Market Overview

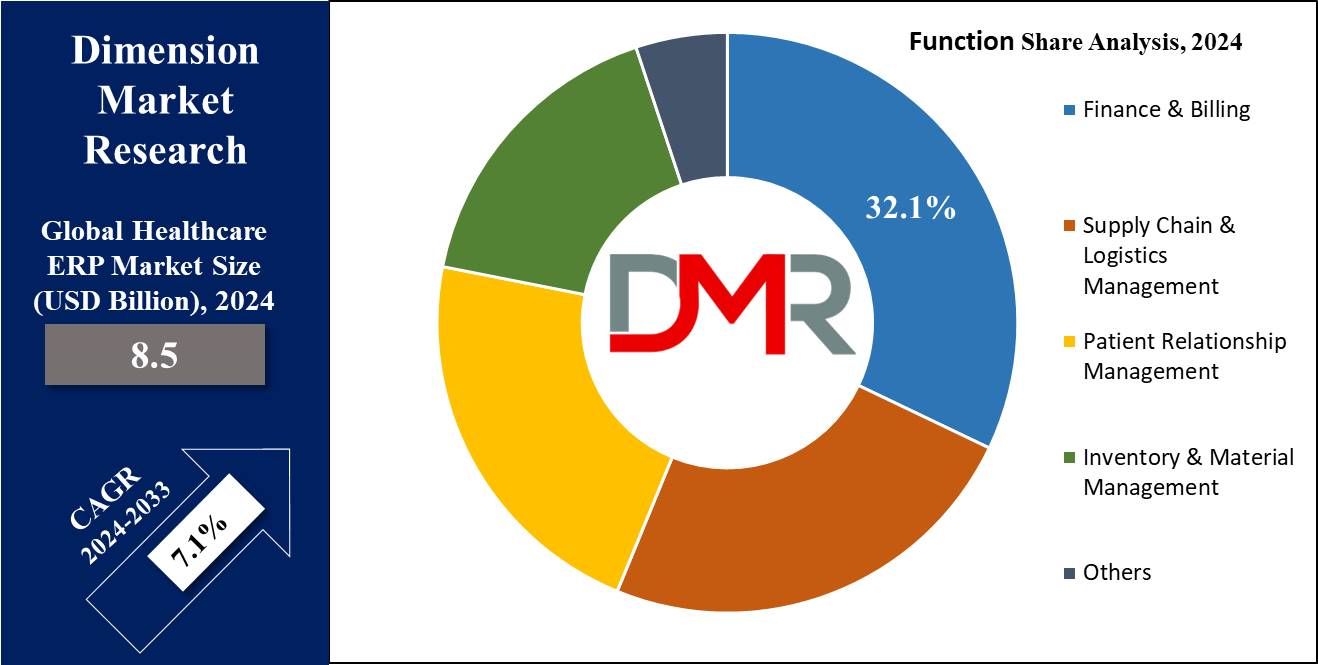

The Global Healthcare ERP Market is expected to reach a value of USD 8.5 billion by the end of 2024, and it is further anticipated to reach a market value of USD 15.7 billion by 2033 at a CAGR of 7.1%.

ERP is used across many industries and integrates software to combine data from different business functions like accounting and supply chain operations. In healthcare, ERP improves patient care by breaking down data barriers, enhancing accessibility, and minimizing costs. Its ability to avoid data duplication and support informed decision-making makes it a valuable tool for streamlining healthcare operations & improving overall efficiency.

Institutions and facilities are increasingly adopting cloud based ERP systems due to the numerous advantages they offer. These include lower ownership costs, agile and flexible infrastructure, minimal need for in house technical expertise, reduced capital requirements, and regular updates.

Unlike on premises ERP systems, which demand significant upfront costs and capital expenditures ranging from USD 50 million to USD 150 million, cloud deployed solutions are more cost effective, particularly for small and medium sized businesses. Cloud based ERP systems eliminate the need for large initial investments, operating instead on a subscription based model with recurring fees, making them a preferred choice for organizations seeking scalability and affordability.

Key Takeaways

- The Global Healthcare ERP Market is projected to reach USD 8.5 billion in 2024 and expand to USD 15.7 billion by 2033, growing at a strong CAGR of 7.1%, driven by increasing digitalization and the demand for operational efficiency in healthcare facilities.

- By Function, the finance & billing segment is expected to lead in 2024 and remain dominant throughout the forecast period, supported by rising adoption of ERP systems for claims management, revenue cycle optimization, and financial transparency.

- By Deployment, the on-premises segment is set to dominate in 2024 due to benefits like enhanced security and reduced vendor dependency. However, cloud-based ERP solutions are expected to witness the fastest growth, owing to their scalability, lower upfront costs, and subscription-based model.

- By End User, hospitals will remain the primary driver of ERP adoption, supported by high patient volumes, chronic disease prevalence, and rising investments in smart hospital development. Nursing homes and clinics are also emerging as important adopters.

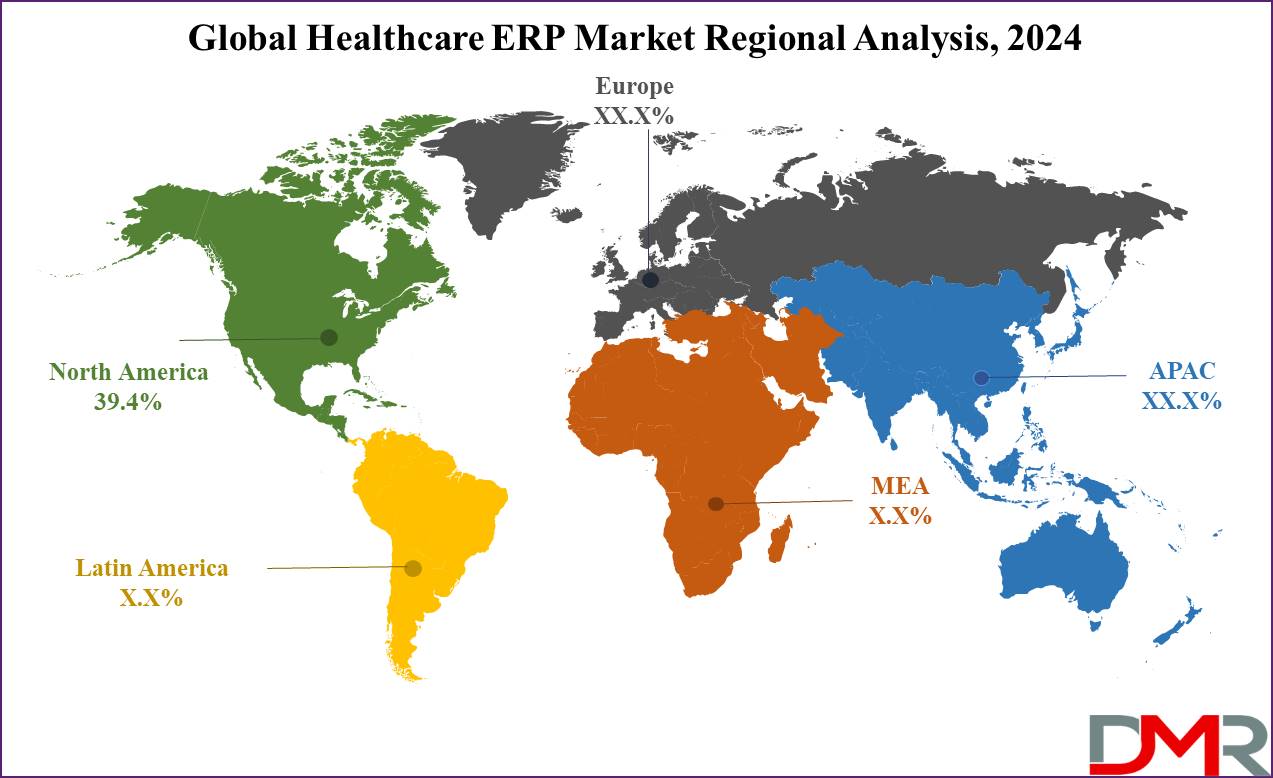

- North America is expected to account for 39.4% of global revenue in 2024, supported by advanced healthcare infrastructure and broad ERP adoption. Meanwhile, Asia-Pacific is projected to experience the fastest growth, fueled by rising healthcare investments, workforce shortages, and increasing

Use Cases

- Patient Management: Healthcare ERP does effective patient registration, appointment scheduling, &medical history management, ensuring smooth coordination between healthcare providers & patients, thus improving complete patient care & experience.

- Inventory and Supply Chain Management: Healthcare ERP easily manages medical inventory, tracks supplies, & automates procurement processes, optimizing inventory levels, minimizing costs, and ensuring the availability of important medical supplies when needed.

- Electronic Health Records (EHR) Management: Healthcare ERP supports the digitization &management of electronic health records, making secure storage, easy accessibility, & efficient sharing of patient information among healthcare professionals, causing improved diagnosis, treatment, & care coordination.

- Financial Management: The Revenue Cycle Management in healthcare ERP combines billing, invoicing, and revenue cycle management, allowing precise financial reporting, streamlined billing processes, and efficient claims management, thereby improving revenue collection and financial transparency within healthcare organizations.

Market Dynamic

The expansion of the global healthcare ERP market is driven by the growth in the adoption of ERP solutions in the healthcare industry, providing improved caregiving efficiency & resource usage. In addition, the growth in patient numbers & the aging population globally contribute to the market's expansion. Further, healthcare ERP systems help providers in delivering quality care while managing costs through automation & efficiency improvements.

However, the healthcare ERP market share experiences challenges due to the high cost of system implementation, including expenses for software, hardware, and customization. Moreover, strict regulations, like GDPR in the EU, pose compliance hurdles for ERP usage, requiring companies to navigate varying national regulations. Understanding and adopting these regulations is critical for market participants.

Driving Factors

A growing need for operational efficiency and data driven decision making drives the Healthcare ERP (Enterprise Resource Planning) Market. Hospitals, clinics, and other healthcare organizations are increasingly turning to ERP systems in order to optimize workflows, allocate resources more efficiently, and enhance patient care. With increasing regulatory requirements for compliance reporting requirements only heightening this necessity.

ERP solutions allow real time data access, optimizing inventory management, financial processes, and human resources functions. As more healthcare systems shift toward value based care models and increase demand for interoperability between healthcare systems, ERP adoption accelerates further to ensure seamless collaboration and improved patient outcomes across healthcare ecosystems.

Trending Factors

Cloud based ERP solutions have quickly become a trend in the Healthcare ERP Market. Offering scalability, cost effectiveness, and remote accessibility ideal features for modern healthcare environments cloud ERPs offer immense potential.

Artificial Intelligence (AI),

Machine Learning (ML) and Predictive Analytics can enhance ERP functionalities to facilitate precise forecasting and decision making processes.

Mobile ERP applications are increasingly used by healthcare professionals for quick, on the go access to essential data. Furthermore, patient centric ERP systems that integrate EHR and

telehealth services are becoming more common as the industry shifts towards personalized and connected healthcare delivery.

Restraining Factors

High implementation and maintenance costs associated with ERP systems is one of the primary inhibitors to growth within the Healthcare ERP Market, especially among smaller healthcare providers who often face financial and resource limitations when adopting them. Integrating ERP solutions with existing healthcare IT infrastructure such as EHRs and laboratory information systems further complicates deployment.

Data security and privacy concerns pose an additional obstacle, given that healthcare organizations handle sensitive patient information. Lastly, resistance among healthcare staff as well as extensive training requirements may delay adoption further emphasizing the necessity for user friendly ERP solutions that offer cost savings over time.

Opportunity

The Healthcare ERP Market presents enormous opportunity through the rapid adoption of advanced technologies and rising demand in emerging economies. Emerging regions offer ERP vendors great potential growth potential. Healthcare investments and digitalization projects present them with tremendous growth opportunities.

AI, IoT, and blockchain integration in ERP systems provides innovative solutions for predictive analytics, real time monitoring, and secure data sharing. ERP platforms designed specifically to address small and midsized healthcare providers represent an untapped market segment; their remote healthcare delivery models open opportunities to optimize operational efficiencies in decentralized or hybrid care models.

Research Scope and Analysis

By Function

The finance and billing function is expected to hold the largest share of revenue in the healthcare ERP market in 2024. Hospitals and healthcare facilities are rapidly adopting ERP systems to streamline operations, mainly in managing finances and billing processes.

These systems combine front-end revenue activities with back-end tasks like claims management, supporting transparency and efficiency. They allow complete financial management, like ledger management, risk assessment, and live monitoring, driving the segment's growth.

Further, the inventory & material management segment is expected to rapid growth during the forecast period. ERP modules dedicated to inventory management provide better reporting, supply chain oversight, and inventory planning.

Their strong functionality breaks down information barriers, streamlines manufacturing, & automates tasks, leading to more effective operations. With features like live analysis and quality checks, these systems are important for optimizing inventory processes in healthcare settings, contributing to the segment's anticipated growth.

By Deployment

The on-premises deployment segment is predicted to lead the market in 2024, having a significant revenue share, which offers benefits like minimal maintenance, reduced dependency on vendors, & enhanced security. Often referred to as "shrink-wrap" deployment, it includes installing software directly onto business computers, creating remote access, and cost savings.

In addition, the cloud deployment segment is expected to experience fast growth during the forecast period. Cloud-based solutions provide flexibility, accessibility, and low cost in comparison to traditional on-premises installations. With no upfront investment needed & data stored remotely, cloud deployment is gaining traction among healthcare organizations looking for affordable while meeting quality care standards in the middle of growing pressure from many stakeholders.

By End User

Hospitals are expected to dominate the global healthcare ERP market in 2024 owing to the increased presence of both public & private hospitals globally. Government & corporate investments in advanced technology drive hospital growth, driven by an increase in chronic disease rates leading to more admissions. In addition, investments in smart hospital development contribute to market growth.

Further, nursing homes are expected to provide more opportunities during the forecast period. With an increase in the number of nursing homes globally, along with the rise in chronic disease occurrence, there's a growing need for their convenient services & personalized treatment, which leads to growth in the adoption of healthcare ERP systems in nursing homes across both developing & developed markets.

The Healthcare ERP Market Report is segmented on the basis of the following

By Function

- Supply Chain & Logistics

- Finance & Billing

- Inventory Management

- Patient Relationship Management

- Others

By Deployment

By End User

- Hospitals

- Clinics

- Nursing Homes

- Others

Regional Analysis

North America is expected to lead the market in 2024 with a revenue

share of 39.4%, due to its advanced healthcare infrastructure & need for modern technology. The region sees broad adoption of ERP systems, helping in workflow optimization and cost reduction, which is driven by the benefits provided by ERP software, like resource efficiency & improved caregiving. Key market players are expanding their offerings to meet small and medium-sized businesses.

Further, Asia Pacific is expected to experience the fastest growth in the coming years due to an increase in healthcare spending and workforce shortages. Also, factors like ineffective health facility management, the rise in patient numbers, and the growth in startups contribute to this growth. While the US healthcare ERP market remains mature and well-established, public and private investments in infrastructure further boost economic development in the Asia Pacific region.

By Region

North America

Europe

- Germany

- The U.K.

- France

- Italy

- Russia

- Spain

- Benelux

- Nordic

- Rest of Europe

Asia-Pacific

- China

- Japan

- South Korea

- India

- ANZ

- ASEAN

- Rest of Asia-Pacific

Latin America

- Brazil

- Mexico

- Argentina

- Colombia

- Rest of Latin America

Middle East & Africa

- Saudi Arabia

- UAE

- South Africa

- Israel

- Egypt

- Rest of MEA

Competitive Landscape

The healthcare ERP market notices moderate competition among key players who use strategic tactics like partnerships, product development, and mergers to gain market dominance. These activities are important for companies focused on securing their position and expanding their market share in the industry.

Some of the prominent players in the global Healthcare ERP Market are

- Infor

- Microsoft

- Oracle

- SAP

- Aptean

- Sage Group

- McKesson Corp

- Odoo

- Epicor Software Corp

- QAD Inc

- Other Key Players

Recent Developments

- In October 2023, Oracle announced healthcare-oriented features for its Fusion Enterprise Performance Management (EPM), Supply Chain and Manufacturing (SCM), and Human Capital Management (HCM) suites, with a growing focus on healthcare industry customers, which focuses on meeting their financial planning, supply chain and human resources needs.

- In September 2023, Oracle introduced new healthcare-specific capabilities to Oracle Fusion Cloud Applications Suite to assist healthcare organizations' growth in financial visibility, build more advanced supply chains, and enhance patient care. The new capabilities will allow healthcare organizations to grow productivity, reduce costs, allow new business models, improve decision-making, and better serve patient needs.

- In September 2023, Wayne HealthCare, a known hospital in Ohio, upgraded its financials & interoperability to the cloud with Infor and GForce Technology Consulting. The rapid migration to modern cloud solutions on AWS ensures agility for growth while maintaining top-notch patient care.

- In April 2023, Workday, Inc. announced its constant momentum within the healthcare industry, by adding several new healthcare organizations to its increase in global reach customers. Further, the company also announced that KLAS Research recognized it as the leading cloud ERP solution for healthcare.

Report Details

| Report Characteristics |

| Market Size (2024) |

USD 8.5 Bn |

| Forecast Value (2033) |

USD 15.7 Bn |

| CAGR (2023-2032) |

7.1% |

| Historical Data |

2018 – 2023 |

| Forecast Data |

2024 – 2033 |

| Base Year |

2023 |

| Estimate Year |

2024 |

| Report Coverage |

Market Revenue Estimation, Market Dynamics, Competitive Landscape, Growth Factors and etc. |

| Segments Covered |

By Function (Supply Chain & Logistics, Finance & Billing, Inventory Management, Patient Relationship Management, and Others), By Deployment (On- Premise and Cloud), By End User (Hospitals, Clinics, Nursing Homes, and Others) |

| Regional Coverage |

North America – The US and Canada; Europe – Germany, The UK, France, Russia, Spain, Italy, Benelux, Nordic, & Rest of Europe; Asia- Pacific– China, Japan, South Korea, India, ANZ, ASEAN, Rest of APAC; Latin America – Brazil, Mexico, Argentina, Colombia, Rest of Latin America; Middle East & Africa – Saudi Arabia, UAE, South Africa, Turkey, Egypt, Israel, & Rest of MEA |

| Prominent Players |

Infor, Microsoft, Oracle, SAP, Aptean, Sage Group, McKesson Corp, Odoo, Epicor Software Corp, QAD Inc, and Other Key Players |

| Purchase Options |

We have three licenses to opt for: Single User License (Limited to 1 user), Multi-User License (Up to 5 Users), and Corporate Use License (Unlimited User) along with free report customization equivalent to 0 analyst working days, 3 analysts working days and 5 analysts working days respectively. |

Frequently Asked Questions

The Global Healthcare ERP Market size is estimated to have a value of USD 8.5 billion in 2024 and is

expected to reach USD 15.7 billion by the end of 2033.

North America is expected to have the largest market share in the Global Healthcare ERP Market with a

share of about 39.4% in 2024.

Some of the major key players in the Global Healthcare ERP Market are Infor, Microsoft, Oracle, and

many others.

The market is growing at a CAGR of 7.1 percent over the forecasted period.