Market Overview

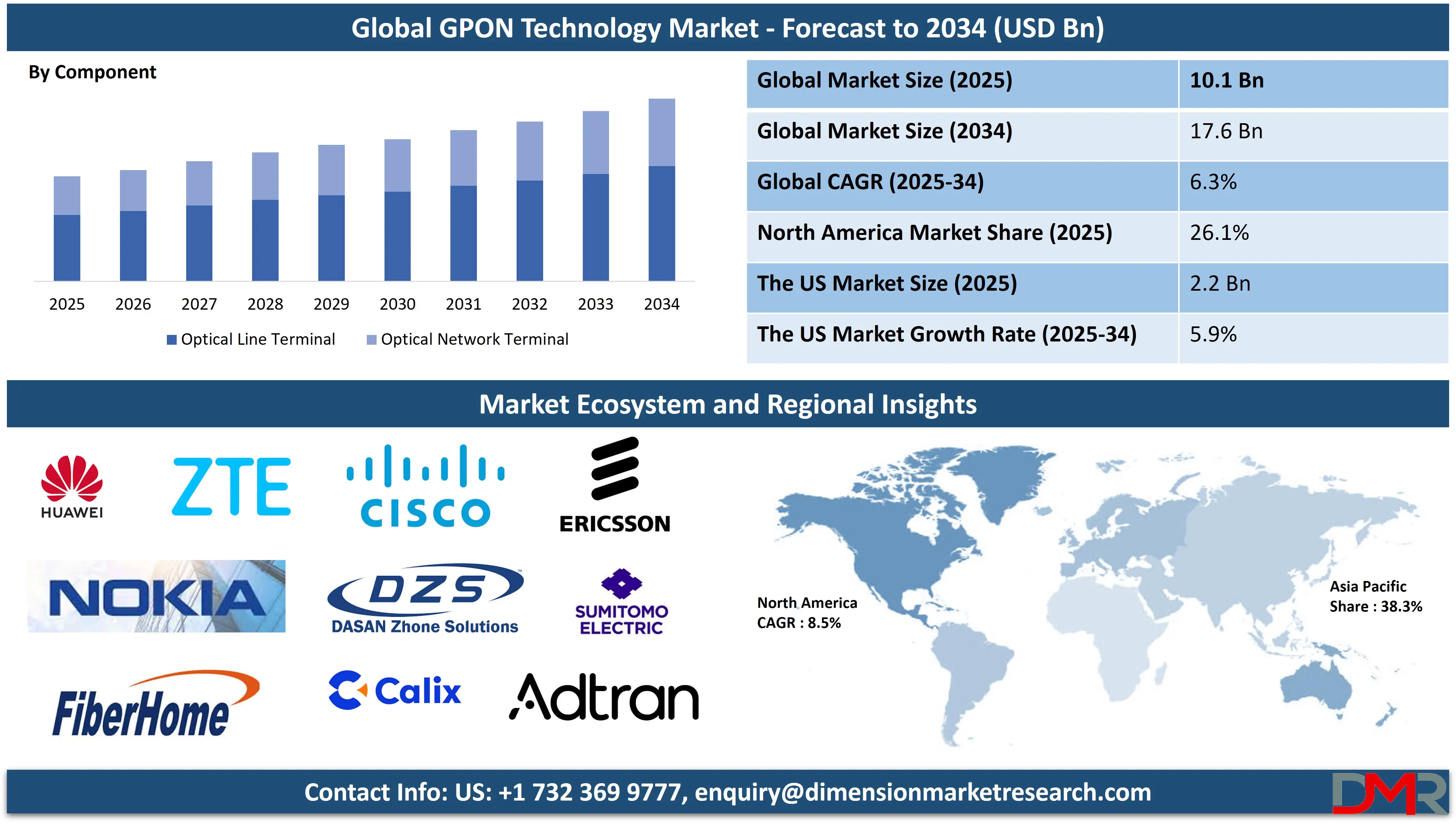

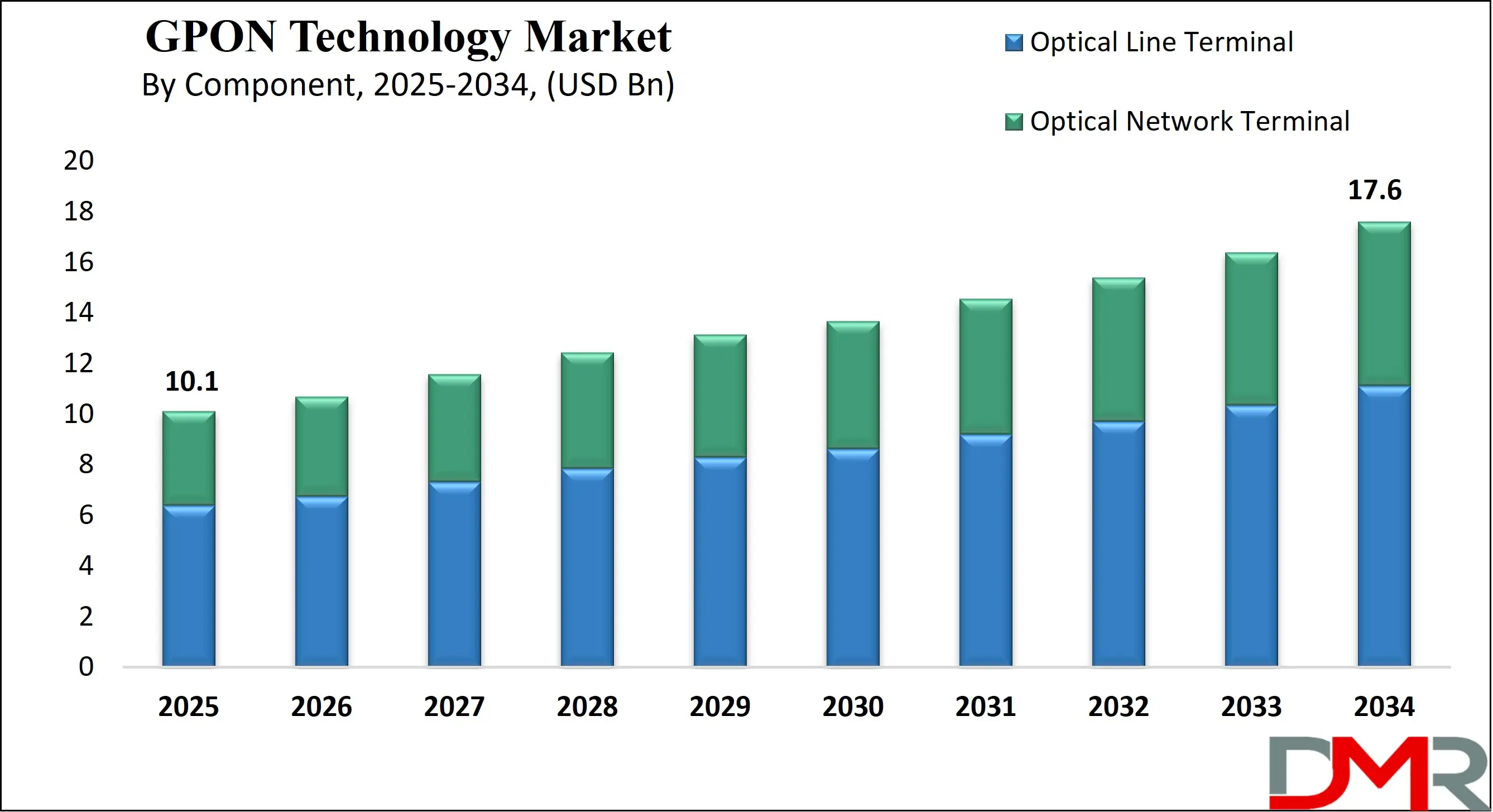

The Global GPON Technology Market is predicted to be valued at USD 10.1 billion in 2025 and is expected to grow to USD 17.6 billion by 2034, registering a compound annual growth rate (CAGR) of 6.3% from 2025 to 2034.

Gigabit Passive Optical Network (GPON) technology is a point-to-multipoint access network that uses fiber-optic cables to deliver high-speed internet, voice, and video services to end-users. It employs passive splitters to serve multiple users from a single fiber line, reducing infrastructure costs. GPON supports downstream speeds of up to 2.5 Gbps and upstream speeds of 1.25 Gbps, making it ideal for Fiber-to-the-Home (FTTH) and enterprise applications. It ensures efficient bandwidth management, low latency, and high reliability. GPON is widely adopted by telecom providers due to its scalability, energy efficiency, and ability to support multiple services over a single infrastructure.

The global GPON (Gigabit Passive Optical Network) technology market is witnessing significant expansion, driven by the increasing demand for high-speed broadband and the growing adoption of fiber-optic networks. As more consumers and enterprises shift towards digital platforms for communication, entertainment, and business operations, the need for efficient, high-capacity network infrastructure has surged. GPON technology offers a cost-effective and scalable solution, providing seamless data, voice, and video transmission through a single optical fiber, making it ideal for both residential and commercial applications.

The rise in smart city initiatives, along with the deployment of 5G and IoT infrastructure, is fueling the demand for fiber-based broadband solutions. Telecom operators are increasingly investing in GPON architecture to modernize their legacy systems and meet consumer expectations for ultra-fast connectivity. This has led to widespread implementation of fiber-to-the-home (FTTH), fiber-to-the-building (FTTB), and fiber-to-the-premises (FTTP) solutions.

Furthermore, the integration of GPON with advanced technologies like network function virtualization (NFV) and software-defined networking (SDN) is enhancing operational efficiency and reducing maintenance costs. The market is also benefiting from government incentives aimed at bridging the digital divide in rural and underserved areas.

Vendors are focusing on innovations such as XGS-PON and NG-PON2, which provide even higher bandwidth and improved latency performance, catering to the rising consumption of high-definition content and cloud-based services. With robust demand from sectors such as healthcare, education, and enterprise networks, the GPON technology market is poised for steady growth, supported by ongoing digital transformation and connectivity requirements across the globe.

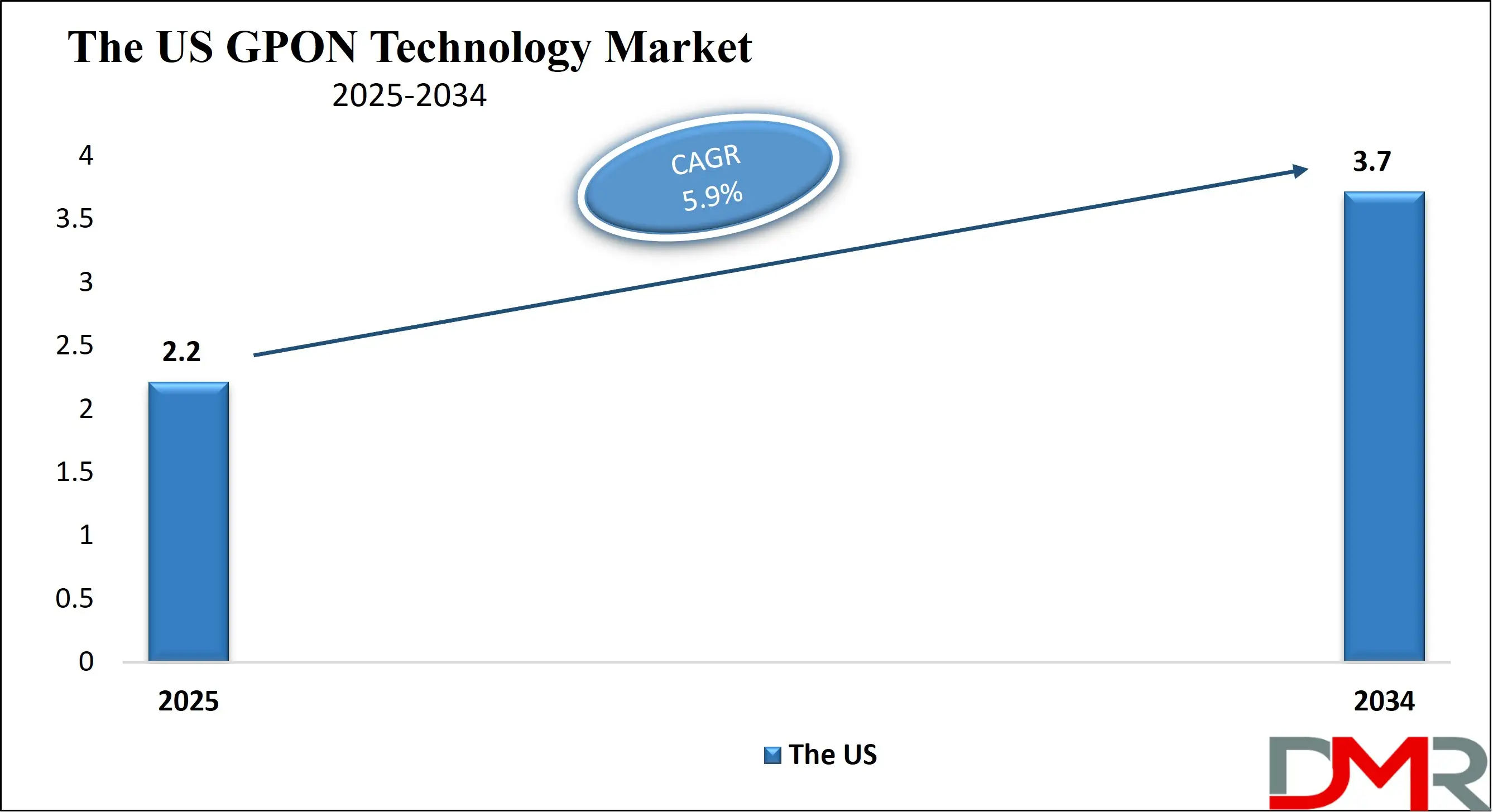

The US GPON Technology Market

The US GPON Technology Market is projected to be valued at USD 2.2 billion in 2025. It is expected to witness subsequent growth in the upcoming period as it holds USD 3.7 billion in 2034 at a CAGR of 5.9%.

The increasing demand for high-speed internet and bandwidth-intensive applications is a major driver of the GPON technology market in the US. With the rise of 4K video streaming, smart homes, and cloud-based services, telecom providers are rapidly upgrading to fiber-optic infrastructure. Government initiatives promoting broadband expansion in rural and underserved areas are also propelling GPON deployments. Additionally, the growth of enterprise cloud adoption and digital transformation is creating a surge in demand for reliable, high-capacity connectivity. These factors are encouraging telecom operators and ISPs to invest in next-generation fiber networks using GPON solutions for cost-effective and scalable deployments.

A significant trend in the US GPON market is the integration of GPON with emerging technologies like 5G, Wi-Fi 6, and IoT. Operators are adopting GPON as a backbone for mobile backhaul to support 5G rollout. The shift toward network virtualization and software-defined networking is also shaping the deployment strategies of service providers. Additionally, the demand for symmetrical bandwidth is encouraging the adoption of next-generation variants like XGS-PON and NG-PON2. There is also growing emphasis on eco-friendly and energy-efficient infrastructure, prompting companies to invest in green GPON solutions that reduce power consumption and operational costs.

The Japan GPON Technology Market

The Japan GPON Technology Market is projected to be valued at USD 1.1 billion in 2025. It is expected to witness subsequent growth in the upcoming period as it holds USD 1.8 billion in 2034 at a CAGR of 5.7%.

Japan’s GPON technology market is primarily driven by its long-standing focus on advanced telecommunications infrastructure and innovation. With one of the highest fiber-to-the-home (FTTH) penetration rates globally, Japan continues to invest in upgrading its networks to meet the growing demand for ultra-fast, reliable connectivity. Government initiatives promoting digital transformation, along with smart city projects, are reinforcing the need for robust GPON networks. Moreover, the country’s leadership in electronics and automation is boosting demand for seamless internet services in both residential and industrial settings, positioning GPON as a vital enabler of Japan’s digital ecosystem.

A key trend in Japan’s GPON market is the increasing adoption of next-generation GPON standards, such as XGS-PON and NG-PON2, to support emerging applications like 8K streaming, VR/AR, and industrial IoT. Telecom providers are focused on enhancing network resilience and scalability to accommodate the country’s aging population and evolving service demands. Another notable trend is the integration of GPON with energy-efficient and compact network hardware, aligning with Japan’s sustainability goals. Additionally, there's a shift towards automation and AI-driven network management, enabling predictive maintenance and improved service delivery across GPON infrastructures.

The Europe GPON Technology Market

The Europe GPON Technology Market is projected to be valued at USD 2.6 billion in 2025. It is expected to witness subsequent growth in the upcoming period as it holds USD 4.6 billion in 2034 at a CAGR of 6.4%.

The push for a unified digital economy across the European Union is driving investment in high-speed fiber networks, propelling the GPON market. EU-backed funding and regulatory frameworks are encouraging public-private partnerships for fiber expansion in both urban and rural areas. Additionally, growing demand for triple-play services, combining voice, video, and data, is increasing the uptake of GPON among telecom operators. Enterprises seeking secure and scalable connectivity for cloud computing and remote work are also contributing to market growth. These developments are accelerating the rollout of GPON infrastructure across major European economies.

One of the prominent trends in Europe’s GPON technology market is the convergence of GPON with smart city infrastructure and digital services. Many governments are integrating fiber networks with municipal IoT platforms for improved utility management and public services. Another trend is the widespread transition from copper-based broadband to fiber-optic technologies, driven by environmental goals and network efficiency. The adoption of XGS-PON and other 10G technologies is also gaining traction, enabling higher bandwidth and better latency performance. Additionally, increasing interest in open-access network models is fostering a competitive and innovative landscape for GPON deployments.

GPON Technology Market: Key Takeaways

- Market Overview: The global GPON technology market is anticipated to reach a valuation of USD 10.1 billion in 2025 and is expected to expand to USD 17.6 billion by 2034, reflecting a CAGR of 6.3% over the forecast period from 2025 to 2034.

- By Component Analysis: The Optical Line Terminal (OLT) segment is expected to lead the global GPON technology market in 2025, contributing approximately 56.3% of the total revenue.

- By Technology Analysis: The 2.5G PON technology is projected to be the most dominant in the global market, accounting for around 49.7% of the total market share in 2025.

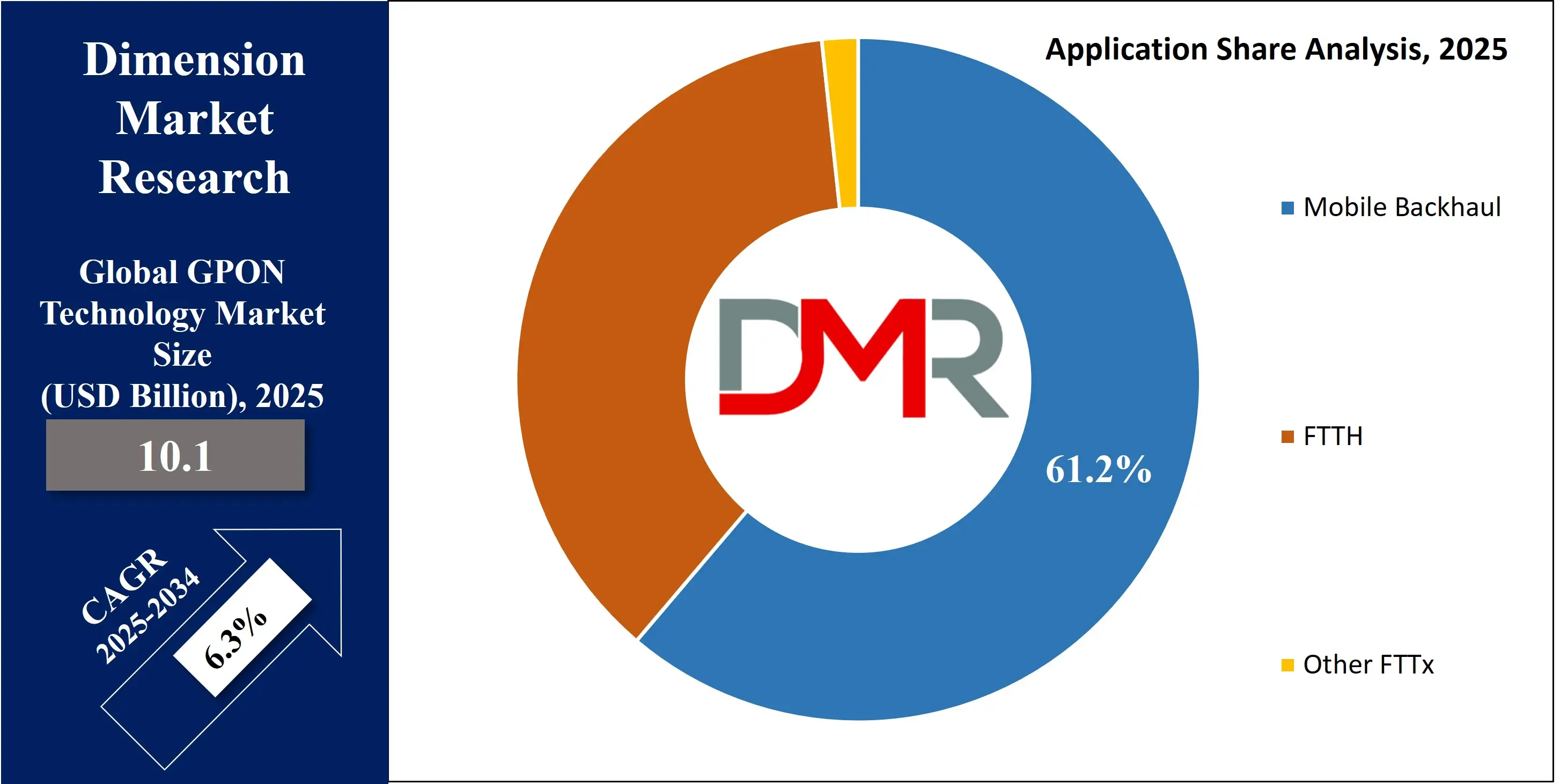

- By Application Analysis: The FTTH (Fiber to the Home) application is poised to command the largest share of the global GPON technology market in 2025, representing about 61.2% of total market revenue.

- Regional Insights: Asia Pacific is set to maintain its position as the leading regional market, with a projected revenue share of 38.3% in 2025.

GPON Technology Market: Use Cases

- FTTH (Fiber to the Home): GPON is widely deployed in FTTH networks, enabling high-speed internet, IPTV, and VoIP services. It provides a cost-effective and scalable solution to deliver gigabit speeds directly to residential users, ensuring low latency and seamless connectivity for smart homes and bandwidth-intensive applications.

- Mobile Backhaul: Telecom operators use GPON to support mobile backhaul for 4G and 5G networks. It delivers reliable and high-capacity fiber connectivity to cell towers, enhancing network efficiency, reducing congestion, and enabling faster data transmission between the core network and mobile users in densely populated areas.

- Enterprise Connectivity: Businesses use GPON for secure and high-speed data transmission across multiple offices. Its ability to support voice, video, and data services over a single infrastructure reduces operational costs and simplifies network management, making it ideal for campuses, hotels, and large corporate facilities.

- Smart Cities Infrastructure: GPON plays a crucial role in smart city development by providing a robust backbone for integrating services like surveillance, traffic management, public Wi-Fi, and smart lighting. Its energy-efficient and scalable architecture supports widespread sensor networks and real-time data exchange across urban environments.

- Educational Institutions: Universities and schools utilize GPON to ensure seamless digital learning experiences. It supports high-bandwidth applications such as video conferencing, e-learning platforms, and campus-wide Wi-Fi, allowing institutions to manage multiple buildings with unified communication and IT infrastructure efficiently.

GPON Technology Market: Stats & Facts

- ITU-T: The GPON standard, as defined by the International Telecommunication Union’s G.984 series, supports downstream speeds of up to 2.5 Gbps and upstream speeds of 1.25 Gbps over a single fiber.

- Broadband Forum: A single GPON port can serve up to 128 end-users using optical splitters, making it highly efficient for last-mile fiber deployments.

- Verizon: As of their 2023 technology update, Verizon reported that their GPON-based FiOS network delivers typical user download speeds of 940 Mbps and upload speeds of 880 Mbps.

- Nokia: In their 2022 technical documentation, Nokia highlighted that GPON has an average latency of less than 2 milliseconds, which supports seamless video streaming and VoIP.

- Telecom Regulatory Authority of India (TRAI): GPON deployment has enabled FTTH services in over 100 Indian cities, with state-run BSNL using GPON as the backbone for its BharatNet rural connectivity mission.

- China Telecom: By 2021, China had deployed over 500 million GPON lines, making it the world leader in passive optical network infrastructure.

- Openreach (UK): In a 2022 rollout update, Openreach announced GPON supports line distances up to 20 kilometers from the central office to the user premises without signal degradation.

- IEEE: The energy efficiency of GPON allows it to consume less than 5 watts per Optical Network Terminal (ONT), making it suitable for residential and small-business applications.

- Federal Communications Commission (FCC): In its 2022 broadband deployment report, the FCC stated that over 36% of U.S. fiber-to-the-premises (FTTP) deployments are powered by GPON infrastructure.

- AT&T: According to AT&T's network investment disclosures, its GPON-enabled fiber network reached over 19 million customer locations in 2023, supporting gigabit broadband in urban and suburban areas.

- U.S. Department of Commerce (NTIA): The Broadband Equity, Access, and Deployment (BEAD) Program includes GPON infrastructure in its funding framework, supporting fiber buildouts in all 50 states by 2030.

- Calix: A U.S.-based access network equipment vendor reported that rural ISPs using Calix GPON systems have delivered symmetrical broadband services to communities with populations under 10,000 residents.

- European Telecommunications Network Operators' Association (ETNO): In its 2023 annual report, ETNO indicated that over 70% of FTTH/B (fiber to the home/building) coverage in the EU is based on GPON and XGS-PON standards.

- Deutsche Telekom (Germany): Deutsche Telekom stated that its GPON infrastructure enabled over 5 million new FTTH connections between 2020 and 2023.

- Orange (France): As of 2023, Orange deployed GPON technology across 100% of its FTTH rollouts, connecting over 30 million households in France, Spain, and Poland combined.

- European Commission (CNECT): The Digital Decade 2030 initiative supports GPON upgrades across rural and underserved EU regions, aiming for gigabit-capable coverage for all households by 2030.

- British Telecom (BT): BT reported that its GPON-based Openreach infrastructure added over 3 million new premises in 2023 alone, pushing toward its 25 million goal.

GPON Technology Market: Market Dynamics

Driving Factors in the GPON Technology Market

Rising Demand for High-Speed Broadband Networks

The increasing reliance on high-speed internet for video streaming, remote work, and cloud-based services is significantly propelling the growth of the GPON technology market. Gigabit Passive Optical Network (GPON) provides ultra-fast broadband connectivity that meets the requirements of high-bandwidth applications. Telecom operators are rapidly deploying GPON networks to upgrade legacy copper infrastructures and deliver fiber-to-the-home (FTTH) services. This shift is also driven by growing consumer expectations for low-latency, high-speed internet access. Furthermore, the expansion of smart cities and digital economies is boosting the adoption of fiber-optic broadband solutions, positioning GPON as a crucial component in the next-generation network infrastructure.

Government Initiatives to Expand Fiber Infrastructure

Government policies and public-private partnerships aimed at improving digital connectivity are playing a critical role in the growth of the GPON technology market. Many nations are investing in national broadband plans that involve deploying fiber-optic networks across rural and underserved areas. These initiatives support the development of smart infrastructure, including e-governance, smart grids, and intelligent transportation systems. GPON technology, known for its cost-effective fiber deployment and high scalability, is being favored for such programs. Regulatory support, subsidies, and funding from international development agencies further accelerate the adoption of GPON solutions across telecom operators and ISPs.

Restraints in the GPON Technology Market

High Initial Deployment Costs

One of the significant challenges in the GPON technology market is the high capital expenditure required for infrastructure development. The deployment of fiber-optic networks, including Optical Line Terminals (OLTs) and Optical Network Terminals (ONTs), involves substantial upfront investment. This cost burden can deter small and medium Internet Service Providers (ISPs) from adopting GPON, especially in developing regions with budget constraints. Additionally, maintenance and skilled labor costs for fiber-optic installations further add to the financial strain. Despite long-term cost efficiency, the initial barrier slows down market penetration and limits access in cost-sensitive markets.

Complexity in Network Upgrades and Integration

Integrating GPON with existing legacy systems or transitioning from older network technologies poses operational challenges. Many telecom operators face difficulties in managing hybrid network environments, especially when integrating GPON with copper-based DSL or Ethernet systems. Compatibility issues, data migration complexities, and the need for specialized technical expertise can delay network upgrades. Moreover, managing a converged network infrastructure with voice, video, and data over a single fiber requires robust network planning. These factors contribute to slower adoption of GPON technology, particularly among operators with limited technical resources.

Opportunities in the GPON Technology Market

Emergence of 5G and Edge Computing

The rollout of 5G networks and the growth of edge computing create substantial opportunities for GPON technology. As mobile operators expand their 5G backhaul infrastructure, the need for reliable, high-bandwidth fiber connections is surging. GPON, with its capability to deliver symmetrical gigabit speeds and low latency, is well-suited for 5G small cell and macro cell backhaul. Additionally, edge data centers require robust last-mile fiber connectivity to process data closer to the user. This growing ecosystem of 5G and distributed computing infrastructure is boosting demand for scalable and cost-effective GPON solutions.

Growth in Smart Homes and IoT Ecosystems

The expansion of smart homes and Internet of Things (IoT) ecosystems presents a major growth opportunity for the GPON technology market. As households adopt more connected devices—such as smart TVs, security systems, voice assistants, and home automation hubs—the demand for uninterrupted, high-speed internet rises sharply. GPON offers the bandwidth and quality of service required to support simultaneous data-heavy applications. Furthermore, telecom providers are bundling GPON-based FTTH services with smart home packages to capture new revenue streams. The trend toward digitally enhanced lifestyles is driving GPON deployment in residential broadband networks.

Trends in the GPON Technology Market

Migration toward Next-Generation PON Technologies

The GPON technology market is witnessing a significant shift toward next-generation PON solutions such as XGS-PON and NG-PON2. These technologies offer higher bandwidth capacities, enhanced security, and better energy efficiency compared to traditional GPON. With data traffic increasing exponentially due to 4K/8K video streaming, cloud computing, and enterprise-grade applications, service providers are upgrading to 10-Gigabit-capable platforms. This trend is accelerating the evolution of optical access networks, enabling telecom operators to future-proof their infrastructure. As a result, multi-gigabit connectivity is becoming a competitive differentiator in broadband services.

Increased Adoption of Virtualized and Software-Defined Networks

Telecom operators are increasingly adopting Software-Defined Networking (SDN) and Network Function Virtualization (NFV) in conjunction with GPON to improve network agility and scalability. Virtualized GPON architectures allow centralized management, dynamic bandwidth allocation, and rapid provisioning of services. This transition supports network slicing, essential for diverse service needs in 5G and IoT environments. The trend toward disaggregated and programmable access networks is fostering innovation in GPON deployments, reducing operational costs while enhancing flexibility. Vendors are launching cloud-native Optical Line Terminals (OLTs) and SDN-compatible GPON platforms to meet evolving market demands.

GPON Technology Market: Research Scope and Analysis

By Component Analysis

The Optical Line Terminal (OLT) segment is projected to dominate the global GPON technology market, accounting for 56.3% of the total revenue share in 2025. OLTs are critical for managing bandwidth distribution and downstream transmission in fiber-optic networks, enabling efficient signal conversion and distribution across multiple endpoints. Their growing deployment in fiber-to-the-home (FTTH) and fiber-to-the-premises (FTTP) infrastructures across urban and semi-urban regions is fueling their market dominance. The rise in gigabit broadband connections and demand for next-generation network infrastructure further accelerates adoption. The segment also benefits from increasing investments in telecom backhaul, network aggregation, and centralized traffic management solutions across developing and developed economies, supporting the broader growth of fiber broadband architecture.

The Optical Network Terminal (ONT) segment is predicted to grow at the highest CAGR in the global GPON technology market by the end of 2025. This surge is primarily driven by the increasing number of end-users adopting high-speed internet services for residential and enterprise applications. ONTs facilitate direct user access to fiber optics networks, supporting multiple services such as IPTV, VoIP, and gigabit broadband. As internet penetration deepens and remote working models expand, the need for efficient last-mile connectivity strengthens ONT demand. Additionally, advancements in smart home integration and cloud-based services are amplifying ONT deployment in homes and businesses, particularly across emerging markets undergoing digital transformation.

By Technology Analysis

2.5G PON segment is predicted to dominate the global GPON technology market, capturing 49.7% of the total market share in 2025. This dominance is largely attributed to its widespread deployment in legacy fiber-optic infrastructures and its cost-efficiency for broadband providers. 2.5G PON remains the preferred choice for telecom operators in residential fiber rollouts due to its adequate bandwidth for high-speed internet, voice, and video services. Its scalability and compatibility with existing passive optical networks also support rapid deployment without substantial infrastructure overhaul. The segment continues to serve as the backbone for affordable fiber-based broadband access, especially in developing regions undergoing initial stages of fiber-to-the-home (FTTH) deployment and digital connectivity expansion.

The XGS-PON segment is projected to register the highest CAGR in the global GPON technology market by the end of 2025. This growth is fueled by rising demand for symmetrical bandwidth to support enterprise-grade internet, cloud computing, and 4K/8K video streaming services. XGS-PON provides up to 10 Gbps downstream and upstream speeds, making it ideal for ultra-broadband applications in smart cities and industrial IoT deployments. Its ability to seamlessly coexist with legacy GPON systems ensures cost-effective upgrades for telecom operators. Moreover, the push for 5G backhaul solutions and growing consumer expectations for faster data services are driving the rapid adoption of next-generation symmetric passive optical networks.

By Application Analysis

The FTTH (Fiber to the Home) segment is expected to dominate the global GPON technology market, accounting for 61.2% of the total market share in 2025. This dominance is primarily driven by the surge in broadband subscriptions and the rising demand for high-speed internet access in residential sectors. FTTH deployments offer superior data rates, low latency, and enhanced user experiences for streaming, remote education, and smart home applications. Governments and telecom providers are increasingly investing in fiber infrastructure to bridge the digital divide, particularly in underserved regions. As a result, FTTH remains the leading application area, supported by rapid urbanization, digital transformation initiatives, and the continuous evolution of internet-connected lifestyles across global households.

The Mobile Backhaul segment is anticipated to witness the highest CAGR in the global GPON technology market by the end of 2025. This growth is fueled by increasing 5G rollout activities, which require high-capacity, low-latency transport solutions. GPON provides a cost-efficient way to backhaul mobile traffic from cell sites to the core network, ensuring robust performance for bandwidth-intensive mobile applications. As data consumption continues to surge through video, cloud gaming, and IoT connectivity, mobile operators are upgrading to fiber-based backhaul to ensure scalability and efficiency. Additionally, the rising density of small cells in urban areas further accelerates the need for resilient GPON-enabled mobile transport networks.

The GPON Technology Market Report is segmented on the basis of the following:

By Component

- Optical Line Terminal

- Optical Network Terminal

By Technology

- 2.5G PON

- XG-PON

- XGS-PON

- NG-PON2

By Application

- Mobile Backhaul

- FTTH

- Other FTTx

Regional Analysis

Region with the largest Share

Asia Pacific is projected to hold the largest share in the global GPON technology market with a revenue share of 38.3% in 2025, driven by extensive fiber-optic infrastructure development and strong government-backed digitalization initiatives. Countries like China, India, South Korea, and Japan are aggressively expanding fiber-to-the-home (FTTH) networks to cater to rapidly growing internet subscriber bases. Major telecom providers across the region are leveraging GPON to deliver high-speed broadband, IPTV, and VoIP services at scale. China, in particular, leads due to its ambitious urban connectivity programs and smart city deployments. The availability of low-cost equipment manufacturers and the rising demand for mobile backhaul in densely populated cities further contribute to Asia Pacific's leadership in the global GPON ecosystem.

Region with Highest CAGR

North America is expected to witness the highest CAGR in the global GPON technology market by 2025, fueled by increasing demand for ultra-fast broadband, cloud-based services, and 5G backhaul solutions. The region's strong focus on upgrading aging copper-based networks with next-generation fiber infrastructure is a key driver. U.S. federal initiatives to boost rural broadband access, combined with investments from major service providers, are accelerating GPON deployment. Additionally, the growth of telehealth, remote education, and smart home technologies is increasing the need for symmetrical high-speed internet, where XGS-PON and NG-PON2 are gaining momentum. The region's innovation-driven telecom landscape makes it a hotspot for rapid GPON technology adoption and scalability.

By Region

North America

Europe

- Germany

- The U.K.

- France

- Italy

- Russia

- Spain

- Benelux

- Nordic

- Rest of Europe

Asia-Pacific

- China

- Japan

- South Korea

- India

- ANZ

- ASEAN

- Rest of Asia-Pacific

Latin America

- Brazil

- Mexico

- Argentina

- Colombia

- Rest of Latin America

Middle East & Africa

- Saudi Arabia

- UAE

- South Africa

- Israel

- Egypt

- Rest of MEA

Impact of Artificial Intelligence in the GPON Technology Market

- Network Optimization and Traffic Management: AI enhances GPON (Gigabit Passive Optical Network) performance by analyzing network traffic in real time. Intelligent algorithms balance loads, predict congestion, and adjust bandwidth dynamically. This results in optimized data flow, reduced latency, and improved service quality across fiber-optic networks, especially in high-demand urban and enterprise environments.

- Predictive Maintenance and Fault Detection: AI-powered monitoring tools detect anomalies, equipment degradation, and potential faults in GPON infrastructure before they cause service interruptions. Predictive analytics schedules proactive maintenance, reducing downtime and repair costs. This boosts network reliability, improves customer satisfaction, and extends the operational life of critical network components.

- Customer Experience and Personalization: AI analyzes user behavior, consumption patterns, and service usage to personalize internet packages and offer dynamic bandwidth provisioning. This ensures seamless connectivity and a better user experience, especially in smart homes and offices. Telecom providers benefit from increased customer retention and reduced churn through data-driven service customization.

- Automated Network Management and Scalability: AI simplifies complex network management tasks by automating provisioning, configuration, and troubleshooting processes. This reduces the need for manual intervention, supports scalable deployments, and lowers operational costs. As demand for high-speed internet grows, AI helps GPON systems meet performance expectations with minimal human oversight.

Competitive Landscape

The competitive landscape of the global GPON technology market is marked by the presence of several key players driving innovation and expanding fiber-based broadband infrastructure across regions. Major companies such as Huawei Technologies, Nokia Corporation, ZTE Corporation, FiberHome, and Calix are focusing on strategic partnerships, new product development, and network modernization to strengthen their market positions. These vendors are investing in next-generation technologies like XGS-PON and NG-PON2 to support high-capacity, low-latency data transmission across residential, commercial, and industrial sectors.

The market is also witnessing increased collaboration between telecom service providers and equipment manufacturers to accelerate fiber-to-the-home (FTTH) deployments and enhance last-mile connectivity. Competitive pricing, enhanced optical network units (ONUs), and software-defined networking integration are among the key focus areas to gain a competitive edge. Companies are actively addressing the rising demand for mobile backhaul, smart city infrastructure, and ultra-broadband services with scalable gigabit passive optical network (GPON) solutions.

In addition, players are expanding their geographic reach through mergers and acquisitions, especially in emerging markets with high digital adoption rates. As demand for reliable fiber-optic access networks grows, the GPON technology ecosystem is expected to become more dynamic, offering robust, energy-efficient, and high-performance solutions across diverse verticals.

Some of the prominent players in the Global GPON Technology Market are:

- Huawei Technologies Co., Ltd.

- ZTE Corporation

- Nokia Corporation

- FiberHome Telecommunication Technologies Co., Ltd.

- Calix, Inc.

- ADTRAN, Inc.

- DASAN Zhone Solutions, Inc.

- Cisco Systems, Inc.

- Ericsson

- NEC Corporation

- Alphion Corporation

- Allied Telesis Holdings K.K.

- Motorola Solutions, Inc.

- Sumitomo Electric Industries, Ltd.

- CommScope Holding Company, Inc.

- Edgecore Networks Corporation

- Tejas Networks

- Genexis

- Ubiquoss Inc.

- Other Key Players

Recent Developments

- In May 2025, the Broadband Forum organized a major interoperability Plugfest focused on 50G-PON and 25GS-PON technologies. The event brought together key players like Nokia, Adtran, Calix, ZTE, and Broadcom, who tested their solutions in a multi-vendor environment, reinforcing industry readiness for mass deployment of next-gen PON networks.

- In March 2024, Nokia introduced a new symmetrical 25G PON fiber modem designed to offer speeds up to 20 times faster than current gigabit broadband. The modem is compatible with existing GPON and 10G PON networks, supporting seamless upgrades. Nokia has already delivered over one million 25G PON-ready ports worldwide.

- In April 2024, In partnership with NBN Co in Australia, Nokia conducted the world’s first live trial that successfully demonstrated 10G, 25G, 50G, and 100G broadband speeds simultaneously over a single fiber. The trial utilized Nokia’s Lightspan MF platform, proving the coexistence of multiple PON technologies on one infrastructure.

Report Details

| Report Characteristics |

| Market Size (2025) |

USD 10.1 Bn |

| Forecast Value (2034) |

USD 17.6 Bn |

| CAGR (2025–2034) |

6.3% |

| Historical Data |

2019 – 2024 |

| The US Market Size (2025) |

USD 2.2 Bn |

| Forecast Data |

2025 – 2033 |

| Base Year |

2024 |

| Estimate Year |

2025 |

| Report Coverage |

Market Revenue Estimation, Market Dynamics, Competitive Landscape, Growth Factors, etc. |

| Segments Covered |

By Component (Optical Network Terminal and Optical Line Terminal), By Technology (2.5G PON, XG- PON, XGS-PON, and NG-PON2), By Application (Mobile Backhaul, FTTH, and Other FTTx) |

| Regional Coverage |

North America – US, Canada; Europe – Germany, UK, France, Russia, Spain, Italy, Benelux, Nordic, Rest of Europe; Asia-Pacific – China, Japan, South Korea, India, ANZ, ASEAN, Rest of APAC; Latin America – Brazil, Mexico, Argentina, Colombia, Rest of Latin America; Middle East & Africa – Saudi Arabia, UAE, South Africa, Turkey, Egypt, Israel, Rest of MEA |

| Prominent Players |

Huawei Technologies Co. Ltd., ZTE Corporation, Nokia Corporation, FiberHome Telecommunication Technologies Co. Ltd., Calix Inc., ADTRAN Inc., DASAN Zhone Solutions Inc., Cisco Systems Inc., Ericsson, NEC Corporation, Alphion Corporation, Iskratel, Allied Telesis Holdings K.K., Motorola Solutions Inc., Sumitomo Electric Industries Ltd., CommScope Holding Company Inc., Edgecore Networks Corporation, Tejas Networks, Genexis, Ubiquoss Inc., and Other Key Players |

| Purchase Options |

We have three licenses to opt for: Single User License (Limited to 1 user), Multi-User License (Up to 5 Users), and Corporate Use License (Unlimited User) along with free report customization equivalent to 0 analyst working days, 3 analysts working days, and 5 analysts working days respectively. |

Frequently Asked Questions

The Global GPON Technology Market size is estimated to have a value of USD 10.1 billion in 2025 and is expected to reach USD 17.6 billion by the end of 2034.

Asia Pacific is expected to be the largest market share for the Global GPON Technology Market with a share of about 38.3% in 2025.

Some of the major key players in the Global GPON Technology Market are Huawei Technologies Co., Ltd., ZTE Corporation, Nokia Corporation and many others.

The market is growing at a CAGR of 6.3% over the forecasted period.

The US GPON Technology Market size is estimated to have a value of USD 2.2 billion in 2025 and is expected to reach USD 3.7 billion by the end of 2034.