The Gear Cutting Machine Market represents a niche within manufacturing that produces advanced machinery designed for precision gear production in various sectors including automotive, aerospace and industrial machinery production. Driven by technological innovations like automation and advanced material processing techniques such as 3D printing technology; demand for high-performance durable gear components has driven market expansion as industry leaders such as Vice-Presidents of Business Operations/CEO/CMO's must navigate new technological trends to strategically position their companies against competing in this increasingly globalized landscape.

Gear Cutting Machine Market is expected to experience explosive expansion due to technological innovations and market demands. Activity in this sector is surging as industries such as automotive, aerospace and industrial machinery require high precision gear components - driven by increasing operational efficiencies, precision requirements and production speeds; all addressed through cutting edge technological solutions.

Key trends include the rapidly increasing adoption of CNC (Computer Numerical Control) gear cutting machines, which offer greater accuracy with minimal manual intervention required for operation. Automation and digitization have transformed the market landscape significantly; Industry 4.0 technologies now facilitate real-time monitoring and predictive maintenance to reduce downtime while optimizing operational costs and save costs overall.

Demand for high-performance gears driven by advancements in electric vehicle and renewable energy sectors continues to spur market expansion. Manufacturers are responding by developing versatile gear cutting machines capable of handling diverse materials and gear types to keep up with modern manufacturing needs.

Key Takeaways

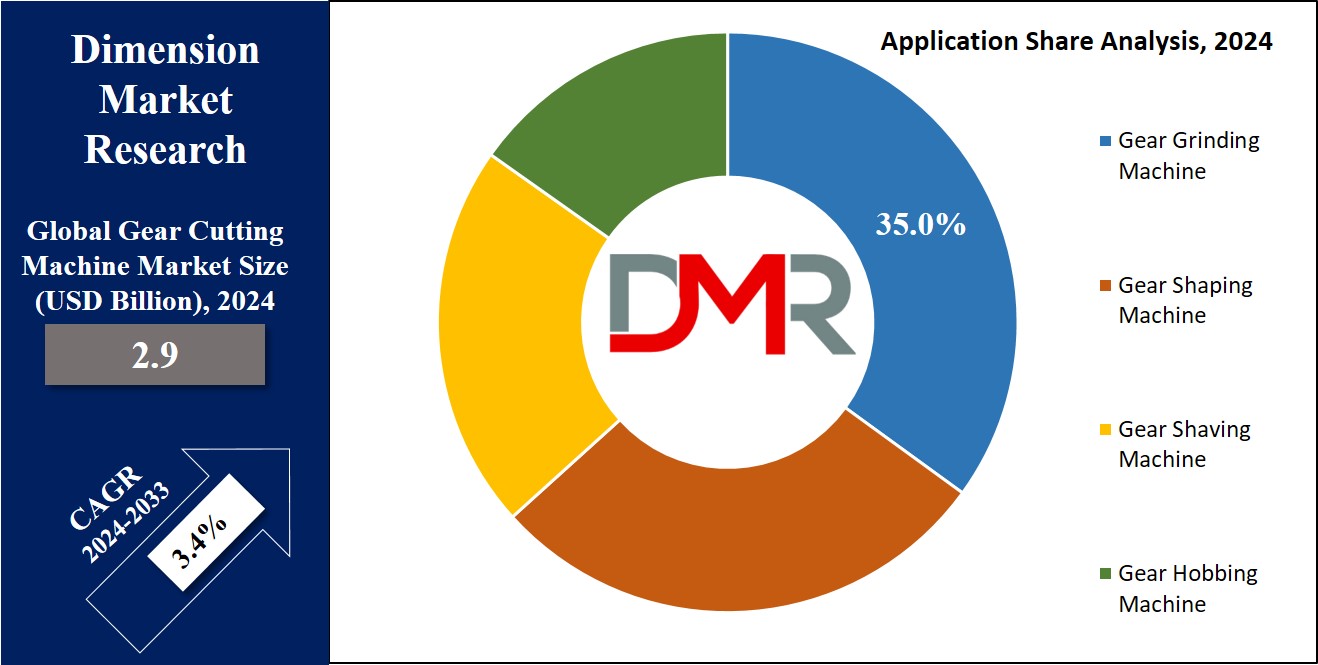

- Market Growth Projections: The Gear Cutting Machine Market is estimated to grow from USD 2.9 billion in 2024 to USD 3.9 billion by 2033, representing a CAGR of 3.4%.

- Dominant Product Segment: Gear Grinding Machines dominate the market, capturing a share of 35% in 2023 because of their precision and high efficiency in producing high-end quality gears.

- Leading Application Sector: The Automotive Industry is the leading application sector for gear cutting machines and is expected to account for about 40% of market share by 2023. This is being driven by the demand for precision gears used in different components of a vehicle.

- Top Regional Market: Asia Pacific is the top regional market for gear cutting machines, expected to hold about 45% market share by 2023. This dominance will be supported by rapid industrial expansion and increased demand observed from automotive and aerospace sectors.

- Key Growth Drivers: Rising demand for hybrid and electric vehicles, technological advancements in automation and additive manufacturing, and increased industrial production contribute significantly to market expansion.

Use Cases

- Automotive Industry Optimization: An automotive manufacturer adopts advanced CNC gear grinding machines to improve precision and efficiency in gear production. This upgrade reduces manual labor and errors, resulting in higher vehicle performance and lower operational costs.

- Aerospace Precision Engineering: An aerospace company uses high-precision gear shaping and shaving machines with Industry 4.0 technologies for strict accuracy and durability in aircraft and spacecraft gears. This ensures high performance and extended machine lifespan through real-time monitoring.

- Industrial Machinery Enhancement: A manufacturer of industrial machinery integrates gear hobbing machines with digital technologies to efficiently produce various gear types. This boosts production versatility, reduces waste, and cuts costs, supporting diverse industrial applications.

- Electric Vehicle Production: An electric vehicle company implements gear grinding machines with additive manufacturing capabilities to produce complex gears for electric drive systems. This speeds up prototyping and production, enhancing vehicle efficiency and accommodating new designs.

Driving Factors

Demand for Hybrid and Electric Vehicles has seen steady increases

Rising hybrid and electric vehicle (EV) sales is one of the primary drivers of growth in the Gear Cutting Machine Market, fuelled by growing environmental awareness, government incentives, and advances in battery technology. According to industry reports, global electric vehicle production is expected to surge at an estimated compound annual growth rate (CAGR) rate from 2023-2030; thus creating demand for advanced gear cutting machines capable of producing such components efficiently and precisely.

Gear cutting machines in this sector have become an indispensable commodity due to the increasingly complex gear systems found on electric and hybrid vehicles, which require precise cutting for optimal performance and reliability. Gear cutting machines that offer enhanced accuracy and efficiency are in high demand as these complex gear systems demand precise cuts for optimal performance and reliability. Furthermore, lighter vehicle designs have led to innovations in gear cutting technologies resulting in market expansion.

Industrial Machinery extensively relies on these applications

Industrial machinery forms a cornerstone of the Gear Cutting Machine Market. Gear cutting machines' use across various industrial sectors - including manufacturing, construction and aerospace - demonstrates their importance in producing high-quality gears for various machines. Demand for precise and dependable gear components drives interest in advanced cutting solutions for producing gears for various machinery.

The industrial machinery sector is projected to experience steady, compound annual compound annual growth over the coming decade. As industries upgrade and modernize their equipment, demand for gear cutting machines capable of handling various materials and complex gear designs grows significantly. Integrating automation and digital technologies into gear cutting machines increases efficiency and precision - keeping with Industry 4.0 trends that is fueling market expansion.

Urbanization and Rise of Middle Class in Latin America

Urbanization and middle class expansion are major contributors to the growth of the Gear Cutting Machine Market. Rapid urbanization in emerging economies has driven infrastructure development and industrial expansion projects that increase infrastructure needs as well as demand for industrial machinery and gear components. Furthermore, this trend also requires advanced gear cutting machines that produce quality gears for various uses.

As emerging market economies experience rapid economic development, emerging middle classes are driving consumer demand for improved infrastructure, automotive products and industrial machinery. Their expanding consumer base fuels investments in manufacturing and industrial sectors resulting in greater investments for gear cutting machines - further driving market growth.

Growth Opportunities

Aerospace Applications Experience Significant Expansion

Aerospace remains an impressive market for gear cutting machines. As new technologies and designs for aircraft and spacecraft emerge, demand for high-precision gears has seen tremendous growth. Modern aerospace components often rely on intricate gear systems capable of withstanding harsh conditions while remaining efficient; hence the demand for advanced gear cutting machines offering precision, durability, and efficiency. Expanded aerospace programs as well as the launch of unmanned aerial vehicles (UAVs) and space exploration vehicles will present manufacturers of gear cutting machines with tremendous opportunities to expand their business portfolios.

Accelerated Production of Industrial Machinery

Reviving industrial machinery production presents gear cutting machine suppliers with another golden opportunity. As global industries increase their manufacturing capacities and invest in new machines, demand for high-quality gears increases dramatically. Gear cutting machines play a pivotal role in producing components for various industrial applications--ranging from heavy equipment to automation systems--with technological advancements driving modernization efforts while increasing production demands providing a promising growth path for gear cutting machine suppliers.

Adopting Additive Manufacturing Technology

Additive manufacturing (3D printing) is revolutionizing gear production processes. Additive manufacturing makes possible complex gear geometries which would otherwise be difficult to produce using traditional methods, enabling faster prototyping, decreased material waste, and custom design for gear products. As more industries embrace additive manufacturing technologies and processes, gear cutting machine manufacturers have the chance to integrate this technology into their offerings or adapt machines so as to cater to a broader array of production needs.

Key Trends

Integration of Industry 4.0 Technologies

Industry 4.0 technologies are revolutionizing gear cutting operations. Focused around smart technologies like IoT (Internet of Things), AI (Artificial Intelligence), and machine learning - Industry 4.0 emphasizes their use in order to augment manufacturing processes. Gear cutting machines increasingly feature sensors for real-time data analysis as well as automated controls which increase precision, efficiency, predictive maintenance capabilities as well as predictive maintenance measures to monitor machine performance, predict potential failures early, optimize production schedules more effectively while decreasing downtime costs and ultimately drive market expansion.

Sensitivity Analysis and Optimization

Sensitivity analysis and optimization techniques have become integral parts of gear cutting processes, with advanced software tools and computational methods employed to understand how various parameters impact gear performance. Manufacturers use detailed sensitivity analyses to detect any potential production issues before they impact production, while optimization algorithms help fine tune gear designs and cutting processes with greater precision and efficiency resulting in reduced material waste for improved quality control practices that contribute towards more eco-friendly, cost-efficient manufacturing practices.

Government Initiatives and Investments in Education

Governments worldwide are becoming more cognizant of advanced manufacturing technologies, investing in initiatives that promote innovation and competitiveness through subsidies, grants and tax incentives for adopting advanced manufacturing equipment - like gear cutting machines - such as subsidies or grants from governments or tax incentives from tax authorities to adopt them are commonplace; public investments into research and development foster technological breakthroughs to help manufacturers transition more seamlessly towards more sophisticated equipment or processes; government initiatives foster market expansion by making cutting-edge technologies accessible and encouraging adoption of modern gear cutting solutions.

Restraining Factors

Environmental regulations are stringent

Environmental regulations represent one of the key impediments to market development for gear cutting machines. Governments globally are taking measures to limit environmental impact by adopting more stringent standards for emissions, waste disposal and energy usage in manufacturing processes. Older gear cutting machines often struggle to comply with environmental regulations without substantial modifications or upgrades, often necessitating expensive retrofits or investments in eco-friendly technologies. Industry reports reveal that manufacturers are increasingly turning to energy-efficient and low emission technologies as part of their compliance strategies, investing in energy-saving and emission reduction technology to meet government regulations. Although this leads to technological advancements, this also increases operational costs and can slow market expansion as companies adjust to these standards.

Geopolitical Tensions and Trade Barriers

Geopolitical tensions and trade barriers present another significant challenge to the Gear Cutting Machine Market. Tariffs, sanctions, and restrictions can disrupt supply chains worldwide and impact essential raw materials and components that comprise essential products. Trade disputes among major economies can result in higher costs associated with imported parts or materials for gear cutting machines, thus altering their overall cost structure and pricing; potentially decreasing market demand. Geopolitical tensions may discourage investments in new technologies and expansion projects, hampering market expansion. According to recent statistics, tariffs imposed on high-tech manufacturing equipment has caused delays and increased costs for manufacturers globally.

Preference for Alternative Manufacturing Methods

Alternative manufacturing techniques are having an effect on the Gear Cutting Machine Market by shifting focus toward more cost-efficient or innovative technologies. Methods like additive manufacturing (3D printing) and advanced machining techniques have gained popularity due to their ability to produce complex geometries while simultaneously reducing material waste. These alternatives to conventional gear cutting methods may offer distinct advantages over their more traditional counterparts, including faster production times and reduced costs for specific applications. As industries turn toward these alternatives, traditional gear cutting machines face competition that threatens their market share; for instance, additive manufacturing is becoming an increasingly popular approach in aerospace and automotive industries for producing high-performance gears, diminishing the demand for conventional gear cutting technologies like gear milling.

Research Scope Analysis

By Type

Gear Grinding Machines held an overwhelming 35% share in the Product Type segment of the Gear Cutting Machine Market in 2023. Their success can be attributed to their advanced precision and efficiency when producing high-quality gears with tight tolerances; as well as their superior surface finishes and dimensional accuracy that makes them indispensable in industries like aerospace and automotive. Meanwhile, demand for high-performance gears continued to propel growth of this segment as its machines meet stringent performance and durability standards.

Gear Shaping Machines were an integral component of the market, accounting for roughly 25% of segment share. Gear shaping machines are highly valued due to their adaptability in handling various gear types and sizes. Their flexibility also makes them an invaluable choice in applications requiring complex gear profiles; industries that demand flexibility and adaptability often employ these machines, creating internal gears as well as special-use forms, which have become a demand-side innovation in various manufacturing sectors.

Gear Shaving Machines held approximately 20% of the market share in 2023. These machines are used primarily to finish gears after they have been cut to enhance surface quality and accuracy after initial cutting process, further increasing performance and longevity especially in high load applications. Their increasing use has become more prominent as more sectors, including automotive and industrial machinery manufacturing companies seek ways to enhance quality and performance across their operations - thus contributing to steady growth for gear shaving machines in general.

Gear Hobbing Machines held approximately 20% of the market share in 2023. Recognized for their efficiency in producing various gear types like spur, helical and bevel gears efficiently, gear hobbing machines were popular choices among high-volume production environments due to their ability to perform continuous cutting operations as well as adaptability with regard to different gear sizes and materials - an integral component in gear manufacturing.

By Application

In 2023, the Automotive Industry held a significant market share for gear cutting machine applications - accounting for approximately 40%. This high market share can be attributed to their demand for precision gears used across many vehicle components such as transmissions, differentials and steering systems - not forgetting their commitment towards improving vehicle performance, efficiency and reliability driving need for advanced gear cutting technologies. Furthermore, their focus on high-volume production and developing next-generation vehicles solidifies this sector's dominance of gear cutting machines designed specifically for automotive use.

General Machinery Industry followed closely behind, accounting for approximately 30% of market share in 2023. This sector's significant contribution can be explained by its wide array of applications that demand gear cutting machines for manufacturing industrial equipment and machinery - such as pumps, compressors and conveyors - using gear cutting machines essential to production. Furthermore, increased industrial activities and technological advancements drive growth within this industry while fuelling increased demand for gear cutting solutions capable of supporting various and complex manufacturing needs.

Aerospace Industry held approximately 20% market share in 2023. Due to their focus on producing precision gears for aircraft engines and other critical components, aerospace industries require sophisticated gear cutting technologies in order to produce precision, high performance gears. To meet aerospace applications' stringent accuracy, reliability, and durability standards requires special machines capable of meeting these exacting standards; advancements in aerospace technology as well as an increased demand for efficient aircraft components further drive this need for advanced gear cutting solutions.

The Gear Cutting Machine Market Report is segmented based on the following:

By Type

- Gear Grinding Machine

- Gear Shaping Machine

- Gear Shaving Machine

- Gear Hobbing Machine

By Application

- Automotive Industry

- General Machinery Industry

- Aerospace Industry

Regional Analysis

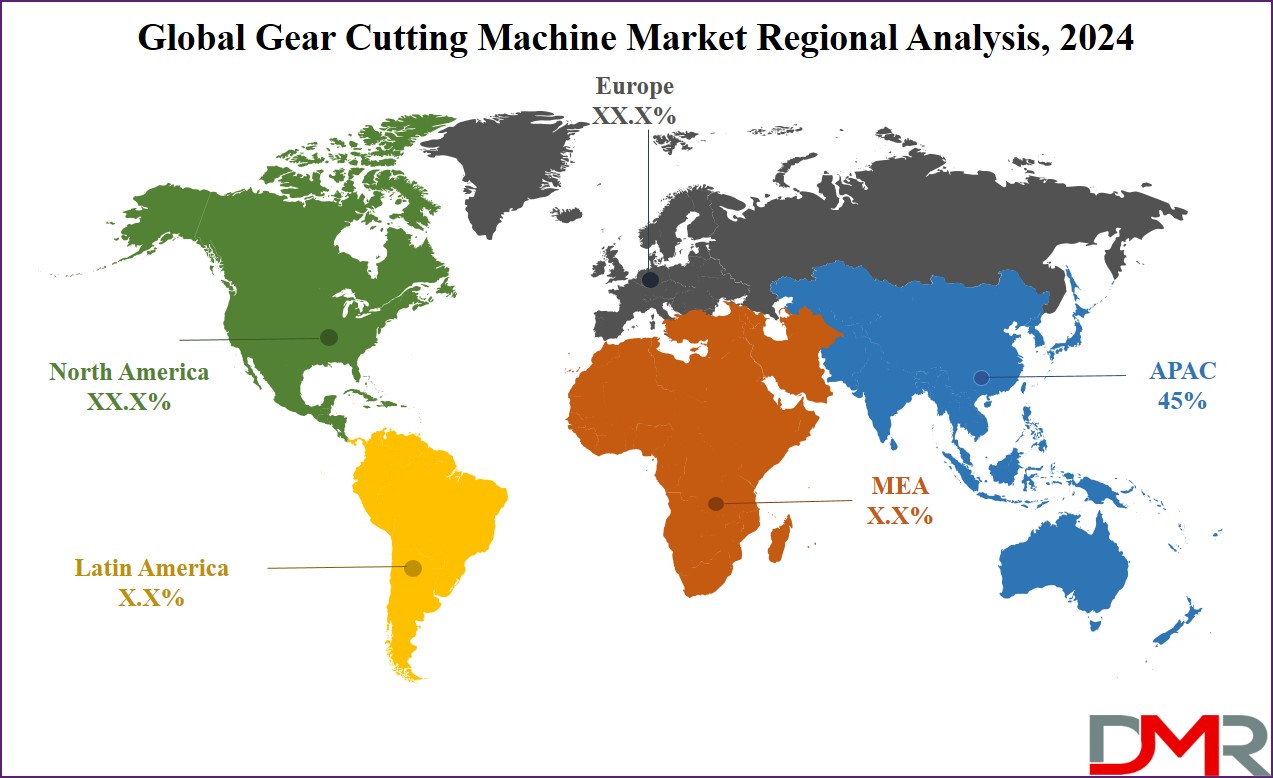

Asia Pacific became the leading region in the global Gear Cutting Machine Market by 2023, accounting for an approximate 45% market share. This remarkable dominance can be attributed to Asia Pacific's robust industrial base and rapid expansion across automotive, aerospace, and general machinery sectors; advanced manufacturing capabilities; increasing investments in infrastructure expansion projects and industrial expansion programs all contributed significantly towards Asia Pacific's dominance. China and India saw particularly notable spikes in gear-cutting machine demand thanks to expanding automotive industries that resulted in a compound annual growth rate (CAGR) of approximately 6.5% across Asia Pacific countries - thus propelling them ahead in this global race!

North America holds 25% of the gear cutting machine market share. Thanks to strong presences in automotive and aerospace industries, it drives high-precision gear cutting machine demand across this region. Both North America's United States and Canada benefit from advanced manufacturing technologies and significant investments in research & development, which contributes to its sustained industrial growth. North America is projected to experience compound annual growth rate of 5.2% reflecting steady industrial development with ongoing technological improvements.

Europe accounted for roughly 20% of the global gear cutting machine market share in 2023. Demand in this region is driven by strong automotive and aerospace sectors as well as significant technological advancements within industrial machinery. Germany, United Kingdom and France are notable contributors to Europe's gear cutting machine market with CAGRs predicted at 4.8% annually due to ongoing technological innovations and regulatory advances.

By Region

North America

Europe

- Germany

- U.K.

- France

- Italy

- Russia

- Spain

- Benelux

- Nordic

- Rest of Europe

Asia-Pacific

- China

- Japan

- South Korea

- India

- ANZ

- ASEAN

- Rest of Asia-Pacific

Latin America

- Brazil

- Mexico

- Argentina

- Colombia

- Rest of Latin America

Middle East & Africa

- Saudi Arabia

- UAE

- South Africa

- Israel

- Egypt

- Rest of MEA

Competitive Landscape

2023 will witness a surge in global Gear Cutting Machine Market activity driven by key players playing an influential role. C-Level Executives play an influential role, shaping strategic directions and driving innovation forward. Their decisions on capital investments, technological advancements, global market expansions and long-term growth ensure their companies can adapt quickly to changing market conditions while taking advantage of any emerging opportunities that present themselves.

Marketing Managers, Brand Managers and Product Managers all play an essential role in the market success by increasing product visibility and meeting customer demands. Marketing and Brand Managers develop and implement strategies to build brand equity while engaging target audiences efficiently; Product Managers focus on refining product features to meet market requirements in an effort to position gear cutting machines favorably and expand market share.

Sales Managers, Procurement Managers, Production Managers, Technical Personnel and Distributors play a pivotal role in operational efficiency and market penetration. Sales Managers and Regional Sales Managers oversee revenue growth while tailoring strategies to local needs, while Procurement Managers ensure cost-effective sourcing of high-quality materials, and Production Managers supervise manufacturing processes while guaranteeing product quality and efficiency. Technical Personnel oversee and upgrade machinery, reducing downtime and enhancing operational reliability while distributors facilitate market reach by making products available across various regions - contributing significantly to overall market expansion. All these roles play an integral part in driving advancement and success within the gear cutting machine market.

Some of the prominent players in the Global Gear Cutting Machine Market are:

- C-Level Executives

- Marketing Manager, Brand Manager, Product Manager

- Sales Manager, Sales Officer, Regional Sales Manager, Country Manager

- Procurement Manager

- Production Manager

- Technical Personnel

- Distributors

Recent developments

- In March 2022, the gear cutting machine market witnessed advancements with the introduction of next-generation CNC gear grinding machines featuring enhanced automation and real-time monitoring capabilities.

- In August 2022, manufacturers began adopting eco-friendly technologies in gear cutting machines, integrating energy-efficient components and emission reduction systems to comply with stricter environmental regulations.

- In January 2023, the integration of 3D printing technology into gear cutting machines enabled the production of complex gear geometries and rapid prototyping, addressing the needs of aerospace and electric vehicle industries.

- In June 2023, Asia Pacific saw increased investments in high-precision gear cutting technologies driven by industrial expansion in China and India, reinforcing the region’s dominance in the market.

Report Details

| Report Characteristics |

| Market Size (2023) |

USD 2.9 Billion |

| Forecast Value (2032) |

USD 3.9 Billion |

| CAGR (2023-2032) |

3.4% |

| Historical Data |

2018 – 2023 |

| Forecast Data |

2024 – 2033 |

| Base Year |

2023 |

| Estimate Year |

2024 |

| Report Coverage |

Market Revenue Estimation, Market Dynamics, Competitive Landscape, Growth Factors and etc. |

| Segments Covered |

By Type(Gear Grinding Machine, Gear Shaping Machine, Gear Shaving Machine, Gear Hobbing Machine), By Application(Automotive Industry, General Machinery Industry, Aerospace Industry) |

| Regional Coverage |

North America – The US and Canada; Europe – Germany, The UK, France, Russia, Spain, Italy, Benelux, Nordic, & Rest of Europe; Asia- Pacific– China, Japan, South Korea, India, ANZ, ASEAN, Rest of APAC; Latin America – Brazil, Mexico, Argentina, Colombia, Rest of Latin America; Middle East & Africa – Saudi Arabia, UAE, South Africa, Turkey, Egypt, Israel, & Rest of MEA

|

| Prominent Players |

C-Level Executives, (Marketing Manager, Brand Manager, Product Manager), (Sales Manager, Sales Officer, Regional Sales Manager, Country Manager), Procurement Manager, Production Manager, Technical Personnel, Distributors |

| Purchase Options |

We have three licenses to opt for: Single User License (Limited to 1 user), Multi-User License (Up to 5 Users), and Corporate Use License (Unlimited User) along with free report customization equivalent to 0 analyst working days, 3 analysts working days and 5 analysts working days respectively. |