Healthcare Business Intelligence (BI) market is expanding quickly as healthcare providers rely more and more on data-driven insights for making decisions and optimizing operations, all to improve patient care and increase overall efficiency. Digital solutions such as Electronic Health Records (EHR) have played a critical role in driving this market's expansion.

Artificial Intelligence and Machine Learning technologies have revolutionized healthcare data analysis. Their implementation allows real-time processing, predictive analysis, personalized care delivery, cost containment measures and personalized care options - essential elements as healthcare systems look to manage costs while improving patient outcomes and provide operational excellence and improved decision-making processes. BI solutions become essential tools in driving operational excellence and improved decision-making practices within healthcare systems.

Innovation opportunities exist within healthcare market, particularly data visualization, cloud platforms and predictive analytics tools. There has been an upsurge of demand for customizable BI solutions tailored specifically for individual healthcare settings; with increased emphasis on value-based care models BI is playing an increasingly pivotal role in managing chronic conditions, improving patient outcomes and expanding resource utilization within this sector.

Cloud-based business intelligence platforms have seen exponential growth within healthcare organizations since 2023; 35% are projected to make the switch by then. 60% of software investments focus on data visualization and reporting tools while predictive analytics adoption increased 25% year over year during this time. This trend shows the growing need for real-time, actionable insights for healthcare management.

Key Takeaways

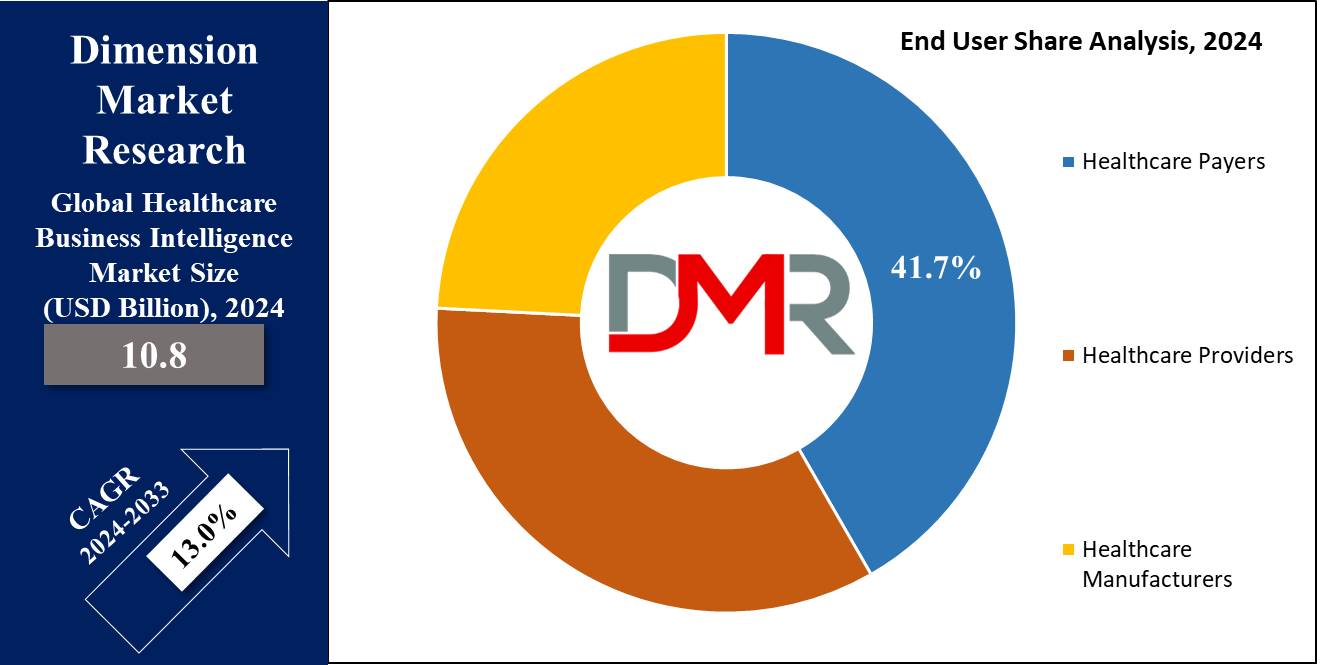

- The Global Healthcare Business Intelligence Market is expected to grow by 21.5 billion, at a CAGR of 13.0% during the forecasted period.

- By Offering, software segment is expected to lead in 2024 & is anticipated to dominate throughout the forecasted period.

- By Mode of delivery, cloud-based segment is expected to have a lead throughout the forecasted period.

- By End User, Healthcare payers are expected to be the dominant driver of the growth of the market in forecasted years.

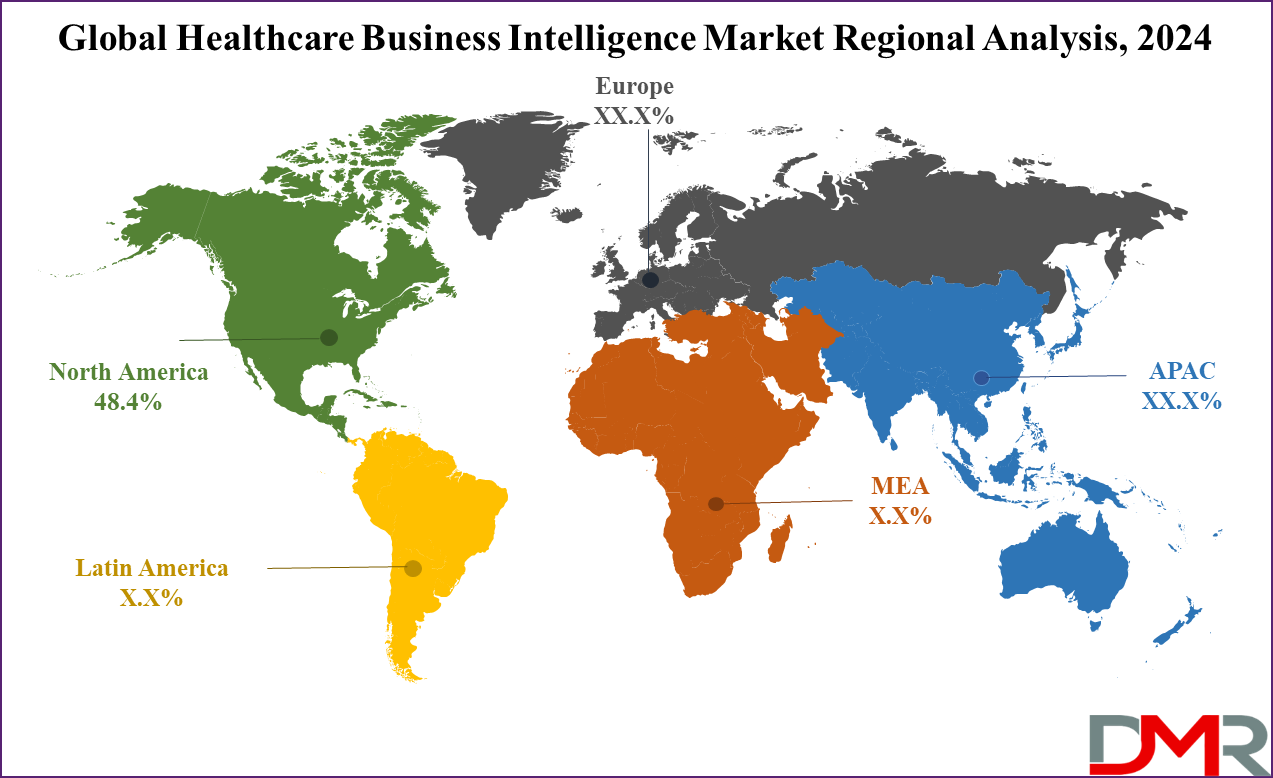

- North America is expected to hold a 48.4% share of revenue in the Global Healthcare Business Intelligence in 2024.

- Some of the use cases of Healthcare Business Intelligence include financial management, operational efficiency, and more.

Use Cases

- Clinical Decision Support: Business intelligence helps clinicians by providing live insights into patient data, treatment effectiveness, and best practices, providing informed clinical decisions and customized care delivery.

- Operational Efficiency: Healthcare BI optimizes resource allocation, improves staff productivity, and streamlines workflows by analyzing operational data, leading to low cost & improved patient satisfaction.

- Financial Management: BI tools monitor financial performance, inspect billing inaccuracies, and forecast revenue streams, allowing healthcare organizations to increase revenue, reduce expenses, and secure regulatory compliance.

- Population Health Management: Business intelligence assists better population health management by analyzing patient demographics, health trends, and risk factors, enabling healthcare providers to implement targeted interventions, enhance outcomes, and lower healthcare costs.

Market Dynamic

The healthcare industry is experiencing a major boost from the integration of advanced technologies like AI and machine learning, which has highly enhanced the efficiency and effectiveness of healthcare operations, leading to major improvements. Both developed & developing economies are investing heavily in R&D, creating major growth opportunities for the healthcare business intelligence market. Integration of IT with healthcare services is expanding the market's scope, driven by growth in funding from government sources & expansion initiatives by public & private players, mainly in developing countries.

However, challenges like the high costs associated with R&D, limited awareness in underdeveloped regions, & issues with data accuracy and management. In addition, there's a shortage of skilled medical professionals & researchers, along with barriers like unfavorable payment scenarios & limited technology availability in developing nations.

Research Scope and Analysis

By Offering

The software segment is expected to have a significant portion of the revenue share in 2024. Healthcare business intelligence software plays an important role across many operations within the healthcare sector, like clinical, financial, and operational analyses. Using data analytics, these software solutions allow accurate results and improve decision-making processes.

Further, the services segment emerges as the fastest-growing sector in the healthcare business intelligence market, which is driven by the increase in demand for services in the healthcare industry & ongoing advancements in BI software. Also, information technology firms are largely providing services customized to healthcare BI solutions, further contributing to the segment's expansion.

By Mode of Delivery

The cloud-based delivery mode segment is expected to dominate the market share in 2024. Cloud computing supports

large data operations by providing large storage & processing capabilities, as the growing adoption of cloud-based BI tools, like Customer Relationship Management (CRM) applications & analytics platforms, is driven by their agility, accessibility, and low cost. Healthcare providers are using cloud computing to manage revenue cycles effectively and improve patient care, driving market growth alongside rising telehealth awareness & adoption.

Further, on-premises deployment is expected to see steady growth. While offering customization options, challenges like implementation issues, staff training, & high upfront costs hinder its adoption. Security risks and network interruptions further encourage healthcare organizations to shift towards cloud-based solutions.

By Application

The financial analysis segment is expected to lead the market with a significant revenue share in 2024. Healthcare business intelligence in financial analysis helps in managing cash flow within the healthcare sector & assesses risks associated with the revenue cycle, while also analyzing profit and loss for hospitals.

Further, the patient care segment is anticipated to be the fastest-growing sector in the healthcare business intelligence market, as it stands as a major application for healthcare BI, aligning with the core goal of hospitals & healthcare centers to deliver effective care. In addition, healthcare BI assists doctors in providing accurate treatment by analyzing patient conditions.

By End User

Healthcare payers are expected to lead in revenue share in 2024, as the growing demand to improve provider networks & adopt different BI tools to simplify operations and reduce costs due to the growing competition is driving market growth. In addition, the growing healthcare expenses & the need to expand memberships while controlling fraudulent claims are driving payers to adopt BI solutions. Moreover, the healthcare manufacturing sector is anticipated to witness substantial growth, as the presence of many

pharmaceutical &

medical device manufacturers, majorly in developed and emerging economies, drive revenue growth.

Further, the adoption of Software as a Service (SaaS) software assists cut maintenance & development costs for manufacturers. Also, customer analytics tools like direct marketing & Customer Relationship Management (CRM) dashboards help hospitals, government agencies, employers, and private exchangers improve efficiency, improve revenue, and trim costs, thus supporting BI tool adoption among providers.

The Healthcare Business Intelligence Market Report is segmented on the basis of the following

By Offering

By Mode of Delivery

- Cloud-based

- On-Premise

- Hybrid

By Application

- Financial Analysis

- Claims Processing

- Revenue Cycle Management

- Payment Integrity and Fraud, Waste, & Abuse (FWA)

- Risk Adjustment and Risk Assessment

- Clinical Analysis

- Quality Improvement and Clinical Benchmarking

- Clinical Decision Support

- Regulatory Reporting and Compliance

- Comparative Analytics/Effectiveness

- Precision Health

- Operational Analysis

- Supply Chain Analysis

- Workforce Analysis

- Strategic Analysis

- Patient Care

By End User

- Healthcare Payers

- Healthcare Providers

- Healthcare Manufacturers

Regional Analysis

North America is expected to lead with

48.4% of the revenue share in 2024 in healthcare BI, driven by the broad adoption of BI solutions for better patient care. Factors like lower expenses & advanced manufacturing centers further support regional growth. The constant upgrade of healthcare & IT infrastructure, alongside the growth in cloud computing adoption, contributes to this growth.

In addition, Asia Pacific is also anticipated to have a promising market due to growing awareness of BI tools among healthcare providers, assisted by government initiatives. Also, the region experiences an expansion in mobile-based solutions & the adoption of technologically advanced BI systems in countries like India, China, and Japan, driving market growth.

By Region

North America

Europe

- Germany

- The U.K.

- France

- Italy

- Russia

- Spain

- Benelux

- Nordic

- Rest of Europe

Asia-Pacific

- China

- Japan

- South Korea

- India

- ANZ

- ASEAN

- Rest of Asia-Pacific

Latin America

- Brazil

- Mexico

- Argentina

- Colombia

- Rest of Latin America

Middle East & Africa

- Saudi Arabia

- UAE

- South Africa

- Israel

- Egypt

- Rest of MEA

Competitive Landscape

Healthcare Business Intelligence (BI) market faces moderate competition, with both established players and emerging startups driving innovation in this space. Established companies continue to refine their offering with advanced analytics, AI and machine learning techniques; smaller players introduce niche solutions tailored specifically for healthcare needs; product innovation such as cloud platforms or data visualization tools is one key driver of market expansion.

Research efforts devoted to developing cutting-edge technologies like predictive analytics and real-time data processing further advance market expansion. Such innovation provides newcomers with ample opportunity to break into existing markets while established players maintain competitive advantages through ongoing improvement initiatives.

As healthcare systems increasingly depend on data-driven solutions to optimize patient care, reduce costs and enhance operational efficiencies, the demand for advanced business intelligence tools will only continue to increase, creating an opportune climate in which both current and emerging market participants can flourish.

Some of the prominent players in the global Healthcare Business Intelligence Market are:

- Oracle

- Microsoft

- SAP SE

- SAS Institute

- Sisense Inc

- Tableau Software

- Panorama Software

- Salesforce

- Epic Systems

- MicroStrategy Inc.

- Other Key Players

Recent Developments

- In December 2023, Google launched MedLM, a suite of foundation models developed to assist healthcare organizations meet their needs through generative AI that builds on company work it has done in the health AI space.

- In November 2023, Genzeon, announced the launch of HIP One, a secure intelligence platform developed particularly for healthcare. Through HIP One, health plans, providers, & other healthcare organizations can transform their clinical & business operations within a single platform, minimizing the burdens of cost & overwhelming management.

- In October 2023, Hoth Therapeutics, Inc. unveiled its initiative to use AI to both screen its current pipeline along with using AI for licensing opportunities in acquiring or partnering with new therapeutics for rare diseases. Further, the company will form and operate a new wholly-owned subsidiary named Merveille.ai, which will aim to screen for collaborative opportunities using AI in the field of drug discovery.

- In September 2023, SAS introduced an advanced healthcare platform that simplifies data management, enhances governance, and hastens patient insights, as it offers an end-to-end solution for analytics and data automation, empowering providers, insurers, and public health agencies to drive innovation. It uses a common health data model & delivers actionable insights for improving patient care and outcomes.

- In July 2023, Amazon Web Services, Inc introduced AWS HealthScribe, a new HIPAA-eligible service that allows healthcare software providers to create clinical applications that use speech recognition & generative AI to save clinicians time by generating clinical documentation. Further, it can use a single API to automatically develop strong transcripts, extract key details, and create summaries from doctor-patient discussions that can then be entered into an EHR system.

Report Details

| Report Characteristics |

| Market Size (2024) |

USD 10.8 Bn |

| Forecast Value (2033) |

USD 32.3 Bn |

| CAGR (2024-2033) |

13.0% |

| Historical Data |

2018 – 2023 |

| Forecast Data |

2024 – 2033 |

| Base Year |

2023 |

| Estimate Year |

2024 |

| Report Coverage |

Market Revenue Estimation, Market Dynamics, Competitive Landscape, Growth Factors and etc. |

| Segments Covered |

By Offering (Software and Service), By Mode of

Delivery (Cloud-based, On-Premise, and Hybrid), By

Application (Financial Analysis, Clinical Analysis,

Operational Analysis, and Patient Care), By End User

(Healthcare Payers, Healthcare Providers, and

Healthcare Manufacturers) |

| Regional Coverage |

North America – The US and Canada; Europe – Germany, The UK, France, Russia, Spain, Italy, Benelux, Nordic, & Rest of Europe; Asia- Pacific– China, Japan, South Korea, India, ANZ, ASEAN, Rest of APAC; Latin America – Brazil, Mexico, Argentina, Colombia, Rest of Latin America; Middle East & Africa – Saudi Arabia, UAE, South Africa, Turkey, Egypt, Israel, & Rest of MEA

|

| Prominent Players |

Oracle, Microsoft, SAP SE, SAS Institute, Sisense Inc,

Tableau Software, Panorama Software, Salesforce,

Epic Systems, MicroStrategy Inc, and Other Key

Players |

| Purchase Options |

We have three licenses to opt for: Single User License (Limited to 1 user), Multi-User License (Up to 5 Users), and Corporate Use License (Unlimited User) along with free report customization equivalent to 0 analyst working days, 3 analysts working days and 5 analysts working days respectively. |