Market Overview

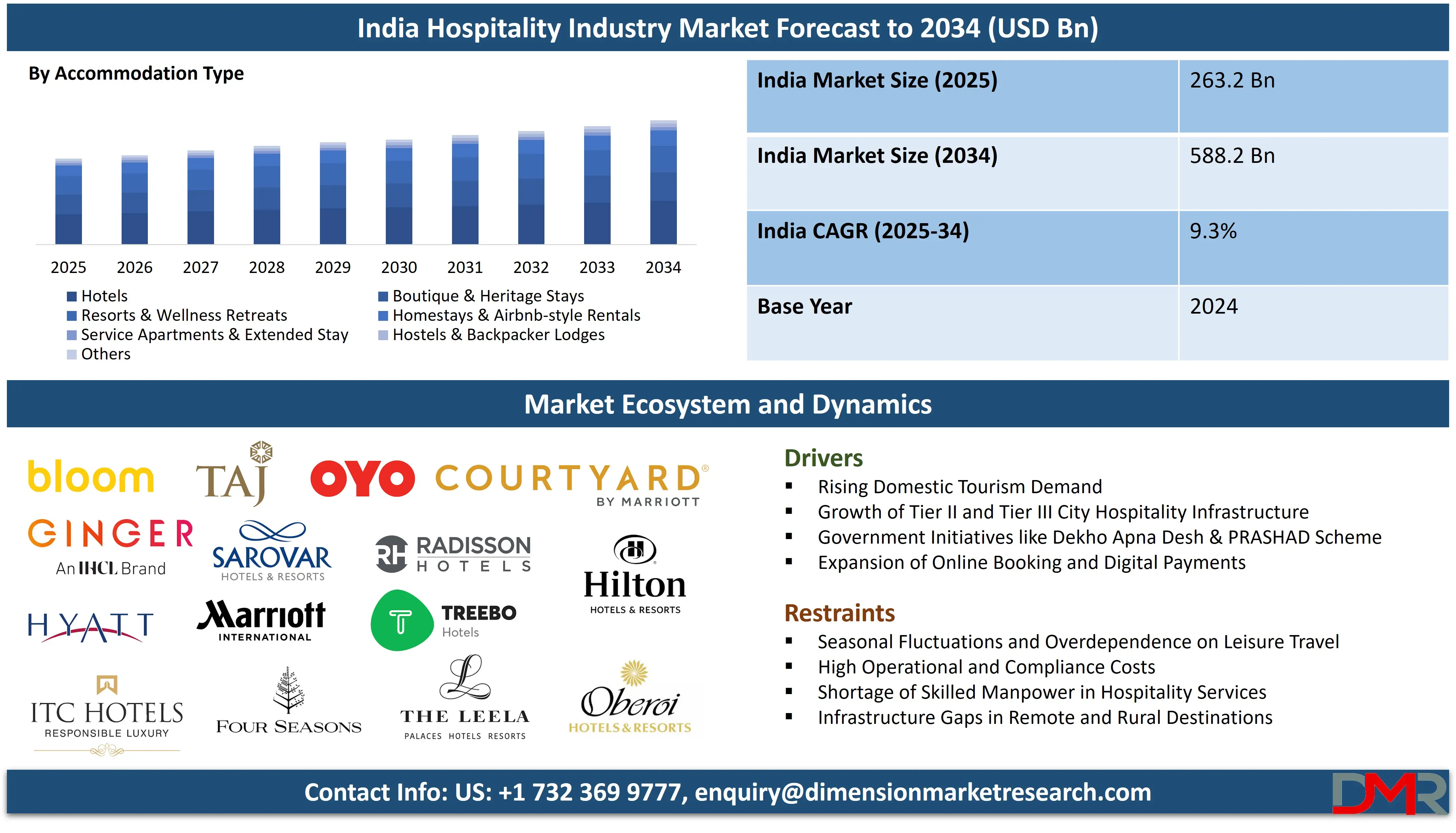

The India Hospitality Industry Market is projected to reach

USD 263.2 billion in 2025 and grow at a compound annual

growth rate of 9.3% from there until 2034 to reach a value of

USD 588.2 billion.

ℹ

To learn more about this report –

Download Your Free Sample Report Here

The Indian hospitality industry is undergoing a transformative phase, driven by rapid urbanization, a growing middle class, and increasing domestic and international tourism. Tier-II and Tier-III cities are emerging as new demand hubs, supported by improved infrastructure, better air connectivity, and rising disposable incomes. The government's initiatives, such as Dekho Apna Desh and the expansion of e-tourist visas, are further catalyzing the sector’s growth.

A significant trend shaping the industry is the shift toward tech-enabled hospitality, with mobile check-ins, AI-driven customer service, and IoT-enabled rooms becoming commonplace in urban properties. Sustainability is also gaining prominence, as eco-friendly resorts and green certifications influence booking decisions. The rise of hybrid hospitality models, combining work and leisure (workations), is redefining service delivery and hotel design, particularly in scenic and remote destinations.

Despite its growth potential, the industry faces several restraints. High operational costs, especially energy and real estate, are pressuring margins. Fragmented regulation across states and bureaucratic delays often hinder hotel project approvals. Additionally, workforce shortages and skill mismatches remain a persistent challenge, affecting service quality in many properties, especially in remote areas.

Opportunities are abundant in budget and mid-segment accommodations, with domestic travelers seeking affordable yet quality experiences. Niche markets like spiritual tourism, medical tourism, and adventure travel are also expanding rapidly. The growth of online travel aggregators (OTAs) and direct digital channels presents a significant advantage for independent and boutique properties.

With robust digital adoption, favorable demographics, and growing investor interest, the Indian hospitality market is poised for sustained expansion. Strategic collaborations, public-private partnerships, and service innovation will be key to unlocking the sector’s full potential.

India Hospitality Industry Market: Key Takeaways

- Market Size Insights: The India Hospitality Industry Market size is estimated to have a value of USD 263.2 billion in 2025 and is expected to reach USD 588.2 billion by the end of 2034.

- By Accommodation Type Segment Insights: Hotels are projected to dominate India's hospitality industry with the highest market share by the end of 2025.

- By Travel Purpose Segment Insights: Leisure Travel is expected to dominate the service type segment of the Indian hospitality industry as it contains a major portion of revenue in 2025.

- Key Players Insights: Some of the major key players in the India Hospitality Industry Market are Taj Hotels (IHCL), Oberoi Hotels & Resorts, ITC Hotels, The Leela Palaces, Hotels & Resorts, Marriott International, Hyatt Hotels, Four Seasons, and many others.

- Market Growth Rate Insights: The market is growing at a CAGR of 9.3 percent over the forecasted period of 2025.

India Hospitality Industry Market: Use Cases

- Medical Tourism Hubs: Cities like Chennai and Delhi are attracting international patients due to high-quality, cost-effective medical care. Hospitals collaborate with hotels to offer medical stay packages, including transportation, lodging, and dietary services, creating a comprehensive hospitality solution for patients and caregivers.

- Spiritual Tourism Ecosystems: Destinations such as Varanasi, Tirupati, and Bodh Gaya are integrating hospitality infrastructure to cater to millions of pilgrims annually. Hotels and guesthouses provide localized vegetarian cuisines, guided temple tours, and multilingual support for diverse visitors.

- Eco-Resorts in Wildlife Sanctuaries: Eco-lodges in areas like Jim Corbett and Kaziranga blend sustainability with tourism by offering solar-powered accommodations and organic food experiences. These resorts employ local communities, promote conservation, and attract eco-conscious travelers seeking immersive nature stays.

- Business Hotels near IT Parks: Cities such as Bengaluru and Hyderabad have witnessed a boom in business hotels located near tech corridors. These hotels provide meeting rooms, high-speed internet, express check-ins, and shuttle services, catering to the fast-paced needs of corporate travelers.

- Workation-Friendly Hill Stations: Hill stations like Manali and Coorg now offer long-stay accommodations with coworking spaces and high-speed internet. Hospitality providers target remote workers and freelancers by combining leisure, comfort, and productivity in tranquil, natural settings.

India Hospitality Industry Market: Stats & Facts

Ministry of Tourism (MoT), Government of India

- Foreign Tourist Arrivals (FTAs):

- India recorded approximately 9.24 million foreign tourist arrivals (FTAs) in 2023, showcasing a significant recovery and a 43.5% rise compared to 2022.

- During the period of January to June 2024, India witnessed 4.78 million FTAs on a provisional basis, indicating sustained growth in inbound travel.

- Delhi Airport emerged as the leading port of entry, accounting for 29.92% of all FTAs during December 2023, reflecting the importance of metropolitan air connectivity.

- Foreign Exchange Earnings (FEEs):

- India generated INR 2.31 lakh crore (approximately USD 28.07 billion) in foreign exchange earnings from tourism in 2023, indicating the sector’s economic strength.

- For January to June 2024, FEEs reached INR 1.27 lakh crore, demonstrating consistent international spending by tourists.

- Domestic Tourism Surge:

- A total of 2.51 billion domestic tourist visits were registered across Indian states in 2023, marking a 44.98% increase from 2022 and underscoring the resilience of domestic travel post-pandemic.

- Tourism-Linked Employment:

- The tourism and hospitality sector supported approximately 76.17 million direct and indirect jobs in FY 2022–23, showcasing its large-scale contribution to employment generation across formal and informal segments.

- Tourism Infrastructure:

- The Swadesh Darshan Scheme, focused on theme-based tourism circuits, sanctioned 76 projects until 2023. Under Swadesh Darshan 2.0, 57 destinations have been selected for integrated sustainable tourism development.

- Budgetary Support:

- The Interim Budget 2024 allocated INR 2,449.62 crore to the tourism sector, marking a 44.7% increase over the previous fiscal, highlighting the government’s emphasis on promoting tourism infrastructure and services.

- Invest India (National Investment Promotion and Facilitation Agency)

- Contribution to GDP:

- The tourism sector is projected to contribute USD 512 billion to India’s GDP by 2028, positioning it as a key driver of economic development.

- By 2047, the direct contribution of tourism to India’s GDP is anticipated to reach an estimated USD 3 trillion, aligning with the nation’s broader vision of becoming a developed economy.

- Employment Potential:

- The tourism and hospitality industry is expected to create approximately 53 million jobs by 2029, reinforcing its role as a high-employment-potential sector.

- Foreign Exchange and Tourism Exports:

- India’s foreign exchange earnings from tourism stood at INR 2.31 lakh crore (USD 28.07 billion) in 2023, with visitor exports expected to grow substantially by 2028.

- UNESCO World Heritage Sites:

- India currently has 43 UNESCO World Heritage Sites, offering significant potential for heritage tourism and cultural preservation.

- E-Visa Facilitation:

- The Indian government offers e-visa facilities to citizens of 167 countries, divided across seven sub-categories, thereby enhancing convenience for international travelers.

- Air Connectivity Through UDAN:

- As part of the Regional Connectivity Scheme (RCS-UDAN), 579 tourism routes have been operationalized, significantly improving access to tier-II and tier-III cities and remote tourist destinations.

- India Brand Equity Foundation (IBEF)

- Inbound Travel Growth:

- A total of 9.24 million foreign tourist arrivals were recorded in 2023, reflecting a strong recovery and interest in Indian destinations.

- Foreign Exchange Earnings from Tourism:

- India earned approximately USD 28.1 billion in 2023 through tourism-related foreign exchange, affirming the sector’s economic relevance.

- FDI in Hospitality Sector:

- From April 2000 to December 2023, the hotel and tourism sector attracted cumulative FDI equity inflows of USD 17.1 billion, representing 2.57% of total FDI across sectors.

India Hospitality Industry Market: Market Dynamics

Driving Factors in the Indian Hospitality Industry Market

Robust Growth in Domestic Tourism Across Tier II & III CitiesDomestic tourism has emerged as the cornerstone of the Indian hospitality market, accounting for over 2.5 billion tourist visits in 2023 alone. With the revival of economic activity, rising disposable incomes, and improved road and air connectivity under schemes like Bharatmala and UDAN, travel beyond metro cities is accelerating. Tier II and III cities such as Indore, Mysore, Bhubaneswar, and Varanasi are witnessing a boom in hotel development driven by spiritual, heritage, medical, and leisure tourism. Additionally, government initiatives like Dekho Apna Desh and the promotion of lesser-known destinations have encouraged Indians to explore regional and rural experiences. Domestic travelers are showing a growing appetite for short stays, weekend getaways, and family vacations, pushing demand for mid-scale hotels, resorts, and homestays.

Affordable travel via low-cost airlines and digital travel platforms is further democratizing access. The consistent rise in intra-state and inter-state travel is helping stabilize occupancy rates and RevPAR for hotels even in non-peak seasons. This localized demand base acts as a strong buffer against international travel volatility and is enabling chains and independents alike to expand aggressively into newer geographies. Overall, the growth of domestic tourism is solidifying a resilient foundation for long-term hospitality sector expansion.

Government Policy Support and Infrastructure Push

Policy interventions and infrastructural investments by the Indian government are critical growth enablers for the hospitality sector. The Swadesh Darshan and PRASHAD schemes aim to develop world-class tourism infrastructure with a thematic and spiritual focus. With 76 Swadesh Darshan projects sanctioned across 30 states, the government is enhancing accessibility to tourist sites via roads, railways, and airports. Additionally, the National Infrastructure Pipeline (NIP) and Gati Shakti initiative are contributing to the expansion of urban and rural connectivity, spurring hospitality growth in hinterlands. FDI liberalization, with 100% foreign ownership allowed under the automatic route for hospitality ventures, has catalyzed capital inflow and global brand entry.

Tax incentives under GST for affordable hotels and promotion of public-private partnerships for heritage property restoration are further supporting the sector. Budget allocations toward tourism saw a 44.7% increase in FY 2024, reflecting prioritization in national planning. Mega campaigns like Incredible India 2.0 and India's G20 tourism exposure are enhancing the country’s brand image globally. These multi-level policy efforts are not only boosting physical infrastructure but also enhancing investor confidence, making India a fertile ground for hotel development, service innovation, and global tourism partnerships.

Restraints in the Indian Hospitality Industry Market

Regulatory Complexity and Fragmented Licensing Framework

One of the most significant challenges confronting India’s hospitality industry is the multiplicity and complexity of regulatory approvals. Operators are required to obtain various licenses related to health, safety, fire, FSSAI, police, excise, pollution, and tourism, each from different authorities at the state and central levels. This fragmented system leads to delays in project commissioning, cost escalation, and legal compliance burdens. Different states apply varied rules on hotel classification, liquor permits, entertainment licenses, and property usage norms, creating operational uncertainty. While the Ministry of Tourism has promoted single-window clearance systems in some regions, adoption remains inconsistent.

This bureaucratic tangle discourages new entrants and foreign investors who seek clarity and uniformity. It also places small and independent operators at a disadvantage due to limited legal resources. In the digital age, such procedural inefficiencies also affect the scalability of online accommodation providers. Streamlining the hospitality compliance ecosystem is imperative to unlock ease of doing business, attract FDI, and ensure faster time-to-market for hospitality ventures across India’s vast and diverse landscape..

Seasonal Demand and Uneven Revenue Cycles

Seasonality remains a major operational challenge for India’s hospitality sector, impacting occupancy rates, pricing strategy, and cash flow. Many tourist destinations—particularly hill stations, beaches, and pilgrimage hubs—experience high demand during specific months, followed by sharp declines in the off-season. For instance, regions like Goa see peak footfall from November to February, but suffer drastic dips during the monsoons. Similarly, the Char Dham circuit in Uttarakhand thrives during summer but becomes inaccessible in winter.

This cyclical nature results in underutilized infrastructure, temporary employment, and revenue unpredictability. Urban hotels also experience lower weekend occupancy compared to weekdays, except during events or festivals. To manage these fluctuations, operators often resort to deep discounting, which impacts profitability. While some brands try to balance the cycle with corporate events and weddings, consistent demand remains elusive. Moreover, seasonality hinders accurate forecasting, ROI planning, and investor confidence, especially in emerging or remote destinations. Developing year-round attractions, promoting off-season tourism, and diversifying the guest mix can help mitigate this restraint, but the challenge remains structurally embedded in India’s climatic and cultural calendar.

Opportunities in the Indian Hospitality Industry Market

Expansion of Alternative Accommodations and Short-Term Rentals

India’s growing middle class, digital-savvy population, and changing consumer preferences are fueling demand for alternative accommodations such as homestays, vacation rentals, boutique lodgings, and eco-resorts. Platforms like Airbnb, Vista Rooms, and StayVista are capitalizing on this trend by offering curated properties in offbeat and rural locations. With travelers prioritizing privacy, personalization, and authentic local experiences, these non-hotel accommodations offer flexibility and cost-effectiveness compared to traditional hotels. The government’s initiative to promote rural homestays in states like Himachal Pradesh, Uttarakhand, and Kerala is creating entrepreneurial opportunities for local communities while catering to experiential tourism.

Domestic travelers, digital nomads, and long-stay guests increasingly prefer such accommodations for workations and retreats. Regulatory streamlining around licensing and taxation can unlock further supply. Furthermore, global travel trends toward sustainable and community-based travel are reinforcing India’s potential to emerge as a strong market for diverse non-branded stays. With over 30% of travelers indicating a preference for non-hotel accommodations post-pandemic, this segment presents a scalable opportunity for both independent hosts and aggregators to thrive in India’s hospitality ecosystem.

MICE Tourism and Business Travel Revival in Urban Hubs

Meetings, Incentives, Conferences, and Exhibitions (MICE) tourism is regaining traction in India as business travel resumes with vigor. Major cities like Delhi NCR, Mumbai, Bengaluru, and Hyderabad are witnessing a surge in corporate events, product launches, trade shows, and international summits. India’s G20 Presidency in 2023 further spotlighted its MICE potential with events hosted across 50+ cities, many of which upgraded their convention infrastructure. Hospitality players are now integrating modular banquet spaces, business lounges, and hybrid conference technology into their offerings. The growth of India’s IT, pharma, BFSI, and startup sectors is further driving the need for business travel and incentive-based stays.

Government efforts to position India as a global convention destination, including the India Convention Promotion Bureau (ICPB), add institutional backing to this opportunity. Upcoming infrastructure, such as the Yashobhoomi Convention Centre in Delhi and planned centers in Kochi and Gujarat, aims to elevate India’s appeal as an international MICE hub. With international arrivals for business picking up and domestic corporates reinstating off-site meets and learning retreats, the MICE vertical is poised to become a significant growth pillar for India’s hospitality segment over the next five years.

Trends in the Indian Hospitality Industry Market

Rise of Experiential and Wellness-Based Hospitality Services

The Indian hospitality landscape is witnessing a distinct shift from conventional lodging models to experience-centric offerings. Modern travelers, particularly millennials and Gen Z, increasingly value immersive experiences over transactional stays. This has spurred demand for boutique hotels, eco-resorts, heritage homestays, and wellness retreats. Operators are curating personalized itineraries that blend cultural exploration, culinary heritage, adventure tourism, and holistic wellness services. Properties across regions like Rishikesh, Coorg, and Ladakh now emphasize yoga, Ayurveda, nature trails, and spiritual experiences.

This trend is further amplified by India's strong positioning in global wellness tourism, supported by traditional practices and a growing focus on mental health and rejuvenation. Hospitality brands are integrating spa facilities, organic cuisine, and sustainable architecture into their offerings to align with wellness-conscious travelers. The shift also aligns with the Ministry of Tourism’s focus on theme-based circuits like Eco-Tourism, Wellness, and Spiritual circuits under Swadesh Darshan 2.0. Thus, the fusion of wellness and experiences is reshaping hospitality demand, pricing strategies, and property development models across urban and rural India alike.

Technology-Driven Guest Personalization and Automation

Digital transformation is deeply influencing guest engagement strategies across India's hospitality sector. From AI-enabled booking platforms to contactless check-ins, technology is now central to operational efficiency and service personalization. Hotels are adopting integrated Property Management Systems (PMS), chatbots for 24x7 virtual concierge services, and dynamic pricing engines to optimize revenue. Mobile apps allow guests to pre-select rooms, control lighting or temperature, order services, and even access local travel guides. The pandemic accelerated digital adoption, with features like QR-based menus, voice-activated room service, and keyless entry becoming standard in premium segments.

Data analytics is being used to tailor offers based on guest history, demographics, and preferences, enhancing satisfaction and loyalty. In parallel, budget hotels and homestays are leveraging OTA integrations and AI tools for inventory and reputation management. These tech-driven shifts improve operational agility and empower brands to deliver hyper-personalized experiences. Technology is not only enhancing guest delight but also enabling cost control, predictive maintenance, and better workforce utilization, establishing a new standard in Indian hospitality services.

India Hospitality Industry Market: Research Scope and Analysis

By Accommodation Type Analysis

Hotels are projected to dominate India’s accommodation segment due to their established infrastructure, credibility, and ability to cater to a wide range of travelers, from luxury seekers to budget-conscious guests. Their extensive geographic presence across urban, suburban, and tourist destinations gives them a structural advantage over emerging accommodation formats. Hotels offer a full-service experience that includes amenities like housekeeping, room service, in-house dining, conference facilities, and often spas or wellness centers. This bundled approach appeals to both business and leisure travelers seeking reliability and comfort.

India’s expanding middle class and increasing travel aspirations have further fueled hotel demand, especially in the mid-scale and economy categories. Brands such as Taj, ITC, Marriott, Lemon Tree, and OYO have consistently expanded their footprints by targeting diverse income groups. Government tourism campaigns and the growth of spiritual circuits, heritage destinations, and Tier II & III cities have also driven hotel construction and bookings in non-metro areas.

Unlike homestays or serviced apartments, hotels are better equipped to meet regulatory compliance and hygiene standards, an aspect that gained significant importance post-pandemic. Business travelers and international tourists, in particular, tend to prefer hotels for safety, reputation, and standardized services. Moreover, the rise of hybrid work models and “workcations” has encouraged longer hotel stays, especially where co-working amenities are integrated.

Hotels also benefit from stronger branding and loyalty programs that build long-term customer relationships. Their dominance is reinforced by continuous investment in digitalization, guest personalization, and sustainability initiatives. Collectively, these factors ensure that hotels remain the preferred and most dominant accommodation format in India’s evolving hospitality market.

By Travel Purpose Analysis

Leisure travel is expected to stand as the dominant segment in India's hospitality industry due to increasing disposable incomes, improved connectivity, and the evolving mindset of Indian travelers prioritizing lifestyle experiences. The rise of a young, aspirational middle class has fueled weekend getaways, family vacations, festival-based travel, and solo adventures. Tier I and II city residents are now exploring cultural, spiritual, nature-based, and luxury tourism across the country, with growing interest in lesser-known destinations promoted under government initiatives like Dekho Apna Desh and Swadesh Darshan.

Post-COVID travel resurgence further accelerated leisure travel demand as people sought relaxation, wellness, and reconnection with nature after extended lockdowns. Destinations like Goa, Himachal Pradesh, Kerala, Rajasthan, and Uttarakhand saw major spikes in domestic tourism, driven by road travel, flexible work-from-home models, and improved road and air infrastructure. The rapid expansion of hospitality facilities in scenic and rural locations has allowed leisure tourism to flourish even outside traditional peak seasons.

Furthermore, the hospitality sector is increasingly tailoring offerings to leisure travelers through experiential stays, boutique properties, eco-tourism, and wellness packages. Resorts, boutique hotels, and luxury homestays have gained popularity for their personalized, thematic experiences catering to romantic getaways, family bonding, or rejuvenation retreats.

Unlike business travel, which is concentrated around metro cities and limited by corporate budgets or seasons, leisure travel spans geographies and timeframes. It supports more flexible price points, longer stay durations, and diverse accommodation choices. With the Indian tourism market evolving from sightseeing to immersive travel, the leisure segment has emerged as the largest and most sustainable demand driver in the country’s hospitality landscape.

By Ownership Type Analysis

Chain-affiliated establishments are projected to dominate India’s hospitality industry due to their strong brand equity, operational consistency, and ability to scale across varied markets. Chains—both domestic and international—offer standardized service experiences that cater to guest expectations across price points and geographies. This consistency ensures trust among travelers, particularly corporate clients, foreign tourists, and high-value domestic guests who prioritize safety, service quality, and hygiene, especially in a post-pandemic environment.

Brands such as Marriott, Hilton, IHCL (Taj), ITC, Accor, Hyatt, and domestic players like Lemon Tree and Ginger have established expansive networks that leverage economies of scale. Chain-affiliated hotels are also early adopters of technology, offering seamless mobile check-ins, loyalty programs, and AI-driven customer engagement. Their ability to access institutional funding, adopt centralized procurement models, and implement professional training programs gives them an operational advantage over independent or unbranded hotels.

Franchise and management agreements allow these chains to rapidly expand without owning physical assets, making them asset-light and agile. Their partnerships with global OTAs, corporate clients, and travel consortiums ensure consistent occupancy, even in competitive or seasonal markets. In smaller towns, midscale chains like Fortune, Sarovar, and Treebo have captured market share by offering branded alternatives to local, independent hotels.

Moreover, international travelers often prefer chain hotels due to their familiarity and adherence to global standards. Chain affiliation also facilitates compliance with tourism regulations, sustainability practices, and third-party audits, strengthening investor confidence. As hospitality competition intensifies and traveler expectations evolve, chain-affiliated hotels continue to lead with scale, trust, and innovation, making them the dominant force in India’s accommodation landscape.

By Booking Channel Analysis

Direct booking is anticipated to have emerged as the dominant channel in India’s hospitality market due to its cost-effectiveness, personalization potential, and brand control. Hotels, resorts, and alternative stays are increasingly focusing on direct-to-consumer (D2C) strategies to reduce dependency on third-party platforms like OTAs, which charge significant commission fees ranging from 15% to 30%. By encouraging guests to book through their own websites, mobile apps, or call centers, hospitality providers are able to improve profitability while maintaining a direct relationship with the customer.

Post-pandemic, the demand for transparency, flexibility, and customized services surged, driving travelers to seek real-time information directly from the property. Direct booking channels offer guests better clarity on cancellation policies, safety protocols, check-in procedures, and personalized offers, often unavailable on aggregator platforms. Hotels are incentivizing direct bookings by offering exclusive discounts, loyalty points, room upgrades, and complimentary add-ons, enhancing guest value while boosting repeat business.

The proliferation of user-friendly websites, secure payment gateways, and mobile optimization has also empowered even smaller properties and homestays to tap into direct bookings. Properties are investing in CRM tools and chatbots to assist customers throughout the journey—from discovery to post-stay engagement—reducing friction and increasing conversions.

Additionally, direct bookings allow hoteliers to capture valuable customer data, enabling them to tailor future offerings and establish brand affinity. The integration of marketing automation, SEO, and social media campaigns further strengthens this channel. As the hospitality sector focuses on personalization, brand loyalty, and higher margins, direct booking remains the most strategic and dominant booking pathway in India’s evolving travel ecosystem.

The India Hospitality Industry Market Report is segmented on the basis of the following

By Accommodation Type

- Hotels

- Premium Hospitality

- Budget & Economy Stays

- Mid-scale Hotels

- Boutique & Heritage Stays

- Heritage Palaces & Forts

- Design-Led Boutique Hotels

- Regional-Themed Boutique Stays

- Resorts & Wellness Retreats

- Beach Resorts

- Hill Station Retreats

- Ayurveda & Yoga Retreats

- Adventure & Eco-Resorts

- Homestays & Airbnb-style Rentals

- Premium Homestays

- Cultural Homestays

- Farm Stays & Rural Tourism

- Service Apartments & Extended Stay

- Corporate Housing

- Co-Living Spaces

- Monthly Rental Apartments

- Hostels & Backpacker Lodges

- Others

By Travel Purpose

- Business Travel (MICE)

- Leisure Travel

- Medical Tourism

- Religious & Pilgrimage Tourism

By Ownership Type

- Chain-Affiliated Hotels

- Independent Hotels

- Franchise-Based

- Leased or Managed Properties

By Booking Channel

- Direct Booking

- Online Travel Agencies (OTAs)

- Travel Agents / Intermediaries

- Corporate Bookings

India Hospitality Industry Market: Competitive Landscape

The competitive landscape of the Indian hospitality industry is shaped by a mix of global hotel chains, domestic hospitality brands, independent operators, and tech-enabled aggregators. Leading international players such as Marriott International, Hilton, Accor, and Hyatt have established a significant presence through both luxury and mid-scale offerings, often targeting metros and high-tourist zones. Simultaneously, Indian giants like Indian Hotels Company Limited (Taj Group), ITC Hotels, Oberoi Group, and Lemon Tree Hotels have built strong brand equity by catering to diverse income groups and expanding into Tier II and III cities.

Tech-driven players like OYO Rooms and Treebo Hotels have transformed the budget and unorganized hospitality segments through asset-light franchise models, offering affordable yet standardized stays. Zostel and SaffronStays are expanding niche offerings such as hostels and vacation homes, reflecting rising demand for experiential and alternative accommodations. In the luxury and boutique domain, players like CGH Earth and Neemrana Hotels offer curated, heritage-based experiences.

Intense competition has spurred digital transformation, personalized services, and sustainability initiatives across the sector. Loyalty programs, AI-based customer service, and dynamic pricing models are key differentiators. Strategic partnerships with OTAs, tourism boards, and airlines are common among market leaders, further amplifying their visibility and reach in the rapidly growing Indian travel and hospitality ecosystem.

Some of the prominent players in the India Hospitality Industry Market are

- Taj Hotels (IHCL)

- Oberoi Hotels & Resorts

- ITC Hotels

- The Leela Palaces, Hotels & Resorts

- Marriott International

- Hyatt Hotels

- Four Seasons

- Radisson Hotel Group

- Lemon Tree Hotels

- Sarovar Hotels & Resorts

- OYO Rooms

- Treebo Hotels

- FabHotels

- Ginger Hotels (Taj Group)

- Ibis Hotels (Accor)

- Courtyard by Marriott

- Hilton

- Club Mahindra (Mahindra Holidays)

- Sterling Holidays

- Bloom Hotels

- Other Key Players

Recent Developments in the India Hospitality Industry Market

May 2025

FoodTech & HotelTech Kerala Expo: Held at Kochi's Jawaharlal Nehru Stadium Ground, this event showcased innovations in food processing and packaging. A highlight was the 104 stalls under the Pradhan Mantri Formalisation of Micro Food Processing Enterprises (PMFME) scheme, featuring diverse products like jackfruit-based items, powdered dried vegetables, traditional snacks, and innovative pickles. The expo also included HotelTech Kerala, focusing on the hospitality sector with over 100 exhibitors.

Accor and InterGlobe Collaboration: Accor, a global hospitality group, and InterGlobe, a major player in the travel industry, announced their decision to appoint Gaurav Bhushan as the chairman of their proposed joint hospitality venture in India. This strategic collaboration aims to strengthen their presence and operations within the Indian hospitality sector.

Rising Northeast Investors Summit: Held at Bharat Mandapam, New Delhi, this summit aimed to transform India’s Northeast into a dynamic hub for investment and trade by showcasing the region's vast economic potential. A significant highlight was the Tata Group's ₹27,000 crore investment in a semiconductor manufacturing facility in Jagiroad, Assam—the largest-ever private sector investment in Northeast India.

World Audio-Visual & Entertainment Summit (WAVES): The inaugural edition took place from May 1 to 4, 2025, at the Jio World Convention Centre in Mumbai. The summit focused on attracting investment, fostering skill development, and positioning India as a global leader in the media and entertainment sector.

Invest Kerala Global Summit: Organized by the Government of Kerala, this event aimed to attract domestic and international investments across various sectors, including hospitality. It showcased the state's potential as a business hub and promoted economic growth.

1st PHDCCI Wedding Tourism Summit & Expo: Held from 18-19 October 2024, this event emphasized the potential of India's wedding tourism industry. With a significant portion of the population under 30 years old, the summit highlighted the vast opportunities in the wedding sector, which contributes notably to the tourism and hospitality industry.

Wyndham and NILE Hospitality Partnership: Wyndham Hotels & Resorts entered an exclusive development agreement with NILE Hospitality LLP to introduce its Microtel by Wyndham brand to India. This partnership aims to open 40 Microtel hotels across the country by 2031, expanding Wyndham’s presence in India, where it currently operates 60 hotels.

HICSA 2024: The 19th Edition of the Hotel Investment Conference – South Asia (HICSA) was held at JW Marriott Bengaluru Prestige Golfshire Resort & Spa from 2–4 April 2024. This annual event is India’s largest hospitality investment conference, and this year it saw over 725 delegates in attendance, indicating a turning point in the industry’s recovery.

IEML and Nippon Group Partnership: India Exposition Mart Limited (IEML) and the Spanish conglomerate Nippon Group of Companies announced a strategic alliance to revolutionize the event and exhibition space. This collaboration aims to elevate the India International Hospitality Expo (IHE) to unprecedented heights, focusing on the food and hospitality sector.

Report Details

| Report Characteristics |

| Market Size (2025) |

USD 263.2 Bn |

| Forecast Value (2034) |

USD 588.2 Bn |

| CAGR (2025–2034) |

9.3% |

| Historical Data |

2019 – 2024 |

| Forecast Data |

2025 – 2033 |

| Base Year |

2024 |

| Estimate Year |

2025 |

| Report Coverage |

Market Revenue Estimation, Market Dynamics, Competitive Landscape, Growth Factors, etc. |

| Segments Covered |

By Property Type (Hotels, Boutique & Heritage Hotels, Resorts & Wellness Retreats, Homestays & Airbnb-style Rentals, Service Apartments & Extended Stay, Hostels & Backpacker Lodges, Others), By Travel Purpose (Business Travel (MICE), Leisure Travel, Medical Tourism, Religious & Pilgrimage Tourism), By Ownership Type (Chain-Affiliated Hotels, Independent Hotels, Franchise-Based, Leased or Managed Properties), By Booking Channel (Direct Booking, Online Travel Agencies (OTAs), Travel Agents/Intermediaries, Corporate Bookings) |

| Regional Coverage |

India |

| Prominent Players |

Taj Hotels (IHCL), Oberoi Hotels & Resorts, ITC Hotels, The Leela Palaces Hotels & Resorts, Marriott International, Hyatt Hotels, Four Seasons, Radisson Hotel Group, Lemon Tree Hotels, Sarovar Hotels & Resorts, OYO Rooms, Treebo Hotels, FabHotels, Ginger Hotels (Taj Group), Ibis Hotels (Accor), Courtyard by Marriott, Hilton, Club Mahindra (Mahindra Holidays), Sterling Holidays, Bloom Hotels, and Other Key Players |

| Purchase Options |

We have three licenses to opt for: Single User License (Limited to 1 user),

Multi-User License (Up to 5 Users), and

Corporate Use License (Unlimited User) along with free report customization equivalent to

0 analyst working days, 3 analysts working days, and 5 analysts working days respectively.

|

Frequently Asked Questions

How big is the Indian Hospitality Industry Market?

▾ The India Hospitality Industry Market size is estimated to have a value of USD 263.2 billion in 2025 and is expected to reach USD 588.2 billion by the end of 2034.

Who are the key players in the Indian hospitality industry?

▾ Some of the major key players in the India Hospitality Industry Market are Taj Hotels (IHCL), Oberoi Hotels & Resorts, ITC Hotels, The Leela Palaces, Hotels & Resorts, Marriott International, Hyatt Hotels, Four Seasons, and many others.

What is the growth rate in the Indian Hospitality Industry Market in 2025?

▾ The market is growing at a CAGR of 9.3 percent over the forecasted period of 2025.