The Food Robotics Market incorporates advanced robotics technology into the food industry to automate food preparation, processing, packaging, and quality control. This sector employs robotic systems to increase operational efficiencies, ensure consistent product quality, and meet rising demands for high-volume production with minimum human intervention. Key drivers include cost reduction, labor shortages, and the quest for greater precision and safety in food handling. Thanks to artificial intelligence and machine learning advances, food robotics offers transformative potential for streamlining operations, improving hygiene standards, and creating competitive advantages in an ever-evolving food sector.

Market analysts view the Food Robotics Market as one of robust expansion, driven by advances in automation technology and evolving industry dynamics. Integration of robotics into food production, processing, and packaging operations has increasingly become recognized as an effective means for improving operational efficiencies, mitigating labor shortages, meeting quality and safety standards, and meeting stringent health standards. With artificial intelligence (AI), machine learning (ML), and advanced sensor technologies revolutionizing its capabilities for more precise, flexible, and adaptable operations.

Consumer demand for personalized, high-quality food packaged conveniently is driving an increased need for automated solutions that can efficiently scale production while accommodating variation. Furthermore, increased regulatory requirements and the focus on reducing contamination risks is compelling food manufacturers to invest in robotics for reduced human contact and compliance purposes. Furthermore, this technology also facilitates agile responses to supply chain disruptions or changing market demands, reinforcing its role as part of resilient production systems.

Key Takeaways

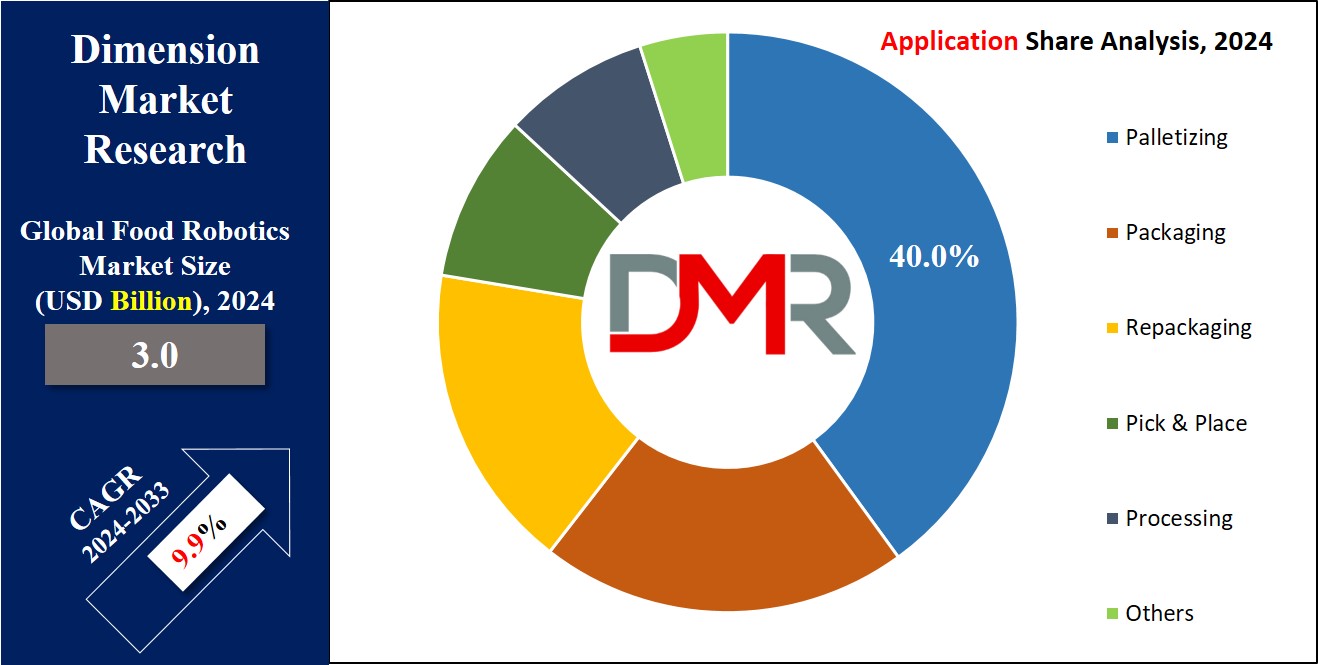

- Market Growth: The Food Robotics Market is set to expand from USD 3.0 billion in 2024 to USD 6.9 billion by 2033, with a robust CAGR of 9.9%.

- Driving Factors: Key drivers include advancements in automation technology, rising food safety regulations, increased investments in automation systems, and the growth of e-commerce.

- Dominating Segment: Articulated robots lead the market, holding a 42% share in 2023, due to their versatility and ability to perform complex tasks.

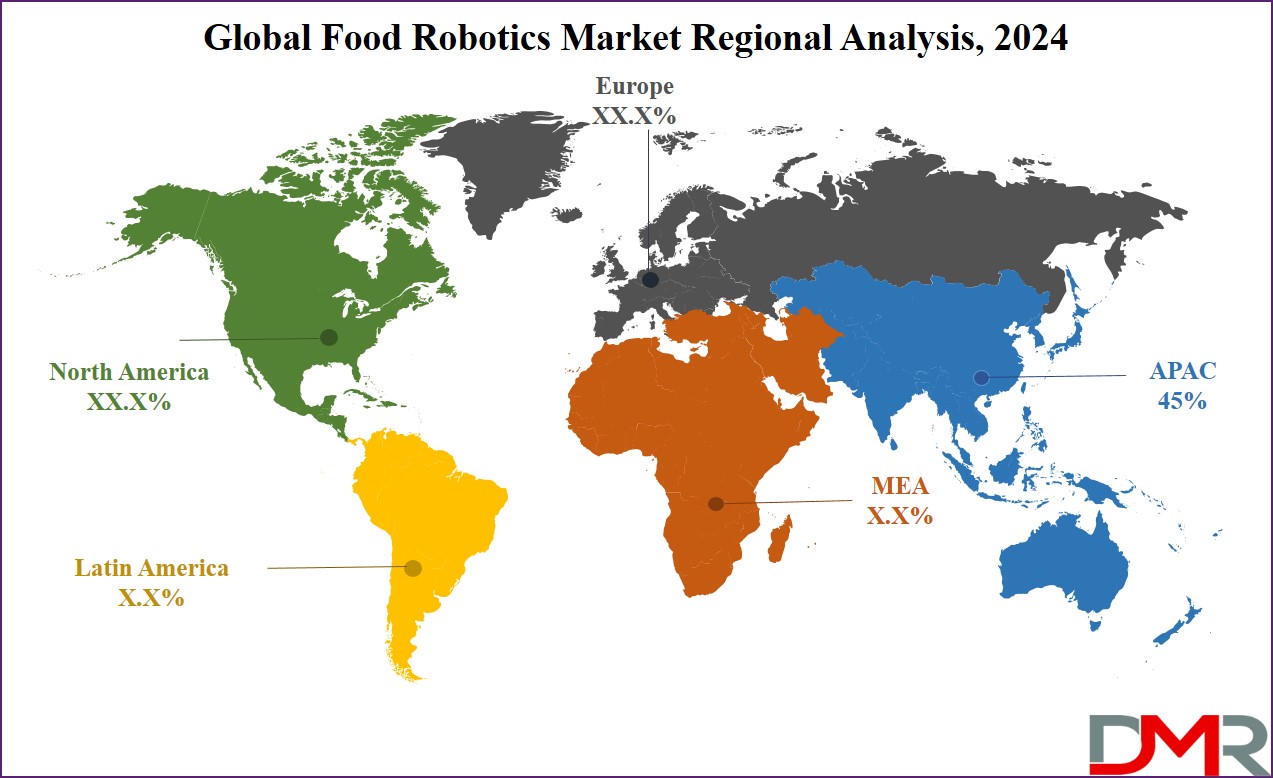

- Regional Insights: Asia-Pacific dominates with a 45% market share, driven by rapid industrialization and significant investments in automation. Europe follows with 30%, and North America holds 20%.

- Investment Trends: The global food automation market, including robotics, is projected to grow at a CAGR of 10.5% from 2023 to 2028, reflecting a strong push towards automation.

Use Cases

- Efficient Packaging: Articulated robots automated high-speed packaging tasks like filling and labeling, boosting efficiency and ensuring consistent quality for packaged foods.

- Enhanced Quality Control: AI-powered robots perform real-time quality inspections, improving accuracy and reducing contamination risks while meeting strict food safety standards.

- Addressing Labor Shortages: Robots handle repetitive tasks such as sorting and palletizing, helping manufacturers overcome labor shortages and maintain production efficiency.

- Streamlined E-Commerce Fulfillment: Robotics automate picking, packing, and sorting for online grocery orders, enhancing speed and accuracy in response to e-commerce growth.

- Flexible Food Processing: Advanced robots handle complex food processing tasks like cutting and mixing, allowing quick adaptation to new products and maintaining high quality.

Driving Factors

Food Safety Regulations

Food safety regulations have been an essential contributor to the expansion of the Food Robotics Market. Due to increasing scrutiny from regulatory bodies, food manufacturers must adopt cutting-edge technologies to adhere to stringent safety and quality standards. Robotic systems play a significant role in this regard by minimizing human contact during food production environments thereby decreasing risks of contamination while improving hygiene in these environments. Furthermore, robotic integration helps not only meet regulatory requirements but also facilitates more precise adherence to safety protocols.

According to a recent report, food safety issues cost the global food industry an estimated annual total of approximately $1.2 trillion due to recalls, legal fees, and lost business. This high figure highlights both the high stakes involved and the increasing need for automated solutions that can mitigate these risks. As regulations tighten further still, demand for robotic solutions that automate tasks such as inspection, packaging, and handling should increase as will drive substantial market expansion.

Increased Investments in Automation Systems

Increased investments in automation are driving growth in the Food Robotics Market. Companies are dedicating capital towards developing and deploying robot systems that enhance production efficiency, decrease labor costs, and enhance operational effectiveness - this surge of investment enables technological advances leading to ever more sophisticated robotic solutions.

The global food automation market, including robotics, was estimated at roughly $12.5 billion in 2023 and is projected to expand at a compound annual growth rate (CAGR) of 10.5% from then until 2028. This robust growth demonstrates widespread recognition of automation as a crucial means of increasing productivity and maintaining competitive advantage; further investment into research and development yielding advanced robotic technologies capable of performing complex tasks more precisely fuels market expansion.

Growth of E-commerce

E-commerce's Rapid Expansion E-commerce's explosive growth is having an immense impact on the Food Robotics Market. As online grocery shopping and delivery services continue to gain traction, demand increases for efficient yet scalable food processing and packaging solutions. Robotics play an invaluable role in fulfilling orders quickly and accurately on these platforms - guaranteeing timely fulfillment!

E-commerce in the food sector is expected to reach $900 billion by 2025, rising from $602 billion in 2022. This projected expansion drives demand for automated systems capable of handling all aspects of online orders from picking, packing, quality control, and shipping - including robotics technology - to meet consumer expectations for speed and accuracy in fulfillment. Integration of robotics in e-commerce operations thus plays a pivotal role in driving market expansion as they offer scalability and agility necessary to thrive within this digital retail ecosystem.

Growth Opportunities

Food Safety Awareness Rising

2023 is expected to bring great opportunities in the global Food Robotics Market as regulations around food safety become stricter, driving companies towards investing in robotic systems designed to enhance hygiene and comply with safety standards. Robots reduce human contact, thus minimizing contamination risks while guaranteeing consistent adherence to safety protocols - helping companies avoid recalls, and legal issues, and cultivate consumer trust at once! As this remains such an integral concern of business, demand for advanced robotic solutions designed to uphold standards will likely grow significantly.

Food Industry Labor Shortages

Labor shortages remain an ever-present threat to the food industry, creating an excellent opportunity for food robotics. Shifting workforce dynamics have only compounded their scarcity of skilled labor, necessitating automation as an indispensable means of maintaining productivity and operational efficiency. Robotics offer solutions by performing repetitive and labor-intensive tasks with high precision and reliability reducing dependency on human labor for operational efficiency reducing immediate workforce shortages as well as long-term benefits by optimizing labor costs and improving process efficiencies reducing dependence on human labor as companies tackle labor shortages their adoption will likely increase further thus fuelling market growth.

Wide Applications of Food Robots

Food robotics have found many uses within various aspects of food production, from processing and packaging, through quality control and logistics, and to quality assurance and distribution. With such wide-ranging applications across food manufacturing processes such as processing and packaging to quality assurance and distribution logistics. Food manufacturers can tailor food robotics solutions specifically to their individual needs thus increasing flexibility and scalability as the industry develops and demands rise for robots that can efficiently handle diverse tasks while adapting quickly to changing production requirements and supporting new product innovations - and that makes food robotics an invaluable asset driving widespread adoption and market growth!

Key Trends

Integrating AI and Machine Learning Technologies

2023 will witness significant trends within the Food Robotics Market driven by Artificial Intelligence (AI) and machine learning technologies, which are increasing robotic systems' capacities to perform complex tasks more precisely and adaptability. AI-enabled robots are adept at quickly processing vast amounts of data in real time and optimizing processes such as quality control, predictive maintenance, and inventory management. Machine learning algorithms enable robots to continually enhance their performance over time by learning from past experiences and adapting their operations accordingly. Integration between AI and machine learning technologies not only increases efficiency and accuracy but also allows more flexible production lines to quickly respond to consumer preferences or product variations. AI/ML capabilities have set new standards in food processing and packaging industries alike - becoming essential tools in driving market expansion.

Collaborative Robots (Cobots)

Cobots (collaborative robots) will play an increasingly crucial role in shaping the Food Robotics Market by 2023. Unlike their industrial counterparts, cobots are designed to work alongside human operators in shared workspaces for improved productivity and safety. Advanced sensors and safety features enable these machines to interact seamlessly with human workers, performing tasks like sorting, packing, and quality inspection more efficiently than humans could. Cobots have gained in popularity due to their ability to streamline workflows, reduce repetitive strain on human workers, and enhance operational flexibility. Their straightforward deployment and adaptability to various tasks make cobots invaluable assets in food industry environments - speeding integration.

Advance Robotic Systems on the Rise

The emergence of advanced robotic systems is at the core of the 2023 Food Robotics Market. Recent advancements in robotics technology are producing more complex, multifunctional robots which are capable of fulfilling various applications. These advanced robots stand out due to their superior dexterity, speed and precision that enable them to accomplish tasks that were once challenging or impossible. New robotic systems can now safely handle delicate food items with greater care, complete complex assembly tasks efficiently, and operate in various environments. Robotic technology has greatly expanded the scope of automation within the food industry while decreasing operational costs simultaneously. As these advanced systems become more cost-effective and accessible, their adoption should increase, further fueling market expansion.

Restraining Factors

Lack of Highly Skilled Workers hinders Adoption of Food Robots

Food Robotics Market. While robotics technology offers substantial advantages, its deployment and management require specific knowledge and abilities that are currently scarce in supply. This shortage is especially apparent in sectors requiring highly technical expertise for the integration, programming, and maintenance of robots. Industry reports reveal that nearly 75% of food manufacturers identify difficulty finding qualified workers as one of the primary obstacles to adopting advanced automation technologies. This workforce deficit can delay adoption rates and drive up training and support costs - ultimately curbing market expansion.

Limited Understanding of Robotics Prevents Widespread Adoption

Food Robotics Market growth may also be hindered by users' limited understanding of robotics technologies. Many food industry stakeholders remain unaware of their advantages and capabilities, which could make adopting robotics more complex than desired. Lack of awareness may result in slower decision-making processes and hesitation to invest in automation solutions. According to one survey, 60% of small to mid-sized food manufacturers have yet to adopt robotics due to uncertainty regarding its impact and return on investment. Therefore, increasing awareness about robotics' advantages while providing examples of successful implementation is the key to breaking through barriers and expanding market penetration.

Reliability and Maintenance Concerns Can Impact Investment Decisions

Concerns surrounding the reliability and maintenance requirements of robotic systems play a part in slowing market expansion. Even as technology improves, some stakeholders remain wary about the long-term reliability requirements of robotics. Issues such as unexpected downtimes, high repair costs, and the need for ongoing technical support may dissuade companies from investing in robotic systems. Industry data indicates that 40% of food manufacturers perceive maintenance and reliability issues as being significant obstacles, citing concerns over potential disruptions to production as well as financial implications of repairs. Addressing these reservations with improved service contracts, predictive maintenance technologies, and demonstrated reliability could alleviate their concerns while encouraging greater investments in food robotics technology.

Research Scope Analysis

By Type

Articulated robots dominated the Food Robotics Market in 2023, accounting for 42% of the market share. Their versatility and ability to complete complex tasks precisely make them ideal for various food processing and packaging applications. Cartesian robots followed closely behind with around 25% market share owing to their cost-effective nature; particularly beneficial when carrying out repetitive linear movements with high repeatability like sorting and packaging applications.

SCARA robots account for 15% of the market and are widely admired for their speed and accuracy in pick-and-place operations, making them particularly suitable for high throughput environments that demand rapid movements with precision. Meanwhile, parallel robots comprise approximately 8%. Their high speed and dexterity in handling delicate objects make them suitable for applications requiring both speed and precision simultaneously.

Cylindrical robots account for roughly 5% of the market and are used for tasks requiring rotational movements, such as filling and dispensing, due to their ability to operate within cylindrical workspaces. Cobots have made impressive gains as collaborative machines by working alongside human operators while increasing flexibility and safety, propelling their popularity in food manufacturing environments.

By Payload

Low-cost robots were the clear winner in 2023's Product Type segment of the Food Robotics Market, accounting for approximately 50% market share. Their popularity can be attributed to their affordability and accessibility - particularly appealing to smaller enterprises looking to automate operations without an upfront capital commitment. They're widely employed for tasks like packaging and material handling where cost efficiency and reliability are crucial considerations.

Medium-cost robots had approximately 35% market share. These robots provided a balance between performance and cost, offering enhanced capabilities compared to low-cost versions. Medium-cost robots are typically employed for applications requiring advanced functionalities like precision food processing or moderate-speed packaging operations; their versatility and improved performance also make them a top choice among mid-sized businesses seeking an upgrade from basic automation solutions.

High-cost robots accounted for approximately 15% of the market. These advanced systems feature cutting-edge technology, superior performance, and specialized capabilities. High-cost robots are utilized for complex and precision tasks such as advanced quality control or high-speed sorting where technology investment can lead to significant operational improvements and efficiency gains. Even with their higher price point, these advanced features and long-term benefits make high-cost robots invaluable resources in large operations with demanding automation needs.

Overall, market share allocation across these segments reflects the diverse needs and budgets of different players within the food industry, driving the adoption of robotics across a broad spectrum of applications.

By Application

Palletizing was the clear leader in the Product Type segment of the Food Robotics Market in 2023, holding approximately 40% market share. This impressive success can be attributed to their central role in improving supply chain efficiency; handling high volumes of goods efficiently while streamlining stacking and arranging processes and helping ensure products reach their destination successfully and safely.

Packaging robots accounted for approximately 30% of the market. Packaging robots are an essential part of food industry operations, performing tasks such as filling, sealing, and labeling quickly and precisely with high speeds and accuracy. Their versatility in adapting to multiple packaging formats and product types makes them invaluable tools in modern food manufacturing facilities.

Repackaging robots accounted for roughly 15% of market share. They specialize in reconfiguring and adjusting packaging to meet various consumer demands and retail specifications, which has grown increasingly important as businesses strive to offer tailored packaging solutions and respond efficiently to shifting market needs.

Pick & Place robots held around 10% of the market. Designed for high-speed product sorting and handling, these robots excel at performing tasks requiring precision and quick movement such as sorting items on production lines or placing products into containers.

Processing robots hold roughly three percent of the market, and specialize in automating food preparation and processing tasks such as cutting, mixing, and cooking. Their role is critical in increasing the efficiency and consistency of food processing operations.

The Food Robotics Market Report is segmented based on the following:

By Type

- Articulated

- Cartesian

- SCARA

- Parallel

- Cylindrical

- Collaborative

- Others

- icon_6

By Payload

By Application

- Palletizing

- Packaging

- Repackaging

- Pick & Place

- Processing

- Others

Regional Analysis

Food Robotics Market 2023 revealed varied regional dynamics, with Asia-Pacific accounting for an approximate 45% market share. This dominance can be attributed to rapid industrialization, significant investments in automation systems, and growing demand for efficient food processing and packaging solutions in countries like China, Japan, and India. Furthermore, Asia-Pacific boasts a robust manufacturing base as well as an increasing focus on improving food safety and production efficiency - factors which further support its position at the top of the global Food Robotics Market.

Europe closely trails behind, capturing approximately 30% of the market share for food robotics solutions. Europe benefits from strong regulatory frameworks which prioritize food safety and quality as well as advanced technological infrastructure; countries like Germany, France and United Kingdom are pioneering sophisticated robotic solutions due to both strict food regulations as well as a drive towards increased automation during production and processing of their foodstuffs.

North America represents approximately 20% of the food manufacturing market. Its significance can be attributed to its well-established food industry and rapid technological innovation; the United States and Canada are leading adopters of robotics in food manufacturing with regards to improving operational efficiencies, addressing labor shortages, and maintaining high standards of food safety.

By Region

North America

Europe

- Germany

- U.K.

- France

- Italy

- Russia

- Spain

- Benelux

- Nordic

- Rest of Europe

Asia-Pacific

- China

- Japan

- South Korea

- India

- ANZ

- ASEAN

- Rest of Asia-Pacific

Latin America

- Brazil

- Mexico

- Argentina

- Colombia

- Rest of Latin America

Middle East & Africa

- Saudi Arabia

- UAE

- South Africa

- Israel

- Egypt

- Rest of MEA

Competitive Landscape

2023 marks a significant turning point for the global Food Robotics Market as several key players exert substantial influences through technological innovations and robust product offerings. ABB Group stands out with its comprehensive suite of food industry robotic solutions tailored specifically to this field; specifically integrating advanced robotics into complex production environments while emphasizing automation and smart manufacturing systems that increase efficiency and flexibility while emphasizing collaborative robots as the basis of advanced automation technologies that meet growing consumer demand for sophisticated food processing solutions.

KUKA AG and Fanuc Corporation are two notable players who are shaping the market with high-precision and versatile robotic systems. KUKA excels at offering flexible automation solutions tailored to specific food industry applications ranging from packaging to processing; while Fanuc maintains its position with durable high-performance robots that excel at speed and reliability in food manufacturing environments. Both firms play key roles in driving advances within this sector through innovative technologies that address requirements for efficiency and customizability in food production.

Kawasaki Heavy Industries Ltd, Rockwell Automation Inc, Mitsubishi Electric Corporation, and Yaskawa Electric Corporation contribute further to the Food Robotics Market with their specialized robotics solutions. Kawasaki provides high-speed and precision robots that support complex food handling tasks; Rockwell integrates robotics with advanced control systems to increase operational intelligence; Mitsubishi offers energy-efficient high-performance robots while Yaskawa Electric delivers versatile solutions that maximize operational efficiency - together, these players support its continuous growth and evolution by meeting industry demands for precision, flexibility and advanced automation.

Some of the prominent players in the Global Food Robotics Market are:

- ABB Group

- KUKA AG

- Fanuc Corporation

- Kawasaki Heavy Industries Ltd.

- Rockwell Automation Inc.

- Mitsubishi Electric Corporation

- Yasakawa Electric Corporation

Recent developments

- In February 2022, Mitsubishi Electric Corporation introduced a teaching-less robot system for food-processing factories, capable of performing tasks like sorting and arrangement with human-like speed and no supervision.

- In April 2021, Rockwell Automation Inc. and Comau announced a collaboration to simplify processing and lifecycle management in the food and beverage industries.

- In October 2021, Gea launched the Xtru Twin 140 extruder, which can produce over 3 tonnes of pellets and 10 tonnes of pet food kibbles per hour, enhancing high-capacity output.

- In June 2021, SPX FLOW released the APV Pilot 4T Homogenizer, a compact unit designed for testing various recipes and efficiently homogenizing immiscible liquids into stable emulsions.

Report Details

| Report Characteristics |

| Market Size (2023) |

USD 3.0 Billion |

| Forecast Value (2032) |

USD 6.9 Billion |

| CAGR (2023-2032) |

9.9% |

| Historical Data |

2018 – 2023 |

| Forecast Data |

2024 – 2033 |

| Base Year |

2023 |

| Estimate Year |

2024 |

| Report Coverage |

Market Revenue Estimation, Market Dynamics, Competitive Landscape, Growth Factors and etc. |

| Segments Covered |

By Type (Articulated, Cartesian, SCARA, Parallel, Cylindrical, Collaborative, Others, icon_6), By Payload(Low, Medium, High, icon_7), By Application(Palletizing, Packaging, Repackaging, Pick & Place, Processing, Others) |

| Regional Coverage |

North America – The US and Canada; Europe – Germany, The UK, France, Russia, Spain, Italy, Benelux, Nordic, & Rest of Europe; Asia- Pacific– China, Japan, South Korea, India, ANZ, ASEAN, Rest of APAC; Latin America – Brazil, Mexico, Argentina, Colombia, Rest of Latin America; Middle East & Africa – Saudi Arabia, UAE, South Africa, Turkey, Egypt, Israel, & Rest of MEA

|

| Prominent Players |

ABB Group, KUKA AG, Fanuc Corporation, Kawasaki Heavy Industries Ltd, Rockwell Automation Inc, Mitsubishi Electric Corporatio, Yasakawa Electric Corporation |

| Purchase Options |

We have three licenses to opt for: Single User License (Limited to 1 user), Multi-User License (Up to 5 Users), and Corporate Use License (Unlimited User) along with free report customization equivalent to 0 analyst working days, 3 analysts working days and 5 analysts working days respectively. |