Interoperability is becoming a key trend in healthcare information software. The ability for systems to seamlessly share and exchange data across different healthcare providers and platforms is crucial for delivering coordinated and efficient patient care. With the rising focus on integrated healthcare systems and connected ecosystems, software solutions that prioritize interoperability are increasingly in demand.

Research Scope and Analysis

By Deployment

The market is divided by deployment model into on-premise and cloud, where the on-premise deployment takes the lead in 2023, capturing the largest market share, which is indicative of the major use of traditional on-site deployment methods across different sectors, as organizations favor on-premise models for their control over data security and customization, aligning with established practices.

Also, cloud deployment is expected to significantly growth over the forecasted period. The flexibility, scalability, & cost-effectiveness of cloud models appeal to many enterprises, encouraging a shift towards cloud-based

healthcare IT solutions.

As technological landscapes evolve and the advantages of cloud deployment become more apparent, the market may experience a shift in dominance from on-premise to cloud solutions in the coming future.

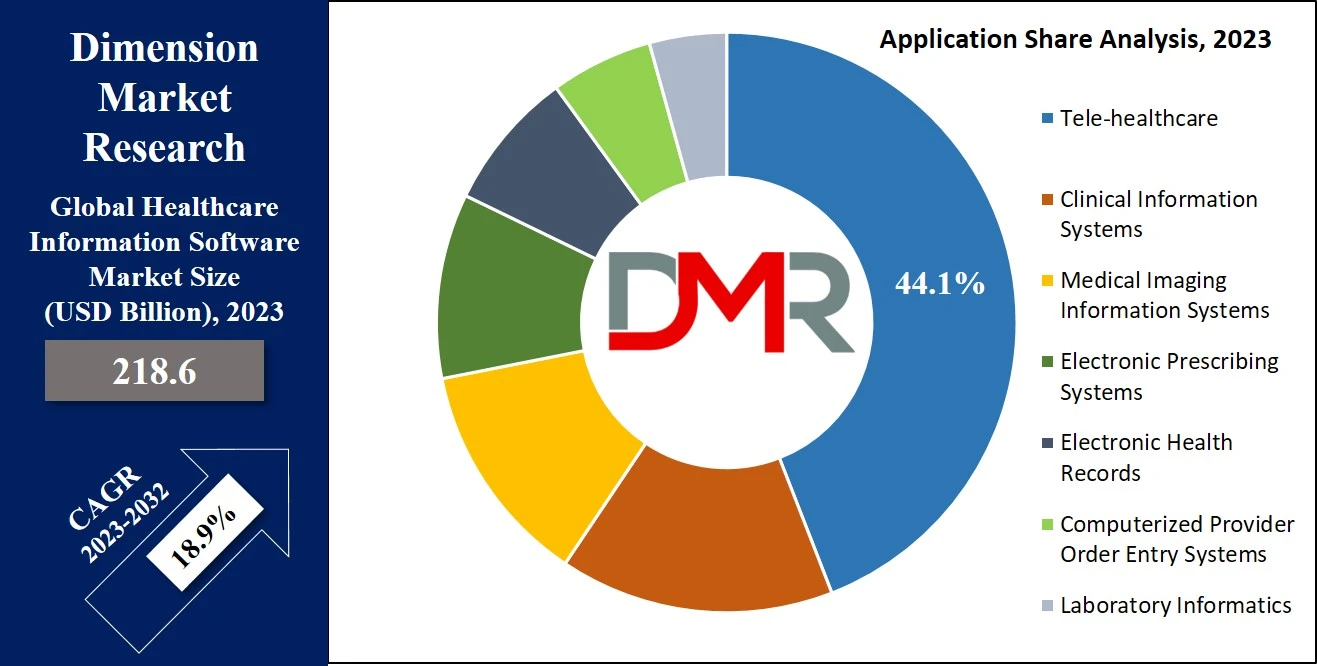

By Application

The

laboratory informatics is categorized by application into Computerized Provider Order Entry Systems (CPOE), Electronic Health Records (EHR),

medical imaging information systems, electronic prescribing systems, laboratory informatics, clinical information systems, & tele-healthcare.

As of 2023, tele-healthcare stands out as the dominant segment in terms of revenue share, which can be attributed to the growth in demand for effective electronic healthcare systems, constant advancements in healthcare IT, & the essential need for technology-integrated tools.

In addition, factors like an increase in health consciousness, a growth in preference for affordable care, & the growing geriatric population contribute significantly to the thriving tele-healthcare sector.

Also, the electronic prescribing system segment is expected to have the fastest growth during the forecast period, driven by increasing awareness of the benefits associated with e-prescribing.

Further, the medical imaging information systems segment, comprising radiology information systems, monitoring analysis software, & picture archiving and communication systems (PACS), is also witnessing substantial growth due to the vital need for streamlined healthcare operations, growing awareness about these systems in tracking billing information & radiology imaging orders, and the global prevalence of chronic diseases.

The Healthcare Information Software Market Report is segmented on the basis of the following:

By Deployment

By Application

- Tele-healthcare

- Clinical Information Systems

- Medical Imaging Information Systems

- Electronic Prescribing Systems

- Electronic Health Records

- Computerized Provider Order Entry Systems

- Laboratory Informatics

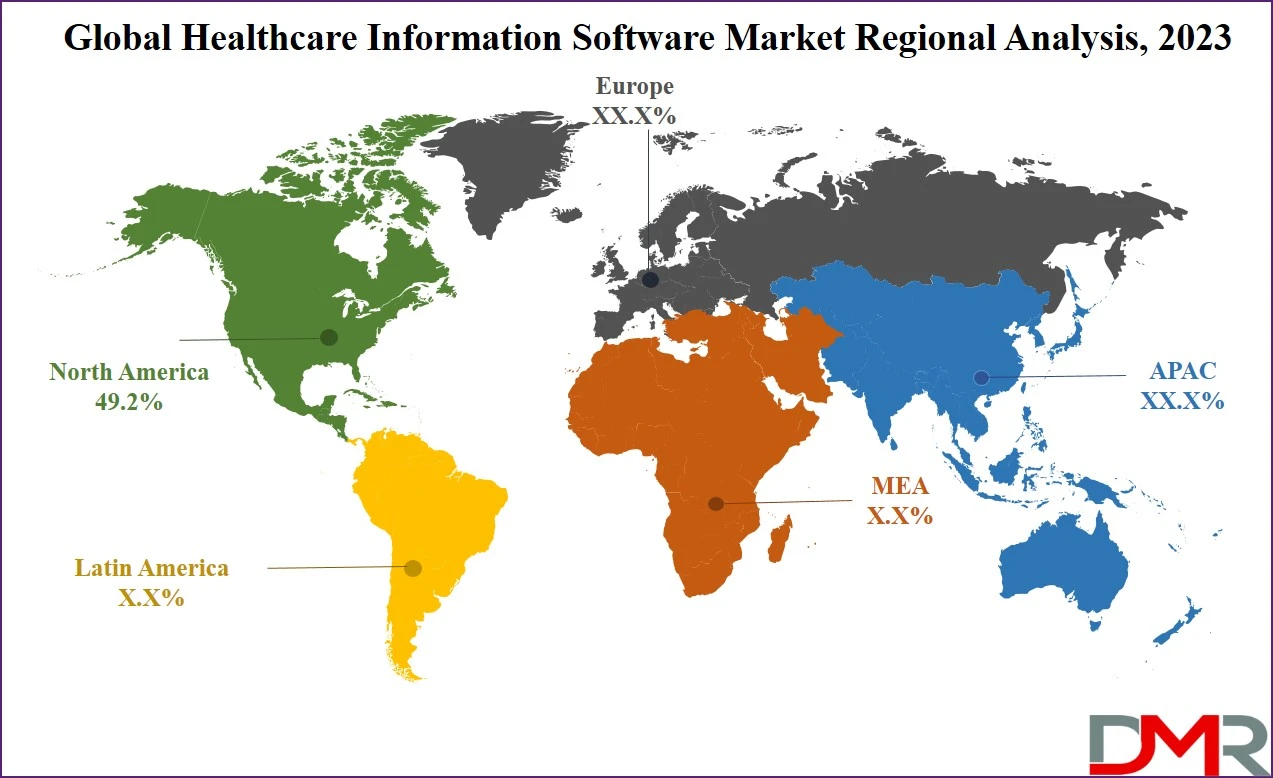

Regional Analysis

In 2023,

North America emerged as the market leader, securing the largest revenue share of

49.2%, driven by the widespread adoption of healthcare IT solutions & services, particularly in the US, which is fueled by a collective effort among healthcare providers to enhance patient care standards while simultaneously reducing costs.

Further, the adoption of healthcare IT solutions showcases variability among providers, exemplified by the major use of Electronic Health Records (EHR) in Oregon, where digital divisions influence adoption rates.

Further, Asia Pacific is expected to show rapid growth in the forecast period, attributed to growth in demand for healthcare IT services., which is driven by increased government investments in healthcare, along with a rising need for efficient management of clinical, financial, & administrative aspects in hospitals. Government initiatives & supportive programs are major in fostering the adoption of these technologies across the region.

By Region

North America

Europe

- Germany

- The U.K.

- France

- Italy

- Russia

- Spain

- Benelux

- Nordic

- Rest of Europe

Asia-Pacific

- China

- Japan

- South Korea

- India

- ANZ

- ASEAN

- Rest of Asia-Pacific

Latin America

- Brazil

- Mexico

- Argentina

- Colombia

- Rest of Latin America

Middle East & Africa

- Saudi Arabia

- UAE

- South Africa

- Israel

- Egypt

- Rest of MEA

Competitive Landscape

The Healthcare Information Software market is highly competitive, led by a handful of key players holding significant market share. Yet, technological progress &"innovative product offerings are allowing midsize & smaller companies to expand their influence.

These companies are leveraging advancements to introduce affordable services, challenging the dominance of larger players, which encourages healthy competition that fosters innovation &affordability in the rapidly evolving healthcare information software market.

For instance, in September 2022, Sharecare unveiled Smart Omix, an advanced digital clinical research tool, that facilitates the collection of real-world data & the creation of digital biomarkers via mobile research studies.

Smart Omix highly contributes to the progress of relevance, equity, & data integrity in clinical research within the healthcare landscape. Its advanced capabilities mark a crucial step forward in improving the efficiency & inclusivity of research efforts across the entire healthcare range.

Some of the prominent players in the global Healthcare Information Software Market are:

- GE Healthcare

- eMDs Inc

- Novarad

- eClinicalWorks

- McKesson Corp

- Carestream Health

- Siemens Healthcare

- Philips Healthcare

- Cerner Corp

- Meditech

- Other Key Players

Recent Development

- In March 2023, Vital raised $24.7 million in Series B funding to enhance its AI-driven software, designed to optimize operations and patient care in hospitals and health systems.

- In December 2023, Ketryx secured $14 million during its Series A funding round, led by Lightspeed Venture Partners, with E14 Fund and Ubiquity Ventures also contributing, aiming to expand its technological offerings.

- In March 2023, HealthPlix, an Indian EMR startup, garnered $22 million in Series C funding to continue its development and expansion of electronic medical record systems across India.

- In January 2023, Volta Medical obtained €36 million in Series B funding to promote the adoption of its innovative AI software for cardiac ablation, coinciding with the introduction of a new CFO to bolster its management team.

| Report Characteristics |

| Market Size (2023) |

USD 218.6 Bn |

| Forecast Value (2032) |

USD 1,036.1 Bn |

| CAGR (2023-2032) |

18.9% |

| Historical Data |

2017 - 2022 |

| Forecast Data |

2023 - 2032 |

| Base Year |

2022 |

| Estimate Year |

2023 |

| Report Coverage |

Market Revenue Estimation, Market Dynamics, Competitive Landscape, Growth Factors and etc. |

| Segments Covered |

By Deployment (On-Premise and Cloud), By Application (Tele-healthcare, Clinical Information Systems, Medical Imaging Information Systems, Electronic Prescribing Systems, Electronic Health Records, Computerized Provider Order Entry Systems, and Laboratory Informatics) |

| Regional Coverage |

North America – The US and Canada; Europe – Germany, The UK, France, Russia, Spain, Italy, Benelux, Nordic, & Rest of Europe; Asia- Pacific– China, Japan, South Korea, India, ANZ, ASEAN, Rest of APAC; Latin America – Brazil, Mexico, Argentina, Colombia, Rest of Latin America; Middle East & Africa – Saudi Arabia, UAE, South Africa, Turkey, Egypt, Israel, & Rest of MEA |

| Prominent Players |

GE Healthcare, eMDs Inc, Novarad, eClinicalWorks, McKesson Corp, Carestream Health, Siemens Healthcare, Philips Healthcare, Cerner Corp, Meditech, and Other Key Players |

| Purchase Options |

We have three licenses to opt for: Single User License (Limited to 1 user), Multi-User License (Up to 5 Users), and Corporate Use License (Unlimited User) along with free report customization equivalent to 0 analyst working days, 3 analysts working days and 5 analysts working days respectively. |