Geographically, North America and Europe remain top markets when it comes to insurance penetration rates and regulatory oversight; however, emerging markets in Asia-Pacific and Latin America have experienced rapid expansion driven by urbanization, rising disposable income levels, and an awareness of its significance.

Competition dynamics are also shifting traditional insurers face increasing threats from

insurtech companies which use data analytics,

artificial intelligence and digital platforms to deliver more customer-friendly solutions than their predecessors. Consumer expectations continue to change dramatically with each digital shift that impacts society at large and established players must accelerate their own digital capabilities to keep pace with consumer preferences.

Key Takeaways

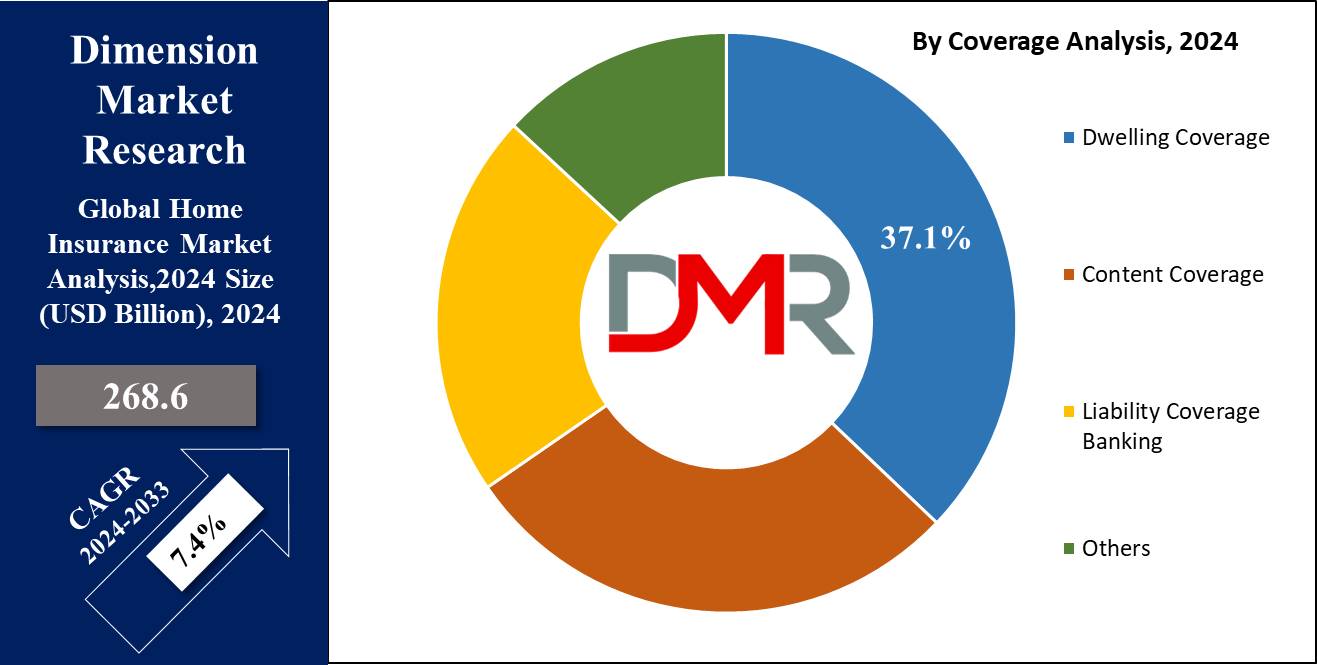

- global Home Insurance Market Size is projected to grow from 268.6 Bn in 2023 to 509.6 Bn by 2033, at a CAGR of 7.4%.

- Dwelling Coverage segment is projected to lead the market with 75.1 Bn market share.

- Landlords segment in End-User's is currently the market leader, holding 157.1 Bn market share.

- North America leads the market, accounting for 30.2%. Europe and Asia Pacific follow closely behind, as Latin America and Middle East/Africa offer opportunities.

- The rising demand for green homes is encouraging insurers to offer specialized coverage and incentives for eco-friendly properties.

- Technological advancements in AI, machine learning, and data analytics are transforming risk assessments and claims processing.

- High insurance premiums, especially in disaster-prone areas, remain a significant barrier to broader market adoption.

Driving Factors

Growing Natural Disasters Increase Demand for Home Insurance Coverage

Natural disasters--floods, hurricanes and wildfires--have been one of the key drivers in driving home insurance market growth. Climate change intensifies their severity and unpredictability homeowners seek comprehensive policies in order to safeguard potential financial losses associated with catastrophic events like these; for instance in 2023 global losses from natural disasters totaled $315 billion alone which shows just how prevalent catastrophic events have become; consumers and governments now prioritize home insurance in order to safeguard properties against financial devastation caused by extreme weather conditions.

Soaring Homeownership Rates Increase Insurance Demand

Urbanization and increasing disposable income have both contributed to an upsurge in homeownership rates worldwide, creating another key driving force of the home insurance market Size. Middle class expansion, increased access to mortgage finance and rising property values have resulted in more residential property purchases; U.S. rates of homeownership reached nearly 66% by 2023 alone, creating an enormous opportunity for home insurers. As more individuals invest in property assets through insurance policies, their need to protect these investments becomes all-the-more crucial, leading to market expansion.

Government Regulations Require Insurance Compliance

Government regulations play an essential role in driving the expansion of the Home Insurance Market. Many countries mandate home insurance as a requirement of mortgage approval, protecting both homeowners and financial institutions against property-related risks. This regulatory framework drives stable demand for insurance products in regions where mortgage lending has seen rapid expansion; for instance in Europe nearly all mortgage agreements include home insurance as a prerequisite - creating an excellent market for insurers to operate within.

Expansion in Mortgage Lending Drives Market Growth

As more consumers gain access to credit facilities to purchase homes, the requirement of home insurance as part of mortgage approval processes ensures an influx of policyholders - especially in emerging markets like India and Brazil, where mortgage lending has grown 20% annually - this trend should only accelerate over time as more individuals enter these regions' housing markets.

Growth Opportunities

Partnerships between Real Estate Developers and Customers Can Quicken Customer Acquisition

Partnerships between home insurers and real estate developers offer home insurers an outstanding opportunity for market penetration in 2023. By working alongside developers to offer packaged home-and-insurance packages at the point of sale, insurers can streamline acquisition for buyers while giving developers an added value by automatically covering new homeowners. Such partnerships also can capitalize on rising homeownership rates in high growth regions like emerging markets to make insurance more accessible thereby driving market expansion.

Rising Demand for Green Homes Creates Niche Market Opportunities

As homeowners prioritize sustainability and eco-friendliness in their home purchasing decisions, demand for green homes worldwide has skyrocketed. Home insurers can seize this opportunity by creating policies that reward environmentally responsible practices such as using renewable energy sources, energy-saving appliances and eco-friendly building materials - offering premium discounts or incentives can attract a growing demographic of eco-minded consumers and take part in furthering sustainable behavior while simultaneously tapping into an entirely new customer segment.

Usage-Based Insurance Models Provide Customization and Flexibility

Usage-based or pay-per-use insurance models give insurers a way to offer more customized and flexible coverage solutions, and are popular among tech-savvy homeowners seeking cost-cutting measures. 2023 will see insurers compete more successfully against one another by providing tailored policies reflecting individual risk profiles in response to demand from potential clients seeking cost-saving measures.

An Increased Focus on Cybersecurity Addresses Emerging Smart Home Risks

With the rapid adoption of smart home technologies comes rising cybersecurity risks that present homeowners. By offering insurance policies covering cyber breaches, data theft, and privacy risks in 2023, insurers could capture an underserved market and develop long-term customer loyalty by covering these emerging risks comprehensively.

Key Trends

Innovations in Insurtech Are Transforming Risk Evaluation and the Customer Experience

2023 is witnessing an unprecedented transformation of the global Home Insurance Market as insurtech firms leverage AI, machine learning and data analytics technologies such as artificial intelligence (AI), machine learning (ML) and data analytics (DA) to boost risk assessments and streamline customer interactions. These innovations allow insurers to provide real-time assessments of property risks more accurately while streamlining customer interactions AI powered customer service tools (e.g.

chatbots and virtual agents) have also greatly increased underwriting accuracy while shortening response times to reduce response costs further driving operational efficiencies while setting costs down while setting new industry standards in terms of service delivery innovations.

Shift toward Digital-Only Insurers Gains Momentum

Digital-only insurers continue to gain momentum, particularly among tech-savvy homeowners seeking convenience and transparency. Digital native platforms provide seamless paperless policy management along with instantaneous access to policy details, claims processing and customer support through mobile apps or web interfaces appealing directly to modern consumers who value speed, simplicity of use and the ability to manage their insurance needs online without traditional agent interactions - driving increasing marketshare growth for digital-only insurers.

Peer-to-Peer Insurance Models Disrupt Traditional Approach

Peer-to-peer (P2P) insurance has emerged as a disruption force in the home insurance market. By providing homeowners the ability to pool premiums and share risks together, P2P models reduce reliance on traditional insurers while potentially offering reduced premiums - appealing especially to cost-conscious buyers as well as those wanting greater transparency regarding how their premiums are spent.

AI-Driven Claims Processing Improves Customer Satisfaction

Artificial Intelligence-powered claims processing has revolutionized the home insurance market since 2023 by drastically shortening claims settlement times and improving customer satisfaction. Automated systems can efficiently analyze claims data, verify damages and process payments more swiftly - significantly shortening claims cycles as policyholders enjoy faster resolutions with fewer delays. This innovation reduces administrative burdens as well as improving policyholder experiences as they enjoy quicker resolutions with faster resolution times and reduced delays.

Restraining Factors

High Premium Costs Limit Adoption in Disaster-Prone Regions

One of the primary barriers to growth within the Home Insurance Market is premium costs, particularly in regions prone to natural disasters like flooding, hurricanes and wildfires. Since insurers adjust rates based on risk, homeowners residing in the disaster-prone areas face significantly higher premiums to cover potential damages caused by potential disasters.

Homeowners in states like Florida and California have seen premium increases of 20% or higher annually as hurricanes and wildfires increase risk levels, deterring many from purchasing comprehensive protection or opting for minimal protection that leaves them more exposed than before a catastrophe strikes. Furthermore, premiums rise disproportionately among vulnerable groups limiting accessibility and affordability thereby inhibiting market expansion and slowing overall market expansion.

Lack of Awareness in Emerging Markets Hinders Demand

Many emerging markets lack awareness about the advantages and importance of home insurance for many citizens, limiting market development further. Limited financial literacy and limited home insurance product exposure contribute to this challenge.

World Bank reports indicate only 10-15% of homeowners in low and middle-income countries possess adequate home insurance, due to an apathy toward understanding its risks. This translates into low insurance penetration rates in regions like Asia-Pacific and Africa where home ownership has seen dramatic gains but where home insurance concepts remain underdeveloped further exacerbated by cultural factors and mistrust for financial services which make engaging potential customers challenging for insurers.

Research Scope and Analysis

By Coverage

Dwelling Coverage held an overwhelming market position within the Coverage segment of the global Home Insurance Market in 2023, taking home an astounding market share of

75.1 billion. Its prominence can be explained by homeowners needing protection for their primary asset--their dwelling--from risks such as fire, theft and natural disasters; as property values increase and frequency of extreme weather events increases demand for robust dwelling coverage remains one of the main drivers behind its presence on this global stage.

Content Coverage is another significant segment, providing homeowners with protection for the items in their insured property that belong to them - especially personal belongings such as photographs. Content coverage experienced steady growth throughout 2023 due to rising homeownership rates in urban areas as more consumers became aware of personal property protection's worth and consumers seeking comprehensive policies beyond structural damage coverage. It accounted for an increasing proportion of total home premiums.

Liability Coverage experienced an unprecedented surge in adoption as consumers recognized its value in protecting themselves against possible lawsuits arising from accidents or injuries on their properties. By 2023, this segment gained additional traction as more homeowners purchased policies with legal liability protection for unexpected financial losses that might otherwise occur without adequate cover.

The Others segment - including flood or earthquake insurance policies - has also witnessed remarkable expansion, particularly in disaster-prone regions. As extreme weather events become more frequent, more tailored insurance solutions to manage specific risks are required to mitigate them effectively; hence fostering this sector's expansion.

By End-User

Landlords held the top market position for End-User policies within the global Home Insurance Market in 2023 with a 157.1 billion market share. Landlords' strong presence was driven primarily by rising rental property demand primarily in urban areas as well as their need to protect these rentals against risks such as property damage or liability claims due to increasing property investments around the world, landlords increasingly sought comprehensive protection solutions to safeguard these investments thus expanding this segment's presence globally and further contributing towards its continued development globally.

Tenants, though representing only a smaller share in terms of market shares, are growing increasingly important as rental population in metropolitan areas increases and homeownership becomes unattainable. Tenant Insurance was one of the major drivers behind its rapid expansion during 2023 as awareness grew of their need to protect personal belongings as well as provide liability coverage should accidents arise insurance providers provided more affordable tailored solutions aimed specifically at renters that appealed to a broader demographic such as younger individuals and families alike.

The Home Insurance Market Report is segmented based on the following:

By Coverage

- Dwelling Coverage

- Content Coverage

- Liability Coverage Banking

- Others

By End-user

By Provider

- Insurance Companies

- Insurance Agents/Brokers

- Others

Regional Analysis

North America held an estimated 30.2% market share for global Home Insurance Market. This dominance can be explained by high homeownership rates and strict government regulations mandating home insurance before mortgage approval as well as increasing natural disaster frequency across North America - particularly within the US itself. Key players like State Farm, Allstate and Liberty Mutual play an invaluable role in North American market where premium growth remains consistent due to rising property values and an increasing need for comprehensive protection policies.

Europe's Home Insurance Market is supported by strong regulatory frameworks and high penetration rates of home insurers like AXA, Allianz and Zurich - countries like UK, Germany and France are major players that contribute significantly to this region's expansion. Growing demand for green home policies such as solar powered systems also play a part in driving this growth market forward.

Asia-Pacific markets are experiencing rapid economic development due to urbanization, rising homeownership rates and an expanding middle class. Emerging markets such as China and India continue to see low insurance penetration but its footprint continues to expand with companies like PICC leading this field. Rising natural disaster risks as well as increasing mortgage loans further contribute to this region's need for home insurance products.

Latin America has seen significant market expansion driven primarily by urbanization and access to mortgage lending however, insurance penetration remains low. Middle East & Africa regions experienced slower market development due to lower homeownership rates and adoption; however opportunities are emerging as real estate sectors expand across Gulf nations and South Africa.

By Region

North America

Europe

- Germany

- U.K.

- France

- Italy

- Russia

- Spain

- Benelux

- Nordic

- Rest of Europe

Asia-Pacific

- China

- Japan

- South Korea

- India

- ANZ

- ASEAN

- Rest of Asia-Pacific

Latin America

- Brazil

- Mexico

- Argentina

- Colombia

- Rest of Latin America

Middle East & Africa

- Saudi Arabia

- UAE

- South Africa

- Israel

- Egypt

- Rest of MEA

Competitive Landscape

In 2023, global Home Insurance Market, led by key players like PICC, AXA, ALLIANZ and American International Group Inc. They all hold leading market shares due to their global reach, diverse insurance portfolios and strong financial performances; PICC remains a market leader due to China's rising homeownership rates as well as demand for comprehensive home protection coverage.

AXA and ALLIANZ maintain leading positions in Europe due to strong brand recognition and extensive networks of agents and brokers, while investing heavily in digital transformation initiatives to streamline services and enhance customer engagement, in line with increasing demands for digital-first insurance solutions. American International Group Inc. and Zurich leverage their global footprint by tailoring solutions specifically tailored for homeowners living across different regions such as Asia-Pacific and Latin America - specifically those regions experiencing rapid expansion such as these two.

Allstate Insurance Company, State Farm Mutual Automobile Insurance Company and Liberty Mutual Insurance Company are top players in the US insurance market due to their broad distribution networks and strong customer bases. Chubb stands out by offering luxury home coverage options tailored towards affluent homeowners while Admiral builds upon its position with competitive pricing and dedicated customer care service in UK market.

Some of the prominent players in the Global Home Insurance Market are:

- PICC

- AXA

- ALLIANZ

- American International Group Inc.

- Zurich

- ADMIRAL

- Allstate Insurance Company

- Chubb

- State Farm Mutual Automobile Insurance Company

- Liberty Mutual Insurance Company

Recent developments

- Tailrow Insurance Co. of HCI Group was approved as an domestic homeowners multiperil insurer by Florida OIR on April 20, 2023 through a consent order filed.

- Amazon com Inc. announced in October 2022 the launch of their home insurance portal in the UK and secured three major insurers as it expanded into financial services globally. At first, Ageas UK (AGES.BR), Co-op Insurance and LV General Insurance of Allianz AG will serve as third party service providers.

- Liberty Mutual Insurance officially acquired State Auto Group in 2022.

Report Details

| Report Characteristics |

| Market Size (2023) |

USD 268.6 Bn |

| Forecast Value (2032) |

USD 509.6 Bn |

| CAGR (2023-2032) |

7.4% |

| Historical Data |

2018 – 2023 |

| Forecast Data |

2024 – 2033 |

| Base Year |

2023 |

| Estimate Year |

2024 |

| Report Coverage |

Market Revenue Estimation, Market Dynamics, Competitive Landscape, Growth Factors and etc. |

| Segments Covered |

By Coverage(Dwelling Coverage, Content Coverage, Liability Coverage Banking, Others), By End-user(Landlords, Tenants), By Provider(Insurance Companies, Insurance Agents/Brokers, Others) |

| Regional Coverage |

North America – The US and Canada; Europe – Germany, The UK, France, Russia, Spain, Italy, Benelux, Nordic, & Rest of Europe; Asia- Pacific– China, Japan, South Korea, India, ANZ, ASEAN, Rest of APAC; Latin America – Brazil, Mexico, Argentina, Colombia, Rest of Latin America; Middle East & Africa – Saudi Arabia, UAE, South Africa, Turkey, Egypt, Israel, & Rest of MEA

|

| Prominent Players |

PICC, AXA, ALLIANZ, American International Group Inc., Zurich, ADMIRAL, Allstate Insurance Company, Chubb, State Farm Mutual Automobile Insurance Company, Liberty Mutual Insurance Company |

| Purchase Options |

We have three licenses to opt for: Single User License (Limited to 1 user), Multi-User License (Up to 5 Users), and Corporate Use License (Unlimited User) along with free report customization equivalent to 0 analyst working days, 3 analysts working days and 5 analysts working days respectively. |