Market Overview

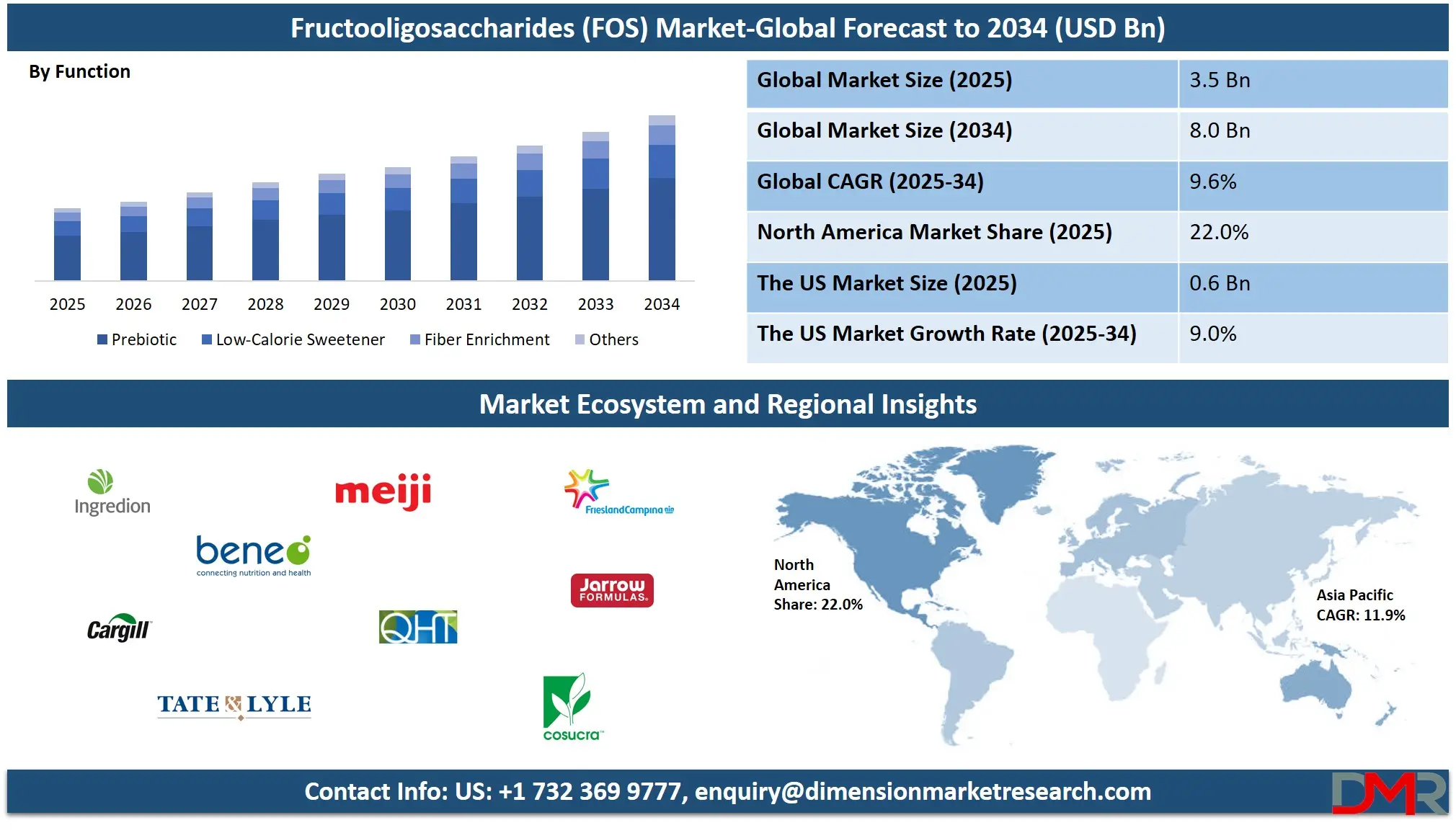

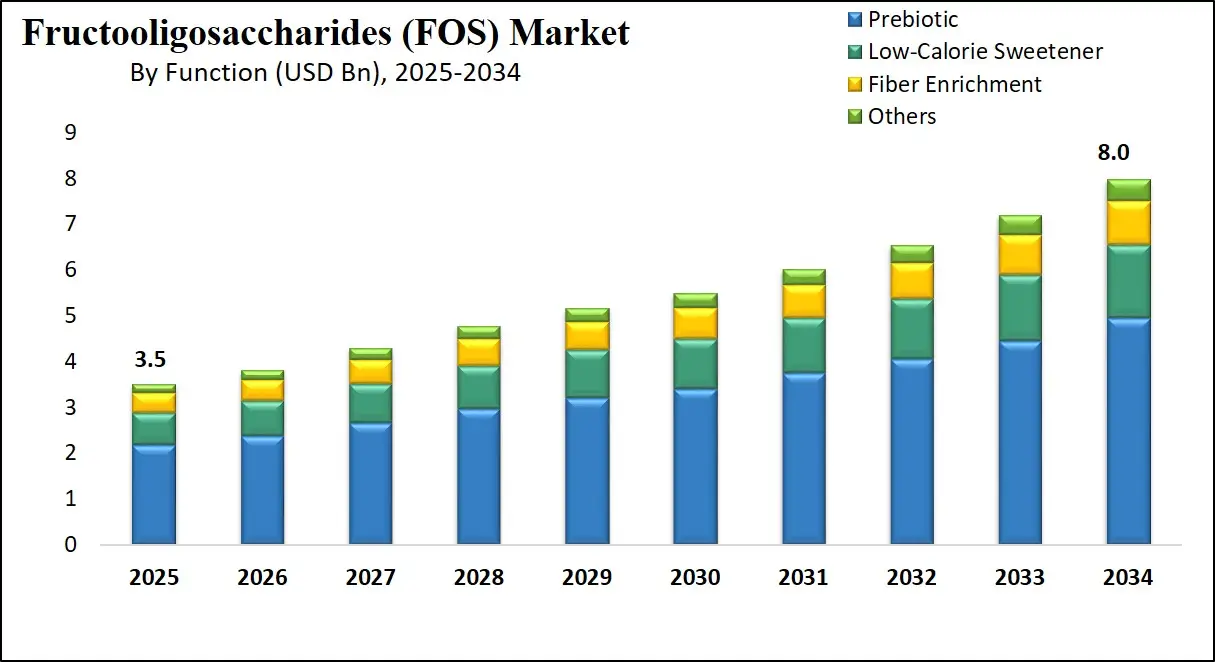

The Global Fructooligosaccharides (FOS) Market is projected to reach USD 3.5 billion by 2025, growing at a CAGR of 9.6%. Driven by rising demand for prebiotic fibers, functional food ingredients, and gut health enhancers, the market is expected to hit USD 8.0 billion by 2034. Increasing applications across dietary supplements, infant nutrition, and low-calorie sweeteners are fueling growth globally.

Fructooligosaccharides, commonly referred to as FOS, are short-chain oligosaccharides composed of fructose units primarily derived from natural sources such as chicory roots, sugar beets, and bananas. They function as soluble dietary fibers and are known for their prebiotic properties, promoting the growth of beneficial gut microbiota like Bifidobacteria and Lactobacilli. Due to their mildly sweet taste and low caloric content, FOS are widely used as sugar alternatives in functional foods and beverages. These compounds resist digestion in the upper gastrointestinal tract, reaching the colon intact where they are fermented by gut bacteria, leading to improved digestive health, enhanced mineral absorption, and immune support. Their utility extends beyond human consumption, finding applications in animal nutrition, pharmaceuticals, and infant formula formulations, making them a versatile ingredient in health-focused product development.

The global Fructooligosaccharides market has witnessed substantial growth in recent years, driven by the rising awareness surrounding gut health, dietary fibers, and low-calorie food ingredients. As consumer demand shifts toward clean-label and plant-based nutrition, FOS are being incorporated into a wide array of products such as dairy items, nutritional supplements, cereals, and baked goods. The surge in lifestyle-related disorders like obesity, diabetes, and gastrointestinal ailments has accelerated the adoption of prebiotic ingredients that enhance digestive health without compromising taste or texture. Moreover, the regulatory approval of FOS as Generally Recognized As Safe (GRAS) across several regions, along with growing penetration in functional foods, is positively influencing market expansion.

The market is further characterized by growing investment in R&D and product innovation, especially in emerging economies across Asia Pacific and Latin America. Food manufacturers are actively exploring the synergistic effects of FOS with other prebiotics and probiotics to launch synbiotic formulations that provide holistic health benefits. Strategic collaborations, sustainable sourcing practices, and growing retail availability of prebiotic-rich products have fueled competitive dynamics in the sector. As the health and wellness trend continues to reshape global food consumption patterns, the fructooligosaccharides market is set to maintain its upward trajectory, driven by consumer demand for natural, safe, and efficacious functional ingredients.

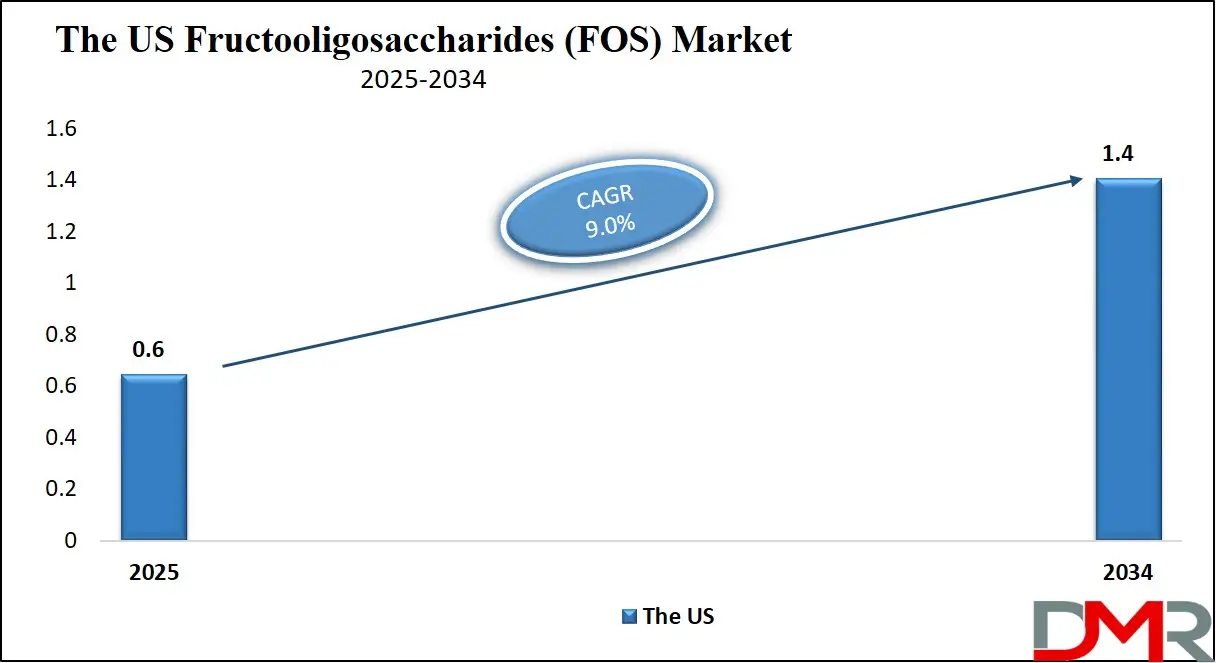

The US Fructooligosaccharides (FOS) Market

The U.S. Fructooligosaccharides (FOS) Market size is projected to be valued at USD 600 million in 2025. It is further expected to witness subsequent growth in the upcoming period, holding USD 8.0 billion in 2034 at a CAGR of 9.0%.

The U.S. Fructooligosaccharides (FOS) market is witnessing robust growth, fueled by growing consumer focus on digestive wellness, dietary fiber intake, and clean-label ingredients. With rising health concerns such as obesity, irritable bowel syndrome (IBS), and poor gut microbiota balance, there has been a significant uptick in the demand for prebiotic-rich functional foods and beverages. Manufacturers across the U.S. are incorporating FOS into diverse product categories, including plant-based dairy alternatives, protein bars, low-glycemic cereals, and nutraceutical blends, capitalizing on the ingredient’s ability to enhance taste while providing digestive and metabolic health benefits. Moreover, the regulatory recognition of FOS as GRAS (Generally Recognized As Safe) by the FDA has paved the way for widespread use across both mainstream and specialized health product lines.

The strong emphasis on personalized nutrition, integrated with an expanding base of health-conscious millennials and aging baby boomers, is reshaping the application scope of FOS in the U.S. market. The growing trend of synbiotic supplements, combinations of prebiotics and probiotics, is further accelerating FOS adoption in the dietary supplement industry. Additionally, increased R&D investment by key players is leading to innovations in FOS-based formulations tailored for blood sugar management, immune modulation, and weight control. With the expanding presence of FOS in sports nutrition, infant formula, and pet food applications, the U.S. market is positioned as a high-value contributor to the global FOS landscape.

Europe Fructooligosaccharides (FOS) Market

In 2025, the European fructooligosaccharides (FOS) market is estimated to generate around USD 100 million in revenue, representing a modest share of the global market. This relatively smaller contribution is notable given the region’s early adoption of functional ingredients and strong emphasis on digestive health. While European consumers are drawn to natural fibers and clean-label products, the FOS market here is relatively mature compared to Asia Pacific and North America. Regulatory approval for prebiotics, including recognition as dietary fiber under EFSA guidelines, has created a supportive framework for product development, but intense competition from other fiber types such as inulin, galacto-oligosaccharides (GOS), and resistant starch, has diluted FOS-specific demand.

Despite this, the market is expected to expand at a steady CAGR of 6.3% through 2034, driven by growing interest in preventive healthcare, plant-based nutrition, and functional foods targeting gut and immune health. Countries like Germany, the Netherlands, and the UK are key contributors to this growth, with established health food sectors and consumer segments that value scientifically supported nutritional claims. Additionally, the growing popularity of synbiotic supplements combining FOS with probiotics is opening new opportunities in the European nutraceuticals and supplement space. However, innovation and clear product positioning will be critical for manufacturers to sustain and grow their presence in a competitive and regulation-sensitive European market.

Japan Fructooligosaccharides (FOS) Market

Japan’s Fructooligosaccharides (FOS) market is projected to reach USD 300 million in 2025, making it one of the more significant contributors among individual countries globally. This strong position can be attributed to Japan’s longstanding history of adopting functional and health-enhancing ingredients, particularly in the food and beverage sector. Japanese consumers are highly familiar with prebiotics like FOS due to early regulatory approvals and wide product availability dating back to the 1990s. The country has integrated FOS into a variety of applications including digestive drinks, dairy alternatives, infant nutrition, and health-targeted snacks. Additionally, Japan’s aging population is a key demographic fueling demand for ingredients that support digestion, immunity, and overall metabolic wellness, all areas where FOS plays a valuable role.

Looking ahead, Japan’s FOS market is expected to grow at a healthy CAGR of 8.4% through 2034, driven by continued innovation in product development and growing interest in personalized nutrition. The expanding use of FOS in synbiotic products (prebiotic and probiotic combinations), as well as functional formulations targeting conditions like constipation and glucose regulation, will further accelerate market uptake. Japan’s food manufacturers are also leveraging FOS in clean-label and low-calorie formulations to meet rising demand for health-conscious and minimally processed foods. With a strong research ecosystem and consumer preference for scientifically backed ingredients, Japan remains a stable and growth-oriented market for FOS, though it is becoming competitive as domestic and international brands vie for market share.

Global Fructooligosaccharides (FOS) Market: Key Takeaways

- Market Value: The global fructooligosaccharides (FOS) market size is expected to reach a value of USD 8.0 billion by 2034 from a base value of USD 3.5 billion in 2025 at a CAGR of 9.6%.

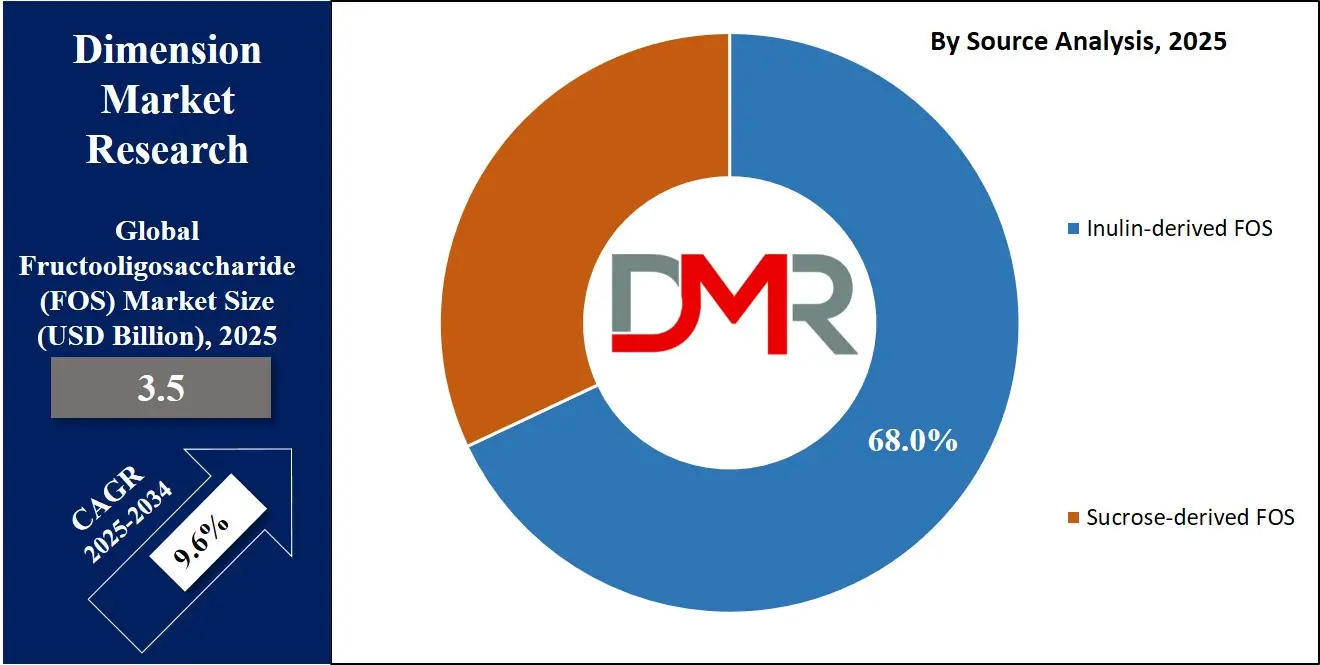

- By Source Type Segment Analysis: Inulin-derived FOS are anticipated to dominate the source type segment, capturing 68.0% of the total market share in 2025.

- By Form Type Segment Analysis: Liquid form type is poised to consolidate its dominance in the form segment, capturing 55.0% of the total market share in 2025.

- By Function Segment Analysis: Prebiotic function type is expected to dominate the function segment, capturing 62.0% of the total market share in 2025.

- By Distribution Channel Mode Segment Analysis: B2B channels will lead in the distribution channel segment, capturing 78.0% of the market share in 2025.

- By Application Segment Analysis: Food & Beverages applications will dominate the application segment, capturing 40.0% of the market share in 2025.

- By End-User Industry Segment Analysis: Food & Beverage Industry will lead the end-user industry segment, capturing 42.0% of the market share in 2025.

- Regional Analysis: Asia Pacific is anticipated to lead the global fructooligosaccharides (FOS) market landscape with 38.0% of total global market revenue in 2025.

- Key Players: Some key players in the global fructooligosaccharides (FOS) market are Ingredion Incorporated, BENEO GmbH, Cargill, Incorporated, Tate & Lyle PLC, Meiji Holdings Co., Ltd., Quantum Hi-Tech (China) Biological Co., Ltd., COSUCRA Groupe Warcoing SA, FrieslandCampina Domo, Jarrow Formulas, Inc., Roquette Frères, Sensus America, Inc., and Other Key Players.

Global Fructooligosaccharides (FOS) Market: Use Cases

- Incorporation in Functional Foods & Beverages: FOS is widely used in the formulation of functional foods and beverages due to its mild sweetness and soluble fiber content. Food manufacturers are incorporating it into products like dairy alternatives, baked goods, breakfast cereals, and snack bars to meet consumer demand for healthier options. It helps improve taste, texture, and shelf life, while offering digestive health benefits. Additionally, its ability to stimulate beneficial gut bacteria makes it an ideal ingredient in wellness-focused food innovations.

- Prebiotic Dietary Supplements: FOS plays a central role in the dietary supplement industry, especially in gut health formulations. It is often used in combination with probiotics in capsule, gummy, and powder forms to create synbiotic products that improve bowel regularity, support nutrient absorption, and strengthen immunity. These supplements are popular among individuals suffering from gastrointestinal disorders, such as IBS and bloating, and among health-conscious consumers focused on microbiome support.

- Infant Nutrition & Formula Fortification: In the infant nutrition space, FOS is used to mimic the natural prebiotics found in human breast milk. It is added to infant formulas to promote the growth of beneficial gut flora, which helps in the development of the baby’s immune system and reduces the risk of infections and allergies. With growing awareness of the long-term benefits of a healthy gut microbiome in early life, manufacturers are investing heavily in FOS-enriched formula products.

- Animal Nutrition & Pet Food Products: FOS is gaining traction in animal feed and pet nutrition as a natural prebiotic to improve gut health and immune function in livestock, poultry, and companion animals. It enhances nutrient utilization, reduces pathogen growth in the digestive tract, and supports weight management. With rising demand for clean-label and functional pet foods, FOS is used in premium dog and cat food formulas, especially those targeting sensitive digestion.

Impact of Artificial Intelligence on Fructooligosaccharides (FOS) Market

- Optimizing Enzyme Discovery and Engineering: Artificial intelligence is accelerating the discovery and engineering of fructosyltransferase enzymes such as levansucrases and endoinulinases used in FOS synthesis. Through AI-assisted genomic analysis and machine learning models, researchers can identify enzyme variants with enhanced transfructosylation capabilities and broader substrate specificity. This allows for the efficient production of longer-chain FOS molecules and reduces the need for trial-and-error in enzyme development, resulting in improved productivity and cost-effectiveness in industrial applications.

- Enhancing Production Yields via Bioprocess Optimization: AI and advanced data analytics are being used to fine-tune fermentation and enzymatic reaction conditions involved in FOS production. By analyzing variables such as sucrose concentration, pH levels, temperature, and enzyme dosage, AI helps determine the most efficient process parameters. This leads to consistently higher FOS yields and better product purity. Automated feedback systems powered by AI are increasingly integrated into bioreactors to ensure process stability and scale-up efficiency.

- Real-Time Monitoring and Quality Assurance: AI-powered sensors and computer vision systems enable real-time monitoring of critical parameters during FOS production, including sugar concentration, viscosity, and impurity levels. These systems allow for adaptive control of enzymatic reactions, ensuring that production remains within optimal thresholds. AI-supported quality assurance reduces batch failures, enhances consistency, and supports compliance with international food safety standards, which is essential as demand grows for functional food ingredients.

- Scaling Sustainable and Waste-Based Production: Artificial intelligence is facilitating the development of sustainable FOS production methods by optimizing the use of agricultural by-products and food waste as raw materials. Through predictive modeling and AI-guided strain selection, producers can convert resources such as carrot pulp, sugarcane molasses, or inulin-rich biomass into high-quality FOS. This not only supports circular economy goals but also reduces reliance on refined sugar inputs and minimizes environmental impact, making FOS production more cost-effective and eco-friendly.

Global Fructooligosaccharides (FOS) Market: Market Dynamics

Global Fructooligosaccharides (FOS) Market: Driving Factors

Rising Demand for Gut Health and Functional Nutrition

The surge in awareness regarding digestive wellness and the importance of maintaining a balanced gut microbiome is a key driver of the FOS market. Consumers are opting for functional food ingredients that not only meet nutritional needs but also offer health benefits such as improved immunity and metabolism. FOS, as a recognized prebiotic fiber, supports the growth of beneficial gut bacteria like Bifidobacteria, making it a preferred ingredient in nutraceuticals, dairy, and plant-based food products.

Shift toward Natural and Low-Calorie Sweeteners

With rising concerns over added sugars and artificial sweeteners, FOS is gaining momentum as a natural low-glycemic sweetener. It provides mild sweetness with minimal caloric impact, making it ideal for sugar-reduction strategies in processed foods, beverages, and infant formulas. This aligns with global dietary trends pushing for clean-label, non-GMO, and plant-derived ingredients that offer both taste and functionality.

Global Fructooligosaccharides (FOS) Market: Restraints

Limited Consumer Awareness in Developing Markets

Despite its proven health benefits, the adoption of FOS remains relatively low in several emerging economies due to limited consumer knowledge about prebiotic fibers and their role in gut health. Unlike mature markets where digestive health trends are well established, consumers in these regions often prioritize macronutrient value over microbiome support, which restricts FOS market penetration.

Regulatory Hurdles and Ingredient Labeling Issues

The fragmented regulatory landscape concerning the classification and usage of FOS across regions—especially in Asia-Pacific and parts of South America, poses a challenge. Variations in health claims approval, dosage limitations, and food safety norms hinder formulation flexibility for manufacturers. Moreover, inconsistent labeling requirements around dietary fibers can create consumer confusion, affecting product transparency and trust.

Global Fructooligosaccharides (FOS) Market: Opportunities

Expansion in Personalized Nutrition and Synbiotic Products

The rising interest in personalized nutrition opens new avenues for FOS integration, especially in custom-tailored gut health solutions. With technological advances in microbiome testing and consumer data analytics, brands can develop targeted dietary supplements combining FOS with specific probiotic strains. This creates scope for high-value synbiotic formulations aimed at digestive health, immunity, and even mood regulation.

Growth in Plant-Based and Clean-Label Food Innovation

The global transition toward plant-based diets and clean-label product development is creating strong tailwinds for FOS as a naturally sourced, multifunctional ingredient. Its compatibility with vegan and gluten-free formulations positions it as a valuable additive in dairy alternatives, meat-free meals, and fiber-enriched snacks. As consumers demand transparency and simplicity in food ingredients, FOS stands out for its clear health value and natural origin.

Global Fructooligosaccharides (FOS) Market: Trends

Emergence of FOS in Sports and Performance Nutrition

Athletes and fitness enthusiasts are turning to gut-optimized sports nutrition to enhance performance and recovery. FOS is now being infused into pre-workout blends, protein powders, and endurance drinks for its prebiotic action, which aids nutrient absorption and reduces gastrointestinal distress. This emerging trend is expanding the functional scope of FOS beyond general wellness into sports-specific dietary formulations.

Integration of FOS in Infant and Pediatric Formulations

Driven by growing scientific support, FOS is being used in infant formula and pediatric supplements to replicate the natural prebiotic effects found in breast milk. It supports immune development, improves stool consistency, and enhances calcium absorption in infants and toddlers. This trend reflects the evolving consumer preference for early-life nutrition that mirrors natural feeding patterns through safe, evidence-based supplementation.

Global Fructooligosaccharides (FOS) Market: Research Scope and Analysis

By Source Analysis

In the global Fructooligosaccharides (FOS) market, inulin-derived FOS are expected to maintain dominance within the source type segment, accounting for approximately 68.0% of the total market share in 2025. This dominance is largely attributed to the widespread availability and ease of extraction of inulin from natural plant sources such as chicory root, Jerusalem artichoke, and agave. Inulin-derived FOS is favored by food and beverage manufacturers due to its clean-label appeal, high solubility, and proven prebiotic benefits. It is widely used in dairy products, infant formulas, baked goods, and dietary supplements, as it offers both functional fiber content and mild sweetness without contributing significant calories.

On the other hand, sucrose-derived FOS, produced enzymatically from common table sugar, accounts for a comparatively smaller portion of the market. While it provides similar functional properties and is often used in processed foods, syrups, and low-calorie beverages, its adoption is limited by consumer preferences shifting toward naturally sourced ingredients. However, sucrose-derived FOS still holds relevance in regions where inulin-rich plant sources are less accessible or where cost-effective production is a priority. Its use is also common in formulations requiring precise sweetness profiles, especially in functional confectionery and beverage products.

By Form Analysis

In the Fructooligosaccharides (FOS) market, the liquid form is expected to maintain a dominant position within the form type segment, accounting for about 55.0% of the total market share in 2025. The preference for liquid FOS is largely driven by its ease of integration into beverages, syrups, and infant formulas, where solubility and processing convenience are critical. Liquid FOS offers consistent texture and better dispersion in water-based formulations, making it ideal for manufacturers producing functional drinks, dairy products, and liquid dietary supplements. Additionally, its high stability and compatibility with other liquid ingredients make it suitable for industrial-scale applications in food processing.

Meanwhile, powder form FOS also holds a significant share of the market, particularly in applications where shelf stability, dosage accuracy, and portability are important. Powdered FOS is commonly used in the production of nutritional supplements, baked goods, meal replacement powders, and snack bars. It offers advantages such as longer shelf life and ease of storage, and is preferred in dry-blend formulations. Although it captures a slightly smaller market share compared to liquid form, the demand for powdered FOS remains strong in the nutraceutical and functional food industries, where customized formulation and consumer convenience are key priorities.

By Function Analysis

In the function-based segmentation of the Fructooligosaccharides (FOS) market, the prebiotic function is projected to dominate, accounting for around 62.0% of the total market share in 2025. This strong market share reflects the growing consumer and industry focus on gut health and microbiome support, as FOS are well-documented for promoting the growth of beneficial intestinal bacteria such as Bifidobacteria and Lactobacilli. Their role in improving digestion, enhancing mineral absorption, and supporting immune function has led to widespread use in dietary supplements, functional foods, and infant formulas. The growing prevalence of digestive disorders and the expanding awareness of the gut-health connection with overall well-being are key factors contributing to the dominance of this segment.

Alongside their prebiotic role, Fructooligosaccharides are also gaining traction as low-calorie sweeteners. Though this function holds a smaller share of the market, it is still significant, especially among manufacturers seeking natural alternatives to sugar. FOS provides mild sweetness without a sharp glycemic response, making it suitable for products aimed at diabetic, weight-conscious, or health-aware consumers. It is commonly used in sugar-free beverages, bakery products, and snacks where sweetness is needed without added sugar. The dual functionality of FOS, as both a prebiotic and a low-calorie sweetener, adds to their value proposition and increases their appeal in a broad range of health-oriented formulations.

By Distribution Channel Analysis

In the distribution channel segment of the Fructooligosaccharides (FOS) market, B2B channels are expected to lead significantly, capturing about 78.0% of the total market share in 2025. This dominance is largely due to the strong demand from food and beverage manufacturers, nutraceutical companies, infant formula producers, and pharmaceutical firms that purchase FOS in bulk for formulation and processing purposes. These businesses rely on direct supply agreements with ingredient suppliers to ensure consistent quality, volume, and compliance with food safety standards. The B2B model allows for large-scale integration of FOS into a variety of end-use products including functional foods, health drinks, supplements, and medical nutrition, making it the primary distribution mode in the global market.

On the other hand, the B2C channel represents a smaller but steadily growing portion of the market. In this mode, FOS is sold directly to consumers in the form of packaged dietary supplements, standalone prebiotic powders, or as part of specialized gut health products. With the rise of e-commerce and health-focused retail outlets, individual consumers are purchasing FOS products for personal use, especially those seeking digestive support, immunity enhancement, or dietary fiber intake. While the B2C segment does not match the scale of B2B, it plays a crucial role in raising awareness about the health benefits of FOS and is expected to grow as consumer interest in self-managed health and wellness continues to rise.

By Application Analysis

In the application segment of the Fructooligosaccharides (FOS) market, food and beverages are expected to lead, capturing approximately 40.0% of the total market share in 2025. This is largely due to the growing consumer demand for healthier, functional food products that promote digestive health without compromising on taste or texture. FOS is widely incorporated into products such as dairy items, breakfast cereals, bakery goods, confectioneries, and plant-based beverages. It acts as both a soluble dietary fiber and a mild sweetener, offering a dual benefit of taste enhancement and prebiotic functionality. Food manufacturers are leveraging these attributes to meet the rising preference for clean-label and gut-friendly products, making FOS a staple ingredient in the formulation of next-generation health foods.

The dietary supplements segment also plays a significant role in the FOS market, holding a considerable share driven by the growing popularity of digestive health solutions. FOS is frequently included in capsule, powder, and gummy formats aimed at improving gut flora, enhancing immunity, and supporting metabolic balance. With the growing awareness of the gut-brain connection and the role of prebiotics in overall wellness, many consumers are turning to FOS-based supplements as part of their daily health routines. The supplement segment also benefits from the expanding market for synbiotic products, where FOS is paired with specific probiotic strains to create targeted gut health formulations. This has positioned FOS as a key ingredient in the global nutraceutical landscape.

By End-User Industry Analysis

In the end-user industry segment of the Fructooligosaccharides (FOS) market, the food and beverage industry is projected to lead with a market share of around 42.0% in 2025. This is primarily driven by the growing integration of FOS into everyday food products as a functional ingredient that offers both nutritional and technological benefits. Food manufacturers are incorporating FOS into products like yogurts, dairy alternatives, baked goods, and ready-to-drink beverages to meet consumer demands for healthier options. Its ability to act as a natural sweetener, improve texture, and enhance shelf life, while also supporting digestive health, makes it highly attractive for mass-market food and beverage applications. The shift toward clean-label, non-GMO, and high-fiber foods has further accelerated FOS adoption across this segment.

The nutraceuticals industry also represents a significant and rapidly expanding end-user for FOS. As awareness grows around the importance of gut health in overall well-being, FOS is being used in various health supplements targeting digestive balance, immune function, and metabolic regulation. It is commonly found in formulations such as prebiotic powders, gut health capsules, and synbiotic blends, often combined with specific probiotic strains to enhance their effectiveness. The nutraceutical sector benefits from the rising popularity of personalized nutrition and preventive healthcare, with FOS positioned as a key ingredient in addressing gastrointestinal disorders and supporting a healthy microbiome. This has made it an essential component in the development of next-generation wellness products.

The Fructooligosaccharides (FOS) Market Report is segmented on the basis of the following

By Source

- Inulin-derived FOS

- Sucrose-derived FOS

By Form

By Function

- Prebiotic

- Low-Calorie Sweetener

- Fiber Enrichment

- Others

By Distribution Channel

By Application

- Food & Beverages

- Dietary Supplements

- Infant Formula

- Animal Feed

- Pharmaceuticals

By End-User Industry

- Food & Beverage Industry

- Nutraceuticals

- Animal Nutrition

- Pharmaceutical Industry

- Cosmetics & Personal Care

- Others

Global Fructooligosaccharides (FOS) Market: Regional Analysis

Region with the Largest Revenue Share

Asia Pacific is expected to lead the global fructooligosaccharides (FOS) market in 2025, accounting for approximately 38.0 percent of total market revenue. This growth is driven by growing consumer awareness of digestive health, rising demand for functional foods, and a strong presence of regional manufacturers producing FOS from locally sourced inulin and sucrose. Countries such as China, Japan, South Korea, and India are witnessing a surge in the consumption of prebiotic-enriched food and beverages, along with growing adoption of dietary supplements targeting gut health. Additionally, supportive government policies promoting health and wellness, along with the expanding middle-class population and urbanization, are creating favorable conditions for FOS market expansion across the region.

Region with significant growth

The Middle East and Africa region is projected to witness the highest compound annual growth rate (CAGR) in the global fructooligosaccharides (FOS) market during the forecast period. This accelerated growth is driven by growing consumer interest in digestive health, rising awareness about the benefits of prebiotic ingredients, and the gradual shift toward functional and fortified foods. As regional economies diversify and invest in healthcare and food innovation, demand for natural, fiber-rich additives like FOS is gaining momentum, especially in urban centers and among health-conscious populations. Although the current market size is relatively small compared to other regions, the untapped potential and growing interest from both local and international food and supplement manufacturers are expected to fuel rapid market expansion.

By Region

North America

Europe

- Germany

- The U.K.

- France

- Italy

- Russia

- Spain

- Benelux

- Nordic

- Rest of Europe

Asia-Pacific

- China

- Japan

- South Korea

- India

- ANZ

- ASEAN

- Rest of Asia-Pacific

Latin America

- Brazil

- Mexico

- Argentina

- Colombia

- Rest of Latin America

Middle East & Africa

- Saudi Arabia

- UAE

- South Africa

- Israel

- Egypt

- Rest of MEA

Global Fructooligosaccharides (FOS) Market: Competitive Landscape

The global competitive landscape of the fructooligosaccharides (FOS) market is characterized by the presence of several established players as well as emerging regional manufacturers competing through product innovation, cost efficiency, and supply chain integration. Leading companies such as Ingredion Incorporated, BENEO GmbH, Cargill, Tate & Lyle, and Roquette Frères dominate the market by offering high-purity, inulin-derived FOS tailored for diverse applications across food, beverage, and nutraceutical sectors. These players focus on expanding their global footprint through strategic partnerships, capacity expansion, and investments in R&D to develop clean-label, non-GMO, and multifunctional prebiotic ingredients. Meanwhile, manufacturers in China, India, and South Korea are strengthening their export presence by offering competitively priced sucrose-derived FOS. The market also sees growing interest in customized formulations and synbiotic solutions, prompting companies to collaborate with probiotic producers to tap into the evolving gut health segment.

Some of the prominent players in the global fructooligosaccharides (FOS) market are

- Ingredion Incorporated

- BENEO GmbH

- Cargill, Incorporated

- Tate & Lyle PLC

- Meiji Holdings Co., Ltd.

- Quantum Hi-Tech (China) Biological Co., Ltd.

- COSUCRA Groupe Warcoing SA

- FrieslandCampina Domo

- Jarrow Formulas, Inc.

- Roquette Frères

- Sensus America, Inc.

- Samyang Corporation

- Galam Group

- BASF SE

- DowDuPont (now part of IFF - International Flavors & Fragrances Inc.)

- Shandong Bailong Chuangyuan Bio-Tech Co., Ltd.

- Natura BioFoods

- Nutriagaves de México S.A. de C.V.

- Now Foods

- Neos Ingredients

- Other Key Players

Global Fructooligosaccharides (FOS) Market: Recent Developments

- July 2024: Meiji launched a functional chocolate line in Japan where FOS replaces added sugar. One variant contains half the sugar and another has complete removal of added sugar to promote gut health and reduce calories.

- May 2023: Beneo introduced Beneo scL85, a universal short chain FOS ingredient designed for sugar reduction and fiber enrichment across a wide range of food products.

- March 2025: Audensiel, a digital transformation firm, acquired a majority stake in FOS SpA. The acquisition aims to leverage FOS SpA’s capabilities in the functional ingredients space to expand Audensiel’s food innovation portfolio.

- October 2023: International Flavors and Fragrances (IFF) finalized the integration of DuPont’s Nutrition and Biosciences division. The move strengthened its position in the FOS and broader prebiotic ingredient market by expanding production capabilities and global reach.

- January 2025: Galam announced a large-scale investment to expand its GOFOS production capacity in Israel and Spain to meet rising global demand for prebiotic fibers in food and supplement industries.

- January 2025: Galam also reported promising clinical research indicating that its FOS ingredients can stimulate GLP 1 hormone levels. This supports potential applications in metabolic health and weight management products, attracting new interest from the functional food sector.

Frequently Asked Questions

The global fructooligosaccharides (FOS) market size is estimated to have a value of USD 3.5 billion in 2025 and is expected to reach USD 8.0 billion by the end of 2034.

The US fructooligosaccharides (FOS) market is projected to be valued at USD 0.6 billion in 2025. It is expected to witness subsequent growth in the upcoming period as it holds USD 1.4 billion in 2034 at a CAGR of 9.0%.

Asia Pacific is expected to have the largest market share in the global fructooligosaccharides (FOS) market, with a share of about 38.0% in 2025.

Some of the major key players in the global fructooligosaccharides (FOS) market are Ingredion Incorporated, BENEO GmbH, Cargill, Incorporated, Tate & Lyle PLC, Meiji Holdings Co., Ltd., Quantum Hi-Tech (China) Biological Co., Ltd., COSUCRA Groupe Warcoing SA, FrieslandCampina Domo, Jarrow Formulas, Inc., Roquette Frères, Sensus America, Inc., and Other Key Players.

The market is growing at a CAGR of 9.6 percent over the forecasted period.