Overview

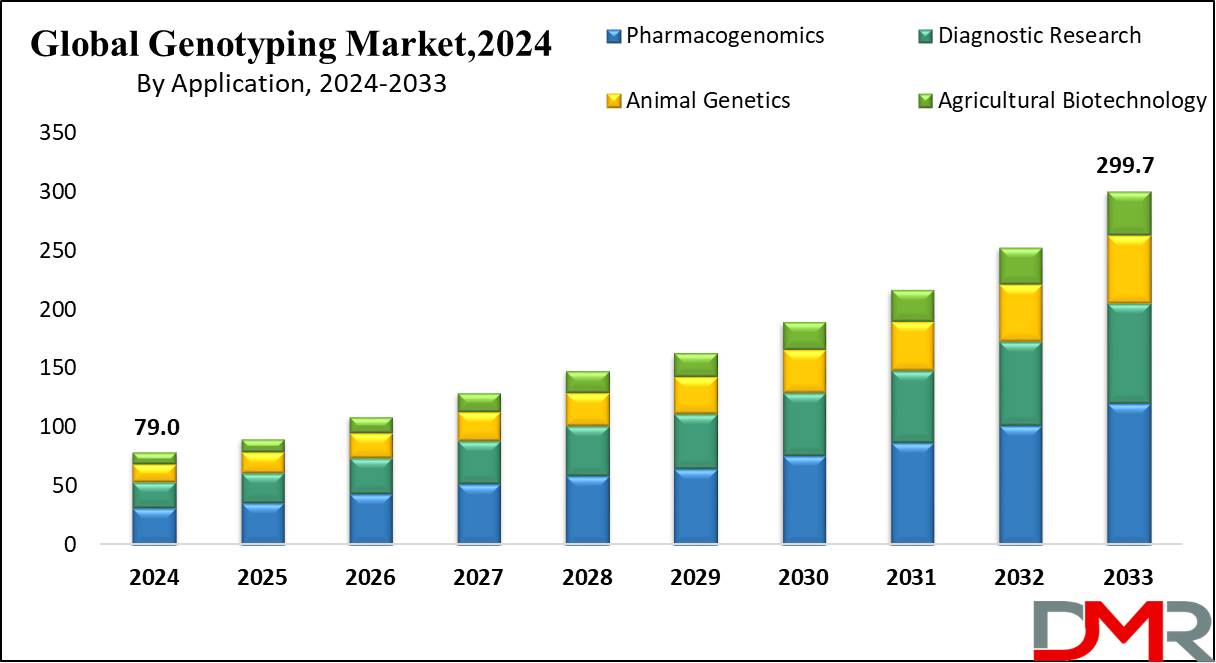

The Global Genotyping Market size is expected to be worth around USD 79.0 Billion by 2033 from USD 299.7 Billion in 2024, growing at a CAGR of 16.0% during the forecast period from 2024 to 2033.

Genotyping is an analytical procedure that utilizes DNA sequences to ascertain the genetic makeup of living organisms, including humans, plants, animals, and microorganisms. Scientists conduct genetic tests on various variations such as changes to DNA structures and single nucleotide polymorphisms detected through biological assays to detect any differences in genetic history between individuals and offer insight into their past genetic development.

Genotyping helps prevent pathogen spread by identifying sources for viral and bacterial disease outbreaks this information also offers insights into their genetic history compared with individuals and allows comparisons among individuals and provides insights into their past genetic history - especially helpful when dealing with microorganisms like viruses and bacteria, where genotyping helps detect sources by identifying sources responsible.

Global Genotyping Market report offers an in-depth analysis of the target market, encompassing factual data like market size and shares at both regional and country levels, with CAGR and year-on-year growth rates. The report gives crystal view on market trends, opportunities, restrains and challenges along with competitive landscape analysis. Porters Five Forces, PESTLE, supply-chain analysis, Ecosystem analysis and Macro economic factors are included to cover all the target market aspects.

The research report on the global genotyping market includes both qualitative as well as quantitative analysis of the market, company profiles of major market players along with complete product details and their competitive scenario. The report highly exhibits on the current and upcoming market trends and provides comprehensive analysis of all the factors that impact the global genotyping market growth and size. The report will help companies to make better strategical business decisions.

Key Takeaways

- Market Size & Share: The Global Genotyping Market size is expected to be worth around USD 299.7 Billion by 2033 from USD 79.0 Billion in 2024, growing at a CAGR of 16.0% during the forecast period from 2024 to 2033.

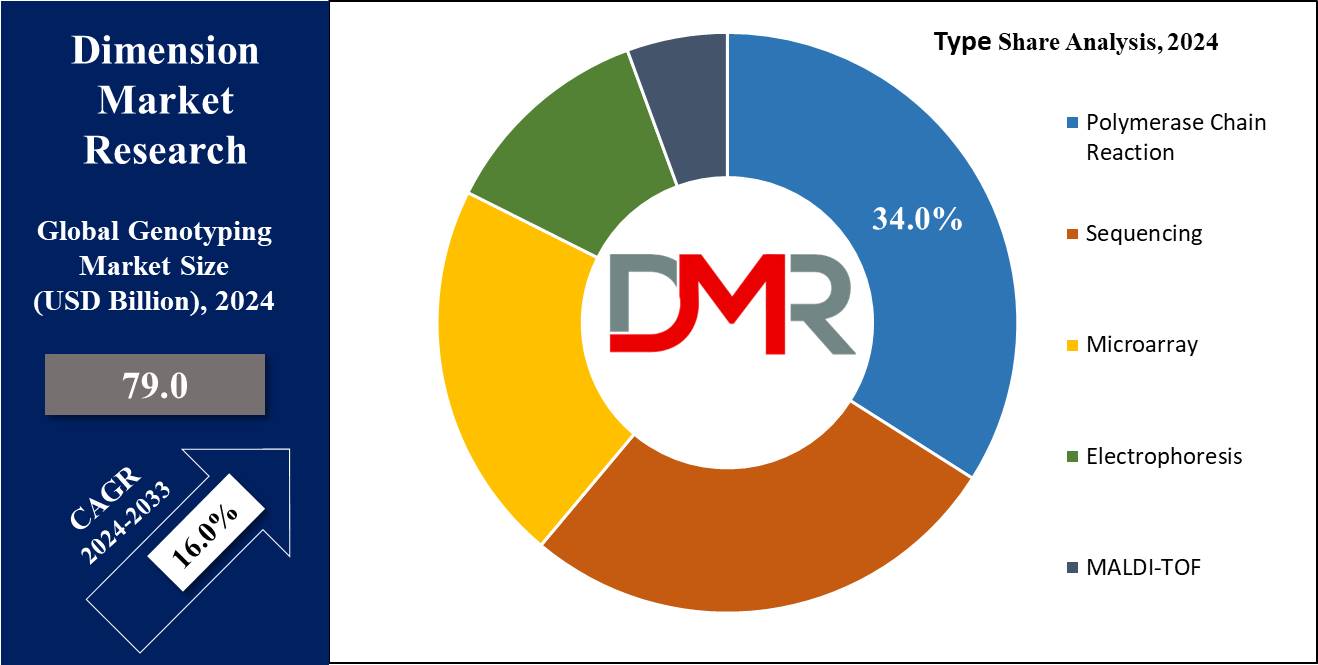

- Type Analsis: Polymerase Chain Reaction (PCR) emerged as the dominant segment by 2024 with 34% market share.

- Application Analysis: Pharmacogenomics was one of the primary drivers in 2024, accounting for 40% of market revenue.

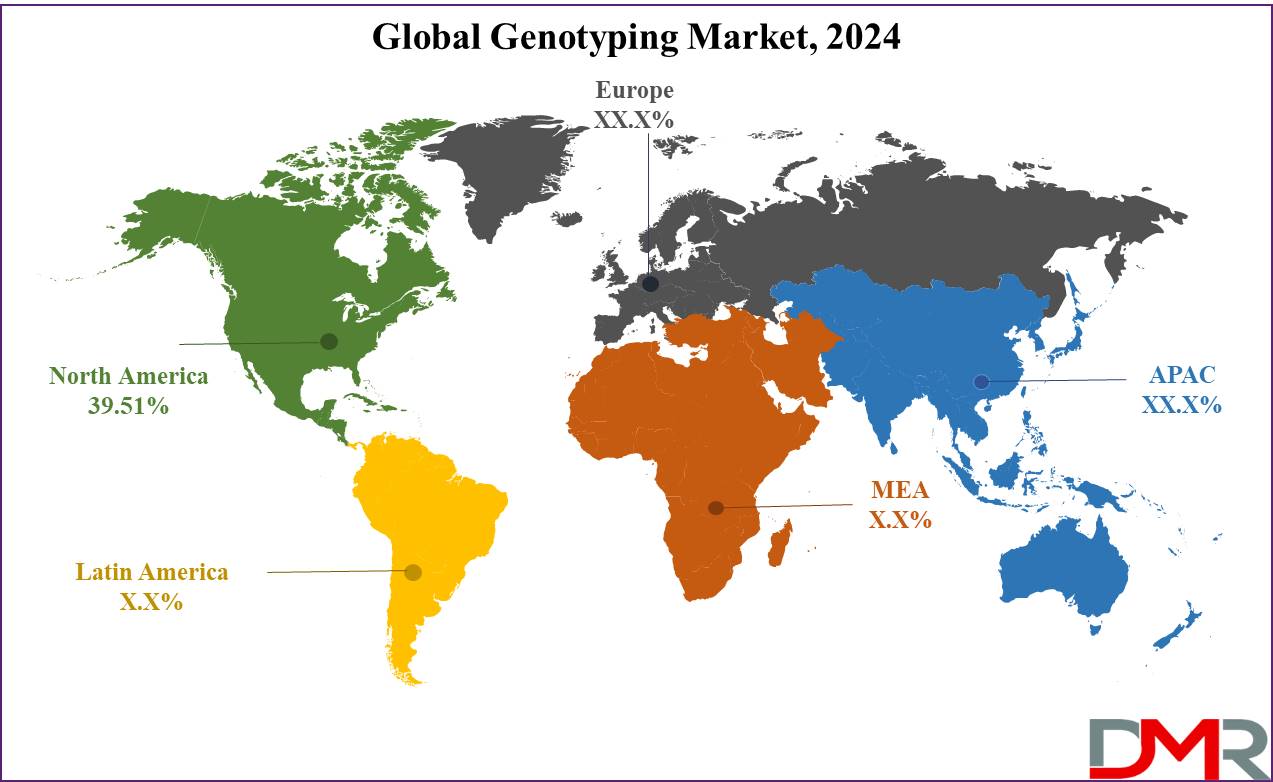

- Regional Analysis: North America dominates the genotyping market due to extensive research activities, advanced healthcare infrastructure, and strong government support for genetic studies.

- Emerging Potential in LAMEA: The LAMEA region exhibits untapped potential, fueled by growing healthcare investments and the adoption of genomics technologies for disease diagnosis and treatment.

- Technological Advancements: Continuous advancements in genotyping technologies are driving market growth, enhancing the accuracy and efficiency of genetic analysis.

Use Cases

- Tailored Healthcare: By leveraging genotyping, healthcare can move towards more individualized treatment plans, improving patient outcomes and reducing healthcare costs.

- Enhanced Agricultural Productivity: Genotyping enables the identification of genetic markers linked to beneficial traits, thus supporting the development of superior agricultural products.

- Advances in Disease Research: The use of genotyping in research facilitates a deeper understanding of genetic predispositions to diseases, paving the way for new therapeutic strategies.

- Improved Drug Development: Pharmaceutical companies use genotyping to identify genetic variations that influence drug metabolism, aiding in the creation of more effective and personalized drugs.

- Forensic Applications: In forensics, genotyping provides a reliable method for individual identification, playing a critical role in criminal justice and legal investigations.

Report Dynamics

Driver:

The genotyping market is driven primarily by increasing demand for personalized medicine, which tailors medical treatments specifically to an individual's genetic profile, lifestyle choices and environmental elements for more targeted therapies that work more effectively and efficiently. Modern advancements in genomics and the lower cost of sequencing technologies have made genotyping more accessible, and enabled its integration into clinical practice more effectively. As chronic diseases such as cancer, diabetes and cardiovascular conditions continue to rise globally, their prevalence has led to an increasing need for precise diagnostic tools - driving further growth of this market. Governments and healthcare organizations worldwide have also invested significantly in genomic research which further propels it. Genotyping market growth will undoubtedly continue to see some notable strides forward over time.

Trend:

Next-generation sequencing (NGS) technologies have emerged as one of the key trends in genotyping markets, offering high-throughput genotyping capabilities that simultaneously analyze thousands of genetic markers. NGS technology has transformed genetics by offering unprecedented insight into genetic variations and disease associations. Another notable development in genotyping technology is artificial intelligence (AI) and machine learning (ML), both capable of processing large amounts of genomic data with pinpoint precision while detecting patterns that predict disease risks with accuracy - thus further increasing efficiency and reliability in genotyping processes.

Restraints:

One of the primary inhibitors to market growth in developing regions is ethical and privacy issues associated with genetic data collection, storage and use. Unauthorized access or misuse can have severe repercussions for individuals. Additionally, nonstandardization in genotyping methods and interpretation creates additional difficulties that lead to variability in results. Lastly, high costs associated with advanced genotyping technologies and limited reimbursement policies hinder market expansion further.

Opportunity:

The genotyping market offers numerous opportunities, particularly within pharmacogenomics. By understanding how genetic variants impact drug response, pharmaceutical companies can develop personalized medications with improved efficacy and reduced adverse side effects. Targeted therapies have proved instrumental in treating various diseases, especially cancer. Agriculture genomics also offers great promise; genotyping can improve crop and livestock breeding programs for higher yields and disease resistance, leading to higher yields overall and better disease resistance ratings. Direct-to-consumer genetic testing services present further growth opportunities as more individuals look for ways to gain insights into their genetic make up both in terms of health benefits as well as family tree context.

The COVID-19 Pandemic & Recession: Impact on the Global Genotyping Market:

Dimension Market Research has closely monitored the impact of COVID-19 and the recession on specific business segments, along with its short and long-term implications at both the global and regional levels. The initial outbreak of the COVID-19 pandemic caused unprecedented economic damage across numerous regions. The COVID-19 pandemic severely disrupted production, sales, and supply chain activities in developed as well as developing economies. Our report comprehensively covers the pre and post-COVID-19 impacts, along with an analysis of the recession's effects on the global genotyping market.

Research Scope and Analysis

Type Analysis

Genotyping Market analysis utilizes various techniques that analyze genetic sequences, each offering their own advantages and applications. Polymerase Chain Reaction (PCR) emerged as the dominant segment by 2023 with 34% market share due to its superior sensitivity, specificity, and versatility when amplifying small amounts of DNA for various uses such as disease diagnosis, genetic research, and forensic examination.

Sequencing, another essential step, provides vital details of genetic code. It has become widely utilized both for research and clinical settings. Microarray technology can quickly analyze multiple genes simultaneously - an ideal technique for large-scale genetic studies. Electrophoresis is often employed for sorting DNA fragments by size before being combined with other techniques; MALDI-TOF (Matrix-Assisted Laser Desorption/Ionization Time of Flight) technology allows rapid identification and characterization of biomolecules such as proteins or nucleic acids for rapid identification and classification. PCR's prominence in the genotyping market illustrates its essential role in furthering genetic research and diagnostics, driving further innovation and application across numerous fields.

Application Analysis

Genotyping Market drivers include several application segments that serve different fields. Pharmacogenomics was one of the primary drivers in 2023, accounting for 40% of market revenue. Pharmacogenomics studies how genes impact an individual's response to drugs; its prominence stems from personalized medicine where understanding genetic variations helps tailor treatment regimens directly for individual patients with better efficacy and reduced adverse side effects.

Diagnostic Research employs genotyping to detect genetic markers associated with diseases for early diagnosis and treatment planning, animal genetics utilizes genotyping for breeding programs to ensure desirable traits are passed onto livestock and pets, and agricultural biotechnology utilizes genotyping to enhance crop yields, resist pests and diseases, develop GMOs for better agriculture productivity.

Pharmacogenomics' dominance in the genotyping market highlights its increasing significance as personalized healthcare and precision medicine become more prominent, driving improvements in drug development and patient care. This trend toward personalized treatment plans should only accelerate growth for genotyping in future years.

Market Analysis and Research Scope:

We provide Comprehensive insights about the genotyping market along with crucial Key factors such as market size, market CAGR, market potential, recent developments, trends, opportunities, new technologies and innovations, recent product launches, restraints and market regulations. This report will help our clients immensely in getting an inside out view of the genotyping market by providing them with the complete information about the genotyping market and its prominent players with their competitive analysis and strategies.

The global genotyping market research report provides accurate estimations for the forecast period 2024 to 2033 based on in-depth research and analysis through rigorous compilation of exhaustive primary and secondary research data. The final data will be carried out after verifying the in-house research analysis by the key opinion leaders of the global genotyping market. Our triangulate research method minimizes error margin and gives holistic view on the report.

The Global Genotyping Market Report is segmented on the basis of the following:

Type

- Polymerase Chain Reaction

- Sequencing

- Microarray

- Electrophoresis

- MALDI-TOF

Application

- Pharmacogenomics

- Diagnostic Research

- Animal Genetics

- Agricultural Biotechnology

Geographical Segmentation of the Global Genotyping Market:

North America dominates the genotyping market due to extensive research activities, advanced healthcare infrastructure, and strong government support for genetic studies. Europe closely follows, with substantial investments in genomics research and a well-established biotechnology sector. The Asia-Pacific region is emerging as a rapidly growing market, driven by increasing awareness of personalized medicine, expanding healthcare expenditure, and rising genetic research initiatives. Additionally, the LAMEA region shows untapped potential, bolstered by growing healthcare investments and the adoption of genomics technologies for disease diagnosis and treatment.

Region and Countries

North America

Europe

- Germany

- The U.K.

- France

- Italy

- Russia

- Spain

- Nordic

- Benelux

- Rest of Europe

Asia-Pacific

- China

- Japan

- South Korea

- India

- ANZ

- ASEAN

- Rest of Asia-Pacific

Latin America

- Brazil

- Mexico

- Argentina

- Colombia

- Rest of Latin America

Middle East & Africa

- Saudi Arabia

- UAE

- Israel

- South Africa

- Egypt

- Rest of MEA

The global genotyping market research report provides competitive examination analysis of the leading players including company description, SWOT analysis, and financial information, exhaustive product portfolio with specifications, key business areas, market share analysis, acquisitions and mergers, and key developments, etc.

Competitive Landscape:

The global genotyping market is highly fragmented due to the presence of several leading players. Prominent market players of the genotyping market are exhibiting a keen interest towards the emerging economies such as China, India, etc. to enhance their revenue generating opportunities. The major market players are continuously focusing on their product branding, marketing and expansion of R&D, to increase their customer base. Exhaustive key vendor analysis has been done to meet the ever-changing needs of our clients and provide them with a complete overview on the competitiveness of the global genotyping market.

Global Genotyping Market Key Players:

Recent Developments

- Technological Innovations: The integration of advanced technologies like CRISPR and next-generation sequencing (NGS) has significantly enhanced the accuracy and efficiency of genotyping. These innovations are enabling more precise genetic modifications and analysis.

- Increased Funding and Investments: Major pharmaceutical and biotech companies have increased their investments in genotyping research and development. This includes funding for startups specializing in genetic testing and personalized medicine, aiming to accelerate the development of new therapies and diagnostic tools.

- Expansion of Personalized Medicine: There has been a substantial focus on personalized medicine, with genotyping playing a crucial role in tailoring treatments to individual genetic profiles. This approach is particularly prominent in oncology, where genetic profiling of tumors helps in selecting the most effective treatment plans for cancer patients.

- Collaborative Research Initiatives: Collaborative efforts between academic institutions, healthcare providers, and biotech firms have intensified. These collaborations aim to leverage genotyping data for large-scale studies, enhancing our understanding of genetic influences on health and disease.

- Regulatory Approvals: Regulatory bodies have been more active in approving new genotyping-based diagnostic tests and treatments. These approvals are crucial for bringing innovative genetic tests to the market, facilitating early diagnosis and treatment of various genetic disorders.

Report Details

| Report Characteristics |

| Market Size (2024) |

USD 79.0 Bn |

| Forecast Value (2033) |

USD 299.7 Bn |

| CAGR (2024-2033) |

16.0% |

| Historical Data |

2018 – 2023 |

| Forecast Data |

2024 – 2033 |

| Base Year |

2023 |

| Estimate Year |

2024 |

| Report Coverage |

Market Revenue Estimation, Market Dynamics, Competitive Landscape, Growth Factors and etc. |

| Segments Covered |

By Type (Occlusive Dressing, Compression Therapy, Cryosurgery, Excision, Radiation Therapy, Laser Therapy, Interferon Therapy, Intralesional Corticosteroid Injection, Others) By Application (Hospitals, Dermatology Clinics, Ambulatory Surgical Centres, Others) |

| Regional Coverage |

North America – The US and Canada; Europe – Germany, The UK, France, Russia, Spain, Italy, Benelux, Nordic, & Rest of Europe; Asia- Pacific– China, Japan, South Korea, India, ANZ, ASEAN, Rest of APAC; Latin America – Brazil, Mexico, Argentina, Colombia, Rest of Latin America; Middle East & Africa – Saudi Arabia, UAE, South Africa, Turkey, Egypt, Israel, & Rest of MEA

|

| Prominent Players |

Novartis, Xylem Inc, RXi, Sonoma, Perrigo, Bristol-Myers Squibb, Pacific World, Valeant, Revitol, Avita |

| Purchase Options |

We have three licenses to opt for: Single User License (Limited to 1 user), Multi-User License (Up to 5 Users), and Corporate Use License (Unlimited User) along with free report customization equivalent to 0 analyst working days, 3 analysts working days and 5 analysts working days respectively. |