The online games market in India includes digital games that are played over the internet through smartphones, tablets, computers, and consoles. These games can be casual, competitive, or skill-based, and include formats such as multiplayer games, battle royale, fantasy sports, and real-money gaming. With affordable smartphones and easy internet access, online games have become a common source of entertainment for many Indians, especially the younger generation.

Over the past few years, the Indian online games market has grown rapidly due to changing digital habits, rising smartphone usage, and better internet services. Games are now played not only for fun but also as a way to connect socially, earn rewards, and even build a career through

eSports and streaming platforms. Increased screen time and interest in interactive content have also pushed more people towards online gaming.

One of the biggest changes in recent years has been the rise of mobile gaming. As most people access games through mobile phones, game developers are focusing on light, fast, and engaging mobile-friendly games. Local developers are also making games in Indian languages and themes that reflect local culture, helping games reach more players. This shift has opened the door for smaller studios and indie developers to enter the market.

Another major trend is the blending of gaming with other forms of entertainment. Short video platforms, social media, and even TV channels are now promoting or collaborating with online games to reach wider audiences. Gamification is also entering education, fitness, and online shopping, creating new ways to engage users using game-like features. These overlaps are making online gaming part of daily life for many.

At the same time, real-money and skill-based gaming have seen huge interest. Fantasy sports, rummy, and quiz-based games are growing in popularity. However, they have also raised concerns around regulation, addiction, and user safety. The Indian government and some state authorities are discussing clearer policies to manage these challenges and protect users while allowing the sector to innovate and grow.

In recent years, several events have shaped the Indian gaming market. These include foreign investments in Indian gaming startups, the rise of eSports tournaments with professional teams, and increased interest from non-gaming brands entering this space. As India becomes a key player in the global gaming scene, the market is expected to keep evolving with new formats, better technology, and more local content.

India Online Games Market: Key Takeaways

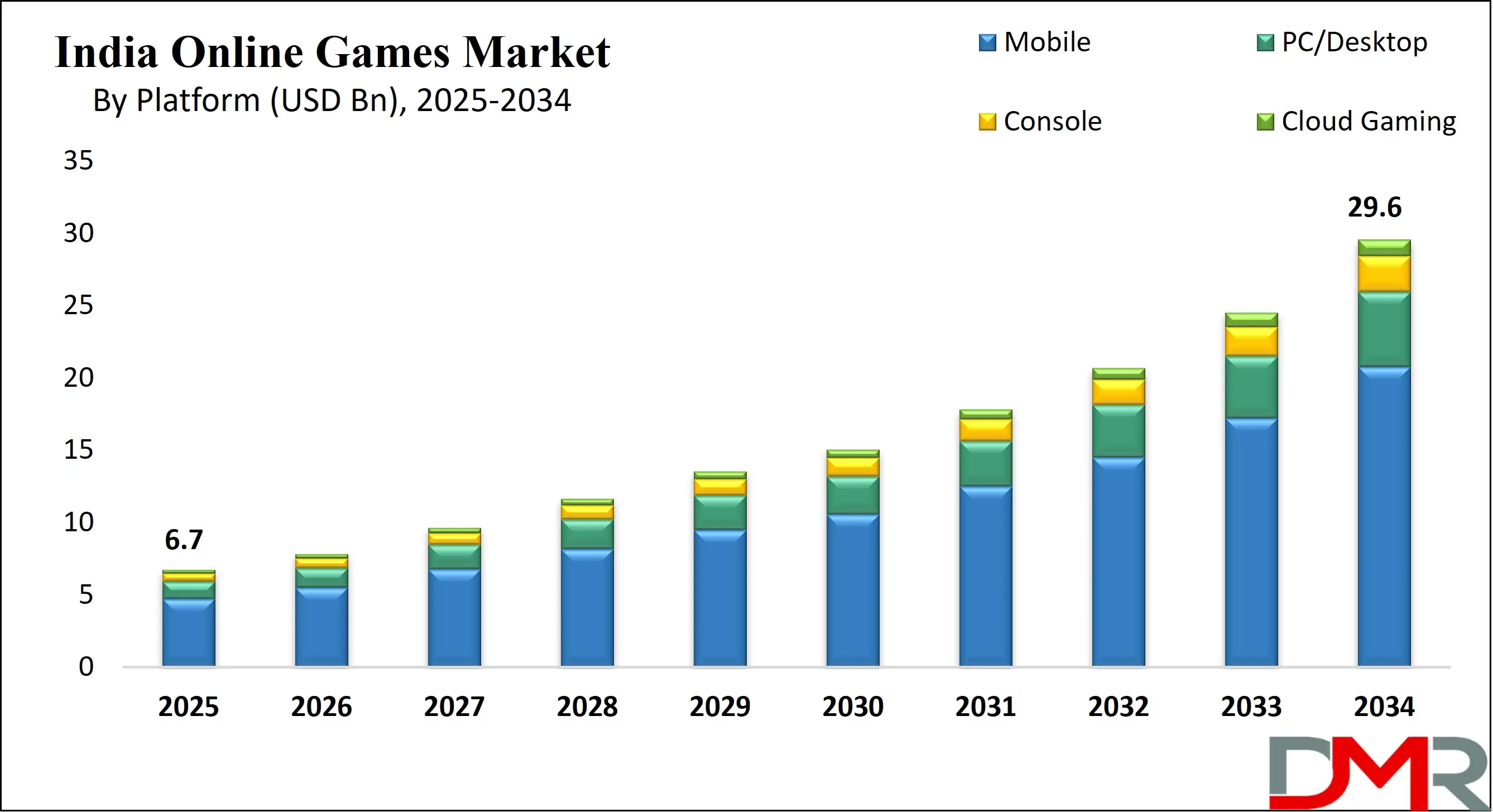

- Market Growth: The India Online Games Market size is expected to grow by USD 21.8 billion, at a CAGR of 17.8%, during the forecasted period of 2026 to 2034.

- By Platform: The mobile segment is anticipated to get the majority share of the India Online Games Market in 2025.

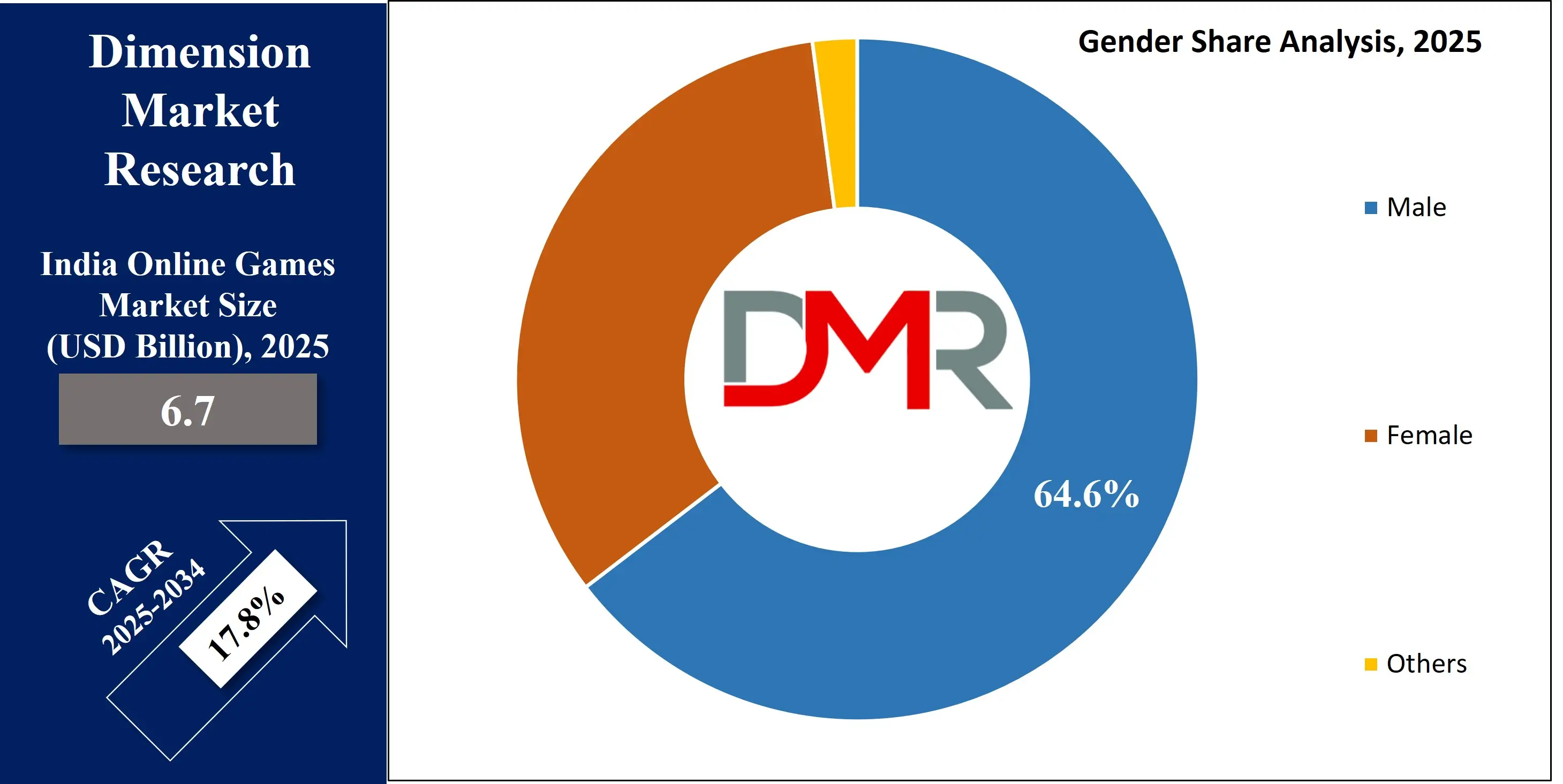

- By Gender: The male segment is expected to get the largest revenue share in 2025 in the India Online Games Market.

- Use Cases: Some of the use cases of Online Games include entertainment & stress relief, skill development & strategic thinking, and more.

India Online Games Market: Use Cases:

- Social Interaction & Community Building: Online games offer a virtual space where users can play with friends or strangers, forming communities and friendships. Multiplayer features, live chat, and team-based challenges help create a sense of belonging. This social layer keeps players engaged and coming back regularly.

- Skill Development & Strategic Thinking: Many online games involve problem-solving, planning, and decision-making under pressure. Players often improve hand-eye coordination, memory, and logical thinking. This makes gaming not just entertaining but also mentally stimulating for many users.

- Entertainment & Stress Relief: For many Indians, online games have become a regular source of fun and relaxation. Whether it’s a quick puzzle game or a long battle royale session, gaming offers an escape from daily stress. It fills short breaks or leisure time enjoyably.

- Earning Opportunities & eSports Careers: Some online games allow users to earn money through rewards, competitions, or in-game achievements. With the rise of eSports, many players are now pursuing careers as professional gamers, streamers, or content creators. This has opened up a new digital career path for Indian youth.

Stats & Facts

As per IBEF

- By 2025, India is expected to have 40–50 million connected smart TVs. Around 30% of the content consumed on these devices will include gaming, social media, short videos, and exclusive content curated by television, print, and radio brands specifically for this audience.

- Approximately 600–650 million Indians are projected to consume short-form video content by 2025, with active users spending an average of 55–60 minutes daily.

- India’s gaming industry witnessed a 23% year-on-year growth, reaching a revenue of USD 3.8 billion in FY24.

- In 2023, the online gaming segment grew by 22%, surpassing filmed entertainment to become the fourth-largest segment within India’s media and entertainment (M&E) sector.

Market Dynamic

Driving Factors in the India Online Games Market

Widespread Smartphone Penetration and Affordable Internet

One of the biggest drivers of growth in the Indian online games market is the increasing use of smartphones across urban and rural areas. With a wide range of affordable mobile devices now available, millions of users can access and play games anytime, anywhere. The rollout of low-cost data plans has further boosted this trend, making online access easier and more consistent. This combination has encouraged casual users to try online gaming, especially among younger people and those in smaller towns. As a result, mobile gaming has become the most common form of online gaming in India. Developers are now focusing on mobile-first strategies, light apps, and offline features to suit the Indian user base.

Rising Popularity of Localized Content and Social Gaming

Indian gamers mainly prefer content that feels familiar, whether through language, characters, or cultural references. This has led developers to create games in regional languages, using Indian themes, stories, and settings. Such localization helps users connect with the game more personally and improves retention. Additionally, the social aspect of gaming such as multiplayer modes, real-time chats, and influencer-driven game communities is making online games more engaging. Friends and family can play together, compete, or collaborate in a shared environment, driving word-of-mouth growth. These social and cultural connections are making online gaming not just a solo hobby, but a collective digital activity embraced across generations.

Restraints in the India Online Games Market

Regulatory Uncertainty and Legal Challenges

One of the major restraints affecting the India online games market is the lack of consistent regulation and clear legal guidelines. Different states in India have different rules regarding online gaming, especially when it comes to real-money and skill-based games. Some states have banned or restricted certain formats, creating confusion for both users and companies. Frequent changes in laws and unclear classification of games whether as skill-based or chance-based pose a risk to business models. This unpredictability limits investment and long-term planning for developers. As a result, many companies face legal hurdles that slow down product launches, marketing, and expansion efforts across the country.

Concerns Around Addiction, Mental Health, and Safety

With the rise in gaming, concerns have grown around screen addiction, especially among children and teenagers. Excessive gaming can affect sleep patterns, academic performance, and overall mental well-being. Some online games also include in-app purchases and reward systems that may lead to compulsive behavior. Parents and educators have expressed worries about the lack of supervision and the potential for harmful content. In addition, data privacy and online safety remain weak spots, as many users especially younger ones—are not fully aware of digital risks. These issues can lead to public pressure and stricter regulations, which may affect the free growth of the industry.

Opportunities in the India Online Games Market

Expansion of eSports and Competitive Gaming

The growth of eSports in India presents a major opportunity for the online gaming market. Competitive gaming is gaining recognition as a serious profession, with the growing participation in tournaments, growing fan bases, and investments from sponsors and media platforms. Youth across the country are now aspiring to become professional gamers, streamers, or shoutcasters. With organized leagues, prize pools, and national-level events, eSports is creating a structured gaming ecosystem. Schools and colleges are also beginning to support eSports clubs and events, further boosting its appeal. As awareness and acceptance grow, this segment can attract more players, advertisers, and viewers. The development of training academies and local talent platforms can further push India onto the global eSports stage.

Growth in Regional Content and Vernacular Gaming

India's linguistic and cultural diversity offers a massive opportunity for gaming companies to tap into regional markets. By developing games in vernacular languages and using culturally relevant themes, developers can reach audiences in Tier 2 and Tier 3 cities. Players feel more connected to games that reflect their language, stories, and traditions, which boosts engagement and retention. With smartphone usage growing in rural areas, regional content is key to unlocking the next wave of online gamers. This also opens doors for collaborations with local influencers, storytellers, and artists. As demand for localized experiences rises, companies that adapt quickly to regional tastes will gain a significant edge in this expanding market.

Trends in the India Online Games Market

Cloud Gaming and Cross‑Platform Play

A major trend in the India online games market is the rise of cloud gaming and cross‑platform play. Instead of downloading and storing games, users now stream high‑quality titles directly to their devices, making premium gaming accessible even on basic smartphones or tablets. This shift is especially popular in regions where people can’t afford expensive hardware. With cloud play becoming common, developers are focusing on lightweight, optimized titles that work seamlessly across mobile, desktop, and even TVs. The result is a more inclusive experience—gamers can pick up a session on one device and continue it on another without hassle. As 5G networks expand, cloud gaming’s appeal and reach are set to grow further.

Immersive Technologies: AR, VR, and AI‑Driven Experiences

Immersive technologies are dramatically changing how Indians interact with games. Augmented reality (AR) and virtual reality (VR) are making their way into mainstream mobile and PC gaming, creating more lifelike and engaging worlds. Developers are building interactive narratives where digital elements blend with real environments, like location‑based AR games or VR fitness experiences.

Artificial intelligence is also playing a key role—NPCs become smarter, game difficulty adapts dynamically, and personalization improves through behavioral analytics. These technologies enrich gameplay by making it more responsive, immersive, and tailored to each player’s style. As headsets and AR accessories become affordable, such innovations are expected to shape India’s gaming scene in the coming years.

Research Scope and Analysis

By Game Type Analysis

Casual games will be leading the India online games market in 2025 with an estimated share of

27.9%, driven by their simple gameplay, easy controls, and short time commitment. These games appeal to a wide age group and are especially popular among new gamers who prefer low-stress, entertaining experiences. From puzzles and card games to arcade and trivia formats, casual games are designed to be light and enjoyable without the need for deep focus or long sessions.

Their accessibility on smartphones and tablets has further boosted their reach, particularly in smaller towns and non-metro areas. Many casual games are available in local languages and offer culturally relatable themes, enhancing user connection and retention. With social sharing, reward-based challenges, and in-app features, casual gaming continues to draw massive audiences, supporting the overall growth of India’s digital entertainment landscape.

Simulation games are projected to witness significant growth over the forecast period, fueled by rising interest in realistic and immersive experiences. These games allow players to manage, build, or experience real-life activities virtually—like running a business, flying an aircraft, or driving a vehicle. With improved graphics, physics, and storytelling, simulation games are gaining popularity among gamers who seek deeper, long-term engagement.

This genre appeals to both casual and serious gamers, offering detailed control and creative freedom. As smartphones and internet connectivity improve, more users are engaging with simulation games for both entertainment and learning. The growing popularity of role-based training, virtual experiences, and life simulation themes is helping this segment stand out. Local developers are also starting to explore culturally relevant simulation games tailored to Indian preferences.

By Platform Analysis

Mobile gaming will be leading the India online games market in 2025 with an estimated share of 70.2%, supported by the major use of smartphones and affordable data plans. With easy access to budget-friendly devices, people across cities and rural areas are playing games on the go. Mobile games are convenient, lightweight, and often free, making them a top choice for all age groups. From casual puzzle games to intense multiplayer formats, the mobile platform offers something for everyone.

The growth of app stores, local-language content, and engaging gameplay has made mobile the preferred gaming platform. Push notifications, social sharing, and reward systems also help keep users hooked. Developers are focusing heavily on mobile-first designs to reach the growing number of users relying on smartphones for entertainment, helping drive the expansion of India’s online gaming space.

Cloud gaming is set to experience significant growth over the forecast period as it removes the need for expensive hardware and large downloads. By streaming games directly to devices, users can enjoy high-quality gaming even on basic smartphones or tablets. This model is becoming attractive to gamers who want quick access to new titles without waiting or using storage space. Cloud platforms are also making it easier for people in smaller towns to access premium gaming experiences without investing in consoles or PCs.

As internet speeds improve and 5G becomes more common, cloud gaming will offer smoother performance and real-time gameplay. Game developers are beginning to design titles optimized for cloud access, enhancing reach and scalability. With cross-device play and easy access, cloud gaming is becoming an important pillar in India’s evolving digital gaming ecosystem.

By Game Mode Analysis

Multiplayer gaming will be leading the Indian online games market in 2025 with a projected share of 41.8%, as it continues to bring people together through shared gaming experiences. These games let players team up or compete with others in real time, adding excitement and social interaction to gameplay. From battle royales to team-based challenges, multiplayer formats offer dynamic action and keep users engaged for longer periods.

Voice chat, leaderboards, and live updates enhance the sense of competition and community. As more friends and families play games together, multiplayer games are becoming a popular way to stay connected. With growing interest in social play and team dynamics, developers are creating titles that promote interaction, teamwork, and online friendships. This form of gaming has become a digital meeting point for users, pushing strong growth across all age groups and regions.

E-sports and competitive gaming are gaining strong momentum, showing significant growth over the forecast period as more Indian players and viewers embrace professional-level gameplay. This segment is not just about entertainment—it’s about skill, recognition, and career opportunities. Competitive titles attract large online communities, influencers, and sponsors, creating a vibrant gaming ecosystem. National tournaments, leagues, and streaming platforms are helping young players showcase their talents and earn rewards.

Schools and colleges are now starting to support gaming clubs and events, encouraging participation at early stages. With structured gameplay, ranked systems, and team-based competition, e-sports is developing into a serious digital sport. As the audience for live-streamed matches and game commentary grows, e-sports continues to strengthen its place in India’s digital entertainment scene.

By Gender Analysis

Male users will be leading the Indian online games market in 2025 with an estimated share of 64.6%, driven by high engagement levels across various gaming genres. From action-packed multiplayer games to competitive e-sports and real-money formats, male gamers form a large and active user base. Many are drawn to high-intensity, strategy, and skill-based games, often playing for longer sessions and participating in online communities.

The popularity of gaming influencers, live streams, and gaming tournaments has also added to the enthusiasm among male players. With access to smartphones, faster internet, and more content in local languages, male users across urban and rural regions are contributing to strong user growth. Game developers and marketers are targeting this segment with competitive gameplay, social features, and in-game rewards, keeping male audiences highly involved and continuously expanding the market.

Further, female gamers are witnessing growing involvement, showing significant growth over the forecast period as online gaming becomes more inclusive and accessible. With a wider choice of casual, puzzle, and story-based games, more women are finding games that match their interests and play styles. Social media, mobile accessibility, and games in regional languages have encouraged participation among female users from different backgrounds.

This segment often prefers quick, engaging formats that fit into daily routines, making mobile casual games especially popular. As the industry shifts toward inclusivity, developers are creating more gender-neutral and women-friendly content. Increased visibility of female gamers and content creators is also inspiring more women to explore gaming, contributing to a more balanced user base in India’s online gaming scene.

The India Online Games Market Report is segmented on the basis of the following

By Game Type

- Casual Games

- Action & Adventure Games

- Role-Playing Games (RPG)

- Strategy Games

- Sports Games

- Racing Games

- Card & Casino Games

- Simulation Games

- Puzzle & Arcade Games

By Platform

- Mobile

- PC/Desktop

- Console

- Cloud Gaming

By Game Mode

- Single Player

- Multiplayer (Online)

- Multiplayer (Local/Offline)

- eSports & Competitive

By Gender

Competitive Landscape

The competitive landscape of the Indian online games market is active and fast-changing, with a mix of local and global companies offering a wide range of games. These include casual games, mobile-based skill games, fantasy sports, and eSports. Companies are focusing on improving user experience, creating regional content, and offering rewards to attract and keep players.

Many developers are designing games for Indian audiences by using local languages, cultural themes, and simple controls. The market is also seeing strong competition in real-money gaming, with platforms offering tournaments and cash prizes. Additionally, partnerships with entertainment brands, influencers, and social media platforms are helping game makers reach more users. Innovation, user engagement, and strong marketing are key to standing out in this growing market.

Some of the prominent players in the India Online Games are

- Dream11

- Nazara Technologies

- Games24x7

- Mobile Premier League (MPL)

- WinZO

- Octro

- Zupee

- Krafton India

- Garena

- Tencent India

- Miniclip

- Zynga India

- EA Sports

- Hitwicket

- Rooter

- SuperGaming

- Rolocule Games

- HalaPlay

- RummyCircle

- A23 (Ace2Three)

- PokerBaazi

- Other Key Players

Recent Developments

- In April 2025, KRAFTON India is strengthening its commitment to shaping the future of the country’s gaming landscape by welcoming six startups into the second cohort of the KRAFTON India Gaming Incubator (KIGI). Expanding from four to six participants, the new cohort reaches emerging gaming hubs like Kolkata and Madurai, underscoring KIGI’s mission to foster a nationwide network of top-tier game developers. The incubator offers promising studios six to twelve months of mentorship and financial support of up to $150,000, helping them build high-quality games and contribute meaningfully to India’s growing gaming ecosystem.

- In March 2025, LightFury Games, India’s introduced its upcoming title E-Cricket with a teaser and demo at the 2025 Game Developers Conference (GDC) in San Francisco. Developed in partnership with Amazon Web Services (AWS), the game aligns with LightFury’s vision of positioning India as a global center for premium game development. E-Cricket uses the newly launched Amazon GameLift Streams, a fully managed AWS solution that allows developers to deliver high-quality, low-latency gameplay directly through web browsers, removing the need for dedicated gaming devices or high-end hardware.

- In February 2025, India’s 88 Games, the gaming division of leading animation and VFX studio 88 Pictures, announced its debut title, Kapih, inspired by Indian folklore. Known for its acclaimed work on Trollhunters: Tales of Arcadia, 88 Pictures is now bringing its storytelling strength into the gaming space. Kapih is a platformer game set to launch on PC and console, aimed at appealing to a global audience. The project follows the footsteps of Black Myth: Wukong, drawing from local mythology to craft a culturally rich experience for international gamers.