Market Overview

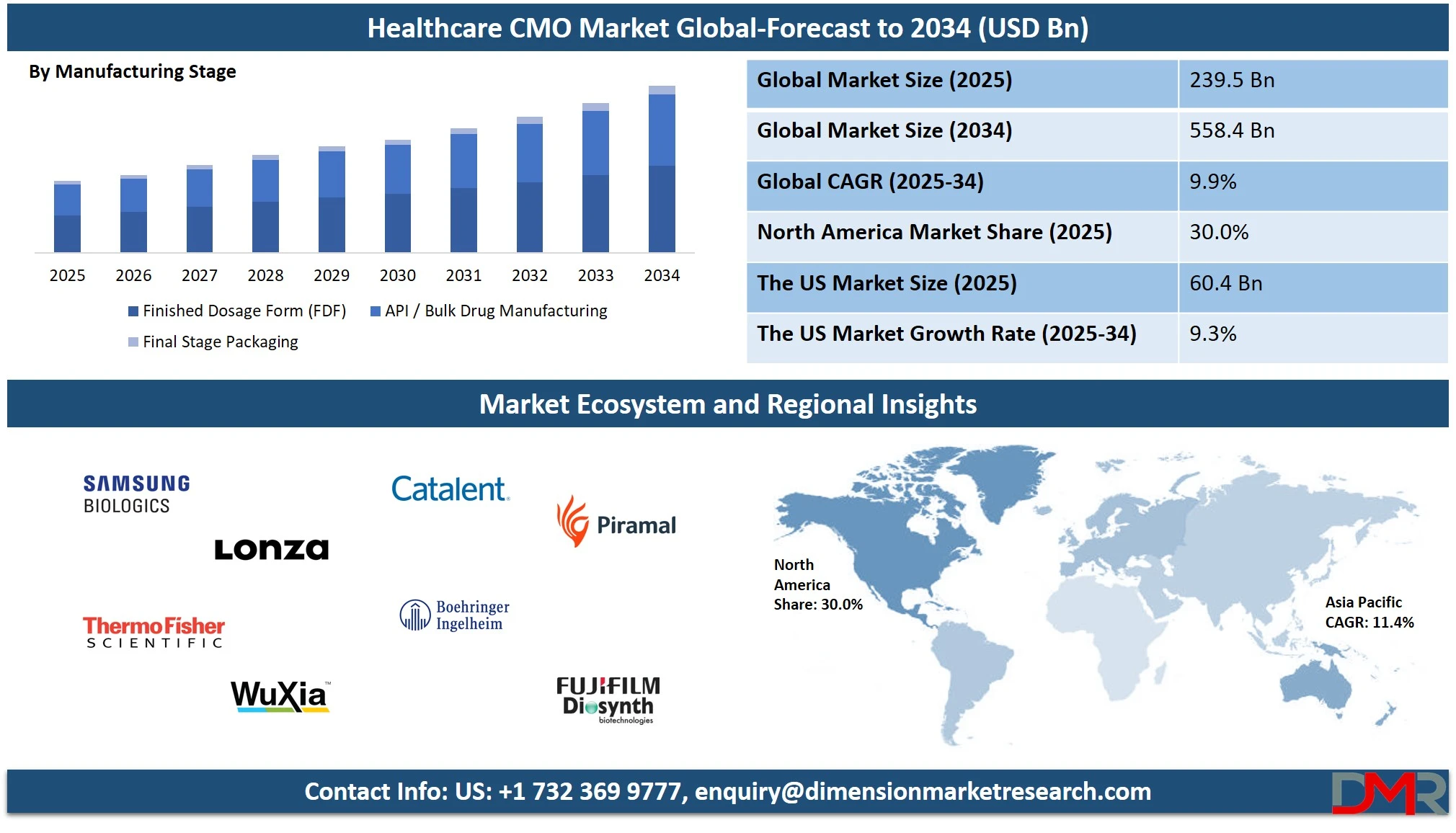

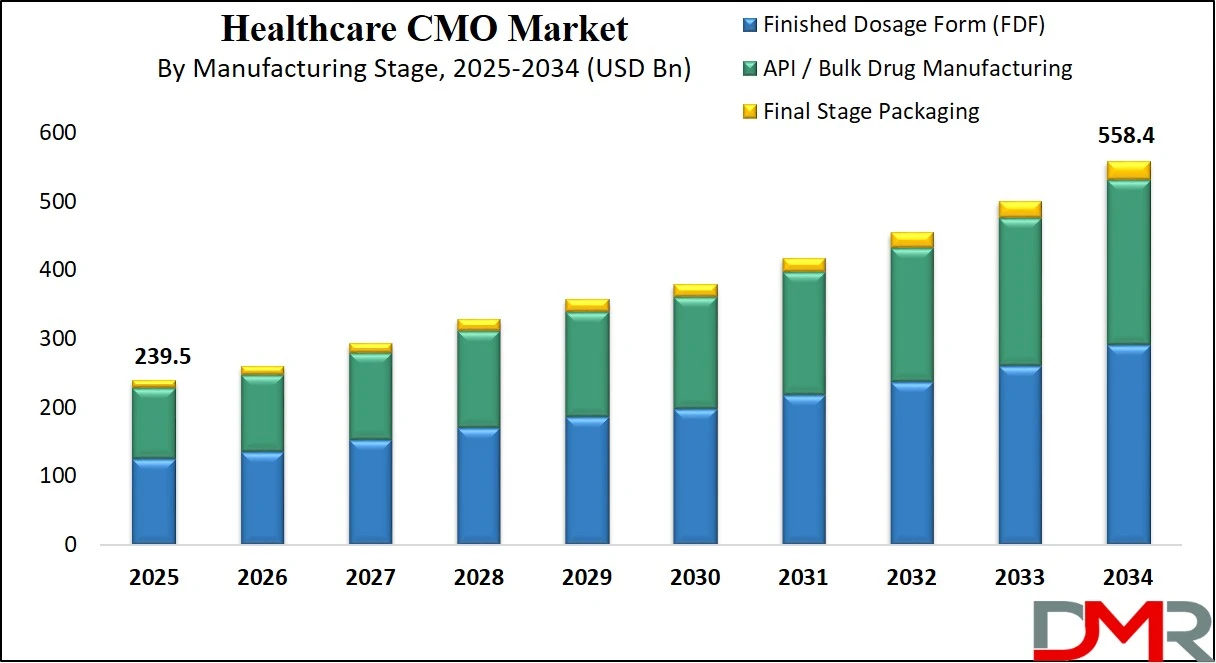

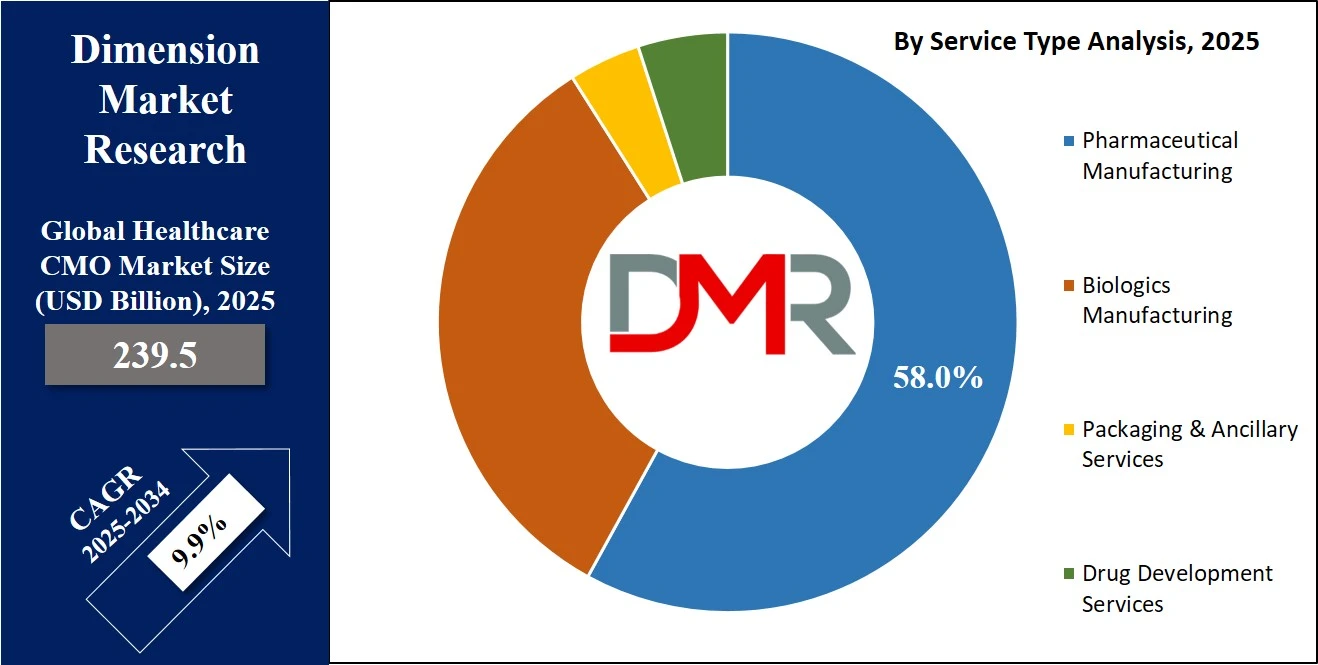

The Global Healthcare Contract Manufacturing Organization (CMO) Market is projected to reach USD 239.5 billion by 2025, and is expected to grow at a CAGR of 9.9%, hitting USD 558.4 billion by 2034. This growth is driven by rising pharmaceutical outsourcing, demand for biologics manufacturing, and cost-efficient drug production solutions across the healthcare industry.

A Healthcare Contract Manufacturing Organization (CMO) is a third-party company that provides comprehensive services to pharmaceutical and biotechnology firms, ranging from drug development to manufacturing and packaging. These organizations allow healthcare product developers to outsource non-core activities such as formulation development, Active Pharmaceutical Ingredient (API) production, and finished dosage manufacturing, ensuring cost efficiency, faster time-to-market, and regulatory compliance. CMOs serve as strategic partners by offering scalable infrastructure, deep industry expertise, and a global supply chain network, enabling their clients to focus on research, innovation, and commercialization without investing heavily in manufacturing capabilities.

The global Healthcare CMO market represents a vital segment within the pharmaceutical and life sciences industry, characterized by a growing trend toward outsourcing drug manufacturing due to rising R&D costs, patent expirations, and growing demand for generic and biologic medications. With evolving pharmaceutical pipelines and the need for specialized manufacturing facilities for biologics, the market is witnessing strong growth across regions, especially in North America, Europe, and Asia-Pacific. Stringent regulatory standards, integrated with the pressure to reduce operational costs and improve production efficiencies, are encouraging both small-scale biotech startups and large pharmaceutical companies to partner with contract manufacturers.

This market also benefits from technological advancements in bioprocessing, serialization, and process optimization that allow CMOs to offer tailored and value-added services such as fill-finish operations, lyophilization, and high-potency drug production. The growing prevalence of chronic diseases, rising healthcare expenditures, and demand for personalized medicine have further expanded the scope of contract manufacturing across therapeutic areas like oncology, cardiology, and immunology. As healthcare companies continue to optimize their product lifecycles and expand into emerging markets, the Healthcare CMO landscape is expected to play a pivotal role in shaping global drug supply chains and accelerating time-to-market for critical treatments.

The US Healthcare CMO Market

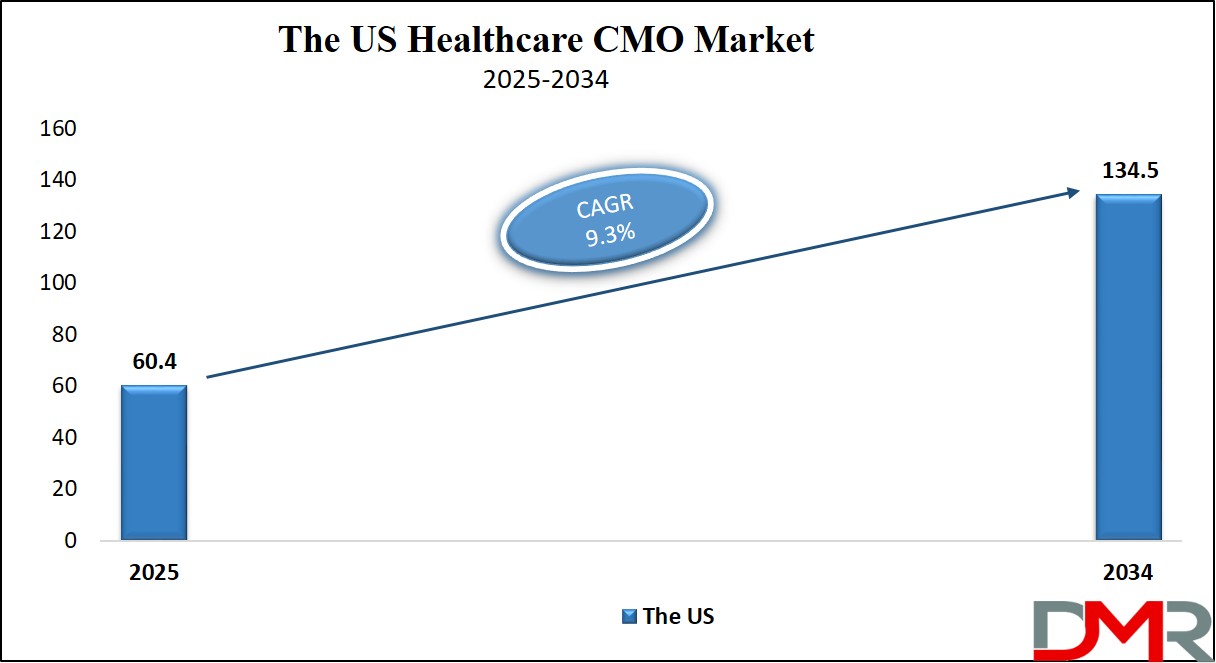

The U.S. Healthcare CMO Market size is projected to be valued at USD 60.4 billion in 2025. It is further expected to witness subsequent growth in the upcoming period, holding USD 134.5 billion in 2034 at a CAGR of 9.3%.

The United States healthcare contract manufacturing organization (CMO) market holds a dominant position globally, driven by the country's advanced pharmaceutical ecosystem, strong regulatory framework, and high demand for outsourced drug development services. With a large number of branded and generic pharmaceutical companies operating in the region, CMOs in the U.S. cater to both small-molecule and biologics manufacturing needs across clinical and commercial scales. The presence of FDA-compliant manufacturing infrastructure, integrated with stringent quality standards and growing biologic pipelines, positions the U.S. as a preferred outsourcing hub for drug formulation, API production, and sterile injectables. Furthermore, rising demand for contract-based fill-finish services, high-potency active pharmaceutical ingredients (HPAPIs), and injectable therapies is expanding the scope of contract manufacturing operations in the country.

The market is also benefiting from increased investment in personalized medicine, gene therapies, and mRNA platforms, which require highly specialized manufacturing capabilities not always feasible in-house for smaller biopharma firms. Strategic partnerships between pharmaceutical companies and U.S.-based CDMOs are accelerating drug commercialization timelines and enabling faster entry into competitive therapeutic areas such as oncology, immunology, and rare diseases. In addition, the trend toward virtual pharmaceutical companies and the growth of orphan drug development are further fueling demand for flexible, end-to-end outsourcing models. As the U.S. continues to experience innovation in drug delivery systems, regulatory modernization, and supply chain localization, the healthcare CMO sector is poised for sustained expansion supported by technological integration and capacity enhancement across major contract manufacturing facilities.

Europe Healthcare CMO Market

Europe is poised to hold a substantial position in the global healthcare CMO market, with its market value expected to reach USD 62.2 billion in 2025. This strong performance reflects the region’s well-established pharmaceutical industry, advanced manufacturing infrastructure, and high regulatory compliance standards. Countries such as Germany, Switzerland, Ireland, and the United Kingdom serve as key hubs for contract manufacturing, offering a mature ecosystem for both small-molecule and biologics production. European CMOs are known for their focus on quality, innovation, and adherence to EMA and global GMP standards, making them reliable partners for pharmaceutical and biotechnology companies globally. The presence of numerous multinational pharma headquarters in Europe further enhances demand for local outsourcing, particularly in the areas of sterile injectables, high-potency APIs, and complex drug formulations.

The region is also expected to grow at a CAGR of 8.2% between 2025 and 2034, driven by the growing shift toward specialty and biologic drugs, as well as the rising need for flexible, cost-effective manufacturing models. European contract manufacturers are investing heavily in expanding biologics capabilities, including cell and gene therapy manufacturing, aseptic fill-finish, and personalized medicine support. The trend toward outsourcing R&D-intensive therapies, combined with strong public and private investments in pharmaceutical innovation, is accelerating growth across both Western and Eastern Europe. Moreover, the region’s strategic location, robust supply chain networks, and skilled scientific workforce position it well to capture growing global demand for high-quality pharmaceutical contract services over the next decade.

Japan Healthcare CMO Market

Japan’s healthcare CMO market is projected to reach a valuation of USD 16.7 billion in 2025, highlighting its steady yet significant role within the global contract manufacturing landscape. The country's strong domestic pharmaceutical industry, high regulatory standards set by the Pharmaceuticals and Medical Devices Agency (PMDA), and aging population have contributed to sustained demand for outsourced manufacturing services. Japanese pharmaceutical companies, traditionally inclined toward in-house production, are shifting toward CMO partnerships to streamline operations, lower manufacturing costs, and focus resources on drug discovery and innovation. Key therapeutic areas such as oncology, metabolic disorders, and rare diseases are driving this demand, especially for sterile injectable drugs and complex formulations where specialized CMO support is essential.

Growing at a projected CAGR of 7.1% from 2025 to 2034, Japan's CMO market is being shaped by a gradual but notable transition toward biologics and advanced therapy medicinal products (ATMPs). This shift has created new opportunities for contract manufacturers that offer high-containment capabilities, biologics processing, and clinical-scale manufacturing. Additionally, Japan’s government initiatives to accelerate drug development timelines and encourage innovation through regulatory harmonization are fostering a more CMO-friendly environment. The rising prevalence of chronic diseases and growing need for personalized medicine are expected to further boost outsourcing in the country, making Japan a strategic player in the broader Asia-Pacific CMO ecosystem.

Global Healthcare CMO Market: Key Takeaways

- Market Value: The global healthcare CMO market size is expected to reach a value of USD 558.4 billion by 2034 from a base value of USD 239.5 billion in 2025 at a CAGR of 9.9%.

- By Service Type Segment Analysis: Pharmaceutical Manufacturing services are anticipated to dominate the service type segment, capturing 58.0% of the total market share in 2025.

- By Manufacturing Stage Segment Analysis: Finished Dosage Form (FDF) is poised to consolidate its dominance in the manufacturing stage, capturing 52.0% of the total market share in 2025.

- By Type of Drug Segment Analysis: Small Molecule Drugs are expected to maintain their dominance in the type of drug segment, capturing 63.0% of the total market share in 2025.

- By End-User Segment Analysis: Pharmaceutical Companies will lead in the end-user segment, capturing 67.0% of the market share in 2025.

- Regional Analysis: Asia Pacific is anticipated to lead the global healthcare CMO market landscape with 47.4% of total global market revenue in 2025.

- Key Players: Some key players in the global healthcare CMO market are Samsung Biologics, Lonza Group, Thermo Fisher Scientific, WuXi Biologics, Catalent Inc., Boehringer Ingelheim (BioXcellence), FUJIFILM Diosynth Biotechnologies, Piramal Pharma Solutions, Akums Drugs & Pharmaceuticals, Syngene, Recipharm, Hovione, Siegfried Holding, Aurobindo Pharma, and Other Key Players.

Global Healthcare CMO Market: Use Cases

- Biologics Manufacturing for Monoclonal Antibody Therapies: With the rising prevalence of cancer and autoimmune diseases, biopharmaceutical companies are outsourcing the manufacturing of monoclonal antibody (mAb) therapies to CMOs with specialized biologics capabilities. These therapies require high-tech bioprocessing facilities and regulatory compliance, often unavailable in-house for emerging biotech firms. Healthcare CMOs like Samsung Biologics and Lonza Group offer large-scale upstream and downstream processing, cell line development, and cGMP manufacturing that accelerate the launch of mAb-based treatments. This outsourcing model ensures quality assurance, scalability, and compliance with global regulatory bodies like the FDA and EMA.

- High-Potency API (HPAPI) Production for Oncology Drugs: Oncology drugs often involve the use of high-potency active pharmaceutical ingredients (HPAPIs), which require highly contained environments and sophisticated handling. Contract manufacturing organizations provide advanced containment technologies, such as isolators and glove boxes, ensuring safety and process integrity. Companies like Evonik Industries and Cambrex specialize in HPAPI synthesis, allowing pharmaceutical firms to bring oncology products to market without investing in complex infrastructure. This use case highlights the role of CMOs in enabling cost-effective manufacturing of cytotoxic compounds while maintaining rigorous occupational and environmental safety standards.

- End-to-End Support for Clinical Trial Material Supply: During the clinical development phase, pharmaceutical sponsors rely heavily on CMOs for the manufacturing, packaging, and distribution of clinical trial materials. This includes small-batch production, placebo matching, labeling, and cold-chain logistics across multiple global sites. Healthcare CMOs streamline the clinical supply chain by offering integrated services that ensure the timely and compliant delivery of investigational medicinal products (IMPs) for Phase I–III trials. Recipharm and Syngene, for example, provide formulation development and clinical packaging tailored for early-stage pharmaceutical R&D, reducing trial delays and regulatory risks.

- Sterile Fill-Finish Services for Injectable Drugs and Vaccines: One of the most critical use cases in the global healthcare CMO market is sterile injectables manufacturing, particularly for biologics, vaccines, and mRNA-based therapies. Fill-finish services involve aseptic filling of vials, syringes, and cartridges under highly controlled conditions. Companies like Catalent and FUJIFILM Diosynth Biotechnologies support large pharmaceutical firms in commercializing injectable therapeutics with high sterility assurance levels. This is especially vital during pandemic preparedness and seasonal vaccine campaigns, where rapid and scalable sterile processing is essential. Outsourcing this phase helps clients meet surge capacity demands while ensuring product safety and integrity.

Impact of Artificial Intelligence on Healthcare CMO Market

-

Enhanced Quality Control and Compliance

- AI-powered vision systems and sensors improve inspection accuracy of medical devices and pharmaceuticals.

- Real-time defect detection minimizes recalls and improves batch consistency.

- AI ensures compliance with stringent regulatory standards such as FDA’s cGMP (Current Good Manufacturing Practices).

- Predictive analytics help identify anomalies and prevent deviations before they occur.

-

Predictive Maintenance and Operational Uptime

- AI monitors equipment health continuously and predicts failures before breakdowns occur.

- Reduces unplanned downtime and extends the life cycle of critical manufacturing assets.

- Enables better scheduling of maintenance, improving overall plant efficiency.

-

Optimized Production and Workflow Automation

- AI algorithms optimize batch scheduling, resource allocation, and production flow.

- Improves agility in meeting variable client demands, especially in small-batch and personalized medicine manufacturing.

- Automation of repetitive tasks leads to lower labor costs and higher operational throughput.

-

Supply Chain and Inventory Intelligence

- AI-driven demand forecasting reduces overproduction and inventory waste.

- Smart inventory systems track raw material usage and reorder automatically based on predictive needs.

- Enhances traceability and accountability throughout the pharmaceutical and medical device supply chains.

- Accelerated Innovation and Product Customization

- AI supports rapid prototyping and simulation in medical device development.

- Enables real-time data integration between R&D and manufacturing teams.

- Facilitates faster adaptation to niche or custom healthcare product requirements.

Global Healthcare CMO Market: Stats & Facts

-

FDA / U.S. Government Accountability Office (GAO)

- Advanced manufacturing technologies, including 3D printing and continuous manufacturing, are seen as critical to improving pharmaceutical supply chain resilience.

- The FDA’s Emerging Technology Program actively supports the adoption of advanced manufacturing practices across drug production facilities.

- The U.S. had 295 active drug shortages at the end of 2022, with sterile injectables being more than twice as likely to face shortages compared to oral tablets.

- Nearly 80% of U.S. API (active pharmaceutical ingredient) production facilities are located outside the United States, primarily in India and China.

-

National Institutes of Health (NIH) / U.S. Department of Health

- Biologics development differs significantly from small molecules due to process dependency, requiring stricter oversight by both the CDER and CBER branches of the FDA.

- Biologics manufacturing processes are highly sensitive, with quality dependent on the exact environment, inputs, and process parameters used.

-

Brazil Ministry of Health

- Brazil’s public healthcare system spent approximately USD 22 billion on pharmaceuticals and USD 2.4 billion on biologic therapies.

- Fourteen biologic drugs, including seven monoclonal antibodies, have been locally developed under Brazil’s Productive Development Partnerships (PDP) to reduce reliance on imports.

-

Washington State Department of Commerce (.gov)

- There are more than 1,500 CMOs globally, with over 1,000 located in the United States.

- Civica Rx, a public-private initiative, has entered long-term agreements with over 800 hospitals to stabilize generic drug supply chains.

- The U.S. has seen growing investment in domestic pharmaceutical infrastructure to reduce supply chain dependency on foreign CMOs.

- U.S. Senate Homeland Security & Governmental Affairs Committee (HSGAC)

- The majority of sterile injectable drugs in shortage in the U.S. are manufactured overseas or rely on imported raw materials.

- Domestic production of essential medicines is being prioritized through federal policy and funding to reduce future risks of drug shortages.

-

FDA Quality Management Reports

- Over 200 pharmaceutical sites globally have reported adherence to the FDA’s Quality Management Maturity (QMM) standards, showing improvements in delivery and compliance performance.

- Facilities with strong quality metrics show a 20–30% higher success rate in maintaining continuous drug supply during peak demand.

Global Healthcare CMO Market: Market Dynamics

Global Healthcare CMO Market: Driving Factors

Surge in Biologics and Biosimilar Demand

The rapid expansion of biologics and biosimilars is significantly driving growth in the healthcare contract manufacturing market. Biopharmaceutical companies outsource biologics manufacturing to CMOs due to the complexity, high cost, and regulatory sensitivity of in-house production. The rising global demand for monoclonal antibodies, recombinant proteins, and cell-based therapies necessitates access to GMP-certified, scalable manufacturing infrastructure, which CMOs like WuXi Biologics and AGC Biologics are well-equipped to provide. This trend also stems from the growing need to support cold-chain logistics and specialized fill-finish services for injectable biologics.

Increasing Drug Development Costs and Time-to-Market Pressure

Pharmaceutical companies face intense pressure to reduce costs and accelerate drug launches due to high R&D expenses and patent expirations. By outsourcing formulation development, clinical-scale manufacturing, and commercial production to CMOs, these companies can focus on core competencies like research and marketing. This enables leaner operations while meeting global regulatory compliance standards, especially in complex dosage forms and high-volume therapeutic segments such as oncology and chronic care drugs.

Global Healthcare CMO Market: Restraints

Complex Regulatory Landscape across Multiple Markets

One of the major restraints in the healthcare CMO market is navigating diverse and evolving regulatory requirements across geographies. CMOs must comply with standards set by regulatory agencies such as the FDA, EMA, and PMDA, which differ in terms of documentation, validation, and audit frequency. Any deviation can delay production timelines or lead to loss of certification, particularly in sterile manufacturing or high-potency drug segments. This increases the risk for both contract manufacturers and their clients relying on time-sensitive delivery.

Capacity Constraints and High Initial Capital Investment

While the demand for contract manufacturing services continues to rise, the lack of sufficient high-quality manufacturing capacity, especially for biologics and injectable drugs, poses a bottleneck. CMOs often require extensive capital investment to expand facilities, integrate automation, and meet GMP standards. Smaller CMOs may struggle to scale operations, while larger firms risk overutilization of existing infrastructure. This can result in production backlogs, increased outsourcing costs, and compromised client delivery timelines.

Global Healthcare CMO Market: Opportunities

Expansion of Biotech Startups and Virtual Pharma Models

The emergence of biotech startups and virtual pharma companies presents a major opportunity for CMOs. These companies often lack in-house production capabilities and rely entirely on third-party partners for product development, clinical material supply, and commercial-scale manufacturing. CMOs offering end-to-end services, from preclinical development to regulatory filing and packaging, stand to gain significant market share. This is especially prominent in personalized medicine and rare disease therapies, where agile and responsive outsourcing partners are crucial.

Growth in Emerging Markets and Localized Manufacturing

The rise in healthcare investments across emerging markets like India, Brazil, and the Middle East has opened new avenues for regional CMOs. Local pharmaceutical companies seek manufacturing partnerships to meet growing domestic demand for affordable generics and biosimilars. Government incentives and regulatory reforms in these regions are supporting the development of contract manufacturing hubs, reducing dependency on imports, and ensuring timely market access. This also enhances supply chain resilience amid global disruptions.

Global Healthcare CMO Market: Trends

Integration of Digital Technologies and Continuous Manufacturing

A major trend in the healthcare CMO sector is the adoption of smart manufacturing practices using digital tools, real-time monitoring, and process automation. Technologies such as PAT (Process Analytical Technology), MES (Manufacturing Execution Systems), and AI-driven analytics are being implemented to improve process efficiency, product quality, and regulatory traceability. Continuous manufacturing, particularly in small-molecule drug production, is gaining traction as a way to reduce batch variability and improve time-to-market.

Increased Focus on Sustainable and Eco-Friendly Operations

Environmental responsibility is becoming a key focus area for CMOs. Contract manufacturers are implementing green chemistry practices, waste reduction strategies, and energy-efficient facility designs to meet both client expectations and environmental regulations. Sustainability initiatives are particularly important in sterile injectables manufacturing and solvent-heavy API production, where eco-conscious practices not only improve compliance but also enhance brand reputation and long-term operational savings.

Global Healthcare CMO Market: Research Scope and Analysis

By Service Type Analysis

Pharmaceutical manufacturing services are expected to hold the leading position within the service type segment of the global healthcare CMO market, accounting for an estimated 58.0% of the total market share in 2025. This dominance is primarily attributed to the consistently high demand for small-molecule drug production, which continues to form the backbone of many therapeutic portfolios globally. Pharmaceutical companies, both large and mid-sized, rely on outsourcing partners for cost-effective production of tablets, capsules, and injectables at commercial scale. Contract manufacturing organizations offer the necessary regulatory expertise, GMP-certified infrastructure, and production scalability, allowing pharmaceutical firms to minimize capital expenditure while ensuring product quality and compliance. Moreover, with the growing approval of generic drugs and the growing need for reformulations of existing therapies, the outsourcing of pharmaceutical manufacturing is becoming a strategic necessity rather than a choice.

Alongside pharmaceutical manufacturing, biologics manufacturing has emerged as a rapidly growing and transformative segment within the healthcare CMO market. Biologics include complex, large-molecule therapeutics such as monoclonal antibodies, recombinant proteins, and vaccines, which require highly specialized manufacturing capabilities and sterile processing environments. The growing adoption of biologic therapies in treating cancer, autoimmune disorders, and rare diseases is driving pharmaceutical and biotech companies to partner with CMOs that possess advanced bioprocessing technologies and strong regulatory track records. Unlike traditional drug production, biologics manufacturing involves more intricate upstream and downstream processes, often customized for each product. This has led to a surge in demand for CDMOs offering biologics services, including cell line development, fermentation, purification, and aseptic fill-finish operations. As the pipeline for biosimilars and novel biologics expands, this segment is expected to continue capturing a larger share of the overall CMO market in the coming years.

By Manufacturing Stage Analysis

Finished Dosage Form (FDF) manufacturing is set to maintain its leading position within the manufacturing stage segment of the global healthcare CMO market, projected to account for 52.0% of the total market share in 2025. This dominance reflects the strong and growing demand for ready-to-administer pharmaceutical products such as tablets, capsules, and injectable formulations. FDF manufacturing involves the final stages of drug production, where active ingredients are formulated, processed, and packaged into a form that patients can use directly. Pharmaceutical companies are outsourcing FDF production to CMOs to meet high-volume demands, reduce operational costs, and accelerate product launches. This is particularly important for generics, branded generics, and reformulated drugs, where speed and scalability are critical. In addition, FDF outsourcing helps companies meet strict regulatory standards and ensures consistent quality across global supply chains. The segment also benefits from the growing demand for sterile injectables and modified-release formulations, which require advanced manufacturing expertise and specialized equipment.

API or bulk drug manufacturing, on the other hand, forms the foundation of pharmaceutical production and is a crucial segment of the healthcare CMO market. This stage involves the synthesis of active pharmaceutical ingredients, which are the core components responsible for a drug’s therapeutic effect. While it accounts for a slightly smaller market share compared to FDF, API manufacturing remains essential, particularly with the rise in demand for high-potency APIs, complex chemical synthesis, and continuous processing methods. Many pharmaceutical companies prefer to outsource API production due to the capital-intensive nature of building compliant facilities, the need for specialized raw materials, and the environmental regulations associated with chemical manufacturing. Furthermore, geopolitical factors and supply chain risks have encouraged companies to diversify API sourcing through reliable CMO partnerships. As the demand for APIs used in chronic disease treatments, antivirals, and oncology drugs increases, this segment is poised to remain a key pillar in the broader healthcare contract manufacturing landscape.

By Type of Drug Analysis

Small-molecule drugs are expected to retain their dominant position within the type of drug segment in the global healthcare CMO market, projected to capture 63.0% of the total market share in 2025. These drugs continue to play a central role in the pharmaceutical industry due to their well-established development pathways, ease of manufacturing, and oral bioavailability. Small-molecule therapeutics are commonly used to treat widespread conditions such as cardiovascular diseases, infections, and metabolic disorders, making them highly scalable and suitable for mass production. Contract manufacturing organizations are ideally positioned to support the large-scale, cost-efficient production of these compounds, especially as global demand for generic medications continues to rise. The outsourcing of small-molecule drug manufacturing enables pharmaceutical companies to streamline operations, reduce time-to-market, and ensure consistent compliance with international regulatory standards. Additionally, with the growing trend of lifecycle management and reformulation of existing drugs, small-molecule CMOs are being relied upon for modified-release dosage forms and combination therapies.

In contrast, large molecule drugs, which include biologics such as monoclonal antibodies, therapeutic proteins, and gene therapies, are gaining substantial traction in the CMO market, albeit from a smaller base. These drugs are structurally complex and require advanced biotechnological processes for development and manufacturing, often involving cell culture systems and highly controlled environments. Large-molecule drugs are commonly used in the treatment of cancer, autoimmune disorders, and rare genetic conditions, areas where traditional small molecules may be less effective. Due to the high cost and technical challenges associated with building in-house biologics manufacturing facilities, pharmaceutical and biotech companies turn to specialized CMOs that offer bioprocessing expertise, state-of-the-art equipment, and regulatory know-how. This segment is experiencing rapid growth as demand for personalized medicine, biosimilars, and injectable biologics rises, driving innovation and investment across the global healthcare CMO landscape.

By End-User Analysis

Pharmaceutical companies are projected to lead the end-user segment of the global healthcare CMO market, capturing 67.0% of the total market share in 2025. This dominance is largely driven by the high volume of outsourcing activity by both branded and generic pharmaceutical manufacturers who seek to optimize production costs, focus on core research activities, and improve supply chain flexibility. With growing pressure to maintain profitability amid patent expirations and intense market competition, pharmaceutical firms are partnering with contract manufacturing organizations for the large-scale production of small-molecule drugs, sterile injectables, and complex dosage forms. CMOs provide these companies with access to GMP-compliant facilities, global regulatory expertise, and high-throughput manufacturing capacity, which are crucial for maintaining consistent product quality and timely market delivery. Additionally, the rapid expansion of generic drug markets and the need for flexible scale-up during new product launches have further encouraged traditional pharma players to deepen their reliance on outsourcing partnerships.

Biotech firms also represent a significant and growing portion of the healthcare CMO market, particularly as innovation in biologics and advanced therapies accelerates. Unlike large pharmaceutical companies, many biotech firms operate with lean internal structures and lack dedicated manufacturing infrastructure, making them highly dependent on third-party CMOs for drug development and production support. These firms typically focus on high-potential areas such as monoclonal antibodies, cell and gene therapies, and other large-molecule drugs, which require sophisticated bioprocessing capabilities. CMOs that specialize in biologics and clinical-scale manufacturing are catering to biotech clients by offering flexible, end-to-end services including formulation development, fill-finish operations, and regulatory consulting. As the pipeline of novel biologics and personalized therapies continues to grow, biotech firms are expected to play a more prominent role in shaping the demand dynamics of the global CMO landscape, contributing to greater diversification of outsourcing needs across the industry.

The Healthcare CMO Market Report is segmented on the basis of the following

By Service Type

- Pharmaceutical Manufacturing

- Biologics Manufacturing

- Packaging & Ancillary Services

- Drug Development Services

By Manufacturing Stage

- Finished Dosage Form (FDF)

- API/Bulk Drug Manufacturing

- Final Stage Packaging

By Type of Drug

- Small Molecule Drugs

- Large Molecule Drugs

By End-User

- Pharmaceutical Companies

- Biotech Firms

- Others

Global Healthcare CMO Market: Regional Analysis

Region with the Largest Revenue Share

Asia Pacific is expected to dominate the global healthcare CMO market in 2025, accounting for 47.4% of total global market revenue. This leadership is driven by the region’s robust pharmaceutical manufacturing ecosystem, cost-effective labor, and expanding base of GMP-certified facilities across key countries like India, China, and South Korea. The availability of skilled scientific talent, supportive government policies, and rising investments in biopharmaceutical infrastructure have positioned Asia Pacific as a global hub for both small-molecule and biologics contract manufacturing. Additionally, growing demand for affordable generics, growing clinical trial activity, and strong export potential have made the region highly attractive to both multinational pharma companies and emerging biotech firms seeking scalable and compliant manufacturing partnerships.

Region with significant growth

The Middle East and Africa (MEA) region is projected to witness the highest CAGR in the global healthcare CMO market over the forecast period. This rapid growth is fueled by growing healthcare investments, expansion of local pharmaceutical production, and strategic government initiatives aimed at reducing dependency on drug imports. Countries such as Saudi Arabia, the United Arab Emirates, and South Africa are actively promoting the localization of drug manufacturing through public-private partnerships and regulatory reforms. The region’s untapped market potential, rising prevalence of chronic diseases, and growing demand for affordable medications are encouraging global CMOs to establish operations or form alliances with regional players. As infrastructure improves and regulatory environments mature, MEA is poised to become a key growth frontier for contract manufacturing in the healthcare sector.

By Region

North America

Europe

- Germany

- The U.K.

- France

- Italy

- Russia

- Spain

- Benelux

- Nordic

- Rest of Europe

Asia-Pacific

- China

- Japan

- South Korea

- India

- ANZ

- ASEAN

- Rest of Asia-Pacific

Latin America

- Brazil

- Mexico

- Argentina

- Colombia

- Rest of Latin America

Middle East & Africa

- Saudi Arabia

- UAE

- South Africa

- Israel

- Egypt

- Rest of MEA

Global Healthcare CMO Market: Competitive Landscape

The global competitive landscape of the healthcare CMO market is characterized by a mix of large, full-service contract development and manufacturing organizations (CDMOs) and specialized niche players competing across service verticals, therapeutic areas, and regions. Major industry leaders such as Lonza, Thermo Fisher Scientific, Samsung Biologics, and Catalent dominate the space through integrated capabilities spanning drug substance manufacturing, fill-finish services, biologics processing, and regulatory support. These players leverage scale, global infrastructure, and strategic acquisitions to expand service offerings and geographic reach. Meanwhile, mid-sized and regional CMOs like Syngene, Recipharm, and Piramal Pharma Solutions differentiate through flexible manufacturing models, targeted technology platforms, and competitive pricing, particularly in emerging markets. The growing complexity of pharmaceutical pipelines, rising demand for personalized medicine, and a shift toward biologics have intensified competition, encouraging players to invest in innovation, digital manufacturing, and sustainability practices to stay ahead. Collaborations, capacity expansions, and service diversification remain core strategies in this highly dynamic and evolving market.

Some of the prominent players in the global healthcare CMO market are

- Samsung Biologics

- Lonza Group

- Thermo Fisher Scientific

- WuXi Biologics

- Catalent Inc.

- Boehringer Ingelheim (BioXcellence)

- FUJIFILM Diosynth Biotechnologies

- Piramal Pharma Solutions

- Akums Drugs & Pharmaceuticals

- Syngene

- Recipharm

- Hovione

- Siegfried Holding

- Aurobindo Pharma

- AbbVie Contract Manufacturing

- Evonik Industries

- Sandoz (Novartis)

- Grifols

- Cambrex Corporation

- AGC Biologics

- Other Key Players

Global Healthcare CMO Market: Recent Developments

- June 2025: Akums Drugs & Pharmaceuticals has started building a new lyophilization and sterile dosage facility to expand its injectables and biologics formulation capacity.

- June 2025: Mallinckrodt announced plans to merge with Endo, creating a diversified pharmaceuticals firm with a complementary sterile injectables business.

- May 2025: Biocon Biologics secured US FDA approval for its JOBEVNE bevacizumab biosimilar, bolstering its oncology biosimilar portfolio.

- April 2025: ResearchAndMarkets estimated the global biologics CDMO market will grow by USD 16.32 billion between 2025 and 2029, driven by efficiencies in emerging markets.

- March 2025: The US Congress allocated USD 650 million to the Congressionally Directed Medical Research Programs (CDMRP) to support biomedical research initiatives.

- January 2025: Klick Health acquired Saratoga-based Peregrine Market Access, expanding its life-sciences market-access and communications services.

Report Details

| Report Characteristics |

| Market Size (2025) |

USD 239.5 Bn |

| Forecast Value (2034) |

USD 558.4 Bn |

| CAGR (2025–2034) |

9.9% |

| Historical Data |

2019 – 2024 |

| The US Market Size (2025) |

USD 60.4 Bn |

| Forecast Data |

2025 – 2033 |

| Base Year |

2024 |

| Estimate Year |

2025 |

| Report Coverage |

Market Revenue Estimation, Market Dynamics, Competitive Landscape, Growth Factors, etc. |

| Segments Covered |

By Service Type (Pharmaceutical Manufacturing, Biologics Manufacturing, Packaging & Ancillary Services, Drug Development Services), By Manufacturing Stage (Finished Dosage Form (FDF), API/Bulk Drug Manufacturing, Final Stage Packaging), By Type of Drug (Small Molecule Drugs, Large Molecule Drugs), By End-User (Pharmaceutical Companies, Biotech Firms, Others). |

| Regional Coverage |

North America – US, Canada; Europe – Germany, UK, France, Russia, Spain, Italy, Benelux, Nordic, Rest of Europe; Asia-Pacific – China, Japan, South Korea, India, ANZ, ASEAN, Rest of APAC; Latin America – Brazil, Mexico, Argentina, Colombia, Rest of Latin America; Middle East & Africa – Saudi Arabia, UAE, South Africa, Turkey, Egypt, Israel, Rest of MEA |

| Prominent Players |

Samsung Biologics, Lonza Group, Thermo Fisher Scientific, WuXi Biologics, Catalent Inc., Boehringer Ingelheim (BioXcellence), FUJIFILM Diosynth Biotechnologies, Piramal Pharma Solutions, Akums Drugs & Pharmaceuticals, Syngene, Recipharm, Hovione, Siegfried Holding, Aurobindo Pharma, and Other Key Players. |

| Purchase Options |

We have three licenses to opt for: Single User License (Limited to 1 user), Multi-User License (Up to 5 Users), and Corporate Use License (Unlimited User) along with free report customization equivalent to 0 analyst working days, 3 analysts working days, and 5 analysts working days respectively. |

Frequently Asked Questions

The global healthcare CMO market size is estimated to have a value of USD 239.5 billion in 2025 and is expected to reach USD 558.4 billion by the end of 2034.

The US healthcare CMO market is projected to be valued at USD 60.4 billion in 2025. It is expected to witness subsequent growth in the upcoming period as it holds USD 134.5 billion in 2034 at a CAGR of 9.3%.

Asia Pacific is expected to have the largest market share in the global healthcare CMO market, with a share of about 47.4% in 2025.

Some of the major key players in the global healthcare CMO market are Samsung Biologics, Lonza Group, Thermo Fisher Scientific, WuXi Biologics, Catalent Inc., Boehringer Ingelheim (BioXcellence), FUJIFILM Diosynth Biotechnologies, Piramal Pharma Solutions, Akums Drugs & Pharmaceuticals, Syngene, Recipharm, Hovione, Siegfried Holding, Aurobindo Pharma, and Other Key Players.

The market is growing at a CAGR of 9.9 percent over the forecasted period.