Market Overview

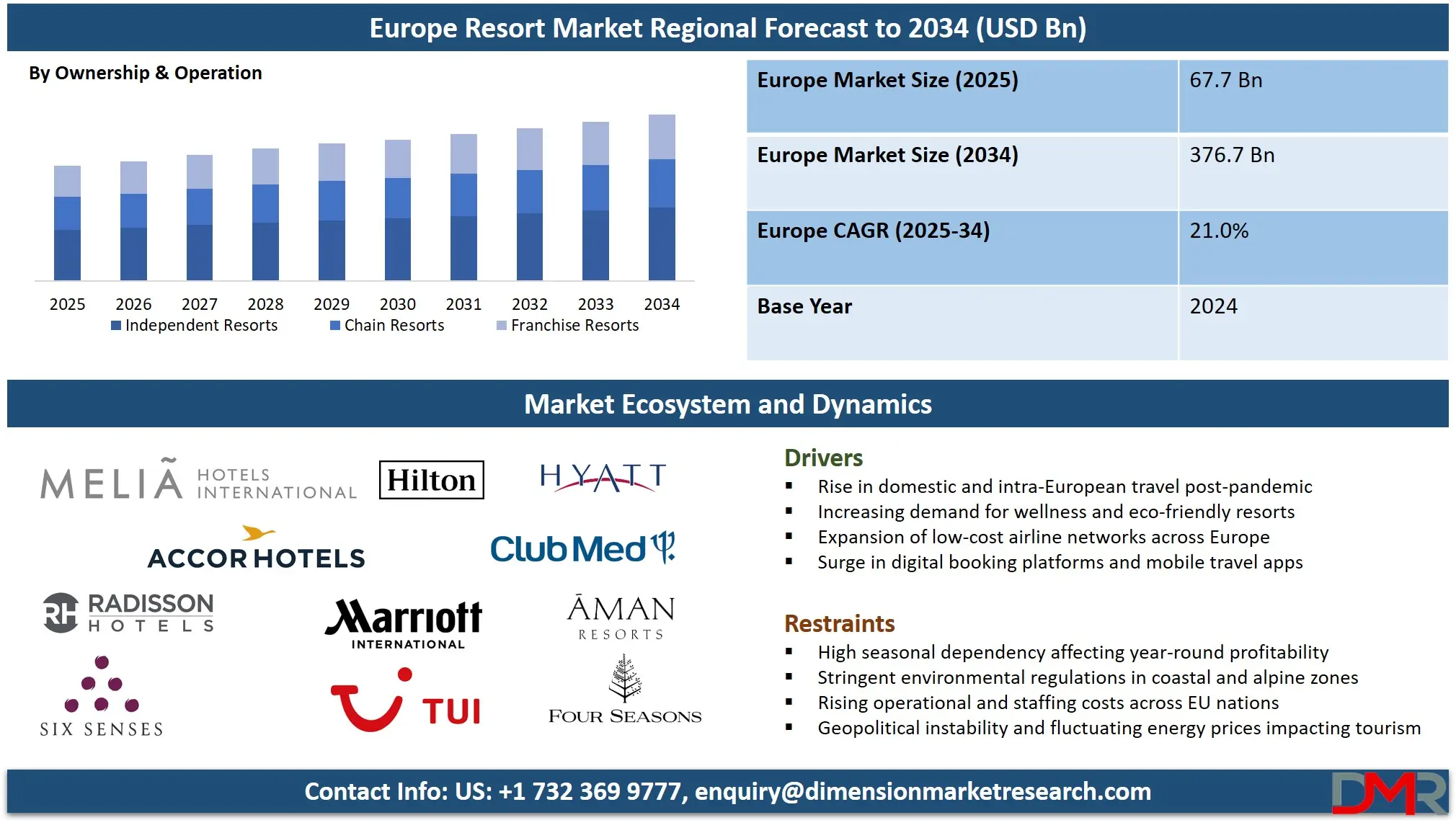

The European Resort Market is projected to reach

USD 67.7 billion in 2025 and grow at a compound annual growth rate of

21.0% from there until 2034 to reach a value of

USD 376.7 billion.

The European resort market is experiencing notable growth, driven by rising demand for experiential travel, wellness tourism, and eco-friendly accommodations. The market growth is propelled by increasing domestic and international travel across popular regions such as Southern Europe, the Alps, and coastal destinations. Digitalization and the popularity of all-inclusive packages are reshaping traveler behavior, while niche resorts targeting wellness and sustainability are gaining traction. Social media influence and a rising preference for personalized luxury are also transforming resort design and services.

ℹ

To learn more about this report –

Download Your Free Sample Report Here

A prominent trend is the rise in wellness and spa resorts, fueled by post-pandemic health consciousness. Resorts offering integrated health experiences such as detox programs, meditation, and thermal spa treatments are drawing European and global tourists alike. Moreover, the integration of smart hospitality tech, including AI-driven booking engines and contactless services, is enhancing operational efficiency and guest satisfaction across resort chains.

Significant opportunities lie in the expansion of eco-resorts and green-certified accommodations. Tourists are increasingly prioritizing sustainability, pushing resort developers to invest in eco-friendly infrastructure, waste reduction systems, and renewable energy use. Countries like Germany, Austria, and the Nordic nations are leading this shift, offering potential for scalable eco-tourism ventures.

However, the market faces constraints such as rising operational costs, staff shortages, and regional over-tourism that strain local resources and infrastructure. Regulatory challenges regarding land use and environmental protection further limit rapid expansion in some regions. Additionally, fluctuating geopolitical conditions and inflationary pressures may impact consumer spending patterns.

Despite these challenges, the long-term outlook for the European resort market remains strong, driven by diversified offerings, supportive tourism policies, and sustained investment in infrastructure and digital transformation. Targeted development in underexploited destinations and off-season tourism can further fuel market expansion and enhance regional economic impact.

Europe Resort Market: Key Takeaways

- Market Size Insights: The Europe Resort Market size is estimated to have a value of USD 67.7 billion in 2025 and is expected to reach USD 376.7 billion by the end of 2034.

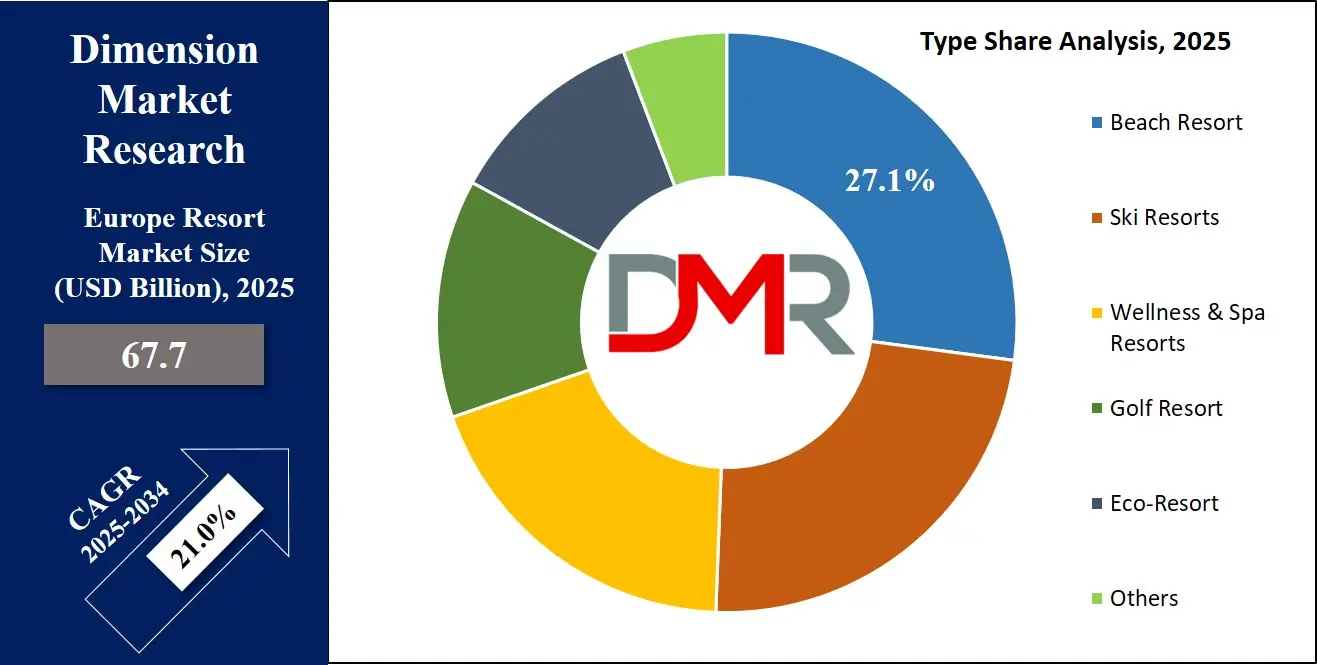

- By Type Segment Analysis: Beach resorts are expected to dominate the European resort market with highest market share by the end of 2025.

- By Ownership & Operation Segment Analysis: Independent resorts are poised to dominate this segment as they command the largest revenue share in 2025.

- Regional Insights: Some of the major key players in the European Resort Market are Club Med, TUI Group, Accor S.A., Melia Hotels International, Iberostar Group, Belmond Ltd., Kempinski Hotels, Four Seasons, Marriott International, Hilton Worldwide, Radisson Hotel Group, and many others.

- Market Growth Rate Insights: The market is growing at a CAGR of 21.0 percent over the forecasted period of 2025.

Europe Resort Market: Use Cases

- Wellness & Spa Retreats in the Alps: Luxury resorts in Austria and Switzerland are attracting affluent tourists seeking wellness therapies, thermal spas, and altitude recovery. These resorts combine natural surroundings with medical-grade health services, making them popular among health-conscious travelers and older tourists recovering from illness or stress.

- Eco-Resorts in Scandinavia: Resorts in Norway and Sweden are capitalizing on sustainable tourism by offering off-grid cabins, zero-emission accommodations, and immersive nature experiences. These eco-resorts appeal to millennials and Gen Z travelers who prioritize environmental impact and are willing to pay a premium for ethical stays.

- Ski Resorts for Winter Sports Tourism: France, Italy, and Austria dominate the winter sports resort segment, with ski resorts offering bundled services including accommodation, lift passes, rentals, and après-ski entertainment. These resorts benefit from both family tourism and international ski enthusiasts, especially during peak season months.

- Golf Resorts for Leisure and Corporate Retreats: Portugal and Spain are leveraging their sunny climates to host golf-centric resorts that double as corporate getaway destinations. These facilities offer integrated experiences with luxury villas, business amenities, and championship-level courses, making them ideal for executive teams and high-net-worth individuals.

- Family-Friendly Beach Resorts in Southern Europe: All-inclusive beach resorts in Greece, Spain, and Italy provide family-oriented packages with kids' clubs, entertainment, and water sports. These resorts are favored by European families for school holiday breaks and offer stable year-over-year occupancy rates due to repeat bookings and family-centric marketing.

Europe Resort Market: Stats & Facts

European Commission & Eurostat

- Tourism in the European Union contributes nearly 10% to the region's total GDP, showcasing its critical role in supporting the economic structure of Member States. It also sustains around 23 million jobs, directly and indirectly, across various service and resort-related industries.

- Approximately 87% of overnight tourist stays in the EU are by EU residents themselves, reflecting a strong preference for domestic and intra-regional travel, which boosts local resort economies.

- The EU tourism ecosystem includes roughly 3.4 million businesses, most of which are small and medium enterprises (SMEs), employing around 15.2 million people, making tourism a cornerstone of the EU's non-financial business economy.

- In 2019, tourists in the EU booked over 554 million overnight stays through online collaborative platforms such as Airbnb, Booking.com, Expedia, and Tripadvisor. This shows the growing reliance on digital booking for resorts and vacation stays.

EU Blue Economy Observatory

- Coastal and maritime tourism has become the single largest sector within the EU Blue Economy, generating the highest gross value added (GVA) and employment figures among marine-related industries.

- In 2021, the coastal tourism sector in the EU recorded a turnover of €140 billion, representing a fourfold increase in profits compared to 2020, which demonstrates a strong post-pandemic recovery for beach and island resorts.

- Spain accounted for the largest share of jobs in coastal tourism with 22%, followed by Greece at 19%, France at 13%, and Italy with 9%, emphasizing the significance of Southern Europe’s resort infrastructure.

- The accommodation subsector within coastal tourism employed about 848,000 individuals, comprising 44% of the workforce in this space, reaffirming the importance of hotels and resorts in the job market.

European Travel Commission (ETC)

- According to the ETC’s 2024 travel behavior report, 19.4% of European travelers preferred sun and beach vacations as their top leisure choice, followed closely by nature-focused and city trips.

- On average, European travelers spend €1,629 per sun and beach trip, which is higher than the €1,547 average spent on other vacation types. These tourists also tend to stay longer, 11.2 nights versus 10.5 nights for other holiday types, indicating higher resort revenue per visit.

- The all-inclusive resort segment remains the most popular among European beach travelers due to its convenience, value, and stress-free vacation experience.

- UK, German, and Dutch tourists show the strongest inclination toward resort destinations, with 66%, 64%, and 55%, respectively, preferring holidays focused on beach and leisure activities.

Eurobarometer (European Commission Surveys)

- When selecting travel destinations, 44% of Europeans consider cultural attractions, 43% look for natural environments, and 43% prioritize affordability, all of which are major elements influencing resort selection.

- A significant portion (31%) of travelers use online platforms to find and book accommodations, while 25% use digital services that combine accommodations with transport, indicating a tech-savvy approach to resort booking.

- About 82% of EU citizens are open to adopting sustainable travel habits, such as consuming local products (55%) and opting for eco-friendly transport (36%), pushing resorts to implement more sustainable and local experiences.

Data. Europa.eu (EU Open Data Platform)

- In 2022, nearly 230 million European residents engaged in at least one leisure or tourism trip, highlighting the vast potential for resort-based holidays.

- 24.5% of EU trips in the same year were international, with the majority of these being intra-EU trips, meaning European resorts were the primary destinations even for outbound travelers.

- Italy emerged as the top foreign destination for EU tourists, attracting 11.3% of all foreign leisure trips, followed closely by Spain with 11%, underlining the dominance of these countries in the resort market.

European Structural and Investment Funds (ESIF)

- Tourism remains vital in remote regions, particularly on islands and in less developed territories, where it represents the primary source of income and job creation, reinforcing the importance of small resort clusters in rural economies.

- In nations like Greece, Spain, Portugal, Italy, Austria, Slovenia, Hungary, Bulgaria, Sweden, and Estonia, the tourism sector contributes more than 10% to GDP, with even higher percentages in specific resort-heavy regions.

Europe Resort Market: Market Dynamics

Driving Factors in the European Resort Market

Expansion of Intra-European and Domestic Travel

The growing emphasis on local and regional tourism within Europe is significantly fueling the resort market. Amid geopolitical uncertainties and post-pandemic travel caution, European travelers are increasingly choosing destinations within the EU. According to Eurostat, nearly 87% of EU tourist nights are spent by EU residents, which bodes well for resorts catering to domestic and nearby foreign guests. This surge in intra-European travel is also enhanced by affordable rail networks, budget airlines, and open-border policies like the Schengen Agreement.

Additionally, the European Travel Commission has noted a steady rise in “second-city” travel where tourists avoid over-touristed capitals in favor of quieter destinations such as Slovenia’s Lake Bled or Portugal’s Algarve region spurring growth in regional resort hubs. Governments are also incentivizing domestic tourism through tax rebates and infrastructure upgrades. As EU consumers prioritize safety, sustainability, and cost-effectiveness, resorts in emerging destinations with easy rail or road access are experiencing heightened demand.

Increased Affordability and Diversification of Resort Options

The proliferation of resort categories ranging from luxury eco-lodges to budget-friendly holiday villages is making resort vacations more accessible to a broader range of income groups. Countries like Greece, Spain, and Croatia are capitalizing on this trend by offering tiered resort products: beachfront luxury villas, mid-scale family resorts, and youth hostels with resort-like amenities. This segmentation allows resorts to target varied customer personas, including families, digital nomads, seniors, and young couples. In addition, the availability of flexible booking models, installment payments, and dynamic pricing has improved affordability.

Popular platforms like Booking.com and Airbnb now list bundled resort packages, enabling price comparisons and better value extraction. Moreover, integrated resort offerings such as wellness programs, childcare, and local tours allow guests to optimize the cost per experience. The net effect is a widened consumer base and improved occupancy rates across seasons. As economic volatility persists, diversified resort pricing strategies remain a powerful lever to maintain demand across demographics.

Restraints in the European Resort Market

Over-Tourism and Environmental Degradation in Key Resort Destinations

While tourism is economically vital, over-tourism in high-density resort zones like the Amalfi Coast, Santorini, and Barcelona is triggering environmental and social backlash. Fragile ecosystems, such as Mediterranean beaches and alpine regions, face increasing strain due to infrastructure overuse, pollution, and uncontrolled construction. For instance, massive cruise ship arrivals and short-stay tourist influxes overwhelm small towns, leading to water shortages, waste management crises, and habitat disruption. Local residents often protest the commercial transformation of their communities, which contributes to regulatory tightening and anti-tourism sentiment. In response, city councils and regional governments are imposing caps on visitor numbers, regulating short-term rentals, and introducing tourist taxes.

For resorts, this translates into stricter zoning laws, higher operational costs, and potential limitations on future expansion. Moreover, the perception of "overtouristed" locations can deter high-value travelers who seek exclusivity and tranquility. Resorts must now balance guest volume with sustainability goals, requiring investment in waste reduction, eco-design, and community integration. Failure to address these pressures could erode long-term viability. As public awareness and activism around environmental issues intensify, resort operators must adapt to a more conscious traveler base and stricter governance models that prioritize preservation over unchecked growth.

Rising Operational Costs and Labor Shortages

The post-pandemic recovery in Europe’s resort industry has been accompanied by sharp increases in operational costs and significant labor shortages. Energy prices have surged due to geopolitical tensions, particularly the Russia-Ukraine conflict, leading to higher electricity, heating, and transportation costs across the continent. Additionally, inflation has driven up the prices of food, linens, cleaning supplies, and essential maintenance services, raising the cost of delivering high-quality resort experiences. Simultaneously, many hospitality workers left the industry during the COVID-19 downturn and have not returned due to better opportunities elsewhere, lower perceived job security, or poor working conditions.

As a result, resorts are struggling to maintain service standards while operating with reduced staffing. This shortage is especially acute in remote or seasonal destinations where housing for staff is limited. Moreover, stricter immigration rules post-Brexit and evolving labor regulations across EU nations further complicate international staffing solutions. These twin pressures, higher expenses and reduced workforce availability, squeeze profit margins and jeopardize customer satisfaction. Resorts must now invest more heavily in staff recruitment, training, and retention while adopting automation to streamline operations. Without targeted interventions and industry-wide reforms, rising costs and labor issues could severely constrain the sector’s capacity to scale and innovate.

Opportunities in the European Resort Market

Senior Tourism and Medical Wellness Retreats

Europe's aging population is creating a burgeoning demand for senior-focused resort experiences. As life expectancy rises and retirement ages become more flexible, older adults are increasingly spending time and money on leisure, wellness, and recuperative travel. Resorts across Southern Europe, particularly in Spain, Portugal, and Italy, are tailoring offerings to meet this demographic’s specific needs, including mobility-friendly infrastructure, therapeutic spa services, and medical tourism add-ons like physiotherapy, diagnostics, and chronic illness management. The combination of leisure and low-impact healthcare creates an ideal environment for extended stays, with average durations far exceeding those of younger tourists.

Governments in countries such as Hungary and Poland are promoting thermal spa resorts that offer both relaxation and medical treatments, targeting domestic and cross-border patients. These resorts often partner with insurance providers or public health agencies, further supporting affordability and access. Moreover, digital nomad visas and long-stay residency permits offered by several EU countries open the door for “silver nomads” who split time between their home countries and resort-based accommodations. This emerging segment, fueled by stable pensions and higher health consciousness, provides a resilient and growing revenue stream for resort operators who can cater to wellness, rehabilitation, and active-aging needs.

Off-Season and Year-Round Resort Utilization

One of the untapped opportunities in the European resort market lies in expanding resort usage beyond traditional summer peaks. To combat seasonality, resorts are increasingly offering off-season incentives and diverse programming aimed at attracting travelers year-round. For example, ski resorts in the Alps and Pyrenees are promoting summer hiking, wellness retreats, and cultural festivals during snow-free months. Coastal resorts are pivoting toward digital detox programs, health boot camps, and corporate offsites during spring and autumn. Meanwhile, wellness resorts are extending their offerings with mindfulness workshops, yoga retreats, and detox packages that attract solo travelers and groups throughout the year.

The growing remote work culture has further enabled “shoulder season” travel, with tourists opting for longer, less crowded, and more affordable stays. Additionally, the climate crisis is pushing tourists to avoid extremely hot months, redistributing demand into cooler parts of the year. Resorts that build year-round appeal not only stabilize revenues but also optimize staffing, infrastructure, and marketing efficiency. Governments and tourism boards are also supporting this shift through seasonal flight subsidies, event sponsorships, and targeted promotions. Developing all-season appeal allows resorts to reduce economic vulnerability and tap into new consumer behaviors tied to wellness, flexibility, and experience-based travel.

Trends in the European Resort Market

Shift Towards Wellness and Sustainable Resorts

Across Europe, there is a marked consumer shift toward wellness-focused and eco-conscious resorts, driven by rising health awareness and climate-conscious travel behaviors. Wellness resorts, offering experiences like yoga retreats, spa therapies, and organic nutrition, are booming in countries like Austria, Slovenia, and Italy. Simultaneously, sustainability certifications such as Green Globe and EU Ecolabel are becoming pivotal in influencing travelers’ resort choices.

Tourists, especially Millennials and Gen Z, are placing increasing value on resorts that integrate green energy, water conservation, plastic reduction, and support for local communities. This trend aligns with the EU’s Green Deal agenda, which indirectly pressures resort operators to adopt climate-resilient business models. Operators that incorporate biophilic design, carbon-neutral infrastructure, and responsible sourcing are gaining competitive advantages. As sustainable tourism receives both regulatory and consumer push, resorts that integrate these elements are likely to see higher occupancy rates and brand loyalty in the long term.

Rise of Digitized and Contactless Guest Experiences

The digital transformation of resort operations is gaining momentum across Europe. Contactless check-in/check-out, mobile room keys, AI-powered concierge services, and personalized digital itineraries are becoming standard features in premium and mid-range resorts. These advancements were accelerated by the COVID-19 pandemic and now reflect permanent guest preferences for hygienic, efficient, and customized service.

For instance, ski resorts in Switzerland and wellness resorts in Germany have started using AI chatbots, QR-based menus, and dynamic pricing algorithms to enhance guest engagement. These smart systems not only improve operational efficiency but also collect behavioral data that resorts use to personalize offers and improve guest satisfaction. Integration with OTA platforms, CRM systems, and real-time feedback apps further creates a seamless guest journey. As digital-savvy tourists become the norm, resorts investing in tech-driven infrastructure will attract higher-value travelers and improve profitability via upselling, loyalty programs, and data-informed marketing strategies.

Europe Resort Market: Research Scope and Analysis

By Type Analysis

Beach resorts are projected to dominate the European resort market due to the continent’s extensive coastline, diverse climatic appeal, and deep-rooted beach tourism culture. Europe is home to globally renowned beach destinations like the French Riviera, Costa del Sol in Spain, Algarve in Portugal, and the Greek Islands, all of which attract millions of domestic and international tourists annually. These destinations offer a potent mix of sun, sand, and culture, which continues to drive high occupancy rates and repeat visitation. Additionally, the Mediterranean climate, with long summers and mild winters, supports extended beach seasons, especially in Southern Europe, giving beach resorts an operational edge over seasonal counterparts like ski resorts.

Beach tourism is further supported by strong infrastructural connectivity. Low-cost airlines and rail networks make it easy for travelers across the EU and the UK to access coastal destinations. Governments and regional tourism boards heavily promote coastal tourism, reinforcing beach resort visibility through marketing campaigns and infrastructure upgrades. The appeal of all-inclusive packages, water sports, seaside wellness offerings, and family-friendly amenities makes beach resorts attractive across age groups and income levels.

Moreover, beach resorts are increasingly modernizing with eco-tourism features, private beaches, and exclusive villas, catering to both budget travelers and luxury seekers. They also benefit from diversified revenue streams, bars, restaurants, and recreational activities, which enhance profitability. Their versatility in hosting weddings, events, and seasonal festivals adds to their dominance. Finally, climate change has increased the appeal of “shoulder season” coastal travel, further strengthening year-round viability. This combination of natural beauty, accessibility, affordability, and strategic development cements the dominance of beach resorts in Europe’s resort landscape.

ℹ

To learn more about this report –

Download Your Free Sample Report Here

By Ownership & Operation Analysis

Independent resorts are expected to dominate the European resort market because of the continent’s emphasis on regional identity, personalized experiences, and authenticity in travel. Unlike chain resorts that offer standardized services, independent resorts often deliver culturally immersive and bespoke guest experiences. These properties tend to reflect local architecture, cuisine, art, and hospitality traditions, qualities highly valued by European and global travelers seeking unique and memorable stays. With Europe’s fragmented tourism landscape spanning historic towns, remote countryside, and diverse coastlines independent resorts are well-positioned to cater to niche travel demands that chain resorts may overlook.

Furthermore, many independent resorts are family-owned or locally managed, allowing them to operate with greater flexibility in pricing, guest service customization, and sustainability practices. They can quickly adapt to local regulations, trends, and seasonal shifts without being bound by rigid corporate protocols. Independent resorts often collaborate with nearby artisans, culinary producers, and tour operators, integrating guests into the local economy and enhancing community-based tourism appeal.

Digitalization has significantly empowered independent resorts to compete with larger chains. Through Online Travel Agencies (OTAs), direct booking platforms, and social media marketing, small operators now access global audiences with cost-effective visibility. Moreover, travelers especially Millennials and Gen Z favor authenticity over luxury, and independent resorts fit that ethos by offering character-rich, story-driven environments.

Finally, the European regulatory and economic environment often supports small hospitality businesses through grants, tax breaks, and rural tourism incentives, making it easier for independent resorts to thrive. Their ability to deliver personalized service, maintain local character, and innovate freely gives them a clear competitive edge, securing their dominant position in the ownership and operation segment.

By Booking Channel Analysis

Online Travel Agencies (OTAs) are poised to dominate the booking channel segment of the European resort market due to their vast reach, user convenience, price comparison features, and mobile integration. Platforms like Booking.com, Expedia, and Agoda allow travelers to explore thousands of resort options with real-time availability, user reviews, dynamic pricing, and instant booking capabilities all in one place. Their ability to aggregate multiple properties ranging from luxury beachfront resorts to small countryside lodges makes them a one-stop solution for diverse customer preferences.

Europe’s highly digital-savvy population, widespread internet access, and growing reliance on smartphones have accelerated OTA adoption. Particularly among Millennials and Gen Z travelers, OTAs are the preferred choice for discovering and booking resort stays. These platforms also enable cross-border planning, language support, and currency conversion tools, making them indispensable for intra-European and international tourists. Moreover, OTAs frequently offer loyalty programs, exclusive deals, and bundling options with flights, rentals, and experiences, enhancing their value proposition.

Resorts especially independent ones also benefit from OTAs' global marketing capabilities and visibility without having to invest heavily in standalone advertising. OTAs bring higher occupancy during off-peak seasons and broaden the customer base beyond traditional markets. Additionally, OTAs offer resorts insights through data analytics and customer reviews, helping them improve service delivery and adjust pricing dynamically.

The dominance of OTAs is further reinforced by their integration with metasearch engines (e.g., Google Travel, Trivago), voice search, and AI-driven recommendation engines, keeping them aligned with technological trends. In a travel environment increasingly shaped by convenience and transparency, OTAs continue to be the dominant booking channel in Europe’s resort market.

The Europe Resort Market Report is segmented on the basis of the following:

By Type

- Beach Resort

- Ski Resorts

- Wellness & Spa Resorts

- Golf Resort

- Eco-Resort

- Others

By Ownership & Operation

- Independent Resorts

- Chain Resorts

- Franchise Resorts

By Booking Channel

- Online Travel Agencies (OTAs)

- Direct Booking

- Travel Agents and Tour Operators

- Corporate/Group Booking

By Region

Europe

- Germany

- The U.K.

- France

- Italy

- Russia

- Spain

- Benelux

- Nordic

- Rest of Europe

ℹ

To learn more about this report –

Download Your Free Sample Report Here

Europe Resort Market: Competitive Landscape

The competitive landscape of the Europe Resort Market is highly fragmented, with a mix of international chains, regional brands, and independent resorts operating across diverse geographies and service categories. Global hospitality giants such as Marriott International, AccorHotels, Hilton Worldwide, and IHG have a strong presence in key tourist hubs including the French Riviera, Spanish coasts, Greek Islands, and the Italian seaside. These players offer premium experiences through branded resorts like Ritz-Carlton, Sofitel, and Conrad, catering primarily to affluent travelers and business tourists.

On the other hand, independent resorts and boutique properties dominate rural, wellness, and eco-tourism destinations, especially in Central and Eastern Europe, capitalizing on authenticity and personalized services. Many of these resorts are family-owned and thrive on cultural immersion, local cuisine, and heritage experiences. Increasingly, hotel technology platforms like Cloudbeds and SiteMinder are leveling the playing field by enabling small resorts to reach a global audience through integration with OTAs.

Sustainability and digital transformation are emerging as key competitive differentiators. Resorts that integrate eco-friendly infrastructure, smart room automation, and contactless services are gaining a market edge. Furthermore, loyalty programs, exclusive wellness packages, and strategic partnerships with travel agencies are central to maintaining repeat customer engagement and boosting market share in this dynamic and evolving European hospitality landscape.

Some of the prominent players in the European Resort Market are:

- Club Med

- TUI Group

- Accor S.A.

- Melia Hotels International

- Iberostar Group

- Belmond Ltd.

- Kempinski Hotels

- Four Seasons Hotels and Resorts

- Marriott International

- Hilton Worldwide

- Radisson Hotel Group

- Hyatt Hotels Corporation

- Barcelo Hotel Group

- Rixos Hotels

- Sani/Ikos Group

- Pierre & Vacances Center Parcs

- Aman Resorts

- Six Senses Hotels Resorts Spas

- Der Touristik Group

- LUX Resorts & Hotels

- Other Key Players

Recent Developments in the European Resort Market

- May 2025: Parkdean Resorts, a major UK-based holiday park operator, announced a fundraising initiative to raise £250 million. This capital is intended to support the company’s expansion plans and benefit from the increasing popularity of staycations across the UK and mainland Europe.

- April 2025: Ireland’s commercial property sector witnessed a surge in investor interest. Marlet, a leading Irish property developer, moved to finalize bids for a €120 million retail park portfolio. Meanwhile, hotel group Dalata was reported to be attracting major private equity firms, with potential bids estimated at around €1.6 billion.

- December 2024: Goldair, through its subsidiary Sunrise Properties, purchased the five-star Mykonos Flow Hotel located at Super Paradise beach for €12 million. This acquisition is part of a broader strategy to expand the company’s presence in premium hospitality locations across Greece.

- November 2024: Hotel Investment Partners (HIP), backed by Blackstone, added the Alexander the Great Beach Hotel in Halkidiki, Greece, to its portfolio. This move reflects ongoing efforts by large investment firms to strengthen their foothold in the Mediterranean resort market.

- October 2024: Prominent shipowner George Prokopiou acquired a 33.75% stake in Apollo Investment Holdco SA, owner of the luxury Four Seasons Astir Palace in Greece, for €150 million.

- Karatzi Group confirmed its acquisition of the five-star Aldemar Knossos Royal in Crete for €80 million, with plans to renovate and relaunch the property by 2026.

- August 2024: Premia Properties announced the planned acquisition of two resort hotels in Greece from Nordic Leisure Travel Group. This step supports its goal of deepening its footprint in leisure hospitality.

- July 2024: Mohari Hospitality and Omnam Group purchased the historic Bauer Hotel in Venice for €300 million. An additional €150 million will be invested to renovate and rebrand the property under the Rosewood Hotel brand, signifying Venice’s luxury resort revival.

- June 2024: Tourism and leisure M&A activity in Europe reached $6.9 billion for Q2 2024, with 47 deals announced. The largest of these was Liberty Media’s acquisition of Dorna Sports for $5.3 billion, underscoring a broader investment trend in experiential and event-based tourism.

- May 2024: Stonebridge Companies, a major US-based hotel operator, completed the acquisition of Real Hospitality Group. This added 160 hotels and 24,000 rooms to its portfolio, further strengthening cross-border hospitality ownership models.

- April 2024: Savills reported a marked increase in investment volumes for European hotels compared to 2023, as more institutional investors returned to the market, encouraged by higher yields and long-term tourism recovery.

- March 2024: Haven Holidays acquired Holivans Caravan Park in Mablethorpe, Lincolnshire. This acquisition reflects the trend toward consolidation in the UK’s holiday park sector, aiming to offer more amenities and modern facilities.

Report Details

| Report Characteristics |

| Market Size (2025) |

USD 67.7 Bn |

| Forecast Value (2034) |

USD 376.7 Bn |

| CAGR (2025–2034) |

21.0% |

| Historical Data |

2019 – 2024 |

| Forecast Data |

2025 – 2033 |

| Base Year |

2024 |

| Estimate Year |

2025 |

| Report Coverage |

Market Revenue Estimation, Market Dynamics, Competitive Landscape, Growth Factors, etc. |

| Segments Covered |

By Type (Beach Resorts, Ski Resorts, Wellness & Spa Resorts, Golf Resorts, Eco-Resorts, Others), By Ownership & Operation (Independent Resorts, Chain Resorts, Franchise Resorts), By Booking Channel (Online Travel Agencies (OTAs), Direct Booking, Travel Agents and Tour Operators, Corporate/Group Booking) |

| Regional Coverage |

North America – US, Canada;

Europe – Germany, UK, France, Russia, Spain, Italy, Benelux, Nordic, Rest of Europe;

Asia-Pacific – China, Japan, South Korea, India, ANZ, ASEAN, Rest of APAC;

Latin America – Brazil, Mexico, Argentina, Colombia, Rest of Latin America;

Middle East & Africa – Saudi Arabia, UAE, South Africa, Turkey, Egypt, Israel, Rest of MEA

|

| Prominent Players |

Club Med, TUI Group, Accor S.A., Melia Hotels International, Iberostar Group, Belmond Ltd., Kempinski Hotels, Four Seasons, Marriott International, Hilton Worldwide, Radisson Hotel Group, Hyatt Hotels, Barcelo Group, Rixos Hotels, Sani/Ikos Group, Pierre & Vacances, Aman Resorts, Six Senses, Der Touristik Group, LUX Resorts, and Other Key Players |

| Purchase Options |

We have three licenses to opt for: Single User License (Limited to 1 user),

Multi-User License (Up to 5 Users), and

Corporate Use License (Unlimited User) along with free report customization equivalent to

0 analyst working days, 3 analysts working days, and 5 analysts working days respectively.

|

Frequently Asked Questions

How big is the European Resort Market?

▾ The Europe Resort Market size is estimated to have a value of USD 67.7 billion in 2025 and is expected to reach USD 376.7 billion by the end of 2034.

Who are the key players in the European Resort Market?

▾ Some of the major key players in the European Resort Market are Club Med, TUI Group, Accor S.A., Melia Hotels International, Iberostar Group, Belmond Ltd., Kempinski Hotels, Four Seasons, Marriott International, Hilton Worldwide, Radisson Hotel Group, and many others.

What is the growth rate in the European Resort Market in 2025?

▾ The market is growing at a CAGR of 21.0 percent over the forecasted period of 2025.