Market Overview

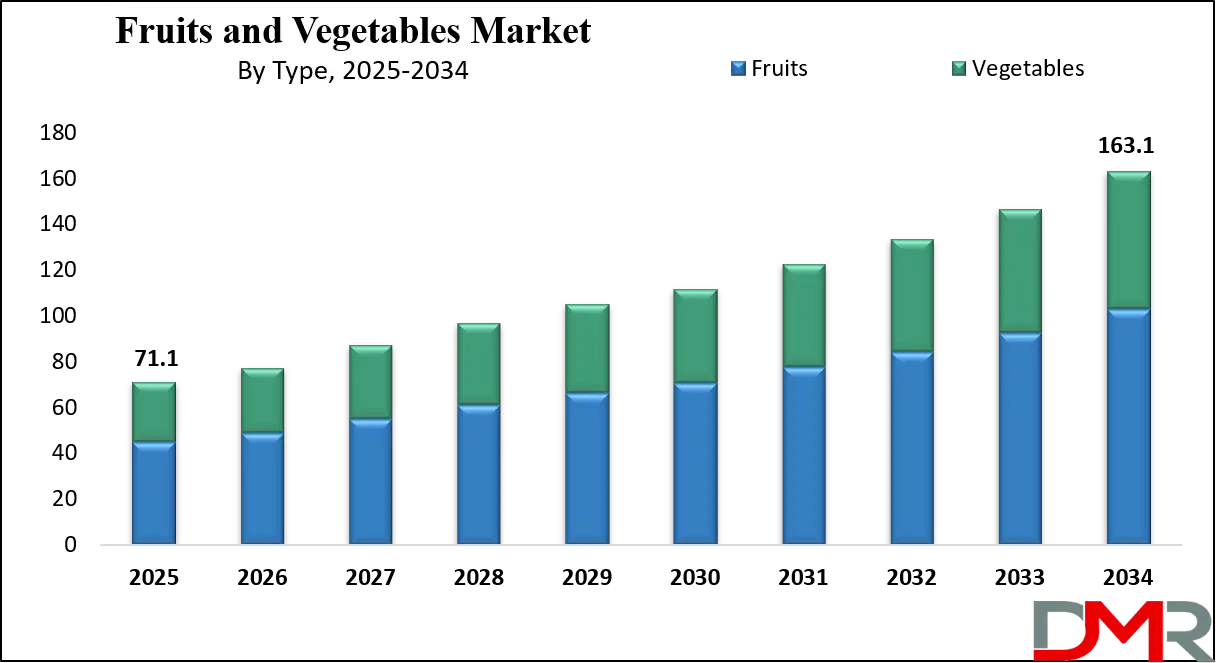

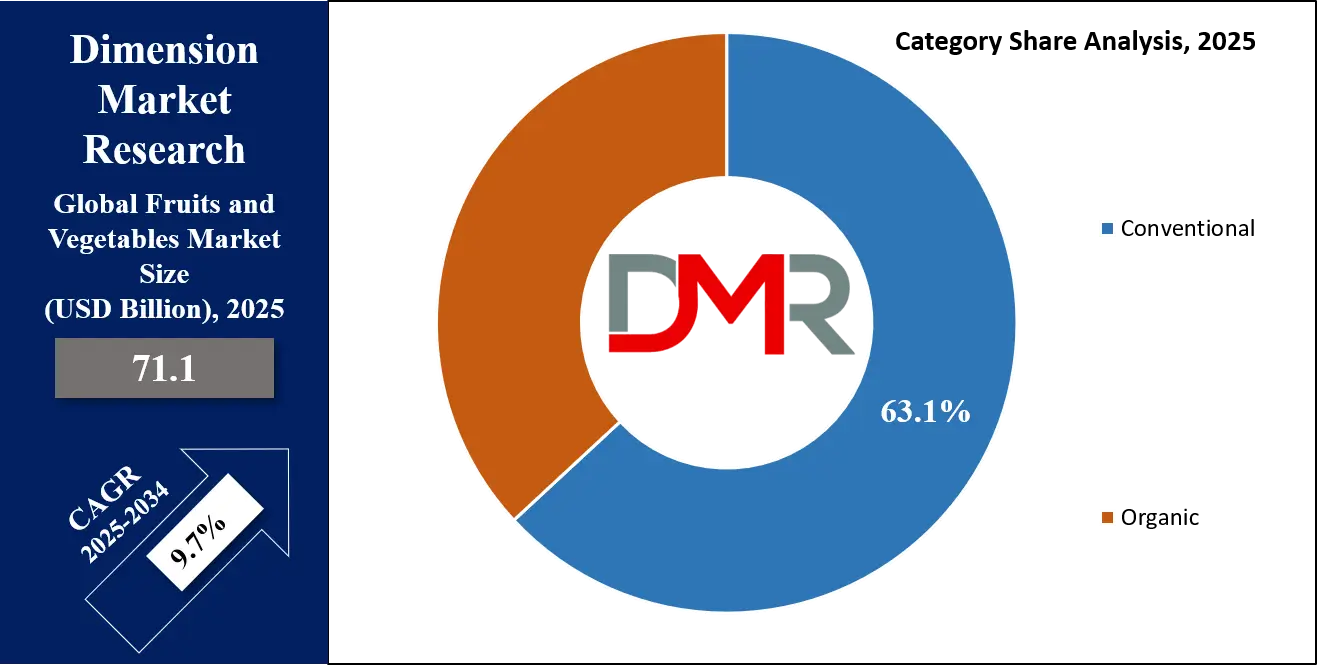

The Global Fruits and Vegetables Market size is projected to reach USD 71.1 billion in 2025 and grow at a compound annual growth rate of 9.7% from there until 2034 to reach a value of USD 163.1 billion.

The global fruits and vegetables market is experiencing steady growth as a result of growing awareness about nutritional values, growing health awareness, and changing eating habits. Growth in veganism and plant-based diets continues to drive fresh produce consumption in both developed and developing markets. Consumer demand for organic fruits and vegetables has also grown, driving further growth in the organic market.

ℹ

To learn more about this report –

Download Your Free Sample Report Here

The fruits and vegetables business is being hit by one central trend that emphasizes the movement of consumers to digital retail and online grocery platforms, especially after the year 2022, remodeling conventional channels. With better logistics and cold infrastructure, shelf lives of fruits and vegetables have extended as well, improving international outreach. With modern technology in precision agriculture and practices of smart farming, producers can efficiently supply fruits globally to meet global demand while keeping quality intact.

Yet, constraints remain in terms of perishability challenges, unstable climatic conditions, and the inordinately high price of organic produce. Such challenges tend to impact supply uniformity and price stability, especially for exotic or seasonal types. In addition, infrastructural gaps in rural or new markets continue to limit widespread market penetration.

The market for fruits and vegetables offers considerable growth potential through innovation in products, processed fruit and vegetable products, and export-driven production. Developing countries with solid agricultural produce and varied climates will stand to gain the most. The market is divided by type, form, distribution channel, and region, while the Asia-Pacific region is expected to share the most due to its large population base and changing consumption trends.

ℹ

To learn more about this report –

Download Your Free Sample Report Here

The US Fruits and Vegetables Market

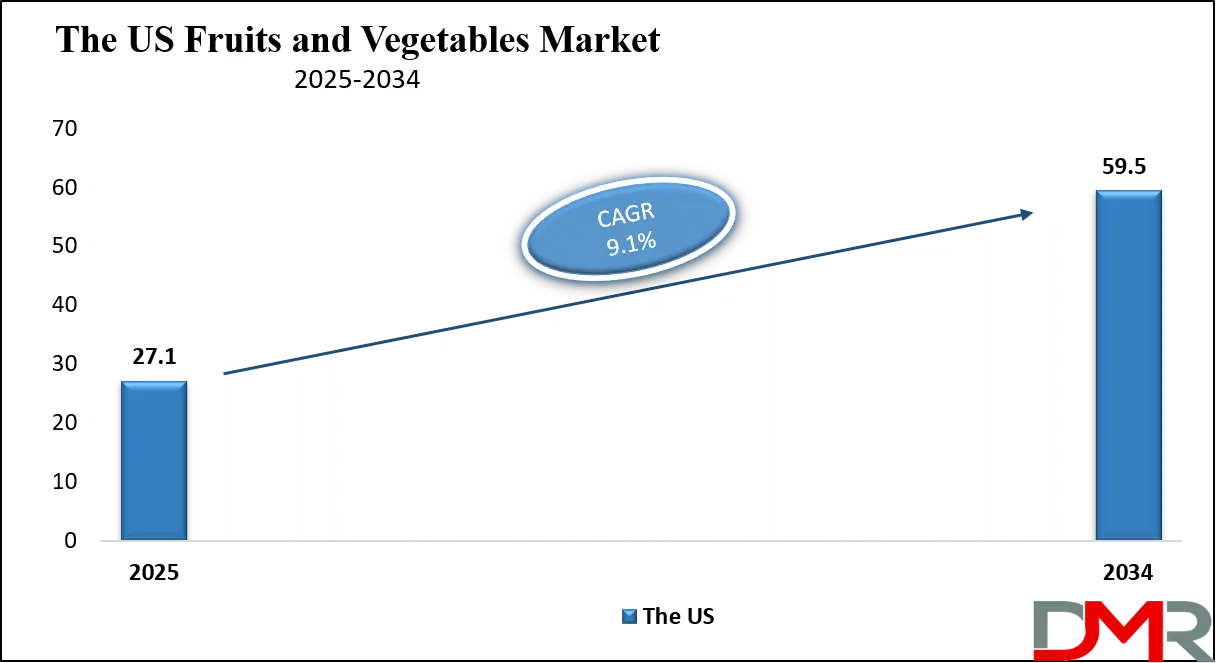

The US Fruits and Vegetables Market is projected to reach USD 27.1 billion in 2025 at a compound annual growth rate of 9.1% over its forecast period.

The U.S. fruits and vegetables market leads the global fruits and vegetables industry based on improved farming methods, a robust domestic supply chain, and increased consumer knowledge. The U.S. enjoys an extensive variety of fruits and vegetables throughout the year because it has a rich geography and robust import channels.

Demographically, growing health awareness among Millennials and Gen Z drives demand for organically grown fruits and vegetables. The organic fruits and vegetables market segment in the U.S. is larger than 15% of overall fruit and vegetable sales and continues to grow. A growing Hispanic population also drives diverse consumption patterns, affecting product assortment and regional demand trends. California and Florida are at the center of domestic production, particularly for fresh fruit and citrus fruits.

Retailing innovation and the growth of online e-commerce platforms have enabled consumers to access fresh produce with ease. Pre-packaged, fresh-cut fruits and vegetables are experiencing increasing demand owing to convenience and time savings. Yet, shortages of labor, climate-related issues such as droughts, and transport disruptions at times stress supply chains.

Government initiatives that promote healthy diets, including SNAP and school meal programs, aid in market expansion. The use of technology in agriculture, like drone surveillance and data-based irrigation, is also maximizing yield quality. In total, the U.S. fruits and vegetables market reflects a strong growth pattern, fueled by innovation, robust logistics, and changing consumer preferences.

ℹ

To learn more about this report –

Download Your Free Sample Report Here

Global Fruits and Vegetables Market: Key Takeaways

- Global Market Share Insights: The Global Fruits and Vegetables Market size is estimated to have a value of USD 71.1 billion in 2025 and is expected to reach USD 163.1 billion by the end of 2034.

- The US Market Size Insights: The US Fruits and Vegetables Market is projected to be valued at USD 27.1 billion in 2025. It is expected to witness subsequent growth in the upcoming period as it holds USD 59.5 billion in 2034 at a CAGR of 9.1%.

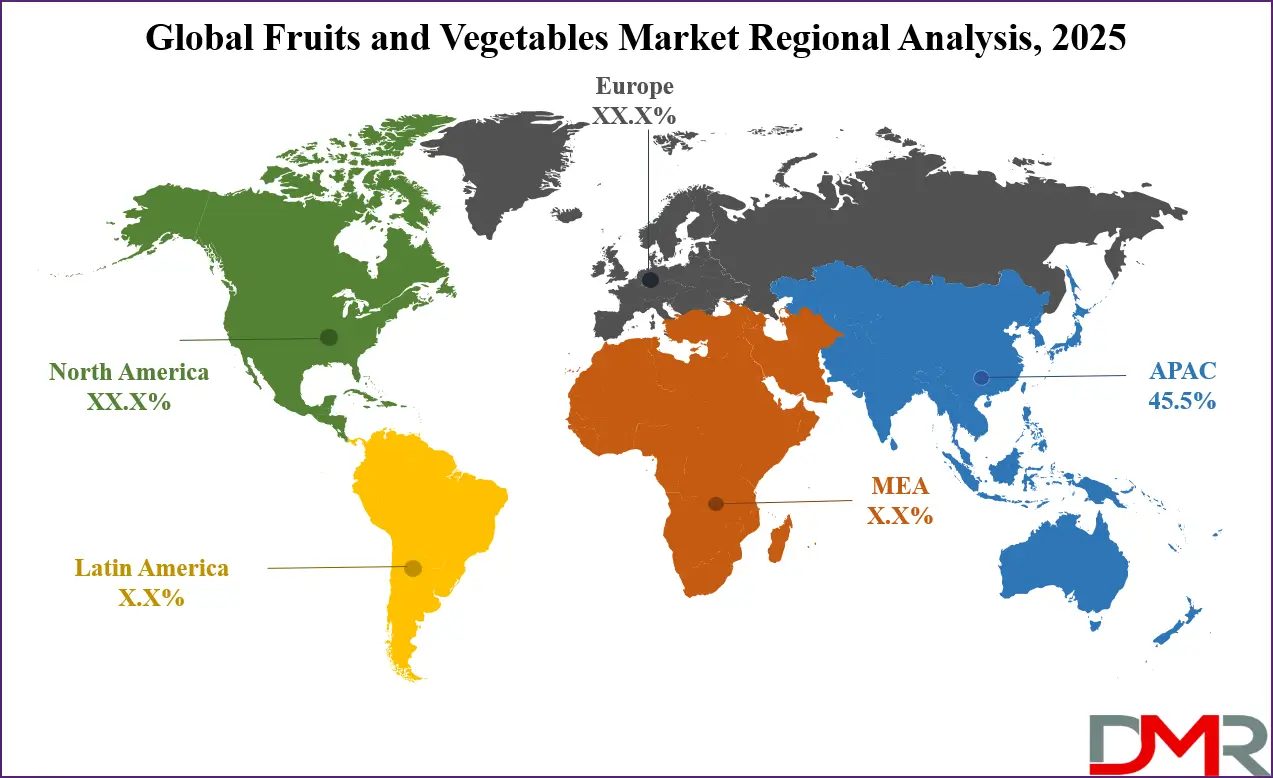

- Regional Insights: Asia Pacific is expected to have the largest market share in the Global Fruits and Vegetables Market with a share of about 45.4% in 2025.

- Key Players: Some of the major key players in the Global Fruits and Vegetables Market are Dole plc, Fresh Del Monte Produce Inc., Chiquita Brands International Sàrl, Total Produce plc, Greenyard NV, and many others.

- The market is growing at a CAGR of 9.7 percent over the forecasted period of 2025.

Global Fruits and Vegetables Market: Use Cases

- Functional Food Production: Vegetables and fruits are utilized in the manufacturing of functional foods like immunity-enhancing beverages, antioxidant supplements, and fortified snacks. Nutrient-dense, they are base ingredients in products promoted for health and wellness purposes, particularly post-pandemic.

- Ready-to-Eat Meals: Pre-cut and processed vegetables and fruits are heavily utilized in ready-to-eat meal kits. This is a reflection of consumer demand for convenience without sacrificing nutrition, particularly in urbanized societies with busy lifestyles.

- Baby Food Manufacturing: Pureed vegetables and fruits are staple ingredients in infant and toddler food. Organic produce is preferred in this segment because of safety issues, increasing demand for pesticide-free, high-quality vegetables and fruits worldwide.

- Juices and Smoothies: Fruits and vegetables are utilized by the beverage industry in the production of juices, smoothies, and detox beverages. With consumers opting for healthier alternatives to carbonated beverages, fruit-based drinks continue to capture a greater market share.

- Institutional and HoReCa Use: Hospitals, schools, hotels, and restaurants depend greatly on fresh and frozen fruits and vegetables for meal preparation. Bulk buying and steady demand make this a significant end-use segment that promotes market stability.

Global Fruits and Vegetables Market: Stats & Facts

- FAO (Food and Agriculture Organization): Global fruit and vegetable production surpassed 2.3 billion metric tons in 2022, with Asia accounting for over 60% of total output.

- USDA (United States Department of Agriculture): In 2023, U.S. per capita consumption of fresh vegetables was approximately 115 pounds, while fresh fruit consumption was about 113 pounds, reflecting a growing trend toward healthier diets.

- WHO (World Health Organization): The organization recommends a minimum intake of 400 grams of fruits and vegetables per day to prevent chronic diseases, yet only about 1 in 10 adults globally meet this guideline.

- UN Comtrade (United Nations International Trade Statistics Database): Global exports of fresh fruits reached over $115 billion in value in 2022, with bananas, apples, and citrus fruits being the most traded commodities.

Global Fruits and Vegetables Market: Market Dynamics

Driving Factors in the Global Fruits and Vegetables Market

Rising Health Consciousness and Changing Dietary Preferences

Globally, consumers are placing greater value on health and wellness, leading to an unprecedented surge in the consumption of fruits and vegetables. This trend can be explained by growing awareness of the role plant-based diets can play in preventing chronic illnesses such as obesity, diabetes, and cardiovascular issues. Fruits and vegetables provide essential vitamins, minerals, antioxidants, and dietary fiber, making them key components of balanced diets.

Governments and health organizations are also encouraging increased intake through public health campaigns, school lunch programs, and nutrition education initiatives. Furthermore, an increase in vegetarianism, veganism, and flexitarianism has further driven up demand for diverse and high-quality produce.

This shift in dietary habits can be seen through growing supermarket sections, plant-based menus at restaurants, and health-oriented food startups. Fitness influencers, dietitians, and wellness platforms continue to shape consumer tastes towards fresh and whole foods. Rising disposable incomes and urbanization in developing economies are catalyzing this transition as more consumers embrace fresh, minimally processed alternatives over processed ones, driving market expansion.

Expansion of Cold Chain Infrastructure and Logistics

Cold chain infrastructure expansion and modernization have significantly enhanced the handling, storage, and transport of perishable fruits and vegetables that must remain fresh until consumed, making them available even in distant and export-heavy markets. Poor storage conditions once posed a considerable challenge to developing economies.

Temperature-controlled logistics--encompassing refrigerator trucks, storage facilities, and smart inventory systems--have significantly cut waste while increasing the shelf life of fresh produce. Government incentives and private sector partnerships have led to rapid cold chain development in high-export nations like India, Brazil, and Mexico.

Cold storage solutions equipped with real-time monitoring and IoT devices ensure optimal conditions during transit, building trust among retailers and their end consumers. These advancements are making seasonal produce available year-round, expanding market potential, and supporting large-scale distribution. E-commerce and grocery delivery platforms rely heavily on efficient cold chain logistics to meet consumer expectations of freshness. With global trade of fresh produce growing steadily, effective cold chain logistics are now more essential than ever for sustainable fruit and vegetable market expansion.

Restraints in the Global Fruits and Vegetables Market

High Post-Harvest Losses and Perishability Issues

Post-harvest losses remain an obstacle in developing countries despite advances in cold chain and storage technology. Fruits and vegetables are delicate commodities that must be handled, stored, and transported under carefully controlled conditions to remain edible. Without adequate infrastructure in place, significant quantities of produce are lost due to spoilage, contamination, or physical damage during transit.

FAO estimates that nearly 45% of global fruit and vegetable production is lost postharvest each year, decreasing profits and discouraging farmers from expanding cultivation. Compounding this issue are inconsistent electricity supplies, outdated storage facilities, inadequate postharvest training for handling fruit crops post-harvest, and inadequate transportation systems, creating an imbalance between supply and demand even when production levels are sufficient.

Spoilage undermines consumer trust, increases price volatility, and compromises food security. Resolving perishability issues effectively requires systemic investments in rural infrastructure, cold chain development, farmer education programs, and policy reform. Without effective resolution of perishability concerns in underserved regions, growth potential will remain severely limited.

Price Fluctuations and Seasonal Supply Constraints

Price fluctuations caused by seasonal production, climate fluctuations, and supply chain disruptions pose an ongoing threat to market stability. Many fruits and vegetables have narrow harvest windows, making their availability and pricing extremely sensitive to weather patterns, pest infestation, water shortage, and climate change impacts such as droughts, floods, and heat waves affecting crop yields.

Consistent pricing results in unpredictable profit margins for farmers and fluctuating costs for retailers and consumers, making planning and investment challenging across the value chain. Dependence on seasonal imports for certain fruits or vegetables makes some countries vulnerable to trade restrictions or geopolitical tensions. Lack of robust agricultural insurance plans and forecasting tools in many regions compounds this problem, leaving stakeholders vulnerable to risk.

As consumers demand affordable, year-round access to produce, seasonal price fluctuations can erode loyalty and divert demand toward other processed or shelf-stable alternatives. Addressing seasonal pricing fluctuations requires diversifying farming practices while simultaneously using accurate predictive analytics in production and distribution.

Opportunities in the Global Fruits and Vegetables Market

Emerging Markets and Untapped Regional Demand

Rapid urbanization and rising disposable incomes across emerging markets in Asia-Pacific, Africa, and Latin America are creating immense opportunities for fruit and vegetable suppliers. These regions are experiencing growing middle-class populations who demand high-quality, nutritious food options. India, Vietnam, Nigeria, and Indonesia are experiencing shifts toward diets that include more plant-based foods; urban consumers in these nations are abandoning high-calorie processed products in favor of healthful alternatives like fresh produce.

Retail infrastructure improvements and the expansion of supermarkets and convenience stores in Tier 2 and Tier 3 cities are helping make fresh produce more accessible. International companies are entering these markets by forging partnerships in local communities, investing in regional farms, and creating culturally specific marketing campaigns.

Mobile-based agri-tech platforms are expanding the relationship between farmers and urban consumers, further streamlining supply chains. As food security and nutrition become national priorities in developing regions, demand for fruit and vegetable products--from fresh to processed--is expected to surge further, creating immense long-term growth potential for market players.

Innovation in Value-Added Fruit and Vegetable Products

The growing consumer demand for convenient and ready-to-eat foods has fuelled innovation in value-added fruit and vegetable products. These foods include pre-cut, peeled, or packaged fruits, vegetable snacks, smoothies, cold-pressed juices, purees, and dried fruit mixes, as well as plant-based meat substitutes made from legumes and vegetables. Health-minded consumers, including millennials and Gen Zers, increasingly demand products that combine nutrition, taste, and convenience, prompting manufacturers to develop unique packaging formats and functional food offerings.

Ready-to-eat and easy-to-use produce formats are becoming increasingly popular among working professionals, students, and parents seeking healthier alternatives to junk food. With increased consumer demand for preservative- and chemical-free options, natural processing techniques like high-pressure processing (HPP) have evolved to preserve nutrition without chemical intervention. Retailers and e-commerce platforms alike are also emphasizing premium offerings with dedicated shelf space and digital promotions, creating not only margin-enhancing innovation but also helping reduce food waste through processing surplus or lower-grade produce into processed forms, creating a circular economy and driving sustainability in the market.

Trends in the Global Fruits and Vegetables Market

Rising Demand for Organic and Locally Sourced Produce

The global focus on wellness and sustainability has greatly altered consumer preferences, leading to an unprecedented surge in interest in organic and locally sourced fruits and vegetables. This trend can be found at its roots in increasing awareness about pesticide-free farming practices, environmental concerns, and the benefits of clean eating.

Consumers are becoming more mindful when it comes to the foods they eat, looking out for produce grown without synthetic fertilizers, GMOs, or chemical pesticides. Local sourcing has gained steam, with farm-to-table movements and community-supported agriculture (CSA) programs creating closer consumer-producer bonds. These changes have also been driven by government incentives and retail partnerships that encourage organic certification and eco-labeling.

Supermarkets and food retailers are devoting more shelf space to organic produce, and online platforms are emphasizing traceable and locally sourced fruits and vegetables. This trend has encouraged farmers to convert conventional farmland to certified organic farms; its market share continues to expand despite higher prices due to perceived superior nutrition and sustainability benefits, further expanding supply chains while driving global investments into organic farming infrastructure projects.

Technology Integration in Cultivation and Supply Chain Management

The adoption and integration of advanced technologies in agriculture and logistics has become a prominent trend, revolutionizing the fruits and vegetables market. Precision farming, AI-powered crop monitoring, and Internet of Things irrigation systems are driving greater yield efficiency while minimizing resource wastage. Meanwhile, blockchain is being tested in supply chains as a traceability solution, guaranteeing origin transparency and quality assurance from farm to fork.

Drone and satellite imaging technologies are becoming more commonly utilized by farmers to assess crop health and predict yields, helping them make data-driven decisions about cropping strategies. Distribution-wise, cold chain logistics are being modernized with real-time temperature monitoring to maintain freshness during long-distance transportation. AI and machine learning are also streamlining sorting and grading processes and ensuring consistent quality standards.

Innovations such as vertical farming and hydroponics have become essential tools in meeting consumer expectations and regulatory standards across regions, with urbanization leading to smart cities, vertical farming, and hydroponics becoming more prevalent as space constraints become an issue. Not only do these tech-enabled shifts optimize supply chains, but they can also mitigate losses caused by spoilage or inefficiencies, making the industry more resilient and responsive.

Global Fruits and Vegetables Market: Research Scope and Analysis

By Type Analysis

Fruits are projected to command the majority in the global fruits and vegetable market due to having universal acceptance, high nutritional intake, and consumption across all groups of age groups. People are making more and more people aware that fruits provide healthy benefits in terms of vitamins, antioxidants, and dietary fiber in the form of immunity, a healthy heart, and digestion.

In contrast to several vegetables that have to be cooked or seasoned, the majority of fruits are eaten raw, and so are an even more convenient food or meal item. This level of convenience has played a strong role in their being so pervasive in both consumer and commercial foodservice operations. Fruits are also more variable in flavor, texture, and color, making them widely useful in juices, smoothies, desserts, salads, and breakfast cereals. The growing demand for plant-based diets has further fueled fruit consumption, especially among health-conscious and fitness-oriented demographics.

Economically, fruits such as bananas, apples, and citrus are among the highest traded commodities globally due to their long shelf life and established export infrastructure. Moreover, global promotional campaigns focused on wellness, such as "5 a Day" programs, have emphasized fruit consumption, encouraging higher per capita intake. The fruit industry also gains from innovation in dried, frozen, and pureed forms, making fruits convenient and available throughout the year. With the growth in premium and exotic fruit availability, and the increase in cold storage and logistics, fruits still maintain a commanding position in the market.

By Category Analysis

Traditional fruits and vegetables are anticipated to dominate the market mainly because they are found in abundance, have cheaper production costs, and are relatively more affordable than their organic counterparts. Traditional farming relies on man-made fertilizers and pesticides, which enable a higher output and better pest and disease management. This leads to increased productivity per acre and overall farming risks, key to sustaining the needs of the fast-expanding global population.

The economies of scale in traditional agriculture also make it cost-effective, making the products affordable to consumers in both the developed and developing world. Though awareness of organic food is on the rise, price sensitivity in most of the world's population continues to push demand towards conventional produce. In addition, big retail chains, such as supermarkets and hypermarkets, carry mostly conventional fruits and vegetables because of regular supply, uniform appearance, and longer shelf life. These characteristics are best suited for mass distribution and consumer buying patterns.

In developing economies, where food security and affordability are more important than organic certification, conventional products occupy market shelves. Conventional produce also sustains big export markets because of its durability during transportation and storage. Governments across several countries also support conventional agriculture through subsidies and research, ensuring its continued dominance. While organic is growing, conventional fruits and vegetables remain the cornerstone of global agricultural trade and household consumption.

ℹ

To learn more about this report –

Download Your Free Sample Report Here

By Form Analysis

Fresh fruits and vegetables are poised to dominate the market by form due to their natural appeal, nutritional superiority, and strong consumer preference for unprocessed, whole foods. Worldwide, the trend is increasingly toward clean eating and the intake of minimally processed foods, particularly among health-oriented groups. Fresh fruits and vegetables are typically seen as being more nutritious and palatable than canned or frozen alternatives because they contain more of their natural enzymes, antioxidants, and vitamins.

This attitude strongly affects buying habits, especially in urban centers where organic stores, farmers' markets, and farm-gate sales are favored. In addition, many of the world's culinary traditions place primary importance on the consumption of fresh ingredients as a support for daily utilization. Fresh produce is an important ingredient in salads, side dishes, fresh juices, and gourmet food preparation in the retail and foodservice sectors.

Advances in technology in cold chain logistics, vacuum cooling, and packaging have increased the possibility of preserving freshness over longer distances and shelf life, increasing the supply of fresh goods in international markets. Supermarkets and hypermarkets also display fresh fruits and vegetables to draw a crowd and enhance the perception of the store.

Furthermore, e-commerce sites have brought fresh fruits and vegetables closer by offering contactless delivery and same-day fulfillment, attracting time-strapped consumers. Owing to its premium position, consumer confidence, and wellness trend affinity, despite the expansion of frozen and processed categories, fresh produce remains the leader.

By Distribution Channel Analysis

Hypermarkets and supermarkets are projected to lead the fruits and vegetables market by distribution channel because they have wide coverage, varied product offerings, and the capacity to offer fresh as well as value-added products in one place. These retail stores are convenience-oriented and are single-stop destinations for customers, providing a variety of produce with varying grades, prices, and types of packaging. Their sophisticated logistics, cold storage facilities, and relationships with local and global suppliers make seasonally and non-seasonally available items accessible year-round.

Supermarkets and hypermarkets also spend on attractive-looking produce departments with refrigerated, well-lit displays that improve product freshness and shopper appeal. Their size permits price competitiveness, regular promotions, and loyalty programs that also appeal to value-conscious shoppers. Most of these retail chains also offer quality guarantees, traceability, and explicit labeling (such as organic and non-GMO labels), and this boosts consumers' confidence and satisfaction.

In developed nations, these stores are the first point of sale for weekly family food shopping. In developing nations, the rapid growth of cities and an increase in organized retailing are driving the development of supermarket chains at the expense of conventional wet markets. In addition, supermarkets have incorporated omnichannel strategies, providing online ordering, in-store pickup, and delivery, which further reinforces their dominance of both physical and digital retailing spaces for fruits and vegetables across the world.

By End Use Analysis

Household consumption is expected to be the largest end-use segment in the global fruits and vegetables market because of steady daily demand, health awareness, and rising per capita fruit and vegetable consumption among consumers. In every culture, fruits and vegetables are the standard ingredients in family meals and are eaten in different forms, such as raw, cooked, pureed, or juiced. Growing health concerns related to lifestyle disorders like obesity, diabetes, and hypertension have prompted consumers to actively include more vegetable-based products in their diet.

Governments and global health organizations are encouraging people to eat five or more portions of fruit and vegetables a day. This health promotion has an effective impact on the consumer, particularly parents, carers, and the elderly. Further, as food prices rise and the wellness trends promote cooking from scratch, fresh and varied produce demand has grown. Technological access has also been a factor—social media, health apps, and cooking sites are shaping dietary patterns and promoting vegetable-focused meal preparation.

In addition, consumption within the household cuts across different economic segments since fruits and vegetables are fairly affordable food products. With shopping choices ranging from discount food stores to upscale organic markets and home delivery services, fresh produce is more accessible to households than ever. This broad and sustained usage underpins its dominance in the market's end-use segment.

The Global Fruits and Vegetables Market Report is segmented on the basis of the following:

By Type

- Fruits

- Citrus Fruits

- Oranges

- Lemons

- grapefruits

- Berries

- Strawberries

- Blueberries

- raspberries

- Tropical Fruits

- Bananas

- Pineapples

- mangoes

- Pome Fruits

- Stone Fruits

- Melons

- Watermelon

- Cantaloupe

- honeydew

- Grapes

- Others

- Vegetables

- Leafy Greens

- Root Vegetables

- Cruciferous Vegetables

- Broccoli

- Cauliflower

- cabbage

- Alliums

- Nightshades

- Tomatoes

- Eggplants

- peppers

- Legumes

- Gourds & Squashes

- Zucchini

- Pumpkin

- cucumber

- Others

By Category

By Form

- Fresh

- Canned

- Frozen

- Dried and Dehydrated

- Purees and Paste

- Concentrates

- Others

By Distribution Channel

- Supermarkets/Hypermarkets

- Convenience Stores

- Online Retail

- Specialty Stores

- Wholesale Markets

- Direct-to-Consumer (D2C) Channels

By End Use

- Household Consumption

- Food Processing Industry

- HoReCa

- Institutional Use

- Schools

- Hospitals

- Military

Global Fruits and Vegetables Market: Regional Analysis

Region with the Highest Market Share

Asia Pacific is the market leader in the global fruits and vegetables market as it holds 45.4% of market share in 2025 with its large population, diverse agricultural land, and robust consumption culture driven by vegetable diets. China and India are two of the world's top producers and consumers of fruits and vegetables, with well-developed supply chains and long-standing farming practices. Asia Pacific has favorable climatic conditions for cultivating various crops throughout the year.

Moreover, the growing urbanization, rising disposable incomes, and enhanced health awareness are fuelling demand for fresh and processed vegetables and fruits. Official measures favouring farm modernization, cold chain improvement, and market-farm linkages additionally add to the robustness of the market. In addition, expansion in the export of tropical and exotic fruits in Southeast Asia reinforces regional presence at the international level. The demand continues to remain healthy within domestic consumption as well, owing to dietary dependency on vegetables for meals daily among Asian communities. As food quality and safety standards continue to rise, Asia Pacific remains the largest regional market, driven by demand as well as volume.

ℹ

To learn more about this report –

Download Your Free Sample Report Here

Region with the Highest CAGR

North America registers the highest CAGR in the global market for fruits and vegetables because of a fast-changing consumer trend toward healthy eating and plant-based nutrition. The area has witnessed increasing demand for organic, non-GMO, and sustainably grown produce, particularly among Gen Z and Millennial consumers. Advances in technology in agriculture, supply chain automation, and intelligent packaging also enable growth.

Increased fresh produce subscription services, D2C formats, and online grocery stores are making fruits and vegetables more accessible than ever. Also, growing awareness of diet-based prevention of chronic disease has led to robust growth in health-food and household consumption. Product development in dried, pre-cut, and ready-to-eat forms also drives market growth. Strategic purchases by large grocery chains, investments in vertical farming, and local sourcing also drive the market's high growth path.

Japan's market for fruits and vegetables is fueled by standards of high quality, premium products available, and cultural preference for seasonal consumption. Freshness, appearance, and safety are priorities for consumers, driving demand for locally produced and imported specialty fruits and vegetables.

Europe's market is projected to account for 17.5% of the market share in 2025 due to high demand for locally grown, eco-friendly, and organic produce. High food safety standards, environmental sustainability efforts, and health-conscious diets driven by consumers spur growth, particularly from Germany, France, Italy, and the Netherlands.

By Region

North America

Europe

- Germany

- The U.K.

- France

- Italy

- Russia

- Spain

- Benelux

- Nordic

- Rest of Europe

Asia-Pacific

- China

- Japan

- South Korea

- India

- ANZ

- ASEAN

- Rest of Asia-Pacific

Latin America

- Brazil

- Mexico

- Argentina

- Colombia

- Rest of Latin America

Middle East & Africa

- Saudi Arabia

- UAE

- South Africa

- Israel

- Egypt

- Rest of MEA

Global Fruits and Vegetables Market: Competitive Landscape

The global fruits and vegetables market is highly competitive and fragmented, comprising multinational conglomerates, regional producers, and vertically integrated agribusinesses. Key players like Dole plc, Fresh Del Monte Produce Inc., Chiquita Brands International, and Greenyard NV hold strong positions due to their vast production capabilities, global sourcing networks, and established branding.

These companies consistently invest in sustainable farming practices, cold chain logistics, and premium packaging to meet evolving consumer preferences. Retail giants such as Walmart Inc., Costco Wholesale Corporation, and The Kroger Co. also exert considerable market influence through private-label produce lines, bulk buying power, and expansive distribution channels. Innovation in eco-friendly packaging, organic farming, and digital supply chain platforms is reshaping the competitive landscape.

Additionally, firms like Bonduelle S.A., Nature’s Pride, and T&G Global focus on premium and value-added segments such as pre-cut, ready-to-eat, and exotic produce. Emerging players are leveraging e-commerce, smart agriculture technologies, and direct-to-consumer models to capture niche markets. Strategic partnerships, mergers, and acquisitions remain common as companies aim to expand their geographic footprint and product portfolios. As consumer demand for freshness, traceability, and sustainability rises, competitive differentiation increasingly hinges on transparency, innovation, and consistent quality assurance.

Some of the prominent players in the Global Fruits and Vegetables Market are:

- Dole plc

- Fresh Del Monte Produce Inc.

- Chiquita Brands International Sàrl

- Total Produce plc

- Greenyard NV

- Sysco Corporation

- The Kroger Co.

- Walmart Inc.

- Costco Wholesale Corporation

- Sunkist Growers, Inc.

- Nature's Pride

- Grimmway Farms

- General Mills, Inc.

- Nestlé S.A.

- The Wonderful Company LLC

- Bonduelle S.A.

- Driscoll’s Inc.

- T&G Global Limited

- Bayer AG (Crop Science Division)

- AMFresh Group

- Other Key Players

Recent Developments in the Global Fruits and Vegetables Market

- March 2025: Greenyard NV announced an investment in expanding its fresh produce logistics and ripening centers in Belgium and Germany. This strategic move enhances the company’s cold chain capabilities and strengthens its leadership in the global fruits and vegetables market, enabling faster delivery and fresher offerings across European retail chains.

- February 2025: The Global Fresh Produce Forum 2025 was held in Berlin, Germany, focusing on trends in sustainable farming, shelf life enhancement, and organic fruits and vegetables. Industry leaders, including Dole plc and Bonduelle, discussed climate-resilient agriculture and innovation in fruit and vegetable packaging.

- January 2025: Fresh Del Monte Produce Inc. partnered with Cruise Automation, a self-driving logistics firm, to pilot autonomous delivery of fresh fruit in Florida. The collaboration aims to cut transit time and reduce spoilage in the high-demand fresh fruit and vegetable segment.

- December 2024: Nature’s Pride finalized its merger with Eosta BV, a leading Dutch organic produce distributor. The consolidation boosts their combined market share in the organic fruits and vegetables segment and enhances export strength across Europe and the Middle East.

- November 2024: At Asia Fruit Logistica 2024 in Hong Kong, over 800 exhibitors showcased innovations in fresh vegetable preservation, smart packaging, and fruit and vegetable processing. Companies unveiled biodegradable trays and reusable crates aimed at reducing food waste and boosting the vegetable market growth.

- October 2024: Driscoll’s Inc. announced a $90 million investment to scale high-tech greenhouse berry production in Mexico. The project will support year-round supply for North America, aligning with the rising demand for organic fruits and locally grown, nutritious fruits and vegetables.

- August 2024: T&G Global entered a strategic agreement with Alibaba Group to expand its digital fruit marketplace across China. This partnership enhances cross-border trade of fresh fruit, utilizing real-time demand analytics and direct-to-consumer logistics.

- July 2024: The World Horticultural Innovation Summit 2024 in the Netherlands focused on precision farming, vertical agriculture, and sustainable irrigation in the vegetable market. Key sessions highlighted the future of fruit and vegetable consumption in urban centers and the integration of AI in smart farming.

- May 2024: Bonduelle S.A. acquired Spain-based Frutas Beltran, expanding its Mediterranean citrus portfolio. The acquisition strengthens Bonduelle’s presence in the citrus fruits segment and enhances distribution across Southern Europe and North Africa.

- March 2024: The Wonderful Company invested $120 million into expanding its almond and citrus operations in California. The investment includes water-efficient irrigation, sustainable fertilization methods, and expanded storage facilities to support growing fruit and tree nut demand.

- January 2024: India's APEDA (Agricultural and Processed Food Products Export Development Authority) launched the “Global Fresh India” program to promote exports of Indian mangoes, pomegranates, and okra to Europe and North America

Report Details

| Report Characteristics |

| Market Size (2025) |

USD 71.1 Bn |

| Forecast Value (2034) |

USD 163.1 Bn |

| CAGR (2025–2034) |

9.7% |

| The US Market Size (2025) |

USD 27.1 Bn |

| Historical Data |

2019 – 2024 |

| Forecast Data |

2026 – 2034 |

| Base Year |

2024 |

| Estimate Year |

2025 |

| Report Coverage |

Market Revenue Estimation, Market Dynamics, Competitive Landscape, Growth Factors, etc. |

| Segments Covered |

By Type (Fruits, Vegetables), By Category (Organic, Conventional), By Form (Fresh, Canned, Frozen, Dried and Dehydrated, Purees and Paste, Concentrates, Others), By Distribution Channel (Supermarkets/Hypermarkets, Convenience Stores, Online Retail, Specialty Stores, Wholesale Markets, Direct-to-Consumer (D2C) Channels), By End Use (Household Consumption, Food Processing Industry, HoReCa, Institutional Use) |

| Regional Coverage |

North America – US, Canada; Europe – Germany, UK, France, Russia, Spain, Italy, Benelux, Nordic, Rest of Europe; Asia-Pacific – China, Japan, South Korea, India, ANZ, ASEAN, Rest of APAC; Latin America – Brazil, Mexico, Argentina, Colombia, Rest of Latin America; Middle East & Africa – Saudi Arabia, UAE, South Africa, Turkey, Egypt, Israel, Rest of MEA |

| Prominent Players |

Dole plc, Fresh Del Monte Produce Inc., Chiquita Brands International Sàrl, Total Produce plc, Greenyard NV, Sysco Corporation, The Kroger Co., Walmart Inc., Costco Wholesale Corporation, Sunkist Growers, Inc., Nature's Pride, Grimmway Farms, General Mills, Inc., Nestlé S.A., The Wonderful Company LLC, Bonduelle S.A., Driscoll’s Inc., T&G Global Limited, Bayer AG (Crop Science Division), AMFresh Group, and Other Key Players |

| Purchase Options |

We have three licenses to opt for: Single User License (Limited to 1 user), Multi-User License (Up to 5 Users), and Corporate Use License (Unlimited User) along with free report customization equivalent to 0 analyst working days, 3 analysts working days, and 5 analysts working days respectively. |

Frequently Asked Questions

How big is the Global Fruits and Vegetables Market?

▾ The Global Fruits and Vegetables Market size is estimated to have a value of USD 71.1 billion in 2025 and is expected to reach USD 163.1 billion by the end of 2034.

What is the size of the US Fruits and Vegetables Market?

▾ The US Fruits and Vegetables Market is projected to be valued at USD 27.1 billion in 2025. It is expected to witness subsequent growth in the upcoming period as it holds USD 59.5 billion in 2034 at a CAGR of 9.1%.

Which region accounted for the largest Global Fruits and Vegetables Market?

▾ Asia Pacific is expected to have the largest market share in the Global Fruits and Vegetables Market with a share of about 45.4% in 2025.

Who are the key players in the Global Fruits and Vegetables Market?

▾ Some of the major key players in the Global Fruits and Vegetables Market are Dole plc, Fresh Del Monte Produce Inc., Chiquita Brands International Sàrl, Total Produce plc, Greenyard NV, and many others.

What is the growth rate in the Global Fruits and Vegetables Market in 2025?

▾ The market is growing at a CAGR of 9.7 percent over the forecasted period of 2025.