Industrial Inkjet Printers Market refers to printing technology that provides fast, high-resolution inkjet solutions designed specifically for industrial use. This market serves a diverse set of industries, from packaging and manufacturing to textiles and textile finishing, providing reliable printing capabilities on various substrates such as plastics, paper, and metals. Industrial inkjet printers are well known for their efficiency, scalability, and ability to reproduce intricate designs with accuracy and speed. Companies use industrial inkjet printers to increase branding efforts while improving traceability and decreasing waste; their market has experienced remarkable expansion due to technological advancements and customer demand for customization and rapid production.

Industrial Inkjet Printer Market growth has been spurred on by various factors that showcase its benefits across different sectors. Companies increasingly prioritize operational efficiencies and cost cuts; as an inkjet solution can provide faster turnaround times with lower setup costs than conventional printing methods, inkjet solutions present an appealing option to traditional printing methods.

One key market driver is the rising need for customization and personalization in products, which drives innovation in ink formulations and printer capabilities. Recent advancements in digital printing technology -- such as increased resolution and multi-material compatibility-- are broadening industrial inkjet applications to enable effective printing across textiles, packaging materials, and labels.

Sustainability is also shaping market dynamics, with manufacturers seeking eco-friendly inks and processes to limit environmental impact. Adopting Industry 4.0 principles with automation and IoT integration further maximizes operational efficiencies through real-time monitoring of printing systems as well as predictive maintenance services.

Key Takeaways

- Market Growth Forecast: The market is projected to reach a value of USD 15.8 billion by 2033, growing from USD 10.4 billion in 2024, at a CAGR of 4.8%.

- Dominating Region: North America is the leading region, holding approximately 35% of the market share in 2023, driven by advanced manufacturing infrastructure and high demand for efficient labeling and packaging solutions.

- Leading Segment: The On-demand Inkjet Printers segment held a significant market share of around 55% in 2023, favored for its versatility and efficiency in various applications.

- Emerging Opportunities: The Asia Pacific region captured about 25% of the market share, with rapid industrialization and rising consumer demand for packaging and labeling driving growth.

- Key Trends: There is a notable shift towards digital printing solutions, driven by the demand for customization and sustainability, particularly the use of UV-curable inks and continuous inkjet technology.

Use Cases

- Food & Beverage Packaging: Industrial inkjet printers facilitate on-demand printing of labels, allowing for rapid customization and compliance with labeling regulations, enhancing brand appeal.

- Pharmaceutical Labeling: These printers ensure accurate printing of critical information on packaging, improving safety and traceability while meeting strict regulatory standards.

- Sustainable Solutions: Eco-friendly inks used in industrial inkjet printers reduce waste and improve efficiency, aligning with the market's focus on sustainable manufacturing practices.

- E-commerce Coding: Integrated with automation, industrial inkjet printers provide fast coding for barcodes and product information, optimizing supply chain efficiency for e-commerce.

- Textile Printing: In textiles, these printers enable intricate designs and quick responses to trends, enhancing production flexibility and reducing inventory costs.

Driving Factors

Integration with Automation Technology

Integration between industrial inkjet printers and automation technologies is an integral component of market expansion. As manufacturers increasingly turn towards automated processes to increase efficiency and decrease labor costs, inkjet printers play an essential part. Automated systems such as conveyor belts and robotic arms can easily incorporate inkjet printing technology for real-time product printing throughout production lines. Automating production speeds while eliminating human error helps increase production speeds while improving output quality, creating an appealing partnership for manufacturers seeking to optimize their processes, thus driving demand for industrial inkjet printers.

Versatility across Materials

Industrial inkjet printers have long been recognized for their flexibility when printing on different materials such as plastics, metals, and textiles - this adaptability making them popular choices in various industries ranging from packaging and automotive production to textile production and apparel design. As businesses seek solutions that can handle varied substrates without compromising on quality, inkjet printers that can accommodate various materials can increase their appeal significantly. Increased versatility allows companies to adapt and diversify their product offerings, leading to market expansion. According to industry reports, inkjet printing's expanding applications is expected to further fuel growth as companies increasingly look for cost-effective printing solutions tailored to specific materials.

Shifting towards Digital Printing will allow for improved printing processes

Digital printing has transformed the landscape of printing industry, and industrial inkjet printers are at the vanguard of this revolution. Digital printing stands apart from conventional methods in several key respects, offering advantages like faster run times, reduced waste output and the capability to customize products on demand. Companies increasingly prioritize sustainability and efficiency so the demand for digital solutions continues to surge. Statistics reveal that digital printing market is projected to experience exponential expansion, underscoring its significance and the role inkjet technology plays. Not only can this trend meet modern consumers' tastes for personalization but it allows manufacturers to decrease inventory costs quickly in response to market shifts thus strengthening their competitive edge.

Growth Opportunities

Expanding into Emerging Markets

As developing regions such as Asia-Pacific and Latin America industrialize, there has been an exponentially rising need for advanced printing solutions. Investment opportunities exist here as local manufacturers strive to hone production capacities and differentiate products. Companies that establish themselves here can take advantage of lower labor costs as their consumer bases expand while meeting this growing need for efficient yet versatile printing technologies.

Diversifying into New Applications (Diversification)

Industrial inkjet printers' versatility paves the way for innovative uses that transcend their original industries of operation, such as food and beverage manufacturing, healthcare delivery systems, and packaging industries. Many such industries now make use of inkjet printing technology for labeling, coding, and customization purposes in industries including food & beverages, healthcare delivery systems, and packaging; diversifying manufacturers into niche markets while expanding customer bases and growing revenue streams simultaneously.

Investment in Research and Development

Constant innovation is vital to maintaining competitive advantage. Investment in R&D can bring advances to ink formulation, printing speeds, printer designs, and sustainable printing solutions - meeting evolving customer demands as well as positioning businesses to capitalize on emerging trends such as digitalization and environmental sustainability.

Key Trends

Rising Demand for UV-C Curable Inks

One of the more notable trends is the increasing interest and use of UV-curable inks. Offering quick drying times and enhanced durability, UV-curable inks make for ideal printing on multiple substrates while helping industries reduce production downtime while producing quality outputs. Furthermore, their adhesive qualities enable them to adhere securely even on difficult materials, opening up an array of new applications in sectors like packaging and signage.

Increased Reliance on Continuous Inkjet Printing Technology

Continuous inkjet (CIJ) technology has rapidly gained prominence due to its efficiency and adaptability. Continuous-inkjet printers operate continuously, making them suitable for high-speed production lines where speed and reliability are crucial. Continuous inkjet systems reflect an industry trend towards automation and efficiency; their increased popularity may signal this broader change as more industries adopt this form of marking and coding technology.

Adopt Green Printing Technologies Now

As environmental sustainability becomes a key priority among manufacturers and their target audiences alike, companies are increasing investment in eco-friendly inks and practices to reduce their environmental footprint and meet regulatory demands while simultaneously satisfying environmentally aware consumers through brand loyalty-building efforts.

Restraining Factors

Complexity of Operation

The complexity of Operation Industrial inkjet printers presents significant barriers to market expansion due to their complexity of operation. Many manufacturers encounter difficulties when setting up, calibrating, and maintaining these systems - tasks that often require expert knowledge and training to perform successfully. Potential customers, particularly small to midsized enterprises (SMEs) that lack technical resources for effective implementation may be put off by this steep learning curve. Companies seeking simpler printing solutions may prefer user-friendly alternatives instead, restricting the penetration of industrial inkjet printers in the market. According to reports, about 25% of potential users cite operational complexity as one of their key barriers to adoption; emphasizing manufacturers' need to develop intuitive technologies with accessible user experiences.

Competition from alternative technologies

Industrial inkjet printers face intense competition from alternative printing technologies like laser and offset printing, both of which can offer cost-effective solutions for high-volume runs. Furthermore, new 3D printing capabilities may divert investment away from conventional inkjet systems - creating pressure on industrial inkjet manufacturers to continuously innovate to justify their value proposition; otherwise, they risk ceding market share to more efficient technologies that offer versatility, speed, or reduced operational costs.

Market Saturation in Developed Regions

Market saturation in developed regions such as North America and Western Europe poses a formidable barrier for industrial inkjet printer manufacturers in their sales growth efforts. Because many businesses already utilize these systems, opportunities for additional sales are restricted and instead, efforts turn toward replacement cycles or upgrades rather than expanding sales further. According to industry statistics, growth rates within mature markets typically linger between 2-3% annually - this saturation compels manufacturers to look abroad where advanced printing solutions demand is still expanding quickly.

Research Scope Analysis

By Type

In 2023, On-demand Inkjet Printers held a significant market share - approximately 55% - within the Industrial Inkjet Printers Market. This sector's expansion is attributable to its versatility and efficiency in producing high-quality prints on various substrates - ideal for industries such as packaging and textiles. The continuous Inkjet Printer segment also displayed notable strength, accounting for around 30% of the market. Continuous inkjet printers have become the go-to choice in high-volume production runs due to their consistent quality, making them particularly suitable for sectors like food and beverage where rapid coding and marking is a necessity. Of the remaining 15% market, other specialized printing technologies account for 1/5th while continuing to compete against more established on-demand and continuous inkjet solutions.

These segments represent the foundation of a robust landscape in the industrial inkjet printers market, marked by a clear preference for technologies that increase operational efficiency and product quality. As businesses prioritize customization and speed over product quality, these segments are well-positioned to meet evolving industry requirements while ultimately driving market expansion.

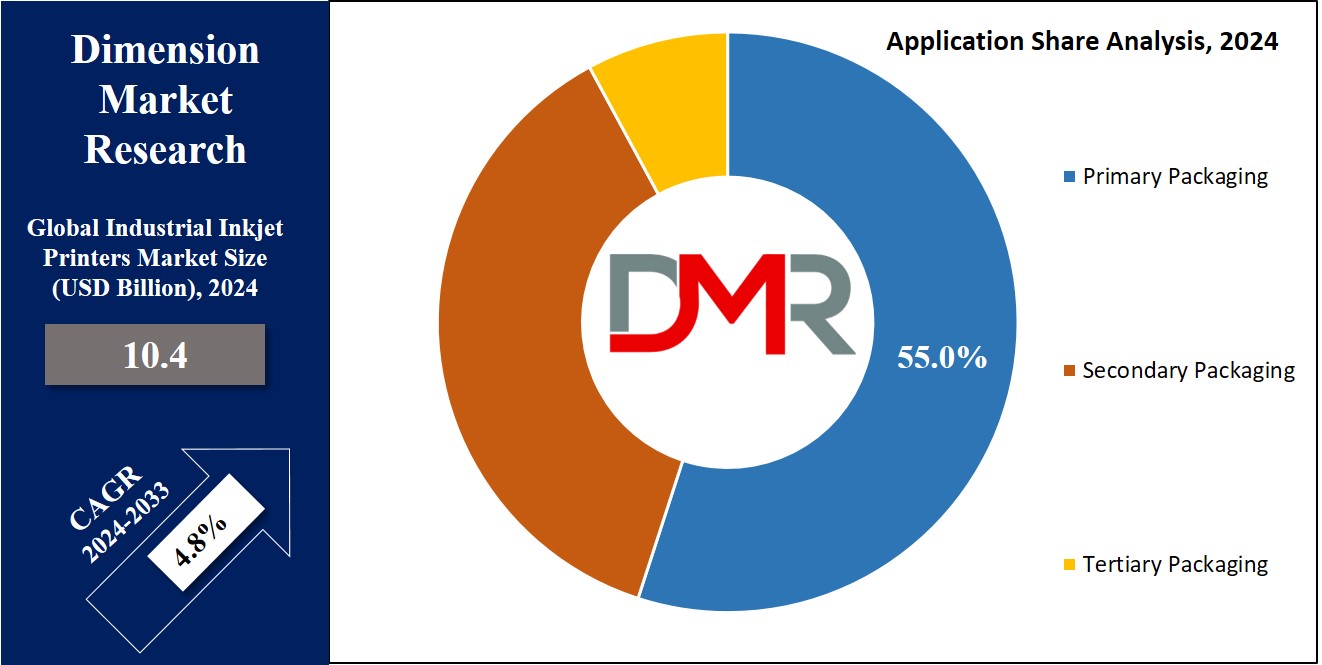

By Packaging Type

Primary Packaging held the leading market position within the Product Type segment of Industrial Inkjet Printers Market in 2023, accounting for 55% of market share overall and reflecting strong demand for efficient and versatile printing solutions in packaging applications. Its growth can be attributed to increasing needs for high-quality labeling/branding solutions across various industries such as food & beverages, pharmaceuticals, consumer goods, etc.

Secondary Packaging held approximately 30% of the market. This segment has seen rapid expansion due to an emphasis on supply chain efficiency and the desire for attractive packaging that increases product visibility. Furthermore, advancements in inkjet technology allow for greater customization options and faster turnaround times, driving further demand in this area.

Tertiary Packaging currently accounts for an approximate 15% market share but has become increasingly relevant as companies prioritize sustainability and cost-effectiveness in their logistics processes. Integrating advanced inkjet solutions allows for enhanced traceability and product information - key requirements in today's supply chains.

By Application

Pouch Printing was the undisputed leader in the Product Type segment of the Industrial Inkjet Printers Market in 2023, accounting for nearly 40% of the total market share. This success can be attributed to the rising demand for flexible packaging solutions across various industries such as food, beverages, and personal care products; its adaptability also allows high-quality graphics printing along with variable data printing for modern consumers seeking both aesthetic appeal and functionality.

Corrugated Box Printing made up approximately 25% of the market. This segment has seen significant growth thanks to the rise of e-commerce and demand for durable yet visually appealing packaging that provides product protection during shipping. Innovations in inkjet printing technologies have allowed faster production rates and customized options, making corrugated boxes an integral part of supply chains worldwide.

Packaging Film Printing represented around 20% of the market in 2016, reflecting its steady demand. This growth can be attributed to advances in flexible packaging solutions which offer improved shelf life and visibility, appealing to manufacturers seeking differentiation in competitive markets.

Bottle printing held approximately 10% of the market in 2018. This sector saw increased adoption due to branding and labeling requirements on various bottle types in both beverage and personal care industries, especially as inkjet technology has allowed efficient high-resolution printing capabilities that make bottle printing an integral component of product packaging processes.

By End-use Industry

Food & Beverage was the dominant market segment within the Industrial Inkjet Printers Market by Product Type in 2023, accounting for roughly 35% of the total market share. This growth can be attributed to growing consumer demands for high-quality labeling, expiration dates, barcodes, and compliance information - key elements required for compliance in this sector - combined with inkjet technology's versatility that allows manufacturers to produce vibrant prints on various packaging types that improve appeal and traceability of products.

The chemical sector held approximately 25% of the market share. With increased safety labeling and compliance regulations requiring printing solutions that were efficient and precise in this segment. Industrial inkjet printers provide effective marking capabilities on various chemical containers so that critical information can be clearly displayed and easily read.

The pharmaceutical segment accounted for approximately 20% of the market share, reflecting its strict regulatory requirements for packaging and labeling. With the demand for clear, accurate, tamper-evident printing solutions in this industry, industrial inkjet printers play an integral part in maintaining patient safety and product integrity.

Packaging as a broad category represented 15-06% of market share. This segment encompasses various materials and applications, taking advantage of inkjet printing's flexibility and efficiency to stay ahead of its competition in an increasingly competitive market. Being able to print high-quality graphics and variable data becomes an invaluable advantage in differentiating themselves from rival brands.

Personal Care & Cosmetics products represented approximately 5% of market share. Consumer demand for visually appealing packaging continues to increase and inkjet technology offers detailed, vibrant prints to meet this need. Inkjet technology meets consumers' desire for visually appealing products by producing detailed images for them to choose from.

By Distribution Channel

Direct Sales was the clear market leader in 2023 in terms of the Product Type segment of the Industrial Inkjet Printers Market, accounting for approximately 60% of its total market share. This can be attributed to manufacturers' strong relationships and direct engagement with their customers allowing tailored solutions and immediate support. Direct sales enable customers to receive personalized consultations and demonstrations that help them gain greater insight into different inkjet printing technologies' capabilities and advantages.

On the other hand, Indirect Sales comprised around 40% of market share. This segment gained momentum due to an increasing reliance on distributors and resellers offering an array of products and services. Through indirect channels sales can gain greater market penetration and accessibility in regions where direct engagement may not be feasible; additionally, these channels often lead to enhanced customer support as well as additional value-added services like installation and maintenance services.

The Industrial Inkjet Printers Market Report is segmented based on the following:

By Type

- On-demand Inkjet Printer

- Continuous Inkjet Printer

By Packaging Type

- Primary Packaging

- Secondary Packaging

- Tertiary Packaging

By Application

- Pouch Printing

- Corrugated Box Printing

- Packaging Film Printing

- Bottle Printing

- Others (wires or cables, building materials, etc.)

By End-use Industry

- Food & Beverage

- Chemical

- Pharmaceutical

- Packaging

- Personal Care & Cosmetics

- Others (textile, construction, etc.)

By Distribution Channel

- Direct Sales

- Indirect Sales

Regional Analysis

North America held approximately 35% of the Global Industrial Inkjet Printers Market in 2023, driven by advanced manufacturing infrastructure, high adoption of automation technologies, and robust demand for efficient labeling and packaging solutions across various industries such as food and beverages, pharmaceuticals, and electronics.

Europe represented approximately 30 % of the market.

Europe's focus on environmental responsibility and regulatory compliance has led to greater investments in innovative printing solutions; countries like Germany and the UK in particular are leading this movement by investing heavily in cutting-edge technology and eco-friendly practices to satisfy an expanding market for eco-friendly packaging solutions.

Asia Pacific captured approximately 25% of the market share, driven by rapid industrialization, an expanding manufacturing base, and rising consumer goods demand. China and India in particular are seeing significant packaging and labeling sector expansion driven by urbanization and shifting consumer tastes. Middle East & Africa made up approximately 5% of this share. Latin America represented approximately 5%. Emerging economies are beginning to adopt modern printing technologies to improve manufacturing processes.

North America

Europe

- Germany

- U.K.

- France

- Italy

- Russia

- Spain

- Benelux

- Nordic

- Rest of Europe

Asia-Pacific

- China

- Japan

- South Korea

- India

- ANZ

- ASEAN

- Rest of Asia-Pacific

Latin America

- Brazil

- Mexico

- Argentina

- Colombia

- Rest of Latin America

Middle East & Africa

- Saudi Arabia

- UAE

- South Africa

- Israel

- Egypt

- Rest of MEA

Competitive Landscape

2023 saw several key players emerge to shape the global Industrial Inkjet Printers Market with innovation and strategic positioning. Anser Coding, Inc. has led this market through innovative coding solutions that emphasize efficiency and reliability across various industrial applications; Engineered Printing Solutions stands out with customizable printing systems tailored specifically for niche markets with enhanced flexibility for users - both companies provide tailored solutions tailored specifically to meet the requirements of industries such as food & beverage, pharmaceuticals, consumer goods.

Hitachi, Ltd. and Videojet Technologies, Inc. are prominent players that specialize in high-speed printing solutions to address the ever-increasing demand for fast and accurate labeling, offering diverse product offerings to meet various customer requirements. Other notable players such as InkJet Inc. and ITW Diagraph incorporate advanced technologies into their offerings, creating user-friendly interfaces and superior print quality while remaining reliable partners within industrial inkjet printing to maintain operational efficiency in manufacturing environments.

Emerging competitors such as KGK Jet India Private Limited and Squid Ink are making impressive strides, propelled by regional demand and providing tailored solutions. Keyence Corporation remains committed to research and development, constantly innovating in an increasingly competitive landscape. Konica Minolta Inc. leverages imaging technology expertise; while Markem-Imaje focuses on sustainable practices aligning with an increasing trend toward eco-friendly packaging; with Weber Packaging Solutions emphasizes integrated packaging solutions all helping drive market expansion - showing their commitment to innovation as they meet rapidly changing industrial conditions.

Some of the prominent players in the Global Industrial Inkjet Printers Market are:

- Anser Coding, Inc.

- Engineered Printing Solutions

- Hitachi, Ltd.

- InkJet, Inc.

- ITW Diagraph

- Keyence Corporation

- KGK Jet India Private Limited

- Konica Minolta, Inc.

- Markem-Imaje, a Dover Company

- Squid Ink

- Videojet Technologies, Inc.

- Weber Packaging Solutions

Recent developments

- In March 2022, Hitachi, Ltd. launched UX2, an advanced inkjet printer that combines innovation with reliability. The UX2 continuous inkjet printer has several new features to enhance the coding process such as enhanced code quality at higher speeds, added convenience and safety, and a newly designed print head.

- In February 2022, Konica Minolta Business Solutions U.S.A., Inc. (Konica Minolta) launched the AccurioJet KM-1e High Definition (HD) model that delivers 1200 x 1200 DPI output

Report Details

| Report Characteristics |

| Market Size (2023) |

USD 10.4 Billion |

| Forecast Value (2032) |

USD 15.8 billion |

| CAGR (2023-2032) |

4.8% |

| Historical Data |

2018 – 2023 |

| Forecast Data |

2024 – 2033 |

| Base Year |

2023 |

| Estimate Year |

2024 |

| Report Coverage |

Market Revenue Estimation, Market Dynamics, Competitive Landscape, Growth Factors and etc. |

| Segments Covered |

By Type(On-demand Inkjet Printer, Continuous Inkjet Printer), By Packaging Type(Primary Packaging, Secondary Packaging, Tertiary Packaging), By Application(Pouch Printing, Corrugated Box Printing, Packaging Film Printing, Bottle Printing, Others), By End-use Industry, By Distribution Channel |

| Regional Coverage |

North America – The US and Canada; Europe – Germany, The UK, France, Russia, Spain, Italy, Benelux, Nordic, & Rest of Europe; Asia- Pacific– China, Japan, South Korea, India, ANZ, ASEAN, Rest of APAC; Latin America – Brazil, Mexico, Argentina, Colombia, Rest of Latin America; Middle East & Africa – Saudi Arabia, UAE, South Africa, Turkey, Egypt, Israel, & Rest of MEA

|

| Prominent Players |

Anser Coding, Engineered Printing Solutions, Hitachi, InkJet, ITW Diagraph, Keyence Corporation, KGK Jet India Private, Limited, Konica Minolta, Markem-Imaje, Squid Ink, Videojet Technologies, Weber Packaging Solutions |

| Purchase Options |

We have three licenses to opt for: Single User License (Limited to 1 user), Multi-User License (Up to 5 Users), and Corporate Use License (Unlimited User) along with free report customization equivalent to 0 analyst working days, 3 analysts working days and 5 analysts working days respectively. |