Immunoassays Market Overview

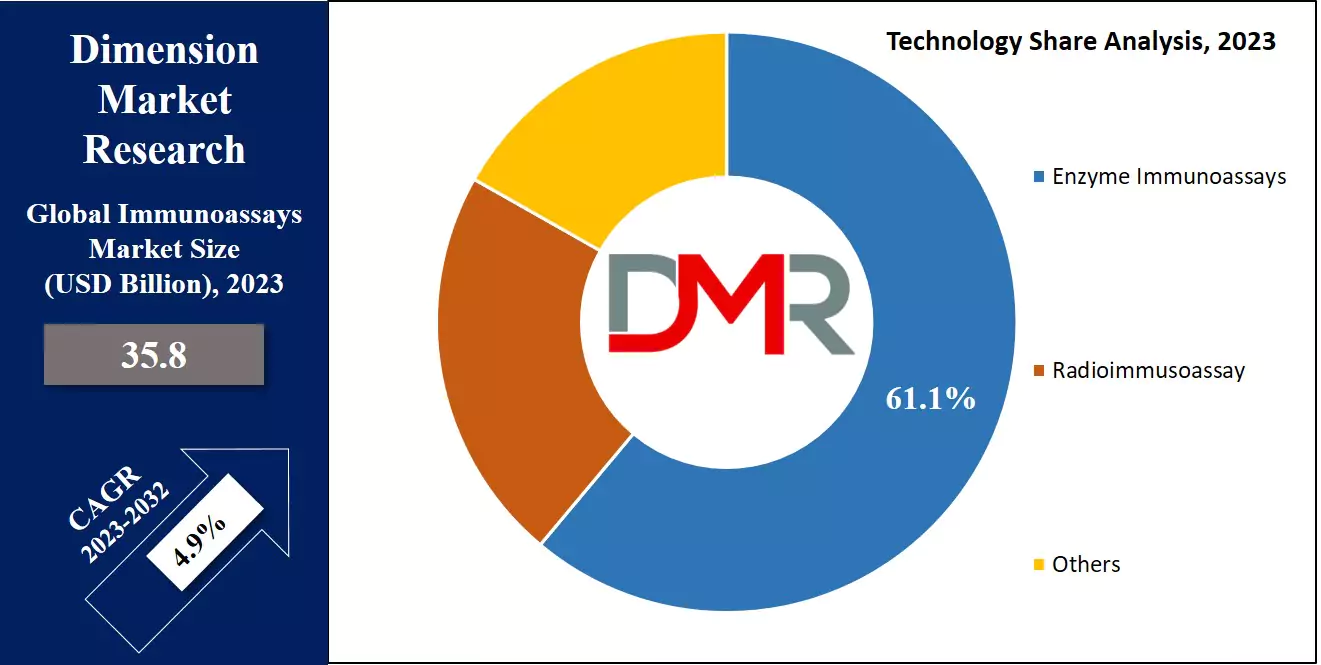

Global Immunoassays Market is expected to reach a value of USD 35.8 billion in 2023, and it is further anticipated to reach a market value of USD 55.0 billion by 2032 at a CAGR of 4.9%.

Immunoassay, a precise lab method, detects proteins, hormones, & drugs in biological samples, as it hinges on specific antigen-antibody interactions, forming quantifiable complexes through methods like ELISA or RIA. Critical for medical diagnostics & research, immunoassays excel in disease detection, drug monitoring, & immune response analysis, owing to their high accuracy in detecting minute substance quantities.

The rising incidence of infectious and non-infectious diseases, including diabetes, cardiovascular conditions, cancer, and gastrointestinal disorders, is a major factor driving global market growth. This increase is linked to various factors such as alcohol abuse, antimicrobial resistance, smoking, and unhealthy, sedentary lifestyles. Cancer &

Cancer Diagnostics, in particular, is becoming more prevalent worldwide.

According to projections by the International Agency for Research on Cancer (IARC), over 20.77 million new cancer cases were expected to be diagnosed in 2023. This growing disease burden underscores the need for advanced diagnostic and treatment solutions, fueling demand in the healthcare market.

Immunoassays Market Key Takeaways

- By Product, Reagents & Kits leads in 2023 & is anticipated to dominate throughout the forecasted period.

- In addition, Software & Services are expected to have significant growth over the forecasted period.

- By Application, Infectious Disease Testing takes the lead & drives the market in 2023.

- Further, By End User, Hospital & Clinics accounts for major revenue share in 2023

- North America has a 36.4% share of revenue in the Global Immunoassays Market in 2023.

Immunoassays Market Use Cases

- Disease Diagnosis: Used for detecting infections, cancer markers, and chronic diseases like diabetes.

- Therapeutic Drug Monitoring: Measures drug levels in patients to ensure optimal dosing and prevent toxicity.

- Biotechnology & Pharmaceutical Research: Supports drug discovery, biomarker identification, and vaccine development.

- Food Safety Testing: Detects allergens, pathogens, and contaminants in food products.

- Environmental Monitoring: Identifies toxins, pollutants, and hazardous substances in water, soil, and air.

- Veterinary Diagnostics: Assists in detecting diseases and monitoring animal health.

Immunoassays Market Dynamic

The clinical interpretation of diagnostic tests depends heavily on assay analyzers & a skilled workforce, where the time taken for interpretation significantly impacts results. Technological development has led to a growth in automated instruments in laboratories, providing benefits like better efficiency, space optimization, & reduced labor requirements, which growth in the market, with players introducing automated laboratory systems & compact, portable point-of-care assays.

The use of antibodies in immunoassays depends on immune responses, while molecular diagnostics employ nucleic acid probes based on specific genetic makeup, potentially challenging the immunoassay market's growth.

Moreover, immunoassay products play a vital role in controlling the spread of the viruses. With no vaccine or medication, efficient diagnosis is crucial. For instance, Rapid testing, including molecular tests, has proven effective for extensive COVID-19 monitoring, as challenges in detecting SARS-CoV-2 have been reduced through extensive research, assessments, & approvals of different immunoassay solutions.

Driver

Growing Demand for Early Disease Detection

An increasing emphasis on early disease diagnosis is driving demand for immunoassays market growth. Immunoassays have long been employed as diagnostic solutions, for the detection of infectious diseases, cancer biomarkers and

chronic conditions management such as diabetes or cardiovascular diseases. With global disease burden increasing at an exponential rate alongside an aging population, demand is high for such solutions.

Improvements to assay sensitivity, specificity and automation has helped drive greater adoption in hospitals, laboratories and clinics alike. Furthermore, increased health check-ups and preventative care initiatives by healthcare organizations contributes to the expansion of immunoassays market by providing accurate diagnostic results in real time.

Trend

Shift to Point-of-Care Testing

The immunoassay market is seeing an increasing shift towards point-of-care (POC) testing solutions, providing rapid diagnostic results in remote or limited resource settings. POC immunoassays offer fast, on-site solutions for improved patient care in these circumstances.

Technological innovations, such as microfluidic systems and portable devices, are driving this trend. The COVID-19 pandemic further expedited POC testing's adoption; showing its significance in controlling outbreaks.

POC immunoassays are increasingly being integrated with digital tools, including mobile apps and cloud-based data platforms, to allow real-time monitoring and sharing. This trend coincides with an increasing need for decentralized healthcare services and tailored medical solutions.

Restraint

Cost of Advanced Technologies

The high costs associated with advanced immunoassay technologies pose a substantial barrier to market expansion. Automated systems, multiplex assays and high-sensitivity diagnostic tools all require substantial investments in equipment, reagents and infrastructure in order to operate successfully. Small laboratories and healthcare facilities located in developing regions often face financial limitations that prevent access to these sophisticated solutions.

Stringent regulatory requirements and the complexity of validating immunoassays significantly raise development and operational costs for manufacturers, compounded with limited reimbursement policies in certain regions; these obstacles prevent widespread adoption and accessibility of immunoassays in resource-limited settings.

Opportunity

Expanding Applications in Precision Medicine

Opportunity in

Precision Medicine Precision medicine presents immuniassay manufacturers with significant opportunities. Immunoassays play an integral role in personalized healthcare by identifying biomarkers that reflect disease progression, therapeutic response and drug efficacy. Innovations in genomics and proteomics are driving development of innovative immunoassay platforms tailored specifically for patient needs.

Immunoassays have become even more useful with the increased adoption of companion diagnostics in

oncology and other fields, along with emerging markets with expanding healthcare infrastructure and supportive government initiatives providing growth potential. Integrating AI/data analytics technologies with immunoassays paves the way for advanced, targeted diagnostic solutions.

Immunoassays Market Research Scope and Analysis

By Product

The immunoassay market witnessed a dominant performance by the kit & reagent segment in 2023, holding the majority of the market share, which is expected to drive market growth in the coming years, mainly fueled by a rising incidence of infectious & autoimmune diseases, driving demand for diagnostic immunoassay kits and reagents. The approval & introduction of new immunoassay kits are anticipated to further contribute to the expansion of this segment.

Moreover, the software and services segment is expected to experience significant growth during the forecast period, as it is attributed to the growing availability & increasing demand for affordable immunoassay services, mainly in emerging markets. The market dynamics suggest a rising future with development in both kit &reagent offerings and expanding software and services options.

By Specimen

The role of blood specimens is major in the immunoassays market, serving as primary specimens for diagnostic analyses. In 2023, these specimens are vital in driving market growth & responding to a growing need for precise diagnostic solutions. Hospitals & clinical settings heavily depend on blood specimens, supporting their diagnostic potential within the context of a quickly evolving global healthcare infrastructure.

Further, clinical laboratories are integral stakeholders, experiencing notable expansion due to increased R&D activities, along with an increasing landscape of clinical trials that heavily depend on blood-based analyses.

Moreover, the blood bank sector demonstrates a strong, with immunoassay technologies, mainly the versatile Enzyme-Linked Immunosorbent Assay (ELISA), contributing highly to its advancements. As the importance of accurate diagnostics in blood transfusions strengthens, particularly in addressing infectious diseases, the role of blood specimens emerges as indispensable in strengthening diagnostic capabilities & enhancing overall healthcare outcomes.

By Technology

Enzyme Immunoassays (EIA) held the largest market in 2023 by generating a high revenue owing to its repeated usage in the detection of infectious and chronic diseases, food allergies, and drugs of abuse among other applications. Some of the major advantages of this method over Immunoelectrophoresis & immunodiffusion are reduced evaluation time, quantitative results, & the need for limited antisera for analysis.

Further a rapid test, known as lateral flow immunoassay, is used to detect the existence of the target analyte without using specialized equipment. The rapid test technique has different applications like in dengue & infections caused by Campylobacter, Legionella, Salmonella, Zika, and Listeria.

Further, monoclonal antibodies are used mainly for Immunoglobulin G (IgG), Immunoglobulin M (IgM), Immunoglobulin A (IgA), & Immunoglobulin (IgD) for accurate identification of target analyte.

By Application

The infectious diseases testing segment commands the largest market share and is poised for rapid growth throughout the forecast period in 2023, which is expected to persist, driven by the increasing number of infectious diseases like malaria, HIV, influenza, & the new COVID-19.

The market's growth is further fueled by the constant introduction of new products dedicated to infectious disease testing. The growth in the need for accurate & timely diagnostics in the face of these health challenges highlights the significance of this segment.

Moreover, the global growth in cancer cases emerges as a major driver for the growth of immunoassays. According to the International Agency for Research on Cancer reports more than 18 million new cancer cases and about 10 million recorded deaths in 2018.

Also, the rising incidence of cancer globally is expected to drive the adoption of immunoassays, as they play a major role in diagnosing & monitoring different cancer types, focusing on the essential role of immunoassays in addressing critical healthcare needs.

By End User

The immunoassay market, categorized by end-users, includes hospitals & clinics, clinical laboratories, pharmaceutical & biotechnology companies, CROs, blood banks, research & academic laboratories, and home care settings. The leading sector in 2023 is the hospital & clinical segment, due to a growth in the number of hospitals & the changing healthcare landscape, needing advanced facilities.

Further, the clinical laboratory segment follows closely as the second fastest-growing sector, driven by growth in clinical trials and heightened R&D activities shaping the immunoassay landscape.

Further, the blood banks are anticipated to exhibit strong growth during the forecast period, which is driven by the growing detection of infectious diseases in blood banks via screening & processing of donated blood. ELIS known for its simplicity & minimal equipment requirements, is broadly employed in blood banks. As the need for blood transfusions increases to address infectious diseases, hospitals are expected to witness a correlated increase in immunoassay testing, benefiting the blood bank segment.

The Immunoassays Market Report is segmented on the basis of the following:

By Product

- Reagents & Kits

- Analyzers/Instruments

- Software & Services

By Specimen

- Blood

- Saliva

- Urine

- Others

By Technology

- Radioimmunoassay

- Enzyme Immunoassays Rapid Test

- Others

By Application

- Therapeutic Drug Monitoring

- Oncology

- Cardiology

- Endocrinology

- Infectious Disease Testing

- Others

By End User

- Hospitals & Clinics

- Clinical Laboratories

- Pharmaceutical & Biotechnology Companies & Cro

- Blood Banks

- Research & Academic Laboratories

- Home Care Setting

How Does Artificial Intelligence Contribute To Improve Immunoassays Market ?

- Enhanced Accuracy & Precision: AI-powered image analysis and pattern recognition minimize human errors, ensuring more reliable immunoassay results.

- Faster Data Processing: AI accelerates data interpretation, enabling rapid diagnosis and reducing turnaround times in clinical settings.

- Automation & Workflow Optimization: AI-driven immunoassay platforms automate sample processing, improving efficiency and reducing manual labor.

- Predictive Analytics & Early Disease Detection: Machine learning models analyze immunoassay data to identify disease patterns, aiding in early diagnosis and personalized treatment.

- Improved Drug Development: AI assists in biomarker discovery and immunoassay optimization, enhancing pharmaceutical research and drug screening.

- Quality Control & Standardization: AI-driven algorithms monitor assay performance, ensuring consistent and reproducible test results.

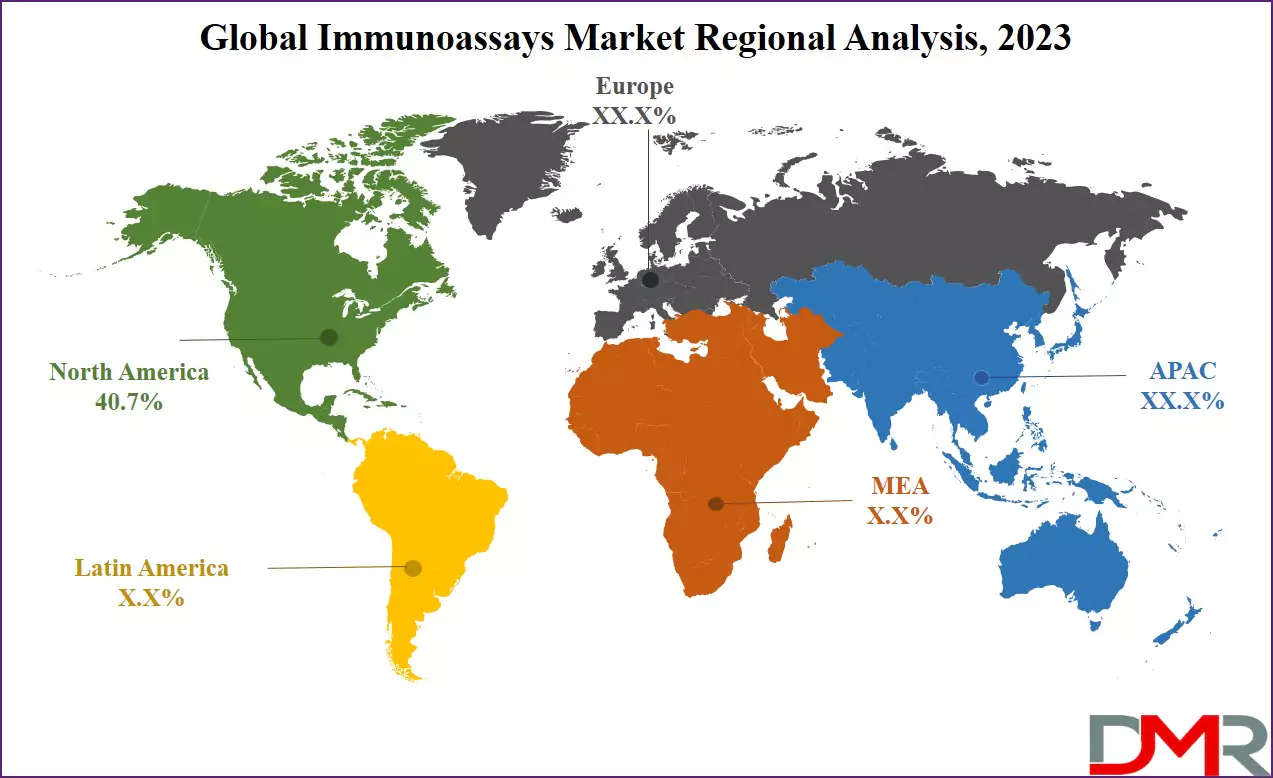

Immunoassays Market Regional Analysis

North America emerged as the leading revenue generator in the immunoassay market, claiming a substantial

40.7% share in 2023, & is poised to sustain dominance throughout the study period, which is attributed to increasing demand for diagnostics driven by the rising incidence of cancer, coupled with the ready availability of technologically advanced diagnostic techniques. The region also grapples with a high prevalence of infectious diseases such as HIV, tuberculosis, and influenza, further propelling the need for detection and treatment.

Meanwhile, the Asia Pacific region is forecasted to experience rapid market growth over the study period, which is driven by the expanding presence of leading industry players in the region & the increasing adoption of innovative laboratory techniques for the quick investigation & diagnosis of infectious and chronic disorders. In addition, the introduction of molecular kits & a surge in the need for diagnostic reagents are vital factors contributing to the market's growth in the region.

By Region

North America

Europe

- Germany

- The U.K.

- France

- Italy

- Russia

- Spain

- Benelux

- Nordic

- Rest of Europe

Asia-Pacific

- China

- Japan

- South Korea

- India

- ANZ

- ASEAN

- Rest of Asia-Pacific

Latin America

- Brazil

- Mexico

- Argentina

- Colombia

- Rest of Latin America

Middle East & Africa

- Saudi Arabia

- UAE

- South Africa

- Israel

- Egypt

- Rest of MEA

Immunoassays Market Competitive Landscape

The immunoassays market is highly competitive, characterized by key players holding significant market share, in the middle of the growing need for healthcare development & continuous progress in immunoassay technologies, the market anticipates the entry of smaller players, which reflects the industry's evolution & the potential for increased innovation and competition in meeting the rising needs of the healthcare sector.

In November 2022, LumiraDx introduced a rapid microfluidic immunoassay HbA1c test across Europe, parts of the Middle East, Asia, Latin America, and Africa, which facilitates quick & efficient measurement of hemoglobin A1c levels, catering to diverse regions & contributing to accessible diagnostic solutions for diabetes monitoring in a broader geographic scope.

Some of the prominent players in the global Immunoassays Market are

Immunoassays Market Recent Development

- In September 2022, Neogen introduced an immunoassay, Veratox VIP, designed for detecting cashew allergens, which is the second in Neogen's Veratox VIP series, and employs an improved quantitative enzyme-linked immunoassay (ELISA) method. Known for its specificity, the test accurately identifies deficient levels of cashew protein, highlighting the need for precise allergen detection in food products.

- In November 2022, Getein introduced the MAGICL 6000 CLIA analyzer during MEDICA 2022, which is designed to be the optimal choice for mid to high-workflow laboratories looking for a streamlined, one-step CLIA solution, which addresses the need for efficiency and innovation in laboratory workflows, particularly for those with substantial testing demands.

- In November 2022, Gethin Biotech unveiled the MAGICAL 6000 chemiluminescence immunoassay Analyzer at MEDICA, which analyzer is customized for mid to high-workflow laboratories, providing a one-step chemiluminescence solution. With fully automated operation & remarkable testing speed, it stands out as a highly productive instrument.

Immunoassays Market Report Details

| Report Characteristics |

| Market Size (2023) |

USD 35.8 Bn |

| Forecast Value (2032) |

USD 55.0 Bn |

| CAGR (2023-2032) |

4.9% |

| Historical Data |

2017 - 2022 |

| Forecast Data |

2023 - 2032 |

| Base Year |

2022 |

| Estimate Year |

2023 |

| Report Coverage |

Market Revenue Estimation, Market Dynamics, Competitive Landscape, Growth Factors and etc. |

| Segments Covered |

By Product (Reagents & Kits, Analyzers/Instruments, and Software & Service), By Specimen (Blood, Saliva, Urine, and Others), By Technology (Radioimmunoassay, Enzyme Immunoassays Rapid Test, and Others), By Application (Therapeutic Drug Monitoring, Oncology, Cardiology, Endocrinology, Infectious Disease Testing, and Others), By End User (Hospitals & Clinics, Clinical Laboratories, Pharmaceutical & Biotechnology Companies & Cro, Blood Banks, Research & Academic Laboratories, and Home Care Setting) |

| Regional Coverage |

North America – The US and Canada; Europe – Germany, The UK, France, Russia, Spain, Italy, Benelux, Nordic, & Rest of Europe; Asia- Pacific– China, Japan, South Korea, India, ANZ, ASEAN, Rest of APAC; Latin America – Brazil, Mexico, Argentina, Colombia, Rest of Latin America; Middle East & Africa – Saudi Arabia, UAE, South Africa, Turkey, Egypt, Israel, & Rest of MEA |

| Prominent Players |

Abbott, Sysmex Corp, Siemens Healthcare, Thermo Fisher Scientific Inc, Quidel Corp, bioMerieux, Bio-Rad Laboratories, Hologic Inc, Qiagen NV, Luminex Corp, and Other Key Players |

| Purchase Options |

We have three licenses to opt for: Single User License (Limited to 1 user), Multi-User License (Up to 5 Users), and Corporate Use License (Unlimited User) along with free report customization equivalent to 0 analyst working days, 3 analysts working days and 5 analysts working days respectively. |

Frequently Asked Questions

The Global Immunoassays Market size is estimated to have a value of USD 35.8 billion in 2023 and is

expected to reach USD 55.0 billion by the end of 2032.

North America has the largest market share for the Global Immunoassays Market with a share of about

40.7% in 2023.

Some of the major key players in the Global Immunoassays Market are Abbott, Sysmex Corp, Siemens

Healthcare, and many others.

The market is growing at a CAGR of 4.9 percent over the forecasted period.