Market Overview

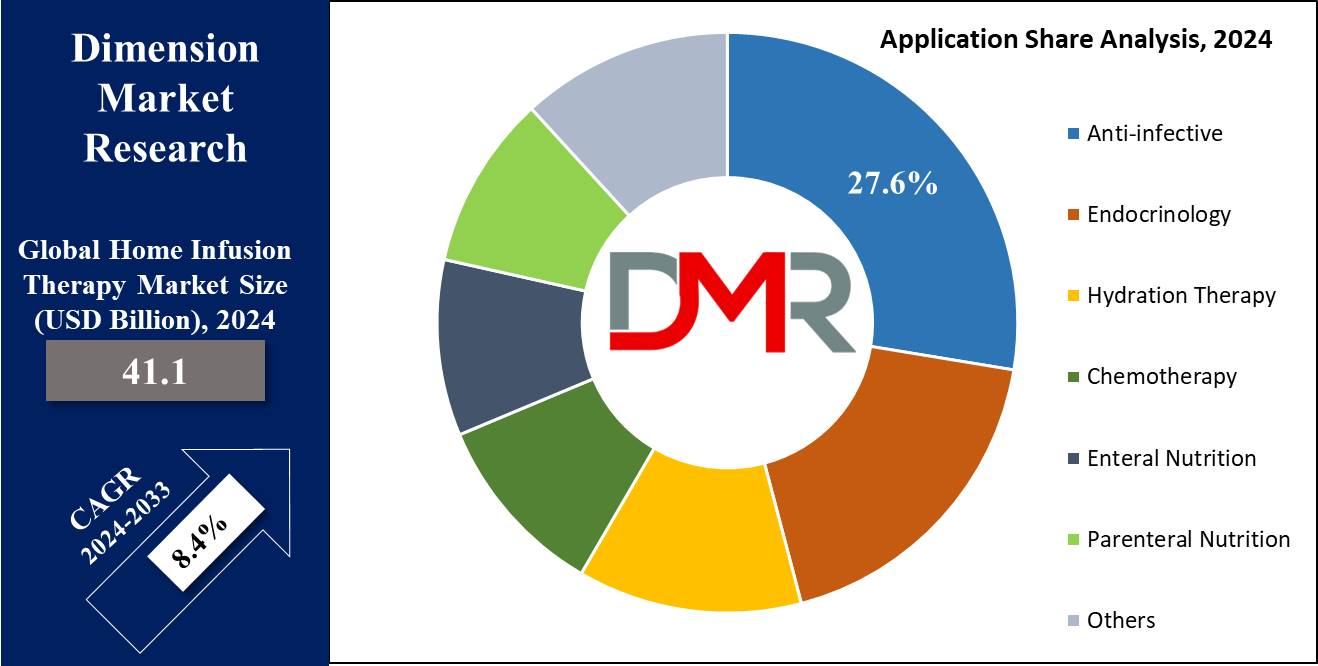

The Global

Home Infusion Therapy Market is expected to reach a value of

USD 41.1 billion by the end of 2024, and it is further anticipated to reach a market value of

USD 85.0 billion by 2033 at a

CAGR of 8.4%.

Infusion therapy is a substitute for oral treatment and targets chronic or severe infections resistant to antibiotics. It's mainly used for cancer-related pain, diarrhea, vomiting, dehydration, and complex diseases.

Further, Home infusion therapy includes administering drugs or biologicals at home under professional supervision, and using catheters and needles, which offers patients the convenience of receiving treatment in their environment while allowing them to receive the necessary care & monitoring.

The growth of the infectious disease drugs market can be attributed to various factors increased awareness campaigns from government and non profit organizations, an increase in infectious disease incidence rates, as well as enhanced funding and research and development efforts.

According to the World Health Organization's Global Tuberculosis Report 2021, most tuberculosis cases occurred within South East Asia (43%), Africa (25%), and the Western Pacific (18%) WHO regions. WHO data from 2021 also demonstrated that 95% of malaria infections occur in Sub-Saharan Africa, showing its significant burden. Furthermore, rising infectious disease prevalence across developed and emerging markets should further fuel the growth of the infectious disease drugs market.

As per PubMed, the home infusion therapy market is a $19 billion industry, catering to over 3.2 million patients annually. Despite pandemic-induced challenges impacting hospital inpatient volumes, the sector demonstrated resilience and is expected to grow at a CAGR of 7.5% through 2028, underscoring its critical role in healthcare delivery.

Key Takeaways

- The Global Home Infusion Therapy Market is expected to grow by 43.9 billion, at a CAGR of 8.4% during the forecasted period.

- By Product, the infusion pumps segment is expected to lead in 2024 & is anticipated to dominate throughout the forecasted period.

- By Application, the anti-infective segment is expected to lead throughout the forecasted period.

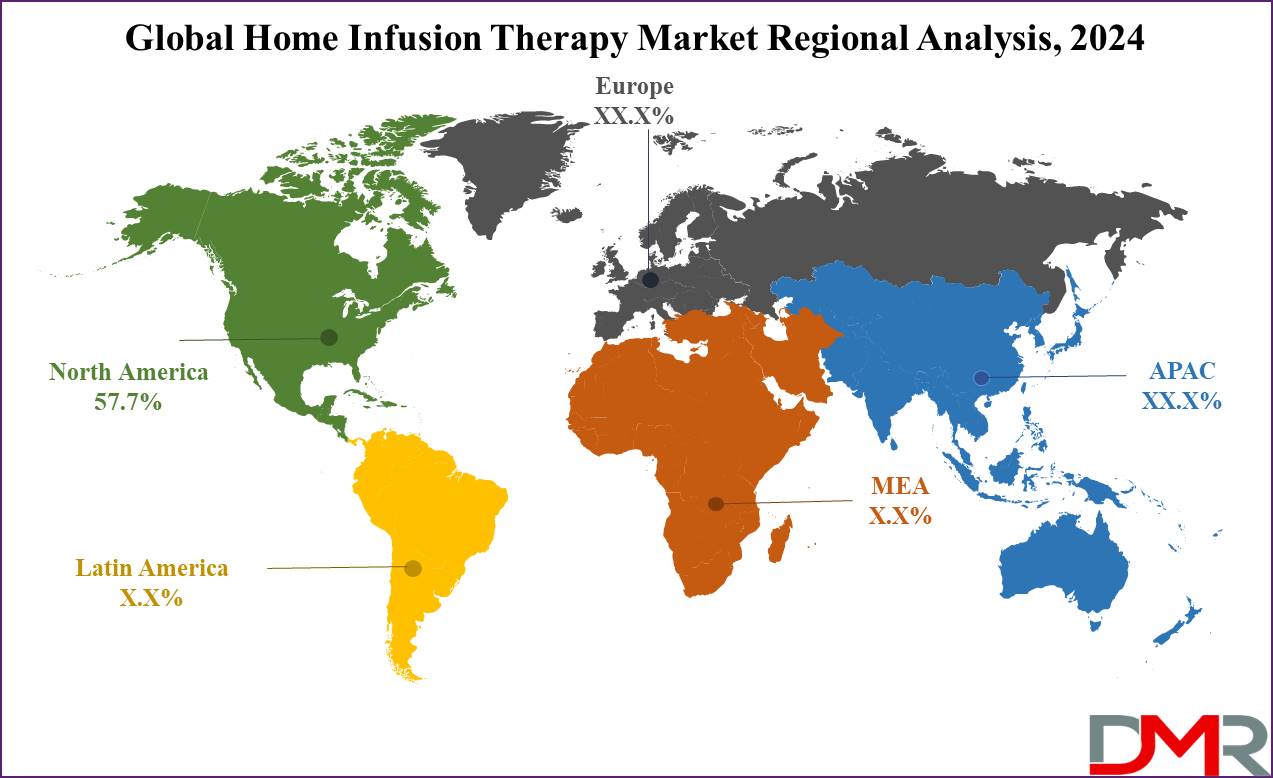

- North America is expected to hold a 57.7% share of revenue in the Global Home Infusion Therapy Market in 2024.

- Some of the use cases of home infusion therapy include palliative care, pediatric care, and more.

Use Cases

- Chronic Disease Management: Patients with chronic conditions like autoimmune diseases, cancer, or genetic disorders often need regular infusion therapy. Home infusion enables these patients to get their medications in a familiar environment, minimizing the need for frequent hospital visits & enhancing their quality of life.

- Post-Surgery Care: After certain surgeries, patients may need intravenous antibiotics, pain management medications, or other specialized treatments. Home infusion therapy allows these patients to proceed with their recovery process at home under the guidance of healthcare professionals, reducing the risk of infections & complications associated with prolonged hospital stays.

- Palliative Care: Patients with extreme illnesses or severe chronic conditions may need palliative care to manage symptoms & improve their comfort levels. Home infusion therapy can be an important component of palliative care, providing patients with pain relief, hydration, & other supportive treatments in a setting that encourages dignity & autonomy.

- Pediatric Care: Children who need long-term medication management, like those with cystic fibrosis, hemophilia, or certain metabolic disorders, can benefit greatly from home infusion therapy. Administering medications at home can lower stress for both children and their families, enhance sticking to treatment plans, & allow children to maintain a sense of normalcy in their daily lives.

Market Dynamic

The global Home Infusion Therapy Market is mainly driven by the growing number of chronic diseases, prompting a switch towards home-based treatment options. In addition, development in infusion pump technology, along with growth in the patient preference for convenience and low-cost healthcare solutions, contributes to market growth. In addition, initiatives focused on expanding

home healthcare services & enhancing patient outcomes further drive the market. These factors collectively boost the adoption of home infusion therapy worldwide.

However, the market includes payment issues, regulatory hurdles, and the need for specialized training for patients & caregivers. In addition, concerns regarding patient safety, medication errors, & logistical complexities may restrain the broad adoption of home infusion therapy.

Driving Factors

Growing prevalence of chronic diseases such as diabetes, cancer and cardiovascular disorders are driving forces behind the Home Infusion Therapy Market. Patient preferences favoring home based treatments due to convenience, cost effectiveness and improved quality of care are driving this growth market.

Advances in infusion devices like portable infusion pumps make administering therapies at home simpler as do an aging population and rising need for long term care, supportive policies from healthcare providers as well as government initiatives encouraging adoption of home infusion services.

Trending Factors

Technological advancements are a significant trend in the Home Infusion Therapy Market. Innovations such as smart infusion pumps, wearable devices, and remote monitoring systems improve patient safety and treatment accuracy, while the integration of telehealth into infusion therapy enables healthcare providers to remotely monitor patients for care compliance purposes.

With an increase in advanced drug delivery systems for

antibiotics, chemotherapy drugs, pain relief medication, etc reflecting its development. Furthermore, personalized medicine and tailored treatment plans is driving development of tailored infusion solutions in line with trend of patient-centric healthcare models.

Restraining Factors

The high cost of infusion therapy equipment and services acts as a barrier to market expansion, especially in low-income regions where many patients face financial issues in accessing home infusion therapies. Furthermore, an inadequate number of skilled healthcare professionals able to administer home infusion therapies presents yet another hurdle.

Patient safety concerns related to improper usage of devices (i.e. risks of infections or complications due to incorrect use) further limit widespread adoption; regulatory complexities for new infusion products prevent market expansion for manufacturers and service providers, making accessing accessible yet affordable solutions more challenging.

Opportunities

The home infusion therapy market holds significant opportunities, especially in countries with improving healthcare infrastructure. As more consumers recognize the advantages of home-based care and investments increase in healthcare technology, market expansion becomes more likely. Partnerships between healthcare providers, technology developers, and home care agencies can fuel innovation and enhance service delivery.

With increasing demands for personalized and patient-specific treatments comes an opportunity for customized infusion solutions; furthermore, artificial intelligence and data analytics promise enhanced monitoring, predictive maintenance, and optimized treatment outcomes, opening up new growth avenues in the market.

Research Scope and Analysis

By Product

The infusion pumps segment is expected to dominate the market in 2024, holding the largest revenue share. Originally limited to healthcare facilities, infusion pumps are now broadly used in outpatient settings, facilitating correct delivery of fluids & medications while reducing errors.

The growing trend of

home healthcare has driven the demand for portable syringes & ambulatory pumps. Advanced smart pumps, having barcode technology, supported by patient identity verification & issue alerts to prevent dosage errors, further driving market expansion.

Moreover, the needleless connectors are anticipated to experience significant growth during the forecast period. These compact devices, integral to intravenous systems, reduce needlestick injuries & bacterial contamination, improving safety protocols.

Further, evaluation criteria like surface mechanisms, blood reflux prevention, & visibility. Needleless connectors streamline operational procedures, allowing safety compliance, and promoting fulfillment of clinical standards, supporting their broad adoption in medical settings.

By Application

The anti-infective segment is anticipated to lead the market in 2024, having the highest revenue share, due to several strategies used for organizing antifungal &antibacterial medications, highly reducing patient exposure to hospital-acquired infections.

Moreover, chemotherapy comes out as the fastest-growing segment during the forecast period. With many cancer incidences, there's a growth in demand for infusion pumps. Mainly designed for home use, these pumps are low-cost, constant-pressure devices that minimize the need for batteries & can be used for extended periods. They ensure the accurate administration of chemotherapy drugs at the optimal infusion rate & dosage, improving treatment outcomes.

The Home Infusion Therapy Market Report is segmented on the basis of the following

By Product

• Infusion Pumps

- Elastomeric

- Electromechanical

- Gravity

- Others

• Intravenous Sets

• IV Cannulas

• Needleless Connectors

By Application

• Anti-infective

• Endocrinology

• Hydration Therapy

• Chemotherapy

• Enteral Nutrition

• Parenteral Nutrition

• Others

Regional Analysis

North America is set to dominate the home infusion therapy market in 2024,

capturing 57.7% of the revenue share, driven by growing R&D efforts and the adoption of advanced infusion pump technologies. The region's aims on long-term patient care & the switch towards home-based treatments due to affordability & better patient mobility are major factors driving this dominance.

Further, the Asia Pacific region is anticipated to show rapid growth, driven by growing awareness among patients about the advantages of home infusion therapy, majorly in managing conditions like diabetes. The growth in the elderly population & the increase in chronic diseases further contribute to the market's growth. In addition, India alone reports about 75 million individuals aged 60 & above suffering from chronic illness, indicating a potential growth in demand for home care services.

By Region

North America

Europe

- Germany

- The U.K.

- France

- Italy

- Russia

- Spain

- Benelux

- Nordic

- Rest of Europe

Asia-Pacific

- China

- Japan

- South Korea

- India

- ANZ

- ASEAN

- Rest of Asia-Pacific

Latin America

- Brazil

- Mexico

- Argentina

- Colombia

- Rest of Latin America

Middle East & Africa

- Saudi Arabia

- UAE

- South Africa

- Israel

- Egypt

- Rest of MEA

Competitive Landscape

In the Global Home Infusion Therapy Market, competition is strong among numerous players competing for market share. These competitors aim at innovation, strategic alliances, & expanding service portfolios to gain a competitive edge.

In addition, development in technology & strict regulatory compliance play major roles in shaping the competitive landscape. Companies focus on differentiating themselves through better product quality, effective service delivery, & customized solutions to meet patient needs.

Some of the prominent players in the global Home Infusion Therapy Market are:

Recent Developments

- In October 2023, Advanced Infusion Care (AIC), a division of AIS Healthcare announced a partnership to conduct a joint study with Grifols to observe the impact of subcutaneous immunoglobulin (SCIG) products on individuals having primary immune deficiencies (PID). AIC and Grifols’ Satisfaction & Outcomes in Primary Immune Deficiency Patients (SOPID) study would look into 60 patients for a three-month period who are starting SCIG therapy, to determine if there are differences in patient experience & satisfaction with immunoglobulin treatments.

- In June 2023, Vivo Infusion announced the acquisition of Specialty Infusion, an industry leader in ambulatory infusion & specialty pharmacy services, specializing in convenient & affordable solutions for infusion patients in 14 ambulatory infusion centers in New York, Massachusetts, & New Jersey. With this acquisition, the company will advance to a combined 55 ambulatory infusion centers across 10 states.

- In June 2023, Baxter International announced its Progressa+ Next Gen ICU bed for addressing the essential needs of patients at their homes, which makes it easier for nurses to take care of patients while supporting therapy at home.

- In April 2023, Eitan Medical launched its new advanced connected infusion multi-therapy ambulatory infusion system Avoset, which is developed to convert post-acute care & specialty infusion therapy with compact & simplified technology that can look into infusion treatment data remotely, focusing on enhancing patient safety and improving the user experience.

- In January 2023, KORU Medical Systems, Inc. announced a partnership with a pharmaceutical manufacturer of subcutaneous immunoglobulin therapy (SCIg) to develop & look into regulatory approval for the Freedom Infusion System with a SCIg prefilled syringe, which includes the Freddom60 & FreedomEdge Syringe Infusion Drivers, Precision Flow Rate Tubing, and HIgH-Flo Subcutaneous Safety Needle Sets.

Report Details

| Report Characteristics |

| Market Size (2024) |

USD 41.1 Bn |

| Forecast Value (2033) |

USD 85.0 Bn |

| CAGR (2023-2032) |

8.4% |

| Historical Data |

2018 – 2023 |

| Forecast Data |

2024 – 2033 |

| Base Year |

2023 |

| Estimate Year |

2024 |

| Report Coverage |

Market Revenue Estimation, Market Dynamics, Competitive Landscape, Growth Factors and etc. |

| Segments Covered |

By Product (Infusion Pumps, Intravenous Sets, IV

Cannulas, Needleless Connectors), By Application

(Anti-infective, Endocrinology, Hydration Therapy,

Chemotherapy, Enteral Nutrition, Parenteral

Nutrition, and Others) |

| Regional Coverage |

North America – The US and Canada; Europe – Germany, The UK, France, Russia, Spain, Italy, Benelux, Nordic, & Rest of Europe; Asia- Pacific– China, Japan, South Korea, India, ANZ, ASEAN, Rest of APAC; Latin America – Brazil, Mexico, Argentina, Colombia, Rest of Latin America; Middle East & Africa – Saudi Arabia, UAE, South Africa, Turkey, Egypt, Israel, & Rest of MEA

|

| Prominent Players |

BD, Baxter, Smith’s Medical, CVS/Coram, ICU Medical

Inc, JMS Co Ltd, Option Care Health, Terumo Corp,

PharMerica, Caesarea Medical Electronics, and Other

Key Players |

| Purchase Options |

We have three licenses to opt for: Single User License (Limited to 1 user), Multi-User License (Up to 5 Users), and Corporate Use License (Unlimited User) along with free report customization equivalent to 0 analyst working days, 3 analysts working days and 5 analysts working days respectively. |

Frequently Asked Questions

The Global Home Infusion Therapy Market size is estimated to have a value of USD 41.1 billion in 2024

and is expected to reach USD 85.0 billion by the end of 2033.

North America is expected to have the largest market share in the Global Home Infusion Therapy Market

with a share of about 57.7% in 2024.

Some of the major key players in the Global Home Infusion Therapy Market are BD, Baxter, Smith’s

Medical, and many others.

The market is growing at a CAGR of 8.4 percent over the forecasted period.