Market Overview

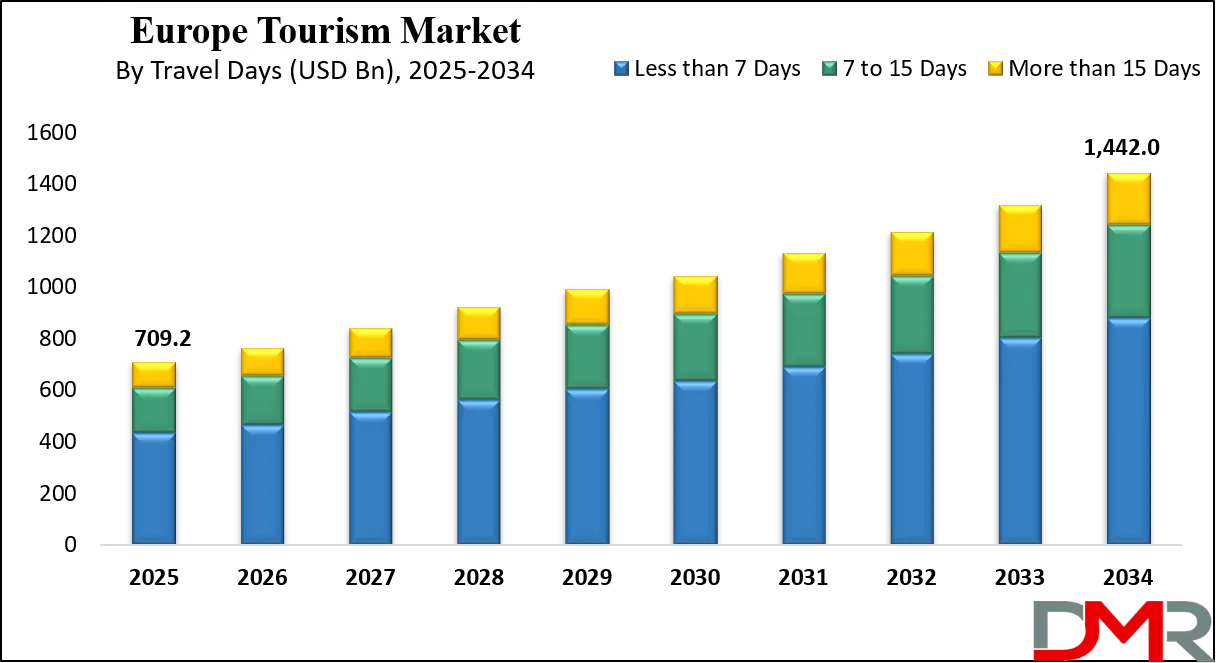

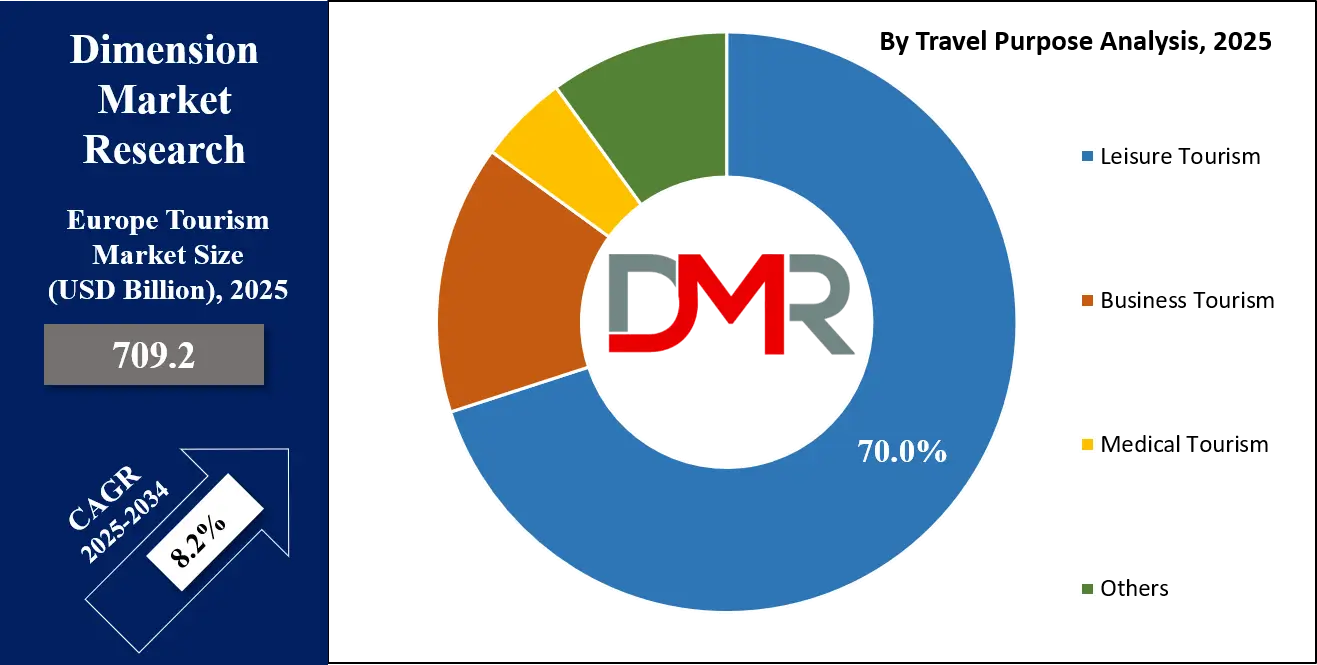

The Europe tourism market is projected at USD 709.2 billion in 2025 and is expected to grow to USD 1,442.0 billion by 2034, registering a robust CAGR of 8.2%, driven by rising travel demand, increasing leisure and business tourism, and expanding digital booking platforms across the region.

Tourism is the activity of traveling to and staying in places outside one’s usual environment for leisure, business, or other purposes. It encompasses a wide range of experiences, including sightseeing, cultural exploration, adventure activities, hospitality services, and participation in events. Beyond personal enjoyment, tourism plays a crucial role in fostering cross-cultural understanding, economic growth, and regional development.

ℹ

To learn more about this report –

Download Your Free Sample Report Here

It involves the interaction between travelers, local communities, and service providers, creating a complex ecosystem that influences infrastructure, employment, and local economies. Sustainable and responsible tourism practices are increasingly emphasized to preserve natural landscapes, heritage sites, and cultural traditions for future generations while offering enriching experiences to visitors.

The Europe tourism market represents one of the most diverse and mature travel regions globally, characterized by a rich blend of historical landmarks, natural attractions, and modern recreational facilities. This market is driven by both domestic and international travelers who seek cultural immersion, culinary experiences, city exploration, and outdoor adventures.

Key components of the market include airlines, hotel chains, travel agencies, tour operators, and digital booking platforms, which collectively enable seamless travel experiences. Growing consumer interest in experiential travel, eco-friendly tourism, and wellness tourism further expands the market, attracting a wide range of age groups and spending categories.

Europe's tourism landscape is shaped by strong connectivity, well-developed infrastructure, and robust regulatory frameworks that facilitate international travel. Countries like France, Spain, Italy, and Germany remain major tourist destinations due to their historical significance, artistic heritage, and vibrant city life. Emerging trends such as digital tourism, personalized travel packages, and the rise of short-term rentals have transformed traveler preferences and service delivery.

Seasonal variations, local festivals, and event tourism continue to influence visitor patterns, while government initiatives and private investments support sustainable growth and regional competitiveness. This dynamic environment positions Europe as a resilient and evolving market in the global tourism sector.

ℹ

To learn more about this report –

Download Your Free Sample Report Here

Europe Tourism Market: Key Takeaways

- Market Value: The Europe tourism market size is expected to reach a value of USD 1,442.0 billion by 2034 from a base value of USD 709.2 billion in 2025 at a CAGR of 8.2%.

- By Travel Purpose Segment Analysis: Leisure Tourism is anticipated to dominate the travel purpose segment, capturing 70.0% of the total market share in 2025.

- By Travel Type Segment Analysis: Group travel type is expected to maintain its dominance in the travel type segment, capturing 69.0% of the total market share in 2025.

- By Booking Mode Segment Analysis: Online Booking Mode will dominate the booking mode segment, capturing 57.0% of the market share in 2025.

- By Travel Days Segment Analysis: Less than 7 Days will account for the maximum share in the travel days segment, capturing 61.0% of the total market value.

- By Age Group Segment Analysis: 30 to 41 age groups are expected to consolidate their dominance in the age group segment, capturing 37.0% of the market share in 2025.

- Key Players: Some key players in the europe tourism market are TUI Group, Ryanair, easyJet, Air France–KLM Group, Lufthansa Group, Amadeus IT Group, eDreams ODIGEO, Booking Holdings, Expedia Group, AccorHotels, InterContinental Hotels Group (IHG), Marriott International, Kuoni Travel, and Others.

Europe Tourism Market: Use Cases

- Cultural and Heritage Tourism: Europe attracts millions of tourists annually for its rich history, iconic landmarks, and UNESCO World Heritage sites. Travelers engage in museum visits, city tours, and historical explorations in countries like Italy, France, and Spain. This segment boosts demand for guided tours, heritage hotels, and local transportation services, while promoting regional cultural preservation and sustainable tourism initiatives.

- Leisure and Vacation Travel: Leisure tourism is a dominant driver in Europe, with travelers seeking beach holidays, ski trips, and city breaks. Online travel agencies, travel apps, and dynamic pricing platforms facilitate seamless bookings for flights, accommodations, and activities. Experiential travel, adventure tourism, and wellness retreats further enhance market growth by catering to evolving traveler preferences.

- Business and Event Tourism: Europe hosts a wide array of international conferences, trade shows, and corporate events, especially in cities like London, Frankfurt, and Amsterdam. Business tourism drives hotel occupancy, convention center usage, and transportation services. Integration of digital event platforms and hybrid meetings enhances efficiency while supporting the growth of corporate travel services across the region.

- Sustainable and Eco-Friendly Tourism: Growing awareness of environmental impacts has fueled demand for green tourism in Europe. Travelers increasingly prefer eco-resorts, low-carbon transportation, and sustainable travel packages. This trend encourages responsible tourism practices, regional community engagement, and preservation of natural landscapes, positioning Europe as a leader in environmentally conscious travel experiences.

Impact of Artificial Intelligence on the Europe Tourism Market

Artificial Intelligence is transforming the Europe tourism market by enhancing both operational efficiency and traveler experiences. AI-driven tools, such as predictive analytics, recommendation engines, and chatbots, enable travel agencies, hotels, and tour operators to offer personalized itineraries, optimize pricing strategies, and manage bookings in real time. Smart algorithms analyze traveler preferences, search patterns, and seasonal trends, allowing destinations to anticipate demand and reduce overcrowding at popular attractions.

Additionally, AI-powered virtual assistants and language translation services improve accessibility for international tourists, while machine learning applications in revenue management and dynamic pricing help tourism businesses maximize profitability. Overall, AI adoption is driving smarter, more seamless, and data-driven tourism experiences across Europe.

Europe Tourism Market: Stats & Facts

- Eurostat – Tourism Statistics

- 2025 Q1: 452 million nights were spent, a 0.2% decrease from Q1 2024.

- 2025 Q1: Hotel nights accounted for 72% of nights spent.

- 2025 Q1: One in four nights spent by foreign visitors was recorded in Spain.

- 2025 Q1: Germany recorded 57.4 million nights spent by residents.

- 2025 Q1: France recorded 46.8 million nights spent by residents.

- 2025 Q1: 14 EU countries saw a decrease in domestic tourism nights.

- 2024: Total nights spent at tourist accommodation establishments exceeded 3 billion.

- 2024: Tourism nights increased by 2.2% compared to 2023.

- 2024: Spain, Italy, France, and Germany accounted for 61.6% of total nights spent.

- 2024 Q4: Tourism nights rose by 5.1% compared to Q4 2023.

- 2024 Q1: 452 million nights were spent, a 0.2% decrease from Q1 2023.

- 2024 Q1: International tourism grew by 1.1% compared to Q1 2023.

- 2024 Q1: Domestic tourism decreased by 1.3% compared to Q1 2023.

- 2024: Estimated number of nights spent at tourist accommodation establishments reached 2.99 billion.

- 2024: Nights spent increased by 2% compared to 2023.

- 2024: Luxembourg, Latvia, and Estonia registered the lowest number of nights.

- 2023: EU residents made over 1.1 billion trips, spending 5.7 billion nights.

- 2023: Tourist expenditure amounted to €555 billion.

- 2023: 65% of EU residents aged 15 and over participated in tourism.

- 2023: Almost half of EU residents' trips were short domestic trips.

- 2023: EU had an estimated total of 29.2 million bed places.

- 2023: Italy and France accounted for slightly more than one-third of the total available capacity.

- 2023: Spain and Germany followed with 3.8 million and 3.4 million bed places, respectively.

- 2023: 1.4 billion nights (48%) were spent at coastal accommodation establishments.

- 2023: Malta's nights spent at coastal establishments accounted for 100%.

- 2023: Cyprus and Greece had 97% and 96% of nights spent at coastal establishments, respectively.

- 2023: Belgium and Romania had the lowest number of tourist nights spent in coastal areas, both at 18%.

- 2023: In one out of six EU NUTS 2 regions, more than 40% of the annual tourism nights were concentrated in the top 2 months.

- 2023: In 7 EU regions, more than half of the tourism nights were spent during July or August.

- 2023: The twenty most seasonal regions jointly recorded 169 million nights spent during their 2 peak months.

Europe Tourism Market: Market Dynamics

Europe Tourism Market: Driving Factors

Rising Inbound International Tourism

Europe continues to attract millions of international travelers due to its rich cultural heritage, historical landmarks, and world-renowned cities. Countries such as France, Spain, Italy, and Germany are leading destinations, contributing significantly to tourism revenue. Increasing disposable income, global connectivity, and relaxed visa policies have further fueled international arrivals, driving demand for accommodation, leisure activities, and local transport services. The rise of short-haul flights and high-speed rail connections within Europe also supports cross-border tourism growth.

Growth of Digital Travel Platforms

The widespread adoption of online booking platforms, mobile travel applications, and virtual tour experiences has revolutionized travel planning in Europe. Tourists increasingly prefer digital tools to compare prices, access reviews, and customize itineraries. This trend enhances convenience, improves travel accessibility, and drives demand for personalized experiences. Integration of AI-driven recommendations and advanced analytics enables service providers to attract more travelers and optimize revenue streams.

Europe Tourism Market: Restraints

Economic Uncertainty and Inflation

Rising inflation rates and economic uncertainty in several European nations have affected travel budgets and consumer confidence. Higher costs for accommodation, flights, and local services can deter domestic and international tourists, particularly price-sensitive segments. Economic fluctuations in key source markets also impact discretionary spending on travel, potentially limiting overall tourism growth.

Environmental and Regulatory Constraints

Europe’s focus on sustainable tourism and carbon reduction has led to stricter regulations on transportation, accommodation, and popular tourist destinations. Over-tourism in cities like Venice and Barcelona has resulted in visitor caps, restricted access, and higher operating costs for tourism businesses. Compliance with environmental regulations can challenge smaller operators, limiting market expansion and increasing operational complexities.

Europe Tourism Market: Opportunities

Rising Demand for Experiential and Niche Tourism

European travelers are increasingly seeking immersive experiences, such as culinary tours, cultural festivals, adventure tourism, and wellness retreats. Niche segments like ecotourism, heritage tourism, and river cruises offer significant revenue potential. Leveraging local culture, gastronomy, and natural landscapes enables destinations to differentiate offerings and capture high-value traveler segments.

Expansion of Smart Tourism and AI Integration

Smart tourism solutions, including AI-powered recommendation engines, augmented reality (AR) guides, and data-driven crowd management systems, provide significant growth opportunities. European cities and resorts can enhance visitor satisfaction, reduce congestion, and increase operational efficiency. Integration of IoT devices and mobile apps enables real-time travel insights, boosting engagement and repeat visits.

Europe Tourism Market: Trends

Sustainable and Responsible Tourism

Sustainability remains a dominant trend, with travelers seeking eco-friendly accommodations, low-carbon transport, and responsible tour options. European destinations are increasingly promoting green initiatives, such as electric mobility, waste reduction programs, and conservation-focused tourism experiences. This trend influences consumer choice and shapes future market development.

Personalized and Tech-Enabled Travel Experiences

Travelers now expect highly personalized itineraries and tech-driven services. AI-driven chatbots, virtual concierge services, and customized tour packages are becoming mainstream, enhancing convenience and satisfaction. Integration of wearable tech and location-based services is enabling seamless mobility across Europe, aligning with modern traveler expectations.

Europe Tourism Market: Research Scope and Analysis

By Travel Purpose Analysis

Leisure tourism is expected to dominate the travel purpose segment in Europe, capturing around 70.0% of the total market share in 2025. This is driven by strong demand for cultural exploration, city breaks, beach holidays, ski trips, and wellness tourism across countries like France, Spain, Italy, and Germany.

Travelers increasingly use online booking platforms, mobile apps, and digital travel services to plan their trips, making personalized itineraries and experiential travel more accessible. This segment is a key revenue contributor for hotels, airlines, and local attractions, supporting regional tourism economies across Europe.

Business tourism, while smaller in comparison, plays a significant role in the European market. Cities such as London, Frankfurt, and Amsterdam host numerous international conferences, trade shows, and corporate events, driving demand for business hotels, convention centers, and transportation services. The rise of hybrid meetings, digital event management platforms, and AI-powered scheduling tools has further enhanced efficiency and convenience for corporate travelers. This segment not only generates substantial economic value but also strengthens the global competitiveness of Europe’s tourism industry.

ℹ

To learn more about this report –

Download Your Free Sample Report Here

By Travel Type Analysis

In Europe, group travel is projected to dominate the travel type segment, accounting for approximately 69.0% of the total market share in 2025. This dominance is largely driven by family vacations, guided tours, educational trips, and organized holiday packages that allow travelers to explore multiple destinations conveniently. Tour operators, travel agencies, and digital booking platforms play a crucial role in facilitating group travel by providing bundled packages that include transportation, accommodation, and curated experiences. Group travel also encourages longer stays, higher per-trip spending, and greater engagement with local attractions, contributing significantly to the overall tourism revenue in the region.

Solo travel, while representing a smaller segment, has been steadily growing in Europe as more travelers seek independence, flexibility, and personalized experiences. Individual tourists often prefer city breaks, adventure tourism, wellness retreats, and cultural immersions that allow them to explore at their own pace.

The rise of solo travel apps, peer-to-peer accommodation platforms, and social travel communities has made planning and safety more accessible for single travelers. This segment drives niche tourism services, boutique hotels, and experiential tours, adding diversity to the European tourism market and catering to evolving traveler preferences.

By Booking Mode Analysis

In Europe, online booking is expected to lead the booking mode segment, capturing around 57.0% of the market share in 2025. The growth of this segment is driven by increasing internet penetration, widespread use of smartphones, and the convenience offered by online travel agencies, airline websites, and mobile apps. Travelers can compare prices, read reviews, and book flights, accommodations, and activities seamlessly from anywhere.

The integration of AI-based recommendation systems, dynamic pricing, and personalized travel packages further enhances the appeal of online booking, making it the preferred choice for both domestic and international tourists.

Physical booking, although representing a smaller portion of the market, continues to hold relevance, particularly among traditional travelers and certain demographic groups who prefer in-person interactions. This segment includes bookings made through travel agencies, tour operators, and hotel front desks.

Physical booking offers personalized guidance, assistance with complex itineraries, and access to exclusive packages or promotions. It also caters to travelers who value direct human support, face-to-face consultations, and the reassurance of handling payment and documentation in person. While digital adoption is rising, physical booking remains an important component of the European tourism ecosystem.

By Travel Days Analysis

In Europe, short-duration trips of less than 7 days are expected to dominate the travel days segment, capturing approximately 61.0% of the total market value. This trend is driven by the growing preference for quick city breaks, weekend getaways, and short leisure vacations that fit into busy lifestyles. Travelers increasingly opt for easily accessible destinations within their own country or neighboring nations, supported by budget airlines, efficient rail networks, and flexible travel packages. Short-duration travel stimulates demand for city tours, cultural experiences, and local attractions, making it a significant contributor to hotel occupancy, transportation services, and regional tourism revenues.

Trips lasting between 7 to 15 days, while representing a smaller portion of the market, cater to travelers seeking more immersive experiences. These medium-duration trips allow tourists to explore multiple cities, regions, or countries in a single itinerary, often combining cultural exploration, adventure activities, and relaxation.

Tour operators and travel agencies offer tailored packages that include accommodations, guided tours, and intercity transportation, facilitating seamless travel experiences. This segment also supports higher per-trip spending on accommodations, dining, and experiences, contributing to the growth of specialized travel services and regional tourism economies.

By Age Group Analysis

In Europe, travelers aged 30 to 41 are expected to dominate the age group segment, capturing approximately 37.0% of the market share in 2025. This age group typically includes young professionals and early-career families who have disposable income and a strong inclination toward leisure, adventure, and experiential travel.

They often prefer city breaks, cultural tours, and wellness or adventure activities, leveraging online booking platforms, travel apps, and curated packages to plan efficient and enriching trips. Their travel patterns significantly influence hotel occupancy, transportation services, and spending on local attractions, making them a key driver of the European tourism market.

Travelers below 30 years, while accounting for a smaller share, represent a growing segment fueled by solo travel, backpacking, and budget-conscious experiences. This group frequently seeks short-duration trips, adventure tourism, music festivals, and social experiences that offer flexibility and unique engagement.

Digital-native travelers in this segment rely heavily on mobile apps, peer-to-peer accommodations, and social media recommendations for planning and booking. Their demand drives the growth of low-cost airlines, hostels, boutique accommodations, and innovative travel experiences, adding diversity and dynamism to Europe’s tourism ecosystem.

The Europe Tourism Market Report is segmented on the basis of the following:

By Travel Purpose

- Medical Tourism

- Leisure Tourism

- Business Tourism

- Others

By Travel Type

By Booking Mode

- Physical Booking

- Online Booking

By Travel Days

- Less than 7 Days

- 7 to 15 Days

- More than 15 Days

By Age Group

- Below 30 years

- 30 to 41 years

- 42 to 49 years

- 50 years & above

By Region

Europe

- Germany

- The U.K.

- France

- Italy

- Russia

- Spain

- Benelux

- Nordic

- Rest of Europe

Europe Tourism Market: Competitive Landscape

The Europe tourism market is highly competitive, with a diverse mix of global and regional players operating across airlines, hotel chains, tour operators, travel agencies, and digital booking platforms. Leading companies such as TUI Group, Ryanair, easyJet, AccorHotels, and Amadeus IT Group leverage extensive networks, strong brand recognition, and technology-driven solutions to attract both leisure and business travelers. Intense competition has led to the adoption of innovative strategies, including personalized travel packages, dynamic pricing, loyalty programs, and sustainable tourism initiatives.

Additionally, smaller boutique operators and niche service providers contribute to market fragmentation, driving differentiation through specialized experiences, eco-friendly travel options, and tailored itineraries, which collectively enhance customer engagement and market growth across Europe.

Some of the prominent players in the Europe Tourism market are:

- TUI Group

- Ryanair

- easyJet

- Air France–KLM Group

- Lufthansa Group

- Amadeus IT Group

- eDreams ODIGEO

- Booking Holdings

- Expedia Group

- AccorHotels

- InterContinental Hotels Group (IHG)

- Marriott International

- Kuoni Travel

- Audley Travel

- Contiki Tours

- Jet2holidays

- Simpson Travel

- Kirker Holidays

- Inntravel

- Jules Verne

- Other Key Players

Europe Tourism Market: Recent Developments

- July 2025: Zara introduced a "Travel Mode" feature in its mobile app, enhancing the shopping experience for travelers. This feature provides access to travel guides, tips, and recommendations for destinations such as Italy, the United Kingdom, and Japan. Users can explore local attractions like museums, restaurants, and hotels, and make purchases with options for hotel delivery.

- June 2025: Tourism Ireland launched its 2025 marketing strategy, aiming to promote the island of Ireland overseas. The plan includes initiatives like "Slow Tourism Month" to inspire visitors to explore communities, scenery, and attractions at a relaxed pace.

- May 2025: Zara unveiled a new "Travel Mode" feature in its mobile app, designed to enrich the customer experience during travel. This feature offers curated travel content, including guides, tips, and recommendations for destinations such as Italy, the UK, and Japan.

Report Details

| Report Characteristics |

| Market Size (2025) |

USD 709.2 Bn |

| Forecast Value (2034) |

USD 1,442.0 Bn |

| CAGR (2025–2034) |

8.2% |

| Historical Data |

2019 – 2024 |

| Forecast Data |

2026 – 2034 |

| Base Year |

2024 |

| Estimate Year |

2025 |

| Report Coverage |

Market Revenue Estimation, Market Dynamics, Competitive Landscape, Growth Factors, etc. |

| Segments Covered |

By Travel Purpose (Medical Tourism, Leisure Tourism, Business Tourism, Others), By Travel Type (Solo, Group), By Booking Mode (Physical Booking, Online Booking), By Travel Days (Less than 7 Days, 7 to 15 Days, More than 15 Days), By Age Group (Below 30 years, 30 to 41 years, 42 to 49 years, 50 years & above) |

| Regional Coverage |

Europe |

| Prominent Players |

TUI Group, Ryanair, easyJet, Air France–KLM Group, Lufthansa Group, Amadeus IT Group, eDreams ODIGEO, Booking Holdings, Expedia Group, AccorHotels, InterContinental Hotels Group (IHG), Marriott International, Kuoni Travel, and Others |

| Purchase Options |

We have three licenses to opt for: Single User License (Limited to 1 user), Multi-User License (Up to 5 Users), and Corporate Use License (Unlimited User) along with free report customization equivalent to 0 analyst working days, 3 analysts working days, and 5 analysts working days respectively. |

Frequently Asked Questions

What is the size of the Europe tourism market?

▾ The Europe tourism market is projected to be valued at USD 709.2 billion in 2025. It is expected to witness subsequent growth in the upcoming period as it holds USD 1,442.0 billion in 2034 at a CAGR of 8.2%.

Who are the key players in the Europe tourism market?

▾ Some of the major key players in the Europe tourism market are TUI Group, Ryanair, easyJet, Air France–KLM Group, Lufthansa Group, Amadeus IT Group, eDreams ODIGEO, Booking Holdings, Expedia Group, AccorHotels, InterContinental Hotels Group (IHG), Marriott International, Kuoni Travel, and Others