Market Overview

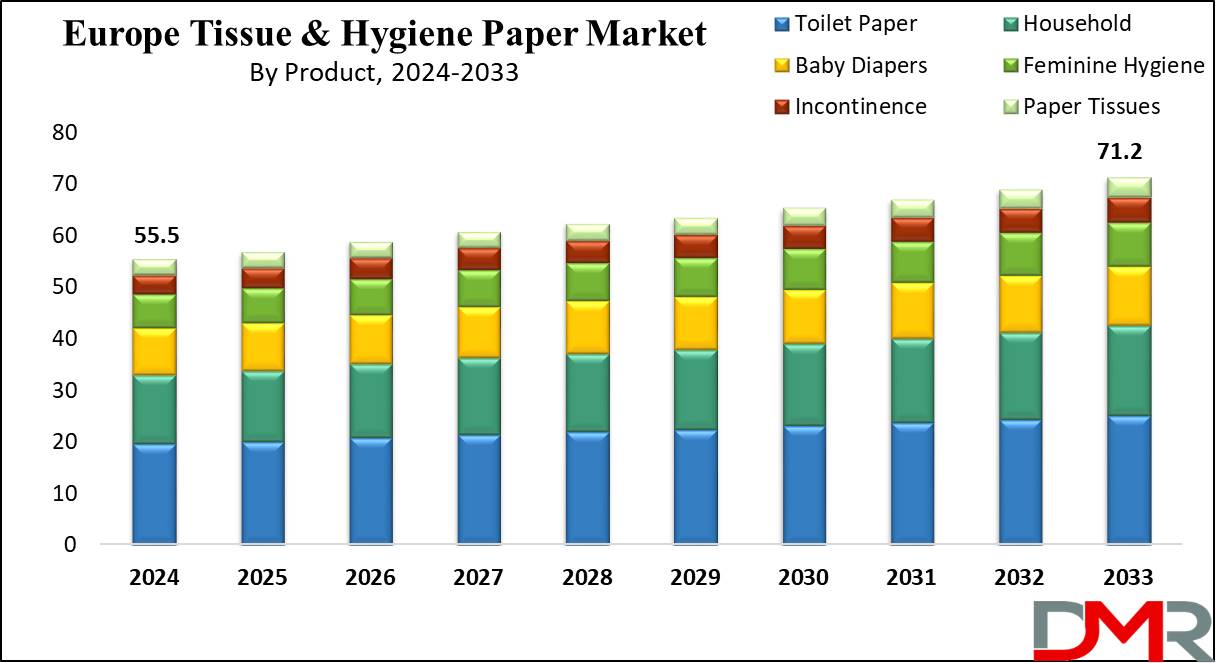

The Europe Tissue and Hygiene Paper Market is expected to reach a value of USD 55.5 billion by the end of 2024, and it is further anticipated to reach a market value of USD 71.2 billion by 2033 at a CAGR of 2.8%.

Tissue paper is developed using a mash of hardwood & softwood trees, water, and synthetic compounds. The methods for producing tissue paper like pulping and retting, adding color or components to build up or soften and enhance the water-holding limit, and finally, compressing the item to create the necessary shape.

As per Hotel Management International, the Europe Tissue and Hygiene Paper Market is a vital segment of the global tissue paper industry, contributing approximately 8.4 million tonnes annually, or nearly 24% of the world’s total estimated production of 35 million tonnes. The European Tissue Symposium (ETS), representing about 90% of Europe’s tissue paper producers, highlights key product categories including toilet tissue, household towels, facial tissue, handkerchiefs, industrial towels, and wipes. Western and Eastern Europe play a significant role in shaping industry trends, reflecting robust demand across commercial and consumer segments. This market remains central to Europe’s sustainability and economic goals.

The European tissue and hygiene paper industry is experiencing significant developments. Essity, a leading global hygiene and health company, has announced plans to acquire a 75% stake in Productos Familia S.A., a Colombia-based hygiene company, to strengthen its presence in Latin America. Additionally, the European Tissue Symposium (ETS) is organizing its annual conference in Brussels on March 15-16, 2025, focusing on sustainability and innovation in tissue products. These events highlight the industry's commitment to growth and environmental responsibility.

Key Takeaways

- The Europe Tissue and Hygiene Paper Market is expected to grow by 15.7 billion, at a CAGR of 2.8% during the forecasted period.

- By Product, the Toilet paper is expected to lead in 2024 & is anticipated to dominate throughout the forecasted period.

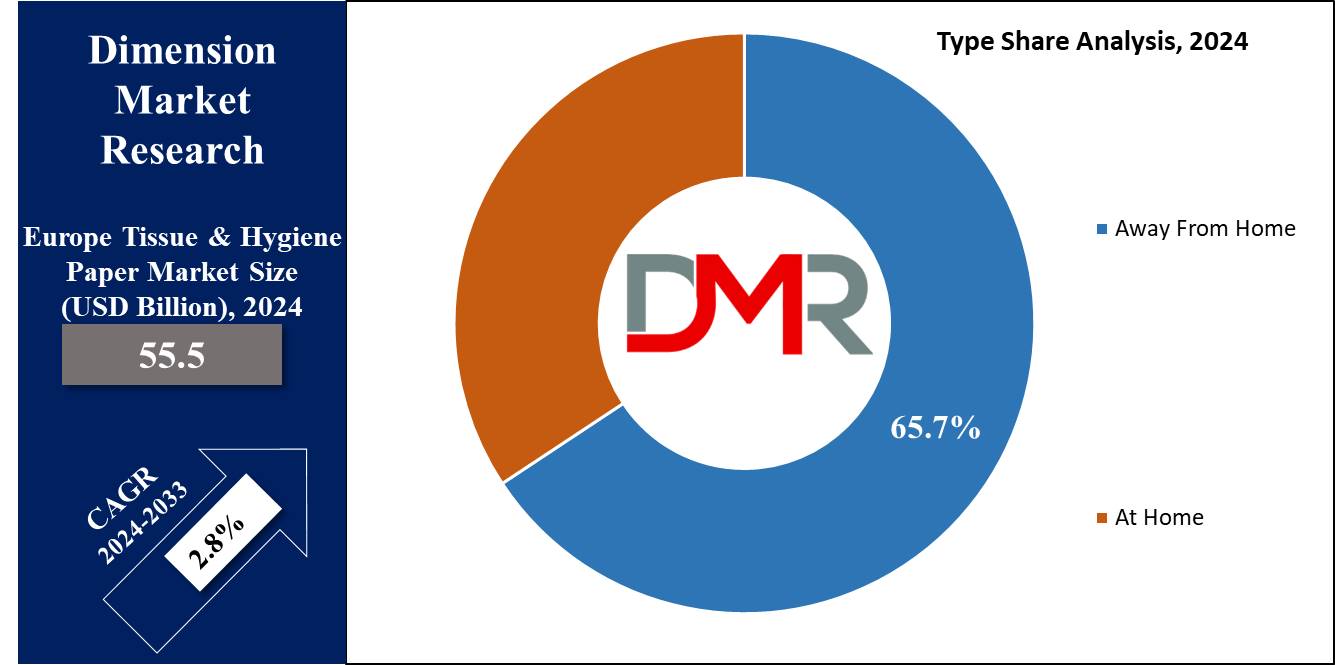

- By Type, Away from home type is anticipated to drive the growth of the fast fashion market.

- By Raw Material, recycled raw materials are predicted to be the dominant segment in the growth of the fast fashion market in Europe in 2024

- Some of the use cases of tissue and hygiene paper include personal hygiene, household cleaning, and more.

Use Cases:

- Personal Hygiene: Important for daily personal care routines, like wiping & cleaning in bathrooms and kitchens, providing convenience and cleanliness.

- Household Cleaning: Versatile for wiping spills, dusting surfaces, and cleaning windows, delivering disposable and hygienic solutions for effective household maintenance.

- Commercial & Industrial Use: Broadly used in businesses for cleaning surfaces, absorbing spills, and maintaining cleanliness standards, providing low-cost solutions for many industries.

- Healthcare & Medical: Essential in healthcare for patient care, infection control, and hygiene, tissue and hygiene products support Digital Health initiatives and work alongside Medical Devices to ensure safe, sterile environments for diagnostics, treatment, and home-based care.

Market Dynamic

The increase in awareness about hygiene is driving up spending on personal care items like paper napkins, towels, wipes, and toilet paper. In Western Europe, the average person uses more than 16 kg of tissue in a year, while in Eastern Europe, it's around 7 kg. The market is expected to expand further due to increasing incomes and the younger generation's preference for soft, high-quality tissue products away from home. Manufacturers are getting into online sales to meet informed institutional buyers, creating growth opportunities. Many companies are also looking for innovations to enhance customer satisfaction.

However, concerns over deforestation & production materials create challenges. A significant percentage of Europe's deforestation is for paper products, like packaging, damaging more than 4.1 billion hectares of forest yearly. Moreover, growing raw material costs could hinder the market growth. Addressing these issues will be critical for sustainable growth in the tissue and hygiene paper market.

Research Scope and Analysis

By Product

Toilet paper is expected to play an important role in the Europe tissue & hygiene paper market in 2024, acting as an important product for personal care and cleanliness. It is a common household item used daily by individuals across the globe. Toilet paper's main function is to provide proper hygiene after using the toilet, as it helps maintain cleanliness and protects against the spread of germs and infections. Apart from its primary use, toilet paper also provides convenience & comfort in daily life, providing a reliable & disposable solution for sanitation needs.

In addition to household use, toilet paper is also majorly used in commercial settings like offices, restaurants, and public facilities, further highlighting its importance in maintaining hygiene standards. Given its nature and consistent demand, toilet paper become a stable & essential segment within the large tissue and hygiene paper market, with manufacturers continuously developing to meet changing consumer preferences and sustainability requirements.

By Type

The "Away from home" type of tissue & hygiene papers are expected to be a main driver in the growth of the European tissue & hygiene paper market, as roles in many non-residential like offices, schools, hospitals, and restaurants. These products, like paper towels, napkins, tissues, and toilet paper, are mainly developed for use outside of the home environment. They play a main in functions promoting hygiene, cleanliness, & convenience in public spaces.

Paper towels are used for hand drying in restrooms, while napkins provide a sanitary solution for dine-in places. In addition, tissues and toilet paper in public institutes provide proper sanitation & comfort for users. The need for away-from-home tissue and hygiene products is driven by the need to maintain cleanliness standards, comply with health regulations, and improve user experience in commercial & institutional settings. Manufacturers aim to deliver high-quality, low-cost, and sustainable solutions to meet the diverse needs of businesses and organizations.

By Raw Material

Recycling raw materials is important in the tissue & hygiene paper industry and is expected to lead the European market in 2024, contributing to sustainability & environmental responsibility. By recycling materials like paper fibers used in cardboard, newspapers, and office waste, manufacturers can reduce their dependency on virgin resources and restrict the environmental impact of production. Recycling also preserves energy and reduces greenhouse gas emissions compared to the production of new materials from scratch.

Moreover, using recycled material aligns with corporate sustainability goals and growing consumer demand for eco-friendly options.

Telehealth-related packaging solutions and other innovative applications are also increasingly using recycled tissue products to meet environmental standards and support circular economy principles.

The Europe Tissue and Hygiene Paper Market Report is segmented on the basis of the following:

By Product

- Toilet Paper

- Household

- Baby Diapers

- Feminine Hygiene

- Incontinence

- Paper Tissues

By Type

By Raw Material

- Kraft

- Recycled

- Sulfite

- Others

European Country Analysis

Major European countries are expected to highly contribute to the growth of the European tissue and hygiene paper market. Countries like Germany, France, and the UK are anticipated to play important roles due to their large populations and strong economies. Like, Germany is projected to stand out as one of the largest consumers of tissue products in Europe, with a focus on quality and innovation driving market growth. Further, France has a significant market share, with aiming for sustainability and eco-friendly products that resonate well with consumers.

The UK with its mature market and higher demand for premium tissue products, also contributes majorly to market expansion. These countries are expected to act as key manufacturing hubs & distribution centers, catering not only to domestic demand but also exporting to neighboring regions. Their strategic importance & market influence make them important drivers of growth in the European tissue and hygiene paper market.

By European Countries

- Germany

- The U.K.

- France

- Italy

- Russia

- Spain

- Benelux

- Nordic

- Rest of Europe

Competitive Landscape

The European tissue and hygiene paper market features a competitive landscape characterized by many key players competing for market share. These companies compete based on factors like product quality, pricing, distribution network, and innovation. In addition, mergers & acquisitions, partnerships, and strategic collaborations are common strategies used by these players to enhance their market position and avail on emerging opportunities in the region.

Some of the prominent players in the Europe Tissue and Hygiene Paper Market are

- Lucart SpA

- Renova

- Ontex Group

- Metsa Group

- Essity AB

- WEPA Industrieholding SE

- Metsa Group

- Sofidel Group

- Kimberly Clark Corp

- Cartiere Carrara SpA

- Other Key Players

Recent Developments

- In February 2024, Metsä Group announced that the company plans to invest EUR 100 million in its tissue paper business at the Mänttä mill, Finland, for over five years. The initial investment would start with a new hand towel line set to begin operations by 2025, which aligns with the Group's 'Future Mill strategy,' focused on top-tier efficiency and environmental standards in tissue production.

- In February 2024, Romanian tissue paper specialist Pehart Group announced that the company plans to invest more than EUR 8 million in a new conversion line, which would make a wide range of away-from-home products. As part of the investment, the Group would launch its new Sovio brand which would consist paper towels, napkins, toilet paper, and other products.

- In November 2023, Valmet announced that the company completely acquired Körber’s Business Area Tissue, by expanding its offerings in tissue industry technology & services, which strengthens the company's position as a leader in the tissue industry, providing complete solutions from fiber to final product. The newly integrated Tissue Converting business unit will aim to provide converting lines, packaging equipment, digital solutions, and services.

- In July 2022, Essity launched its first toilet paper product named Zewa using straw in the German market, which uses straw leftover from local agriculture at its Mannheim plant, as it rapidly grows back and can be processed into cellulose. Also, the complete Zewa range consists of a straw pulp content of at least 10%.

Report Details

| Report Characteristics |

| Market Size (2024) |

USD 55.5 Bn |

| Forecast Value (2033) |

USD 71.2 Bn |

| CAGR (2023-2032) |

2.8% |

| Historical Data |

2018 – 2023 |

| Forecast Data |

2024 – 2033 |

| Base Year |

2023 |

| Estimate Year |

2024 |

| Report Coverage |

Market Revenue Estimation, Market Dynamics, Competitive Landscape, Growth Factors and etc. |

| Segments Covered |

By Product (Toilet Paper, Household, Baby Diapers, Feminine Hygiene, Incontinence, and Paper Tissues), By Type (Away From Home and At Home), By Raw Material (Kraft, Recycled, Sulfite, and Others) |

| Regional Coverage |

North America – The US and Canada; Europe – Germany, The UK, France, Russia, Spain, Italy, Benelux, Nordic, & Rest of Europe; Asia- Pacific– China, Japan, South Korea, India, ANZ, ASEAN, Rest of APAC; Latin America – Brazil, Mexico, Argentina, Colombia, Rest of Latin America; Middle East & Africa – Saudi Arabia, UAE, South Africa, Turkey, Egypt, Israel, & Rest of MEA |

| Prominent Players |

Lucart SpA, Renova, Ontex Group, Metsa Group, Essity AB, WEPA Industrieholding SE, Metsa Group, Sofidel Group, Kimberly Clark Corp, Cartiere Carrara SpA, and Other Key Players |

| Purchase Options |

We have three licenses to opt for: Single User License (Limited to 1 user), Multi-User License (Up to 5 Users), and Corporate Use License (Unlimited User) along with free report customization equivalent to 0 analyst working days, 3 analysts working days and 5 analysts working days respectively. |

Frequently Asked Questions

The Europe Tissue and Hygiene Paper Market size is estimated to have a value of USD 71.2 billion in

2024 and is expected to reach USD 55.5 billion by the end of 2033.

Some of the major key players in the Europe Tissue and Hygiene Paper Market are Lucart SpA, Renova,

Ontex Group, and many others.

The market is growing at a CAGR of 2.8 percent over the forecasted period.