Fiber optics is a type of cutting-edge technology transforming communication & data transmission. By using thin strands of transparent glass or plastic fibers to convey information as light signals, fiber optics provides remarkable capabilities.

These fibers support the rapid and reliable transfer of vast amounts of data over long distances at incredible speeds, surpassing the performance of traditional copper cables. With features like high bandwidth, immunity to electromagnetic interference, and lower signal loss, fiber optics finds several applications in Telecommunications, internet connectivity, Data Centers, and many industries requiring quick and dependable data transmission.

Businesses are collectively driving innovation in fiber networks to streamline operations and minimize both construction and maintenance costs of optical distribution networks (ODNs). Government initiatives focused on expanding fiber optic cable deployment further contribute to market growth.

Also, the significant adoption of fiber optic cables in underwater settings, a key segment of the

Submarine Cables Market, has supported market expansion. Using deployed fiber not only improves network capacity and spectral efficiency but also provides the rapid transmission of large data volumes, fostering the development of new technologies.

Also, within the healthcare & medical industry, fiber optic technology finds several applications spanning X-ray imaging, diagnostics, ophthalmic lasers, surgical instrumentation, and light therapy. Further, the growing preference for lower invasive surgeries among patients drives the need for advanced medical practices, like those using fiber optics technology in

Medical Imaging. As patient expectations for superior medical treatments rise, so it does the need for innovative solutions that driving the constant growth of the fiber optics market within the healthcare industry.

As per Cloudwards, the Fiber Optics Market is a pivotal component of modern telecommunications, characterized by its exceptional efficiency and rapid adoption. Fiber-optic cables, thinner than human hair, transmit data 65,000 times faster than copper cables, revolutionizing global connectivity. In 2023, the industry is valued at $8.07 billion, with robust growth prospects despite inflation-driven cost pressures. Notably, Monaco leads with 100% fiber-optic coverage, while Singapore boasts the fastest internet speeds powered by fiber.

Globally, over 80% of long-distance communication cables have been fiber-optic since 2000. By the end of 2023, 96% of broadband connections are expected to exceed speeds of 10 Mbps, underscoring the technology's pervasive impact. Investment is concentrated in the U.S. and Europe, accounting for 75% of global fiber-optic development. This sustained momentum highlights the critical role of fiber optics in driving digital transformation and enabling next-generation infrastructure worldwide.

Key Takeaways

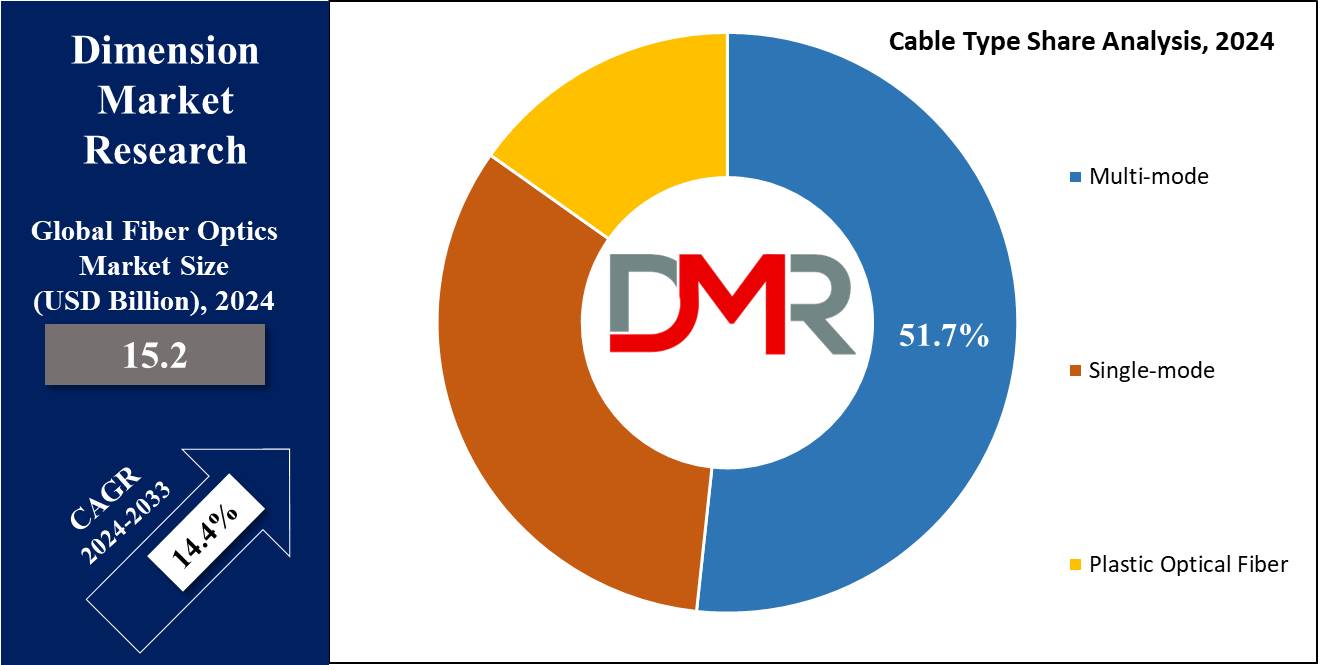

- Market Growth: The Fiber Optics Market is expected to grow by 33.9 billion, at a CAGR of 14.4% during the forecasted period of 2025 to 2033.

- By Material: The glass segment is expected to lead in 2024 with a major & is anticipated to dominate throughout the forecasted period.

- By Cable Type: Multi-mode is expected to get the largest revenue share in 2024 in the Fiber Optics market.

- By Deployment: Aerial mode form of deployment is expected to lead the Fiber Optics market in 2024

- By Application: The telecommunication sector is expected to get the largest revenue share in 2024 in the Fiber Optics market.

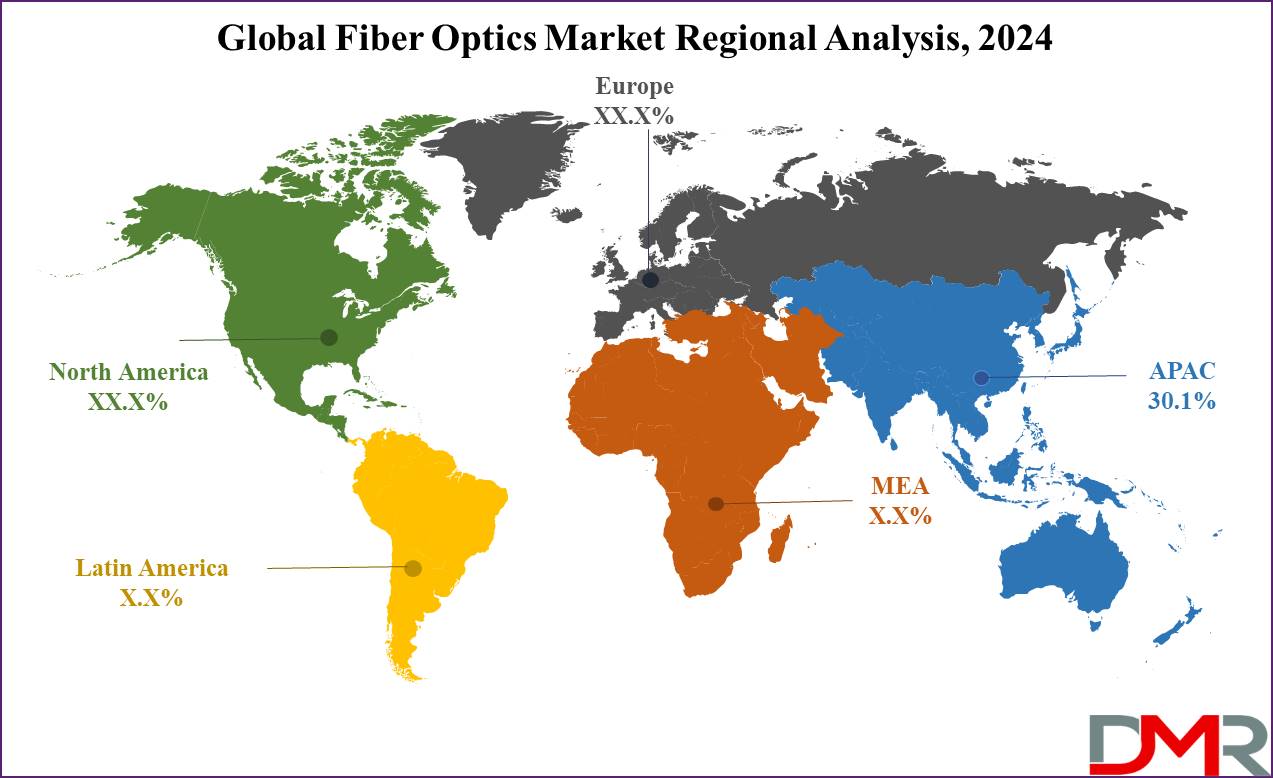

- Regional Insight: Asia Pacific is expected to hold a 30.1% share of revenue in the Global Fiber Optics Market in 2024.

- Use Cases: Some of the use cases of Fiber Optics include telecommunications, industrial sensing & monitoring, and more.

Use Cases

- Telecommunications: Fiber optics are broadly used in telecommunications for transferring data over long distances at high speeds. They are used across various communication systems, like telephone networks, internet connections, and cable television systems. Fiber optics allow the transmission of large amounts of data reliably & quickly, making them important for modern communication networks.

- Medical Imaging: Fiber optic cables are used in medical imaging equipment like endoscopes & laparoscopes. These devices use flexible fiber optic bundles to transmit light &images, allowing doctors to examine internal organs and tissues without invasive surgery. Fiber optics create high-resolution imaging with low discomfort to the patient, making them valuable tools in medical diagnostics & surgeries.

- Industrial Sensing and Monitoring: Fiber optic sensors are used in various industrial applications for sensing &monitoring purposes. They can measure parameters like temperature, pressure, strain, and vibration in harsh environments where traditional sensors may not be suitable. Fiber optic sensors provide advantages like immunity to electromagnetic interference, high sensitivity, & the ability to cover large distances, making them ideal for applications in industries like aerospace, oil & gas, and structural health monitoring.

- Data Centers: Fiber optic cables are integral to the infrastructure of modern data centers. They are used for interconnecting servers, storage devices, and networking equipment within the data center, creating high-speed data transmission & low latency. Fiber optics support the high demand for bandwidth-intensive applications & cloud computing services, creating efficient data transfer and scalability in large-scale computing environments.

Market Dynamic

The fiber optics market is experiencing significant growth due to increased demand for video streaming and online gaming. With consumers prioritizing easy & uninterrupted experiences, fiber optics provides the high-speed and reliable internet connectivity necessary for these activities. As video streaming & online gaming require fast and stable internet connections to deliver high-definition content without buffering or lag, fiber optics' ability to transmit data at incredibly high speeds ensures smooth playback & immersive gaming sessions.

Also, the low signal loss & high bandwidth capabilities of fiber optics reduce latency, providing a competitive advantage to gamers and driving investments from internet service providers & telecom companies to expand fiber optic networks, making it a major infrastructure component for delivering high-quality experiences in these sectors, including the rollout of the

5g services market and the expanding Internet of Things market.

However, while the fiber optics market experiences strong growth, it also faces challenges. The market is highly competitive, with many companies offering a variety of products, making it challenging for new entrants or smaller companies to gain market share. In addition, the high cost of fiber optics systems presents a barrier to entry, mainly for industries like automotive systems and payers, where cost pressures are very high.

Despite the growing demand for fiber optics, there is also a need for affordable solutions to meet market demands, as manufacturers must strike a balance between developing innovative solutions and ensuring affordability to remain competitive in the market, while also addressing critical needs in Network Security Market.

Research Scope and Analysis

By Material

The glass segment is anticipated to get the largest revenue share in the global fiber optics market in 2024 due to its broad use across the industry. However, plastic optical fiber is expected to experience the fastest growth during the forecast period, driven by its versatility & cost-saving benefits.

Unlike glass, plastic optical fiber supports dynamic applications & is constructed with a polymer core, mainly reducing manufacturing costs, which when combined with its adaptable nature, positions plastic optical fiber as a compelling choice for many applications, driving its growth in the fiber optics market.

Further, plastic optical fiber is expected to show higher growth opportunities over the forecasted period, mainly due to its dynamic applications and inherent cost-saving features. With a polymer core distinguishing it from traditional glass fibers, plastic optical fiber provides an affordable alternative, appealing to industries looking for efficient yet affordable solutions. Its flexibility and persistency in bending make it mainly suitable for many sensing applications, like those requiring compact installations or frequent movement.

In addition, plastic fibers demonstrate less signal attenuation in comparison to their glass counterparts, further improving their attractiveness for a variety of sensing applications. As a result, plastic optical fiber emerges as a versatile &budget-friendly option, meeting the evolving needs of industries requiring reliable and low cost fiber optic solutions.

By Cable Type

The multi-mode fiber optic segment is set to show its dominance in the global fiber optics market, commanding a significant revenue share of 51.7% in 2024. Its broad adoption stemmed from its cost-effectiveness and adaptability across diverse industries. Within the healthcare sector, multi-mode fibers became essential for illumination & surgical lighting, providing dependable solutions for medical instruments, diagnostics, operating rooms, telemedicine setups, & medical imaging systems. By providing higher quality, better efficiency, and enhanced resolution, multi-mode fibers played a vital role in advancing medical technologies & improving patient care standards.

Furthermore, expanding beyond healthcare, the multi-mode segment met many needs within the automotive industry, addressing communication, lighting, & sensing requirements. Further, its increasing adoption in mission-critical applications highlights its high bandwidth capabilities and affordability, catering to industries reliant on strong communication networks & efficient sensing systems.

Moreover, the fiber optics market is set to show major growth in the signal segment, driven by the rising demand for single-mode fibers. Telecom companies mainly favor single-mode fibers for their ability to support high-bandwidth, long-distance transmissions, critical for meeting the evolving connectivity needs of modern communication networks.

In addition, the plastic optic fiber (POF) segment is anticipated to show major growth, as it is expected to experience rapid expansion in the forecast period, which is fueled by factors like population growth, shifting lifestyles, better disposable income, and the inherent durability of POF against bending and stretching. The distinctive core materials used in POF cable construction positioned it as a resilient & reliable option, further driving its adoption across various industries looking for advanced fiber optic solutions.

By Deployment

The aerial mode of deployment is set to be the leading driver in the growth of the global fiber optics market, which involves installing fiber optic cables above ground, mainly along existing utility poles or aerial support structures. One key advantage of aerial deployment is its affordability and relatively quick installation process compared to underground methods, which makes it particularly attractive for expanding fiber optic networks in urban & suburban areas where digging trenches for underground deployment may be challenging or costly. In addition, aerial deployment provides scalability, allowing for easier expansion & maintenance of fiber optic infrastructure as demand grows.

Also, aerial deployment facilitates quick deployment of fiber optics in remote or rural areas, where underground installation may not be feasible, which also minimizes disruptions to existing infrastructure & reduces the environmental impact associated with damage. Overall, the aerial mode of deployment allows efficient and low cost expansion of fiber optic networks, thereby supporting the growth of high-speed internet connectivity, advanced communication services, and emerging technologies reliant on robust data transmission capabilities.

By Application

The telecommunication sector is anticipated to be the top revenue contributor in the global fiber optics market in 2024, a trend projected to persist in the coming future, which is fueled by the growing adoption of fiber optics for data transmission services & communication needs. The technology supports high-speed information transfer over both short & long distances, meeting the increasing need for services like Video-on-Demand, cloud-based applications, and audio-video services, which is driving the market growth of fiber optics within the telecom sector, promising constant expansion & innovation in the coming years.

Moreover, the military & aerospace, and medical sectors are expected to rapid growth, driven by the growing application of optic technology devices. The growing concerns over security due to the growth in terrorist activities have caused defense services & government authorities to adopt advanced technologies like wearable devices, body cams, and other responders to improve connectivity and response capabilities regardless of location.

In addition, the need for high-speed internet to support the growth of the Internet of Everything (IoE) & need to maintain national security further drives the need for fiber optics. These factors collectively contribute to the growing significance of fiber optics across many sectors, reflecting a wide trend toward leveraging advanced technologies to address evolving challenges and opportunities in various industries.

The Fiber Optics Market Report is segmented on the basis of the following

By Material

By Cable Type

- Single Mode

- Multi-mode

- Plastic Optical Fiber (POF)

By Deployment

- Underground

- Underwater

- Aerial

By Application

- Military & Aerospace

- Weapon System

- Secure Communication

- Surveillance System

- UAV

- Optical Computing

- Military Vehicle Sensing

- Oil & Gas

- High Bandwidth Communications

- Material Sensing

- Others

- BFSI

- Railway

- Speed Monitoring

- Railway Maintenance

- Dynamic Load Calculation

- Telecom

- Medical

- Minimal Invasive Surgery

- Biomedical Sensing

- Imaging

- Others

Regional Analysis

Asia Pacific is expected to have the largest market share accounting for

30.1% in 2024, fueled by fast economic growth stimulating the need for energy-efficient solutions across many sectors. The region's ongoing economies have driven the adoption of fiber optics as the preferred choice for communication networks & data transmission due to its high-speed capabilities & low energy consumption, which has solidified its dominance in the market.

Furthermore, the growing demand for fiber optic sensors in industries like aerospace, oil & gas, healthcare, and automotive is contributing to market growth. These sensors provide accurate and reliable data for monitoring & control applications, driving their increased adoption across many industries.

Also, the ongoing developments in fiber optic technology, like the development of higher-capacity fibers & improved connectivity solutions, have supported the region's market leadership. Asia Pacific stands at the forefront of R&D efforts in fiber optics, promoting innovation and attracting major investments in the sector. In addition, the region's major population & rapid urbanization have created a high demand for high-speed internet connectivity, further driving the expansion of fiber optic networks, which aligns with the region's technological developments, positioning Asia Pacific as a major region in driving the evolution and widespread adoption of fiber optic technologies.

By Region

North America

Europe

- Germany

- The U.K.

- France

- Italy

- Russia

- Spain

- Benelux

- Nordic

- Rest of Europe

Asia-Pacific

- China

- Japan

- South Korea

- India

- ANZ

- ASEAN

- Rest of Asia-Pacific

Latin America

- Brazil

- Mexico

- Argentina

- Colombia

- Rest of Latin America

Middle East & Africa

- Saudi Arabia

- UAE

- South Africa

- Israel

- Egypt

- Rest of MEA

Competitive Landscape

The global fiber optics market is characterized by strong competition among many key players competing for market share. These companies constantly look to innovate and improve their products & services to meet the growing demand for high-speed data transmission & communication solutions. Factors driving competition like technological advancements, pricing strategies, and geographical reach.

In addition, the market is influenced by factors like government regulations, industry standards, and customer preferences. As a result, companies in the fiber optics industry focus on improving their product portfolios, expanding their market presence, and forging strategic partnerships to stay competitive in this dynamic & rapidly changing market landscape.

Some of the prominent players in the global Fiber Optics Market are

- Molex

- AFL

- OFS Fitel

- Optical Cable Corporation

- Prysmian Group

- Leoni AG

- Finolex

- Furukawa Electric

- Finisar

- LS Cable & System

- Other Key Players

Recent Developments

- In February 2024, West Coast Optilinks, WCO, announced the completion of the expansion of their fiber optic cable manufacturing capacity, as the doubling of the manufacturing capacity was achieved by constructing a facility at Fab City, Hyderabad, Telangana, as the company has an existing fiber cable production facility in Mysore, Karnataka where the company produces different types of loose tube type fiber optic cables.

- In October 2023, Sterlite Technologies Ltd (STL) announced the development of a 160-micron optical fiber, which it claims to be the world’s slimmest fiber for telecommunication, and has been conceptualized & developed indigenously at STL’s Centre of Excellence in Maharashtra, India making it the first company across the world to design and patent this technology. Further, the cable made with 160-micron fiber can pack 3X more capacity than traditional 250-micron fiber.

- In July 2023, STL announced its partnership with Windstream, a privately held communications & software company, to assist their large-scale fiber expansion projects. Windstream Wholesale, an optical technology leader of fast & flexible advanced solutions, has numerous fiber construction projects underway like an extension of its existing Tulsa, OK route from Little Rock, AR, to Memphis, TN; a new fiber build from Raleigh, NC, to Jacksonville, FL; and another project from New York City to Montreal. In addition, the company, through its Kinetic business, is bringing the finest internet experience to more Y more homes, businesses, and carrier partners across America. Kinetic by Windstream is investing USD 2 billion to dramatically expand gigabit internet service across its 18-state footprint.

- In April 2023, the National Highways Authority of India (NHAI) announced its plans to develop an integrated network of around 10K kilometers of optic fiber cables (OFC) infrastructure around the country by FY 2025, which will be implemented by NHAI’s special purpose vehicle, National Highways Logistics Management Limited (NHLML), and build utility corridors along the national highways to develop the OFC infrastructure. The OFC network will provide internet connectivity to remote regions in India & support the country’s transition to modern telecommunication technologies like 5G & 6G.

- In March 2023, CommScope announced that the company is expanding fiber-optic cable production to accelerate the rollout of broadband across the United States, connecting more communities & underserved areas, and will include growing fiber-optic cable output, accelerating the deployment of broadband to underserved communities. Further, the HeliARC™ lines are expected to help 500,000 homes per year in fiber-to-the-home (FTTH) deployments. Also, it would increase employment opportunities with the addition of at least 250 jobs over the next five years, 90% of which will not need a college degree Moreover, the company would invest USD 47 million CapEx in the U.S. toward expanding fiber optic cable production focused on rural applications.

- In October 2022, Nokia launched the world’s first Generation 6 broadband platform, developed for a ‘fiber-for-everything’ world where fiber broadband networks develop to become a single infrastructure for all services. The new Lightspan MF-14 platform extends the upper end of Nokia’s fiber broadband portfolio bringing advanced capacity, low latency, intelligence, six-nines reliability, and the highest power efficiency, allowing operators to address broadband needs for the next decades.