Market Overview

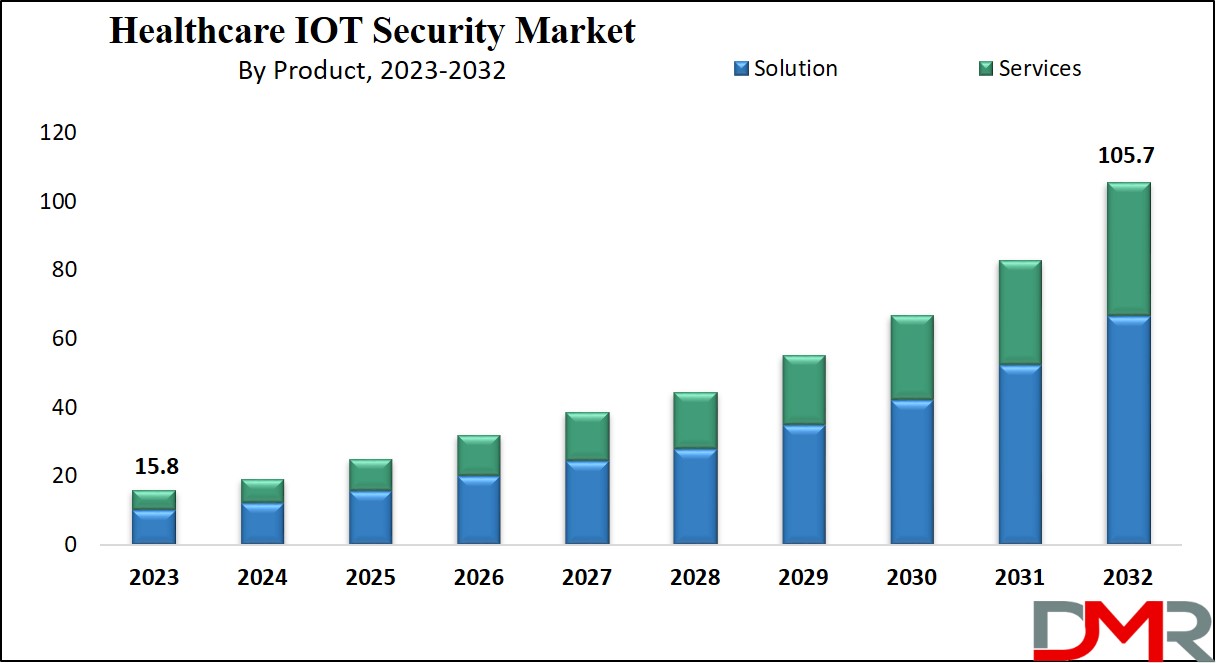

The Global Healthcare IOT Security Market is expected to hold a market value of USD 15.8 billion in 2023 and is projected to show subsequent growth with a market value of USD 105.7 billion by the end of 2032 at a CAGR of 23.7%.

The global healthcare IoT security market offers a comprehensive range of solutions to address security challenges linked to the rise in Internet of Things (IoT) technologies in healthcare. Focused on securing interconnected medical devices and data, it employs measures like encryption, access controls, and secure communication protocols to ensure security in the healthcare sector.

This market ensures network security, emphasizing data transmission integrity and confidentiality. As authentication, access control, and incident response are crucial for thwarting unauthorized access. Moreover, it adapts to advanced technologies like AI, IoT Microcontroller, and machine learning for enhanced threat detection. With a global reach, the market prioritizes maintaining trust, safety, and integrity in an interconnected healthcare landscape.

The global prevalence of chronic diseases such as cancer, cardiovascular diseases (CVD), and diabetes has risen significantly in recent decades. The World Health Organization (WHO) reported in 2016 that CVD is the leading cause of death globally, responsible for 17.3 million fatalities annually.

This figure is projected to increase to over 23.6 million by 2030, including 7.4 million deaths from coronary heart disease and 6.7 million from stroke. Additionally, GLOBOCAN data predicts that the annual number of new cancer cases will grow to 19.3 million by 2025, compared to 14.1 million in 2012.

A key factor contributing to the rise in chronic conditions is the growing global geriatric population. WHO estimates that between 2015 and 2050, the proportion of individuals aged over 60 will nearly double, reaching 22% of the global population, or approximately 2 billion people, by 2050.

Furthermore, data from the National Council on Aging reveals that 92% of older adults have at least one chronic illness, with 77% experiencing two or more, underscoring the impact of aging on healthcare challenges.

Key Takeaways

- Strong Market Growth: The Healthcare IoT Security Market is projected to rise from USD 15.8 billion in 2023 to USD 105.7 billion by 2032, growing at a CAGR of 23.7%, driven by IoT adoption and rising cyber threats.

- Solutions Lead the Segment: With a 73.1% share in 2023, security solutions such as identity & access management, data encryption, and intrusion detection systems dominate due to their critical role in protecting sensitive healthcare data.

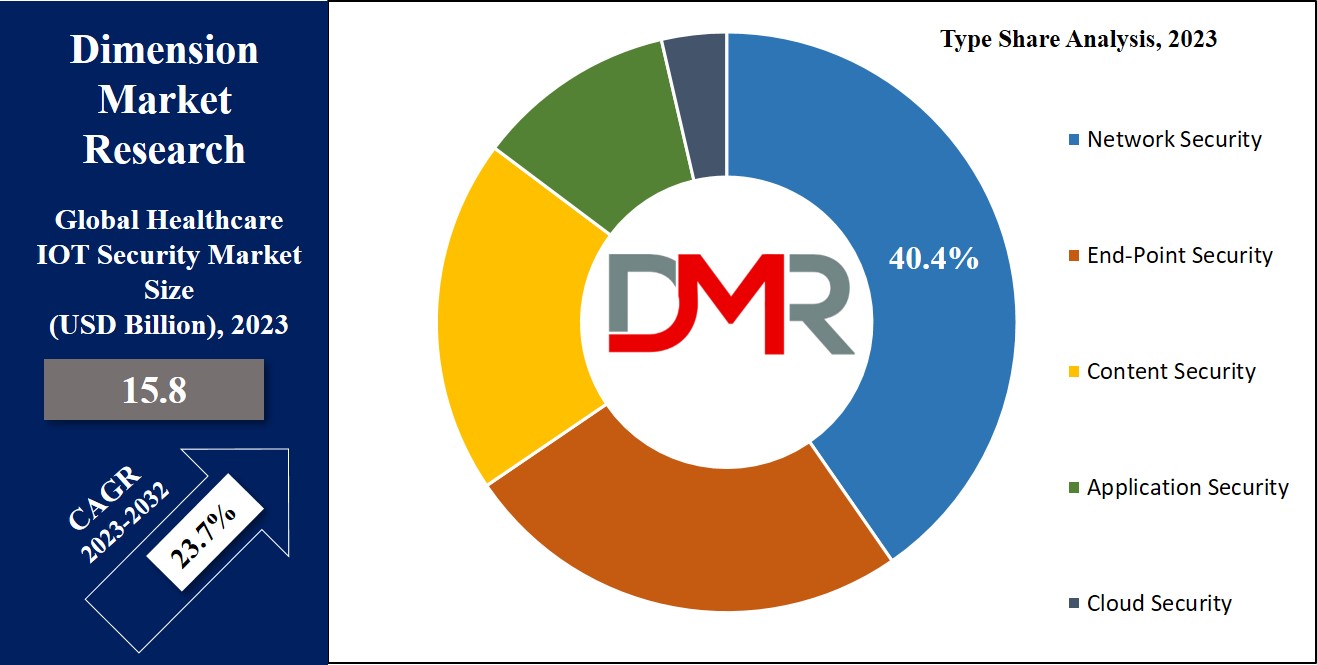

- Network Security Dominance: Accounting for 40.4% of the market in 2023, network security remains the foundation of IoT security, ensuring data confidentiality, system integrity, and protection against ransomware and malware attacks.

- Regional Leadership: North America holds 36.2% of the market share in 2023, driven by advanced healthcare infrastructure, strict regulatory requirements (HIPAA), and early adoption of digital health technologies.

- AI & Blockchain Integration: Emerging technologies such as artificial intelligence, machine learning, and blockchain are enhancing IoT security with real-time threat detection, predictive analytics, and tamper-proof data transactions.

Use Cases

- Securing Remote Patient Monitoring & Telemedicine: As telehealth adoption rises, IoT security ensures real-time data integrity and patient privacy, safeguarding medical information exchanged across connected devices.

- Protecting Connected Medical Devices: From insulin pumps to pacemakers, healthcare IoT security solutions prevent unauthorized access and cyberattacks on life-saving devices.

- Compliance with Data Protection Regulations: IoT security frameworks help healthcare organizations maintain HIPAA, GDPR, and other regulatory compliance, reducing legal risks while ensuring patient trust.

- AI & Blockchain-Enhanced Security: Advanced IoT security integrates AI for predictive threat detection and blockchain for tamper-proof data sharing, creating more resilient healthcare networks.

- Safeguarding Electronic Health Records (EHRs): Encryption, access control, and intrusion detection systems protect sensitive patient data during transmission and storage across healthcare ecosystems.

Market Dynamic

The healthcare enterprise may increasingly embrace emerging technologies like synthetic intelligence (AI) and blockchain to enhance security measures. This technology can complement IoT security efforts, supplying more robust protection against evolving threats to connected ecosystems such as

Smart Homes Systems and digital healthcare platforms.

The international healthcare AI security marketplace is undergoing dynamic variations shaped by using several key elements like the healthcare enterprise step by step adopting synthetic intelligence (AI) for numerous programs like diagnostics and customized medicine, there is a heightened demand for sturdy safety features to shield sensitive affected person data.

Explainability and transparency are crucial in AI algorithms that play a crucial position in healthcare choice-making approaches. The emphasis on making AI-driven insights understandable and verifiable is essential for constructing consider in the healthcare AI security panorama. Cybersecurity worries in healthcare have escalated, pushed by using the industry's attractiveness to cyberattacks because of valuable facts holdings.

Regulatory landscapes, notably guidelines like HIPAA, substantially influence the healthcare AI protection marketplace, necessitating compliance for strong data protection. As cyber threats evolve in sophistication, advanced persistent threats (APTs) and ransomware assault goal healthcare groups, propelling the development of AI safety solutions able to detect and mitigate these superior threats.

The integration of AI into Wearable Fitness trackers, connected medical devices, and healthcare IoT introduces new safety demands, emphasizing the need for a comprehensive approach to secure the entire environment. Collaborations between cybersecurity firms, AI solution providers, and healthcare organizations are on the rise, aiming to create tailored AI security solutions.

Driving Factors

The main driver of Healthcare IoT Security Market is its rapid adoption by healthcare settings of IoT devices that increase patient monitoring, diagnostics, and treatment efficiency while simultaneously creating vulnerabilities. Rising cyberattacks against healthcare organizations and stringent data protection regulations have resulted in the surged need for IoT security solutions.

Furthermore, with an ever-increasing use of remote patient monitoring,

Data Center technologies, and telemedicine, healthcare providers are prioritizing patient safety and data integrity—further driving market expansion through investments in advanced security technologies like encryption, authentication, and real-time threat detection.

Trending Factors

One notable trend in the Healthcare IoT Security Market is the increasing integration of artificial intelligence and machine learning (ML) technologies into security frameworks, which enhance threat detection and response by analyzing vast amounts of data in real time.

Furthermore, blockchain has gained ground as an innovative method for protecting IoT transactions while protecting data integrity; zero-trust security models have also proven useful against advanced threats; as healthcare organizations increasingly adopt interconnected devices, their focus on developing proactive, adaptive, scalable security solutions to protect sensitive patient information is growing ever stronger.

Restraining Factors

One major constraint in the Healthcare IoT Security Market is its high implementation and maintenance costs. Many healthcare organizations, particularly smaller ones, struggle to allocate sufficient budget for advanced cybersecurity measures.

Furthermore, lack of standardization among IoT devices creates vulnerabilities while limited awareness/expertise among healthcare professionals about IoT security further complicates integration; growing IoT ecosystem complexity combined with evolving cyber threats create ongoing difficulty when it comes to protecting healthcare IoT networks while adhering to stringent data protection regulations.

Opportunity

The Healthcare IoT Security Market presents huge potential with the rise in adoption of 5G technology and edge computing. These advances significantly expand IoT devices' connectivity and processing abilities, necessitating robust security frameworks. Emerging markets with rising IoT adoption and digital healthcare initiatives present security providers with unrealized potential.

Furthermore, remote healthcare services and wearable medical devices further heighten demand for advanced security solutions. Partnerships between technology firms and healthcare providers to co-develop tailored security systems, along with innovations in cloud-based security platforms, offer great potential in protecting the rapidly developing IoT landscape in healthcare.

Research Scope and Analysis

By Type

Based on type, network security asserts its dominance in this segment as it

holds 40.4% of the market share in 2023 and is projected to show subsequent growth in the upcoming years of 2023 to 2032. Network security dominates this segment as it is vital in safeguarding this flow, acting as a foundational defense layer for healthcare IT systems. Healthcare organizations heavily rely on seamless data transmission across various systems and departments.

Critical patient data, including electronic health records (EHRs), requires secure network access control. Network safety is crucial in monitoring and controlling get entry to, ensuring that simplest legal personnel can retrieve and update affected person facts. Patient privacy is paramount in healthcare. Network security features, like encryption and get right of entry to controls, make contributions to keeping confidentiality and stopping unauthorized get admission to to touchy patient data throughout transmission.

Network safety is fundamental in stopping and mitigating cyber-attacks focused on healthcare systems. Robust measures, inclusive of firewalls and intrusion detection systems, thwart threats like ransomware, malware, and phishing, ensuring the continuity of healthcare operations.

Additionally,

network security forms the foundation of an integrated security architecture in healthcare, working in tandem with other types like endpoint security and cloud security. This interconnected approach enhances the overall resilience of the healthcare AOT security framework.

By Product

In terms of products, solutions dominate this segment as they hold 73.1% of the market share in 2023 and are further projected to show subsequent growth in the forthcoming period of 2023 to 2032. solution’s dominance in this segment can be attributed to its vital role in meeting core security needs within healthcare organizations.

Elements such as Identity & Access Management, Data Encryption, Intrusion Detection Systems, and Device Authentication & Management are integral for protecting sensitive healthcare data because these products facilitate solving the challenges of healthcare information management; meeting critical security needs. Such dynamism of cyber threats requires technologically advanced solutions.

Advanced tools are needed for healthcare organizations that aim to resist the attacks on their systems, which have recently become much more sophisticated. Various solutions such as Intrusion Detection Systems are intended to quickly detect and respond to advanced threats. The technological depth of these solutions positions them as primary choices for organizations striving to stay ahead of the cybersecurity curve. Identity and Access Management and Data Encryption solutions directly tackle concerns related to data protection and privacy.

Solutions in the healthcare AOT security market often offer a holistic cybersecurity approach. Organizations in the healthcare sector often require tailored solutions that seamlessly integrate into their existing systems. Solutions like Identity & Access Management and Device Authentication & Management can be customized to align with specific workflows and technologies deployed in healthcare settings. This adaptability contributes to their dominance in this segment.

The Healthcare IOT Security Market Report is segmented on the basis of the following

By Type

- Network Security

- End-Point Security

- Content Security

- Application Security

- Cloud Security

By Product

- Solutions

- Identity & Access Management

- Data Encryption

- Intrusion Detection system

- Device Authentication & Management

- Others

- Services

- Professional services

- Managed Services

Regional Analysis

North America dominates the global healthcare IOT security market as it

holds 36.2% of the market share in 2023 and is expected to show significant growth in the forthcoming period of 2023 to 2032. North America asserts its dominance in the global healthcare Advanced Threat Protection (ATP) security market for compelling reasons.

The region has a well-developed economic infrastructure, particularly in the United States, which foresees substantial investments in healthcare, creating an environment ideal for adopting advanced security solutions.

This region fosters a high concentration of large healthcare organizations, research institutions, and pharmaceutical companies, that naturally drive the demand for cutting-edge ATP security measures. Moreover, North America leads in technological innovation, especially in healthcare, driving the increased adoption of advanced technologies like IoT devices and telemedicine.

This expansion of the attack surface further enhances the requirement for rapidly responsive security solutions. While North America's prominence is clear, ongoing global developments necessitate continuous monitoring of the healthcare ATP security market landscape.

By Region

North America

Europe

- Germany

- The U.K.

- France

- Italy

- Russia

- Spain

- Benelux

- Nordic

- Rest of Europe

Asia-Pacific

- China

- Japan

- South Korea

- India

- ANZ

- ASEAN

- Rest of Asia-Pacific

Latin America

- Brazil

- Mexico

- Argentina

- Colombia

- Rest of Latin America

Middle East & Africa

- Saudi Arabia

- UAE

- South Africa

- Israel

- Egypt

- Rest of MEA

Competitive Landscape

In the global healthcare IoT security market, these few leading drivers have a significant impact on driving trends for this sector. Some of the prominent leaders in this industry have incorporated vast experience and infrastructure, such as Cisco Systems, Inc., Symantec Corporation (now Broadcom Inc.), IBM Corporation McAfee, and FortinetInc.

In the meantime, companies such as Armis, CyberMDX, and Sensato Cybersecurity Solutions help innovate this particular market by introducing new technologies to it. McAfee, a well-recognized leader in cybersecurity and Fortinet—focusing on network security also adds to the competitive environment.

In this market, technological development is a significant factor since companies such as Armis focus mainly on IoT security, and CyberMDX together with Sensato specializes in healthcare cybersecurity and demonstrates innovative solutions. The global presence of each player, their partnerships and alliances, financial strength, and the size and diversity of their customer base further contribute to the intricate web that defines the competitive dynamics.

The evolving landscape of this market drives attention to recent developments, mergers, acquisitions, product launches, and other significant events enabling strategic decision-making in the rapidly evolving healthcare IoT security sector.

Some of the prominent players in the Global Healthcare IOT Security Market are

- Cisco Systems Inc.

- GE Healthcare Ltd.

- Google (Alphabet)

- International Business Machines Corporation

- Medtronic PLC

- Microsoft Corporation

- Proteus Digital Health

- Koninklijke Philips N.V.

- QUALCOMM Incorporated

- Abbot Laboratories

- Other Key Players

Recent Developments

- In December 2022, Palo Alto Networks recently announced Medical IoT Security, a comprehensive Zero Trust security solution designed to protect connected devices critical to patient care as the solution is recognized as a leader in the inaugural Frost RADAR. This security solution employs machine learning to enable healthcare organizations to create device rules with enhanced precision and ensure the security of medical devices in a connected environment.

- In July 2022, the acquisition of Stanley Security and Healthcare by Securitas was announced. The primary aim of Securitas from this takeover was to develop new security solutions using the acquired infrastructure.

- In June 2022, GE Healthcare's Portrait Mobile employs wearable sensors for remote patient monitoring, aiding early detection of deterioration.

Report Details

| Report Characteristics |

| Market Size (2023) |

USD 15.8 Bn |

| Forecast Value (2032) |

USD 105.7 Bn |

| CAGR (2023-2032) |

23.7% |

| Historical Data |

2018 – 2023 |

| Forecast Data |

2024 – 2033 |

| Base Year |

2023 |

| Estimate Year |

2024 |

| Report Coverage |

Market Revenue Estimation, Market Dynamics, Competitive Landscape, Growth Factors and etc. |

| Segments Covered |

By Type (Network Security, End-Point Security, Content Security, Application Security and Cloud Security), By Product (Solutions and Services) |

| Regional Coverage |

North America – The US and Canada; Europe – Germany, The UK, France, Russia, Spain, Italy, Benelux, Nordic, & Rest of Europe; Asia- Pacific– China, Japan, South Korea, India, ANZ, ASEAN, Rest of APAC; Latin America – Brazil, Mexico, Argentina, Colombia, Rest of Latin America; Middle East & Africa – Saudi Arabia, UAE, South Africa, Turkey, Egypt, Israel, & Rest of MEA |

| Prominent Players |

Cisco Systems Inc., GE Healthcare Ltd., Google (Alphabet), International Business Machines Corporation, Medtronic PLC, Microsoft Corporation, Proteus Digital Health, Koninklijke Philips N.V., QUALCOMM Incorporated, Abbott Laboratories, and Other Key Players. |

| Purchase Options |

We have three licenses to opt for: Single User License (Limited to 1 user), Multi-User License (Up to 5 Users), and Corporate Use License (Unlimited User) along with free report customization equivalent to 0 analyst working days, 3 analysts working days and 5 analysts working days respectively. |

Frequently Asked Questions

The Global Healthcare IOT Security Market size is estimated to be USD 15.8 billion in 2023 and is

expected to reach USD 105.7 billion by the end of 2032.

North America has the largest market share for the Global Healthcare IOT Security Market with a share

of about 36.2% in 2023.

Some of the major key players in the Global Healthcare IOT Security Market are Cisco Systems Inc., GE

Healthcare Ltd., Google (Alphabet), International Business Machines Corporation, Medtronic PLC, and

many others.

The Healthcare IOT Security market is growing at a CAGR of 23.7% over the forecasted period.