Market Overview

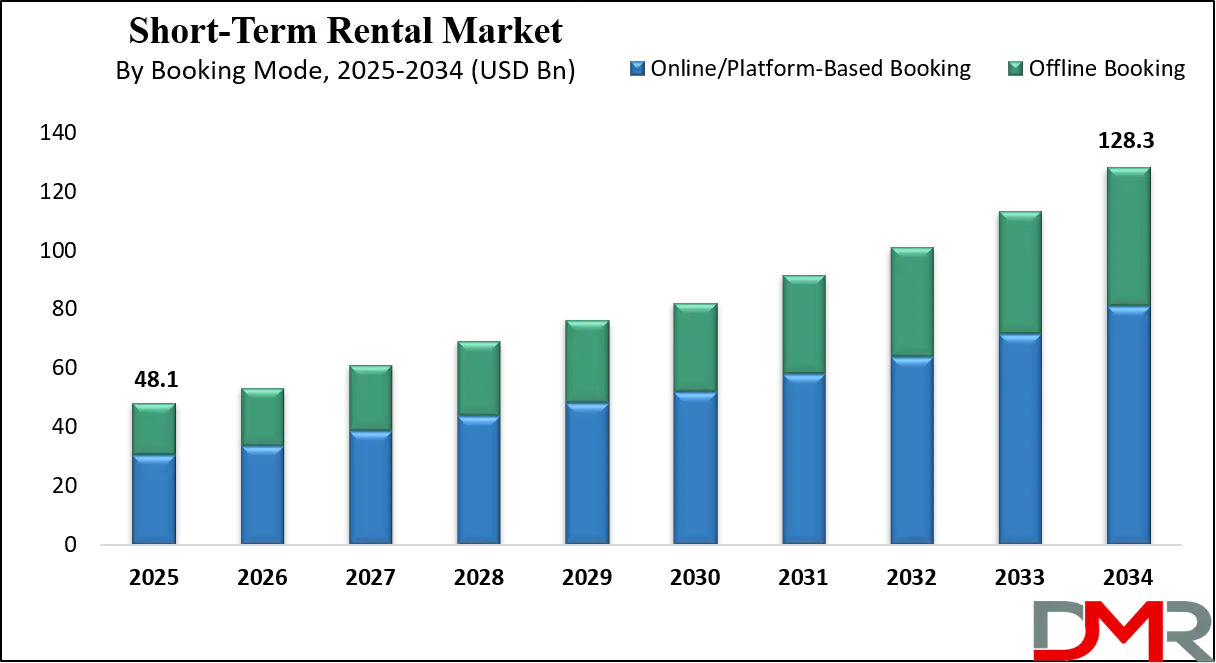

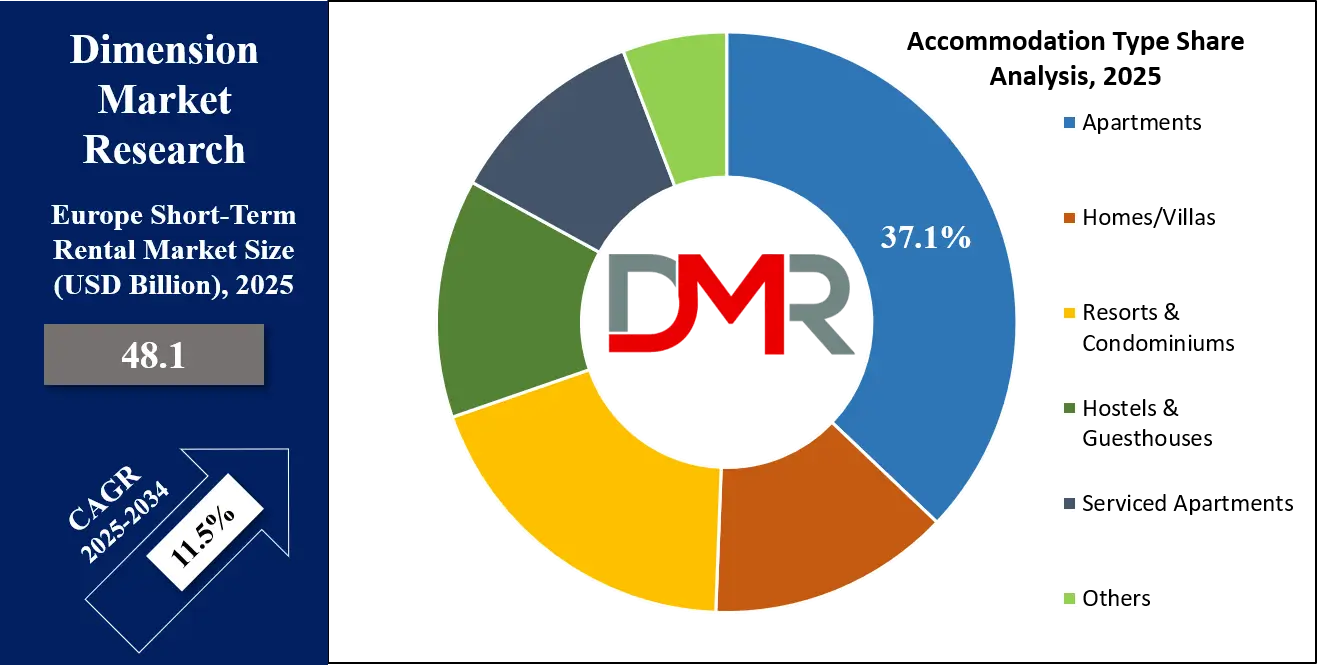

The Europe Short-Term Rental Market is projected to reach USD 48.1 billion in 2025 and is anticipated to expand at a robust CAGR of 11.5% from 2025 to 2034, attaining a market value of USD 129.3 billion by 2034. This strong growth trajectory is fueled by rising cross-border tourism, the surge in digital booking platforms such as Airbnb, Booking.com, and Vrbo, and the growing consumer preference for cost-effective, flexible, and experience-driven accommodations over traditional hotels.

Increasing adoption of smart property management systems, integration of AI-powered pricing and booking algorithms, and supportive regulatory frameworks across major European destinations such as France, Italy, Spain, and the U.K. are accelerating market penetration. Furthermore, the post-pandemic recovery in travel, coupled with the expanding trend of remote work and long-stay rentals, continues to reshape the European short-term rental landscape, positioning the region as a global leader in the vacation and temporary accommodation ecosystem.

ℹ

To learn more about this report –

Download Your Free Sample Report Here

The European short-term rental market is navigating a post-pandemic landscape characterized by robust consumer demand and increasing regulatory scrutiny. A pronounced trend is the shift in traveler preference away from crowded urban centers towards rural and secondary destinations. This dispersal is fueled by the normalization of remote work, allowing for extended "workations" and a deeper exploration of the countryside and coastal regions. This decentralization is reshaping the geographic distribution of rental income and stimulating investment in property management within previously underserved areas, promoting regional economic diversification beyond traditional tourist hotspots.

Significant opportunities are emerging in the professionalization of property management and the integration of sustainability. As the market matures, there is a growing bifurcation between professionally managed, high-quality listings and amateur offerings. This creates a fertile ground for property management companies and technology platforms that offer services like dynamic pricing, 24/7 guest support, and premium cleaning protocols. Concurrently, a burgeoning consumer consciousness around sustainable travel presents an opportunity for hosts to differentiate their properties through green certifications, energy-efficient appliances, and partnerships with local eco-tourism experiences, aligning profitability with planetary responsibility.

However, the industry's expansion is tempered by a complex and evolving regulatory environment. Major European cities and national governments are implementing stringent rules to address concerns over housing affordability, neighborhood disruption, and the impact on the traditional hotel sector. These regulations often include strict licensing schemes, caps on the number of rental days per year, and requirements for hosts to obtain permits. This regulatory patchwork across different municipalities creates operational uncertainty and compliance costs for hosts, potentially limiting the available inventory in the most sought-after urban markets.

ℹ

To learn more about this report –

Download Your Free Sample Report Here

Europe Short-Term Rental Market: Key Takeaways

- Strong Market Expansion: The Europe Short-Term Rental Market is projected to grow from USD 48.1 billion in 2025 to USD 128.3 billion by 2034, indicating strong and sustained regional demand for flexible accommodation options.

- Robust Growth Rate: The market is anticipated to register an impressive CAGR of 11.5% during 2025–2034, driven by the rising popularity of short-term stays among both leisure and business travelers.

- Tourism Recovery & Domestic Travel Surge: Post-pandemic recovery in tourism, coupled with increased domestic travel across countries such as France, Italy, Spain, and Germany, is fueling the expansion of the short-term rental ecosystem.

- Digitalization of Booking Platforms: Online platform-based bookings are projected to dominate the European market as digital transformation, mobile applications, and AI-driven dynamic pricing enhance consumer convenience and trust.

- Shift Toward Urban and Experiential Stays: Growing demand for apartments, villas, and serviced units in urban centers reflects a shift from traditional hotels to personalized, home-like experiences that cater to diverse traveler preferences.

- Technological Integration & Automation: The use of smart property management systems, IoT-enabled access, and automated check-in solutions is improving operational efficiency and guest satisfaction across the region.

- Competitive Landscape Led by Global Giants: Major players such as Airbnb, Booking.com, Vrbo, Expedia Group, Awaze, Sonder, Onefinestay, Vacasa, and Casago dominate the market, leveraging strong brand equity, digital ecosystems, and extensive property listings across Europe.

Europe Short-Term Rental Market: Use Cases

- Urban Cultural Immersion: Travelers eschew generic hotels for apartments in vibrant districts like Berlin's Kreuzberg or Barcelona's El Born. They seek authentic living experiences, using the rental as a base to explore local cafes, independent boutiques, and cultural sites, valuing the feeling of "living like a local" over standardized tourist accommodations and curated hotel concierge services.

- Rural Workation Retreats: Professionals leverage remote work policies to book month-long stays in countryside cottages in Tuscany or the Scottish Highlands. These guests require robust, high-speed internet and dedicated workspaces, combining productivity with access to nature and outdoor activities, representing a fundamental blurring of the lines between leisure travel, professional life, and temporary habitation.

- Extended Business Travel: Corporations and consultants utilize platforms for project-based relocations, finding furnished apartments more cost-effective and comfortable than extended hotel stays. These rentals offer kitchen facilities and separate living areas, enhancing employee well-being and productivity during lengthy assignments in cities like Frankfurt or Zurich, providing a home-like environment.

- Family Festival & Event Stays: During major events like Munich's Oktoberfest or the Edinburgh Festival Fringe, families and groups book entire homes to accommodate multiple people. This offers a communal, cost-effective alternative to booking multiple hotel rooms, providing shared living and cooking spaces that enhance the group travel experience and social dynamics.

- Accessible Tourism Stays: There is growing demand for rentals that cater to travelers with mobility or sensory impairments. Properties featuring step-free access, roll-in showers, and visual alert systems are increasingly listed, opening up travel opportunities and providing inclusive accommodation options that are often scarce in the traditional hotel sector across many European destinations.

Europe Short-Term Rental Market: Stats & Facts

Eurostat

- In 2022, nights spent at short-term rental accommodations in the EU increased by 58% compared to 2021.

- In 2023, Croatia had the highest share of nights spent in holiday rental accommodations (including short-term rentals) as a percentage of all tourist accommodations at over 35%.

- The number of online bookings for holiday accommodation in the EU has grown by over 200% in the last decade.

European Commission

- The collaborative economy, which includes short-term rentals, generated an estimated €28 billion in EU28 transactions in 2022.

- According to a Commission study, 1 in 10 Europeans has used an online platform to arrange accommodation.

European Central Bank (ECB)

- An analysis found that a 1% increase in Airbnb listings in German cities was associated with a 0.03% increase in rental prices.

- The share of short-term rentals in the total housing stock exceeds 3% in several popular European capital city centers.

Government of France (INSEE)

- In Paris, furnished tourist rentals represented approximately 5% of the total housing stock in the city center before the implementation of stricter registration rules.

- The number of secondary residences in France used for tourist rental has increased by 15% over the last five years.

Government of Spain (INE)

- In the Balearic Islands, tourist apartments account for over 20% of the total lodging capacity available.

- In 2023, Spain recorded over 60 million overnight stays in non-hotel tourist establishments, a category largely comprising short-term rentals.

- The number of properties listed for tourist use in Spain has increased by 40% since 2018.

Government of Italy (ISTAT)

- In 2023, non-hotel facilities in Italy, including short-term rentals, hosted over 100 million overnight stays.

- Cities like Florence and Venice have seen the number of licensed short-term rental properties increase by over 25% in the last three years.

Government of Portugal (INE)

- Local accommodation establishments (AL) in Portugal accounted for 18% of total tourist overnight stays in 2023.

- The number of AL registrations in Lisbon has decreased by 10% since the introduction of a licensing moratorium in certain parishes.

Government of the Netherlands (CBS)

- In Amsterdam, the number of homes available for short-term rental through platforms was estimated to be around 12,000 before the introduction of stricter regulations.

- The average price for a short-term rental in Amsterdam city center was 40% higher per night than a traditional hotel room in 2022.

Government of Ireland (CSO)

- In 2023, there were over 27,000 properties active on short-term rental platforms across Ireland.

- Short-term rentals accounted for an estimated 4.5% of the national housing stock in Dublin.

City of Berlin Senate Department for Urban Development

- Following the introduction of the Zweckentfremdungsverbot (Prohibition of Misappropriation) law, the number of illegal short-term rentals in Berlin decreased by over 80%.

City of Barcelona City Council

- Barcelona has removed over 3,000 illegal tourist apartments from the market since strengthening its enforcement unit in 2016.

- The city has capped the number of tourist apartment licenses at 10,000.

Scottish Government

- In Edinburgh, short-term rentals are estimated to represent over 7% of the total housing stock in the city center.

- A new licensing scheme for short-term rentals in Scotland received over 15,000 applications in its first year.

Europe Short-Term Rental Market: Market Dynamics

Driving Factors in the Europe Short-Term Rental Market

Persistent Consumer Demand for Authentic and Flexible Travel

The core engine of market growth remains a profound and sustained shift in traveler preferences. Modern tourists, particularly millennials and Gen Z, increasingly seek authentic, localized experiences over the standardized offerings of traditional hotels. Short-term rentals provide a gateway to residential neighborhoods, offer unique properties with character, and facilitate a "live like a local" ethos through features like fully-equipped kitchens and personal host recommendations.

This is compounded by the structural rise of flexible and remote work, which has unlocked demand for longer-term stays, or "workations," where travelers blend work and leisure for weeks or months. This demographic values the space, comfort, and cost-effectiveness of a rental for extended periods, directly fueling demand outside of traditional holiday patterns and driving growth in both urban and, increasingly, rural markets across Europe.

Technological Enablers and Platform Ecosystem Maturation

The expansion of the short-term rental market is intrinsically linked to the sophistication and accessibility of its underlying technology. User-friendly platforms have drastically lowered the barrier to entry for hosts while providing guests with a seamless booking, payment, and communication experience. Beyond the primary booking engines, a robust ecosystem of ancillary service providers has emerged, which acts as a significant growth driver.

This includes specialized software for automated pricing, channel management across multiple platforms, smart lock systems for self-check-in, and digital guest guides. These technologies reduce the operational friction and management burden for hosts, enabling them to scale their operations and improve efficiency. This technological maturation professionalizes the sector, enhances reliability for consumers, and makes hosting a more accessible and profitable venture, thereby expanding the overall market supply and quality.

Restraints in the Europe Short-Term Rental Market

Intensifying and Fragmented Regulatory Scrutiny

The most significant restraint on market growth is the escalating and often inconsistent regulatory landscape across Europe. Major cities like Paris, Barcelona, Amsterdam, and Berlin have implemented stringent measures, including caps on the number of annual rental days, mandatory host registration with strict enforcement, and outright bans on short-term rentals of entire apartments in central zones without a specific permit.

This regulatory patchwork creates a complex compliance burden for hosts operating across different jurisdictions, increasing operational costs and legal risks. The uncertainty surrounding potential future regulations also discourages investment in new properties. These rules are primarily designed to preserve long-term housing stock, mitigate tourist overcrowding, and protect neighborhood integrity, but they directly constrain the growth and operational flexibility of the short-term rental sector in its most profitable markets.

Economic Pressures and Market Saturation Concerns

The market is facing headwinds from broader macroeconomic conditions and signs of saturation in popular locales. Rising inflation, increased energy costs, and potential economic downturns can dampen discretionary travel spending, reducing demand for short-term rentals. Concurrently, hosts are facing increased operational costs for cleaning, maintenance, and utilities, squeezing profit margins.

In many top-tier destinations, the rapid growth in listings has led to market saturation, intensifying competition and forcing hosts to engage in aggressive price wars, which can be unsustainable. This saturation, combined with the high costs of acquisition through platform service fees and marketing, challenges the profitability of individual hosts, particularly smaller, non-professional operators, potentially leading to a shakeout and consolidation within the market.

Opportunities in the Europe Short-Term Rental Market

Strategic Expansion into Underserved Secondary and Rural Destinations

While major urban hubs face regulatory headwinds, significant growth potential exists in the dispersal of tourism to smaller cities, towns, and rural regions. The remote work revolution has permanently altered travel patterns, creating demand for longer stays in scenic, less-congested areas. This presents a prime opportunity for property owners and professional managers in these underserved locales to attract a new demographic of "digital nomads" and travelers seeking nature-based and cultural tourism.

Developing and marketing properties that cater to this demand with reliable high-speed internet, dedicated workspaces, and access to local experiences can capture a high-value market segment. This geographic diversification not only mitigates the risks associated with urban regulation but also promotes more sustainable tourism by distributing economic benefits more evenly across a country's regions.

Differentiation Through Sustainability and Experiential Stays

A powerful avenue for growth lies in transcending the basic accommodation model by integrating sustainability and curated experiences. A growing segment of environmentally conscious travelers actively seeks eco-friendly accommodations. Hosts can capitalize on this by obtaining green certifications, installing energy-efficient systems, utilizing sustainable materials, and offering waste-reduction options. This "green" positioning can command premium pricing and attract a loyal customer base.

Furthermore, bundling accommodations with unique, hyper-local experiences such as private cooking classes with a local chef, guided hiking tours, or artisan workshops creates a compelling value proposition. This shift from selling a room to providing a holistic, memorable travel experience fosters differentiation, increases average booking value, and builds a defensible competitive advantage in an increasingly crowded marketplace.

Trends in the Europe Short-Term Rental Market

Proliferation of Professionalized Hosting and Portfolio Management

The market is witnessing a decisive shift from individual, occasional hosts towards professional entities managing multiple properties. This trend is driven by the economic advantages of scale, which allow for sophisticated revenue management, standardized guest experiences, and streamlined operational logistics.

Professional managers leverage advanced software for dynamic pricing, which adjusts rental rates in real-time based on demand signals, local events, and competitor pricing. They also implement consistent quality control protocols, including professional photography, standardized amenity kits, and dedicated maintenance and cleaning services. This professionalization creates a more reliable and hotel-like experience for guests, increasing review scores and repeat business.

Regulatory Normalization and Data Sharing Mandates

A dominant and irreversible trend is the move by European municipalities and national governments to formalize the short-term rental sector through comprehensive legislation. This represents a shift from reactive measures to proactive, data-driven governance. Key regulatory tools include mandatory registration and licensing schemes, which require hosts to obtain a unique identifier from local authorities to legally operate.

Furthermore, there is a growing push for data-sharing agreements between rental platforms and government bodies, providing transparency on listing locations, occupancy rates, and host details. This enables authorities to enforce caps on rental days, ensure the collection of tourist taxes, and monitor the impact of STRs on housing availability.

Europe Short-Term Rental Market: Research Scope and Analysis

By Accommodation Type Analysis

Apartments are projected to be the dominant segment in the global short-term rental market, accounting for the largest share in 2024 and continuing to lead due to their versatility, affordability, and high demand among urban travelers and digital nomads. Travelers increasingly prefer apartments because they provide a cost-effective alternative to hotels, offering privacy, flexibility, and the convenience of fully furnished living spaces.

Apartments are especially attractive for short- to medium-term stays, accommodating both leisure and business travelers who seek home-like comfort with essential amenities. Major platforms such as Airbnb, Booking.com, and Vrbo host millions of apartment listings across metropolitan areas worldwide, providing easy access and broad geographic coverage. The scalable nature of apartments makes them highly appealing to property management companies, as they can optimize occupancy rates and revenue through dynamic pricing models and flexible inventory management.

Business travelers also prefer apartments for extended stays due to the availability of work-friendly spaces, while leisure travelers favor them for the ability to host family and friends comfortably. Rising trends in furnished rentals, digital nomadism, and urbanization are further strengthening apartments’ position as the go-to accommodation type.

Additionally, local governments and tourism authorities are gradually supporting regulated apartment rentals, which improves safety, compliance, and consumer trust. With these factors, apartments continue to dominate short-term rental portfolios and bookings, making them a critical driver of market growth, especially in urban centers and popular tourist destinations across Europe, North America, and the Asia-Pacific regions.

ℹ

To learn more about this report –

Download Your Free Sample Report Here

By Booking Mode Analysis

Online or platform-based bookings are expected to be the dominant mode in the global short-term rental market, accounting for over 80% of total reservations worldwide. This dominance is primarily driven by the rapid adoption of digital technologies, smartphone penetration, and the influence of major online platforms such as Airbnb, Booking.com, Expedia, and Vrbo, which provide travelers with instant access to a wide variety of properties, real-time availability, and competitive pricing.

Online platforms have revolutionized the short-term rental experience by offering secure payment gateways, user reviews, transparent policies, and instant booking confirmation, all of which increase traveler confidence and convenience. Artificial intelligence, predictive analytics, and algorithm-driven recommendations enhance the personalization of search results, while digital tools like virtual property tours and automated customer support improve decision-making and satisfaction. The post-pandemic travel environment has accelerated this trend, with travelers now accustomed to online-first booking practices across both leisure and business segments.

Moreover, online booking platforms allow hosts to manage their properties efficiently, implement dynamic pricing, and maximize occupancy, creating a mutually beneficial ecosystem for guests and property owners alike. Offline bookings, though still present through direct reservations or travel agencies, have seen a relative decline as consumers increasingly rely on digital platforms for convenience, speed, and transparency. Consequently, online or platform-based bookings remain the backbone of the short-term rental market, driving growth and shaping industry practices globally.

By End User Analysis

Leisure travelers are projected to be the largest end-user group in the global short-term rental market, accounting for more than 60% of total bookings, and their dominance is expected to continue through 2034. This trend is fueled by a growing global appetite for travel experiences that are more flexible, immersive, and personalized than traditional hotel stays.

Families, couples, and solo travelers increasingly prefer homes, villas, and apartments for the comfort, privacy, and convenience they offer, including fully equipped kitchens, living areas, and private amenities that enhance the travel experience. Seasonal tourism, festivals, local attractions, and event-driven travel maintain high occupancy rates for leisure-focused rentals throughout the year. Additionally, social media platforms, influencer marketing, and travel review communities influence destination choices and encourage experiential stays, further driving demand in this segment.

The rise of remote work and the popularity of “workations” also blur the lines between business and leisure travel, boosting bookings in leisure-oriented properties. Urban apartments, resorts, and serviced villas see significant traction among travelers seeking both short and extended stays. This segment’s growth is further supported by platforms like Airbnb, Booking.com, and Vrbo, which tailor listings, pricing, and recommendations to meet leisure travelers’ expectations. Overall, the leisure traveler segment remains the key driver of global short-term rental market growth, shaping property offerings, digital innovations, and marketing strategies to cater to this increasingly experience-driven audience.

The Europe Short-Term Rental Market Report is segmented on the basis of the following:

By Accommodation Type

- Apartments

- Homes/Villas

- Resorts & Condominiums

- Hostels & Guesthouses

- Serviced Apartments

- Others

By Booking Mode

- Online/Platform-Based Booking

- Vacation Rental Platforms

- Travel Aggregator Websites

- Property Management Platforms

- Offline Booking

- Direct Bookings (Walk-ins, Phone Reservations)

- Travel Agencies & Tour Operators

By End User

- Leisure Travelers

- Business Travelers

- Group Travelers

- Solo Travelers

Impact of Artificial Intelligence on the Europe Short-Term Rental Market

- Dynamic Pricing and Revenue Optimization: AI-driven pricing algorithms help property owners and rental platforms automatically adjust rental rates based on factors such as demand, seasonality, local events, competitor pricing, and booking trends. In Europe, this allows short-term rental operators to maximize revenue and occupancy rates, especially in high-demand cities like Paris, London, and Barcelona.

- Personalized Guest Experiences: AI enhances guest satisfaction by analyzing historical booking data, preferences, and online behavior to deliver tailored recommendations for properties, amenities, and services. European platforms like Airbnb and Booking.com use AI to suggest listings that match a traveler’s unique needs, whether for family vacations, solo trips, or business stays.

- Predictive Analytics for Market Insights: AI tools analyze large datasets to forecast market trends, occupancy patterns, and traveler behavior in Europe. This enables property managers and platforms to make informed investment and operational decisions, such as expanding inventory in cities with growing tourist inflows or adjusting offerings for emerging travel trends.

- Automated Customer Support and Operations: AI-powered chatbots and virtual assistants provide instant responses to guest inquiries, booking changes, and problem resolution, reducing reliance on human customer service teams. In Europe, where short-term rental demand is high across multiple languages and time zones, AI enhances operational efficiency, reduces response times, and improves the overall guest experience.

- Enhanced Fraud Detection and Security: AI algorithms detect suspicious bookings, payment fraud, and fake reviews by analyzing behavioral patterns and transaction data. This ensures safer transactions for both hosts and guests across European platforms, building trust and credibility.

By Region

Europe

- Germany

- The U.K.

- France

- Italy

- Russia

- Spain

- Benelux

- Nordic

- Rest of Europe

Europe Short-Term Rental Market: Competitive Landscape

The competitive landscape of the Europe Short-Term Rental Market is highly fragmented yet increasingly consolidated around a few dominant global platforms and a burgeoning ecosystem of specialized service providers. Airbnb remains the undisputed market leader, wielding immense brand recognition and a vast, diverse inventory that spans entire homes to unique stays.

However, it faces stiff competition from Booking Holdings, primarily through its Booking.com portal, which leverages its established credibility in the traditional hotel sector to offer a comprehensive travel booking ecosystem that seamlessly integrates short-term rentals. This duopoly is pressured by regional champions like Germany's Holidu, which aggregates listings with a focus on family-friendly filters and competitive pricing.

Beyond the booking platforms, the landscape is defined by the rise of professional property managers and property management companies (PMCs) who operate large portfolios, bringing hotel-grade professionalism to guest experiences and operational efficiency. These PMCs rely on a sophisticated B2B software ecosystem, including providers like Hostaway and Guesty, which offer tools for channel management, dynamic pricing, and automated guest communication. The competition is no longer just about listing volume; it is a multi-front battle centered on regulatory compliance, data analytics, professionalized service delivery, and capturing specific traveler niches like sustainable or long-term stays.

Some of the prominent players in the Europe Short-Term Rental Market are:

- Airbnb

- Booking.com

- Vrbo

- Expedia Group

- Awaze

- Sonder

- Onefinestay

- Vacasa

- Casago

- Plum Guide

- Xiaozhu

- Evolve

- TurnKey Vacation Rentals

- 9flats

- Guesty

- Jetstream

- Awning

- Tujia

- Qstay

- CanadaStays

- Other Key Players

Recent Developments in the Europe Short-Term Rental Market

2024

- May 2024: The European Commission initiated formal dialogues with several major short-term rental platforms and EU member states to ensure full compliance with the new Data Sharing Regulation (DSA) and forthcoming sector-specific rules, focusing on transparent data reporting.

- March 2024: Airbnb announced a significant platform update focused on enhanced guest and host verification tools and a new "Displayed Total Price" feature across the EU, aiming to build trust and ensure pricing transparency ahead of new consumer protection laws.

- February 2024: Booking Holdings reported a 17% year-on-year increase in its alternative accommodation revenue for the European market in its Q4 2023 earnings, highlighting continued strong demand and market share gains against competitors.

2023

- November 2023: The European Parliament formally adopted the new regulation on data collection and sharing relating to short-term accommodation rental services, creating a single, harmonized framework for data transparency across the entire EU to take effect in 2025.

- September 2023: Keyframe, a prominent European proptech investor, led a €15 million Series B funding round into Hosthub, a Spanish-Polish SaaS company providing connectivity and management software for short-term rental operators, signaling strong investor confidence in B2B enablers.

- June 2023: The Short Term Rental Expo (STRE) was held in London, featuring keynotes on regulatory compliance and yield management, with major participation from European PMCs and technology vendors like Guesty and Hostaway.

2022

- October 2022: Airbnb permanently integrated a "Flexible Search" tool for European long-term stays (28 days or more), directly capitalizing on the workation trend and solidifying its product-market fit for the digital nomad demographic.

- July 2022: The European Cities Alliance on Short-Term Holiday Rentals, a coalition of over 20 major cities including Paris, Barcelona, and Amsterdam, issued a joint statement calling for stricter EU-wide rules to regulate platforms and protect residential housing.

Report Details

| Report Characteristics |

| Market Size (2025) |

USD 48.1 Bn |

| Forecast Value (2034) |

USD 128.3 Bn |

| CAGR (2025–2034) |

11.5% |

| Historical Data |

2019 – 2024 |

| Forecast Data |

2026 – 2034 |

| Base Year |

2024 |

| Estimate Year |

2025 |

| Report Coverage |

Market Revenue Estimation, Market Dynamics, Competitive Landscape, Growth Factors, etc. |

| Segments Covered |

By Accommodation Type (Apartments, Homes/Villas¸ Resorts & Condominiums, Hostels & Guesthouses, Serviced Apartments, and Others), By Booking Mode (Online/Platform-Based Booking, and Offline Booking), By End User (Leisure Travelers, Business Travelers, Group Travelers, and Solo Travelers) |

| Regional Coverage |

Europe |

| Prominent Players |

Airbnb, Booking.com, Vrbo, Expedia Group, Awaze, Sonder, Onefinestay, Vacasa, Casago, Plum Guide, Xiaozhu, Evolve, TurnKey Vacation Rentals, 9flats, Guesty, Jetstream, Awning, Tujia, Qstay, and CanadaStays, and Other Key Players |

| Purchase Options |

We have three licenses to opt for: Single User License (Limited to 1 user), Multi-User License (Up to 5 Users), and Corporate Use License (Unlimited User) along with free report customization equivalent to 0 analyst working days, 3 analysts working days, and 5 analysts working days respectively. |

Frequently Asked Questions

How big is the Europe short-term Rental Market?

▾ The Europe Short-Term Rental Market size is estimated to have a value of USD 48.1 billion in 2025 and is expected to reach USD 128.3 billion by the end of 2034.

What is the growth rate in the Europe Short-Term Rental Market in 2025?

▾ The market is growing at a CAGR of 11.5 percent over the forecasted period of 2025.

The market is growing at a CAGR of 11.5 percent over the forecasted period of 2025.

▾ Some of the major key players in the Europe Short-Term Rental Market are Airbnb, Booking.com, Vrbo, Expedia Group, Awaze, Sonder, Onefinestay, Vacasa, Casago, and many others.