Market Overview

The

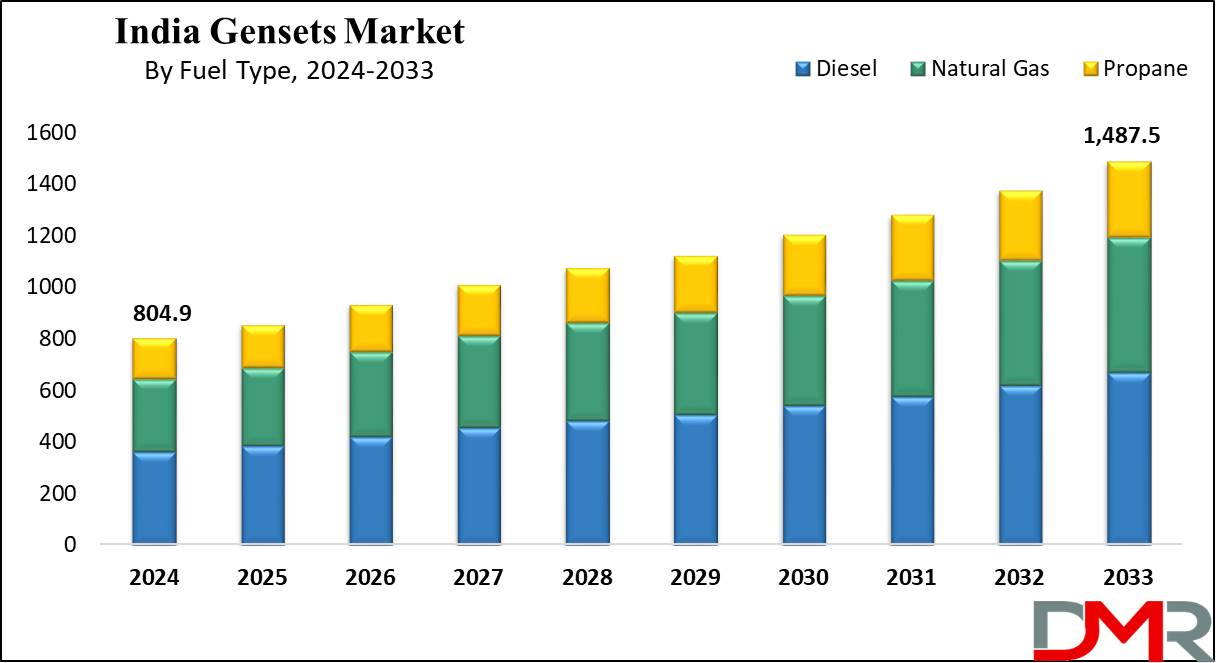

India Gensets Market size is expected to reach a

value of USD 804.9 million in 2024, and it is further anticipated to reach a market

value of USD 1,487.5 million by 2033 at a

CAGR of 7.1%.

The power gensets market is in a good position today, with good demand recorded across the board; fundamentally driven by reasons such as rapid industrialization and urbanization, apart from the ever-growing need for reliable power backup solutions on account of widespread power outages across the nation. Reliability of power is among the top issues, mostly in rural but also increasingly in urban areas of India, especially in semi-urban and rural sectors. This dependency on gensets spans all verticals, starting from residential and commercial to industrial sectors, making them very vital in the energy landscape of India.

The demand for diesel gensets is very high due to better fuel economy, lesser upfront cost, and also because it is widely available in the country. Performance and versatility have gained for diesel-powered gensets continuous dominance, despite growing concerns over environmental impact and the rise in fuel prices. Also, this rising demand for uninterruptible power supply from businesses, specifically those in the energy-consuming industries like textiles, manufacturing, and pharmaceuticals, is the contributing factor towards market growth.

Government initiatives for better infrastructure development, such as Smart Cities and rural electricity plans, will also add to the growth prospects of the market. It will drive up the adoption rate in gensets for applications not only of backup but also off-grid power supply solutions. Besides, design and fuel efficiency technological changes are some factors expected to drive the segment growth. With this energy efficiency and reduction in environmental degradation, hybrids mixing renewable energy with conventionally fueled systems could be the main growth area for gensets.

However, there are challenges, and the most notable ones involve stringent environmental regulations that place limits on diesel engine emissions and increased cost of maintenance and fuel. On such counts, manufacturers of gensets are responding well to the development of fuel-efficient and cleaner genset models such as Tier IV diesel engines with increased and enhanced emission standards. New changes bring new avenues in industries and have positioned the India gensets market to continue maintaining the uptick momentum for several years ahead.

The India Gensets Market presents a good number of opportunities, given the growing infrastructure and manufacturing. The shift toward gas-powered gensets, as a result of environmental regulations, is also a potential growth path. Besides, the increasing adoption of gensets in data centers where uninterrupted power becomes imperative will add to the market potential.

The emerging trends in hybrid genset solutions that incorporate renewable sources of energy are also gaining momentum and prove to be eco-friendly and more cost-effective. This rapid electrification of villages and development of smart cities opens many doors for market participants to further increase their presence to cater to larger customer segments.

The growth of the India Gensets Market is being driven by several trends: a growing preference for gas-powered gensets on account of lower emissions and cleaner operations; integration of IoT and remote monitoring technologies in gensets to improve operational efficiency by reducing downtime; compact and portable gensets find their applications in residential and small business sectors; hybrid genset solutions that combine conventional and renewable energy sources are emerging as a sustainable alternative. More precisely, increasing awareness of energy efficiency and tight control over emission norms have brought innovations even to genset technologies.

The India gensets market is promising in its outlook, with sound demand emerging from the residential, commercial, and industrial segments. In line with this growth, key infrastructural projects about highways, railways, and metro lines would eventually push up the demand. Similarly, the health sector, with a continuing need for stable power supplies during medical emergencies, continues to be in strong demand. Increasing investments in IT infrastructure and data centers, coupled with increasing awareness of backup power solutions, further enhance the market prospects.

Increased disposable incomes and urbanization trends are leading to an increased adoption of gensets in residential areas. Even with growth, the fluctuating fuel prices may considerably raise the operating cost of the India Gensets Market. Stringent government regulations regarding emissions and noise pollution are some of the challenges that manufacturers face, especially in the production of diesel gensets. Other major restraints are the high initial cost of advanced gensets and competition from alternative power sources, such as renewable energy systems and battery storage.

In addition, the market faces some challenges in rural electrification programs targeted at reducing dependence on gensets by improving grid reliability. Diesel-based gensets have the largest share in the market owing to their wide range of applications in industries. However, gas-based gensets are gaining rapidly owing to increasing environmental concerns and the availability of natural gas. In the power rating segment, the 75-375 kVA category holds the leading position as these gensets are widely used in commercial and industrial applications. Geographically, North India holds the maximum share of the market on account of wide infrastructure development and high demand from urban areas.

Key Takeaways

- Market Size: The India Gensets Market size is estimated to have a value of USD 804.9 million in 2024 and is expected to reach USD 1,487.5 million by the end of 2033.

- Key Players: The India Gensets Market are Cummins India, Caterpillar Inc., Kirloskar Oil Engines Ltd., Mahindra Powerol, Ashok Leyland Ltd., MTU Onsite Energy, Greaves Cotton Limited, and many others.

- By Fuel Type Segment Analysis: Diesel is projected to dominate the fuel type segment in this market as it will hold 44.9% of market share in 2024.

- By Power Rating Segment Analysis: Up to 75 kVA is anticipated to dominate this segment with 37.1% of market share in 2024.

- Growth Rate: The market is growing at a CAGR of 7.1 percent over the forecasted period.

Use Cases

- Residential Power Backup: Gensets ensure a reliable power supply for homes during outages, thus enabling seamless operation of essential appliances and home offices. This is particularly critical in semi-urban areas that face power cuts.

- Industrial Applications: Various industries like textiles, chemicals, and steel use gensets to maintain production during grid failures. In manufacturing units, heavy machinery and critical processes require reliable power.

- Construction Sites: Portable gensets provide energy for tools and machinery at construction sites, especially in grid-inaccessible regions. Their adaptability makes them indispensable for infrastructure projects.

- Healthcare Facilities: Hospitals and clinics depend on gensets to keep their life-support equipment and all other essential services running without fail in case of an outage, ensuring continuous care and safety for the patients.

Market Dynamic

Trends in the India Gensets Market

Technological InnovationsHybrid gensets have now gained widespread acceptance and marked a revolution in the Indian gensets market. Hybrid genset systems integrate conventional fuel engines with renewable sources of energy, such as solar or wind power. The combination reduces dependence on fossil fuels, lowers operating costs, and minimizes environmental impact; hence, it is an attractive option for businesses aiming to achieve higher levels of energy efficiency while still following environmental regulations.

Such systems can further switch between available energy sources depending on efficiency and cost considerations to optimize energy use. In the present scenario of environmental concerns, hybrid gensets are bound to find a major share of this market shortly.

Smart Gensets

The inclusion of IoT into gensets has become one of the key trends for improving operational efficiency. The IoT-enabled gensets permit remote monitoring and predictive maintenance that offer considerable advantages to industries where downtime can result in high costs. Using IoT sensors, users can monitor real-time data on engine performance, fuel consumption, and scheduled maintenance. Alerts can also be set based on scheduled maintenance, enabling users to predict failures before they occur, reducing unplanned downtime, and improving the reliability of the genset.

This current trend is very important in industrial sectors like manufacturing to telecom, where power discontinuity will lead to losses due to disrupted or disturbed operations. The penchant for smart gensets due to the increasing concerns on matters relating to reliability and cutting down on operational costs will cause an increase in this trend.

Growth Drivers in the India Gensets Market

Frequent Power Outages

The power outage issue remains a major growth driver of the Indian gensets market, especially in rural and semi-urban areas. Due to underdeveloped grid infrastructure and erratic power supply, coupled with seasonal fluctuations in power supply, power cuts are commonplace. These also create a sustained demand for backup power options. For places like villages where grid-based electricity distribution continues to be inadequate, gensets prove to be one of the more reliable sources of power supplies for households, businesses, and industries. Besides increasing in frequency, the length of the outages is forcing businesses-especially those far from city centers to use gensets out of necessity for continuous operations.

Expanding Infrastructure Projects

In the light of increasing focus on infrastructure development in India, the Smart Cities Mission, expansion of cities, and investment by the government in major sectors like healthcare, transportation, and commercial real estate, the demand for gensets is expected to see a sharp rise. Gensets meet the demand for continuous and reliable power supply in infrastructure projects, mainly in construction, healthcare, and IT.

With the expansion and urbanization of these sectors, temporary and long-term power requirements increase, making gensets a necessity. Further, it increases the density of industries, data centers, and commercial establishments that rely on gensets for backup power to ensure continuous operations without any disruption due to grid failure.

Growth Opportunities in the India Gensets Market

Rural Electrification

The large-scale rural electrification by the Indian government has opened vast avenues for genset manufacturers. Emphasis on enhancing the supply of electricity in remote and backward areas, gensets are gaining increasing popularity in rural segments, especially in villages with incomplete or no power grid infrastructure. Demand from rural agricultural areas that require low-capacity gensets, where power supply is not regular and most frequent, will continue to increase. Therefore, affordability and accessibility of reliable gensets offer huge market potential, particularly in these regions with rural electrification works gaining momentum in tune with India's general development programs.

Growing Renewable Energy Integration

With a great deal of emphasis laid on renewable energy, mainly solar and wind power integration by the Government of India, avenues for hybrid gensets, therefore, stand wide open. Conventionally, the fuel-based engines are integrated with renewable generation technologies like solar photoelectricity and wind turbine alternators, which in times when pure grid power or any of its feasible alternatives become/is not available, have produced an ideal solution for clients.

This allows the customer to switch to gensets only during periods of drought or reduced renewable energy levels. Growing pressure for clean energy, along with increasing solar and wind power penetrations at residential and industrial levels, is expected to raise the bar for hybrid gensets as a sustainable solution for power shortages and reduced reliance on fossil fuels.

Restraints in the India Gensets Market

Stringent Emission Norms

More stringent emission norms such as Bharat Stage IV and V have led to greater responsibilities for diesel genset manufacturers in innovation and upgradation of their technologies to suit the new needs. Their strict adherence to regulations resulted in cleaner, more efficient engines; however, this transition came with more production costs. Less affordable would be gensets that don't meet the new emission codes because of the increased costs associated with this technology.

These are somewhat less affordable, especially for the small business and rural customers who may struggle with a higher initial investment. At the same time, of course, the trend must go toward cleaner technologies if the environment is to continue having lower environmental harm. This creates a type of market affordability challenge and therefore makes the product inaccessible to poorer clientele.

High Operating Costs

The high operating cost of diesel gensets is the major restraint factor. With the continuous rise in fuel prices, the operation of diesel gensets is becoming increasingly unaffordable. Diesel is the major used fuel for gensets, and its price volatility increases the cost of genset operation. This factor is further compounded by rising maintenance costs, especially in higher-end models of gensets. Operating inefficiencies of traditional fuel-powered gensets increase the barrier to entry for smaller businesses and rural users, who may deviate to cheaper alternatives like solar energy systems or other renewable solutions.

Research Scope and Analysis

By Fuel Type

Diesel is projected to dominate the fuel type segment in this market as it hold 44.9% of market share in 2024. Diesel remains the major fuel type used in Indian gensets, mainly because of its better fuel economy, reliability, and easy availability. Diesel engines can run for several hours without requiring refueling and, as such, find their application in industries and residential areas where the power grid is unreliable. Diesel gensets are a perfect fit for power-demanding applications, such as industrial machinery, HVAC in commercial buildings, and life-support systems in hospitals.

These applications require power that can be supplied without any break and this is the reason why diesel has remained at the forefront of the market. Relatively low diesel fuel costs compared to other sources of energy provide an attractive avenue for effective, reliable backup power. Besides, diesel engines have higher torque and can bear heavy loads for longer operation hours, thus being quite appropriate for an industrial environment. The easy availability of diesel as a fuel all over India, including the remotest and rural parts, guarantees the operability of these gensets in areas devoid of natural gas or electricity.

While there has been growing concern over the environmental impact of diesel engines, technological advancements have mitigated some of these concerns through improved fuel efficiency and reduced emissions with things such as Tier IV-compliant engines. Because of these technological developments and the fuel's capability to provide a reliable and cost-effective solution for power generation, the diesel genset market is expected to stay strong.

By Power Rating

The Indian gensets market is dominated by gensets with power ratings up to 75 kVA because they are the perfect blend of power output, portability, and affordability. The base of application for these gensets includes small and medium-sized applications related to residential backup power, small businesses, retail shops, and educational institutions. These are preferred by users who require an economical solution for reliable power due to lower fuel consumption and reduced maintenance costs.

The small-scale industries, like local manufacturing units, food processing businesses, and agricultural facilities, have applied gensets in the range of 75 kVA, which would provide sufficient power for everyday operations. Gensets within this power range find particular prominence in semi-urban and rural areas, where the grid infrastructure is relatively not as stable because these gensets are easy to move, and install, and, considering the costs, cheaper than higher-rating gensets.

However, compactness and portability provide enough reason to use gensets with ratings up to 75 kVA as an efficient solution for backup power applications for a limited duration even by residential users and small businessmen. They find wide applications where there are frequent disruptions to power: areas in which an economical and reliable solution to one's power requirements is required. Manufacturers also introduce advanced technologies such as noise-reduction features and IoT-based remote monitoring systems, increasing the appeal of gensets within this power range.

By Application

Standby power applications dominate the Indian gensets market due to the critical need for uninterrupted electricity supply in various sectors. Standby gensets automatically switch on in case of failure of the main power supply, thus ensuring seamless continuity of operations without human intervention. Standby gensets provide requisite backup power for sectors like healthcare, data centers, and industrial plants, where losses or danger due to downtime are very high.

Applications involving lifesaving equipment and diagnostic tools such as ventilators and MRI machines require standby gensets on site to provide for uninterrupted operation without power disruption in healthcare facilities, for example. Similarly, genset systems at data centers ensure that electricity supply is not interrupted since any such event may cause great losses due to service interruption, loss of data, or/and destruction of sensitive equipment. To the business customer, this could mean lost income, dissatisfied customers, or even worse, spoilage of drugs or food products.

Also, with more and more digitization and reliance on IT infrastructure across all sectors, including banking and education, there is growing demand for standby power gensets. As urbanization and infrastructural development further grow, so does the need for an efficient backup power supply to the residential areas and commercial establishments. Standby gensets with automatic start and continuous power supply during emergency services have emerged as the prime choice for such sectors.

By End User

The construction sector dominates the end-users in the Indian gensets market, as the sector essentially requires portable and reliable sources of power for on-site operations. Most construction projects, particularly those at remote or grid-inaccessible sites, cannot avoid the problem of unstable or unavailable grid power that makes gensets a critical tool to ensure smooth and continuous work. These power systems are required for heavy machinery, power tools, lighting systems, and temporary on-site offices and housing.

From small, portable units to large, high-capacity systems, gensets possess versatility that enables them to perform well for a wide range of construction needs. They can supply consistent power for either short-term projects or long-term developments, making them indispensable in many stages of construction laying the foundation for finishing. Besides, these gensets feed power to other equipment, like cranes, cement mixers, and compressors, which are fundamentally required in the operation area.

Add to this, the government's initiative in the direction of the Smart Cities mission, coupled with large-scale affordable housing. The continuous push towards infrastructure development in this space, coupled with the uninterruptible power supply requirements for maintaining timelines and productivity, will keep genset playing the central role in construction projects undertaken in different parts of India continuously. Their ability to ensure a reliable source of electricity even in the most precarious of environments keeps them highly sought after in the industry.

The India Gensets Market Report is segmented on the basis of the following

By Fuel Type

- Diesel

- Natural Gas

- Propane

By Power Rating

- Up to 75 kVA

- 75-375 kVA

- 375-750 kVA

- Above 750 kVA

By Application

- Standby Power

- Peak Shaving

- Prime/Continuous Power

By End-User

- Construction

- Manufacturing

- Telecom

- Healthcare

- Retail

- Data Centers

- Others

Competitive Landscape

New entrants and established players compete with each other, making the gensets market of India highly competitive. Cummins India Ltd., Kirloskar Oil Engines Ltd., Mahindra Powerol Ltd., and Caterpillar are some important companies that use advanced technologies, a wide range of product portfolios, and strong distribution networks to meet the increasing demand for power solutions.

Cummins India is a market leader, offering a diverse range of diesel and gas gensets tailored to meet the demand for stringent environmental standards.

The company's emphasis on emission-compliant technologies and fuel efficiency has made it strong in the market, especially for industrial and commercial use. Kirloskar Oil Engines has a strong presence in the small and medium genset segments, serving both rural and urban markets. It is known for its reliable and reasonably priced products, and the company has focused on regional needs, such as agriculture and SMEs.

Mahindra Powerol is known for its innovation, providing silent, fuel-efficient gensets that are considered to be gaining momentum in residential and commercial segments. On the other hand, Caterpillar leads in high-capacity gensets, especially for large-scale industrial applications. The entity's global expertise and focus on durability and performance indeed give it a competitive edge in heavy-duty sectors. The major differentiators that companies use in this highly competitive market to maintain their market leader position are customer support and service networks.

Some of the prominent players in the India Gensets Market are

- Cummins India

- Caterpillar Inc.

- Kirloskar Oil Engines Ltd.

- Mahindra Powerol

- Ashok Leyland Ltd.

- MTU Onsite Energy

- Greaves Cotton Limited

- Perkins Engines Company Limited

- Honda Siel Power Products Ltd.

- Eicher Engines

- Himoinsa

- Volvo Penta

- Kohler Power Systems

- Other Key Players

Recent Developments

- November 2024: Cummins India launched hybrid gensets integrating renewable energy and diesel power, marking a significant step towards cleaner and more efficient energy solutions. This hybrid system aims to reduce operational costs and environmental impact by combining renewable energy sources, such as solar, with traditional diesel-powered systems.

- August 2024: Kirloskar introduced IoT-enabled gensets for remote monitoring. This innovative step allows users to monitor the performance, fuel levels, and maintenance needs of their gensets remotely through a smartphone app or web portal. The technology enables predictive maintenance, which minimizes downtime and ensures that gensets are operating at optimal efficiency.

- April 2024: Mahindra Powerol expanded its manufacturing facility in Gujarat. This expansion enables Mahindra Powerol to meet the growing demand for high-performance gensets in the country. The enhanced facility will also contribute to improving the company’s supply chain and manufacturing capacity, particularly for its range of silent and fuel-efficient genset models.

- January 2024: Caterpillar introduced low-emission gensets targeting the construction sector. These gensets are specifically designed to meet the demands of the construction industry, offering reliable backup power while adhering to the latest environmental standards.

Report Details

| Report Characteristics |

| Market Size (2024) |

USD 804.9 Mn |

| Forecast Value (2033) |

USD 1,487.5 Mn |

| CAGR (2024-2033) |

7.1% |

| Historical Data |

2018 – 2023 |

| Forecast Data |

2024 – 2033 |

| Base Year |

2023 |

| Estimate Year |

2024 |

| Report Coverage |

Market Revenue Estimation, Market Dynamics, Competitive Landscape, Growth Factors and etc. |

| Segments Covered |

By Fuel Type (Diesel, Natural Gas, Propane), By Power Rating (Up to 75 kVA, 75-375 kVA, 375-750 kVA, Above 750 kVA), By Application (Standby Power, Peak Shaving, Prime/Continuous Power), By End-User (Construction, Manufacturing, Telecom, Healthcare, Retail, Data Centers, Others) |

| Regional Coverage |

India

|

| Prominent Players |

Cummins India, Caterpillar Inc., Kirloskar Oil Engines Ltd., Mahindra Powerol, Ashok Leyland Ltd., MTU Onsite Energy, Greaves Cotton Limited, Perkins Engines Company Limited, Honda Siel Power Products Ltd., Eicher Engines, Himoinsa, Volvo Penta, Kohler Power Systems., and Other Key Players |

| Purchase Options |

We have three licenses to opt for: Single User License (Limited to 1 user), Multi-User License (Up to 5 Users), and Corporate Use License (Unlimited User) along with free report customization equivalent to 0 analyst working days, 3 analysts working days and 5 analysts working days respectively. |

Frequently Asked Questions

The India Gensets Market size is estimated to have a value of USD 804.9 million in 2024 and is expected to reach USD 1,487.5 million by the end of 2033.

Some of the major key players in the India Gensets Market are Cummins India, Caterpillar Inc., Kirloskar Oil Engines Ltd., Mahindra Powerol, Ashok Leyland Ltd., MTU Onsite Energy, Greaves Cotton Limited, and many others.

The market is growing at a CAGR of 7.1 percent over the forecasted period.