Fencing refers to the installation of barriers or enclosures made from various materials, such as wood, metal, vinyl, or concrete, to demarcate boundaries, provide security, or add aesthetic appeal to properties. Fencing is widely used across residential, commercial, and industrial sectors for purposes like privacy, protection, and safety. It also plays a significant role in controlling access to certain areas, be it private property, construction sites, agricultural land, or government institutions.

The fencing market encompasses the demand and supply dynamics of these materials, including the manufacturing, installation, and maintenance of fences. This market is driven by factors such as urbanization, increasing security concerns, and the need for boundary demarcation in various industries.

The global fencing market spans several segments, including residential, commercial, and industrial fencing solutions, with demand varying based on region, material preferences, and specific use cases. With the rising popularity of perimeter security solutions and property boundary protection, fencing continues to be a key element in both urban and rural infrastructure.

As we approach 2024, the fencing market presents a host of growth opportunities for both established players and new entrants. For larger companies, expanding product offerings and leveraging advancements in technology, such as smart fences with integrated surveillance systems, can provide a competitive edge.

On the other hand, for new and entry-level businesses, tapping into the growing demand for eco-friendly and customizable fencing solutions can be a key growth strategy. Urbanization, particularly in developing countries, is driving the need for residential and commercial fences.

Another area of opportunity lies in technological integration, including automated gates, smart locks, and security sensors in fencing products. With increasing concerns over safety and crime, these smart fences could attract customers looking for high-tech, reliable solutions across the fencing market, especially in segments like the agricultural fencing market, plastic fencing market, and wood fencing market. As the global fencing market size continues to expand, incorporating smart technologies offers a competitive edge for manufacturers and suppliers targeting both residential and commercial applications.

The fencing market is witnessing several key trends that are shaping its future. One of the major trends is the growing focus on security, particularly in both public and private sectors. With increased concerns about safety, there is a rising demand for durable, high-security fencing options, such as barbed wire fences, electrified fences, and anti-climb solutions. These fences are being used more widely around sensitive installations, such as government buildings, data centers, and private estates.

Another notable trend is the shift towards eco-friendly and sustainable fencing materials. With environmental concerns at the forefront of business practices, companies are increasingly turning to recyclable materials like composite wood and metal for their fence construction. Additionally, urban growth has led to greater demand for aesthetically pleasing designs, creating opportunities for companies offering decorative and custom-made fences.

Several trends support the positive growth of the fencing market. As mentioned earlier, the percentage of the population living in urban areas worldwide is steadily increasing. According to projections, over 68% of the global population will live in urban areas by 2050. This urbanization fuels greater demand for residential fencing, commercial property security solutions including the growing

Security as a Service and government infrastructure projects. The need for scalable, technology-driven protection aligns fencing systems with modern security frameworks, reinforcing market expansion.

The ongoing investments in border security, as seen with the allocated by the Department of Homeland Security in 2018, underline the increasing need for fencing in national security projects. This is an ongoing trend, creating substantial opportunities for fencing providers that can meet the high-security standards required for these projects. Furthermore, global border walls and fences, such as the Great Wall of China (

8500km) exemplify the scale of fencing infrastructure needed for securing vast territories.

Key Takeaways

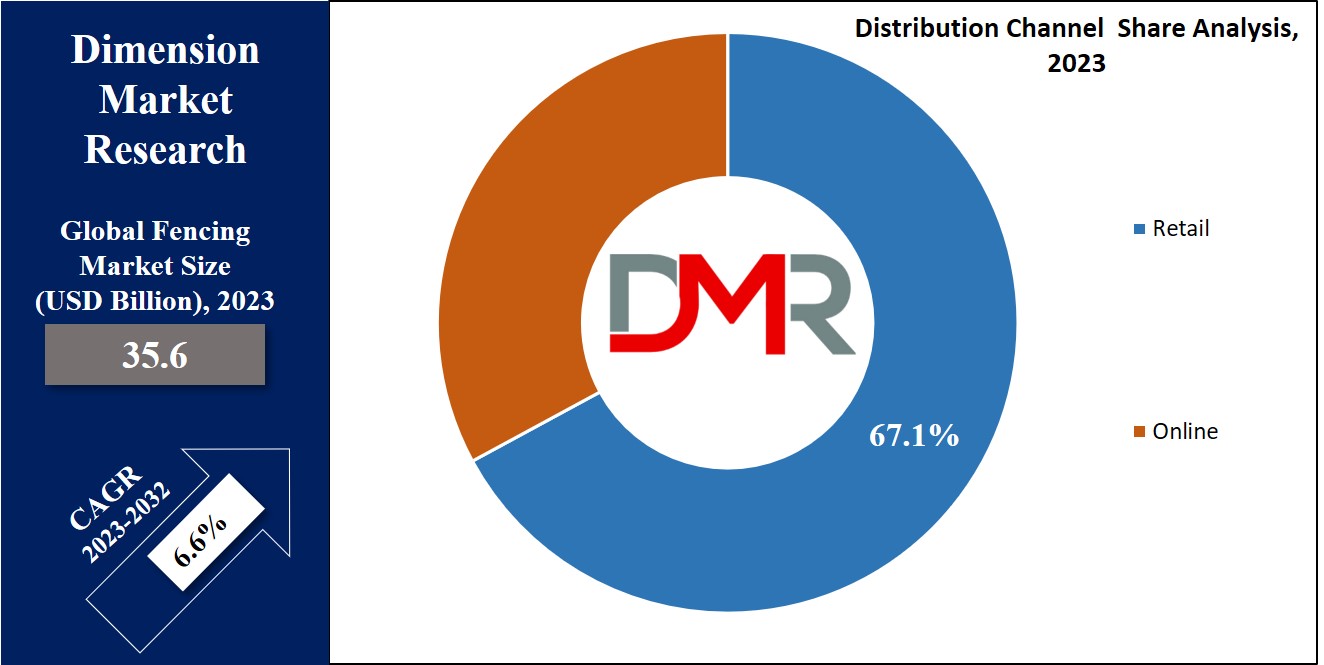

- The global fencing market is projected to grow from USD 35.6 billion in 2023 to USD 63.5 billion by 2032, with a CAGR of 6.6%.

- The metal sector dominated revenue in 2022, driven by increased demand for chain link and ornamental fencing.

- The retail sector led the market share in 2022, benefiting from quick access to products and reduced marketing expenses for vendors.

- The contractor segment held the largest share in fence installation in 2022, due to customer preference for customized and expert installations.

- The residential application segment was the dominant market share holder in 2022, spurred by increased construction and a focus on security and privacy.

- The military and defense sector had the highest revenue share in 2022, driven by the demand for enhanced border control and security measures.

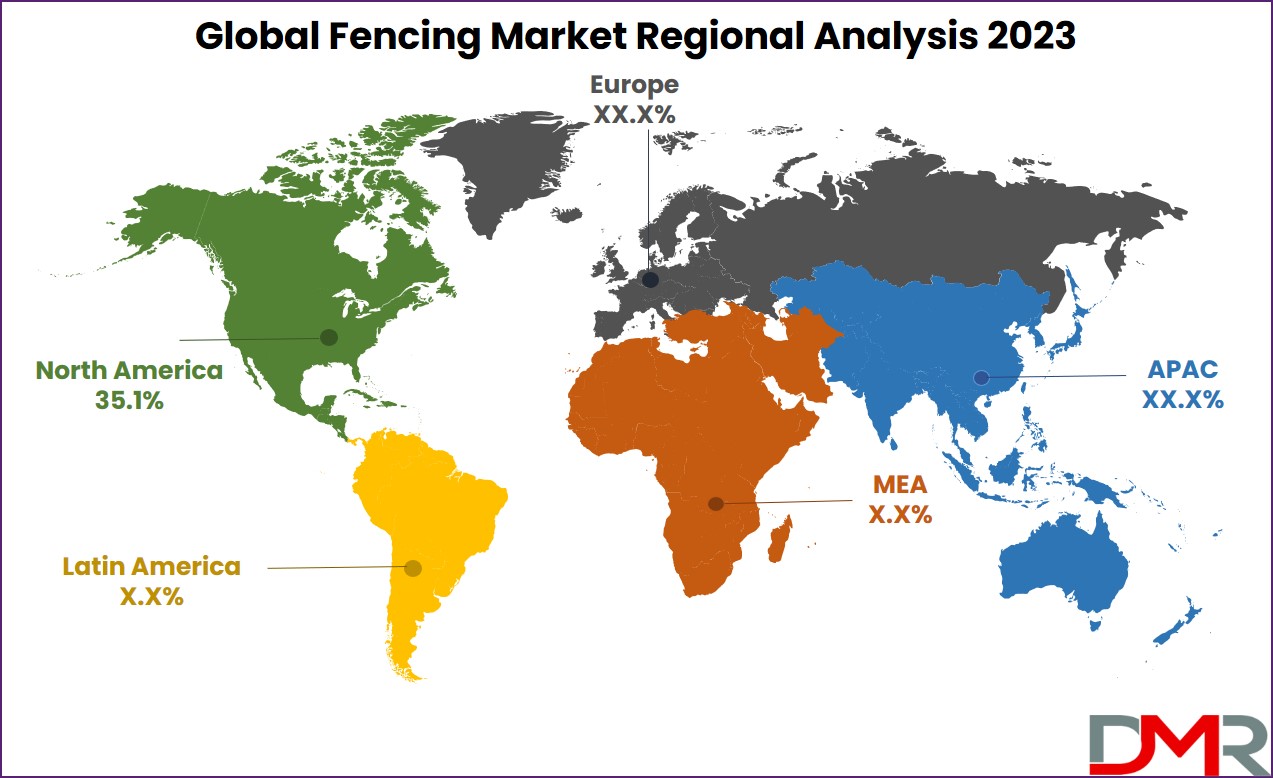

- North America is expected to account for more than 35% of the global fencing market in 2023, supported by ongoing construction growth in the region.

Use Cases

- Residential Security & Privacy: Rising urbanization and increased disposable income drive homeowners to adopt fences made of wood, metal, or vinyl, providing privacy, enhancing property aesthetics, and ensuring safety against trespassing.

- Commercial & Industrial Facilities: Businesses and warehouses utilize durable fencing solutions with high-security features, including anti-climb and electrified fences, to safeguard assets, control access, and comply with workplace safety regulations.

- Agricultural Protection: Farmers and agribusinesses employ fencing systems to protect crops, livestock, and farmland from wildlife and theft, with solutions tailored to environmental conditions and livestock management needs.

- Government & Military Applications: National security, border control, and sensitive government installations rely on high-strength metal and concrete fencing, often integrated with surveillance systems, to ensure perimeter security and prevent unauthorized access.

- Energy, Power & Infrastructure: Power plants, petroleum facilities, and transport infrastructure deploy specialized fencing systems, including anti-cut and anti-climb barriers, to safeguard critical assets, maintain operational safety, and meet regulatory compliance standards.

Market Dynamic

The demand for real estate development, industrialization, and investments in construction, especially in growing & developing markets like China & India, is driving the need for safety & security solutions. Security breaches are at an all-time high, leading fencing companies to offer advanced solutions customized to evolving needs.

While eco-friendly fencing is gaining popularity, its high maintenance costs are increasing demand for low-maintenance options like vinyl and cost-effective, lightweight plastic fencing. In agriculture, smart solutions are being introduced to give precise data-driven insights for property & livestock protection.

However, the market's growth is likely to be affected by the growing number of unlicensed contractors offering subpar products & high-end raw material prices.

Research Scope and Analysis

By Material

In 2022, the metal sector claimed the most significant portion of revenue share. Metal fencing finds major application in public areas and is widely used by governmental institutions, aligning closely with the growing demands of the Public Safety and Security Market. The segment is expected to grow due to increasing favorability toward chain link and ornamental fencing.

Furthermore, the rising need for robust fencing solutions to enhance security driven by investments in the

Public Safety and Security plays a major role in boosting demand for metal fencing. The growing preference for long-lasting fences capable of withstanding harsh weather conditions also contributes to the segment's expansion, as durability remains a key priority for infrastructure and safety projects.

Further, wooden fencing has gained substantial popularity in residential settings, mainly in semi-urban and rural regions, due to its unique aesthetic charm and the readily accessible, supply of wood. These factors have been instrumental in developing the growth of the wood fencing segment in recent years. Further, wooden fencing is anticipated to face stiff competition from plastic and composite fencing, mainly due to their lower costs and maintenance needs. As a result, the plastic and composite segment is also anticipated for major growth during the projected period.

By Distribution Channel

In 2022, the retail sector held the dominant market share. Within this segment, the retail distribution channel stands out by granting customers quick access to products offered by prominent vendors. Additionally, it aids vendors in holding back their marketing expenses, thus surging towards the segment's expansion.

When customers seek custom made fencing solutions, they tend to gravitate towards retail establishments. This preference arises because personalized options are less likely to be found on well-known online marketplaces, prompting customers to conveniently visit physical retail stores to get fences tailored to their specific needs.

Further, during the forecast period, the online segment is also expected to exhibit a fast growth. As online distribution channels provide various advantages, including lower initial setup costs compared to traditional retail stores. Furthermore, these online platforms provide customers to easily explore the entire product range, allowing real-time comparisons between various offerings. The increasing recognition of the advantages associated with online distribution channels is also motivating vendors to adopt this approach, thereby boosting towards the segment's growth.

ℹ

To learn more about this report –

Download Your Free Sample Report Here

By Installation

In 2022, the contractor sector had the highest share of revenue when it comes to fence installation. The market contains various contractors who excel in executing fence installations custom made to customers' aesthetic preferences. Contractors provide its customer with the valuable ability to handle materials, often challenging for customers to manage independently.

Moreover, they can employ skilled experts who excel in the efficient and precise installation of fences. Further, customers favor engaging contractors for their fence installation needs. These collective factors contribute to the contractor segment's market dominance.

Further, the Do-It-Yourself (DIY) segment is also experiencing substantial growth throughout the forecast period due to the increasing preference among customers for personalized fences. A multitude of DIY fencing kits is readily available in the market. In many instances, vinyl fences are the preferred choice for DIY projects because of their relative ease deployment.

However, while working on the DIY route for fence construction as an option available to customers, it's essential to note that it often needs a considerable amount of time. In simpler terms, customers who opt for DIY kits may find themselves engaged in a complex fence-building process.

By Application

In 2022, the residential application segment secured a major market share. This dominance can be attributed to the increase in residential construction and renovation projects, which have grown the segment to the forefront of the market. The increasing importance that households place on security and privacy, coupled with growing levels of disposable income, has accelerated investments in fencing products for residential use. Additionally, the inclination toward customized fence installations and the desire to improve the visual appeal of residential properties have been a significant factor driving the segment's growth.

Moreover, the growing need to protect farm animals, crops, and agricultural lands from both wildlife and potential theft is anticipated to stimulate demand for agricultural fencing. This trend aligns with the broader expansion of the Agricultural Biologicals Market, as farmers increasingly adopt integrated solutions that combine physical barriers with eco-friendly biological crop protection methods.

The rise in incidents involving trespassing and encroachments on agricultural areas is further fueling the need for such fencing solutions. Typically, fences for agricultural purposes are crafted to meet specific customer requirements, using high-quality raw materials that ensure durability and sustainability—key priorities for stakeholders in the

Agricultural Biologicals. Meanwhile, the industrial segment is also projected to expand, driven by growing demand for fencing solutions in manufacturing and storage facilities that safeguard both infrastructure and biological inputs.

By End-user Industry

In 2022, the military and defense sector held the leading market share. The segment's growth is majorly fueled by the growing imperative for enhanced border control and improved security measures. Meanwhile, the energy and power sector are also anticipated to emerge towards growing end-use segment during the forecast period. This expansion can be attributed to the escalating demand for advanced security fencing solutions, containing anti-cut and anti-climb perimeter fencing, along with partitioning systems, aimed at safeguarding critical power grid infrastructure.

Further, petroleum and chemical companies are channeling significant investments into the modernization of their existing refineries and processing facilities, in addition to constructing new industrial infrastructure. The operations conducted within these plants frequently consists of handling of hazardous chemicals and gases, posing risks to both unauthorized intruders and unwitting individuals who may enter the premises.

Consequently, these companies are taking proactive measures by installing high-end and resilient fencing systems to eliminate the potential risks associated with trespassing. This commitment to security is a driving force behind the growth of the petroleum and chemicals segment.

The Global Fencing Market Report is segmented on the basis of the following:

By Material

- Wood

- Plastic & Composite

- Metal

- Concrete

By Distribution Channel

By Installation

- Contractor

- Do-It-Yourself

By Application

- Residential

- Industrial

- Agricultural

By End-user Industry

- Government

- Military & Defense

- Petroleum & Chemicals

- Energy & Power

- Transport

- Mining

- Others

Regional Analysis

In 2023, the North America region is anticipated to have a significant market share, contributing more

than 35.0% of the total revenue in the Global Fencing Market. The continuous growing of construction projects throughout North America positions the region as a dominant force in the global market. Notably, the United States have a staggering number of fence contractors who supply materials and services internationally.

Moreover, the regional market is primed for substantial expansion in the coming future, propelled by the growing appetite for home decoration products among North American households, which is anticipated to be a major driver for growth in this region.

Further, the Asia Pacific market is set to see heightened growth in the market in the coming years. This is attributed to increasing safety concerns among consumers, government efforts to improve public infrastructure, ongoing urbanization, and a strong focus on property protection by farmers in the region. Furthermore, the increased investment in institutional construction projects in India is a positive indicator of the regional market's growth.

ℹ

To learn more about this report –

Download Your Free Sample Report Here

By Region

North America

Europe

- Germany

- The U.K.

- France

- Italy

- Russia

- Spain

- Benelux

- Nordic

- Rest of Europe

Asia-Pacific

- China

- Japan

- South Korea

- India

- ANZ

- ASEAN

- Rest of Asia-Pacific

Latin America

- Brazil

- Mexico

- Argentina

- Colombia

- Rest of Latin America

Middle East & Africa

- Saudi Arabia

- UAE

- South Africa

- Israel

- Egypt

- Rest of MEA

Competitive Landscape

The fencing industry has many different companies competing in it. A big factor creating new opportunities for these companies is the growth in residential fencing for new construction projects. Additionally, the market is seeing growth due to major manufacturers forming partnerships and making agreements to expand their market reach. In order to grow in the fencing market, businesses in this industry are using different strategies like developing new products, teaming up with others, merging with or buying other companies, making agreements, and working together with others.

For instance, in February 2023, Crossplane Capital, a private equity firm announced its collaboration with Sal Chavarria and the existing management team to acquire a controlling interest in Viking Fence. Viking Fence is a leading supplier of fence rentals, sanitation rentals, fence installations, and numerous other construction products and services, catering to both commercial and residential markets across Texas.

Some of the prominent players in the Global Fencing Market are

- PLY Gem

- CertainTeed

- Allied Tube & Conduit

- Bekaert

- Betafence NV

- Poly Vinyl Creations Inc

- Long Fence Company Inc

- Specrail

- A1 Fence Products

- Gregory Industries

- Other Key Players

Recent Developments

- February 2025: Fenceworks, a portfolio company of Gemspring Capital, announced its acquisition of Kansas Fencing, Inc., expanding its footprint in the fencing industry.

- February 2025: Perimeter Solutions Group partnered with Strategic Fence & Wall, backed by Bertram Capital, to broaden its geographic reach and capabilities in the fencing market.

- March 2025: Plastic fencing market size is projected to reach USD 8.41 billion by 2031 from USD 5.67 billion in 2024, expected to register a CAGR of 5.8% during 2025–2031.

- March 2025: Oldcastle APG launched Catalyst™ Fence Solutions, its flagship fence brand, debuting at FENCETECH 2025 alongside a new state-of-the-art website.

Report Details

| Report Characteristics |

|

Market Size (2023)

|

USD 35.6 Bn

|

|

Forecast Value (2032)

|

USD 63.5 Bn

|

|

CAGR (2023-2032)

|

6.6%

|

|

Historical Data

|

2017 - 2022

|

|

Forecast Data

|

2023 - 2032

|

|

Base Year

|

2022

|

|

Estimate Year

|

2023

|

|

Report Coverage

|

Market Revenue Estimation, Market Dynamics, Competitive Landscape, Growth Factors and etc.

|

|

Segments Covered

|

By Material (Wood, Plastic & Composite, Metal and Concrete), By Distribution Channel (Retail and Online), By Installation (Contractor and Do-It-Yourself) By Application (Residential, Industrial and Agricultural), By End-user Industry (Government, Military & Defense, Petroleum & Chemicals, Energy & Power, Transport, Mining and Others)

|

|

Regional Coverage

|

North America – The US and Canada; Europe – Germany, The UK, France, Russia, Spain, Italy, Benelux, Nordic, & Rest of Europe; Asia- Pacific– China, Japan, South Korea, India, ANZ, ASEAN, Rest of APAC; Latin America – Brazil, Mexico, Argentina, Colombia, Rest of Latin America; Middle East & Africa – Saudi Arabia, UAE, South Africa, Turkey, Egypt, Israel, & Rest of MEA

|

|

Prominent Players

|

PLY Gem, CertainTeed, Allied Tube & Conduit, Bekaert, Betafence NV, Poly Vinyl Creations Inc, Long Fence Company Inc, Specrail, A1 Fence Products, Gregory Industries, and Other Key Players

|

|

Purchase Options

|

We have three licenses to opt for: Single User License (Limited to 1 user), Multi-User License (Up to 5 Users), and Corporate Use License (Unlimited User) along with free report customization equivalent to 0 analyst working days, 3 analysts working days and 5 analysts working days respectively.

|