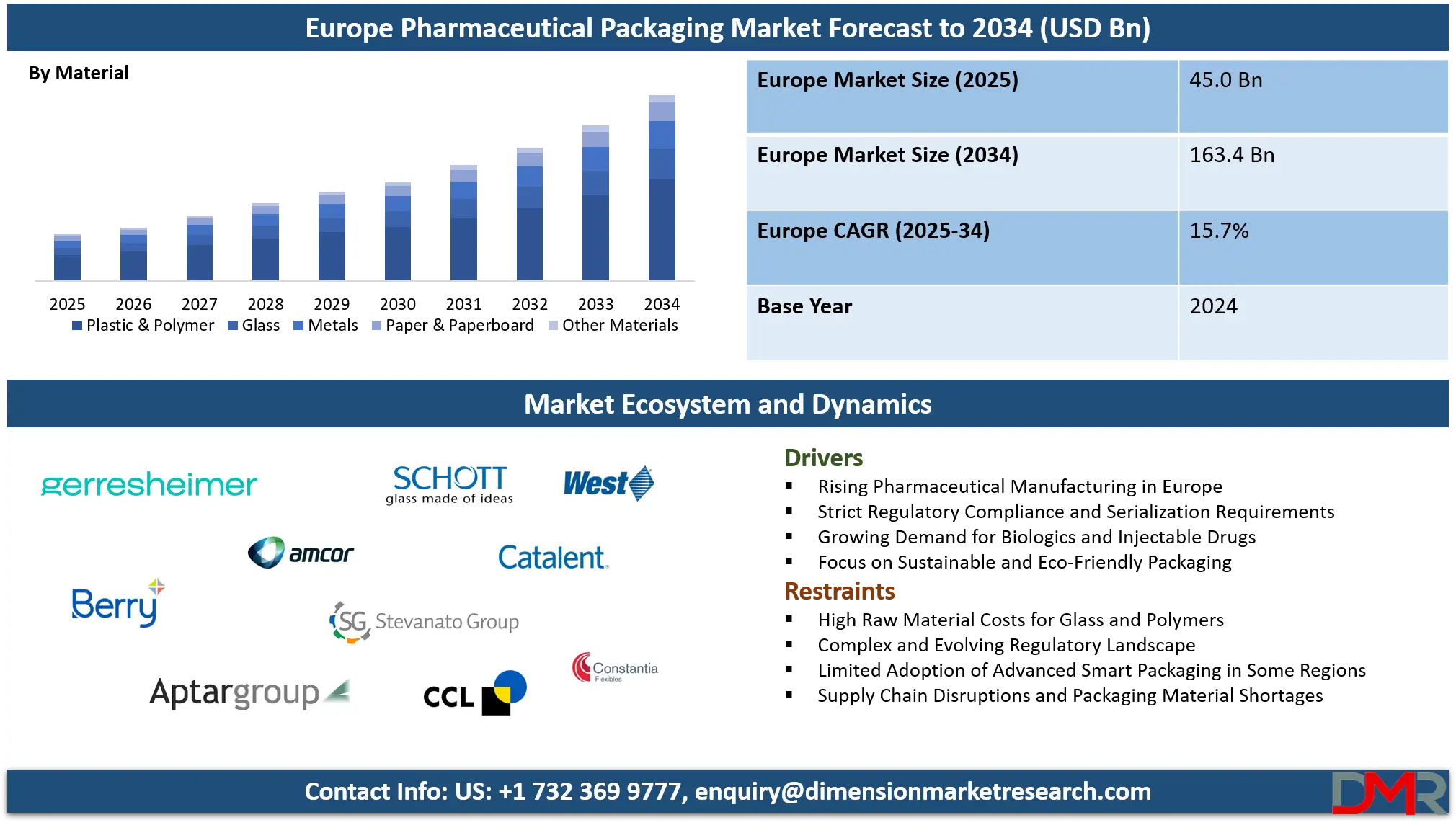

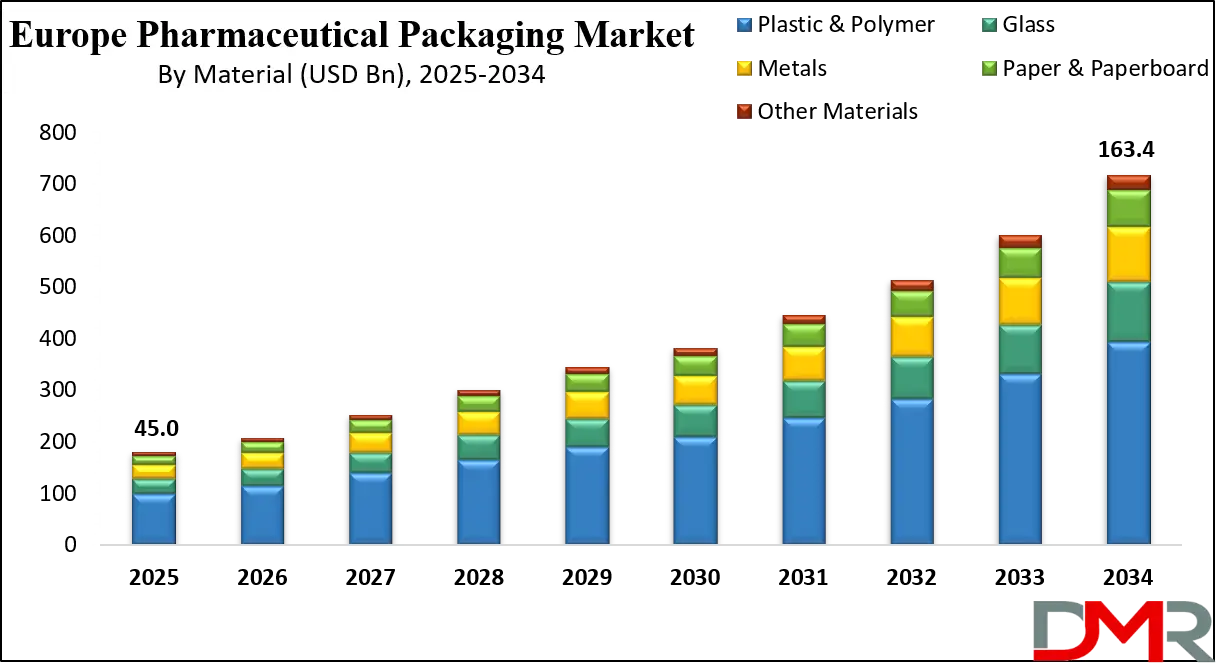

The Europe pharmaceutical packaging market is valued at USD 45.0 billion in 2025 and is projected to reach USD 163.4 billion by 2034, expanding at a CAGR of 15.7%, driven by growth in primary packaging, blister packs, glass vials, sustainable materials, and regulatory compliant drug packaging solutions.

Pharmaceutical Packaging refers to the process and materials used to enclose, protect, and preserve medicinal products from the point of manufacture until they reach the end consumer. It involves a wide range of packaging formats such as bottles, vials, blister packs, ampoules, and syringes, designed to maintain the efficacy, stability, and safety of drugs while ensuring compliance with regulatory standards. Pharmaceutical packaging not only safeguards the product from environmental factors such as moisture, light, and contamination but also plays a crucial role in patient convenience, dosage accuracy, and supply chain efficiency. It integrates technologies like child-resistant closures, tamper-evident seals, and serialization to prevent counterfeiting, making it a critical component in the overall healthcare ecosystem.

The Europe Pharmaceutical Packaging Market encompasses the production, distribution, and utilization of packaging solutions specifically tailored for pharmaceuticals across the European region. It is driven by the increasing demand for high-quality, safe, and sustainable packaging solutions in line with stringent regulatory requirements imposed by authorities such as the European Medicines Agency.

The market includes glass and plastic containers, prefilled syringes, flexible blister packs, and specialized cold chain packaging to maintain the stability of sensitive biologics and vaccines. Rapid advancements in materials, automation, and smart packaging technologies have further strengthened the market landscape by improving product protection and reducing operational costs.

The market in Europe is characterized by strong competition among global and regional players who focus on innovation, sustainability, and compliance to gain market share. Key trends influencing the market include the growing adoption of eco-friendly materials, the integration of digital tracking systems for serialization and anti-counterfeiting, and the increasing preference for patient-centric designs that enhance usability and adherence. Europe remains a significant contributor to the global pharmaceutical packaging industry due to its well-established healthcare infrastructure, high pharmaceutical manufacturing activity, and emphasis on regulatory compliance and quality standards.

Europe Pharmaceutical Packaging Market: Key Takeaways

- Market Value: The Europe pharmaceutical packaging market size is expected to reach a value of USD 163.4 billion by 2034 from a base value of USD 45.0 billion in 2025 at a CAGR of 15.7%.

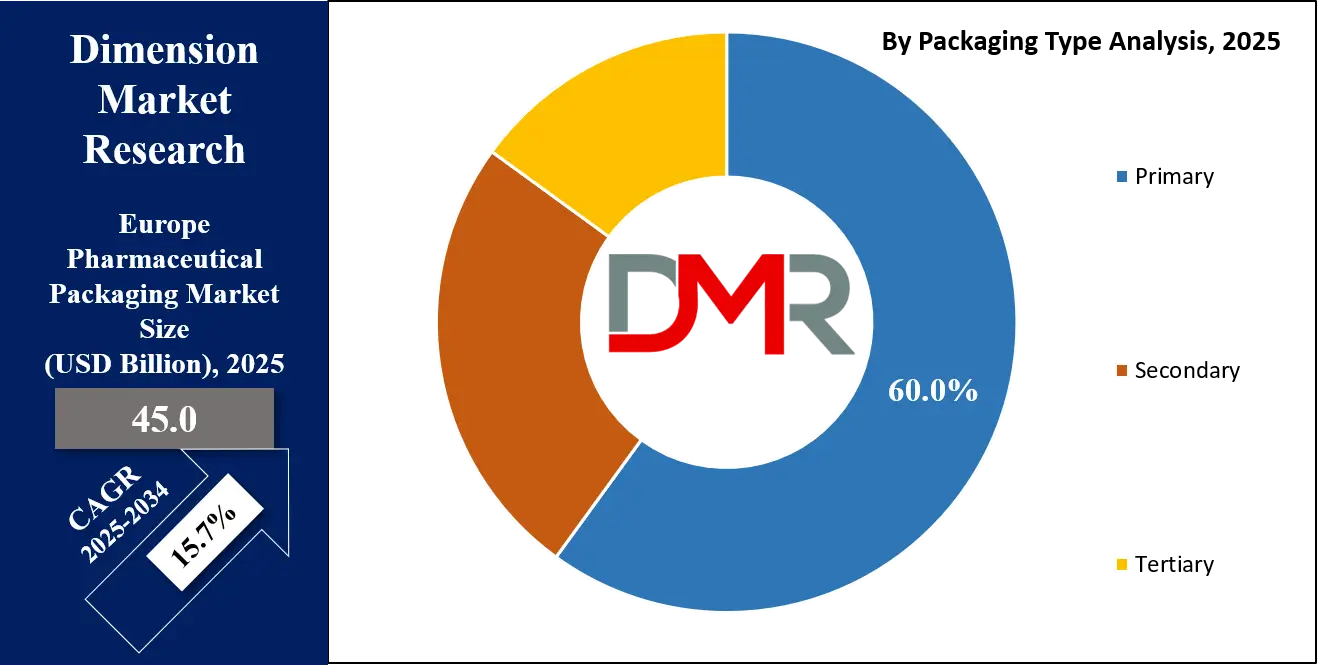

- By Packaging Type Segment Analysis: Primary type is anticipated to dominate the packaging type segment, capturing 60.0% of the total market share in 2025.

- By Material Segment Analysis: Plastic & Polymers are expected to maintain their dominance in the material segment, capturing 55.0% of the total market share in 2025.

- By Drug Delivery Mode Segment Analysis: Oral Drug Delivery Packaging will dominate the drug delivery mode segment, capturing 15.0% of the market share in 2025.

- By Sustainability Segment Analysis: Recyclable Packaging will dominate the sustainability segment, capturing 47.0% of the market share in 2025.

- By End-User Segment Analysis: Pharmaceutical Companies will capture the maximum share in the end-user segment, capturing 25.0% of the market share in 2025.

- Key Players: Some key players in the Europe pharmaceutical packaging market are Gerresheimer AG, Amcor plc, Berry Global, Inc., AptarGroup, Inc., Schott AG, Stevanato Group S.p.A., West Pharmaceutical Services, Inc., Catalent, Inc., CCL Industries Inc., Constantia Flexibles, SGD Pharma, Nipro Corporation, Vetter Pharma-Fertigung GmbH & Co. KG, Bormioli Pharma S.p.A., Origin Pharma Packaging, Intrapac Group, and Others.

Europe Pharmaceutical Packaging Market: Use Cases

- Blister Packaging for Solid Oral Dosage Forms: Blister packaging is widely used across Europe for tablets and capsules due to its superior barrier protection against moisture, oxygen, and light. It supports unit dose packaging, improves patient adherence, and enables easy traceability through printed batch and expiry details. High adoption is driven by regulatory compliance, demand for tamper evident packaging, and the growing production of generic drugs across European pharmaceutical manufacturing hubs.

- Primary Glass Packaging for Injectables and Biologics: Glass vials, ampoules, and prefilled syringes are extensively used for vaccines, biologics, and injectable drugs due to their chemical inertness and high sterility assurance. With the rise of biologic therapies and cold chain pharmaceuticals, Europe sees strong demand for high quality borosilicate glass packaging that ensures drug stability, contamination control, and long term storage safety.

- Child Resistant and Senior Friendly Drug Packaging: Pharmaceutical companies across Europe increasingly adopt child resistant closures and senior friendly packaging to meet safety regulations and improve patient convenience. These packaging solutions are critical for liquid medicines, oral suspensions, and high risk drugs. The demand is supported by Europe’s aging population and strict requirements for patient centric pharmaceutical packaging designs.

- Sustainable and Eco Friendly Pharmaceutical Packaging: Sustainability is a major use case in the Europe pharmaceutical packaging market, with rising adoption of recyclable plastics, reduced material formats, and eco compliant packaging solutions. Companies are focusing on carbon footprint reduction, circular economy goals, and regulatory pressure for green packaging. This trend is reshaping material selection in both primary and secondary pharmaceutical packaging across the region.

Impact of Artificial Intelligence on the Europe Pharmaceutical Packaging market

Artificial intelligence is transforming the Europe pharmaceutical packaging market by enhancing quality control, production efficiency, and regulatory compliance across the packaging value chain. AI powered vision inspection systems are widely used to detect micro defects, labeling errors, and seal integrity issues in real time, significantly reducing packaging failures and product recalls. Machine learning algorithms also enable predictive maintenance of packaging equipment, minimizing downtime and improving overall operational efficiency for pharmaceutical packaging manufacturers.

AI is further strengthening smart packaging and serialization by enabling real time tracking, anti counterfeit measures, and data driven supply chain optimization. Advanced data analytics supports demand forecasting, material optimization, and faster batch release processes, ensuring better traceability and regulatory transparency. With the growing focus on automation, digital transformation, and patient safety, artificial intelligence is becoming a critical enabler for innovation, compliance, and cost efficiency in the European pharmaceutical packaging ecosystem.

Europe Pharmaceutical Packaging Market: Stats & Facts

Eurostat

- 2023 — Packaging waste generated in the EU: 79.7 million tonnes; packaging waste per inhabitant 177.8 kg.

- 2023 — Plastic packaging waste per EU inhabitant: 35.3 kg (generated) and 14.8 kg (recycled).

- 2023 — Municipal waste generated per person in the EU: 511 kg (down from 515 kg in 2022).

- 2023 — Between 2013 and 2023, the per-capita amount of plastic packaging waste increased by 6.4 kg while recycled amount increased by 3.8 kg.

European Commission — Environment / PPWR (Packaging & Packaging Waste Regulation)

- 2024–2025 — New Packaging & Packaging Waste Regulation (PPWR) sets stricter recyclability, recyclate content, and reporting requirements for packaging placed on the EU market.

- 2024–2025 — Roughly 40% of plastics used in the EU are in packaging applications.

- 2024–2025 — Regulation emphasizes mandatory reporting by producers and national producer responsibility organizations and tighter rules on substances of concern in packaging.

Europe Pharmaceutical Packaging Market: Market Dynamics

Europe Pharmaceutical Packaging Market: Driving Factors

Expansion of Pharmaceutical Manufacturing in Europe

Rising production of generic drugs, biosimilars, and specialty medicines across Germany, France, Italy, and Eastern Europe is directly increasing demand for primary packaging, sterile containers, blister packs, and dosage protection solutions. This manufacturing expansion strengthens long term demand for compliant and scalable pharmaceutical packaging systems.

Strict Drug Safety and Traceability Regulations

European serialization laws, tamper evident requirements, and counterfeit prevention mandates are accelerating adoption of track and trace packaging, smart labels, and secure secondary packaging. These regulations strongly support investments in high precision, regulatory compliant packaging technologies.

Europe Pharmaceutical Packaging Market: Restraints

Volatility in Raw Material Pricing

Fluctuating costs of glass tubing, aluminum foils, and pharmaceutical grade polymers impact production economics and restrict price stability for packaging suppliers. This volatility affects long term procurement strategies across the pharmaceutical supply chain.

Complex Regulatory Compliance Burden

Frequent updates in EU packaging, environmental, and sterility standards increase validation costs and delay product launches. Smaller manufacturers face challenges in meeting qualification, documentation, and audit readiness requirements.

Europe Pharmaceutical Packaging Market: Opportunities

Growth of Sustainable Pharmaceutical Packaging

Strong regulatory pressure and ESG goals are driving demand for recyclable materials, lightweight containers, and reduced plastic packaging formats. This shift creates high growth potential for eco friendly pharmaceutical packaging solutions.

Rising Demand for Biologics and Injectable Drugs

The rapid growth of vaccines, monoclonal antibodies, and injectable therapies is generating strong opportunities for prefilled syringes, sterile vials, cold chain packaging, and high barrier aseptic containers across Europe.

Europe Pharmaceutical Packaging Market: Trends

Adoption of Smart and Connected Packaging

The use of QR codes, RFID, and digital authentication features is increasing for supply chain visibility, patient engagement, and anti-counterfeit protection, transforming how pharmaceutical packaging interacts with end users.

Automation and AI Driven Packaging Operations

AI based inspection systems, robotic packaging lines, and predictive maintenance technologies are becoming standard across European packaging plants to improve accuracy, reduce recalls, and enhance operational efficiency.

Europe Pharmaceutical Packaging Market: Research Scope and Analysis

By Packaging Type Analysis

Primary packaging is anticipated to dominate the Europe pharmaceutical packaging market in 2025 by capturing nearly 60.0% of the total market share, as it comes in direct contact with pharmaceutical products and plays a critical role in ensuring drug safety, stability, and shelf life. High demand for bottles, vials, ampoules, blister packs, and prefilled syringes across solid, liquid, and injectable dosage forms is driving the strong adoption of primary packaging solutions.

The rapid growth of biologics, vaccines, and specialty drugs further strengthens the demand for high quality glass and plastic primary containers that offer superior barrier protection, sterility assurance, and regulatory compliance. Additionally, stringent European regulations related to contamination control and patient safety continue to reinforce the dominance of primary packaging across pharmaceutical manufacturing and contract packaging operations.

Secondary packaging also holds a significant position in the market as it supports branding, product identification, and regulatory information display while adding an extra layer of protection during storage and transportation. Cartons, labels, leaflets, and outer wraps are widely used to enhance product traceability through serialization, barcoding, and anti counterfeit features.

The growing focus on patient centric labeling, multilingual compliance requirements, and shelf ready packaging formats across retail and hospital pharmacies is steadily strengthening the role of secondary packaging. Moreover, rising demand for sustainable paperboard materials and lightweight packaging formats is further supporting steady growth of secondary packaging within the overall Europe pharmaceutical packaging market.

By Material Analysis

Plastic and polymers are expected to maintain their dominance in the Europe pharmaceutical packaging market by capturing nearly 55.0% of the total market share in 2025, largely due to their lightweight nature, design flexibility, cost effectiveness, and excellent barrier performance for a wide range of drug formulations. Materials such as polyethylene, polypropylene, PET, and cyclic olefin polymers are extensively used in bottles, blister packs, closures, prefilled syringes, and liquid containers for both prescription and over the counter medicines.

Their compatibility with high speed automated packaging lines, resistance to breakage during transportation, and suitability for child resistant and tamper evident features further support strong adoption across European pharmaceutical production facilities. The growing focus on recyclable and bio based polymer solutions is also reinforcing the long term demand for plastic based pharmaceutical packaging.

Glass continues to hold a vital position in the material segment due to its unmatched chemical inertness, high transparency, and superior ability to preserve drug integrity for sensitive formulations. It is widely used in vials, ampoules, cartridges, and prefilled syringes for injectables, biologics, and vaccines where contamination control and sterility assurance are critical. Type I borosilicate glass remains the preferred choice for high value drugs due to its resistance to thermal shock and chemical interaction. Despite higher weight and fragility compared to plastics, ongoing innovations in lightweight glass and strengthened coatings are supporting the steady utilization of glass packaging across the Europe pharmaceutical packaging market.

By Drug Delivery Mode Analysis

Oral drug delivery packaging is expected to dominate the drug delivery mode segment in the Europe pharmaceutical packaging market by capturing around 15.0% of the market share in 2025, supported by the high consumption of tablets, capsules, syrups, and oral suspensions across both prescription and over the counter drug categories. Bottles, blister packs, strip packs, and closures are extensively used for oral formulations due to their convenience, cost efficiency, dose accuracy, and strong patient compliance. The growing burden of chronic diseases, expanding geriatric population, and rising self medication trends across Europe are further strengthening the demand for reliable and easy to use oral drug packaging formats.

Injectable packaging holds a strategically important position in the market due to the rising use of vaccines, biologics, insulin, and specialty injectable therapies. Vials, ampoules, cartridges, and prefilled syringes are widely adopted to ensure sterility, contamination control, and safe drug administration in hospital and clinical settings. The increasing focus on ready to use injectable formats, cold chain packaging requirements, and the rapid growth of biologic drug manufacturing across Europe are steadily enhancing the demand for high quality injectable pharmaceutical packaging solutions.

By Sustainability Analysis

Recyclable packaging is expected to dominate the sustainability segment of the Europe pharmaceutical packaging market by capturing around 47.0% of the market share in 2025, driven by strong regulatory pressure, circular economy targets, and rising adoption of mono material packaging formats. Pharmaceutical companies are increasingly shifting toward recyclable plastics, aluminum based blister foils, and paper based secondary packaging to reduce environmental impact while maintaining regulatory compliance.

The use of PET, HDPE, and recyclable polypropylene in bottles, closures, and blister packs is expanding due to their compatibility with existing recycling streams and high barrier performance. Growing corporate sustainability commitments, extended producer responsibility regulations, and consumer preference for eco friendly packaging are further strengthening the dominance of recyclable pharmaceutical packaging solutions across Europe.

Biodegradable packaging is gaining steady traction as pharmaceutical manufacturers explore compostable and plant based materials to further minimize plastic waste and carbon footprint. Materials such as biopolymers, starch based films, and cellulose derived packaging are being tested for secondary packaging, sachets, and limited primary applications where moisture and oxygen sensitivity can be managed.

Although biodegradable packaging currently faces challenges related to cost, scalability, and regulatory validation, increasing investments in material innovation and green chemistry are gradually improving its commercial viability. As Europe continues to tighten its sustainability and waste reduction policies, biodegradable pharmaceutical packaging is expected to witness gradual but consistent growth over the coming years.

By End-User Analysis

Pharmaceutical companies are expected to capture the maximum share of the end user segment in the Europe pharmaceutical packaging market by accounting for around 25.0% of the market share in 2025, driven by large scale production of generic, branded, and over the counter medicines. These companies require high volume usage of primary and secondary packaging such as bottles, blister packs, vials, labels, and cartons to support mass drug manufacturing and wide distribution across hospital, retail, and online pharmacy channels. The continuous launch of new drug formulations, rising exports of finished pharmaceutical products, and strict regulatory requirements for labeling, serialization, and patient safety are key factors sustaining strong packaging demand from pharmaceutical manufacturers across Europe.

Biopharmaceutical companies represent a fast growing end user group due to the rapid increase in biologics, vaccines, monoclonal antibodies, and cell and gene therapies. These companies require highly specialized packaging solutions such as sterile vials, prefilled syringes, cartridges, and advanced cold chain packaging to maintain drug stability and efficacy.

The complexity of biologic formulations, along with stringent sterility and contamination control standards, is driving demand for high performance glass packaging and advanced polymer containers. As Europe strengthens its position in biopharmaceutical research and production, the demand for precision driven and temperature controlled pharmaceutical packaging from this segment is expected to rise steadily.

The Europe Pharmaceutical Packaging Market Report is segmented on the basis of the following:

By Packaging Type

- Primary

- Plastic Bottles

- Caps & Closures

- Parenteral Containers

- Syringes

- Vials & Ampoules

- Others

- Pre-Fillable Inhalers

- Pre-Fillable Syringes

- Vials & Ampoules

- Blister Packs

- Bags & Pouches

- Jars & Canisters

- Others

- Secondary

- Prescription Containers

- Pharmaceutical Packaging Accessories

- Tertiary

By Material

- Plastic & Polymer

- Polyvinyl Chloride (PVC)

- Polypropylene (PP)

- Homo-Polypropylene

- Random-Polypropylene

- Polyethylene Terephthalate (PET)

- Polyethylene (PE)

- High-Density Polyethylene (HDPE)

- Low-density polyethylene (LDPE)

- Linear Low-Density Polyethylene (LLDPE)

- Polystyrene (PS)

- Others

- Glass

- Type I (Borosilicate Glass)

- Type II (Treated Soda-Lime Glass)

- Type III (Regular Soda-Lime Glass)

- Metals

- Aluminum

- Stainless Steel

- Tin

- Other Metal Alloys

- Paper & Paperboard

- Other Material

By Drug Delivery Mode

- Oral Drug Delivery Packaging

- Injectable Packaging

- Topical Drug Delivery Packaging

- Pulmonary Drug Delivery Packaging

- Transdermal Drug Delivery Packaging

- Ocular Drug Delivery Packaging

- Nasal Drug Delivery Packaging

- Other Drug Delivery Mode

By Sustainability

- Recyclable Packaging

- Biodegradable Packaging

- Compostable Packaging

By End-user

- Pharmaceutical Companies

- Biopharmaceutical Companies

- Contract Manufacturing Organizations (CMOs)

- Contract Packaging Organizations (CPOs)

Europe Pharmaceutical Packaging Market: Regional Analysis

The Europe pharmaceutical packaging market demonstrates strong growth across Western, Central, and Eastern Europe, supported by robust pharmaceutical manufacturing activity, advanced healthcare infrastructure, and strict regulatory compliance standards. Germany, France, Italy, the UK, and Spain remain the core revenue contributors due to their large drug production bases, strong presence of global packaging players, and high demand for primary packaging such as blister packs, vials, bottles, and prefilled syringes.

Eastern European countries including Poland, Czech Republic, and Hungary are emerging as high growth manufacturing hubs due to cost efficient production, contract packaging expansion, and increasing export of generic medicines. The region also benefits from rising adoption of sustainable packaging, smart labeling, and anti counterfeiting technologies, driven by EU environmental policies and drug traceability mandates, making Europe a highly regulated and innovation driven pharmaceutical packaging market.

By Region

Europe

- Germany

- The U.K.

- France

- Italy

- Russia

- Spain

- Benelux

- Nordic

- Rest of Europe

Europe Pharmaceutical Packaging Market: Competitive Landscape

The Europe pharmaceutical packaging market is highly competitive and characterized by the presence of multinational players and strong regional manufacturers offering a wide range of primary, secondary, and tertiary packaging solutions. Competition is driven by continuous innovation in sterile packaging, sustainable materials, and smart packaging technologies to meet strict regulatory and patient safety requirements.

Market participants focus heavily on automation, quality control systems, and advanced material science to enhance barrier properties, extend shelf life, and support the growing demand for biologics and specialty drugs. Strategic partnerships with pharmaceutical and biopharmaceutical manufacturers, investments in capacity expansion, and increased adoption of recyclable and low carbon packaging formats are shaping the competitive dynamics across the European region.

Some of the prominent players in the Europe Pharmaceutical Packaging market are:

- Gerresheimer AG

- Amcor plc

- Berry Global, Inc.

- AptarGroup, Inc.

- Schott AG

- Stevanato Group S.p.A.

- West Pharmaceutical Services, Inc.

- Catalent, Inc.

- CCL Industries Inc.

- Constantia Flexibles

- SGD Pharma

- Nipro Corporation

- Vetter Pharma-Fertigung GmbH & Co. KG

- Bormioli Pharma S.p.A.

- Origin Pharma Packaging

- Intrapac Group

- Gaplast GmbH

- Ardagh Group SA

- Nolato AB

- WestRock Company

- Other Key Players

Europe Pharmaceutical Packaging Market: Recent Developments

- Oct 2025: A European glass packaging manufacturer acquired a tubular glass converting company to strengthen its ready to use vial and ampoule capabilities, expanding capacity for injectable and biologics packaging.

- Mar 2025: A major pharmaceutical glass packaging supplier announced a multi-million euro investment to modernize its European manufacturing sites and expand production of vials and prefilled syringe components.

- Jan 2025: A leading glass packaging company launched a new internal coated vial platform to improve chemical resistance and enhance stability for sensitive injectable drugs and biologics.

- Jan 2025: A major packaging solutions provider introduced a fiber based cold chain pharmaceutical shipper designed to replace EPS and support recyclable temperature controlled drug transportation.

Report Details

| Report Characteristics |

| Market Size (2025) |

USD 45.0 Bn |

| Forecast Value (2034) |

USD 163.4 Bn |

| CAGR (2025–2034) |

15.7% |

| Historical Data |

2019 – 2024 |

| Forecast Data |

2026 – 2034 |

| Base Year |

2024 |

| Estimate Year |

2025 |

| Report Coverage |

Market Revenue Estimation, Market Dynamics, Competitive Landscape, Growth Factors, etc. |

| Segments Covered |

By Packaging Type (Primary, Secondary, and Tertiary), By Material (Plastic & Polymer, Glass, Metals, Paper & Paperboard, and Other Material), By Drug Delivery Mode (Oral Drug Delivery Packaging, Injectable Packaging, Topical Drug Delivery Packaging, Pulmonary Drug Delivery Packaging, Transdermal Drug Delivery Packaging, Ocular Drug Delivery Packaging, Nasal Drug Delivery Packaging, Other Drug Delivery Mode), By Sustainability (Recyclable Packaging, Biodegradable Packaging, and Compostable Packaging), By End-user (Pharmaceutical Companies, Biopharmaceutical Companies, Contract Manufacturing Organizations (CMOs), and Contract Packaging Organizations (CPOs)) |

| Regional Coverage |

Europe – Germany, The UK, France, Russia, Spain, Italy, Benelux, Nordic, & Rest of Europe

|

| Prominent Players |

Gerresheimer AG, Amcor plc, Berry Global, Inc., AptarGroup, Inc., Schott AG, Stevanato Group S.p.A., West Pharmaceutical Services, Inc., Catalent, Inc., CCL Industries Inc., Constantia Flexibles, SGD Pharma, Nipro Corporation, Vetter Pharma-Fertigung GmbH & Co. KG, Bormioli Pharma S.p.A., Origin Pharma Packaging, Intrapac Group, and Others. |

| Purchase Options |

We have three licenses to opt for: Single User License (Limited to 1 user), Multi-User License (Up to 5 Users), and Corporate Use License (Unlimited User) along with free report customization equivalent to 0 analyst working days, 3 analysts working days, and 5 analysts working days respectively. |

Frequently Asked Questions

The Europe pharmaceutical packaging market size is estimated to have a value of USD 45.0 billion in 2025 and is expected to reach USD 163.4 billion by the end of 2034, with a CAGR of 15.7%.

Some of the major key players in the Europe pharmaceutical packaging market are Gerresheimer AG, Amcor plc, Berry Global, Inc., AptarGroup, Inc., Schott AG, Stevanato Group S.p.A., West Pharmaceutical Services, Inc., Catalent, Inc., CCL Industries Inc., Constantia Flexibles, SGD Pharma, Nipro Corporation, Vetter Pharma-Fertigung GmbH & Co. KG, Bormioli Pharma S.p.A., Origin Pharma Packaging, Intrapac Group, and Others.