ℹ

To learn more about this report –

Download Your Free Sample Report Here

There is a significant opportunity in emerging economies, where rising disposable incomes and a growing appetite for travel among the middle class are driving demand for varied accommodation and recreation services. Alternative lodging models such as homestays and short-term vacation rentals are gaining traction alongside traditional hospitality offerings. The rise of hybrid business-leisure travel and long-stay packages is also reshaping hospitality service portfolios.

Despite the positive outlook, the sector faces pressing challenges. Labor shortages are impacting service delivery and operational continuity across regions. Additionally, hospitality providers must continually invest in technology infrastructure and training to remain competitive. Regulatory complexities across different jurisdictions, rising operating costs, and increasing demands for sustainability also pose significant hurdles.

Nonetheless, the long-term growth prospects remain robust. The industry's ability to adapt to shifting demographic trends, customer expectations, and environmental imperatives will determine its future trajectory. With an increasingly interconnected global travel ecosystem and heightened focus on experience-driven hospitality, the market is positioned for sustained innovation and growth across all service segments.

ℹ

To learn more about this report –

Download Your Free Sample Report Here

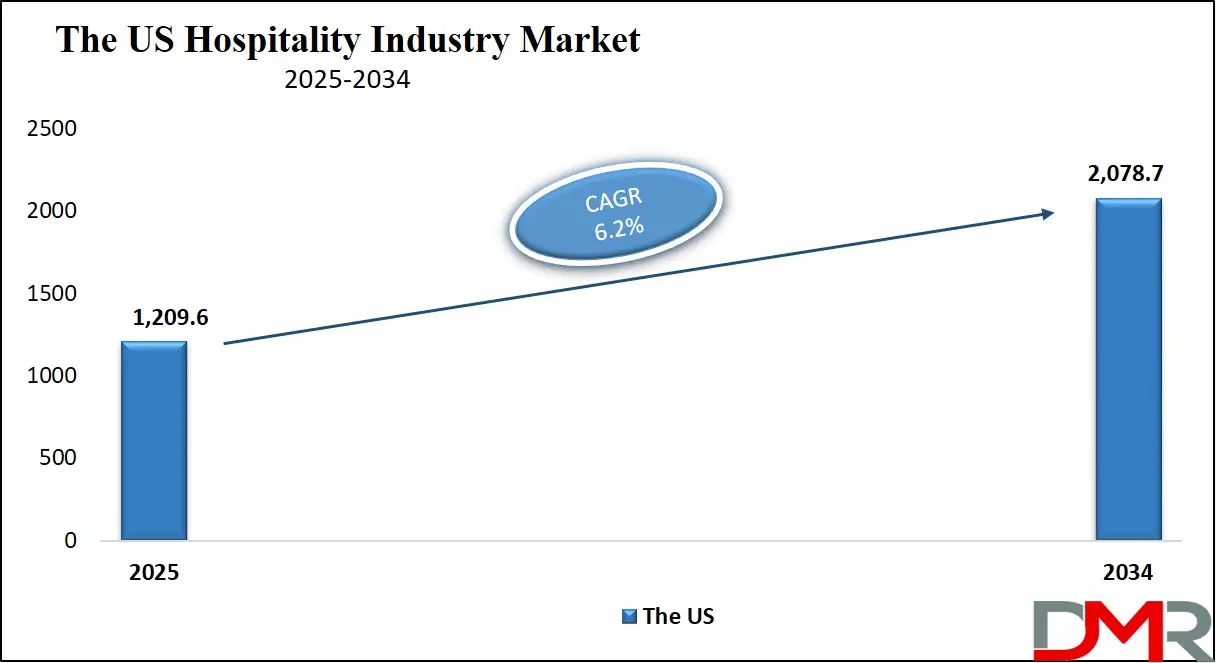

The US Hospitality Industry Market

The US Hospitality Industry Market is projected to reach

USD 1,209.6 billion in 2025 at a compound annual growth rate of

6.2% over its forecast period.

The United States has a highly diversified hospitality market, supported by its vast domestic travel base, world-renowned cities, and a robust infrastructure of hotels, restaurants, and entertainment venues. The sector serves both business and leisure travelers, with a wide spectrum of accommodations ranging from upscale resorts to budget motels. A large population, strong purchasing power, and a well-established travel culture contribute to the vitality of the industry.

The country benefits from an extensive interstate highway system, a major airline network, and iconic tourist attractions spanning natural parks, entertainment hubs, and cultural landmarks. Domestic tourism plays a key role in sustaining hospitality revenues, with urban, rural, and regional destinations increasingly popular among both local and international travelers. Theme parks, ski resorts, national monuments, and coastal getaways all contribute to a vibrant tourism mix.

Demographic advantages include a growing population of millennials and Gen Z travelers who prioritize unique, technology-enabled experiences. Many hospitality providers are shifting toward contactless services, mobile apps, digital concierge systems, and self-service kiosks to meet these expectations. Additionally, the country’s multicultural demographic fosters diverse culinary and recreational offerings, boosting inclusivity and regional tourism development.

While labor availability and wage inflation pose operational constraints, the industry’s adaptability and ongoing investments in innovation continue to drive growth. Sustainability is becoming a core focus, with hotels adopting green building standards, waste reduction strategies, and energy-efficient systems. With continuous support from local and federal tourism initiatives, the U.S. hospitality sector is well-positioned for long-term expansion and diversification.

ℹ

To learn more about this report –

Download Your Free Sample Report Here

The European Hospitality Industry Market

The European Hospitality Industry Market is estimated to be valued at

USD 1,242.7 billion in 2025 and is further anticipated to reach

USD 1,846.79 billion by 2034 at a

CAGR of 4.5%.

Europe remains one of the world’s most dynamic and culturally rich hospitality markets, attracting travelers with its historical cities, culinary experiences, festivals, and architectural heritage. The region’s geographic diversity offers year-round appeal from Mediterranean beaches and alpine resorts to heritage towns and modern metropolises. Each European country contributes unique offerings, making intra-regional and long-haul travel both vibrant and varied.

European travelers often prioritize quality, sustainability, and cultural immersion, driving growth in boutique hotels, eco-lodges, and artisanal food tourism. The proliferation of short-stay rentals, serviced apartments, and heritage guesthouses reflects evolving traveler preferences. The widespread use of digital platforms has also accelerated the booking and planning process, especially among younger demographics.

Europe benefits from a dense transportation network, including high-speed railways and budget airlines, making cross-border travel affordable and accessible. Cultural capital cities such as Paris, Rome, Berlin, and Amsterdam serve as global travel magnets. Government bodies across the continent promote regional tourism through digital campaigns, infrastructure investment, and incentives for sustainable hospitality practices.

However, rising operational costs, skilled labor shortages, and complex regulatory compliance remain persistent challenges. The need for modernization and digitization is especially pressing for small and medium-sized enterprises. There is also growing pressure to balance tourism growth with environmental and community impact, particularly in popular tourist hotspots.

Nonetheless, Europe’s hospitality industry continues to exhibit resilience and innovation. With an emphasis on personalization, sustainability, and digital transformation, the sector is well-equipped to adapt to global tourism trends and maintain its leadership in global travel experiences.

The Japan Hospitality Industry Market

The Japan Hospitality Industry Market is projected to be valued at USD 345.20 billion in 2025. It is further expected to witness subsequent growth in the upcoming period, holding USD 634.63 billion in 2034 at a CAGR of 7.0%.

Japan’s hospitality industry blends centuries-old cultural traditions with cutting-edge innovation, offering travelers a unique and immersive experience. As a nation known for its hospitality ethos, referred to as “omotenashi,” Japan provides exceptional service standards across its hotels, inns, restaurants, and transportation systems. Urban hubs like Tokyo and Osaka contrast with rural retreats and hot spring resorts, creating diverse tourism offerings that appeal to international and domestic travelers alike.

A strong tourism ecosystem supports the hospitality sector, with Japan positioned as a top destination for historical tourism, gastronomy, and technology-driven experiences. A well-developed public transportation system, including high-speed trains and efficient subway networks, enhances tourist mobility across cities and remote areas. Local governments promote regional tourism, spreading the benefits of travel beyond urban centers through grants, infrastructure projects, and cultural events.

Japan also stands out for its unique accommodation models, including ryokans (traditional inns), capsule hotels, and luxury international chains. Visitors are increasingly drawn to Japan’s natural landscapes, festivals, and historical landmarks, which support sustainable tourism models. Efforts are being made to incorporate green building practices, energy-efficient systems, and digital innovations such as facial recognition check-ins.

Challenges remain in managing workforce shortages, especially given Japan’s aging population. The hospitality sector is adopting automation and foreign workforce inclusion to mitigate this issue. Moreover, with rising global expectations, continuous investment in digital experiences and customer service is essential. Japan’s commitment to blending tradition with innovation ensures that its hospitality market will remain competitive and attractive in the global landscape.

Global Hospitality Industry Market: Key Takeaways

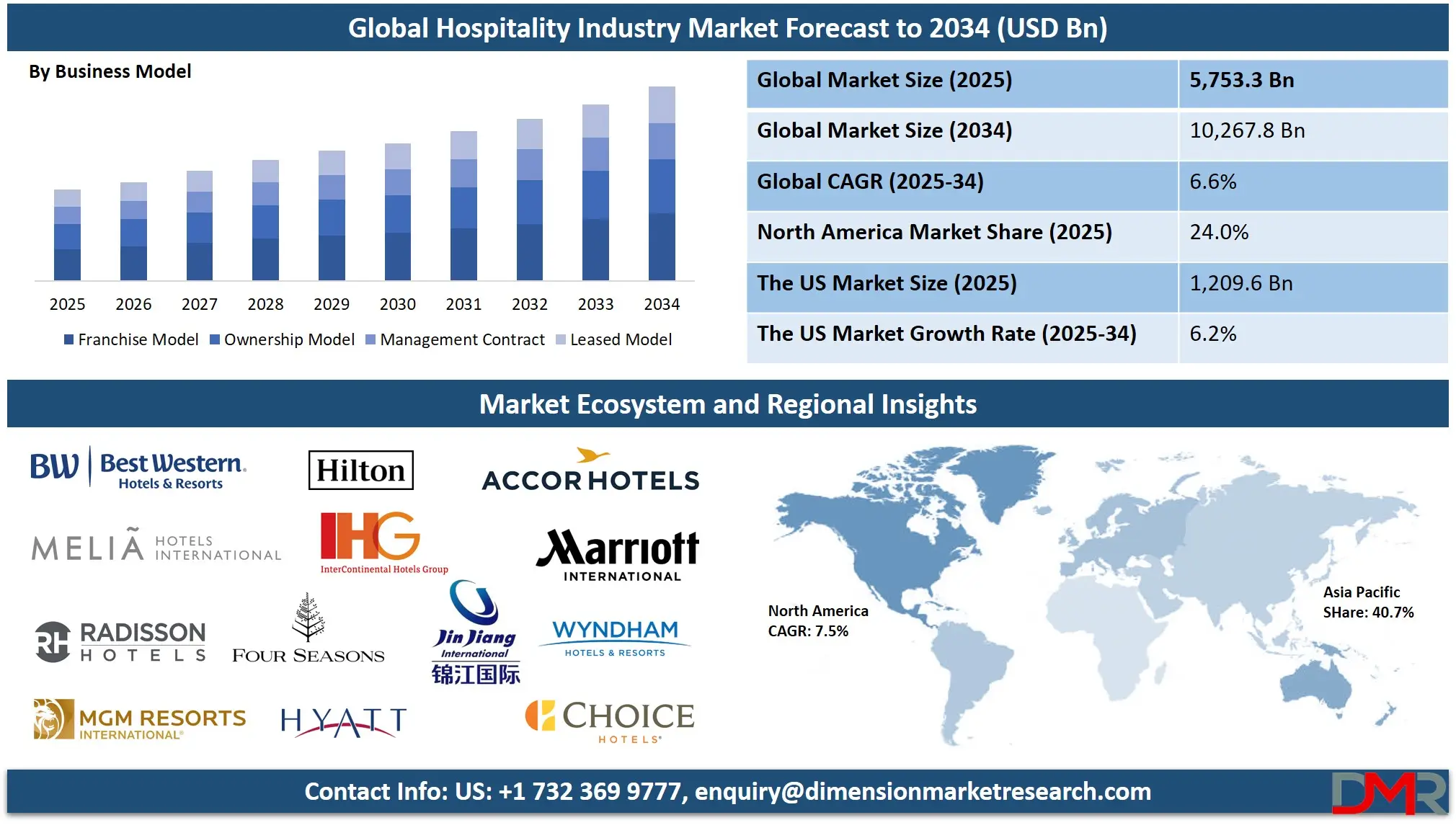

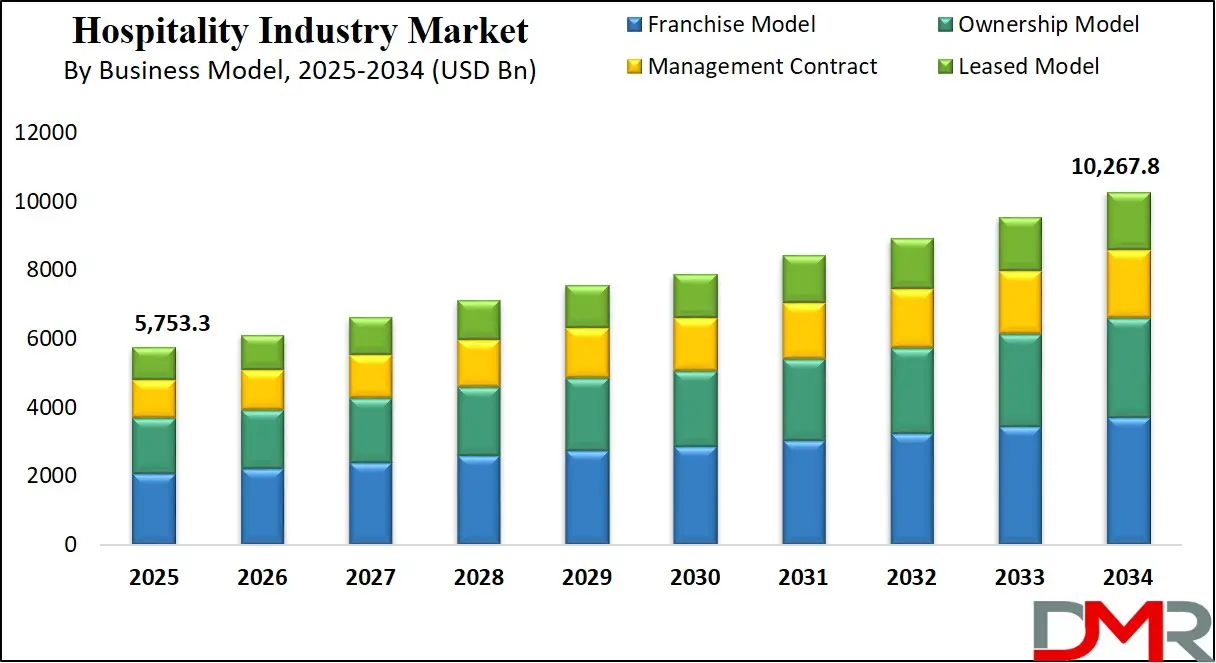

- The Global Market Size Insights: The Global Hospitality Industry Market size is estimated to have a value of USD 5,753.3 billion in 2025 and is expected to reach USD 10,267.8 billion by the end of 2034.

- The US Market Size Insights: The US Hospitality Industry Market is projected to be valued at USD 1,209.6 billion in 2025. It is expected to witness subsequent growth in the upcoming period as it holds USD 2,078.7 billion in 2034 at a CAGR of 6.2%.

- Japan Hospitality Industry Market Size Insights: Japan's market for the hospitality industry is estimated to be valued at USD 345.20 million in 2025 and is forecasted to grow to USD 634.63 million by 2034, exhibiting a CAGR of 7.0%.

- Regional Insights: Asia Pacific is expected to have the largest market share in the Global Hospitality Industry Market with a share of about 40.7% in 2025.

- Key Players Insights: Some of the major key players in the Global Hospitality Industry Market are Marriott International, Hilton Worldwide Holdings, InterContinental Hotels Group (IHG), AccorHotels, Hyatt Hotels Corporation, Wyndham Hotels & Resorts, Choice Hotels International, Jin Jiang International, MGM Resorts International, and many others.

- The Global Market Size Insights: The market is growing at a CAGR of 6.6 percent over the forecasted period of 2025.

Global Hospitality Industry Market: Use Cases

- Smart Hotel Automation: Hotels integrate IoT-based systems for lighting, climate control, and entertainment, allowing guests to tailor room environments using smartphones or voice commands for enhanced comfort and energy savings.

- AI-Powered Concierge Services: Chatbots and virtual assistants provide real-time information, booking services, and local recommendations, streamlining guest services while reducing front-desk workloads.

- Green Hospitality Operations: Properties implement energy-efficient lighting, water conservation systems, and waste recycling programs, aligning with global sustainability standards and meeting eco-conscious traveler expectations.

- Virtual Booking and Previews: Travel operators use 360-degree virtual tours to allow customers to preview rooms, resorts, and destinations before booking, improving transparency and increasing booking conversion rates.

- Dynamic Pricing and Yield Management: Hospitality businesses employ AI algorithms to adjust pricing based on demand, seasonality, and competitor data, maximizing occupancy rates and revenue.

Global Hospitality Industry Market: Stats & Facts

World Tourism Organization (UNWTO)

- International tourist arrivals reached 1.5 billion in 2023, signaling a strong rebound as global travel restrictions eased following the COVID-19 pandemic. This figure reflects renewed consumer confidence and increasing demand for international travel experiences.

- Tourism contributed approximately 10.5% to the global GDP in 2023, underlining the hospitality sector's critical role in driving economic growth worldwide. This percentage includes direct spending on accommodation, food services, transportation, and entertainment.

- The hospitality sector employs around 320 million people globally, making it one of the largest employment sectors. This workforce includes hotel staff, restaurant workers, tour operators, event planners, and many other service roles.

- Domestic tourism accounts for over 70% of total tourism expenditure globally, highlighting the importance of local travelers in sustaining the hospitality ecosystem, especially during times of international travel disruption.

- The Asia-Pacific region is the fastest-growing market for international tourism receipts, driven by rising middle-class incomes, improved infrastructure, and increased outbound travel from countries like China and India.

World Travel & Tourism Council (WTTC)

- Travel and Tourism’s direct contribution to the global economy was $4.7 trillion in 2023, reflecting the sector’s significance in supporting a wide range of economic activities beyond just accommodation and transport.

- The sector supports one in every ten jobs worldwide, demonstrating its essential role in global employment, from front-line hospitality workers to management and service providers.

- Leisure travel spending globally increased by 15% in 2023 compared to the previous year, reflecting pent-up demand from travelers who postponed vacations during the pandemic.

- Business travel is projected to reach 80% of pre-pandemic levels by 2025, showing a steady recovery in corporate travel as companies resume face-to-face meetings and conferences.

- Sustainable tourism practices have been adopted by approximately 60% of global hospitality operators, indicating a growing commitment to environmental and social responsibility within the industry.

U.S. Travel Association

- Domestic travel spending in the United States exceeded $1.3 trillion in 2023, emphasizing the vital role of local tourism and hospitality services in the country’s economic recovery.

- Leisure travel makes up about 75% of total travel volume in the U.S., underscoring the demand for vacations, family visits, and recreational trips as the primary driver of the hospitality sector.

- Business travel spending recovered to 65% of pre-pandemic levels in 2023, reflecting the gradual normalization of corporate travel budgets and events.

- The hospitality industry in the U.S. employs nearly 16 million people, ranging from hotel staff and restaurant employees to travel agents and event coordinators.

- Hotel occupancy rates averaged 68% in the U.S. during 2023, showing strong utilization of accommodation capacity as both domestic and international travelers returned.

European Travel Commission (ETC)

- Europe received over 743 million international tourist arrivals in 2023, continuing its position as the world’s most visited region due to its rich cultural heritage and diverse attractions.

- Cultural and heritage tourism represents about 40% of all tourism activities in Europe, reflecting travelers’ strong interest in museums, historic sites, and traditional festivals.

- Europe’s hospitality sector employs approximately 13 million people, contributing significantly to regional employment and economic stability.

- The average length of stay for international tourists in Europe is about 6.9 nights, indicating a preference for extended visits that boost local hospitality revenue.

- About 45% of European travelers express a preference for sustainable tourism options, such as eco-friendly accommodations and responsible travel packages, reflecting increased environmental awareness.

Japan National Tourism Organization (JNTO)

- Japan welcomed over 32 million international visitors in 2023, marking a strong recovery driven by eased travel restrictions and heightened interest in Japan’s unique cultural and natural attractions.

- Domestic tourism spending in Japan surpassed ¥15 trillion (around $110 billion) in 2023, highlighting the importance of local travel to the country’s hospitality industry.

- The average hotel occupancy rate in Japan stood at 74% in 2023, reflecting steady demand from both domestic and foreign tourists.

- The hospitality sector employs more than 2 million people in Japan, spanning various accommodation types, restaurants, and tourism-related services.

- Capsule hotels and traditional ryokans account for about 15% of all accommodation types in Japan, showcasing the diversity and cultural uniqueness of its hospitality offerings.

United Nations Environment Programme (UNEP)

- More than 50% of hotels worldwide have implemented energy efficiency measures, such as LED lighting and HVAC upgrades, to reduce operational costs and environmental impact.

- Water consumption in the hospitality sector can be reduced by up to 30% through green technologies, including low-flow fixtures and water recycling systems.

- Approximately 45% of hotels globally have active waste reduction programs, targeting reductions in food waste, single-use plastics, and packaging materials.

- 35% of hospitality businesses have established sustainability targets aligned with the UN Sustainable Development Goals (SDGs), showing increased accountability and long-term planning for environmental stewardship.

International Air Transport Association (IATA)

- Passenger air traffic is projected to grow by 4.2% annually through 2030, which will drive demand for hospitality services near airports and popular tourist destinations.

- 90% of international tourists arrive at their destination by air, underlining the strong connection between aviation and hospitality sectors.

- Airport hotels globally achieve an average occupancy rate of 75%, catering to business travelers, transit passengers, and airline staff.

- Business travelers account for 23% of all airline passengers, highlighting their importance to both the aviation and hospitality industries.

OECD (Organisation for Economic Co-operation and Development)

- On average, hospitality contributes around 4.5% to the GDP of OECD member countries, demonstrating its economic significance across developed nations.

- Tourism employment in OECD countries increased by an average of 3.5% annually from 2018 to 2023, reflecting steady sector growth despite economic challenges.

- Digital bookings represent over 60% of total accommodation reservations in OECD countries, signaling a major shift toward online platforms and mobile apps for travel planning.

- Average hotel room rates in OECD countries rose by 5% in 2023, reflecting higher demand and inflationary pressures on the hospitality industry.

International Labour Organization (ILO)

- Women make up 54% of the global hospitality workforce, highlighting the sector’s role in providing employment opportunities for women worldwide.

- Youth aged 15-24 constitute 30% of the hospitality workforce globally, making the industry an important entry point into employment for young people.

- Hospitality workers face a 20% higher risk of job insecurity compared to other sectors, indicating vulnerability, especially during economic downturns or crises.

- Training programs focused on digital skills in hospitality have increased by 40% worldwide, reflecting the growing importance of technology in service delivery and management.

Global Hospitality Industry Market: Market Dynamics

Driving Factors in the Global Hospitality Industry Market

Expanding Middle Class and Disposable Income in Emerging Markets

One of the most powerful growth drivers for the global hospitality industry is the expanding middle class, particularly in Asia-Pacific, Africa, and Latin America. Countries like India, China, Indonesia, Brazil, and Nigeria are witnessing rapid urbanization and rising disposable incomes, which are translating into increased travel and demand for quality hospitality services. Millions of first-time travelers are entering the leisure and business tourism segments, seeking accommodation, dining, and entertainment experiences that were previously unaffordable. Governments in these regions are also supporting tourism through visa relaxations, infrastructure investments, and public-private partnerships, thus creating a fertile ground for hospitality expansion.

Hotel chains are entering tier-II and tier-III cities with budget and midscale offerings to meet local demand. Domestic tourism is particularly robust, contributing more to occupancy and revenue than international travelers in many countries. Moreover, the rise of digital payment systems and online booking platforms is enabling easy access to travel planning. As aspirational lifestyles grow, the middle class in emerging markets is expected to be a long-term catalyst for global hospitality development.

Rapid Urbanization and Infrastructure Development

Urbanization is significantly transforming the hospitality landscape by creating new demand nodes in major cities and regional hubs. As global cities expand, the need for business accommodations, leisure options, and conference facilities increases in tandem. Infrastructure development, such as new airports, roads, metros, and high-speed trains, makes travel easier and encourages intercity tourism and business trips. Mega-events, sports tournaments, international expos, and cultural festivals also boost short-term demand in urban areas.

Cities are investing in convention centers, shopping malls, and entertainment districts that attract tourists and create synergistic opportunities for hotels and restaurants. Hospitality companies are capitalizing on this trend by launching urban-centric brands tailored for compact spaces, co-living models, and modern amenities that appeal to urban dwellers and travelers alike. Moreover, urban hospitality development fosters employment, drives real estate appreciation, and enhances economic vitality. The trend is not limited to capitals; secondary cities and business hubs are also seeing growth in branded hotels, hostels, and serviced apartments.

Restraints in the Global Hospitality Industry Market

Labor Shortages and High Employee Turnover

The hospitality industry is heavily labor-dependent, and labor shortages have emerged as a significant constraint in recent years. Post-pandemic, many former workers in the hospitality sector have transitioned to other industries offering more stable hours, higher pay, and safer working environments. This trend has led to critical gaps in key operational roles such as housekeeping, front desk, culinary services, and maintenance. High employee turnover remains a long-standing issue due to long working hours, physically demanding tasks, and limited career advancement opportunities.

The shortage of skilled labor impacts service quality, guest satisfaction, and revenue performance. To counteract this, hospitality firms are investing heavily in recruitment, training, automation, and retention strategies. However, rising wages and operational costs continue to strain profit margins. In some regions, visa restrictions and immigration policies exacerbate the shortage by limiting access to migrant labor. Without a sustained strategy for workforce development, this structural issue may hamper long-term growth and expansion plans across global markets.

Economic Uncertainty and Geopolitical Disruptions

The global hospitality industry is inherently sensitive to macroeconomic and geopolitical variables, which serve as major restraints. Economic recessions, inflation spikes, currency volatility, and interest rate hikes reduce consumers’ disposable income and corporate travel budgets, leading to declines in occupancy and spending. Additionally, geopolitical events such as wars, terrorist threats, and diplomatic tensions discourage international travel and affect destination desirability. For instance, the Russia-Ukraine conflict disrupted tourism flows across Europe, while sanctions and travel bans created operational challenges for multinational hospitality firms.

Political instability and regulatory unpredictability in emerging markets can also impact investment planning and profitability. Travel advisories, security risks, and public health alerts often result in large-scale cancellations. Moreover, supply chain disruptions triggered by global crises affect food & beverage sourcing, maintenance, and logistics operations in hotels. As the industry operates on relatively thin margins, prolonged external shocks can severely dent recovery efforts and delay new projects.

Opportunities in the Global Hospitality Industry Market

Sustainable and Eco-Friendly Hospitality Concepts

Sustainability is no longer a niche consideration but a mainstream expectation among travelers, particularly younger demographics who prioritize environmental responsibility. This shift presents a massive growth opportunity for the global hospitality sector. Properties that emphasize energy-efficient design, zero-waste kitchens, local sourcing, carbon-neutral operations, and eco-tourism experiences are gaining popularity and customer loyalty. LEED certification, solar power integration, and green building techniques are becoming key differentiators for hotels aiming to attract conscious consumers. Many global hospitality groups are setting ambitious sustainability goals and launching green brands that showcase a commitment to the environment.

Additionally, partnerships with local communities for resource management, waste disposal, and cultural engagement provide added authenticity and resilience. In rural and coastal regions, eco-resorts and nature lodges are thriving as travelers seek regenerative experiences. Government policies are also promoting green tourism through tax incentives and regulatory frameworks. Ultimately, aligning with sustainability not only enhances brand equity but also ensures long-term operational cost savings and regulatory compliance.

Digital Nomadism and Long-Stay Travel Models

The global shift toward remote work and location-independent careers has given rise to a new traveler segment: digital nomads. This trend has opened up opportunities for the hospitality industry to offer extended-stay and workation-focused models that blend work and leisure in appealing destinations. Hotels, resorts, and serviced apartments are now creating co-working amenities, high-speed internet infrastructure, flexible room packages, and wellness programs to attract long-term guests. From Bali to Barcelona, and from Lisbon to Chiang Mai, hospitality operators are developing loyalty programs and partnerships with freelance platforms to engage digital nomads.

The average stay duration among such travelers is much longer than that of traditional tourists, translating into stable revenue streams and lower turnover costs. Moreover, suburban and rural destinations are emerging as hotspots for work-from-anywhere lifestyles, driving the expansion of hospitality services beyond traditional urban centers. The long-stay travel segment also appeals to relocating professionals, medical tourists, students, and retired travelers, diversifying demand.

Trends in the Global Hospitality Industry Market

Rise of Experience-Driven and Lifestyle Hospitality Offerings

Modern consumers, especially Millennials and Gen Z, are increasingly seeking personalized, experience-rich stays over traditional, standardized accommodations. This shift is driving the rise of boutique hotels, themed resorts, and lifestyle hotels that emphasize local culture, design, gastronomy, and wellness. These properties offer immersive experiences, such as cooking classes, nature-based retreats, art-driven interiors, and curated neighborhood explorations, which align with travelers' emotional and cultural aspirations. This trend is especially pronounced in urban destinations, nature reserves, and historic towns. Hospitality brands are reengineering their portfolios by acquiring or launching niche brands that cater to this experiential demand.

Major players like Marriott and Accor have expanded lifestyle collections under brands like Moxy and Mama Shelter. Tech integration also supports this trend, hotels now use apps, in-room tablets, and virtual concierge services to enhance guest personalization and engagement. Ultimately, the shift toward experience-first offerings reflects a broader consumer movement toward meaningful travel, prompting operators to invest in storytelling, community integration, and sustainability.

Integration of Smart Technology and Contactless Services

The post-pandemic era has accelerated the adoption of smart technologies across the hospitality industry. Hotels and resorts are rapidly integrating contactless check-in/out systems, mobile room keys, AI-powered service bots, IoT-enabled rooms, and voice-controlled amenities. These innovations enhance operational efficiency while meeting the growing demand for hygiene, speed, and personalization. Guests increasingly expect digital convenience, such as remote booking modifications, keyless entry, and instant room service ordering from their smartphones.

Moreover, smart thermostats, lighting systems, and entertainment controls have become industry norms in upscale accommodations. Back-end systems are also transforming cloud-based property management systems, AI-driven demand forecasting, and CRM platforms to streamline operations. Contactless payments, digital menus, and automated housekeeping scheduling further support leaner, safer hospitality services. This digital shift not only enhances guest satisfaction but also reduces labor dependencies, improves data collection for analytics, and increases profitability. As technology costs decrease, smart features are trickling down from luxury hotels to mid-scale and economy properties, setting a new industry standard globally.

Global Hospitality Industry Market: Research Scope and Analysis

By Service Type Analysis

Accommodation services are projected to dominate the global hospitality industry as they form the fundamental core around which all other services revolve. Whether for business, leisure, religious, or medical travel, the need for a place to stay is the starting point of any trip. Hotels, motels, resorts, hostels, and serviced apartments provide essential shelter, comfort, and security, fulfilling a universal and non-substitutable requirement. This universality ensures consistent demand across regions and customer segments, from budget-conscious backpackers to ultra-luxury travelers.

According to the World Tourism Organization (UNWTO), global tourist arrivals surpassed 1.3 billion pre-pandemic, and nearly every one of those travelers required accommodation, reinforcing the segment’s unshakeable centrality. Accommodation services also have high revenue-generation potential due to their ability to upsell premium services such as suites, room service, mini-bars, and add-on packages (spa, dining, entertainment). Furthermore, innovations in short-term rentals and home-sharing (e.g., Airbnb) have expanded the definition of accommodation, capturing a broader market share and transforming traditional hospitality models.

Another contributing factor is the recurring nature of occupancy, which creates long-term value. Large-scale hotel chains with branded accommodation services can also capitalize on global loyalty programs and standardization strategies. Moreover, accommodation properties act as hubs, often offering in-house dining, event hosting, recreation, and retail services, making them vertically integrated business centers. From urban business hotels to beachside resorts and rural eco-lodges, accommodation services remain indispensable across all geographies and customer segments. Their dominance is not just based on volume but on their irreplaceable function within the broader hospitality ecosystem.

By Business Model Analysis

The franchise model is poised to dominate the global hospitality industry because it enables rapid and scalable expansion while balancing brand control with local market adaptation. Major hotel chains like Marriott, Hilton, Wyndham, and IHG extensively utilize this model to grow their international presence without the full capital burden of ownership. Franchising allows parent companies to license their well-established brand, operational standards, and booking platforms to independent or regional property owners, who then operate the hotels under the brand name in exchange for royalty fees.

This approach significantly reduces risk for the franchisor while empowering franchisees with instant brand equity, customer loyalty, and global distribution systems. The flexibility of the franchise model suits a wide variety of property types, from economy and midscale hotels to boutique and luxury establishments. It supports both greenfield projects and conversions of existing independent hotels, making it highly adaptable in diverse markets.

Franchise models are also operationally efficient. Local operators manage day-to-day responsibilities while following standardized protocols, which ensures brand consistency across global locations. Meanwhile, the franchisor focuses on marketing, innovation, quality audits, and technology upgrades. This structure creates a symbiotic relationship where both parties benefit from revenue growth.

Additionally, the model thrives due to its alignment with asset-light strategies. With minimal physical asset ownership, major hospitality brands achieve higher returns on investment and better resilience during market fluctuations. The franchise system has proven especially effective in emerging markets where local entrepreneurs can leverage international brand power. It is this hybrid of scalability, profitability, and adaptability that makes franchising the most dominant business model in hospitality.

By Booking Channel Analysis

Direct booking channels are projected to emerge as the dominant force in the hospitality industry due to their ability to offer higher profitability, improved customer engagement, and stronger brand loyalty. Unlike third-party booking platforms or travel agencies, direct bookings through a hotel’s website, app, call center, or in-person bypass commission fees that can range from 15% to 25%, significantly enhancing the bottom line. This cost efficiency is particularly vital for budget and mid-range hotels with thinner margins, making direct bookings a strategic imperative.

Moreover, direct booking channels offer hotels better control over the customer experience. Hotels can gather critical guest data such as preferences, behaviors, and feedback, which can be used for personalization, upselling, and targeted marketing. Personalized offers, loyalty rewards, exclusive discounts, and flexible cancellation policies are key incentives that hotels use to attract customers to book directly rather than via intermediaries.

Another driver behind this dominance is the increased investment in digital transformation by hospitality brands. Enhanced websites, seamless mobile experiences, AI chatbots, and user-friendly booking engines have drastically improved the convenience and reliability of direct channels. Loyalty programs like Marriott Bonvoy or Hilton Honors further incentivize direct engagement by offering points, room upgrades, and elite status to repeat customers.

Direct bookings also foster trust and transparency, as customers often feel more secure transacting directly with the property, especially post-pandemic, when cancellation flexibility and safety assurances became top priorities. Ultimately, direct booking combines profitability, personalization, and relationship-building, making it the preferred and most dominant booking method for modern hospitality enterprises.

The Global Hospitality Industry Market Report is segmented on the basis of the following:

By Service Type

- Accommodation Services

- Hotels & Resorts

- Motels

- Vacation Rentals

- Hostels

- Serviced Apartments

- Food & Beverage Services

- Full-Service Restaurants

- Quick Service Restaurants (QSR)

- Cafés and Bars

- Catering Services

- Travel & Tourism Services

- Tour Operators

- Travel Agencies

- Cruise Lines

- Recreational Services

- Casinos

- Theme Parks

- Spas & Wellness Centers

- Event Management Services

- MICE (Meetings, Incentives, Conferences, and Exhibitions)

- Wedding and Social Events

- Corporate Events

By Business Model

- Franchise Model

- Ownership Model

- Management Contract

- Leased Model

By Booking Channel

-

Indirect Booking

-

Direct Booking

-

Website & Mobile App

- Walk-in

Global Hospitality Industry Market: Regional Analysis

Region with the Largest Revenue Share

Asia-Pacific is projected to dominate the global hospitality industry market as it holds 40.7% of the total market revenue by the end of 2025, due to its vast and rapidly growing middle-class population, increasing international and domestic tourism, and aggressive infrastructure development across emerging economies. Countries like China, India, Thailand, Indonesia, Vietnam, and Malaysia have witnessed a surge in disposable income, which has fueled travel and leisure demand among the region’s younger demographic. According to the UN World Tourism Organization (UNWTO), Asia-Pacific has consistently led global tourism arrivals in recent years, driven by intra-regional tourism and the proliferation of budget airlines and digital booking platforms.

Moreover, government initiatives such as India's "Incredible India" campaign, China’s Belt and Road tourism corridor, and ASEAN's cross-border tourism partnerships have significantly boosted tourism flows. The region also hosts some of the world’s most visited cities, including Bangkok, Tokyo, and Seoul. Mega-events like the Beijing Olympics, Tokyo Olympics, and international expos further catalyze hospitality investments. Global hotel chains are expanding aggressively in Asia-Pacific via franchising and joint ventures, attracted by the region’s dynamic demand. With ongoing urbanization, smart city projects, and an emphasis on experiential travel, Asia-Pacific's dominance is expected to remain strong, particularly in accommodation and food services.

Region with the Highest CAGR

North America is projected to register the highest CAGR in the hospitality industry due to strong technological adoption, high spending per tourist, and a mature yet rapidly evolving market structure. The U.S. and Canada boast some of the world’s largest hospitality brands, including Marriott, Hilton, and Hyatt, which continue to innovate via asset-light models, personalized digital booking channels, and sustainability-driven operations. The region also benefits from robust domestic tourism, with the U.S. Travel Association reporting over 2.3 billion domestic person-trips annually.

Post-pandemic recovery in the U.S. has been particularly resilient, supported by leisure travel, “workcations,” and hybrid business events. Additionally, North America leads in integrating AI, CRM tools, mobile apps, and IoT-enabled smart rooms to elevate guest experience and operational efficiency. Policy support for tourism development and tax incentives for hotel construction further enhance growth potential. Moreover, increasing cross-border travel with Latin America and Europe is contributing to the growing demand. These factors collectively support the region’s status as the fastest-growing in terms of compound annual growth rate.

By Region

North America

Europe

- Germany

- The U.K.

- France

- Italy

- Russia

- Spain

- Benelux

- Nordic

- Rest of Europe

Asia-Pacific

- China

- Japan

- South Korea

- India

- ANZ

- ASEAN

- Rest of Asia-Pacific

Latin America

- Brazil

- Mexico

- Argentina

- Colombia

- Rest of Latin America

Middle East & Africa

- Saudi Arabia

- UAE

- South Africa

- Israel

- Egypt

- Rest of MEA

Global Hospitality Industry Market: Competitive Landscape

The global hospitality industry is highly competitive, marked by the presence of both multinational hotel chains and regional players vying for market share. Major corporations such as Marriott International, Hilton Worldwide, Hyatt Hotels, and InterContinental Hotels Group (IHG) dominate through extensive global footprints, diversified brand portfolios, and strong loyalty programs. These companies adopt asset-light models, relying heavily on franchising and management contracts to accelerate growth while minimizing capital exposure.

Luxury brands like Four Seasons, Mandarin Oriental, and The Ritz-Carlton focus on premium guest experiences and exclusive destinations, while budget and mid-range chains such as Choice Hotels, Best Western, and Wyndham appeal to price-conscious travelers. Increasingly, traditional hotel companies face competition from alternative lodging platforms like Airbnb and Vrbo, prompting incumbents to adapt through acquisitions, innovation, and hybrid lodging models.

Technology-driven strategies such as contactless check-in, AI-based personalization, mobile key access, and CRM-powered loyalty systems are reshaping competition. Sustainability initiatives like green building certifications, zero-waste operations, and local sourcing also differentiate brands in a climate-conscious market. Regional players in Asia-Pacific, the Middle East, and Latin America are gaining ground through culturally aligned services and local investment. As the market evolves, competition will hinge on adaptability, personalization, and operational excellence.

Some of the prominent players in the Global Hospitality Industry Market are:

- Marriott International

- Hilton Worldwide Holdings

- InterContinental Hotels Group (IHG)

- AccorHotels

- Hyatt Hotels Corporation

- Wyndham Hotels & Resorts

- Choice Hotels International

- Jin Jiang International

- MGM Resorts International

- Four Seasons Hotels and Resorts

- Radisson Hotel Group

- Melia Hotels International

- Best Western Hotels & Resorts

- Mandarin Oriental Hotel Group

- The Ritz-Carlton Hotel Company

- Host Hotels & Resorts

- Caesars Entertainment

- Shangri-La Hotels and Resorts

- Loews Hotels & Co

- Whitbread PLC (Premier Inn)

- Other Key Players

Recent Developments in the Global Hospitality Industry Market

- May 2025: Henderson Park acquired the Arizona Biltmore for $705 million. This acquisition signifies the continued momentum of institutional investment in high-end resort properties. The Arizona Biltmore, a luxury resort with historic significance and premium branding, was purchased by Henderson Park as part of its strategy to diversify into experience-based hospitality assets. The deal reflects the rising demand for properties that combine legacy, brand equity, and destination value as travelers increasingly seek exclusive, curated experiences.

- May 2025: The Lodging Conference 2025 was convened in Phoenix, Arizona. The event brought together thousands of hotel owners, real estate developers, investment banks, and hospitality CEOs to discuss trends such as AI-enabled guest service platforms, sustainable construction, and generational travel preferences. The conference underscored how economic resilience, rising leisure travel, and experiential tourism are shaping the next wave of hotel investments across global markets.

- May 2025: Boutique Hotel Investment Conference 2025 held in New York, NY. Hosted by the Boutique Lifestyle Leaders Association (BLLA), this event highlighted key trends such as the rise of art-integrated design hotels, sustainability-focused capital injections, and localized service delivery models. Investors explored the financial viability of boutique properties and the increasing value of niche storytelling in hospitality branding.

- April 2025: Vinci acquired a 50% stake in Edinburgh Airport for $1.58 billion. French infrastructure giant Vinci’s investment in Edinburgh Airport emphasizes the deepening connection between travel infrastructure and hospitality growth. As gateway hubs significantly influence tourism patterns, the acquisition enhances Vinci’s access to one of the UK’s busiest tourism-driven transport centers, signaling long-term confidence in global travel recovery.

- April 2025: Hospitality Innovation Summit held in Dubai, UAE. This major event spotlighted AI-powered concierge systems, biometric room access, sustainable energy usage in hotel design, and VR-enabled travel planning. The summit attracted global hospitality operators, tech providers, and investors exploring the intersection of digital transformation and guest personalization in the hotel and resort segments.

- April 2025: AAHOA Convention & Trade Show (AAHOACON) took place in Orlando, Florida The largest hospitality gathering in the U.S. for hotel owners of Asian American descent, the 2025 event focused on ownership equity, operational excellence, digital transition, and franchise negotiations. Attendees participated in policy discussions with brand leaders and examined data trends shaping hotel development pipelines.

- March 2025: American Express Global Business Travel completed its acquisition of CWT for $570 million. The merger of two of the world's largest travel management companies creates a unified entity with expanded capabilities in corporate travel, loyalty systems, and business lodging. The acquisition is expected to streamline back-end operations and offer enhanced service personalization for corporate clients across global markets.

- March 2025: Hunter Hotel Investment Conference held in Atlanta, Georgia. The conference addressed investor sentiment around rising interest rates, inflation-resistant asset classes, and adaptive reuse of commercial properties into hospitality units. Panelists emphasized the resilience of limited-service hotels and how select-service models are drawing significant franchise and private equity attention.

- January 2025: Hyve Group, a UK-based global event organizer, unveiled aggressive M&A strategies post-privatization. Following its acquisition by Providence and Searchlight Capital, Hyve announced plans to double revenue by acquiring targeted B2B hospitality expos, conferences, and networking platforms to capitalize on the booming demand for face-to-face industry engagement after years of digital-only forums.

- December 2024: Clarion Events announced a strategy to scale through annual acquisitions Owned by Blackstone, Clarion stated its goal to acquire two to three event businesses per year, especially those in hospitality, travel, and tourism sectors. The company seeks to dominate trade shows and summits where hotel owners, tech vendors, and foodservice operators converge, enabling global expansion.

- November 2024: Mews acquired Atomize, a cloud-based revenue management software provider. This deal enables Mews to offer hoteliers AI-driven dynamic pricing models, enabling better yield management, real-time room rate adjustments, and data analytics. The acquisition supports Mews' ambition to be an all-in-one hospitality cloud platform combining PMS, booking engines, and financial intelligence tools.

- October 2024: Cendyn acquired Knowland, a meetings and events data intelligence company. This move enhances Cendyn’s offerings in group business forecasting, lead scoring, and RFP automation. It also strengthens hotel sales teams’ ability to win more group bookings, a crucial revenue stream post-COVID as the MICE (Meetings, Incentives, Conferences, and Exhibitions) sector rebounds globally.