Market Overview

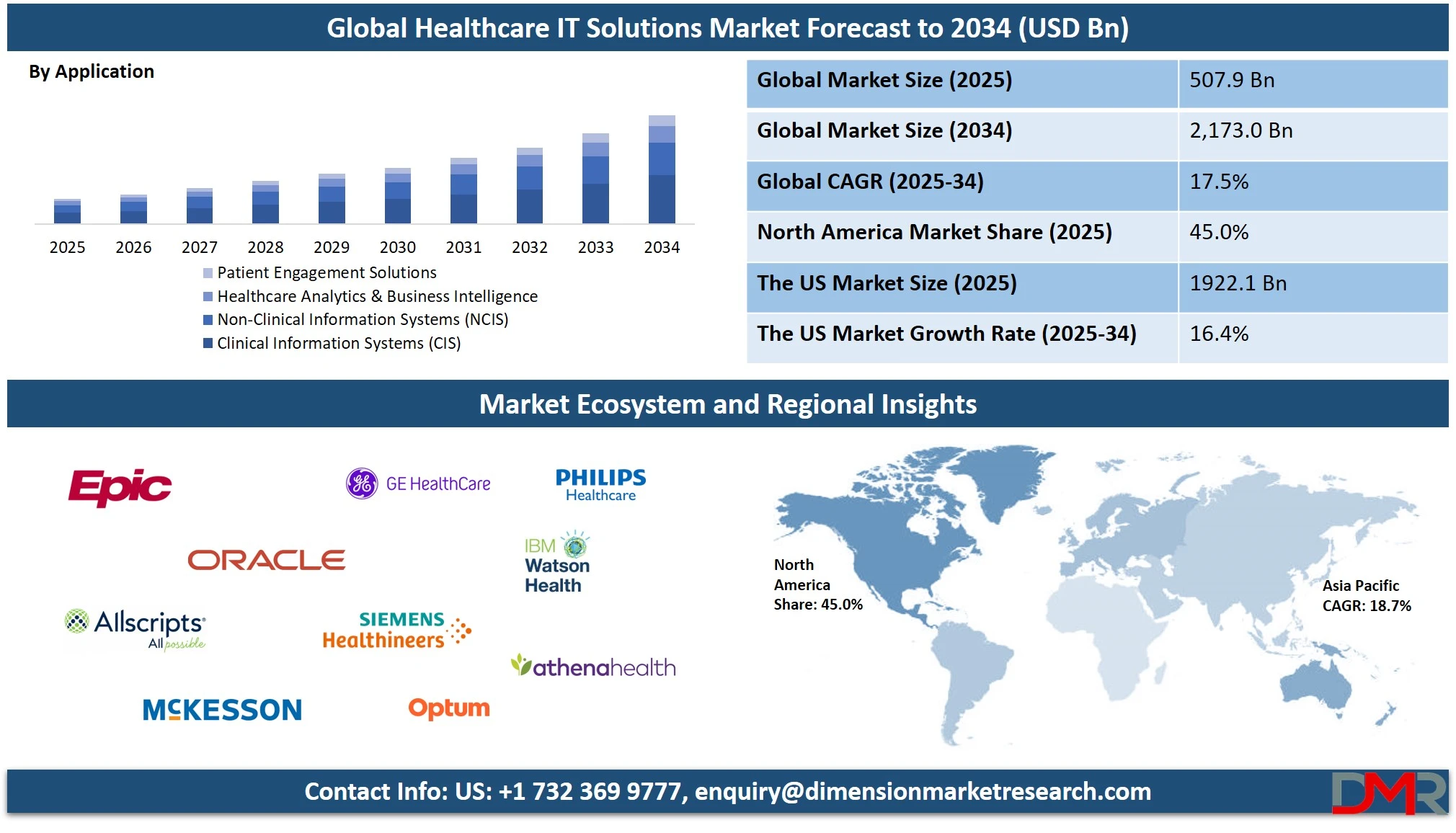

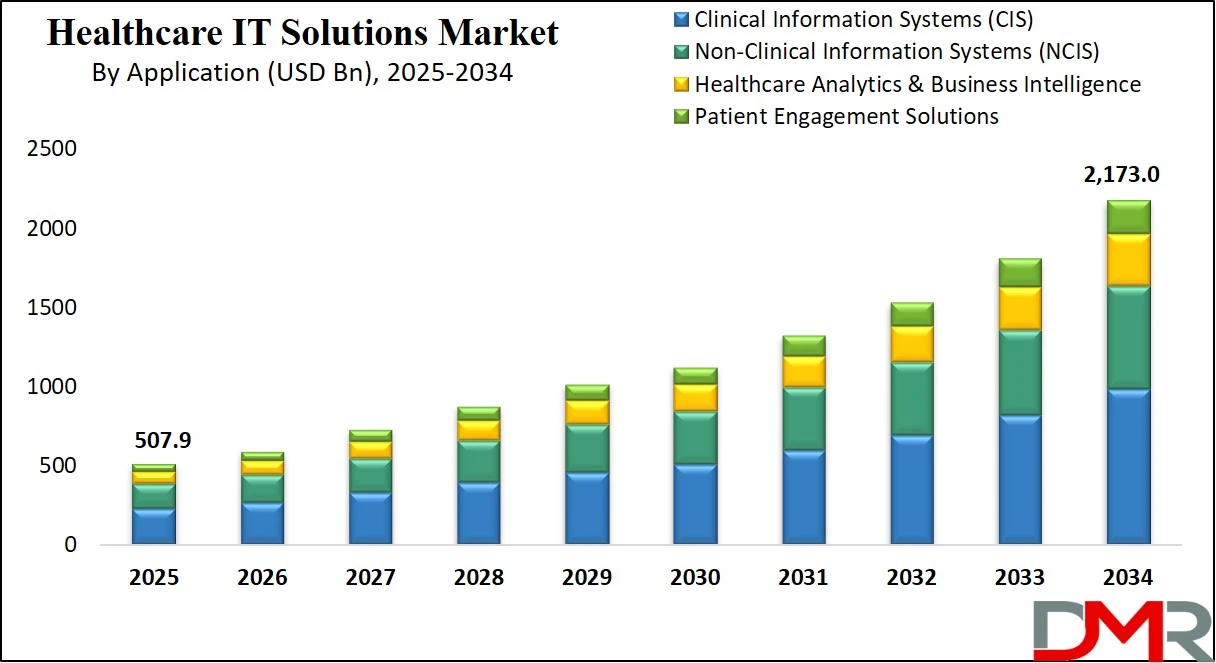

The global healthcare IT solutions market is projected to reach USD 507.9 billion in 2025 and is expected to grow to USD 2,173.0 billion by 2034, expanding at a CAGR of 17.5%. This growth is driven by rising demand for digital health platforms, EHR systems, telehealth services, healthcare analytics, and cloud-based health IT infrastructure.

ℹ

To learn more about this report –

Download Your Free Sample Report Here

Healthcare IT solutions encompass a wide range of technologies and services designed to enhance the delivery, efficiency, and management of healthcare services through digital means. These solutions integrate various software, hardware, and IT-enabled services to support clinical, administrative, and operational tasks within healthcare systems.

They include electronic health records, telemedicine platforms, clinical decision support systems, healthcare analytics, revenue cycle management, and patient engagement tools. By enabling real-time access to data, improving communication among providers, and automating routine processes, healthcare IT plays a crucial role in streamlining patient care, reducing errors, and ensuring regulatory compliance. These technologies also contribute significantly to personalized medicine, remote monitoring, and health information exchange across providers.

ℹ

To learn more about this report –

Download Your Free Sample Report Here

The global healthcare IT solutions market represents a rapidly expanding sector fueled by technological advancements, rising healthcare expenditures, and the growing demand for digital health infrastructure. With governments and private sectors emphasizing digital transformation in healthcare systems, the market has witnessed a surge in the adoption of cloud-based solutions, artificial intelligence in diagnostics, and integrated health information systems. The need to manage large volumes of patient data securely, along with growing concerns about improving patient outcomes, has driven hospitals, clinics, and other providers toward adopting comprehensive health IT systems.

Furthermore, emerging economies are experiencing accelerated adoption of healthcare IT due to improved internet penetration, mobile health trends, and rising awareness of telehealth benefits. The growing geriatric population, growing prevalence of chronic diseases, and the necessity for cost-efficient healthcare delivery models are further shaping the market landscape.

Companies in this domain are investing heavily in innovation and strategic partnerships to offer scalable, interoperable, and regulatory-compliant digital solutions tailored for both developed and developing regions. As a result, the global healthcare IT market is poised for sustained growth, with expanding applications across clinical informatics, operational management, and patient engagement solutions.

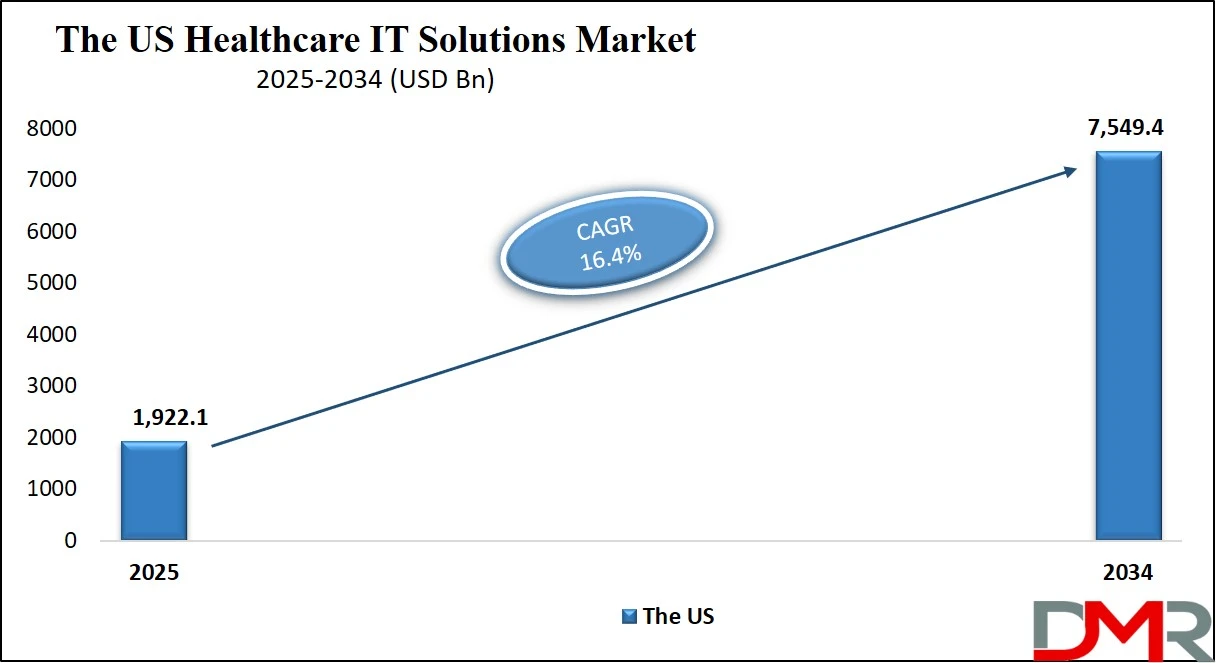

The US Healthcare IT Solutions Market

The U.S. Healthcare IT Solutions market size is projected to be valued at USD 1,922.1 billion by 2025. It is further expected to witness subsequent growth in the upcoming period, holding USD 7,549.4 billion in 2034 at a CAGR of 16.4%.

ℹ

To learn more about this report –

Download Your Free Sample Report Here

The United States healthcare IT solutions market stands as the most mature and technologically advanced globally, driven by strong federal initiatives, widespread adoption of electronic health records (EHR), and significant investment in digital health infrastructure. Regulatory mandates such as the Health Information Technology for Economic and Clinical Health (HITECH) Act and the 21st Century Cures Act have played a pivotal role in encouraging healthcare providers to adopt interoperable health IT systems.

The presence of a robust network of hospitals, health insurance providers, and advanced clinical settings has accelerated the deployment of integrated healthcare IT platforms, including revenue cycle management (RCM), patient engagement systems, clinical decision support tools, and telemedicine technologies. The growing need for accurate clinical documentation, medical data interoperability, and administrative automation further supports the digital transformation across the U.S. healthcare ecosystem.

Moreover, the U.S. market is witnessing rapid advancements in artificial intelligence (AI)-powered diagnostics, healthcare cybersecurity, remote patient monitoring, and population health management (PHM). Increased focus on value-based care, data-driven medical decision-making, and personalized treatment is pushing healthcare organizations to invest in real-time data analytics and cloud-based health IT platforms.

The demand for seamless health information exchange (HIE), wearable medical devices integration, and secure patient portals is also on the rise, fostering innovations in digital health infrastructure. With strong government support, a highly digitalized payer-provider ecosystem, and a tech-savvy patient population, the U.S. remains a dominant force in shaping the global healthcare IT landscape.

Europe Healthcare IT Solutions Market

Europe is expected to account for approximately USD 111.7 billion of the global healthcare IT solutions market in 2025. This substantial market presence is fueled by strong government initiatives aimed at digitizing healthcare systems, such as the European Health Data Space (EHDS) and national eHealth programs across countries like Germany, France, and the Netherlands.

The region’s emphasis on interoperability, data privacy under GDPR, and secure health information exchange is encouraging healthcare providers to invest heavily in electronic health records (EHR), telemedicine platforms, and clinical decision support systems. Additionally, the rise in chronic disease burden, an aging population, and growing demand for integrated care are driving the adoption of digital platforms across the public and private healthcare sectors.

Looking ahead, the European healthcare IT market is projected to grow at a healthy CAGR of 15.8% from 2025 to 2034. This growth trajectory is supported by growing investments in AI-powered health analytics, cloud-based solutions, and population health management systems. The push toward value-based care and precision medicine is further accelerating the demand for advanced IT infrastructure that supports predictive modeling and personalized treatment planning.

Moreover, cross-border health initiatives within the EU are fostering the development of interoperable platforms, encouraging vendor competition, and ensuring better patient outcomes through seamless access to medical data across member states. With a combination of strong policy support, innovation in digital health, and rising consumer expectations, Europe is poised to remain a vital growth hub in the global healthcare IT solutions market.

Japan Healthcare IT Solutions Market

Japan is projected to hold a market share of approximately USD 25.4 billion in the global healthcare IT solutions market in 2025. This market size is underpinned by Japan’s urgent need to modernize its healthcare infrastructure, particularly in response to its rapidly aging population and growing burden of chronic diseases.

Hospitals and clinics are progressively adopting electronic medical records (EMR), clinical information systems, and diagnostic imaging software to improve care delivery and administrative efficiency. Government initiatives such as the “Digital Garden City Nation” and health data standardization policies are pushing forward digital transformation across medical institutions. Additionally, the country's strong technology base and skilled workforce support the integration of healthcare IT with robotics, AI, and automated medical devices.

With a forecasted CAGR of 13.2% from 2025 to 2034, Japan’s healthcare IT market is expected to grow steadily over the coming decade. The growth will be driven by expanding telemedicine adoption, increased investments in health data analytics, and the rising use of cloud-based solutions among small and mid-sized healthcare providers.

Moreover, Japan’s Ministry of Health, Labour and Welfare is actively promoting the digitization of public health records and nationwide data interoperability, which is encouraging hospitals to shift away from legacy systems.

The demand for patient engagement platforms, population health management tools, and AI-enabled clinical decision support is also on the rise, as providers seek to improve both patient outcomes and operational efficiency. These combined forces position Japan as one of the most promising digital health markets in the Asia-Pacific region.

Global Healthcare IT Solutions Market: Key Takeaways

- Market Value: The global healthcare IT solutions market size is expected to reach a value of USD 2,173.0 billion by 2034 from a base value of USD 507.9 billion in 2025 at a CAGR of 17.5%.

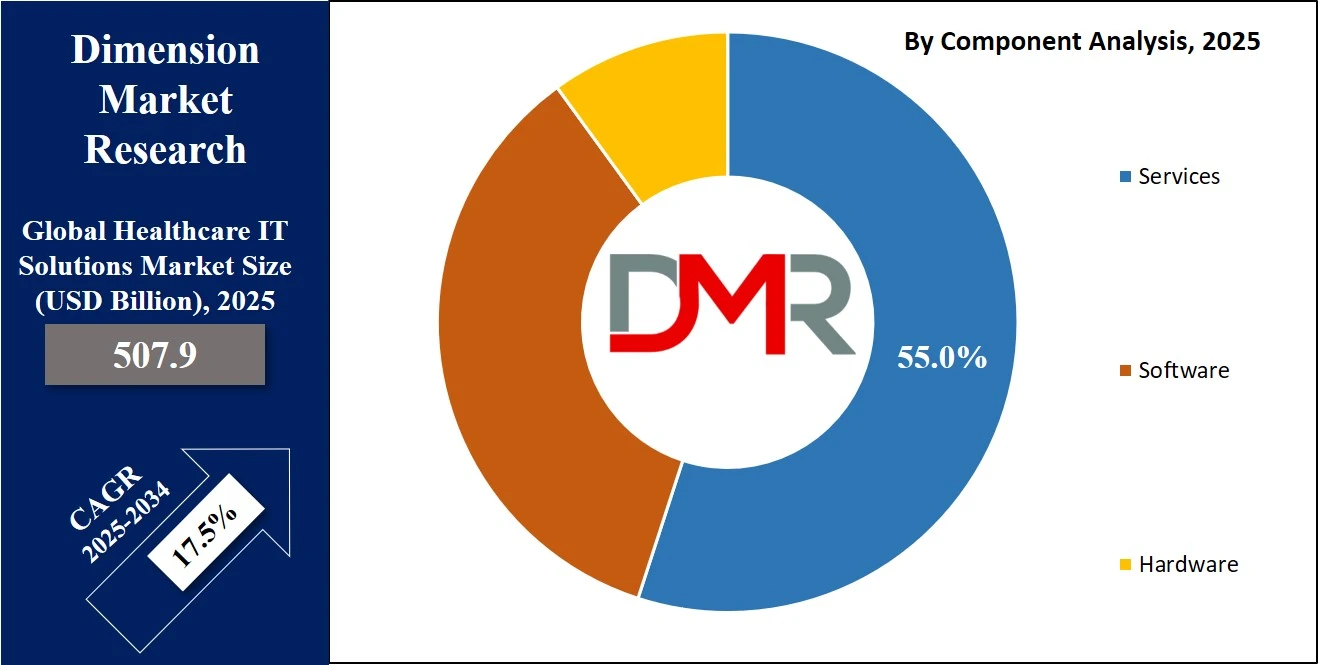

- By Component Segment Analysis: Services are anticipated to dominate the component segment, capturing 55.0% of the total market share in 2025.

- By Solution Type Segment Analysis: Electronic Health Records (EHR) are expected to maintain their dominance in the solution type segment, capturing 24.0% of the total market share in 2025.

- By Deployment Mode Segment Analysis: Cloud-based mode is poised to consolidate its dominance in the deployment mode segment, capturing 54.0% of the market share in 2025.

- By Application Segment Analysis: Clinical Information Systems (CIS) will dominate the application segment, capturing 45.0% of the market share in 2025.

- By End User Segment Analysis: Hospitals & Clinics are expected to consolidate their dominance in the end user segment, capturing 48.0% of the market share in 2025.

- Regional Analysis: North America is anticipated to lead the global healthcare IT solutions market landscape with 45.0% of total global market revenue in 2025.

- Key Players: Some key players in the global healthcare IT solutions market are Epic Systems, Cerner (Oracle Health), Allscripts, McKesson, GE HealthCare, Siemens Healthineers, Philips, IBM Watson Health, Optum, Athenahealth, Meditech, eClinicalWorks, NextGen Healthcare, and Others.

Global Healthcare IT Solutions Market: Use Cases

- Electronic Health Record (EHR) Integration for Clinical Workflow Optimization: Healthcare providers globally are leveraging EHR systems to streamline clinical documentation and enhance workflow efficiency. In hospitals and multispecialty clinics, EHR platforms allow physicians to access patient histories, lab results, imaging reports, and medication data from a centralized interface. For example, Epic Systems and Cerner offer EHR software with built-in clinical decision support tools that help reduce medical errors and improve patient safety. These systems also enable automated scheduling, order entry, and discharge summaries, thus minimizing administrative burden. With increased demand for care coordination and regulatory compliance, especially under frameworks like value-based care, EHR adoption continues to be a fundamental healthcare IT solution. Enhanced data interoperability and real-time record access have further improved cross-provider communication and patient outcomes.

- Telemedicine and Remote Patient Monitoring in Rural and Underserved Regions: Telehealth platforms have become essential in bridging the healthcare access gap, particularly in remote and underserved areas. With the integration of healthcare IT tools such as video consultation software, digital diagnostics, and remote patient monitoring devices, patients can receive continuous care without traveling to urban hospitals. Companies like Philips and Teladoc Health offer cloud-based telemedicine platforms that integrate with EHR systems to ensure a consistent flow of health data. These systems are particularly valuable for managing chronic conditions like diabetes, hypertension, and heart failure. Through connected care solutions, wearable health devices, and mobile apps, providers can monitor vital signs, medication adherence, and symptom progression in real-time. This use case highlights the growing demand for mHealth, virtual care solutions, and home-based healthcare IT technologies.

- Healthcare Analytics and Predictive Modeling for Population Health Management: Health systems are increasingly adopting advanced healthcare analytics platforms to gain actionable insights from large datasets. These solutions support population health management by identifying at-risk patients, predicting disease outbreaks, and optimizing treatment plans. For instance, IBM Watson Health and Optum provide AI-driven analytics tools that integrate with claims data, EHRs, and social determinants of health to generate risk scores and predictive insights. Public health organizations and payers use these platforms to design targeted intervention programs and reduce hospital readmission rates. With the rise in chronic disease burden and the need for cost-effective care, predictive analytics and big data in healthcare have become key components of digital health transformation. This use case demonstrates how IT solutions are enabling data-driven strategies to enhance public health outcomes and resource planning.

- Revenue Cycle Management (RCM) Automation for Financial Efficiency: Revenue cycle management systems are widely used by hospitals and private practices to automate financial workflows, from patient registration to claims processing and reimbursement. Solutions offered by providers like Athenahealth and NextGen Healthcare include automated coding, billing, and insurance verification tools that reduce manual errors and accelerate cash flow. These platforms also help comply with insurance regulations and payer requirements by providing real-time eligibility checks and denial management. The integration of RCM systems with EHR platforms ensures accuracy in clinical and billing data, enabling seamless reimbursement cycles. With growing pressure to improve operational margins and reduce administrative costs, healthcare financial management software, medical billing automation, and claims analytics platforms are critical in maintaining financial sustainability in modern healthcare environments.

Impact of Artificial Intelligence on Healthcare IT Solutions Market

Artificial Intelligence (AI) is transforming the healthcare IT solutions market by enabling smarter, faster, and more personalized care delivery. From enhancing diagnostic accuracy to optimizing administrative operations, AI technologies are deeply integrated into modern health IT ecosystems.

Machine learning algorithms, natural language processing (NLP), and predictive analytics are being deployed across a range of healthcare applications, most notably in clinical decision support systems (CDSS), radiology image analysis, patient risk stratification, and virtual health assistants. These AI-powered tools are improving diagnostic speed and accuracy, reducing human error, and allowing clinicians to make evidence-based decisions with confidence.

In addition to clinical applications, AI significantly boosts operational and financial efficiency through automation of routine processes such as medical coding, appointment scheduling, claims processing, and revenue cycle management. Predictive AI models also help healthcare organizations manage population health by identifying high-risk patients, forecasting disease outbreaks, and optimizing resource allocation.

Furthermore, AI enhances patient engagement through intelligent chatbots, symptom checkers, and personalized health recommendations. With the growing need for cost containment, improved outcomes, and real-time data analysis, AI is becoming a cornerstone of innovation in healthcare IT solutions. As AI adoption accelerates, it is expected to reshape the global digital health landscape, driving demand for interoperable, cloud-based, and AI-ready IT infrastructure across providers and payers.

Global Healthcare IT Solutions Market: Stats & Facts

U.S. Department of Health and Human Services / ONC (National Trends in Hospital & Physician EHR Adoption)

- 2021: 96% of U.S. non-federal acute care hospitals had adopted a certified EHR system

- 2023: 88% of U.S. office-based physicians had adopted some form of EHR

OECD / 2021 eHealth Survey of 27 Countries

- 2021: Only 15 out of 27 OECD countries had a nationally unified EHR system

- 2021: 24 of 27 OECD countries had adopted a minimum core health data set for standardized electronic health records

European Commission / European Health Data Space (EHDS) Regulation

- March 2025: Regulation (EU) 2025/327 on EHDS was published in the Official Journal

- March 2025: EHDS entered into force on 26 March 2025, mandating EHR interoperability across EU member states

Japan Ministry of Health, Labour and Welfare / PeOPLe Platform

- 2020: PeOPLe digital health platform launched, integrating lifetime health and insurance data via unique identifiers

- 2025: Platform operational as a foundational national infrastructure for healthcare interoperability in Japan

U.S. HITECH Act & CMS / FHIR Mandates

- 2014: U.S. hospital EHR adoption rose from 10% to ~70% following HITECH meaningful use requirements

- 2021: CMS interoperability rule under the 21st Century Cures Act required payers to implement FHIR APIs for patient access and payer-to-payer exchange

WHO-backed Surveys & European Commission Studies on GP eHealth

- 2013: Up to nearly 100% of GPs in Estonia, Denmark, Croatia, Sweden, and Iceland used e-prescription systems

- 2013: High GP uptake of cross-provider patient data exchange in northern European countries like Finland and Iceland

Canada Health Infoway (Government-funded Digital Health Agency)

- 2018: Canada allocated CAD 2.45 billion to accelerate national EHR adoption and digital service integration

- 2018: Approximately 85% of primary care providers in Canada had implemented electronic medical records

Global Healthcare IT Solutions Market: Market Dynamics

Global Healthcare IT Solutions Market: Driving Factors

Rising Adoption of Digital Health Technologies across Healthcare Providers

The growing implementation of digital health tools such as electronic medical records (EMR), telemedicine platforms, and health information exchanges (HIE) is a major driver fueling market growth. Hospitals, clinics, and ambulatory care centers are leveraging these technologies to streamline patient care, reduce clinical errors, and enhance provider collaboration. With the growing need for integrated care delivery and data-driven decision-making, healthcare IT systems are now essential for improving care coordination and clinical workflow automation.

Government Initiatives and Regulatory Push for EHR Implementation

Governments around the world, especially in developed economies like the United States and the United Kingdom, are promoting the use of health IT through regulatory frameworks and funding support. Programs such as the HITECH Act, HIPAA, and the NHS Digital Transformation Plan encourage healthcare providers to adopt interoperable EHR systems and maintain health data compliance. This policy-driven momentum is accelerating the deployment of secure and standardized IT infrastructure across both public and private healthcare institutions.

Global Healthcare IT Solutions Market: Restraints

High Implementation Costs and Budget Constraints in Emerging Markets

Despite the long-term benefits, the initial cost of deploying healthcare IT solutions, especially enterprise-level systems like PACS, RCM platforms, and AI-powered analytics, remains a major hurdle for small to mid-sized facilities and hospitals in developing countries. The financial burden of system integration, staff training, infrastructure upgrades, and ongoing technical support can be overwhelming, slowing down digital transformation in price-sensitive markets.

Concerns around Data Privacy, Cybersecurity, and Interoperability

As the volume of sensitive patient data grows, so do concerns related to health data breaches, unauthorized access, and regulatory non-compliance. Interoperability challenges between disparate systems further complicate the secure exchange of medical records. Ensuring compliance with standards like GDPR, HIPAA, and HL7 while maintaining data integrity and security is a constant struggle for healthcare IT vendors and providers alike.

Global Healthcare IT Solutions Market: Opportunities

Expanding Telehealth and Remote Diagnostics in Rural Healthcare

The increased acceptance of telehealth and remote patient monitoring systems, especially post-pandemic, presents a massive opportunity for healthcare IT vendors. Telemedicine platforms integrated with EHRs and mobile health (mHealth) apps are empowering care delivery in rural and underserved regions where access to hospitals is limited. This shift creates demand for scalable, cloud-based digital health platforms that support real-time virtual care, remote diagnostics, and patient engagement.

Growing Demand for AI-Powered Clinical Decision Support Systems

As healthcare organizations move toward predictive and personalized medicine, the adoption of AI-enabled clinical decision support systems (CDSS) is accelerating. These tools can analyze vast amounts of patient data to assist in early diagnosis, treatment planning, and clinical risk assessment. The growing reliance on advanced data analytics and AI in healthcare creates new growth avenues for IT vendors specializing in smart health systems, deep learning algorithms, and precision medicine tools.

Global Healthcare IT Solutions Market: Trends

Shift toward Cloud-Based and Interoperable Healthcare Platforms

One of the most significant trends is the move from legacy on-premise systems to flexible, cloud-based health IT infrastructure. These solutions offer scalability, lower maintenance costs, and enhanced data access from multiple devices. The focus is now on building interoperable platforms that support seamless communication between hospitals, labs, payers, and pharmacies, fostering connected care ecosystems.

Rising Use of Mobile Health (mHealth) and Wearable Technology Integration

With patients becoming more tech-savvy, there is a surge in demand for mHealth apps and wearable devices that integrate with health IT systems. Fitness trackers, smartwatches, and remote monitoring tools are now generating real-time health data that can be analyzed by healthcare providers for proactive intervention. This trend is driving innovation in patient-centric healthcare models and expanding the role of consumer health technologies in mainstream clinical practice.

Global Healthcare IT Solutions Market: Research Scope and Analysis

By Component Analysis

In the component segment of the healthcare IT solutions market, services are expected to dominate with an estimated 55.0% share of the total market in 2025. This dominance is largely attributed to the growing need for implementation, integration, training, support, and maintenance services that accompany the deployment of complex healthcare IT systems.

As hospitals, clinics, and other healthcare facilities increasingly adopt digital platforms such as electronic health records, telemedicine systems, and healthcare analytics tools, the demand for skilled professionals and ongoing technical support rises significantly.

Service providers play a crucial role in ensuring seamless system integration, regulatory compliance, user training, and continuous upgrades, making this segment essential to the success of any health IT deployment. Additionally, the complexity of interoperability, cybersecurity concerns, and evolving government regulations has led to a strong reliance on third-party vendors and consultants, further boosting the services segment.

On the other hand, the software segment also holds a substantial share of the market and is expected to witness steady growth. This segment includes a wide range of solutions such as electronic medical records (EMR), revenue cycle management (RCM), healthcare customer relationship management (CRM), population health management (PHM), and clinical decision support systems (CDSS).

The demand for healthcare software is being driven by the need to streamline administrative processes, enhance clinical workflow, improve data analytics capabilities, and provide more personalized patient care. With advancements in artificial intelligence, cloud computing, and mobile technologies, healthcare software is evolving rapidly to support predictive modeling, telehealth integration, and real-time health data exchange. As digital transformation continues to reshape healthcare delivery, software solutions remain central to operational efficiency and better clinical outcomes.

ℹ

To learn more about this report –

Download Your Free Sample Report Here

By Solution Type Analysis

In the solution type segment of the healthcare IT solutions market, electronic health records (EHR) are projected to retain their leading position, accounting for approximately 24.0% of the total market share in 2025.

EHR systems have become the backbone of digital healthcare infrastructure, offering a centralized and digitized repository of patient health information. Their ability to streamline clinical documentation, reduce medical errors, and improve overall care coordination has made them indispensable for hospitals, clinics, and ambulatory care centers.

The widespread adoption of EHR systems is further fueled by regulatory mandates, such as those promoting meaningful use and data interoperability standards, which encourage healthcare providers to digitize patient records and ensure secure information exchange.

The integration of advanced features such as clinical decision support, e-prescribing, and telehealth compatibility has also expanded the functional scope of EHR platforms, enhancing both administrative efficiency and clinical accuracy.

Meanwhile, healthcare analytics is rapidly emerging as one of the most dynamic and transformative segments within the healthcare IT ecosystem. This solution type leverages big data, artificial intelligence, and machine learning to extract actionable insights from vast volumes of clinical, operational, and financial data. Healthcare analytics tools are being used to support population health management, optimize treatment pathways, forecast disease trends, and monitor healthcare performance metrics.

As value-based care models gain traction, providers are increasingly relying on predictive analytics to identify at-risk patients, prevent readmissions, and enhance patient outcomes. Furthermore, healthcare payers and public health agencies use analytics to drive strategic planning, cost control, and policy formulation. The rising demand for real-time data visualization, risk assessment, and decision-making support continues to fuel the growth of healthcare analytics as a core component of digital health transformation.

By Deployment Mode Analysis

In the deployment mode segment of the healthcare IT solutions market, cloud-based systems are projected to solidify their dominance by capturing 54.0% of the market share in 2025. This growth is largely driven by the scalability, flexibility, and cost-efficiency offered by cloud-based platforms.

Healthcare providers are increasingly adopting cloud solutions to streamline data storage, enable remote access, and support real-time collaboration across multiple care settings. Cloud-based deployment also facilitates faster implementation of updates, stronger disaster recovery options, and seamless integration with mobile health and telemedicine platforms.

Moreover, as healthcare organizations expand their digital infrastructure to accommodate growing volumes of patient data and analytics needs, cloud technology proves to be a practical and future-ready choice. The shift toward value-based care, interoperability, and collaborative healthcare ecosystems further accelerates the demand for secure, HIPAA-compliant cloud-based health IT systems.

On the other hand, the on-premise deployment mode continues to serve healthcare facilities that require complete control over their IT infrastructure, particularly when handling highly sensitive patient data. On-premise solutions are often favored by large hospitals, specialty clinics, and government health agencies that prioritize internal data governance, customized configurations, and direct oversight of system security.

While the upfront investment and maintenance costs are typically higher than cloud models, on-premise deployments offer enhanced control over hardware, network environments, and compliance protocols. These systems are particularly suitable in regions where data localization laws are strict or where cloud infrastructure is less developed. Despite the growing trend toward cloud adoption, on-premise deployment remains relevant for organizations with specific security, regulatory, or performance needs that necessitate in-house IT management.

By Application Analysis

In the application segment of the healthcare IT solutions market, clinical information systems (CIS) are expected to dominate by capturing 45.0% of the total market share in 2025. These systems play a crucial role in enhancing patient care by supporting core clinical functions such as electronic health records, computerized physician order entry, e-prescribing, and clinical decision support.

CIS platforms are designed to improve diagnostic accuracy, streamline clinical workflows, and enable real-time access to patient data for physicians, nurses, and specialists. Their integration across departments like radiology, laboratory, and pharmacy ensures that critical medical information is readily available, which enhances coordination and reduces the likelihood of errors. The growing demand for data-driven treatment planning, personalized care, and improved clinical outcomes continues to fuel the widespread adoption of clinical information systems in hospitals and specialty care facilities.

In parallel, non-clinical information systems (NCIS) also represent a vital segment within healthcare IT, focusing on the operational, financial, and administrative aspects of healthcare delivery. These systems include revenue cycle management, supply chain management, human resource management, and healthcare customer relationship management solutions. NCIS platforms help healthcare organizations automate billing, manage appointments, track inventory, and improve overall facility operations.

As providers face growing pressure to improve cost-efficiency and meet compliance requirements, the role of non-clinical systems in streamlining back-end functions becomes increasingly significant. These solutions not only support organizational productivity but also contribute indirectly to patient satisfaction by ensuring that healthcare services are delivered in a timely and well-coordinated manner. The integration of NCIS with clinical systems further enhances hospital performance by creating a seamless flow of both clinical and administrative data.

By End User Analysis

In the end-user segment of the healthcare IT solutions market, hospitals and clinics are projected to maintain their dominant position by capturing 48.0% of the total market share in 2025. These institutions are the primary adopters of healthcare IT systems due to their extensive need for clinical documentation, patient data management, and care coordination.

With the growing pressure to improve patient outcomes, reduce operational costs, and comply with evolving healthcare regulations, hospitals and clinics are investing heavily in solutions such as electronic health records, telemedicine platforms, clinical decision support systems, and patient engagement tools.

The integration of these technologies allows for streamlined workflows, faster diagnosis, enhanced communication among departments, and better resource utilization. As the volume of patient data continues to grow, the role of healthcare IT in supporting efficient, data-driven clinical environments becomes even more essential for hospitals and outpatient care facilities globally.

Healthcare payers, including insurance companies and third-party administrators, also represent a significant segment within the healthcare IT ecosystem. These organizations utilize IT solutions primarily for claims management, fraud detection, customer relationship management, and population health analytics.

As value-based care models become more prevalent, payers are increasingly relying on healthcare analytics, data integration platforms, and interoperability tools to gain deeper insights into patient risk profiles, care quality metrics, and cost trends. By leveraging advanced IT systems, healthcare payers can automate routine processes, improve member services, and ensure faster reimbursement cycles.

Additionally, the use of predictive analytics and AI-driven tools enables insurers to better manage care coordination, chronic disease trends, and resource planning. The growing emphasis on cost transparency, regulatory compliance, and data-driven decision-making continues to strengthen the role of healthcare payers in driving IT adoption across the broader health ecosystem.

The Healthcare IT Solutions Market Report is segmented based on the following:

By Component

- Services

- Software

- Hardware

By Solution Type

- Electronic Health Records (EHR)

- Healthcare Analytics

- Telehealth / Telemedicine

- Revenue Cycle Management (RCM)

- Population Health Management (PHM)

- e-Prescribing Systems

- Picture Archiving and Communication System (PACS)

- Laboratory Information Systems (LIS)

- Other Solutions

By Deployment Mode

- Cloud-based

- On-premise

- Web-based (Hybrid)

By Application

- Clinical Information Systems (CIS)

- Non-Clinical Information Systems (NCIS)

- Healthcare Analytics & Business Intelligence

- Patient Engagement Solutions

By End User

- Hospitals & Clinics

- Healthcare Payers

- Diagnostic & Imaging Centers

- Pharmacies

- Other End Users

Global Healthcare IT Solutions Market: Regional Analysis

Region with the Largest Revenue Share

North America is expected to lead the global healthcare IT solutions market in 2025, accounting for approximately 45.0% of the total market revenue. This dominance is driven by a well-established digital health infrastructure, widespread adoption of electronic health records, and strong regulatory frameworks such as HIPAA and the HITECH Act that mandate healthcare data interoperability and security.

The region benefits from significant government funding, advanced healthcare facilities, and the presence of major industry players offering innovative health IT platforms. Additionally, the growing focus on value-based care, personalized medicine, and integration of artificial intelligence and cloud technologies further supports the rapid adoption of healthcare IT across hospitals, clinics, and payer organizations in the United States and Canada.

ℹ

To learn more about this report –

Download Your Free Sample Report Here

Region with significant growth

The Asia Pacific region is projected to witness the most significant growth in the global healthcare IT solutions market over the forecast period. This surge is fueled by rapid digitization of healthcare systems, rising government investments in eHealth initiatives, and the growing adoption of telemedicine and mobile health technologies across countries like China, India, Japan, and South Korea.

Expanding healthcare infrastructure, a growing population with rising chronic disease prevalence, and improved internet penetration are driving demand for scalable, cloud-based healthcare IT solutions. Additionally, the growing focus on data interoperability, AI-driven diagnostics, and public-private partnerships in healthcare modernization further positions Asia Pacific as a key growth hub in the global digital health landscape.

By Region

North America

Europe

- Germany

- The U.K.

- France

- Italy

- Russia

- Spain

- Benelux

- Nordic

- Rest of Europe

Asia-Pacific

- China

- Japan

- South Korea

- India

- ANZ

- ASEAN

- Rest of Asia-Pacific

Latin America

- Brazil

- Mexico

- Argentina

- Colombia

- Rest of Latin America

Middle East & Africa

- Saudi Arabia

- UAE

- South Africa

- Israel

- Egypt

- Rest of MEA

Global Healthcare IT Solutions Market: Competitive Landscape

The global competitive landscape of the healthcare IT solutions market is characterized by the presence of both established technology giants and specialized health IT vendors competing to expand their market footprint through innovation, strategic partnerships, and acquisitions. Companies such as Epic Systems, Cerner (Oracle Health), Philips Healthcare, GE HealthCare, and IBM Watson Health dominate the market with comprehensive solutions spanning electronic health records, clinical decision support, and integrated care platforms.

Meanwhile, firms like Optum, Allscripts, Athenahealth, and Meditech are strengthening their positions by focusing on cloud-based deployments, AI integration, and interoperability enhancements. The competitive dynamics are further intensified by the entry of IT service providers like Accenture, Infosys, TCS, and Wipro, offering tailored digital transformation services to healthcare organizations. With rising demand for patient-centric care, data security, and real-time analytics, companies are increasingly investing in R&D and global expansion to address evolving customer needs and regulatory landscapes across diverse regions.

Some of the prominent players in the global healthcare IT solutions market are:

- Epic Systems Corporation

- Cerner Corporation (Oracle Health)

- Allscripts Healthcare Solutions

- McKesson Corporation

- GE HealthCare

- Siemens Healthineers

- Philips Healthcare

- IBM Watson Health

- Optum (UnitedHealth Group)

- Athenahealth

- Meditech

- eClinicalWorks

- NextGen Healthcare

- Dell Technologies

- Cognizant Technology Solutions

- Accenture

- Infosys

- Tata Consultancy Services (TCS)

- Wipro

- Fujitsu Ltd.

- Other Key Players

Global Healthcare IT Solutions Market: Recent Developments

- August 2025: United Imaging unveiled new multi-modality imaging solutions and software targeting provider success at the AHRA 2025 conference. The launch features AI-enhanced imaging workflows designed for medical imaging management professionals.

- July 2025: Samsung Electronics acquired U.S.-based healthcare platform Xealth to enhance its digital health ecosystem and integrate its wearable devices with Xealth’s hospital–patient engagement tools.

- April 2025: CharmHealth introduced “Charm AI Scribe,” a clinical documentation tool that uses artificial intelligence to transcribe patient consultations into medical notes, improving clinician efficiency and reducing administrative burden.

- March 2025: Prime Healthcare acquired multiple hospitals and senior living facilities from Ascension in the Chicago area, expanding its provider network and market presence in healthcare delivery services.

Report Details

| Report Characteristics |

| Market Size (2025) |

USD 507.9 Bn |

| Forecast Value (2034) |

USD 2,173.0 Bn |

| CAGR (2025–2034) |

17.5% |

| Historical Data |

2019 – 2024 |

| The US Market Size (2025) |

USD 1,922.1 Bn |

| Forecast Data |

2025 – 2033 |

| Base Year |

2024 |

| Estimate Year |

2025 |

| Report Coverage |

Market Revenue Estimation, Market Dynamics, Competitive Landscape, Growth Factors, etc. |

| Segments Covered |

By Component (Services, Software, Hardware), By Solution Type (Electronic Health Records, Healthcare Analytics, Telehealth/Telemedicine, Revenue Cycle Management, Population Health Management, e-Prescribing Systems, PACS, Laboratory Information Systems, Other Solutions), By Deployment Mode (Cloud-based, On-premise, Web-based/Hybrid), By Application (Clinical Information Systems, Non-Clinical Information Systems, Healthcare Analytics & Business Intelligence, Patient Engagement Solutions), and By End User (Hospitals & Clinics, Healthcare Payers, Diagnostic & Imaging Centers, Pharmacies, Other End Users). |

| Regional Coverage |

North America – US, Canada; Europe – Germany, UK, France, Russia, Spain, Italy, Benelux, Nordic, Rest of Europe; Asia-Pacific – China, Japan, South Korea, India, ANZ, ASEAN, Rest of APAC; Latin America – Brazil, Mexico, Argentina, Colombia, Rest of Latin America; Middle East & Africa – Saudi Arabia, UAE, South Africa, Turkey, Egypt, Israel, Rest of MEA |

| Prominent Players |

Epic Systems, Cerner (Oracle Health), Allscripts, McKesson, GE HealthCare, Siemens Healthineers, Philips, IBM Watson Health, Optum, Athenahealth, Meditech, eClinicalWorks, NextGen Healthcare, and Others. |

| Purchase Options |

We have three licenses to opt for: Single User License (Limited to 1 user), Multi-User License (Up to 5 Users), and Corporate Use License (Unlimited User) along with free report customization equivalent to 0 analyst working days, 3 analysts working days, and 5 analysts working days respectively. |

Frequently Asked Questions

How big is the global healthcare IT solutions market?

▾ The global healthcare IT solutions market size is estimated to have a value of USD 507.9 billion in 2025

and is expected to reach USD 2,173.0 billion by the end of 2034.

What is the size of the US healthcare IT solutions market?

▾ The US healthcare IT solutions market is projected to be valued at USD 1,922.1 billion in 2025. It is

expected to witness subsequent growth in the upcoming period as it holds USD 7,549.4 billion in 2034 at

a CAGR of 16.4%.

Which region accounted for the largest global healthcare IT solutions market?

▾ North America is expected to have the largest market share in the global healthcare IT solutions market,

with a share of about 45.0% in 2025.

Who are the key players in the global healthcare IT solutions market?

▾ Some of the major key players in the global healthcare IT solutions market are Epic Systems, Cerner

(Oracle Health), Allscripts, McKesson, GE HealthCare, Siemens Healthineers, Philips, IBM Watson Health,

Optum, Athenahealth, Meditech, eClinicalWorks, NextGen Healthcare, and Others.

What is the growth rate of the global healthcare IT solutions market?

▾ The market is growing at a CAGR of 17.5 percent over the forecasted period.