Managing patient data, characterized by its unstructured, intricate, & sensitive nature, creates a significant challenge in integrating it into the healthcare delivery process. Overcoming this hurdle is crucial to unlock the full potential of enhanced patient care, driving the market's expansion. Further Government support & initiatives play a major role in supporting the higher growth of the healthcare integration market.

However, challenges like interoperability concerns & increasing costs associated with healthcare integration solutions are anticipated to hinder market growth in the targeted period. In addition, issues related to data security create potential challenges to the continued growth of the healthcare integration market during the forecasted period.

Research Scope and Analysis

By Component

Based on component type, the healthcare integration market is classified into services & products. Products currently dominate the market share in 2023 and are expected to experience substantial growth in the forecasted period, which is driven by rising demands & healthcare reforms, emphasizing the imperative to improve healthcare quality.

Further, the rise in the adoption of Electronic Health Records (EHRs) & other interoperability solutions contributes significantly to the growth of products in the market. As the healthcare landscape evolves, the growing importance of efficient, integrated solutions highlights the crucial role of products in meeting the sector's requirements.

The growth in demand for products reflects a strategic response to the pressing need for advanced, cohesive healthcare technologies that align with the goals of improving quality & fostering interoperability in healthcare systems.

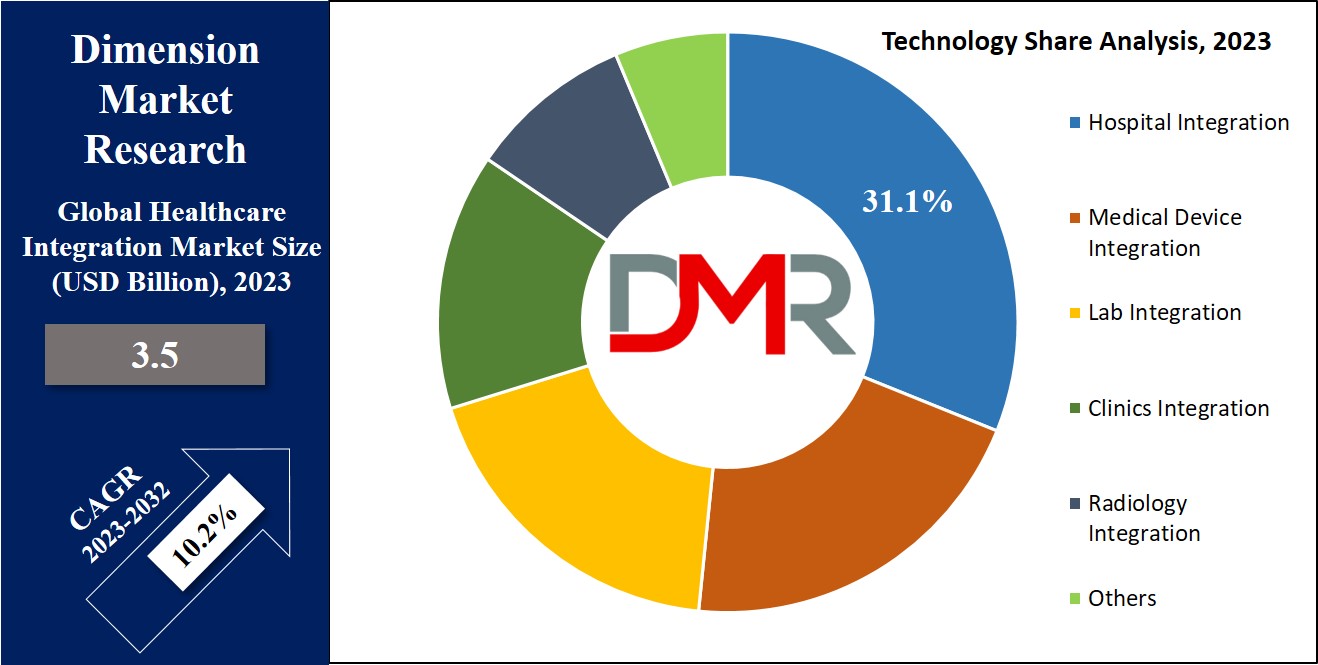

By Technology

In terms of technology, the healthcare integration market is divided into hospital integration, medical device integration, lab integration, clinics integration, radiology integration, and others.

Among all these technologies, the hospital integration segment takes the lead with the largest share in 2023, & its prominence is anticipated to grow significantly in the forecasted period, which can be attributed to the imperative to deliver top-quality services, supported by factors like better purchasing power, advanced IT integration capabilities, & a heightened adoption of

Healthcare Information Technology (HCIT) solutions.

Also, the hospital integration sector stands out as an essential driver in meeting the evolving demands of the healthcare landscape, reflecting a strategic focus on enhancing service quality, operational efficiency, and overall healthcare delivery through effective technology integration.

The Healthcare Integration Market Report is segmented on the basis of the following:

By Component

By Technology

- Hospital Integration

- Medical Device Integration

- Lab Integration

- Clinics Integration

- Radiology Integration

- Others

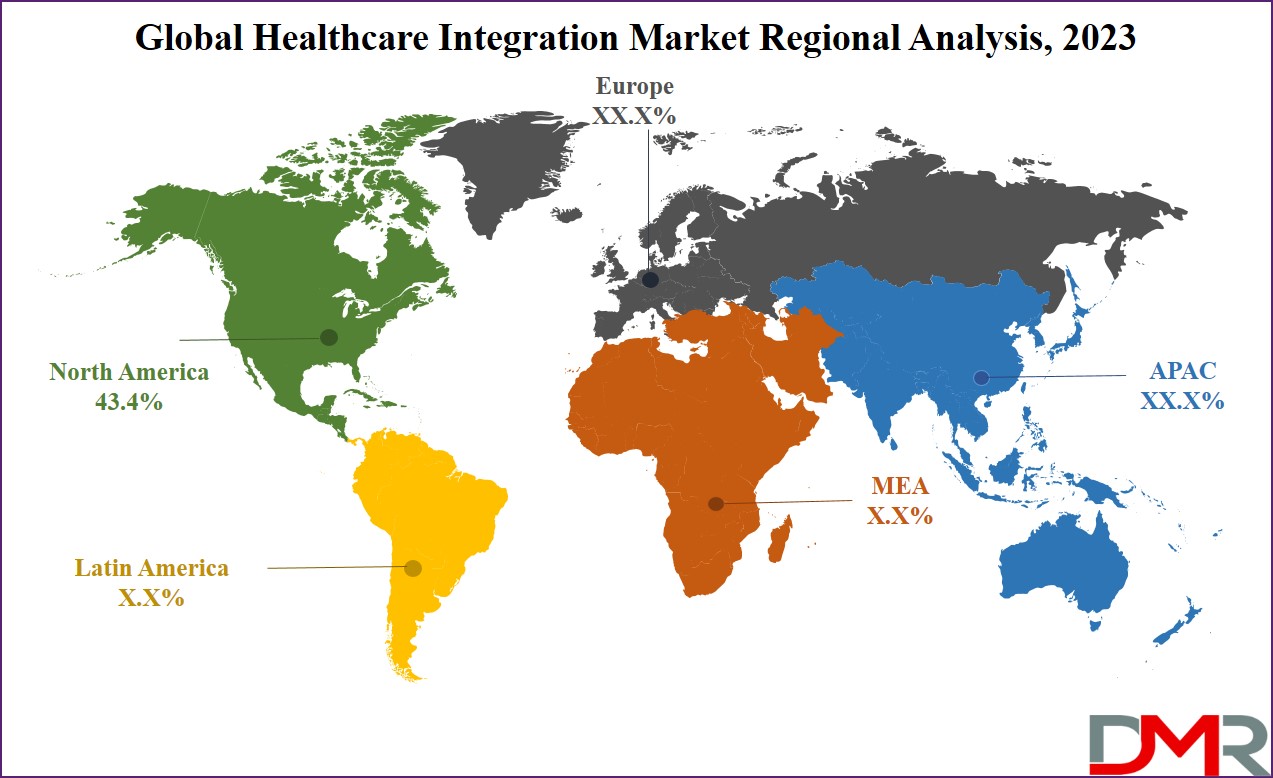

Regional Analysis

North America dominates the healthcare integration market, holding the largest share at 43.4% in 2023, fueled by the increasing adoption of healthcare information technology among providers & payers. Also, the region experiences growth due to heightened government initiatives to improve patient care & the growing demand for optimizing healthcare infrastructure through IT integration solutions.

Moreover, the Asia Pacific region is expected to have rapid expansion in the forecast period. Factors contributing to this growth include a vast patient population & the increasing commercialization of healthcare IT integration solutions by global market players. These dynamics are expected to fuel the clinical risk grouping solutions market in the Asia Pacific, reflecting the region's growing significance in the evolving landscape of healthcare integration.

By Region

North America

Europe

- Germany

- The U.K.

- France

- Italy

- Russia

- Spain

- Benelux

- Nordic

- Rest of Europe

Asia-Pacific

- China

- Japan

- South Korea

- India

- ANZ

- ASEAN

- Rest of Asia-Pacific

Latin America

- Brazil

- Mexico

- Argentina

- Colombia

- Rest of Latin America

Middle East & Africa

- Saudi Arabia

- UAE

- South Africa

- Israel

- Egypt

- Rest of MEA

Competitive Landscape

The healthcare integration market is highly competitive, featuring major players. However, technological advancements & innovative products allow mid-size to smaller companies to expand their market presence. These companies gain a share of the market by introducing cost-effective solutions with new ingredients. The dynamic landscape reflects a switch towards higher diversity & accessibility, as smaller entities leverage innovation to compete, contributing to the industry's growth & development.

For instance, in July 2022, the Aster Innovation & Research Centre, part of Aster DM Healthcare Group, announced its partnership with Intel Corporation & AI platform provider CARPL.ai to create an AI-driven health data platform for the Indian market, to harness the capabilities of

artificial intelligence in healthcare, leveraging the expertise of the partners to develop & introduce an advanced health data platform in India.

Some of the prominent players in the global Healthcare Integration Market are:

- Infor

- Orion Health

- AVI-SPL

- GE Healthcare

- Siemens Healthcare

- Dell Technologies

- Meditech

- IBM Corp

- NextGen Healthcare

- Corepoint Health

- Other Key Players

Recent Development

- In October 2024, Even Healthcare secured a $30 million funding round led by Khosla Ventures, aimed at expanding its operational capacity and enhancing its healthcare integration technologies.

- In December 2024, Metropolis Healthcare announced the acquisition of Core, a strategic move designed to bolster its long-term growth plans and expand its service offerings in the healthcare sector.

- In November 2024, MDC completed the acquisition of Lighteum, a manufacturer specializing in nitinol-based medical components, enhancing MDC's capabilities in advanced medical technology

Report Details

| Report Characteristics |

| Market Size (2023) |

USD 3.5 Bn |

| Forecast Value (2032) |

USD 11.4 Bn |

| CAGR (2023-2032) |

10.2% |

| Historical Data |

2017 - 2022 |

| Forecast Data |

2023 - 2032 |

| Base Year |

2022 |

| Estimate Year |

2023 |

| Report Coverage |

Market Revenue Estimation, Market Dynamics, Competitive Landscape, Growth Factors and etc. |

| Segments Covered |

By Component (Products and Services), By

Technology (Hospital Integration, Medical Device

Integration, Lab Integration, Clinics Integration,

Radiology Integration, and Others) |

| Regional Coverage |

North America – The US and Canada; Europe – Germany, The UK, France, Russia, Spain, Italy, Benelux, Nordic, & Rest of Europe; Asia- Pacific– China, Japan, South Korea, India, ANZ, ASEAN, Rest of APAC; Latin America – Brazil, Mexico, Argentina, Colombia, Rest of Latin America; Middle East & Africa – Saudi Arabia, UAE, South Africa, Turkey, Egypt, Israel, & Rest of MEA

|

| Prominent Players |

Infor, Orion Health, AVI-SPL, GE Healthcare, Siemens

Healthcare, Dell Technologies, Meditech, IBM Corp,

NextGen Healthcare, Corepoint Health, and Other

Key Players |

| Purchase Options |

We have three licenses to opt for: Single User License (Limited to 1 user), Multi-User License (Up to 5 Users), and Corporate Use License (Unlimited User) along with free report customization equivalent to 0 analyst working days, 3 analysts working days and 5 analysts working days respectively. |