Market Overview

The Global

Industrial Distribution Market size is expected to reach a

value of USD 8,153.1 billion in 2024, and it is further anticipated to reach a market value of

USD 12,975.4 billion by 2033 at a

CAGR of 5.3%.

The global industrial distribution market covers all types of supply categories from industrial goods and services to different industry verticals, such as manufacturing, construction, and energy. An industrial distributor is an intermediary between end-users and the producer of a good, providing a critical link in the supply chain.

The size of the global industrial distribution market is expected to increase by USD 4,822.3 billion in the coming decade, driven by strong demand for industrial supplies in various sectors. The various products retailed by the industrial distributors include machinery, MRO supplies, electrical components, and safety equipment, among others. Strong industry trends that continue to drive the demand in the sector include increasing automation and digitization of industries.

Also, e-commerce has revitalized the routes of distribution and eased access to industrial supplies of firms. This growth is further bolstered by the coming-of-age technologies under Industry 4.0, which create high demand for automation solutions. On account of the growth of the manufacturing sector in regions including Asia-Pacific and North America.

However, some factors that may restrain the growth include supply chain disruptions and fluctuations in raw material costs. Some of the major companies dealing within the industrial distribution market are MSC Industrial Supply, Applied Industrial Technologies, Fastenal, and W.W. Grainger, which collectively hold a significant market share.

The manufacturing sector plays a crucial role in driving the industrial distribution market, as it relies heavily on the efficient and timely delivery of industrial products and supplies. According to the U.S. Census Bureau, the total value of manufactured goods delivered in the United States surpassed USD 5.9 trillion in 2021, reflecting a 10.6% increase from the previous year. This growth in manufacturing activity highlights the rising demand for industrial distribution services.

A survey by the Institute for Supply Management (ISM) found that 74% of firms are investing in supply chain resilience strategies, including supplier diversification and enhanced visibility. This focus on supply chain optimization is expected to drive demand for industrial distribution services that offer greater reliability and flexibility.

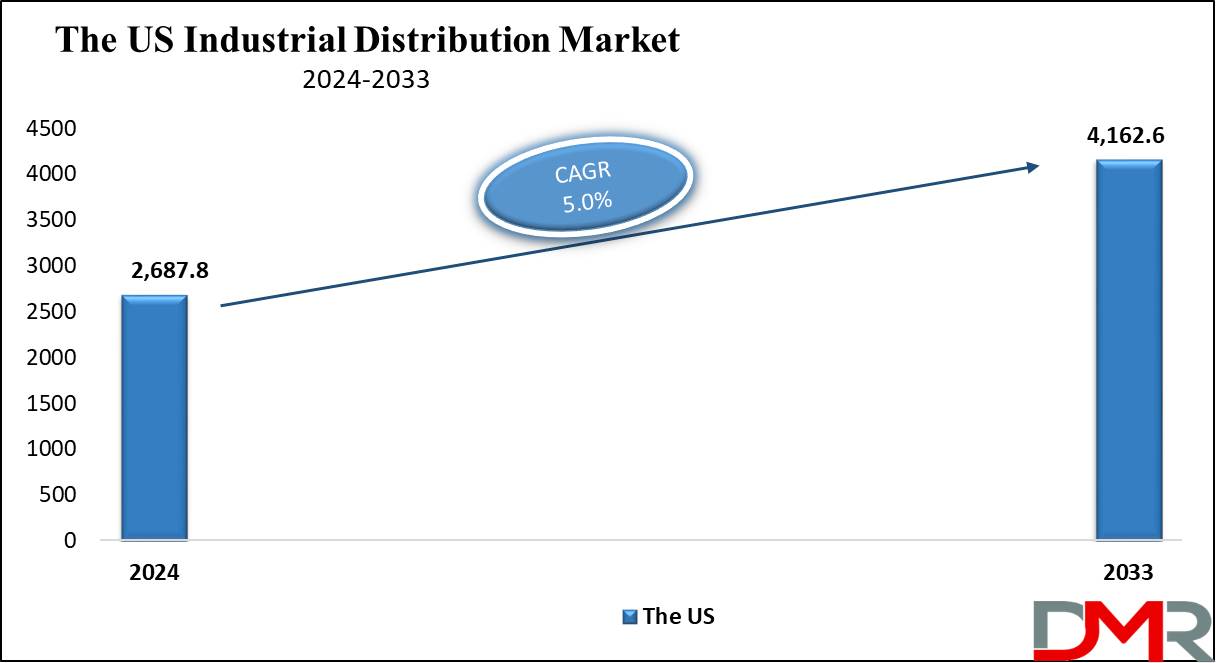

The US Industrial Distribution Market

The

US Industrial Distribution Market is projected to be valued at

USD 2,687.8 billion in 2024. It is expected to witness subsequent growth in the upcoming period as it holds

USD 4,162.6 billion in 2033 at a

CAGR of 5.0%. The US might have an industrial distribution market that is mature but picks up trend changes, hence making a considerable contribution towards the global industrial distribution market size.

Key market trends include increased infiltration of digital tools and platforms, especially e-commerce, to ease procurement processes. This has driven more growth in the market, with businesses trying to be efficient and quicker in ways of accessing industrial supplies. The growth of accident repairs is a notable development; MRO services ensure machinery and equipment continue to work, thus limiting downtimes for manufacturing industries creating items for automotive, aerospace, etc.

The other trend relates to greener supply chain practices engaged by distributors and energy-efficient products. Advancement in usages of technology such as IoT and automation contributes to the growth of the market, as companies increasingly seek to utilize such solutions to enhance their business operations further. The trend of Industry 4.0 has encouraged the usage of smart technologies that increased demand for automated machinery and advanced industrial tools.

However, global uncertainties are still causing disruptions in supply chains that act as a barrier to this sector. Despite this fact, major players such as MSC Industrial Supply, Fastenal Company, and W.W. Grainger continue to expand distribution capabilities and remain the drivers of growth in the U.S. industrial distribution market.

Key Takeaways

- Global Market Value: The global industrial distribution market size is estimated to have a value of USD 8,153.1 billion in 2024 and is expected to reach USD 12,975.4 billion by the end of 2033.

- The US Market Value: The US industrial distribution market is projected to be valued at USD 4,162.6 billion in 2033 from the base value of USD 2,687.8 billion in 2024 at a CAGR of 5.0%.

- Regional Analysis: North America is expected to have the largest market share in the global industrial distribution market with a share of about 39.2% in 2024.

- By Product Segment Analysis: The machinery and equipment segment is projected to dominate the product segment with 32.2% of the market share in 2024.

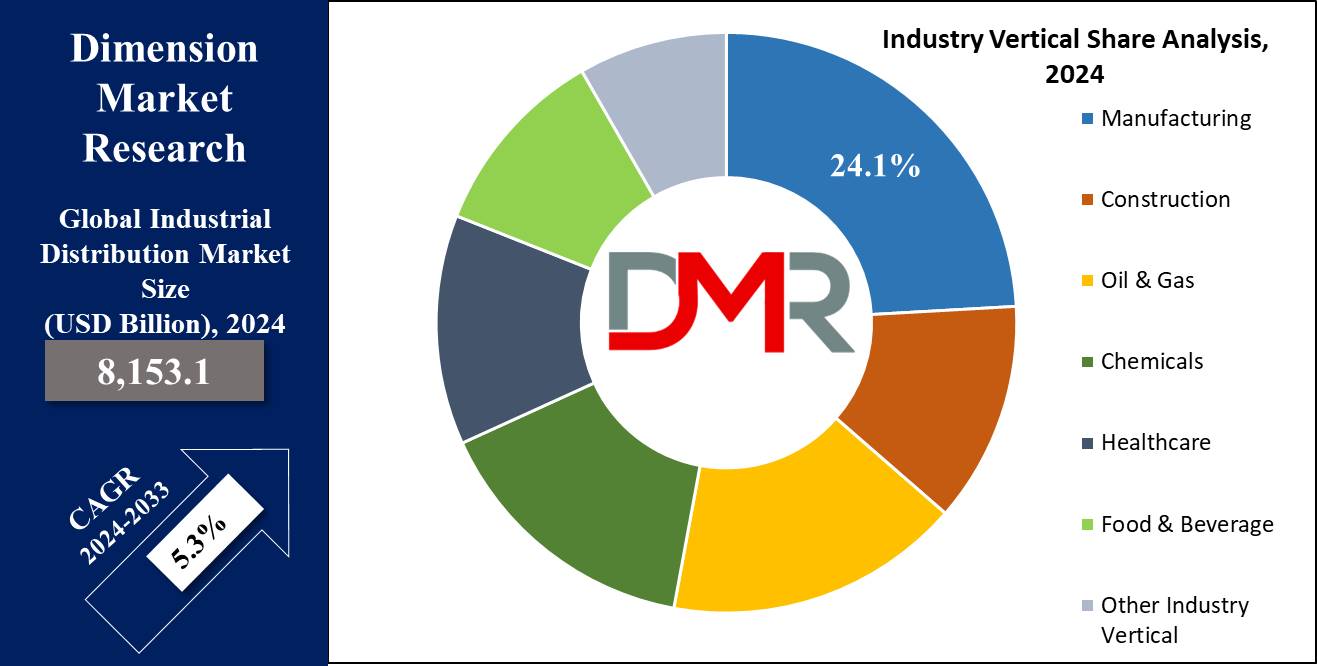

- By Industry Vertical Segment Analysis: Manufacturing is anticipated to dominate the industry vertical segment in this market as it holds 24.1% of the market share in 2024.

- Key Players: Some of the major key players in the Global Industrial Distribution Market are W.W. Grainger, WESCO International, Sonepar USA, Würth Industry, Wolseley Industrial Group, DXP Enterprises Inc., and many others.

- Global Growth Rate: The market is growing at a CAGR of 5.3 percent over the forecasted period.

Use Cases

- Manufacturing Equipment Supply: The industrial distributor supplies crucial machinery, spare parts, and instruments for production lines for evaluation in enterprises like automotive and electronics.

- Maintenance and Repair Operations (MRO): With distributors, companies are assured of critical spare parts and maintenance products that reduce downtimes in their operations.

- Energy Sector Equipment: The industrial distributor provides spare parts for power generation, oil, and gas, and renewable energy projects that keep operations running non-stop.

- Construction Tools and Materials: Construction materials and tools suppliers can provide all types of products to allow contractors and builders to adhere to schedules and address all safety concerns.

Market Dynamic

Market Trends

Digital TransformationIn this way, the revolution is taking place within the industrial distribution landscape, fostered by e-commerce and digital procurement platforms. But of course, this can be attributed to the growing investment being made in online or advanced platforms by distributors themselves, where customer experience would be improved and ordering processes simplified.

This opens up a wider range of products to businesses faster and more efficiently, greatly improving procurement speed. It finds its integration in supply chain management with technologies like artificial intelligence and

machine learning, thus enabling predictive analytics for better inventory management and demand forecasting. Emphasis shall be laid on real-time data that will drive businesses toward informed decisions that shall assist them in increasing their operational efficiency and responsiveness toward changes in the market.

Sustainability and Green Initiatives

Sustainability becomes a point of priority for companies of various lines of activity, and even industrial distribution is not an exception. Distributors are increasingly adopting green practices, offering eco-friendly products, and providing sustainable supply chain solutions. This shift can be attributed to increasing consumer awareness and rising regulatory pressures that urge organizations to minimize their environmental footprint.

Energy-efficient machinery and sustainable materials are the new demands that reshape the product offerings, whereby the distributor focuses on bringing in solutions that meet their customers' goals of sustainability. This trend of growth not only enhances corporate responsibility but also opens up new avenues for growth in the industrial distribution market.

Growth Drivers

Technological Advancements

Rapid development and advancement in technologies are acting as catalysts in the growth of the industrial distribution market. There is increased inculcation of automation, robotics, and IoT technologies into manufacturing and industrial operations. This would drive the demand for specialized equipment, tools, and MRO supplies as industries looked upon increasing efficiency and productivity.

Besides continuous product design and functionality innovations, further interest for distributors spurs them to extend the product range, reaching new endings towards catching the changing needs of businesses. In addition, the rise of smart factories and Industry 4.0 solutions is driving further demand for value-added industrial products, making technology a very vital driver for growth.

Infrastructure Development

Ongoing infrastructure projects in emerging economies and the need for upgrades in developed regions significantly boost the demand for industrial supplies. Governments are investing heavily in infrastructure development to support economic growth, which directly impacts the industrial distribution sector. The construction of roads, bridges, and industrial facilities creates a consistent demand for machinery, tools, and building materials.

Additionally, as industries like energy and transportation expand, the requirement for specialized equipment and maintenance supplies grows. This trend supports sustained growth in the global industrial distribution market as more projects come online.

Growth Opportunities

E-commerce Expansion

The increasing shift towards online purchasing is creating great growth prospects for industrial distributors. A company that invests in a strong e-commerce platform can reach out to more customers because of the ease of purchasing. This ease of ordering online, replicated by enhanced logistics and distribution capabilities, enables distributors to compete with the fast-paced nature of contemporary industries. As more companies seek to simplify the processes of procurement, the ones better positioned digitally will be in a position to capture a significant percentage of market share.

Emerging Markets

The rise of industrialization in developing regions, such as Asia-Pacific and Latin America, brings immense opportunities to key market participants. Along with the economic growth of these segments, the demand for industrial goods and services will continue to grow.

Therefore, a strong presence in such markets would indeed prove to be beneficial for any distributor owing to increased sales and a larger customer base. Since different regions come with their peculiar challenges, local partnerships and solutions that work best may be necessary in navigating these. This makes these emerging areas strategic in the growth of the industrial distribution market.

Restraints

Supply Chain Disruptions

Global supply chain instability remains one of the big inhibitions of the industrial distribution industry. Geopolitical tensions, natural disasters, and pandemics usually create logistic disruptions that lead to a shortage of essential products. These heighten the lead times and, as would be expected, raise costs that impact the profitability of a distributor. Resiliency in the supply chain is something that has become quite critical while companies try to reduce risks from external shocks.

Fluctuating Raw Material Costs

Volatile raw material prices pose financial uncertainty for industrial distributors. Fluctuations in prices can challenge companies to maintain stable pricing structures; further, rising costs could impose increased end-user prices that hinder demand. Distributors must devise effective plans to effectively navigate this uncertainty for sustained success within the global industrial distribution marketplace.

Research Scope and Analysis

By Product

The machinery and equipment products are projected to dominate the product segment in the global industrial distribution market as it will hold 32.2% of the market share in 2024. The machinery and equipment dominate in the global industrial distribution market in terms of product, since this class of product is considered highly essential in day-to-day business operations in every industry sector. Fundamentally, special machinery and tools are needed in various industries such as manufacturing, construction, mining, and energy for their respective production, assembly, and maintenance needs.

Among the main driving forces of the industrial machinery distribution market, one might point out the increased usage of automation, robotics, and IoT technologies of Industry 4.0. Since industries do not stop upgrading their operations at ever higher efficiencies, this brings higher demand for high-end machinery, hence contributing a great deal to the market growth. Moreover, continuous infrastructure development within various regions fuels the demand for construction equipment and heavy machinery.

This segment also draws from the growing trend towards outsourcing maintenance services.

Today, scores of companies depend on third-party industrial distributors for equipment supplies and maintenance, lessening the need for companies to support large inventories. Industrial distributors accordingly provide value-added services such as the repair, calibration, and maintenance of equipment, further cementing the importance of this player in the supply chain.

Additionally, the increased sophistication of machinery across different industries, including but not limited to aerospace, automotive, and heavy machinery, requires highly specialized tools and parts. This demand further cements the machinery and equipment segment as the top product category in the market for industrial distributors during the forecast period.

By Industry Vertical

Manufacturing is anticipated to dominate the industry vertical segment in the global industrial distribution market with 24.1% of the market share in 2024 because of the sector's massive demand for a wide range of industrial supplies and services. Since these products are considered highly essential in day-to-day business operations in every industry sector. Fundamentally, special machinery and tools are needed in various industries such as manufacturing, construction, mining, and energy for their respective production, assembly, and maintenance needs.

Among the main driving forces of the industrial machinery distribution market, one might point out the increased usage of automation, robotics, and IoT technologies of Industry 4.0. Since industries do not stop upgrading their operations at ever higher efficiencies, this brings higher demand for high-end machinery, hence contributing significantly to the market growth. Moreover, continuous infrastructure development within various regions fuels the demand for construction equipment and heavy machinery. This segment also draws from the growing trend towards outsourcing maintenance services.

Many companies now rely on third-party industrial distributors to supply and maintain equipment, reducing their need to manage large inventories. Industrial distributors accordingly provide value-added services such as the repair, calibration, and maintenance of equipment, further cementing the importance of this market in the supply chain.

Additionally, the increased sophistication of machinery across different industries, including but not limited to aerospace, automotive, and heavy machinery, requires highly specialized tools and parts. This demand further cements the machinery and equipment segment as the top product category in the market for industrial distributors during the forecast period.

The Industrial Distribution Market Report is segmented on the basis of the following

By Product Type

- Machinery & Equipment

- Electrical & Electronics

- Industrial Supplies

- Raw Materials

- Safety Products

- Other Product Type

By Industry Vertical

- Manufacturing

- Construction

- Oil & Gas

- Chemicals

- Healthcare

- Food & Beverage

- Other Industry Vertical

How Does Artificial Intelligence Contribute To Improve Industrial Distribution Market ?

- Demand Forecasting – AI-powered predictive analytics help industrial distributors anticipate demand trends and optimize inventory management.

- Supply Chain Optimization – AI enhances logistics, reducing delays and improving the efficiency of transportation and warehousing.

- Automated Order Processing – AI-driven systems streamline order fulfillment, reducing errors and improving delivery speed.

- Predictive Maintenance – AI monitors equipment performance, predicting potential failures and minimizing downtime in distribution centers.

- Smart Inventory Management – AI optimizes stock levels, preventing overstocking or shortages by analyzing real-time data.

- Route Optimization for Logistics – AI-powered algorithms determine the most efficient delivery routes, reducing fuel costs and improving delivery times.

- Fraud Detection & Risk Management – AI enhances security by detecting anomalies in transactions and preventing supply chain fraud.

Regional Analysis

North America is projected to lead the global industrial distribution market as it is anticipated to

hold 39.2% of the total market revenue by the end of 2024. With its robust industrial base, well-developed infrastructure, and large-scale adoption of newer technologies, North America is anticipated to be the leading region within the global industrial distribution market.

Some of the largest manufacturing, construction, and energy companies in the world are headquartered in this region, and these companies are also the biggest clients for such industrial supplies and services.

Manufacturing is a well-developed sector in the U.S., ensuring stable demand for industrial distribution solutions. The factors that drive the dominance of industrial distribution in North America are very notably encouraged by the high level of technological adoption within the region.

Companies are increasingly investing in automation, IoT, and smart manufacturing technologies that help advance efficiency while reducing eventual costs of operation. This ever-increasing trend toward the adoption of Industry 4.0 technologies has created a high demand for advanced machinery, MRO supplies, and maintenance services very critical offerings in the industrial distribution market.

It is also influenced by a well-established distribution network that guarantees the timely delivery of industrial products in the region. Major distributors like MSC Industrial Supply, Fastenal, and W.W. Grainger have long networks across North America and hold a significant market share in the region. The growing use of e-commerce and digital procurement platforms further strengthens the growth of the market in the region.

Additionally, North America also enjoys a favorable regulatory environment that attracts investments for industrial expansion and an influx of infrastructure projects. Furthermore, major industries such as aerospace, automotive, and energy drive demand for special equipment and tools. Overall, these market drivers place North America in the leading position within the global industrial distribution market during the forecast period.

Europe

- Germany

- The U.K.

- France

- Italy

- Russia

- Spain

- Benelux

- Nordic

- Rest of Europe

Asia-Pacific

- China

- Japan

- South Korea

- India

- ANZ

- ASEAN

- Rest of Asia-Pacific

Latin America

- Brazil

- Mexico

- Argentina

- Colombia

- Rest of Latin America

Middle East & Africa

- Saudi Arabia

- UAE

- South Africa

- Israel

- Egypt

- Rest of MEA

Competitive Landscape

The competition in the global industrial distribution market is intense, with a few key players holding substantial market share. The key players are large multinational companies, and regional and niche distributors operating in an industrial distribution market that is constantly undergoing evolution. Other well-known companies in the field are MSC Industrial Supply, Fastenal Company, W.W. Grainger, Applied Industrial Technologies, and Würth Industry. All firms operate in creating a wide variety of industrial products and services in several industry verticals.

Companies leverage their thorough distribution networks as strengths to secure their competitiveness across diversified customer segments in the manufacturing, construction, and energy industries, among others. Technological innovation has been one of the key differentiators among the market players.

Companies are incorporating digital platforms, e-commerce solutions, and automated systems to increase efficiency as they make their customer experiences more enriching. For instance, Fastenal Company has been at the forefront of the adoption of vending machines and e-procurement solutions, thus giving out a seamless procuring experience for customers.

Other regional participants include Wolseley Industrial Group and Kaman Distribution Group, which have strong positions in some markets by being focused on niche industrial products and services. Going forward, the industrial distribution market is likely to witness investments in some important partnerships, mergers, and acquisitions in order to hold larger market shares during the forecast period.

Some of the prominent players in the Global Industrial Distribution Market are

- W.W. Grainger

- WESCO International

- Sonepar USA

- Würth Industry

- Wolseley Industrial Group

- DXP Enterprises, Inc.

- Border States

- Kaman Distribution Group

- F.W. Webb

- Edgen Murray

- HD Supply

- Motion Industries

- Fastenal Company

- Rexel USA, Inc.

- Other Key Players

Recent Developments

2024 Developments

- September 2024: MSC Industrial Supply launched a revamped e-commerce platform featuring enhanced order tracking, predictive analytics, and user-friendly interfaces to improve customer procurement experiences. This initiative is expected to position MSC as a leader in digital solutions within the industrial distribution market.

- August 2024: Fastenal Company introduced a new line of eco-friendly industrial supplies, focusing on sustainable sourcing and production methods. The initiative reflects the growing demand for environmentally friendly products, aligning with broader sustainability trends in the market.

- July 2024: W.W. Grainger expanded its MRO product offerings through the acquisition of a regional distributor, enhancing its service capabilities and product range. This strategic move aims to capture a larger share of the growing MRO market and bolster its competitive position.

- June 2024: Würth Industry introduced new automated inventory management systems aimed at improving supply chain efficiency for manufacturers. This development highlights the increasing importance of automation in the industrial distribution landscape.

- May 2024: Applied Industrial Technologies announced a strategic partnership with an IoT provider to offer smart maintenance solutions. This collaboration aims to enhance service offerings and drive innovation in the industrial supply sector.

- April 2024: Kaman Distribution Group opened a new distribution center in Texas, expanding its reach in the Southern U.S. This move is part of Kaman's strategy to improve service delivery and operational efficiency in a key growth market.

2023 Developments

- December 2023: Fastenal Company launched a new mobile application that allows customers to place orders, track shipments, and manage inventory from their devices. This initiative enhances customer convenience and aligns with the growing trend of mobile commerce.

- November 2023: MSC Industrial Supply announced a commitment to sustainability by pledging to reduce carbon emissions across its supply chain by 30% by 2030. This commitment reflects the company's dedication to addressing environmental concerns in the industrial distribution sector.

- September 2023: Applied Industrial Technologies expanded its service offerings with a new suite of custom engineering solutions aimed at helping clients optimize their industrial processes.

Report Details

| Report Characteristics |

| Market Size (2024) |

USD 8,153.1 Bn |

| Forecast Value (2033) |

USD 12,975.4 Bn |

| CAGR (2024-2033) |

5.3% |

| Historical Data |

2018 – 2023 |

| The US Market Size (2024) |

USD 2,687.8 Bn |

| Forecast Data |

2025 – 2033 |

| Base Year |

2023 |

| Estimate Year |

2024 |

| Report Coverage |

Market Revenue Estimation, Market Dynamics, Competitive Landscape, Growth Factors and etc. |

| Segments Covered |

By Product Type (Machinery & Equipment, Electrical & Electronics, Industrial Supplies, Raw Materials, Safety Products, and Other Product Type), By Industry Vertical (Manufacturing, Construction, Oil & Gas, Chemicals, Healthcare, Food & Beverage, and Other Industry Vertical) |

| Regional Coverage |

North America – The US and Canada; Europe – Germany, The UK, France, Russia, Spain, Italy, Benelux, Nordic, & Rest of Europe; Asia- Pacific– China, Japan, South Korea, India, ANZ, ASEAN, Rest of APAC; Latin America – Brazil, Mexico, Argentina, Colombia, Rest of Latin America; Middle East & Africa – Saudi Arabia, UAE, South Africa, Turkey, Egypt, Israel, & Rest of MEA

|

| Prominent Players |

W.W. Grainger, WESCO International, Sonepar USA, Würth Industry, Wolseley Industrial Group, DXP Enterprises, Inc., Border States, Kaman Distribution Group, F.W. Webb, Edgen Murray, HD Supply, Motion Industries, Fastenal Company, Rexel USA Inc., and Other Key Players |

| Purchase Options |

We have three licenses to opt for: Single User License (Limited to 1 user), Multi-User License (Up to 5 Users) and Corporate Use License (Unlimited User) along with free report customization equivalent to 0 analyst working days, 3 analysts working days and 5 analysts working days respectively. |

Frequently Asked Questions

The Global Industrial Distribution Market size is estimated to have a value of USD 8,153.1 billion in 2024 and is expected to reach USD 12,975.4 billion by the end of 2033.

The US Industrial Distribution Market is projected to be valued at USD 2,687.8 billion in 2024. It is expected to witness subsequent growth in the upcoming period as it holds USD 4,162.6 billion in 2033 at a CAGR of 5.0%.

North America is expected to have the largest market share in the Global Industrial Distribution Market with a share of about 39.2% in 2024.

Some of the major key players in the Global Industrial Distribution Market are W.W. Grainger, WESCO International, Sonepar USA, Würth Industry, Wolseley Industrial Group, DXP Enterprises Inc., and many others.

The market is growing at a CAGR of 5.3 percent over the forecasted period.