Fiber Optic Preform Market Overview

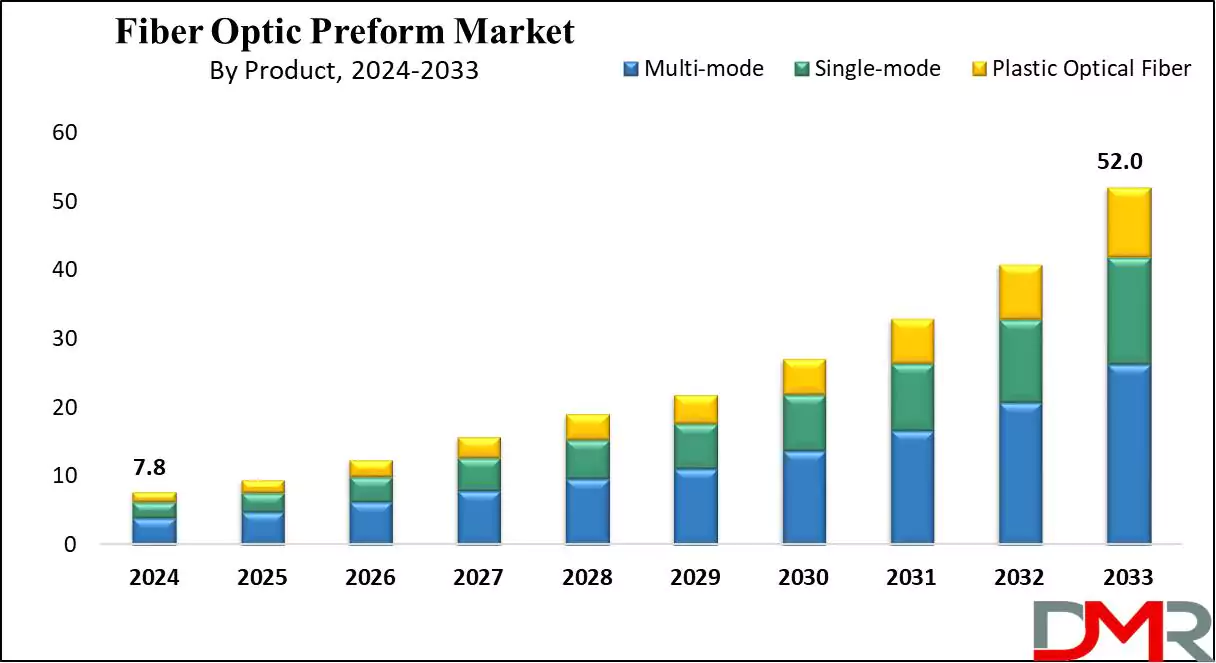

The Global Fiber Optic Preform Market is expected to reach a value of USD 7.8 billion by the end of 2024, and it is further anticipated to reach a market value of USD 52.0 billion by 2033 at a CAGR of 23.4%.

Optical fibers are the type of flexible, transparent fiber cables made from high-quality glass, plastic, & silica that work on the total internal reflection of light principle. Light transmission & illumination, laser delivery systems, and flexible bundling are the most common applications for fiber optics. Further, most of the preforms are made of glass filaments as they are advantageous for deep moldings or items with unpredictable structural qualities.

The rapid advancements in the telecommunications sector have driven the expansion of bandwidth-intensive communication, primarily through fiber optic networks. In addition,

optical films are playing a vital role in enhancing display technologies and communication systems. Beyond telecom, fiber optics are also gaining traction across industries such as oil and gas, aerospace, defense, railways, and healthcare, owing to their superior data transmission capabilities and reliability.

In August 2021, SLB (Schlumberger) introduced Optiq, an advanced fiber optic solution featuring multidomain distributed sensing. This technology enhances operational efficiency and environmental monitoring across the energy sector by providing continuous and real-time insights. Additionally, the fifth generation of fiber optics, leveraging Dense Wave Division Multiplexing (DWDM) technology, is further optimizing data transmission capacities.

The industry is witnessing significant investments to meet growing demand. In January 2024, Sterlite Technologies Ltd. announced an investment of Rs 800 crore to expand its optical fiber manufacturing capacity from 33 million fiber kilometers (MFKM) to 42 MFKM by the end of FY24.

The deployment of 5G-powered healthcare networks is also transforming the sector. China Unicom and Huawei have implemented AI-integrated telemedicine infrastructure across Hainan Province, enabling remote diagnosis and AI-assisted consultations. This initiative has reduced patient wait times by 40% and improved treatment efficiency by 30%, demonstrating fiber optics' growing impact beyond traditional telecommunications.

Fiber Optic Preform Market Key Takeaways

- The Global Fiber Optic Preform Market is expected to increase by 44.2 billion, at a CAGR of 23.4% during the forecasted period.

- By Product, the multi-mode segment is expected to lead in 2024 & is anticipated to dominate throughout the forecasted period.

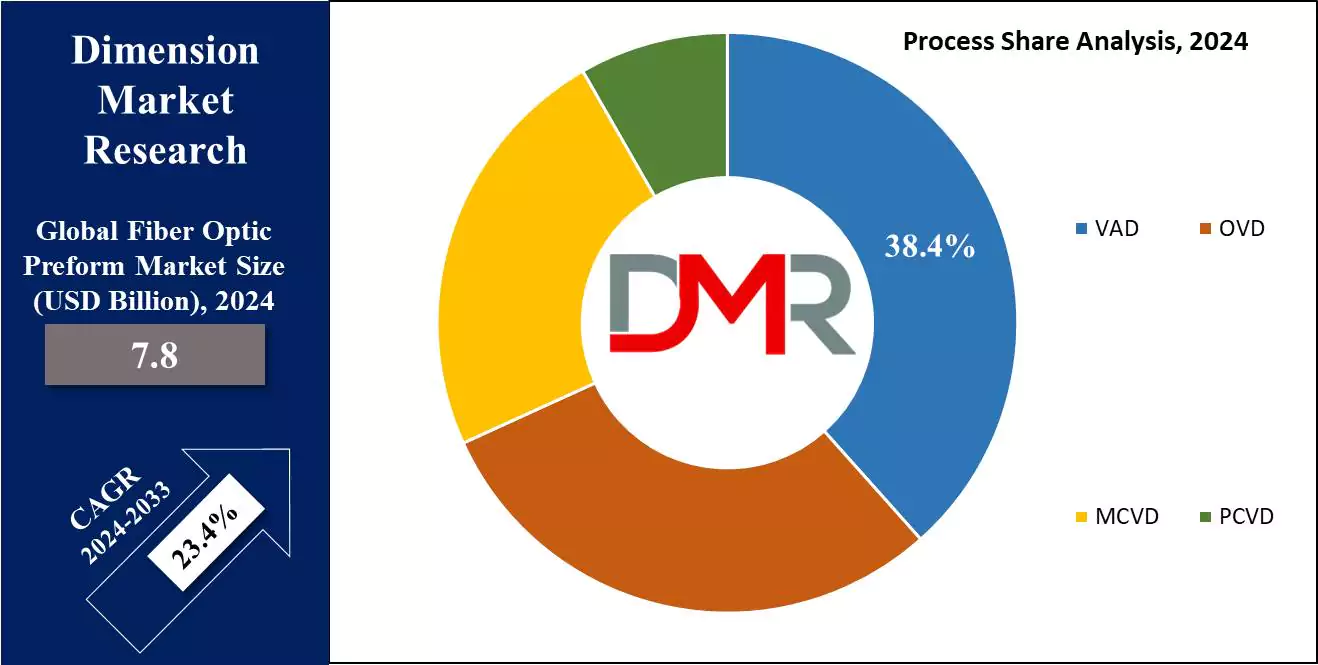

- By Process, the VAD segment is expected to have a lead throughout the forecasted period.

- By End Use, the telecom sector is expected to be the dominant driver of the growth of the market in forecasted years.

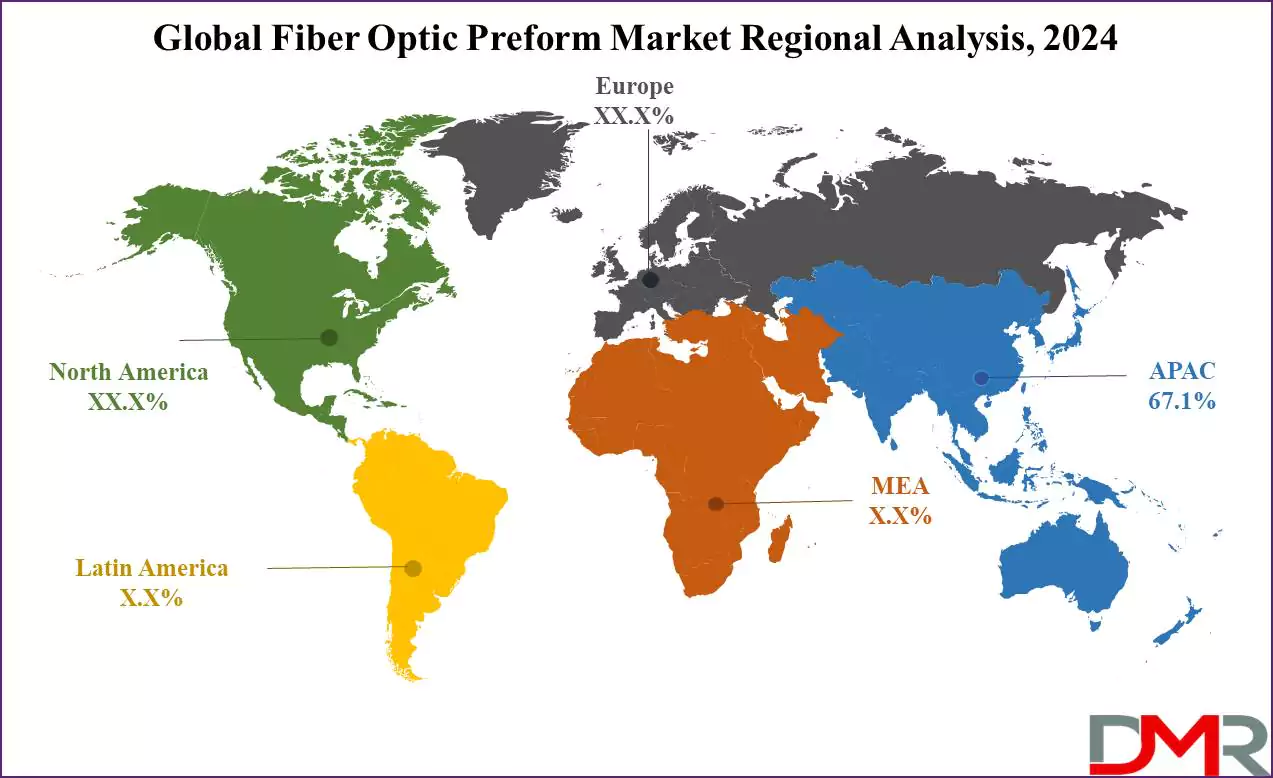

- Asia Pacific is expected to hold a 67.1% share of revenue in the Global Fiber Optic Preform Market in 2024.

- Some of the use cases of fiber optic preform include data centers, medical imaging & sensing, and more.

Fiber Optic Preform Market Use Cases

- Telecommunications Infrastructure: Fiber optic preforms are important for the deployment of high-speed telecommunications networks. They are utilized to produce optical fibers that make the backbone of internet infrastructure, allowing rapid data transmission over long distances with low signal degradation.

- Data Centers: In data centers, fiber optic preforms are used to manufacture optical fibers for high-speed data transmission between servers, storage systems, & networking equipment. The low latency & high bandwidth of optical fibers assist meet the higher demand for fast & reliable data processing.

- Medical Imaging and Sensing: Fiber optic preforms play an important role in medical imaging technologies like endoscopy & optical coherence tomography (OCT). These forms are used to develop specialized optical fibers capable of transmitting light into the human body for imaging purposes or for sensing various biological parameters.

- Industrial Sensing and Monitoring: Fiber optic sensors made from preforms are broadly used in industrial environments for monitoring parameters like temperature, strain, pressure, and vibration. These sensors provide advantages like immunity to electromagnetic interference, high sensitivity, & the ability to operate in harsh conditions, making them valuable for structural health monitoring, oil & gas exploration, and other industrial applications.

Fiber Optic Preform Market Dynamic

The key players in the fiber optic preform market are constantly improving the energy efficiency & performance of their products to meet the growing demand, mainly in teleconferencing applications & mobile computing devices. To address electronic blockage at network edges, metropolitan area networks are highly adopting optical technologies, which aligns with the growing investment in telecom infrastructure & constant developments in fiber optics technology, driving the global fiber optic preform market forward.

Furthermore, the changing landscape of fiber-rich network infrastructure is generating high demand for fiber optic cables, thereby restoring the growth in the global fiber optic preform market. The growth in demand for high-bandwidth communication is another major factor driving market expansion during the forecast period. However, despite these opportunities, the relatively higher installation cost of fiber cables in comparison to copper wires may create a challenge to the growth of this market in the coming years.

Fiber Optic Preform Market Research Scope and Analysis

By Product

In terms of type, the global fiber optic preform market is divided into multi-mode, single-mode, and plastic optical fiber segments, where in 2024, the multi-mode segment is expected to hold the largest market share in terms of revenue. These fibers support a broader core in comparison to single-mode ones, allowing them to contain longer wavelengths of light. Further, they show better light-gathering capabilities from laser sources. Manufacturers are strategically aiming at vertical integration efforts to streamline processes related to assembly & testing, focusing on greater efficiency & affordability.

Further, the plastic optical fiber segment is expected to show quick growth over the forecast period, which is due to several advantages it provides, like lower packaging & production expenses, growth in bending capacity, immunity to noise interference, ruggedness, & flexibility, supporting easier installation. These qualities make

plastic optical fibers a better choice for many applications, driving their growing adoption across different industries.

By Process

The global market for fiber preforms is segmented into VAD, OVD, MCVD, and PCVD methods. Among these, the VAD segment is expected to hold the largest revenue share in 2024 & is anticipated to experience the fastest growth throughout the forecast period, as VAD excels in producing high-quality preforms with low signal loss & outstanding transmission characteristics.

The main manufacturing method used as Vapor Axial Deposition or VAD is that various materials, like silica, are deposited onto a rotating rod, which is then drawn into the final optical fiber. VAD comes out for its ability to create large quantities of high-quality glass efficiently, supporting mass production of optical fibers.

Further, the OVD segment is anticipated to experience high expansion in the coming years, which can be due to the number of advantages it provides, like high scalability, less signal loss during data transmission, uniform deposition, & flexibility. Moreover, the OVD method acts as a dependable option for manufacturers looking for efficient & effective ways to create fiber preforms, meeting diverse market demands while maintaining high standards of quality & performance.

By End User

The global fiber optics preform market is categorized by end-user into segments like oil & gas, telecom, military & aerospace, medical, BFSI, railway, and others. It is expected that the telecom segment is expected to lead the market share in 2024, mainly due to the growth in the need for high-speed internet & efficient data transmission. This growth is driven by factors like the broad use of smartphones, the constant expansion of internet connectivity, and the increasing dependency on cloud services, all of which are driving demand within this segment.

Further, significant growth is expected in the "others" segment during the forecast period, which is primarily due to growing investments & initiatives by governments & public sector organizations focused on enhancing connectivity in many underserved rural & remote areas. Such efforts are important for bridging the digital divide & ensuring equitable access to communication infrastructure, thus contributing to the complete expansion of the market.

The Fiber Optic Preform Market Report is segmented on the basis of the following

By Product

- Multi-Mode

- Single-Mode

- Plastic Optical Fiber

By Process

By End User

- Telecom

- Military & Aerospace

- Medical

- Oil & Gas

- BFSI

- Railway

- Others

How Does Artificial Intelligence Contribute To Improve Fiber Optic Preform Market ?

- Enhanced Manufacturing Precision: AI-driven automation improves the precision of fiber optic preform production, reducing material wastage and defects.

- Predictive Maintenance: AI-powered predictive analytics help detect equipment failures before they occur, minimizing downtime and maintenance costs.

- Process Optimization: AI algorithms analyze real-time data to optimize temperature control, chemical compositions, and overall efficiency in the preform manufacturing process.

- Quality Control & Defect Detection: AI-based computer vision systems inspect preforms for micro-defects, ensuring higher quality and consistency.

- Supply Chain Efficiency: AI optimizes raw material procurement, inventory management, and logistics to streamline production and reduce costs.

- Market Demand Forecasting: AI-driven data analysis helps manufacturers predict market trends and adjust production accordingly.

- Energy Efficiency: AI enhances energy management in manufacturing plants, reducing power consumption and operational costs.

Fiber Optic Preform Market Regional Analysis

Asia Pacific is expected to lead the global fiber optic preform market with a major revenue

share of 67.1% in 2024, which is driven by the region's growing internet usage, ongoing telecom sector, & expanding end-use industries. Asia Pacific has experienced a major growth in telecommunication infrastructure development, driven by the growing demand for broadband connectivity, the increase of 4G and 5G networks, and the rising adoption of smartphones.

Further, there has been a significant growth in the demand for fiber optical preforms mainly for these devices. Further, the Middle East & Africa region is expected to show rapid growth during the forecast period, driven by current digital transformations and major expansion in the telecom &other end-user sectors.

By Region

North America

Europe

- Germany

- The U.K.

- France

- Italy

- Russia

- Spain

- Benelux

- Nordic

- Rest of Europe

Asia-Pacific

- China

- Japan

- South Korea

- India

- ANZ

- ASEAN

- Rest of Asia-Pacific

Latin America

- Brazil

- Mexico

- Argentina

- Colombia

- Rest of Latin America

Middle East & Africa

- Saudi Arabia

- UAE

- South Africa

- Israel

- Egypt

- Rest of MEA

Fiber Optic Preform Market Competitive Landscape

The global fiber optic preform market experiences competition among key players looking to innovate and improve product efficiency to meet the increasing demand. These players aim to improve energy efficiency & performance to meet teleconferencing & mobile computing needs. Further, developments in fiber optics technology and growing investment in telecom infrastructure intensify competition.

Some of the prominent players in the global Fiber Optic Preform Market are

Fiber Optic Preform Market Recent Developments

- In February 2024, HFCL Limited (HFCL) unveiled its strategic expansion into Europe by building an OFC manufacturing plant in Poland, which highlights a major milestone in the Company’s global expansion strategy, aimed at addressing the rising demand for OFC in European markets like the UK, Germany, Belgium, France, Poland, etc.

- In August 2023, PLP announced that the company is improving its COYOTE Fiber Optics product line to help global service providers in broadband infrastructure projects. The expanded range of solutions was showcased at events like Fiber Connect in Orlando, ISE Expo in Kansas City, and SCTE Cable-Tec Expo in Denver, featuring live demonstrations of their capabilities to help ongoing network construction & maintenance endeavors.

- In July 2023, Heraeus Comvance announced that the company acquired a portion of OFS Fitel Denmark ApS in Brøndby to develop standard optical telecommunication fibers for the EMEA market. OFS will maintain its offerings outside EMEA & develop specialty fiber in Denmark, while Furukawa Electric will serve the global market from Japan.

- In April 2023, CommScope announced that the company is expanding fiber optic cable production to expand the broadband rollout across the US, connecting more communities & underserved areas.

- In October 2022, Nokia introduced the world’s first Generation 6 broadband platform, developed for a ‘fiber-for-everything’ world where fiber broadband networks develop to become a single infrastructure for all services. The new Lightspan MF-14 platform expands the upper end of Nokia’s fiber broadband portfolio providing unmatched capacity, low latency, intelligence, six nines reliability, and the highest power efficiency, making operators address broadband needs for the next decades.

Fiber Optic Preform Market Report Details

| Report Characteristics |

| Market Size (2024) |

USD 7.8 Bn |

| Forecast Value (2033) |

USD 52.0 Bn |

| CAGR (2023-2032) |

23.4% |

| Historical Data |

2018 – 2023 |

| Forecast Data |

2024 – 2033 |

| Base Year |

2023 |

| Estimate Year |

2024 |

| Report Coverage |

Market Revenue Estimation, Market Dynamics, Competitive Landscape, Growth Factors and etc. |

| Segments Covered |

By Product (Multi-Mode, Single-Mode, and Plastic Optical Fiber), By Process (VAD, OVD, MCVD, and PCVD), By End User (Telecom, Military & Aerospace, Medical, Oil & Gas, BFSI, Railway, and Others) |

| Regional Coverage |

North America – The US and Canada; Europe – Germany, The UK, France, Russia, Spain, Italy, Benelux, Nordic, & Rest of Europe; Asia- Pacific– China, Japan, South Korea, India, ANZ, ASEAN, Rest of APAC; Latin America – Brazil, Mexico, Argentina, Colombia, Rest of Latin America; Middle East & Africa – Saudi Arabia, UAE, South Africa, Turkey, Egypt, Israel, & Rest of MEA |

| Prominent Players |

AFL, OFS Fitel LLC, Prysmian Group, Corning Inc, Fujikura Ltd, Sterlite Technologies Ltd, Optical Cable Corp., Shin-Etsu Chemical, Furukawa Electrical, Heraeus Holding, and Other Key Players |

| Purchase Options |

We have three licenses to opt for: Single User License (Limited to 1 user), Multi-User License (Up to 5 Users), and Corporate Use License (Unlimited User) along with free report customization equivalent to 0 analyst working days, 3 analysts working days and 5 analysts working days respectively. |

Frequently Asked Questions

The Global Fiber Optic Preform Market size is estimated to have a value of USD 7.8 billion in 2024 and is expected to reach USD 52.0 billion by the end of 2033.

Asia Pacific is expected to have the largest market share in the Global Fiber Optic Preform Market with a share of about 67.1% in 2024.

Some of the major key players in the Global Fiber Optic Preform Market are AFL, OFS Fitel LLC, Prysmian Group, and many others.

The market is growing at a CAGR of 23.4 percent over the forecasted period.