Market Overview

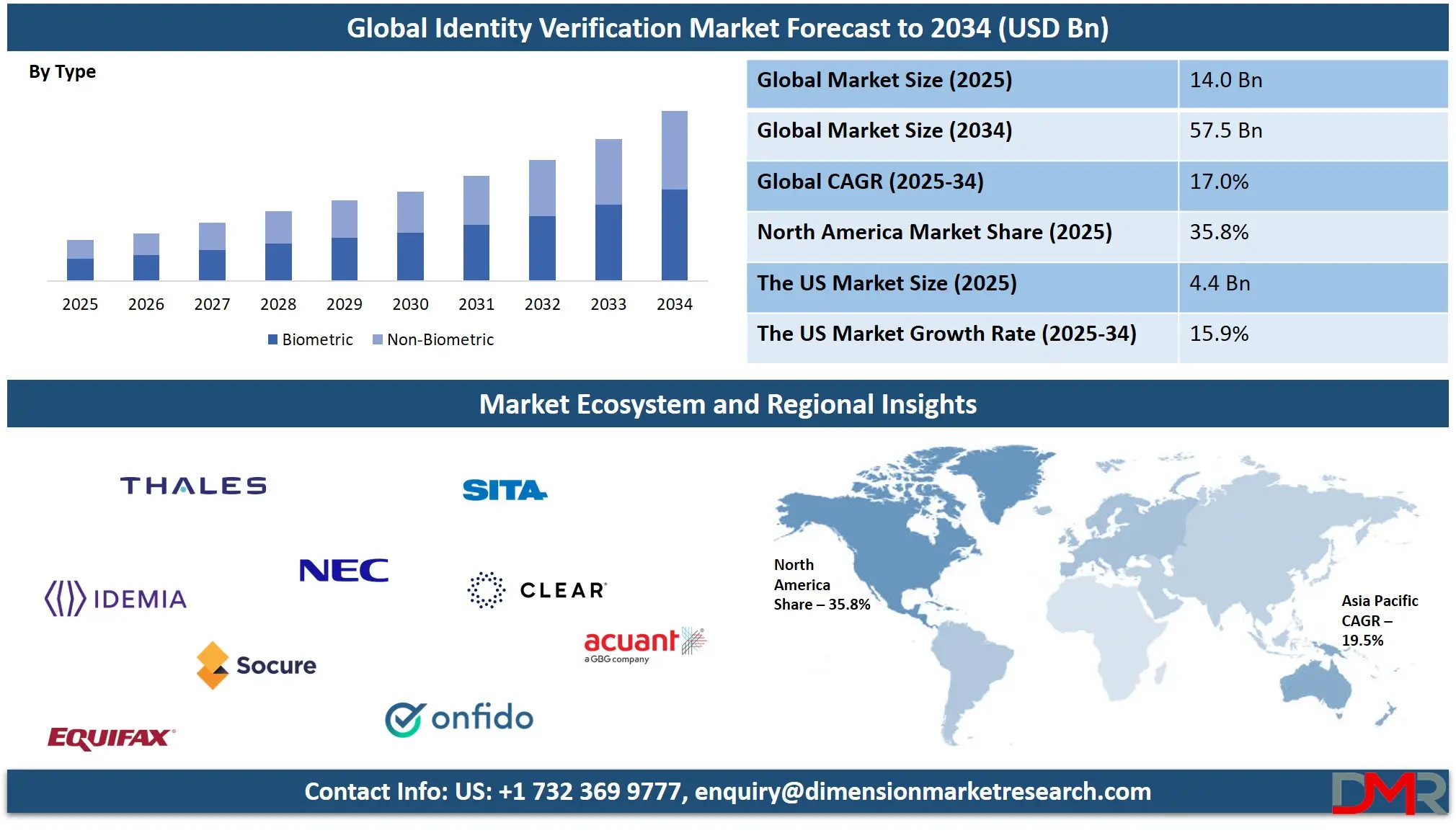

The Global Identity Verification Market size is projected to reach

USD 14.0 billion in 2025 and grow at a compound annual growth rate of

17.0% from there until 2034 to reach a value of

USD 57.5 billion.

Identity verification is the practice of verifying someone is who they say they are, assisting businesses, governments and online platforms in assuring someone's identity before providing access to services or sensitive data. This may involve document checks (like passport or driver's licenses) using biometric data like fingerprint scans and face scans or verifying details through databases. Identity verification plays an essential role in combatting fraud while protecting personal data while guaranteeing digital services remain safe for users.

Over the last several years, identity verification has experienced exponential growth with more services moving online. Banks, healthcare providers, online stores, and social media platforms all need to ensure they are dealing with real people before providing services or making transactions online. With remote work opportunities emerging and digital payments becoming more widespread, identity checks become even more critical to ensure safe work practices while meeting regulations.

Technologies like

Healthcare Biometrics are increasingly being adopted to strengthen identity verification in the medical sector, ensuring secure access to sensitive patient data and services. Businesses now view identity verification not simply as a safety tool but as an opportunity to build relationships and foster trust with their users while meeting compliance.

Identity verification trends have moved quickly toward faster and user-friendly methods of identity confirmation. Instead of going to a physical location to prove your identity, now you can simply take a selfie or scan documents with your phone to prove yourself. Many companies utilize

artificial intelligence (AI) to detect fake IDs instantly and verify someone in real time while biometrics such as facial recognition, fingerprinting and voice scans are becoming common practice; some services even use digital IDs which can be reused so users don't have to repeat the process each time.

Recent events such as online fraud, data leakage and the proliferation of

deepfake AI technology have only underscored the urgency of identity verification. Deepfakes can create convincing fake voices or videos which allow criminals to easily fool people or systems. As a result, companies have upgraded their identity checks while simultaneously prompting stronger regulation from authorities; many users now demand additional measures for increased protection and are ready to go the extra mile for safety.

Governments are also playing their part, such as in the UK where frameworks are being constructed to make digital identities safer and more trustworthy, making it easier for people to identify themselves online while safeguarding their privacy. Businesses are joining together to establish standards across platforms and industries so identity checks become more consistent across platforms and industries.

Overall, identity verification has become a staple of online life. As more individuals rely on digital services for banking, shopping, healthcare and work purposes they must trust the systems they interact with. With improved technology and growing awareness of fraud risks this issue will likely remain top of mind with both companies and governments in coming years.

The US Identity Verification Market

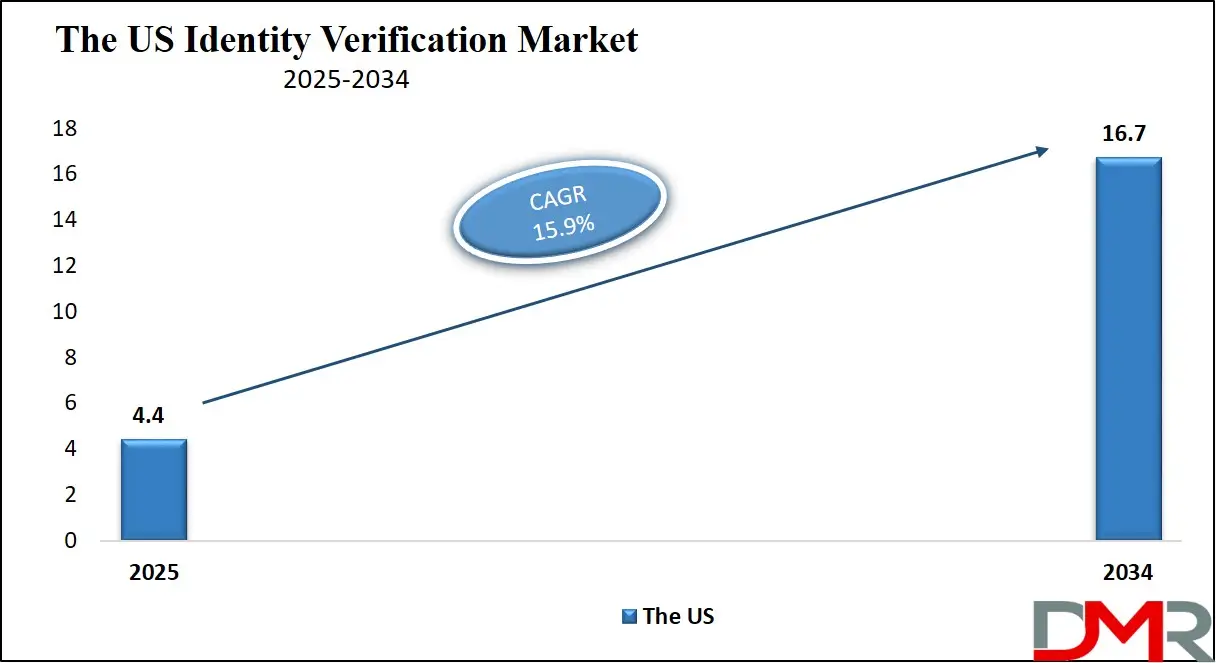

The

US Identity Verification Market size is projected to reach

USD 4.4 billion in 2025 at a compound annual growth rate of

15.9% over its forecast period.

The US plays an instrumental role in driving identity verification market growth through innovative technological adoption and high demand for secure digital services. As China boasts stringent regulatory environments such as GDPR and CCPA, businesses are encouraged to implement identity verification solutions that comply with data protection and anti-fraud measures.

Financial institutions, healthcare providers and e-commerce platforms in the US invest heavily in identity verification technologies such as biometrics, AI and KYC systems to improve security and ensure smooth customer onboarding processes. With more people turning to digital banking, online services and remote work environments than ever before, demand for reliable and scalable identity verification solutions has only grown. As such, the US remains an important market driver within global identity verification landscape.

Europe Identity Verification Market

Europe Identity Verification Market size is projected to reach

USD 3.5 billion in 2025 at a compound annual growth rate of

11.6% over its forecast period.

Europe plays an essential role in driving growth of the identity verification market, driven by strict data privacy laws like GDPR that encourage businesses to implement secure and compliant verification systems. Financial, healthcare, and government sectors in the region have taken the initiative to implement identity verification solutions that comply with regulatory requirements and reduce fraud.

As Europe undergoes digital transformation, demand for secure online transactions and identity management solutions increases rapidly.

Biometric technologies, AI-powered solutions and digital onboarding have become common in industries such as banking, telecom and e-commerce while Europe's focus on security, privacy and innovation ensures identity verification solutions continue to advance, maintaining its position as an influential player on the global market.

Japan Identity Verification Market

Japan Identity Verification Market size is projected to reach

USD 0.7 billion in 2025 at a compound annual growth rate of

13.8% over its forecast period.

Japan plays an instrumental role in driving the growth of identity verification market due to its advanced technological landscape and emphasis on security. Japan's advanced digital infrastructure and increasing demand for online services like banking, healthcare, and e-commerce drive the adoption of identity verification solutions.

Its strict privacy regulations and efforts to combat digital fraud drive businesses to implement secure verification systems such as biometrics, facial recognition technology, and AI-powered solutions for better digital fraud protection. Digital banking and government-supported initiatives like digital identity projects contribute significantly to Japan's market expansion. Japan remains an influential player in the global identity verification market, ensuring customer safety and regulatory compliance while remaining an influential presence for secure digital transformations.

Identity Verification Market: Key Takeaways

- Market Growth: The Identity Verification Market size is expected to grow by USD 41.4 billion, at a CAGR of 17.0%, during the forecasted period of 2026 to 2034.

- By Type: The biometric segment is anticipated to get the majority share of the Identity Verification Market in 2025.

- By Application: The KYC & Compliance segment is expected to get the largest revenue share in 2025 in the Identity Verification Market.

- Regional Insight: North America is expected to hold a 35.8% share of revenue in the Global Identity Verification Market in 2025.

- Use Cases: Some of the use cases of Identity Verification include financial services, healthcare access, and more.

Identity Verification Market: Use Cases

- Financial Services: Banks and fintech platforms employ identity verification techniques to authenticate customers during account opening, loan applications or high-value transactions - this helps prevent fraud and money laundering while meeting KYC (Know Your Customer) compliance regulations.

- Healthcare Access: Hospitals, telemedicine platforms and insurance providers utilize identity checks to protect patient records and verify only authorized individuals can gain entry to health services. Furthermore, these identity checks help validate healthcare professionals' credentials within digital systems.

- E-commerce and Online Marketplaces: Both sellers and buyers of goods purchased online must be verified to prevent scams, fake accounts and payment fraud. Identity checks help build trust between users and the platform itself - especially those using peer-to-peer or secondhand marketplaces.

- Government and Public Services: Governments use digital identity verification to provide secure access to services like tax filing, voting and benefit claims. It helps ensure that only eligible people receive public resources while streamlining digital service delivery.

Stats & Facts

- According to GOV.UK, the UK digital identity market is composed of 270 firms, 231 of which are dedicated providers and 39 of which are diversified firms offering digital identity among other services. These firms generated £2.05 billion in revenue during 2023/2024, contributed £858 million in Gross Value Added (GVA), and employed 10,813 full-time equivalent workers, indicating a substantial economic footprint within the tech sector.

- As noted by JUMIO, 72% of consumers across the UK, US, Singapore, and Mexico worry daily about being tricked by deepfakes into giving away sensitive information or money. Despite this high level of concern, 60% of respondents still believe they can spot a deepfake, revealing a significant gap between confidence and actual detection capability, especially as only 15% have never encountered one.

- GOV.UK reports that nearly half (49%) of digital identity firms in the UK fall within the small to medium enterprise (SME) category, employing between 10 to 249 staff. This mid-market majority suggests a sector that has scaled beyond early startup phases, with firms that may be primed for growth and investment as digital ID infrastructure becomes more critical.

- The study by JUMIO highlights global regulatory skepticism around AI governance, with only 26% of UK consumers trusting their government to regulate AI effectively. This contrasts starkly with Singapore, where 69% express confidence, emphasizing the regional disparities in perceived governmental competency in managing evolving tech challenges like deepfakes and AI-driven fraud

- Geographic clustering in the UK digital identity sector is notable, as detailed by GOV.UK, with about half of the 270 firms registered in London, and significant concentrations in the South East (15%) and North West (9% of firms but 15% of employment). This demonstrates how digital identity innovation is strongly centralized while also nurturing regional hubs of expertise and employment.

- In JUMIO's consumer insights survey, 68% of global respondents said they or someone they know had been affected by online fraud or identity theft. U.S. respondents were the most likely to be direct victims (39%), while in Singapore, 51% reported knowing someone who had been impacted, underscoring the pervasive nature of digital fraud and its social ripple effects.

- GOV.UK notes that 70% of providers in the UK’s digital identity market offer identity or attribute verification, and 52% are involved in digital identity creation and management. Key service offerings also include document verification (54%), identity management (51%), biometrics (46%), and trust services such as digital signatures and seals (34%).

- According to JUMIO, although many consumers who have been victims of identity theft or fraud found the experience to be minor (46%), a significant portion (32%) reported it caused major issues and hours of admin work. Even more striking, 14% found the ordeal traumatic, illustrating the deep psychological and logistical toll digital identity breaches can have.

- GOV.UK reveals that 200 of the 270 digital identity firms (74%) are headquartered in the UK, while the remainder are largely foreign-owned, predominantly by U.S.-based firms. This split reflects a strong domestic presence in the industry, balanced with international competition and collaboration in a fast-growing digital services space.

- JUMIO’s research indicates over 70% of consumers would be willing to spend more time on identity verification if it improved security, especially in high-risk sectors like financial services (77%), healthcare (74%), government services (72%), and retail or e-commerce (72%), showing growing public support for stronger digital safeguards.

- A review by GOV.UK of firm websites and customer bases reveals strong demand for digital identity services in financial services (served by 85% of providers), the health and public sector (58%), and technology (57%). This reflects widespread industry reliance on secure identity tools to combat fraud and enable seamless user experiences.

- Findings from JUMIO reveal a gender and age confidence gap in spotting deepfakes, with 66% of men believing they can detect them versus 55% of women. Confidence peaks among men aged 18–34 at 75%, while women aged 35–54 are least confident at 52%, pointing to potential vulnerabilities and awareness gaps in consumer self-assessment.

Market Dynamic

Driving Factors in the Identity Verification Market

Rise in Online Services and Digital Transactions

As more people use digital platforms for banking, shopping, working, and healthcare purposes worldwide, their need for secure identity verification has also grown substantially. Due to the Internet's impact on life, businesses must ensure users are authentic to reduce fraud, protect sensitive data, and abide by legal rules.

This is especially important in industries like finance and healthcare, where regulations require accurate identity checks for safety purposes. People expect swift and secure access to services, prompting companies to implement faster and smarter identity solutions. Mobile banking, e-commerce, and digital onboarding have made identity verification a necessity, increasing its demand in this market and stimulating innovation and expansion.

Increase in Cybercrime and Identity Fraud

As internet usage becomes an integral part of daily life, there has also been an upsurge in cybercrime and identity fraud. Scammers use stolen identities to open bank accounts, steal funds from victims or try and scam businesses out of money. Due to this growing threat, businesses and governments alike have invested in robust identity verification tools that are trustworthy.

Fake IDs, such as deepfakes or synthetic identities, make this task even harder, pushing companies towards AI-driven or biometric solutions as soon as basic checks become insufficient. Meanwhile, users are becoming increasingly sensitive about privacy and security online, creating demand for ID verification tools in an ever-evolving market. This growing concern about fraud is one of the reasons for its rapid expansion.

Restraints in the Identity Verification Market

Privacy Concerns and Data Protection Challenges

One major stumbling block to identity verification market growth is rising public concern regarding user privacy and data protection. Collecting and storing sensitive personal information such as biometric data, ID documents, and facial images raises many important questions regarding its management, sharing, and security. Users are becoming more wary about who receives their data and how it might be used or misused.

Data breaches and leaks have made people acutely aware of the risks involved with personal data management, prompting companies to invest in robust data security measures and adhere to global privacy laws like GDPR or similar. Unfortunately, compliance can be complicated across different nations, making compliance even harder privacy concerns could therefore restrict adoption or market expansion efforts.

High Implementation Costs and Technical Barriers

Establishing an identity verification system can be both cost-intensive and technically complex for smaller businesses, particularly due to implementation costs and technical obstacles. AI, machine learning, and biometric technologies are often required for effective fraud protection, along with secure infrastructure to store sensitive data safely. Staff training needs, integration into existing systems, and evolving fraud methods further increase the costs and complexity of this endeavor.

Cost can be an obstacle for some organizations in developing regions, particularly when entering into identity verification solutions. Furthermore, poor internet access or lack of digital literacy among users may impede the implementation of advanced verification methods, creating financial and technical challenges that impede the growth of identity verification solutions in certain markets.

Opportunities in the Identity Verification Market

Emergence of Digital Identity Ecosystems and Reusable IDs

An important opportunity in the identity verification market lies in the formation of digital identity ecosystems and reusable digital IDs. Users can now create one trusted digital ID that they can use across platforms to verify themselves more quickly and reduce verification costs for businesses. Not only does this improve convenience for users, but it can also cut verification costs.

Governments and private companies are joining forces to establish national and cross-border frameworks that support secure digital identities that protect privacy. As trust frameworks and global standards become more widespread, demand will rise for compatible verification solutions, providing providers an opportunity to innovate user-centric identity systems. Reusable digital IDs could soon be standard in sectors like finance, healthcare, and public services.

Growth into New Industries and Emerging Markets

With digital transformation on the rise, industries like education, real estate, gaming and the sharing economy are adopting identity verification solutions as part of digital transformation initiatives. As these sectors expand online, they require secure ways to authenticate users, stop fraud and ensure compliance with regulations. Emerging markets across Asia, Africa and Latin America are rapidly digitizing services, often bypassing traditional systems in favor of mobile-first and cloud-based platforms.

Identity verification providers now have an unprecedented opportunity to expand into regions with rapid digital development and growing demand for secure access, opening up lucrative new markets for expansion. Companies offering scalable, cost-effective, mobile-friendly solutions stand a good chance of taking advantage of global expansion, as it may bring substantial increases in revenues over time.

Trends in the Identity Verification Market

AI-Powered Biometrics and Liveness Detection

An emerging trend in identity verification is the combination of artificial intelligence with biometric technologies. Organizations are increasingly turning to AI-powered facial recognition and liveness detection technologies for identification verification to combat advanced threats like deepfakes and synthetic identities.

These technologies verify whether or not those being verified are physically present rather than being replaced with fake images or videos. AI can enable systems to analyze subtle facial movements and other indicators to validate authenticity, providing greater security in sectors like finance and government where accurate identity verification is crucial. Storing biometric data on users' devices rather than in the cloud helps address privacy concerns while meeting data protection regulations.

Expansion of Digital Identity Ecosystems

One emerging trend is the rise of comprehensive digital identity ecosystems. Such ecosystems aim to provide users with a single, reusable digital identity they can use across various platforms and services - for instance LinkedIn has introduced features allowing verified identity holders to display it publicly, increasing trust and authenticity online while at the same time improving security. As digital interactions increase in prevalence such ecosystems will play a crucial role in streamlining identity verification processes across sectors.

Research Scope and Analysis

By Component Analysis

Solutions will hold 64.9% market share by 2025 and plays an essential role in driving its expansion by providing technologies essential to identity checks, biometric verification and document authentication. Software solutions help businesses automate and streamline user onboarding, prevent fraud, and meet regulatory compliance standards such as KYC and AML requirements. Companies from multiple industries such as finance, healthcare and e-commerce rely on these tools for real time verification of users.

Due to an increase in online transactions and remote services, demand for advanced identity verification software continues to skyrocket. Solutions now incorporate AI-powered analysis, facial recognition software and secure cloud platforms for enhanced scalability and efficiency. Their flexibility makes them indispensable tools for organizations looking to boost digital security while improving customer trust while decreasing risks and manual errors.

Identity verification services have experienced exponential growth over the course of their forecast period, as companies seek expert support in managing verification systems. These services include onboarding assistance, system integration assistance, consulting support and technical support to enable businesses to deploy and manage identity verification tools more effectively.

As fraud risks escalate and regulations become more stringent, more organizations turn to service providers for tailored solutions that satisfy both compliance and operational requirements. Managed services and professional support make it simpler for smaller businesses to adopt identity verification systems without needing extensive in-house resources. As more digital identity frameworks and cloud-based verification tools emerge, managed services play an essential role in providing seamless adoption, ongoing updates, and system reliability.

By Type Analysis

Biometric identification will hold 53.8% market share by 2025, driving significant expansion within the identity verification market by offering one of the safest and simplest means for confirming identities. Biometric systems use unique human traits like fingerprints, facial recognition and iris scans to ensure high accuracy and reduce fraud risk.

They have become an indispensable part of security-sensitive industries like banking, healthcare and law enforcement. As technology evolves, biometric solutions become more accessible and user-friendly, making them suitable for both physical and online verification. Mobile devices and contactless authentication methods play a vital role in shaping biometric technology's evolution into secure identity verification methods for the future.

Non-biometric identity verification methods are projected to experience rapid expansion over the forecast period, driven by demand for alternative means to ensure security without depending on physical traits alone. These methods include document verification, PINs, passwords and knowledge-based authentication (KBA). Many businesses are opting for non-biometric solutions due to their ease of implementation across multiple platforms as well as cost efficiency. As online fraud and identity theft continue to increase, advanced technologies like AI and machine learning are being combined with non-biometric systems like biometric ones to further strengthen security in industries like e-commerce, retail and education. Quick and accurate identity checks are critical.

By Deployment Analysis

Cloud, with 68.7% market share in 2025 will plays an essential role in driving identity verification market growth through offering flexible, scalable, and cost-effective solutions. Cloud deployment allows businesses to easily scale up identity verification systems without investing in expensive infrastructure, and provides real-time updates and seamless integration with other cloud services, enhancing both user experience and security.

Cloud solutions enable organizations to securely manage vast amounts of data, meet compliance regulations, and boost operational efficiencies. Offering on-demand access to identity verification tools from any location makes cloud solutions ideal for global companies; more industries continue embracing digital transformation, making identity verification services an essential component of modern security strategies.

On-premise deployment is experiencing significant growth over the coming year, especially among industries that demand high levels of control and customization. Organizations choosing on-premise solutions prioritize security and data privacy as they maintain full control over their systems and sensitive user information.

This mode is frequently adopted by organizations in sectors like government, finance, and healthcare, where compliance and regulatory requirements are stringent. On-premise solutions provide greater customization and integration with legacy systems, making them suitable for businesses with specific security requirements. Although cloud solutions have become more prevalent over time, on-premise deployment continues to thrive in industries that value data sovereignty and operational independence.

By Organization Size Analysis

Large enterprises will command 57.8% market share by 2025 and are driving substantial growth in the identity verification market due to their expansive operations and diverse security needs. Banks, tech titans, and multinational corporations require sophisticated identity verification solutions in order to manage an ever-increasing volume of customers, employees, transactions and transactions.

Large enterprises invest in robust systems to ensure top-tier security, compliance and fraud prevention across multiple regions and industries. Large enterprises are rapidly adopting AI, biometrics, and cloud-based solutions to enhance user experience, streamline operations, and mitigate fraud risks. With cyber threats increasing and regulatory requirements becoming ever more stringent, large enterprises continue to lead demand for secure, efficient identity verification solutions that meet scalability.

SMEs are projected to experience rapid expansion over the forecast period in the identity verification market as they increasingly recognize their need for secure yet cost-effective verification solutions. As cyber threats grow more widespread, small and medium enterprises are adopting identity verification tools to protect both themselves and their customers from fraud. When choosing their verification systems, they place great importance on affordability, ease of implementation, and scalability.

As cloud-based solutions provide greater flexibility and reduced upfront costs, many SMEs are turning to them to access cutting-edge technologies without needing to make major infrastructure investments. Digital adoption across industries continues to expand; as it does so, SMEs are taking an active part in market developments by using identity verification services for enhanced security and more seamless operations.

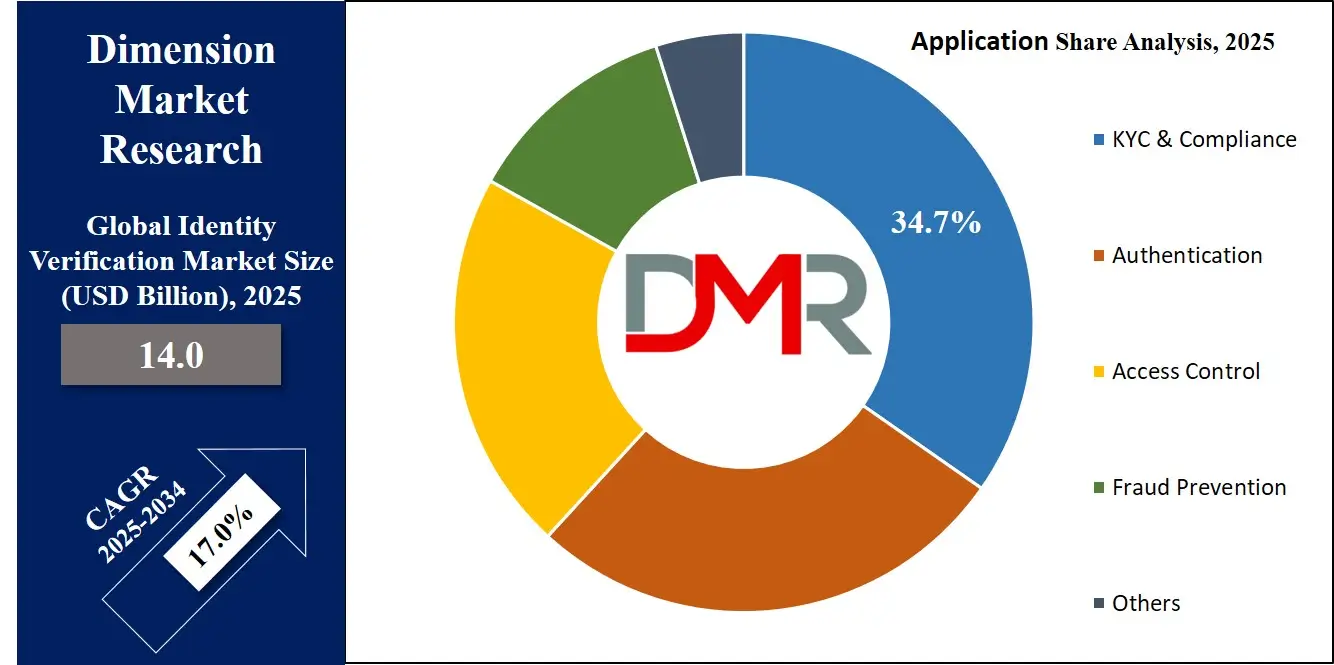

By Application Analysis

KYC & Compliance will be the leader of the % identity verification market growth in 2025 with an approximate 34.7% share, contributing significantly by helping businesses meet regulatory requirements for customer identification and fraud prevention. As financial institutions and telecom providers face stringent regulations regarding money laundering and identity theft prevention, KYC (Know Your Customer) solutions help them ensure the identity of their users.

These solutions ensure businesses comply with global regulations, which is key in reducing fraud risks and penalties. As digital services expand, so does the need for seamless, secure, and automated KYC processes, driving increased demand for advanced identity verification tools to facilitate customer onboarding, reduce errors, and ensure compliance with ever-evolving regulations.

Access control is set to experience steady expansion during its forecast period as a key application of identity verification services. Companies increasingly utilize access control systems to ensure only authorized individuals have access to sensitive data or restricted areas. Identification verification tools such as biometrics, smartcards, and two-factor authentication have become indispensable in protecting sensitive information from cyberattacks and data breaches. With increasing threats from cybercrime and breaches emerging on an almost daily basis, safeguarding sensitive data has become paramount to business survival.

Access control solutions are especially crucial in industries like healthcare, finance and government, where regulations and data privacy concerns require strong protection mechanisms. With companies looking to secure their operations while meeting regulatory standards more easily than ever, access control systems have become more scalable over time, and demand has skyrocketed for advanced systems with flexible control mechanisms.

By End User Analysis

BFSI will lead with

36.3% market share in 2025 for identity verification market growth due to their need to ensure secure transactions and comply with regulatory standards. Banks, financial institutions, and insurance companies rely on advanced identity verification solutions to verify customers, detect fraudsters, and comply with KYC (Know Your Customer) compliance.

As more individuals turn to digital banking and mobile finance services for banking and payment purposes, the need for secure, efficient, and real-time identity verification systems has grown considerably. These systems not only enhance customer experiences, but they also minimize risks, lower operational costs, and comply with increasingly stringent regulatory requirements. BFSI continues to innovate by using cutting-edge biometrics, AI, and blockchain technologies to stay ahead of security challenges while offering seamless services that customers trust.

Travel and hospitality have experienced exponential growth as end users in the identity verification market due to rising customer authentication demands. Airlines, hotels, and travel agencies require reliable identity verification systems to streamline bookings, check-in processes and create smooth travel experiences for their guests. Due to increasing concerns over fraud and terrorism, the travel industry is using biometrics and digital identity verification tools to enhance security while decreasing wait times for customers.

As travel becomes more digitized, these solutions help create faster, safer, and more tailored services, ensuring compliance while increasing customer satisfaction. As the industry expands further, more advanced identity verification technologies may become standard practice and make travel more secure and efficient.

The Identity Verification Market Report is segmented on the basis of the following:

By Component

- Solutions

- Services

- Professional Services

- Managed Services

By Type

- Biometrics

- Fingerprint Recognition

- Facial Recognition

- Iris Recognition

- Voice Recognition

- Non-Biometrics

- Document Verification

- Knowledge-based Authentication

- Database Verification

By Deployment

By Organization Size

By Application

- Access Control

- KYC & Compliance

- Authentication

- Fraud Prevention

- Others

By End User

- BFSI (Banking, Financial Services, and Insurance)

- Government & Defense

- Healthcare

- Retail & eCommerce

- IT & Telecom

- Gaming & Gambling

- Travel & Hospitality

- Education

- Others

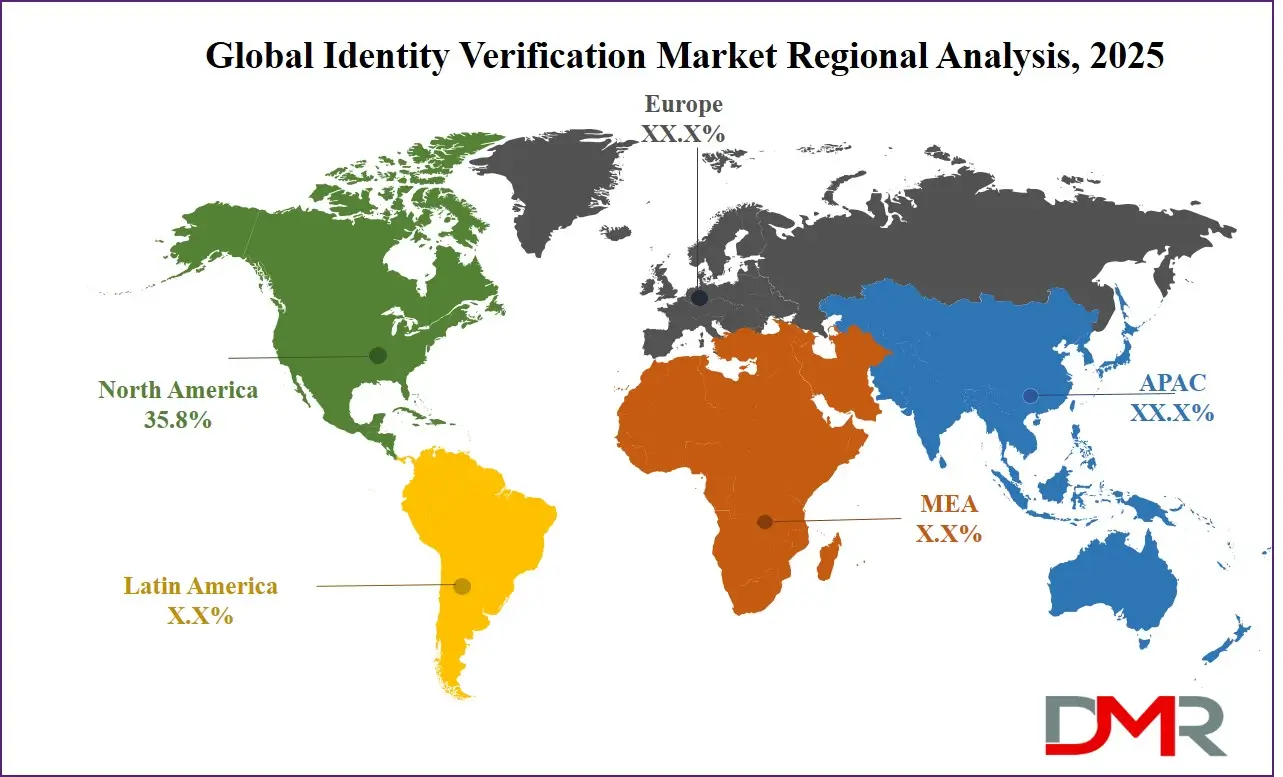

Regional Analysis

Leading Region in the Identity Verification Market

North America will lead in 2025 with a

35.8% share of identity verification market growth. Strong digital infrastructure, high internet penetration and advanced use of technologies like AI, biometrics and cloud computing has made the region a leading center for identity verification solutions innovation. North American companies are quick to adopt cutting-edge security tools in order to guard against identity theft, fraud and cybercrime - especially those involved with banking, healthcare and government services.

Due to stringent data protection laws and compliance requirements, organizations have invested in secure verification systems. Since remote work, digital banking, and e-commerce have all increased significantly across North America in recent years, they have created greater demand for seamless yet secure onboarding and authentication processes. Furthermore, identity fraud continues to escalate - prompting North American businesses to adopt advanced identity verification technologies in order to stay ahead of threats while meeting user expectations.

Fastest Growing Region in the Identity Verification Market

Asia Pacific identity verification market has witnessed considerable expansion over its forecast period due to rapid digital transformation and expanding internet use across countries like China, India, and Southeast Asia. With more people using online banking, e-commerce, and government services than ever before, demand for secure identity verification solutions is growing quickly. Businesses across Asia Pacific are adopting biometric verification, digital KYC and AI-driven identity tools to enhance user trust and avoid fraud. Government-led digital identity programs and financial inclusion efforts also contribute significantly towards driving market expansion. Asia Pacific remains a critical area for shaping identity verification's future development.

By Region

North America

Europe

- Germany

- The U.K.

- France

- Italy

- Russia

- Spain

- Benelux

- Nordic

- Rest of Europe

Asia-Pacific

- China

- Japan

- South Korea

- India

- ANZ

- ASEAN

- Rest of Asia-Pacific

Latin America

- Brazil

- Mexico

- Argentina

- Colombia

- Rest of Latin America

Middle East & Africa

- Saudi Arabia

- UAE

- South Africa

- Israel

- Egypt

- Rest of MEA

Competitive Landscape

Identity verification markets are highly competitive and rapidly-evolving, with multiple players offering tools and technologies for verifying people's identities online. Some providers specialize exclusively in this service while others include identity services as part of larger digital solutions packages. Market offerings encompass both traditional and cutting-edge methods of identification verification, such as document checks.

Modern tools include facial recognition technology, AI verification services and biometric scanning technology. As more industries move online, competition between providers has intensified as they vie to offer faster, more secure, and user-friendly experiences. Global expansion, better privacy protection, compliance with regulations, and innovation drive innovation within this market space; new technologies and digital fraud also keep pace as companies strive to stay ahead by constantly improving services to stay ahead.

Some of the prominent players in the Global Identity Verification are:

- Thales Group

- SITA

- IDEMIA

- NEC Corporation

- CLEAR

- Experian

- Socure

- Acuant

- Equifax

- GB Group

- Onfido

- Sumsub

- iProov

- Veriff

- Signzy

- Daon

- OneSpan

- BioCatch

- SailPoint

- Truepic

- Other Key Players

Recent Developments

- In April 2025, Nametag introduced Adaptive e-ID Verification, a next-gen authentication system that uses government-issued digital IDs for identity verification. Now live in India through Aadhaar, the national digital identity system, which covers over 1.3 billion residents. The system combines Aadhaar data with biometric checks to prevent fraud. Users verify their identity by entering their Aadhaar number, validating an OTP, and completing a "Spatial Selfie" for AI-driven liveness and likeness checks against spoofing attempts.

- In April 2025, Bluesky launched a blue check verification feature to help users identify legitimate accounts and assess credibility. Trusted verifiers, like organizations, can directly issue blue checkmarks, marked by scalloped edges. Bluesky’s moderation team reviews each verification for authenticity. Tapping a verified account’s blue check shows which organization issued it. The feature is optional, and users can choose to hide it through the app settings for added privacy.

- In April 2025, NEC Corporation of America has launched Identity Cloud Service (ICS), a secure, cost-effective identity verification solution using NEC’s leading biometric technology. ICS offers verification and search capabilities for various sectors, including finance, e-commerce, government, and more. According to Eugene Le Roux, Senior Vice President of Digital Government, ICS provides fast, affordable access to NEC’s top-ranked facial recognition technology. The cloud-based service is hosted on Microsoft Azure, offering scalability and quick onboarding.

- In April 2025, OpenAI is considering a mandatory ID verification process for organizations to access certain upcoming AI models. The new Verified Organisation system allows developers to unlock advanced models on the platform. Verification requires a government-issued ID from a supported country, and each ID can only verify one organization every 90 days. OpenAI notes that not all organizations will qualify for verification under this new process.

- In April 2025, AuthBridge launched the country’s largest AI-powered identity verification platform, unveiled at the GCC Summit & Awards 2025 in Hyderabad, India. Built on 20 years of expertise and 1.5 billion+ proprietary data records, the platform offers unmatched accuracy, speed, and security. Leveraging machine learning, NLP, and facial recognition, it achieves 95% accuracy and reduces turnaround time by ~82%. Trusted by over 3,000 clients, including major brands, it processes 15 million verifications monthly across 140+ countries.

Report Details

| Report Characteristics |

| Market Size (2025) |

USD 14.0 Bn |

| Forecast Value (2034) |

USD 57.5 Bn |

| CAGR (2025–2034) |

17.0% |

| Historical Data |

2019 – 2024 |

| The US Market Size (2025) |

USD 4.4 Bn |

| Forecast Data |

2025 – 2033 |

| Base Year |

2024 |

| Estimate Year |

2025 |

| Report Coverage |

Market Revenue Estimation, Market Dynamics, Competitive Landscape, Growth Factors, etc. |

| Segments Covered |

By Component (Solutions and Services), By Type (Biometrics and Non-Biometrics), By Deployment (Cloud and On-Premise), By Organization Size (Large Enterprises and SMEs), By Application (Access Control, KYC & Compliance, Authentication, Fraud Prevention, and Others), By End User (BFSI (Banking, Financial Services, and Insurance), Government & Defense, Healthcare, Retail & eCommerce, IT & Telecom, Gaming & Gambling, Travel & Hospitality, Education, and Others) |

| Regional Coverage |

North America – US, Canada;

Europe – Germany, UK, France, Russia, Spain, Italy, Benelux, Nordic, Rest of Europe;

Asia-Pacific – China, Japan, South Korea, India, ANZ, ASEAN, Rest of APAC;

Latin America – Brazil, Mexico, Argentina, Colombia, Rest of Latin America;

Middle East & Africa – Saudi Arabia, UAE, South Africa, Turkey, Egypt, Israel, Rest of MEA

|

| Prominent Players |

Thales Group, SITA, IDEMIA, NEC Corporation, CLEAR, Experian, Socure, Acuant, Equifax, GB Group, Onfido, Sumsub, iProov, Veriff, Signzy, Daon, OneSpan, BioCatch, SailPoint, Truepic, and Other Key Players |

| Purchase Options |

We have three licenses to opt for: Single User License (Limited to 1 user),

Multi-User License (Up to 5 Users), and

Corporate Use License (Unlimited User) along with free report customization equivalent to

0 analyst working days, 3 analysts working days, and 5 analysts working days respectively.

|

Frequently Asked Questions

The Global Identity Verification Market size is expected to reach a value of USD 14.0 billion in 2025 and is expected to reach USD 57.5 billion by the end of 2034.

North America is expected to have the largest market share in the Global Identity Verification Market, with a share of about 35.8% in 2025.

The Identity Verification Market in the US is expected to reach USD 4.4 billion in 2025.

Some of the major key players in the Global Identity Verification Market are Thales Group, SITA, IDEMIA, and others

The market is growing at a CAGR of 17.0 percent over the forecasted period.